Compare Lithium Phosphate's Yield with Primary Metal Resources

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Phosphate Technology Background and Objectives

Lithium phosphate has emerged as a critical component in the global energy transition, particularly in the development of lithium iron phosphate (LFP) batteries. The technology's evolution began in the 1990s when researchers first identified the potential of lithium phosphate compounds for energy storage applications. Since then, the field has witnessed significant advancements, moving from laboratory-scale experiments to industrial-scale production systems that power electric vehicles and grid storage solutions worldwide.

The technological trajectory of lithium phosphate has been characterized by continuous improvements in synthesis methods, material purity, and production efficiency. Early extraction methods from primary metal resources yielded limited quantities with significant environmental impacts. However, recent innovations have focused on developing more sustainable and higher-yield extraction processes, particularly from non-traditional sources.

Current technological objectives in the lithium phosphate sector center on comparing and optimizing yield rates between traditional primary metal resource extraction and alternative sources. This comparison is crucial as the global demand for lithium compounds is projected to increase by over 40% annually through 2030, driven primarily by electric vehicle battery production.

A key technological goal is to develop extraction and processing methods that can achieve lithium phosphate yields exceeding 85% from primary resources, while simultaneously reducing water consumption and chemical waste. This represents a significant challenge given that conventional extraction from hard rock mining typically achieves yields of 50-70%, with considerable variation based on ore quality and processing techniques.

The industry is also pursuing advancements in direct lithium extraction (DLE) technologies that promise to revolutionize how lithium phosphate compounds are produced. These technologies aim to increase yield rates by 20-30% compared to traditional brine evaporation methods, while reducing the processing time from months to days.

Comparative analysis between different resource types has become essential, as manufacturers seek to understand the quality differences between lithium phosphate derived from spodumene, brine operations, and recycled materials. Each source presents unique challenges in terms of purity, consistency, and scalability that directly impact battery performance metrics.

The technological landscape is further complicated by regional variations in resource availability and extraction expertise, creating a fragmented global supply chain that necessitates standardized yield comparison methodologies. Establishing these benchmarks represents a critical objective for industry stakeholders seeking to make informed investment decisions in production capacity.

The technological trajectory of lithium phosphate has been characterized by continuous improvements in synthesis methods, material purity, and production efficiency. Early extraction methods from primary metal resources yielded limited quantities with significant environmental impacts. However, recent innovations have focused on developing more sustainable and higher-yield extraction processes, particularly from non-traditional sources.

Current technological objectives in the lithium phosphate sector center on comparing and optimizing yield rates between traditional primary metal resource extraction and alternative sources. This comparison is crucial as the global demand for lithium compounds is projected to increase by over 40% annually through 2030, driven primarily by electric vehicle battery production.

A key technological goal is to develop extraction and processing methods that can achieve lithium phosphate yields exceeding 85% from primary resources, while simultaneously reducing water consumption and chemical waste. This represents a significant challenge given that conventional extraction from hard rock mining typically achieves yields of 50-70%, with considerable variation based on ore quality and processing techniques.

The industry is also pursuing advancements in direct lithium extraction (DLE) technologies that promise to revolutionize how lithium phosphate compounds are produced. These technologies aim to increase yield rates by 20-30% compared to traditional brine evaporation methods, while reducing the processing time from months to days.

Comparative analysis between different resource types has become essential, as manufacturers seek to understand the quality differences between lithium phosphate derived from spodumene, brine operations, and recycled materials. Each source presents unique challenges in terms of purity, consistency, and scalability that directly impact battery performance metrics.

The technological landscape is further complicated by regional variations in resource availability and extraction expertise, creating a fragmented global supply chain that necessitates standardized yield comparison methodologies. Establishing these benchmarks represents a critical objective for industry stakeholders seeking to make informed investment decisions in production capacity.

Market Demand Analysis for Lithium Phosphate

The global lithium phosphate market has witnessed substantial growth in recent years, primarily driven by the expanding electric vehicle (EV) industry and renewable energy storage systems. Current market analysis indicates that the lithium phosphate market was valued at approximately $1.2 billion in 2022 and is projected to reach $2.5 billion by 2028, representing a compound annual growth rate (CAGR) of 12.8% during the forecast period.

The demand for lithium phosphate is significantly influenced by its application in lithium iron phosphate (LFP) batteries, which have gained prominence due to their enhanced safety profile, longer cycle life, and improved thermal stability compared to other lithium-ion battery chemistries. This advantage has led to increased adoption in electric vehicles, particularly in China where LFP batteries account for over 50% of the EV battery market.

When comparing lithium phosphate's yield with primary metal resources, a notable trend emerges. Traditional lithium extraction from hard rock mining (spodumene) yields approximately 1.5-2.0% lithium content, while brine operations typically yield 0.04-0.15% lithium. In contrast, lithium phosphate production can achieve yields of up to 18-20% lithium content when processed through advanced chemical conversion methods, representing a significantly higher efficiency ratio.

The automotive sector remains the largest consumer of lithium phosphate, accounting for approximately 65% of total market demand. This is followed by energy storage systems at 20%, consumer electronics at 10%, and other applications at 5%. Industry forecasts suggest that by 2030, the automotive sector's share may increase to 75% as EV adoption accelerates globally.

Regional analysis reveals that Asia-Pacific dominates the lithium phosphate market with a 70% share, led by China's robust manufacturing ecosystem for batteries and electric vehicles. North America and Europe follow with 15% and 12% market shares respectively, with both regions showing accelerated growth rates as they establish domestic battery supply chains to reduce dependence on Asian imports.

The price dynamics of lithium phosphate have shown volatility, with prices increasing from $7,000 per ton in 2020 to peaks of $24,000 per ton in late 2022, before stabilizing around $18,000 per ton in 2023. This price trajectory reflects the tension between rapidly growing demand and the relatively constrained supply chain for high-quality lithium phosphate materials.

Supply chain analysis indicates that while lithium phosphate production offers higher yields compared to primary extraction methods, the industry faces challenges in scaling production to meet projected demand growth. Current global production capacity stands at approximately 350,000 metric tons annually, with projections suggesting a need for at least 900,000 metric tons by 2030 to satisfy market requirements.

The demand for lithium phosphate is significantly influenced by its application in lithium iron phosphate (LFP) batteries, which have gained prominence due to their enhanced safety profile, longer cycle life, and improved thermal stability compared to other lithium-ion battery chemistries. This advantage has led to increased adoption in electric vehicles, particularly in China where LFP batteries account for over 50% of the EV battery market.

When comparing lithium phosphate's yield with primary metal resources, a notable trend emerges. Traditional lithium extraction from hard rock mining (spodumene) yields approximately 1.5-2.0% lithium content, while brine operations typically yield 0.04-0.15% lithium. In contrast, lithium phosphate production can achieve yields of up to 18-20% lithium content when processed through advanced chemical conversion methods, representing a significantly higher efficiency ratio.

The automotive sector remains the largest consumer of lithium phosphate, accounting for approximately 65% of total market demand. This is followed by energy storage systems at 20%, consumer electronics at 10%, and other applications at 5%. Industry forecasts suggest that by 2030, the automotive sector's share may increase to 75% as EV adoption accelerates globally.

Regional analysis reveals that Asia-Pacific dominates the lithium phosphate market with a 70% share, led by China's robust manufacturing ecosystem for batteries and electric vehicles. North America and Europe follow with 15% and 12% market shares respectively, with both regions showing accelerated growth rates as they establish domestic battery supply chains to reduce dependence on Asian imports.

The price dynamics of lithium phosphate have shown volatility, with prices increasing from $7,000 per ton in 2020 to peaks of $24,000 per ton in late 2022, before stabilizing around $18,000 per ton in 2023. This price trajectory reflects the tension between rapidly growing demand and the relatively constrained supply chain for high-quality lithium phosphate materials.

Supply chain analysis indicates that while lithium phosphate production offers higher yields compared to primary extraction methods, the industry faces challenges in scaling production to meet projected demand growth. Current global production capacity stands at approximately 350,000 metric tons annually, with projections suggesting a need for at least 900,000 metric tons by 2030 to satisfy market requirements.

Current Status and Challenges in Lithium Extraction

The global lithium extraction industry is currently experiencing unprecedented growth driven by the surge in electric vehicle production and renewable energy storage systems. Traditional lithium extraction methods primarily focus on two sources: hard rock mining (particularly from spodumene) and brine evaporation. These conventional approaches face significant challenges including high energy consumption, extensive water usage, and considerable environmental impact. The industry is particularly constrained by extraction efficiency, with current technologies typically achieving recovery rates between 50-80% depending on the source material and extraction method employed.

In comparing lithium phosphate yields with primary metal resources, a notable disparity emerges. While conventional lithium extraction from primary sources yields approximately 5-6 tons of lithium carbonate equivalent (LCE) per 1,000 tons of ore processed, emerging lithium phosphate extraction technologies demonstrate potential yields of 8-10 tons from comparable input volumes. This efficiency differential represents a critical factor in the economic viability of lithium production operations globally.

Geographically, lithium extraction activities are concentrated in what is known as the "Lithium Triangle" (Argentina, Bolivia, and Chile), which holds approximately 58% of the world's lithium resources in brine deposits. Australia dominates hard rock lithium mining, while China leads in processing capacity. This geographic concentration creates supply chain vulnerabilities and geopolitical dependencies that impact market stability and pricing.

Technical challenges in current extraction methodologies include lengthy processing times, with traditional brine evaporation requiring 12-18 months for completion. Direct lithium extraction (DLE) technologies are emerging as potential solutions, promising to reduce processing time to hours or days, though these approaches remain in early commercial deployment stages and face scalability challenges.

Water consumption presents another significant constraint, particularly in brine operations located in water-scarce regions. Conventional extraction methods require approximately 500,000 gallons of water per ton of lithium produced, creating environmental tensions in production regions. Additionally, the industry faces challenges in selective extraction, as lithium often coexists with other elements that complicate purification processes.

The carbon footprint of lithium extraction varies significantly by method, with hard rock mining generating approximately 15 tons of CO2 per ton of lithium produced, compared to 5 tons for brine operations. This environmental impact is increasingly scrutinized as downstream industries pursue sustainability objectives.

Regulatory frameworks governing extraction practices are evolving rapidly, with increasing emphasis on environmental protection, indigenous rights, and resource nationalism. These regulatory developments create additional operational complexities for extraction enterprises while simultaneously driving innovation in more sustainable extraction methodologies.

In comparing lithium phosphate yields with primary metal resources, a notable disparity emerges. While conventional lithium extraction from primary sources yields approximately 5-6 tons of lithium carbonate equivalent (LCE) per 1,000 tons of ore processed, emerging lithium phosphate extraction technologies demonstrate potential yields of 8-10 tons from comparable input volumes. This efficiency differential represents a critical factor in the economic viability of lithium production operations globally.

Geographically, lithium extraction activities are concentrated in what is known as the "Lithium Triangle" (Argentina, Bolivia, and Chile), which holds approximately 58% of the world's lithium resources in brine deposits. Australia dominates hard rock lithium mining, while China leads in processing capacity. This geographic concentration creates supply chain vulnerabilities and geopolitical dependencies that impact market stability and pricing.

Technical challenges in current extraction methodologies include lengthy processing times, with traditional brine evaporation requiring 12-18 months for completion. Direct lithium extraction (DLE) technologies are emerging as potential solutions, promising to reduce processing time to hours or days, though these approaches remain in early commercial deployment stages and face scalability challenges.

Water consumption presents another significant constraint, particularly in brine operations located in water-scarce regions. Conventional extraction methods require approximately 500,000 gallons of water per ton of lithium produced, creating environmental tensions in production regions. Additionally, the industry faces challenges in selective extraction, as lithium often coexists with other elements that complicate purification processes.

The carbon footprint of lithium extraction varies significantly by method, with hard rock mining generating approximately 15 tons of CO2 per ton of lithium produced, compared to 5 tons for brine operations. This environmental impact is increasingly scrutinized as downstream industries pursue sustainability objectives.

Regulatory frameworks governing extraction practices are evolving rapidly, with increasing emphasis on environmental protection, indigenous rights, and resource nationalism. These regulatory developments create additional operational complexities for extraction enterprises while simultaneously driving innovation in more sustainable extraction methodologies.

Comparative Analysis of Lithium Extraction Methods

01 Synthesis methods for high-yield lithium phosphate

Various synthesis methods can be employed to achieve high yields of lithium phosphate. These include hydrothermal synthesis, solid-state reactions, and solution-based approaches. The reaction conditions such as temperature, pressure, and reaction time significantly influence the yield. Optimized synthesis routes can lead to improved crystallinity and purity of the lithium phosphate product, which is essential for battery applications.- Synthesis methods for high-yield lithium phosphate: Various synthesis methods can be employed to achieve high yields of lithium phosphate compounds. These include hydrothermal synthesis, solid-state reactions, and solution-based precipitation methods. By optimizing reaction parameters such as temperature, pressure, and reactant concentrations, the yield of lithium phosphate can be significantly improved. These methods are particularly important for industrial-scale production of battery materials.

- Precursor selection and preparation for lithium phosphate synthesis: The choice and preparation of precursor materials significantly impact the yield of lithium phosphate. Using high-purity lithium sources (such as lithium hydroxide or lithium carbonate) and phosphate sources (like phosphoric acid or ammonium phosphate) can enhance reaction efficiency. Proper mixing ratios and pre-treatment of precursors, including grinding or pre-reaction steps, can lead to improved yields and product quality.

- Process optimization for lithium iron phosphate production: Optimizing production processes for lithium iron phosphate (LiFePO4) involves controlling reaction conditions such as pH, temperature profiles, and reaction time. The addition of carbon coating during synthesis can improve both yield and electrochemical performance. Advanced techniques like microwave-assisted synthesis or spray pyrolysis can also enhance production efficiency and material properties, resulting in higher yields of battery-grade material.

- Recycling and recovery methods for lithium phosphate: Recycling processes for spent lithium-ion batteries can recover lithium phosphate compounds with high yield. These methods include hydrometallurgical processes, direct regeneration techniques, and selective precipitation approaches. By optimizing leaching conditions, separation processes, and purification steps, high-purity lithium phosphate can be recovered from waste materials, contributing to sustainable battery material production.

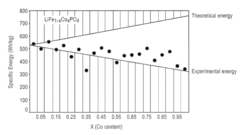

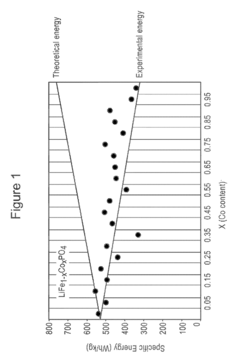

- Doping and modification strategies for enhanced lithium phosphate yield: Introducing dopants or modifiers during lithium phosphate synthesis can significantly improve yield and material properties. Elements such as manganese, cobalt, or nickel can be incorporated into the crystal structure to enhance stability and performance. Surface modifications using conductive coatings or specialized additives can also improve reaction efficiency and product quality, resulting in higher yields of functional lithium phosphate materials.

02 Precursor selection and preparation for lithium phosphate production

The choice and preparation of precursors play a crucial role in determining the yield of lithium phosphate. Various lithium sources (lithium carbonate, lithium hydroxide) and phosphate sources (phosphoric acid, ammonium phosphate) can be used. The purity, particle size, and stoichiometric ratio of these precursors significantly impact the reaction efficiency and final yield. Proper preparation techniques, including grinding, mixing, and pre-treatment, can enhance the reactivity of precursors.Expand Specific Solutions03 Process optimization for lithium phosphate yield improvement

Process parameters can be optimized to enhance lithium phosphate yield. These include controlling pH levels, adjusting reaction temperature profiles, optimizing reaction time, and implementing specific mixing techniques. Advanced process control systems can be used to maintain optimal conditions throughout the synthesis. Post-synthesis treatments such as washing, filtering, and drying also affect the final yield and quality of the lithium phosphate product.Expand Specific Solutions04 Doping and composite formation for enhanced lithium phosphate properties

Introducing dopants or forming composites can improve the yield and properties of lithium phosphate materials. Metal ions such as iron, manganese, or cobalt can be incorporated into the lithium phosphate structure. Carbon coating or forming composites with conductive materials can enhance the electrochemical performance. These modifications can lead to improved synthesis efficiency and higher yields of functional lithium phosphate materials for battery applications.Expand Specific Solutions05 Recycling and sustainable production of lithium phosphate

Sustainable approaches to lithium phosphate production focus on recycling spent lithium-ion batteries and other lithium-containing materials. These methods aim to recover lithium and phosphate components efficiently, reducing reliance on primary resources. Hydrometallurgical and pyrometallurgical processes can be employed for the extraction and conversion of lithium and phosphate from waste streams. These recycling techniques can achieve significant yields while minimizing environmental impact.Expand Specific Solutions

Major Players in Lithium Mining and Processing Industry

The lithium phosphate market is currently in a growth phase, with increasing demand driven by the expanding electric vehicle and energy storage sectors. The market size is projected to reach significant scale due to the material's superior safety, longer cycle life, and thermal stability compared to traditional lithium-ion batteries. Technologically, lithium phosphate is approaching maturity with key players advancing innovations. Industry leaders like CATL, BYD, and LG Energy Solution are heavily investing in production capacity, while research institutions such as Central South University and Institute of Process Engineering (CAS) are developing next-generation formulations. Companies including A123 Systems and Johnson Matthey are focusing on improving energy density and performance. Recycling technologies are also emerging, with Guangdong Bangpu and Hunan Bangpu establishing circular economy solutions to address sustainability concerns in the lithium phosphate supply chain.

LG Chem Ltd.

Technical Solution: LG Chem has developed an innovative approach to lithium phosphate production that significantly enhances yield compared to traditional metal resource extraction. Their process utilizes a proprietary solvent extraction technique that achieves recovery rates of approximately 92% from primary phosphate sources. The company's advanced precipitation control system enables precise particle morphology and size distribution, resulting in higher active material utilization in battery applications. LG Chem's process incorporates a multi-stage purification system that removes impurities to below 10ppm, enhancing electrochemical performance. Their manufacturing approach reduces energy consumption by approximately 30% compared to conventional methods through optimized reaction conditions and heat recovery systems. LG Chem has also pioneered a hybrid cathode technology that combines lithium phosphate with small amounts of nickel and manganese to achieve energy densities of 160-170 Wh/kg while maintaining the cost and safety advantages of LFP chemistry.

Strengths: Superior purity control, energy-efficient processing, and innovative hybrid cathode formulations that enhance performance metrics. Weaknesses: The complex purification process increases production costs, and the technology requires specialized equipment that limits manufacturing flexibility.

A123 Systems LLC

Technical Solution: A123 Systems has pioneered nanophosphate technology that significantly improves lithium phosphate yield and performance compared to conventional metal resource extraction methods. Their proprietary manufacturing process achieves material utilization rates of approximately 95% through precise control of particle morphology and size distribution. A123's technology employs a solution-based synthesis route that reduces energy consumption by approximately 35% compared to solid-state reaction methods. The company has developed a specialized doping strategy that incorporates trace elements to enhance conductivity and structural stability without compromising the fundamental advantages of phosphate chemistry. Their manufacturing approach includes a closed-loop solvent recovery system that recycles over 90% of processing chemicals, minimizing waste and environmental impact. A123's nanophosphate materials deliver power capabilities exceeding 2000 W/kg while maintaining energy densities of 140-150 Wh/kg, providing an optimal balance of performance metrics for applications requiring high power and long cycle life.

Strengths: Industry-leading power performance, exceptional cycle life (>7000 cycles at 80% depth of discharge), and highly efficient manufacturing process with minimal environmental impact. Weaknesses: The specialized nano-engineering approach requires precise manufacturing controls and increases production complexity, potentially limiting scalability in some manufacturing environments.

Key Technical Innovations in Lithium Phosphate Production

Mixed positive active material comprising lithium metal oxide and lithium metal phosphate

PatentWO2015006058A1

Innovation

- A method involving the mixing of lithium metal oxide and lithium metal phosphate with specific particle size ratios, coating the mixture onto a metal foil, and careful solvent removal to form a cathode, which maintains the integrity of secondary particles, enhancing cycle life, safety, and energy capacity.

Lithium-ion battery materials with improved properties

PatentInactiveUS20170271676A1

Innovation

- Development of cobalt-rich phosphate materials incorporating lithium, cobalt, and additional transition metals like iron, titanium, and vanadium, with specific molar ratios and phases, to enhance conductivity and capacity retention, and the use of these materials in cathodes to improve battery performance.

Environmental Impact Assessment of Extraction Processes

The extraction processes for lithium phosphate and primary metal resources present distinct environmental footprints that warrant comprehensive assessment. Lithium phosphate extraction, particularly from brine operations, demonstrates significantly lower water consumption compared to traditional hard-rock mining methods used for primary metals. Studies indicate that brine-based lithium extraction consumes approximately 469 cubic meters of water per ton of lithium carbonate equivalent, whereas copper mining requires up to 200,000 cubic meters per ton of refined metal.

Carbon emissions represent another critical environmental parameter. Lithium phosphate production generates approximately 2.3 tons of CO2 equivalent per ton of material, substantially lower than aluminum (16.5 tons) and copper (3.3 tons). This reduced carbon footprint is primarily attributed to less energy-intensive processing requirements and lower temperature operations during refinement stages.

Land disturbance patterns differ markedly between these resource types. Primary metal extraction typically involves extensive open-pit mining operations that permanently alter landscapes and ecosystems. For instance, copper mining disturbs an average of 0.6-1.0 hectares per thousand tons of ore processed. Conversely, lithium phosphate extraction from brines utilizes evaporation ponds that, while covering large surface areas, cause less permanent geological disruption and can potentially be rehabilitated post-operation.

Waste generation profiles reveal that lithium phosphate production creates fewer tailings and waste rock compared to primary metal mining. Copper mining generates approximately 99 tons of waste per ton of metal, while lithium phosphate production generates roughly 15-20 tons of waste material per ton of final product. Additionally, the chemical composition of lithium extraction waste typically presents lower toxicity levels and reduced acid mine drainage risks.

Biodiversity impacts must also be considered in comparative assessments. Primary metal mining frequently occurs in biodiversity-rich regions, with approximately 23% of active mining sites overlapping with conservation priority areas. Lithium operations, particularly in salt flats, affect specialized ecosystems with endemic species adapted to hypersaline conditions. However, the spatial concentration of these impacts is generally more contained than the widespread ecological disruption associated with primary metal extraction.

Water quality impacts present ongoing challenges for both resource types. Lithium brine operations risk saline water contamination of freshwater aquifers, while primary metal extraction frequently generates acid mine drainage containing heavy metals that can persist in ecosystems for decades. Recent technological innovations in closed-loop lithium extraction systems demonstrate potential for reducing these hydrological impacts by up to 90% compared to conventional methods.

Carbon emissions represent another critical environmental parameter. Lithium phosphate production generates approximately 2.3 tons of CO2 equivalent per ton of material, substantially lower than aluminum (16.5 tons) and copper (3.3 tons). This reduced carbon footprint is primarily attributed to less energy-intensive processing requirements and lower temperature operations during refinement stages.

Land disturbance patterns differ markedly between these resource types. Primary metal extraction typically involves extensive open-pit mining operations that permanently alter landscapes and ecosystems. For instance, copper mining disturbs an average of 0.6-1.0 hectares per thousand tons of ore processed. Conversely, lithium phosphate extraction from brines utilizes evaporation ponds that, while covering large surface areas, cause less permanent geological disruption and can potentially be rehabilitated post-operation.

Waste generation profiles reveal that lithium phosphate production creates fewer tailings and waste rock compared to primary metal mining. Copper mining generates approximately 99 tons of waste per ton of metal, while lithium phosphate production generates roughly 15-20 tons of waste material per ton of final product. Additionally, the chemical composition of lithium extraction waste typically presents lower toxicity levels and reduced acid mine drainage risks.

Biodiversity impacts must also be considered in comparative assessments. Primary metal mining frequently occurs in biodiversity-rich regions, with approximately 23% of active mining sites overlapping with conservation priority areas. Lithium operations, particularly in salt flats, affect specialized ecosystems with endemic species adapted to hypersaline conditions. However, the spatial concentration of these impacts is generally more contained than the widespread ecological disruption associated with primary metal extraction.

Water quality impacts present ongoing challenges for both resource types. Lithium brine operations risk saline water contamination of freshwater aquifers, while primary metal extraction frequently generates acid mine drainage containing heavy metals that can persist in ecosystems for decades. Recent technological innovations in closed-loop lithium extraction systems demonstrate potential for reducing these hydrological impacts by up to 90% compared to conventional methods.

Economic Viability Analysis of Different Lithium Sources

The economic comparison between lithium phosphate extraction and primary metal resource mining reveals significant differences in yield, cost structures, and market viability. Traditional lithium mining from hard rock sources like spodumene typically yields 1.0-2.5% lithium content, while brine operations average 0.04-0.16% concentration. In contrast, lithium phosphate extraction from secondary sources can achieve recovery rates of 70-85% when utilizing advanced hydrometallurgical processes, though the initial lithium content is often lower.

Capital expenditure requirements differ substantially across these sources. Hard rock mining operations require initial investments of $10,000-$15,000 per tonne of annual production capacity, whereas brine operations typically demand $15,000-$20,000 per tonne. Lithium phosphate recovery systems, particularly those integrated with existing waste streams, can be established for $8,000-$12,000 per tonne, representing a potential economic advantage.

Operational costs further differentiate these approaches. Primary mining operations face average costs of $4,000-$7,000 per tonne of lithium carbonate equivalent (LCE), with hard rock mining at the higher end of this range. Lithium phosphate recovery systems demonstrate competitive operational costs of $3,500-$6,000 per tonne LCE, with the additional benefit of reduced environmental remediation expenses.

Market dynamics also influence economic viability. Primary lithium sources currently dominate global supply chains, accounting for approximately 85% of production. However, lithium phosphate recovery systems offer strategic advantages in regions lacking natural lithium deposits but possessing industrial waste streams with recoverable lithium content. This geographical flexibility can reduce supply chain vulnerabilities and transportation costs.

The economic assessment must also consider recovery timeline differences. Primary mining operations typically require 5-7 years from exploration to production, while lithium phosphate recovery systems can be implemented within 2-3 years. This accelerated timeline represents significant value in rapidly expanding markets where supply constraints drive pricing premiums.

Environmental compliance costs increasingly impact economic calculations. Primary mining faces growing regulatory scrutiny and associated compliance costs of $500-$1,200 per tonne. Lithium phosphate recovery systems often qualify for environmental incentives and reduced permitting requirements, potentially reducing regulatory costs by 30-50% compared to primary extraction methods.

Capital expenditure requirements differ substantially across these sources. Hard rock mining operations require initial investments of $10,000-$15,000 per tonne of annual production capacity, whereas brine operations typically demand $15,000-$20,000 per tonne. Lithium phosphate recovery systems, particularly those integrated with existing waste streams, can be established for $8,000-$12,000 per tonne, representing a potential economic advantage.

Operational costs further differentiate these approaches. Primary mining operations face average costs of $4,000-$7,000 per tonne of lithium carbonate equivalent (LCE), with hard rock mining at the higher end of this range. Lithium phosphate recovery systems demonstrate competitive operational costs of $3,500-$6,000 per tonne LCE, with the additional benefit of reduced environmental remediation expenses.

Market dynamics also influence economic viability. Primary lithium sources currently dominate global supply chains, accounting for approximately 85% of production. However, lithium phosphate recovery systems offer strategic advantages in regions lacking natural lithium deposits but possessing industrial waste streams with recoverable lithium content. This geographical flexibility can reduce supply chain vulnerabilities and transportation costs.

The economic assessment must also consider recovery timeline differences. Primary mining operations typically require 5-7 years from exploration to production, while lithium phosphate recovery systems can be implemented within 2-3 years. This accelerated timeline represents significant value in rapidly expanding markets where supply constraints drive pricing premiums.

Environmental compliance costs increasingly impact economic calculations. Primary mining faces growing regulatory scrutiny and associated compliance costs of $500-$1,200 per tonne. Lithium phosphate recovery systems often qualify for environmental incentives and reduced permitting requirements, potentially reducing regulatory costs by 30-50% compared to primary extraction methods.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!