Compare Lithium Phosphate's Market Trends with Other Cathode Materials

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Phosphate Evolution and Strategic Objectives

Lithium iron phosphate (LFP) has emerged as a significant player in the lithium-ion battery market since its commercial introduction in the late 1990s. The evolution of this cathode material has been marked by continuous improvements in performance characteristics, manufacturing processes, and cost-effectiveness. Initially developed as a safer alternative to cobalt-based cathodes, LFP has undergone substantial technological refinements to address its inherent limitations, particularly its lower energy density compared to competing materials.

The historical trajectory of LFP development reveals a pattern of innovation focused on enhancing conductivity and rate capability through particle size reduction, carbon coating techniques, and doping strategies. These advancements have progressively improved the material's electrochemical performance while maintaining its inherent safety advantages and thermal stability.

Market adoption of LFP has followed a non-linear path, with significant regional variations. China has emerged as the dominant force in LFP production and implementation, driven by strategic government policies and substantial investments in manufacturing infrastructure. This regional concentration has shaped global supply chains and influenced technology development priorities.

When comparing LFP with other cathode materials such as nickel manganese cobalt (NMC), nickel cobalt aluminum (NCA), and lithium manganese oxide (LMO), several distinct trends become apparent. While high-nickel cathodes have dominated premium electric vehicle applications due to their superior energy density, LFP has carved out a growing niche in applications where safety, cycle life, and cost considerations outweigh energy density requirements.

Recent technological breakthroughs, particularly in cell-to-pack integration strategies, have significantly narrowed the practical energy density gap between LFP and nickel-rich cathodes at the system level. This development has catalyzed renewed interest in LFP across broader market segments, including mid-range electric vehicles and stationary energy storage systems.

The strategic objectives for LFP technology development are multifaceted. Primary goals include further enhancing energy density through novel synthesis methods and advanced particle engineering, improving low-temperature performance through electrolyte optimization, and reducing manufacturing costs through process innovations and economies of scale.

Additionally, sustainability considerations are increasingly shaping the strategic direction of LFP development. The material's cobalt-free composition aligns with growing industry efforts to reduce reliance on critical minerals with supply chain vulnerabilities and ethical sourcing concerns. This advantage positions LFP favorably within the broader context of battery sustainability initiatives and circular economy principles.

The historical trajectory of LFP development reveals a pattern of innovation focused on enhancing conductivity and rate capability through particle size reduction, carbon coating techniques, and doping strategies. These advancements have progressively improved the material's electrochemical performance while maintaining its inherent safety advantages and thermal stability.

Market adoption of LFP has followed a non-linear path, with significant regional variations. China has emerged as the dominant force in LFP production and implementation, driven by strategic government policies and substantial investments in manufacturing infrastructure. This regional concentration has shaped global supply chains and influenced technology development priorities.

When comparing LFP with other cathode materials such as nickel manganese cobalt (NMC), nickel cobalt aluminum (NCA), and lithium manganese oxide (LMO), several distinct trends become apparent. While high-nickel cathodes have dominated premium electric vehicle applications due to their superior energy density, LFP has carved out a growing niche in applications where safety, cycle life, and cost considerations outweigh energy density requirements.

Recent technological breakthroughs, particularly in cell-to-pack integration strategies, have significantly narrowed the practical energy density gap between LFP and nickel-rich cathodes at the system level. This development has catalyzed renewed interest in LFP across broader market segments, including mid-range electric vehicles and stationary energy storage systems.

The strategic objectives for LFP technology development are multifaceted. Primary goals include further enhancing energy density through novel synthesis methods and advanced particle engineering, improving low-temperature performance through electrolyte optimization, and reducing manufacturing costs through process innovations and economies of scale.

Additionally, sustainability considerations are increasingly shaping the strategic direction of LFP development. The material's cobalt-free composition aligns with growing industry efforts to reduce reliance on critical minerals with supply chain vulnerabilities and ethical sourcing concerns. This advantage positions LFP favorably within the broader context of battery sustainability initiatives and circular economy principles.

Market Demand Analysis for Cathode Materials

The global cathode materials market is experiencing significant growth, driven primarily by the rapid expansion of the electric vehicle (EV) industry and increasing demand for energy storage solutions. Current market valuations place the cathode materials sector at approximately $22.5 billion in 2023, with projections indicating a compound annual growth rate (CAGR) of 12.8% through 2030, potentially reaching $52.7 billion by the end of the decade.

Lithium iron phosphate (LFP) cathodes have demonstrated remarkable market resurgence in recent years, particularly in China where they now account for over 50% of the EV battery market. This growth contrasts with previous market dominance by nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminum (NCA) cathodes. The shift toward LFP is primarily driven by its superior cost efficiency, with production costs approximately 30-40% lower than nickel-based alternatives.

Safety considerations have become increasingly paramount in battery material selection, particularly following several high-profile thermal runaway incidents. LFP's inherent thermal stability and resistance to oxygen release during thermal events have positioned it favorably against other cathode chemistries, especially in applications where safety outweighs energy density requirements.

Regional market analysis reveals divergent adoption patterns. While China leads in LFP implementation across multiple sectors, European and North American markets have traditionally favored higher energy density NMC and NCA cathodes. However, recent supply chain disruptions and price volatility in nickel and cobalt markets have accelerated Western interest in LFP technology, with major manufacturers announcing significant shifts toward LFP chemistry.

Application segmentation shows distinct preference patterns across different sectors. Consumer electronics continue to prioritize high energy density cathodes like NMC and lithium cobalt oxide (LCO), while grid storage applications increasingly favor LFP for its cycle life and safety advantages. The EV segment demonstrates the most dynamic shift, with a growing bifurcation between premium vehicles utilizing high-nickel cathodes and mass-market models adopting LFP technology.

Price sensitivity analysis indicates that LFP cathodes maintain a significant cost advantage, with current market prices averaging $12-15 per kilogram compared to $30-45 for high-nickel NMC variants. This price differential has proven particularly decisive during recent raw material price fluctuations, where cobalt prices experienced volatility exceeding 300% during peak periods.

Future market projections suggest continued growth for all major cathode chemistries, though at different rates. LFP is expected to maintain the highest growth trajectory in volume terms, while high-nickel cathodes will likely retain premium market segments where maximum energy density justifies their cost premium. Emerging technologies like lithium-rich layered oxides and solid-state compatible cathodes represent potential market disruptors in the 2025-2030 timeframe.

Lithium iron phosphate (LFP) cathodes have demonstrated remarkable market resurgence in recent years, particularly in China where they now account for over 50% of the EV battery market. This growth contrasts with previous market dominance by nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminum (NCA) cathodes. The shift toward LFP is primarily driven by its superior cost efficiency, with production costs approximately 30-40% lower than nickel-based alternatives.

Safety considerations have become increasingly paramount in battery material selection, particularly following several high-profile thermal runaway incidents. LFP's inherent thermal stability and resistance to oxygen release during thermal events have positioned it favorably against other cathode chemistries, especially in applications where safety outweighs energy density requirements.

Regional market analysis reveals divergent adoption patterns. While China leads in LFP implementation across multiple sectors, European and North American markets have traditionally favored higher energy density NMC and NCA cathodes. However, recent supply chain disruptions and price volatility in nickel and cobalt markets have accelerated Western interest in LFP technology, with major manufacturers announcing significant shifts toward LFP chemistry.

Application segmentation shows distinct preference patterns across different sectors. Consumer electronics continue to prioritize high energy density cathodes like NMC and lithium cobalt oxide (LCO), while grid storage applications increasingly favor LFP for its cycle life and safety advantages. The EV segment demonstrates the most dynamic shift, with a growing bifurcation between premium vehicles utilizing high-nickel cathodes and mass-market models adopting LFP technology.

Price sensitivity analysis indicates that LFP cathodes maintain a significant cost advantage, with current market prices averaging $12-15 per kilogram compared to $30-45 for high-nickel NMC variants. This price differential has proven particularly decisive during recent raw material price fluctuations, where cobalt prices experienced volatility exceeding 300% during peak periods.

Future market projections suggest continued growth for all major cathode chemistries, though at different rates. LFP is expected to maintain the highest growth trajectory in volume terms, while high-nickel cathodes will likely retain premium market segments where maximum energy density justifies their cost premium. Emerging technologies like lithium-rich layered oxides and solid-state compatible cathodes represent potential market disruptors in the 2025-2030 timeframe.

Technical Status and Barriers in Cathode Technology

The global cathode materials market is currently experiencing significant technological evolution, with lithium iron phosphate (LFP) competing against other major cathode chemistries including nickel manganese cobalt (NMC), nickel cobalt aluminum (NCA), and lithium cobalt oxide (LCO). Each material presents distinct advantages and limitations that influence their market adoption and technological development trajectory.

LFP technology has demonstrated remarkable progress in energy density improvements, achieving approximately 160-170 Wh/kg, though this remains below the 200-220 Wh/kg typical of NMC cathodes. This energy density gap represents one of the primary technical barriers for LFP in certain applications, particularly in the electric vehicle sector where range anxiety remains a consumer concern.

Thermal stability constitutes a significant advantage for LFP, which exhibits superior safety characteristics compared to nickel-rich alternatives. While NMC and NCA cathodes face challenges with thermal runaway at temperatures above 150°C, LFP remains stable up to approximately 350°C, substantially reducing fire and explosion risks. This stability advantage, however, comes with trade-offs in electrochemical performance.

Manufacturing scalability presents varying challenges across cathode technologies. LFP benefits from simpler synthesis processes and less stringent environmental controls compared to cobalt-containing alternatives. The technical complexity of maintaining precise stoichiometry and phase purity during high-volume production remains a challenge for all cathode materials, though LFP's more forgiving chemistry offers manufacturing advantages.

Cycle life performance shows LFP outperforming competitors, with commercial cells demonstrating 2,000-3,000 cycles before reaching 80% capacity retention, compared to 1,000-1,500 cycles for typical NMC formulations. This durability advantage partially compensates for LFP's lower energy density in total lifetime energy delivery calculations.

Raw material constraints differ significantly between cathode technologies. While NMC and NCA face increasing pressure from limited cobalt and nickel supplies, with associated price volatility and ethical sourcing concerns, LFP relies on more abundant elements. However, high-purity lithium carbonate remains a shared constraint across all lithium-ion technologies.

Low-temperature performance represents a persistent technical barrier for LFP, which experiences more significant capacity loss below 0°C compared to nickel-rich cathodes. Research efforts focusing on electrolyte modifications and carbon coating optimization have improved this characteristic but have not fully closed the performance gap.

The intellectual property landscape reveals regional specialization, with Chinese manufacturers controlling approximately 75% of LFP patents, while Japanese and Korean companies maintain stronger positions in advanced NMC formulations. This geographic distribution of technical expertise influences global supply chains and technology transfer opportunities.

LFP technology has demonstrated remarkable progress in energy density improvements, achieving approximately 160-170 Wh/kg, though this remains below the 200-220 Wh/kg typical of NMC cathodes. This energy density gap represents one of the primary technical barriers for LFP in certain applications, particularly in the electric vehicle sector where range anxiety remains a consumer concern.

Thermal stability constitutes a significant advantage for LFP, which exhibits superior safety characteristics compared to nickel-rich alternatives. While NMC and NCA cathodes face challenges with thermal runaway at temperatures above 150°C, LFP remains stable up to approximately 350°C, substantially reducing fire and explosion risks. This stability advantage, however, comes with trade-offs in electrochemical performance.

Manufacturing scalability presents varying challenges across cathode technologies. LFP benefits from simpler synthesis processes and less stringent environmental controls compared to cobalt-containing alternatives. The technical complexity of maintaining precise stoichiometry and phase purity during high-volume production remains a challenge for all cathode materials, though LFP's more forgiving chemistry offers manufacturing advantages.

Cycle life performance shows LFP outperforming competitors, with commercial cells demonstrating 2,000-3,000 cycles before reaching 80% capacity retention, compared to 1,000-1,500 cycles for typical NMC formulations. This durability advantage partially compensates for LFP's lower energy density in total lifetime energy delivery calculations.

Raw material constraints differ significantly between cathode technologies. While NMC and NCA face increasing pressure from limited cobalt and nickel supplies, with associated price volatility and ethical sourcing concerns, LFP relies on more abundant elements. However, high-purity lithium carbonate remains a shared constraint across all lithium-ion technologies.

Low-temperature performance represents a persistent technical barrier for LFP, which experiences more significant capacity loss below 0°C compared to nickel-rich cathodes. Research efforts focusing on electrolyte modifications and carbon coating optimization have improved this characteristic but have not fully closed the performance gap.

The intellectual property landscape reveals regional specialization, with Chinese manufacturers controlling approximately 75% of LFP patents, while Japanese and Korean companies maintain stronger positions in advanced NMC formulations. This geographic distribution of technical expertise influences global supply chains and technology transfer opportunities.

Current Technical Solutions in Cathode Materials

01 Market growth and adoption of lithium phosphate cathode materials

The market for lithium phosphate (LiFePO4) cathode materials is experiencing significant growth due to their enhanced safety, longer cycle life, and thermal stability compared to other lithium-ion battery materials. These advantages have led to increased adoption in electric vehicles, energy storage systems, and consumer electronics. The market trend shows a shift towards LFP batteries particularly in cost-sensitive applications where energy density requirements are moderate but safety and longevity are prioritized.- Lithium iron phosphate (LFP) cathode material advancements: Recent advancements in lithium iron phosphate (LFP) cathode materials focus on improving energy density, cycling stability, and rate capability. Innovations include surface modifications, doping strategies, and novel synthesis methods to enhance electrochemical performance. These improvements address the traditional limitations of LFP such as low electronic conductivity while maintaining its advantages of safety, cost-effectiveness, and environmental friendliness.

- Nickel-rich cathode materials market growth: Nickel-rich cathode materials (NCM/NCA) are gaining significant market share due to their higher energy density compared to traditional materials. The trend is moving toward higher nickel content formulations (NCM 811, NCA 90+) to maximize energy density for electric vehicle applications. Manufacturing processes are being optimized to address challenges related to thermal stability, cycle life, and cost reduction while meeting the growing demand for longer-range electric vehicles.

- Sustainable and resource-efficient cathode technologies: The industry is shifting toward more sustainable and resource-efficient cathode materials to address supply chain concerns and environmental impact. This includes developing cobalt-free or low-cobalt formulations, recycling technologies for battery materials, and utilizing more abundant elements. These approaches aim to reduce dependency on critical raw materials while maintaining or improving battery performance characteristics.

- Solid-state battery cathode integration: Cathode materials are being adapted for use in solid-state battery technologies, representing a significant market trend. These adaptations include interface engineering between cathode and solid electrolyte, development of composite cathodes, and novel manufacturing processes. The integration challenges being addressed include volume changes during cycling, interfacial resistance, and compatibility with various solid electrolyte systems to enable the next generation of safer, higher-energy batteries.

- Advanced manufacturing and processing techniques: Innovative manufacturing and processing techniques are emerging to improve cathode material performance and reduce production costs. These include single-crystal cathode structures, gradient composition designs, and precision control of particle morphology. Advanced coating technologies, dry processing methods, and scalable synthesis routes are being developed to enhance material properties while reducing environmental impact and manufacturing expenses.

02 Advancements in high-energy density cathode materials

Research and development efforts are focused on improving high-energy density cathode materials such as nickel-rich NMC (nickel manganese cobalt oxide) and NCA (nickel cobalt aluminum oxide) formulations. These materials are being optimized to achieve higher energy densities while addressing stability and safety concerns. Market trends indicate growing demand for these materials in premium electric vehicles and portable electronics where maximum range and performance are critical factors.Expand Specific Solutions03 Sustainable and cobalt-free cathode material development

The industry is moving toward more sustainable and environmentally friendly cathode materials with reduced or eliminated cobalt content. This trend is driven by ethical concerns about cobalt mining practices and supply chain risks. Alternative materials being developed include manganese-rich formulations, sodium-ion cathodes, and other earth-abundant element compositions. These materials aim to maintain performance while reducing environmental impact and material costs.Expand Specific Solutions04 Manufacturing innovations and cost reduction strategies

Significant innovations in manufacturing processes for cathode materials are emerging to reduce production costs and improve scalability. These include water-based processing methods, direct precursor synthesis, and advanced coating technologies. The market is seeing increased investment in production capacity expansion and vertical integration of supply chains. These manufacturing advancements are critical for meeting the growing demand from electric vehicle and energy storage markets while driving down battery costs.Expand Specific Solutions05 Regional market dynamics and supply chain developments

The global cathode materials market is experiencing significant regional shifts with Asia-Pacific maintaining leadership in production capacity while North America and Europe are investing heavily to establish domestic supply chains. China continues to dominate in lithium phosphate production, but new manufacturing facilities are being established worldwide to reduce dependency. Government policies, including subsidies and regulations promoting localized battery production, are reshaping the global market landscape and influencing investment patterns.Expand Specific Solutions

Key Industry Players and Competitive Landscape

Lithium Phosphate cathode materials are gaining significant market traction in a maturing but still rapidly evolving battery materials landscape. The global market is experiencing robust growth, driven by electric vehicle adoption and energy storage applications, with projections indicating a compound annual growth rate exceeding 15% through 2030. Technologically, Lithium Phosphate offers superior safety and cycle life compared to other cathode chemistries, though with lower energy density. Key players like BYD, LG Chem, and A123 Systems have achieved commercial-scale production with established supply chains, while companies such as Nano One Materials and BTR Nano Tech are advancing next-generation manufacturing processes. Traditional battery manufacturers including Panasonic Energy, SK Innovation, and Tianjin Lishen are increasingly incorporating Lithium Phosphate into their product portfolios to diversify beyond conventional nickel-based cathodes.

BYD Co., Ltd.

Technical Solution: BYD has pioneered the development and commercialization of Lithium Iron Phosphate (LFP) batteries through their proprietary Blade Battery technology. This innovative cell-to-pack design eliminates the need for module housing, increasing energy density by 50% compared to conventional LFP packs. BYD's approach focuses on prismatic cell formats that optimize thermal management and structural integrity. Their manufacturing process includes precision control of particle morphology and size distribution, achieving 99.9% purity in phosphate precursors. BYD has invested heavily in vertical integration, controlling the entire supply chain from raw materials to finished batteries, which has allowed them to reduce production costs by approximately 30% compared to industry averages. Their LFP cathode formulation incorporates nano-scale doping with elements like manganese and zinc to enhance conductivity while maintaining the inherent safety advantages of LFP chemistry.

Strengths: Superior safety profile with virtually no risk of thermal runaway; longer cycle life (over 3,000 cycles); lower raw material costs due to absence of cobalt and nickel; excellent thermal stability. Weaknesses: Lower energy density compared to NMC/NCA cathodes (approximately 30% less); reduced performance in cold temperatures; higher initial manufacturing complexity requiring precise control of synthesis parameters.

LG Chem Ltd.

Technical Solution: LG Chem has developed a hybrid approach to cathode materials, focusing on advanced NMC (Nickel Manganese Cobalt) formulations while strategically incorporating LFP technology for specific applications. Their NMCA (Nickel Manganese Cobalt Aluminum) cathode technology achieves energy densities of 700-800 Wh/L, significantly higher than LFP's typical 450 Wh/L. LG Chem's manufacturing process for high-nickel cathodes involves precise control of precursor co-precipitation, with proprietary stabilization techniques to prevent oxygen release during cycling. For their LFP offerings, they've developed a modified synthesis route using hydrothermal methods that improves crystallinity and reduces impurities. Their cathode material portfolio strategically positions different chemistries for specific applications: NMCA for premium EVs requiring maximum range, NMC622/NMC712 for mainstream applications balancing cost and performance, and LFP for energy storage systems and entry-level EVs where cost and safety are prioritized over energy density.

Strengths: Diversified cathode portfolio allowing optimization for different applications; high energy density solutions with NMC/NMCA; established global manufacturing footprint; strong vertical integration. Weaknesses: Higher exposure to nickel and cobalt price volatility compared to LFP-focused competitors; more complex supply chain management; greater environmental footprint from nickel and cobalt mining operations.

Critical Patents and Innovations in Lithium Phosphate

Cathode materials for lithium batteries

PatentWO2009117869A1

Innovation

- A cathode material composition comprising lithium metal phosphate salts and lithium transition metal oxides, with specific chemical formulas and particle sizes, combined with a binder and conductive additives, to enhance electrical and thermal performance.

Cathode material

PatentWO2022058737A1

Innovation

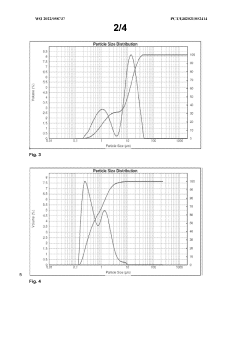

- A composition comprising carbon-coated particles of agglomerated lithium metal phosphate and carbon-coated powder lithium metal phosphate, with specific particle size distributions and a weight ratio, optimized to achieve high volumetric and gravimetric capacities and rate capabilities, is developed, utilizing a hydrothermal process and carbon coating to enhance properties.

Supply Chain Resilience and Raw Material Considerations

The supply chain for lithium phosphate (LFP) cathode materials demonstrates distinct advantages over competing cathode chemistries, particularly in terms of raw material accessibility and geopolitical distribution. Phosphorus and iron, key components of LFP, are abundant globally and sourced from diverse geographical regions, reducing dependency on politically sensitive areas. This contrasts sharply with nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminum (NCA) cathodes, which rely heavily on cobalt predominantly mined in the Democratic Republic of Congo, creating significant supply vulnerabilities.

LFP supply chains have shown remarkable resilience during recent global disruptions, including the COVID-19 pandemic and international trade tensions. While NMC and NCA material prices fluctuated dramatically due to nickel and cobalt supply constraints, LFP material costs remained relatively stable, providing manufacturers with greater pricing predictability and risk management capabilities.

China currently dominates the LFP production landscape, controlling approximately 90% of global manufacturing capacity. However, recent geopolitical shifts have accelerated supply chain diversification efforts, with significant investments in LFP production facilities across North America, Europe, and other Asian countries. This emerging geographical diversification represents a strategic advantage for LFP adoption in various markets concerned with supply security.

Raw material processing for LFP also presents fewer environmental and social challenges compared to other cathode materials. The extraction and refinement of lithium, phosphorus, and iron generally involve less intensive mining operations and fewer associated environmental impacts than cobalt and nickel extraction. This aligns with increasing regulatory pressure and corporate sustainability commitments worldwide.

The simplified supply chain for LFP materials translates to reduced procurement complexity and potentially lower supply chain management costs. With fewer critical raw materials requiring specialized handling and fewer geopolitically sensitive sourcing regions, LFP-based battery manufacturers can implement more streamlined logistics and inventory management systems.

Looking forward, the LFP supply chain appears positioned for continued growth and resilience. Ongoing investments in production capacity outside China, coupled with technological advancements in manufacturing efficiency, suggest improving economies of scale. Additionally, the relative abundance of raw materials indicates less vulnerability to supply shocks that periodically affect nickel and cobalt markets, providing a compelling advantage for mass-market applications where cost predictability and supply security outweigh energy density considerations.

LFP supply chains have shown remarkable resilience during recent global disruptions, including the COVID-19 pandemic and international trade tensions. While NMC and NCA material prices fluctuated dramatically due to nickel and cobalt supply constraints, LFP material costs remained relatively stable, providing manufacturers with greater pricing predictability and risk management capabilities.

China currently dominates the LFP production landscape, controlling approximately 90% of global manufacturing capacity. However, recent geopolitical shifts have accelerated supply chain diversification efforts, with significant investments in LFP production facilities across North America, Europe, and other Asian countries. This emerging geographical diversification represents a strategic advantage for LFP adoption in various markets concerned with supply security.

Raw material processing for LFP also presents fewer environmental and social challenges compared to other cathode materials. The extraction and refinement of lithium, phosphorus, and iron generally involve less intensive mining operations and fewer associated environmental impacts than cobalt and nickel extraction. This aligns with increasing regulatory pressure and corporate sustainability commitments worldwide.

The simplified supply chain for LFP materials translates to reduced procurement complexity and potentially lower supply chain management costs. With fewer critical raw materials requiring specialized handling and fewer geopolitically sensitive sourcing regions, LFP-based battery manufacturers can implement more streamlined logistics and inventory management systems.

Looking forward, the LFP supply chain appears positioned for continued growth and resilience. Ongoing investments in production capacity outside China, coupled with technological advancements in manufacturing efficiency, suggest improving economies of scale. Additionally, the relative abundance of raw materials indicates less vulnerability to supply shocks that periodically affect nickel and cobalt markets, providing a compelling advantage for mass-market applications where cost predictability and supply security outweigh energy density considerations.

Environmental Impact and Sustainability Assessment

The environmental footprint of lithium phosphate (LFP) cathode materials presents a significantly more favorable profile compared to other mainstream cathode materials such as nickel manganese cobalt (NMC) and nickel cobalt aluminum (NCA). LFP production generates approximately 30% lower carbon emissions throughout its lifecycle, primarily due to the absence of nickel and cobalt mining operations, which are energy-intensive and environmentally disruptive.

Raw material extraction for LFP involves less destructive mining practices compared to cobalt extraction, which has been associated with severe environmental degradation and water pollution, particularly in the Democratic Republic of Congo. The phosphate mining required for LFP production typically has lower environmental impact metrics across land use, water consumption, and ecosystem disruption parameters.

Manufacturing processes for LFP cathodes consume less energy and generate fewer toxic byproducts than nickel-rich alternatives. Recent life cycle assessment (LCA) studies indicate that LFP battery production requires approximately 50-60 kWh of energy per kWh of battery capacity, compared to 65-75 kWh for NMC batteries, representing a meaningful efficiency advantage.

Water usage metrics further highlight LFP's sustainability advantages, with production requiring approximately 40-50 liters per kWh of battery capacity, versus 65-85 liters for cobalt-containing cathodes. This reduced water footprint becomes increasingly significant as battery production scales globally, particularly in water-stressed regions.

End-of-life considerations strongly favor LFP chemistry. The absence of valuable but toxic elements like cobalt and nickel simplifies recycling processes and reduces hazardous waste management requirements. Current recycling technologies can recover up to 95% of lithium and phosphate components from spent LFP batteries, compared to 80-90% recovery rates for other cathode materials.

Regulatory compliance trajectories also favor LFP adoption, as environmental legislation increasingly incorporates carbon footprint metrics and responsible sourcing requirements. The European Battery Directive revisions and similar frameworks in North America and Asia are establishing sustainability benchmarks that inherently advantage LFP chemistry over alternatives with more complex supply chains and higher environmental impacts.

While LFP's environmental advantages are substantial, continued innovation in manufacturing efficiency and recycling technologies remains essential to maximize its sustainability benefits as deployment scales. Emerging research into water-based processing and direct recycling methods could further enhance LFP's environmental credentials relative to competing cathode materials.

Raw material extraction for LFP involves less destructive mining practices compared to cobalt extraction, which has been associated with severe environmental degradation and water pollution, particularly in the Democratic Republic of Congo. The phosphate mining required for LFP production typically has lower environmental impact metrics across land use, water consumption, and ecosystem disruption parameters.

Manufacturing processes for LFP cathodes consume less energy and generate fewer toxic byproducts than nickel-rich alternatives. Recent life cycle assessment (LCA) studies indicate that LFP battery production requires approximately 50-60 kWh of energy per kWh of battery capacity, compared to 65-75 kWh for NMC batteries, representing a meaningful efficiency advantage.

Water usage metrics further highlight LFP's sustainability advantages, with production requiring approximately 40-50 liters per kWh of battery capacity, versus 65-85 liters for cobalt-containing cathodes. This reduced water footprint becomes increasingly significant as battery production scales globally, particularly in water-stressed regions.

End-of-life considerations strongly favor LFP chemistry. The absence of valuable but toxic elements like cobalt and nickel simplifies recycling processes and reduces hazardous waste management requirements. Current recycling technologies can recover up to 95% of lithium and phosphate components from spent LFP batteries, compared to 80-90% recovery rates for other cathode materials.

Regulatory compliance trajectories also favor LFP adoption, as environmental legislation increasingly incorporates carbon footprint metrics and responsible sourcing requirements. The European Battery Directive revisions and similar frameworks in North America and Asia are establishing sustainability benchmarks that inherently advantage LFP chemistry over alternatives with more complex supply chains and higher environmental impacts.

While LFP's environmental advantages are substantial, continued innovation in manufacturing efficiency and recycling technologies remains essential to maximize its sustainability benefits as deployment scales. Emerging research into water-based processing and direct recycling methods could further enhance LFP's environmental credentials relative to competing cathode materials.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!