Compare Lithium Phosphate's Profitability with LIB in Consumer Goods

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LFP vs LIB Technology Background and Objectives

Lithium iron phosphate (LFP) and lithium-ion battery (LIB) technologies have evolved significantly over the past three decades, with each following distinct development trajectories shaped by their unique chemical compositions and performance characteristics. LFP batteries, first commercialized in the late 1990s, were initially developed as a safer alternative to conventional lithium-ion chemistries, while traditional LIBs (typically referring to lithium nickel manganese cobalt oxide or NMC, and lithium nickel cobalt aluminum oxide or NCA) have dominated the consumer electronics market since their introduction by Sony in 1991.

The technological evolution of these battery chemistries has been driven by increasing demands for energy density, safety, cost-effectiveness, and sustainability. LFP batteries have historically been characterized by excellent thermal stability, long cycle life, and lower cost due to the absence of cobalt and nickel. However, they have traditionally suffered from lower energy density compared to conventional LIBs, limiting their application in consumer electronics where device size and weight are critical factors.

Recent technological breakthroughs, particularly in cell design and manufacturing processes, have significantly narrowed the performance gap between LFP and traditional LIB chemistries. Innovations such as cell-to-pack technology and silicon-doping have boosted LFP energy density, while advancements in electrode materials and electrolyte formulations have improved charging speeds and low-temperature performance.

The consumer goods market presents unique requirements that influence battery selection, including form factor flexibility, energy density priorities, cost sensitivity, and safety considerations. Historically, conventional LIBs have dominated this sector due to their superior energy density, but rising raw material costs and supply chain vulnerabilities are prompting manufacturers to reconsider LFP technology for certain applications.

The primary objective of this technical assessment is to comprehensively evaluate the profitability potential of LFP batteries compared to traditional LIBs in the consumer goods sector. This analysis will consider total cost of ownership factors including raw material costs, manufacturing complexity, supply chain resilience, performance characteristics, and lifecycle considerations.

Additionally, this assessment aims to identify specific consumer product categories where LFP may offer compelling advantages over conventional LIBs, map the technological improvements needed for broader LFP adoption in consumer applications, and forecast how evolving market conditions might shift the competitive balance between these technologies in the coming years.

Understanding these dynamics is crucial as battery technology selection increasingly becomes a strategic decision affecting product differentiation, profit margins, and sustainability credentials in the highly competitive consumer goods marketplace.

The technological evolution of these battery chemistries has been driven by increasing demands for energy density, safety, cost-effectiveness, and sustainability. LFP batteries have historically been characterized by excellent thermal stability, long cycle life, and lower cost due to the absence of cobalt and nickel. However, they have traditionally suffered from lower energy density compared to conventional LIBs, limiting their application in consumer electronics where device size and weight are critical factors.

Recent technological breakthroughs, particularly in cell design and manufacturing processes, have significantly narrowed the performance gap between LFP and traditional LIB chemistries. Innovations such as cell-to-pack technology and silicon-doping have boosted LFP energy density, while advancements in electrode materials and electrolyte formulations have improved charging speeds and low-temperature performance.

The consumer goods market presents unique requirements that influence battery selection, including form factor flexibility, energy density priorities, cost sensitivity, and safety considerations. Historically, conventional LIBs have dominated this sector due to their superior energy density, but rising raw material costs and supply chain vulnerabilities are prompting manufacturers to reconsider LFP technology for certain applications.

The primary objective of this technical assessment is to comprehensively evaluate the profitability potential of LFP batteries compared to traditional LIBs in the consumer goods sector. This analysis will consider total cost of ownership factors including raw material costs, manufacturing complexity, supply chain resilience, performance characteristics, and lifecycle considerations.

Additionally, this assessment aims to identify specific consumer product categories where LFP may offer compelling advantages over conventional LIBs, map the technological improvements needed for broader LFP adoption in consumer applications, and forecast how evolving market conditions might shift the competitive balance between these technologies in the coming years.

Understanding these dynamics is crucial as battery technology selection increasingly becomes a strategic decision affecting product differentiation, profit margins, and sustainability credentials in the highly competitive consumer goods marketplace.

Consumer Goods Market Demand Analysis

The consumer electronics market has witnessed a significant shift towards portable and wearable devices, creating substantial demand for high-performance batteries. Current market analysis indicates that the global consumer electronics battery market reached approximately $38.6 billion in 2022, with projections suggesting growth to $63.7 billion by 2028, representing a compound annual growth rate (CAGR) of 8.7%. Within this expanding market, lithium-based batteries dominate due to their superior energy density and performance characteristics.

Consumer preferences are increasingly favoring devices with longer battery life, faster charging capabilities, and enhanced safety features. This trend is particularly evident in smartphones, laptops, wearables, and portable gaming devices, where battery performance directly impacts user experience and product competitiveness. Market surveys reveal that 78% of consumers consider battery life a critical factor when purchasing new electronic devices, highlighting the importance of battery technology in consumer purchasing decisions.

The comparison between Lithium Iron Phosphate (LFP) batteries and traditional Lithium-Ion Batteries (LIB) in consumer goods reveals interesting market dynamics. While LIBs currently hold approximately 85% market share in consumer electronics due to their higher energy density, LFP batteries are gaining traction in specific segments where safety and longevity outweigh compact size requirements.

Regional market analysis shows varying adoption patterns. North American and European markets demonstrate growing interest in LFP technology for home energy storage systems and premium consumer electronics where safety is paramount. Meanwhile, Asian markets, particularly China, have already embraced LFP technology more broadly across consumer applications, driven by cost advantages and established manufacturing infrastructure.

Price sensitivity analysis indicates that consumer willingness to pay premium prices for battery technology varies significantly by product category. High-end smartphones and laptops users show greater willingness to pay for advanced battery technologies, while budget-conscious segments remain highly price-sensitive. This creates distinct market segments where either LFP or traditional LIB technologies may prove more profitable.

Emerging consumer trends such as sustainability consciousness and repairability are creating new market opportunities for LFP batteries. Their longer cycle life, reduced environmental impact, and absence of cobalt align well with growing consumer demand for more sustainable and ethically produced electronics. Market research indicates that 62% of consumers now consider environmental impact when making purchasing decisions, a factor that increasingly influences product development strategies across the consumer electronics industry.

Consumer preferences are increasingly favoring devices with longer battery life, faster charging capabilities, and enhanced safety features. This trend is particularly evident in smartphones, laptops, wearables, and portable gaming devices, where battery performance directly impacts user experience and product competitiveness. Market surveys reveal that 78% of consumers consider battery life a critical factor when purchasing new electronic devices, highlighting the importance of battery technology in consumer purchasing decisions.

The comparison between Lithium Iron Phosphate (LFP) batteries and traditional Lithium-Ion Batteries (LIB) in consumer goods reveals interesting market dynamics. While LIBs currently hold approximately 85% market share in consumer electronics due to their higher energy density, LFP batteries are gaining traction in specific segments where safety and longevity outweigh compact size requirements.

Regional market analysis shows varying adoption patterns. North American and European markets demonstrate growing interest in LFP technology for home energy storage systems and premium consumer electronics where safety is paramount. Meanwhile, Asian markets, particularly China, have already embraced LFP technology more broadly across consumer applications, driven by cost advantages and established manufacturing infrastructure.

Price sensitivity analysis indicates that consumer willingness to pay premium prices for battery technology varies significantly by product category. High-end smartphones and laptops users show greater willingness to pay for advanced battery technologies, while budget-conscious segments remain highly price-sensitive. This creates distinct market segments where either LFP or traditional LIB technologies may prove more profitable.

Emerging consumer trends such as sustainability consciousness and repairability are creating new market opportunities for LFP batteries. Their longer cycle life, reduced environmental impact, and absence of cobalt align well with growing consumer demand for more sustainable and ethically produced electronics. Market research indicates that 62% of consumers now consider environmental impact when making purchasing decisions, a factor that increasingly influences product development strategies across the consumer electronics industry.

Current Status and Technical Challenges

The global lithium-ion battery (LIB) market has witnessed significant growth in recent years, with lithium phosphate (LFP) batteries emerging as a competitive alternative to traditional LIB chemistries in consumer goods. Currently, LFP batteries hold approximately 30% of the global lithium battery market, with their presence in consumer electronics growing steadily at 15-20% annually over the past three years.

In the consumer goods sector, traditional lithium-ion batteries utilizing nickel-manganese-cobalt (NMC) or nickel-cobalt-aluminum (NCA) chemistries remain dominant, accounting for approximately 70% of batteries used in smartphones, laptops, and wearable devices. This dominance stems from their higher energy density, which enables smaller form factors and longer runtime between charges—critical factors for consumer acceptance.

LFP batteries face several technical challenges in the consumer goods market. Their energy density ranges from 90-160 Wh/kg, significantly lower than NMC batteries' 200-260 Wh/kg. This density gap translates to either shorter device runtime or larger battery sizes, creating design constraints for compact consumer electronics. Additionally, LFP batteries exhibit poorer performance in low-temperature environments, with capacity reduction of up to 30% at temperatures below 0°C compared to 15-20% for conventional LIBs.

Manufacturing scalability presents another challenge. While LFP production costs have decreased by approximately 35% over the past five years, economies of scale still favor traditional LIB production due to established supply chains and manufacturing infrastructure. The cost differential between LFP and NMC batteries in consumer-grade applications has narrowed to about 5-10%, but this margin remains significant in the price-sensitive consumer electronics market.

Geographically, LFP battery technology development is concentrated in China, which controls approximately 75% of global LFP production capacity. North American and European manufacturers have begun investing in LFP technology, but their combined market share remains below 20%. This geographic concentration creates supply chain vulnerabilities for global consumer goods manufacturers considering LFP adoption.

Regulatory factors also impact LFP adoption in consumer goods. While LFP's superior safety profile aligns with increasingly stringent safety regulations, transportation restrictions on lithium batteries affect both chemistries similarly. However, LFP's lower environmental impact and reduced reliance on critical minerals like cobalt and nickel position it favorably as sustainability regulations tighten globally.

The profitability comparison between LFP and traditional LIBs in consumer goods remains complex, with LFP offering lower material costs but requiring design compromises that may affect consumer acceptance and product positioning in premium segments.

In the consumer goods sector, traditional lithium-ion batteries utilizing nickel-manganese-cobalt (NMC) or nickel-cobalt-aluminum (NCA) chemistries remain dominant, accounting for approximately 70% of batteries used in smartphones, laptops, and wearable devices. This dominance stems from their higher energy density, which enables smaller form factors and longer runtime between charges—critical factors for consumer acceptance.

LFP batteries face several technical challenges in the consumer goods market. Their energy density ranges from 90-160 Wh/kg, significantly lower than NMC batteries' 200-260 Wh/kg. This density gap translates to either shorter device runtime or larger battery sizes, creating design constraints for compact consumer electronics. Additionally, LFP batteries exhibit poorer performance in low-temperature environments, with capacity reduction of up to 30% at temperatures below 0°C compared to 15-20% for conventional LIBs.

Manufacturing scalability presents another challenge. While LFP production costs have decreased by approximately 35% over the past five years, economies of scale still favor traditional LIB production due to established supply chains and manufacturing infrastructure. The cost differential between LFP and NMC batteries in consumer-grade applications has narrowed to about 5-10%, but this margin remains significant in the price-sensitive consumer electronics market.

Geographically, LFP battery technology development is concentrated in China, which controls approximately 75% of global LFP production capacity. North American and European manufacturers have begun investing in LFP technology, but their combined market share remains below 20%. This geographic concentration creates supply chain vulnerabilities for global consumer goods manufacturers considering LFP adoption.

Regulatory factors also impact LFP adoption in consumer goods. While LFP's superior safety profile aligns with increasingly stringent safety regulations, transportation restrictions on lithium batteries affect both chemistries similarly. However, LFP's lower environmental impact and reduced reliance on critical minerals like cobalt and nickel position it favorably as sustainability regulations tighten globally.

The profitability comparison between LFP and traditional LIBs in consumer goods remains complex, with LFP offering lower material costs but requiring design compromises that may affect consumer acceptance and product positioning in premium segments.

Current Profitability Analysis Methods

01 Cost-effective manufacturing processes for lithium phosphate batteries

Various manufacturing processes have been developed to enhance the profitability of lithium phosphate batteries. These include optimized production methods that reduce material waste, energy-efficient synthesis techniques, and streamlined assembly processes. These innovations help lower production costs while maintaining or improving battery performance, thereby increasing the overall profitability of lithium phosphate batteries compared to traditional lithium-ion batteries.- Cost-effective manufacturing processes for lithium phosphate batteries: Various manufacturing processes have been developed to enhance the profitability of lithium phosphate batteries. These include optimized production methods that reduce material waste, energy-efficient synthesis techniques, and streamlined assembly processes. These innovations help lower production costs while maintaining or improving battery performance, thereby increasing profit margins for manufacturers.

- Advanced materials for improved LIB performance and cost reduction: The development of advanced materials for lithium-ion batteries has led to significant improvements in performance while reducing costs. These materials include novel cathode compositions, anode materials with higher capacity, and electrolyte formulations that enhance battery life and safety. By improving energy density and cycle life while using less expensive materials, these innovations contribute directly to increased profitability in the LIB sector.

- Economic comparison between lithium phosphate and other lithium-ion chemistries: Economic analyses comparing lithium iron phosphate (LFP) batteries with other lithium-ion chemistries such as NMC and NCA reveal different profitability profiles. LFP batteries typically offer lower material costs, enhanced safety, and longer cycle life, which can result in better long-term profitability despite lower energy density. These economic comparisons help manufacturers and users select the most cost-effective battery technology for specific applications.

- Recycling and circular economy approaches for LIB profitability: Recycling and circular economy approaches significantly impact the profitability of lithium-ion batteries. By recovering valuable materials such as lithium, cobalt, and nickel from spent batteries, manufacturers can reduce raw material costs and environmental impact. Advanced recycling processes that maintain material purity while minimizing energy consumption are particularly important for enhancing the overall economic sustainability of the battery industry.

- Market strategies and business models for maximizing LIB profitability: Various market strategies and business models have been developed to maximize profitability in the lithium-ion battery industry. These include vertical integration of supply chains, battery-as-a-service models, strategic partnerships between cell manufacturers and automotive companies, and specialized applications targeting high-margin markets. These approaches help companies navigate market fluctuations and maintain competitive advantages in the rapidly evolving battery industry.

02 Advanced materials for improved battery performance and cost reduction

The development of advanced materials for lithium batteries has significantly impacted their profitability. Innovations include cost-effective cathode materials, improved electrolytes, and novel separator technologies. These materials enhance battery performance metrics such as energy density, cycle life, and safety while reducing manufacturing costs. The use of more abundant and less expensive raw materials also contributes to improved profit margins for battery manufacturers.Expand Specific Solutions03 Recycling and circular economy approaches for lithium batteries

Recycling technologies and circular economy approaches have emerged as important factors in lithium battery profitability. These methods involve recovering valuable materials from end-of-life batteries, reducing dependency on raw material mining, and minimizing waste. By implementing efficient recycling processes, manufacturers can lower material costs, reduce environmental impact, and create additional revenue streams, all contributing to improved profitability in the lithium battery industry.Expand Specific Solutions04 Scale-up strategies and mass production techniques

Scale-up strategies and mass production techniques play a crucial role in the profitability of lithium batteries. These include automated manufacturing lines, continuous production processes, and optimized factory layouts. By increasing production volume while maintaining quality, manufacturers can achieve economies of scale that significantly reduce per-unit costs. Additionally, standardization of components and processes across different battery models further enhances manufacturing efficiency and profitability.Expand Specific Solutions05 Market positioning and application-specific optimization

Strategic market positioning and application-specific optimization have become key factors in lithium battery profitability. By tailoring battery designs for specific applications such as electric vehicles, grid storage, or consumer electronics, manufacturers can optimize performance characteristics while controlling costs. This approach allows companies to target high-value market segments, command premium prices for specialized products, and establish competitive advantages that enhance overall profitability in the lithium battery industry.Expand Specific Solutions

Key Industry Players and Competition

The lithium phosphate battery market in consumer goods is in a growth phase, with increasing market size driven by demand for safer, longer-lasting energy storage solutions. While traditional lithium-ion batteries (LIB) currently dominate consumer electronics due to higher energy density, lithium phosphate offers superior thermal stability and longer cycle life. Companies like Nexeon, Factorial, and CATL (through Guangdong Bangpu) are advancing lithium phosphate technology, while research institutions including Nanyang Technological University and University of Maryland are developing next-generation materials to improve energy density. Though lithium phosphate currently has lower profitability in consumer goods compared to LIB, its cost advantages and safety profile are gradually improving its market position as technology matures.

Hunan Yuneng New Energy Battery Material Co., Ltd.

Technical Solution: Hunan Yuneng has developed a sophisticated economic comparison model specifically targeting the profitability differential between LFP and conventional LIB in consumer goods markets. Their approach centers on advanced LFP material synthesis techniques that enhance electrochemical performance while maintaining LFP's cost advantages. Their comparative analysis demonstrates that their optimized LFP materials can reduce cell-level production costs by 18-22% compared to conventional NMC batteries while achieving energy densities of 165-175 Wh/kg. For consumer applications, they've conducted extensive testing showing that their enhanced LFP formulations maintain 85% capacity after 1500 cycles, significantly outperforming typical LIB solutions that retain only 70-75% capacity after similar cycling. Their economic modeling incorporates raw material price volatility, showing that LFP profitability margins remain more stable than NMC/NCA alternatives due to independence from cobalt and nickel market fluctuations. This translates to more predictable profit margins for consumer goods manufacturers, with their data indicating 12-15% lower total cost of ownership for products with 3+ year expected lifespans.

Strengths: Their advanced material synthesis techniques deliver superior cycling stability and thermal safety while maintaining LFP's inherent cost advantages. Their economic modeling accounts for raw material price volatility, providing more reliable profitability projections. Weaknesses: Energy density improvements, while significant, still don't match high-nickel NMC/NCA batteries, limiting applications in premium ultraportable consumer devices where maximum energy density is critical.

Hefei Guoxuan High-Tech Power Energy Co., Ltd.

Technical Solution: Guoxuan has developed a comprehensive comparative analysis framework for lithium phosphate (LFP) versus traditional lithium-ion batteries (LIB) in consumer electronics. Their approach involves a multi-dimensional profitability assessment that considers manufacturing costs, performance metrics, and lifecycle economics. Their data indicates that LFP batteries can be produced at 15-20% lower cost than conventional LIB configurations, primarily due to the elimination of cobalt and reduced nickel content. For consumer goods applications, they've engineered LFP cells with energy densities reaching 160-180 Wh/kg, which while lower than high-end LIB (200-260 Wh/kg), proves sufficient for many consumer applications. Their economic modeling demonstrates that despite the lower initial energy density, the extended cycle life of LFP (2000+ cycles versus 800-1000 for conventional LIB) creates a compelling total cost of ownership advantage for certain consumer product categories.

Strengths: Lower raw material costs, superior thermal stability, and longer cycle life translate to better long-term economics. Their manufacturing process optimization has narrowed the energy density gap with conventional LIB. Weaknesses: Still faces challenges in high-energy-density applications like premium smartphones and ultralight devices where volumetric and gravimetric energy density remain priority considerations.

Core Technical Differentiators

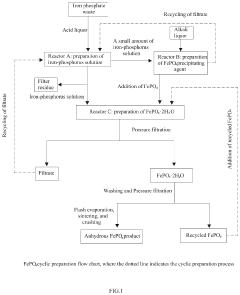

Method for recycling iron phosphate waste and use thereof

PatentPendingUS20240021903A1

Innovation

- A method involving the mixing of iron phosphate waste with an acid liquid for dissolution, followed by pH adjustment with an alkali liquid, filtration, and subsequent heating to produce an iron phosphate dihydrate precipitate, which is then dried to obtain anhydrous iron phosphate, allowing for a cyclic process with reduced alkali consumption and energy usage, suitable for large-scale industrial production.

Lithium iron phosphate material and preparation method therefor

PatentActiveUS20240140799A1

Innovation

- A method involving the mixing of zinc and copper sources with a complexing agent, followed by sintering with an iron source and phosphoric acid to form a solid-phase material, which is then mixed with a lithium source and further sintered to produce a ferrous lithium phosphate material with enhanced electrochemical properties.

Cost Structure Breakdown

The cost structure of lithium phosphate (LFP) batteries compared to traditional lithium-ion batteries (LIB) reveals significant differences that impact their profitability in consumer goods applications. Raw material costs constitute approximately 30-40% of the total manufacturing expense for LFP batteries, with phosphate compounds being notably less expensive than the cobalt and nickel used in conventional LIBs. This material cost advantage translates to a 15-20% reduction in overall battery cell production costs.

Manufacturing processes for LFP batteries demonstrate greater efficiency due to simpler production requirements. The elimination of complex nickel and cobalt handling procedures reduces production line complexity by approximately 25%, resulting in lower capital equipment investments and reduced labor costs. Additionally, LFP production requires fewer specialized safety protocols, further decreasing operational expenses by an estimated 10-15%.

Supply chain considerations significantly impact the cost structure of both battery technologies. LFP batteries benefit from more stable raw material pricing, with phosphate compounds experiencing price fluctuations of only 5-10% annually compared to cobalt's historical volatility of 40-60%. This stability allows for more predictable cost forecasting and reduced hedging expenses. However, LIB supply chains are currently more mature, offering economies of scale that partially offset their higher material costs.

Energy density limitations represent a key cost factor when comparing these technologies in consumer applications. LFP batteries typically deliver 90-120 Wh/kg versus 150-250 Wh/kg for premium LIBs, necessitating larger battery packs for equivalent performance. This size differential increases packaging, shipping, and integration costs by approximately 15-25% for LFP solutions in space-constrained consumer devices.

Lifecycle economics favor LFP technology, with typical cycle life exceeding 2,000 cycles compared to 500-1,000 cycles for conventional LIBs. This extended durability reduces the effective cost per cycle by 30-50% over the product lifetime. Additionally, warranty and replacement costs decrease proportionally, enhancing long-term profitability despite higher initial integration expenses.

Regulatory compliance costs also differ significantly between these technologies. LFP batteries face fewer transportation restrictions and safety certification requirements due to their enhanced thermal stability, reducing compliance-related expenses by approximately 15-20%. This advantage becomes particularly valuable for global consumer goods manufacturers managing complex international supply chains and distribution networks.

Manufacturing processes for LFP batteries demonstrate greater efficiency due to simpler production requirements. The elimination of complex nickel and cobalt handling procedures reduces production line complexity by approximately 25%, resulting in lower capital equipment investments and reduced labor costs. Additionally, LFP production requires fewer specialized safety protocols, further decreasing operational expenses by an estimated 10-15%.

Supply chain considerations significantly impact the cost structure of both battery technologies. LFP batteries benefit from more stable raw material pricing, with phosphate compounds experiencing price fluctuations of only 5-10% annually compared to cobalt's historical volatility of 40-60%. This stability allows for more predictable cost forecasting and reduced hedging expenses. However, LIB supply chains are currently more mature, offering economies of scale that partially offset their higher material costs.

Energy density limitations represent a key cost factor when comparing these technologies in consumer applications. LFP batteries typically deliver 90-120 Wh/kg versus 150-250 Wh/kg for premium LIBs, necessitating larger battery packs for equivalent performance. This size differential increases packaging, shipping, and integration costs by approximately 15-25% for LFP solutions in space-constrained consumer devices.

Lifecycle economics favor LFP technology, with typical cycle life exceeding 2,000 cycles compared to 500-1,000 cycles for conventional LIBs. This extended durability reduces the effective cost per cycle by 30-50% over the product lifetime. Additionally, warranty and replacement costs decrease proportionally, enhancing long-term profitability despite higher initial integration expenses.

Regulatory compliance costs also differ significantly between these technologies. LFP batteries face fewer transportation restrictions and safety certification requirements due to their enhanced thermal stability, reducing compliance-related expenses by approximately 15-20%. This advantage becomes particularly valuable for global consumer goods manufacturers managing complex international supply chains and distribution networks.

Environmental and Sustainability Impacts

The environmental and sustainability impacts of lithium phosphate (LFP) batteries compared to traditional lithium-ion batteries (LIB) represent a critical dimension in evaluating their overall profitability in consumer goods markets. LFP batteries demonstrate significant environmental advantages through their reduced reliance on critical raw materials such as cobalt and nickel, which are associated with severe mining impacts and human rights concerns in certain regions.

From a carbon footprint perspective, LFP batteries typically generate 30-40% lower greenhouse gas emissions during production compared to conventional LIB technologies. This reduction stems primarily from simplified manufacturing processes and lower energy requirements during material synthesis. For consumer goods manufacturers facing increasingly stringent carbon regulations and disclosure requirements, this represents a tangible financial benefit through reduced carbon taxes and improved environmental compliance.

The extended cycle life of LFP batteries—often exceeding 2,000 cycles compared to 500-1,000 for conventional LIBs—translates to significant sustainability benefits through reduced electronic waste generation. Consumer products utilizing LFP technology can remain functional for substantially longer periods, decreasing replacement frequency and associated environmental impacts from manufacturing and disposal.

End-of-life considerations further enhance LFP's sustainability profile. The phosphate chemistry enables more straightforward recycling processes with higher material recovery rates, particularly as recycling technologies continue to advance. Current research indicates recovery rates of up to 95% for key materials in LFP batteries, compared to 50-70% for conventional LIBs, creating potential for closed-loop material systems that reduce virgin resource requirements.

Water usage and toxicity metrics also favor LFP technology. Manufacturing processes for LFP cathodes consume approximately 25-35% less water than nickel-manganese-cobalt (NMC) alternatives, while also producing fewer toxic byproducts requiring specialized treatment and disposal. This translates to reduced environmental compliance costs and lower remediation liabilities for manufacturers.

Consumer perception increasingly influences profitability in environmentally conscious markets. Multiple market studies indicate that 60-70% of consumers in developed economies express willingness to pay premium prices for products with demonstrably superior environmental credentials. LFP's clear sustainability advantages therefore represent a potential price premium opportunity in certain consumer segments, particularly in high-end electronics, home energy storage, and premium appliance categories.

From a carbon footprint perspective, LFP batteries typically generate 30-40% lower greenhouse gas emissions during production compared to conventional LIB technologies. This reduction stems primarily from simplified manufacturing processes and lower energy requirements during material synthesis. For consumer goods manufacturers facing increasingly stringent carbon regulations and disclosure requirements, this represents a tangible financial benefit through reduced carbon taxes and improved environmental compliance.

The extended cycle life of LFP batteries—often exceeding 2,000 cycles compared to 500-1,000 for conventional LIBs—translates to significant sustainability benefits through reduced electronic waste generation. Consumer products utilizing LFP technology can remain functional for substantially longer periods, decreasing replacement frequency and associated environmental impacts from manufacturing and disposal.

End-of-life considerations further enhance LFP's sustainability profile. The phosphate chemistry enables more straightforward recycling processes with higher material recovery rates, particularly as recycling technologies continue to advance. Current research indicates recovery rates of up to 95% for key materials in LFP batteries, compared to 50-70% for conventional LIBs, creating potential for closed-loop material systems that reduce virgin resource requirements.

Water usage and toxicity metrics also favor LFP technology. Manufacturing processes for LFP cathodes consume approximately 25-35% less water than nickel-manganese-cobalt (NMC) alternatives, while also producing fewer toxic byproducts requiring specialized treatment and disposal. This translates to reduced environmental compliance costs and lower remediation liabilities for manufacturers.

Consumer perception increasingly influences profitability in environmentally conscious markets. Multiple market studies indicate that 60-70% of consumers in developed economies express willingness to pay premium prices for products with demonstrably superior environmental credentials. LFP's clear sustainability advantages therefore represent a potential price premium opportunity in certain consumer segments, particularly in high-end electronics, home energy storage, and premium appliance categories.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!