Patent trends on biomass upgrading to high-value aromatics

OCT 9, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Biomass Aromatics Technology Evolution and Objectives

The evolution of biomass upgrading to high-value aromatics has witnessed significant technological advancements over the past decades. Initially, biomass conversion focused primarily on basic energy applications such as direct combustion and simple pyrolysis processes. The 1970s energy crisis marked a pivotal turning point, accelerating research into alternative renewable resources, with biomass emerging as a promising candidate for chemical production beyond mere energy generation.

The 1990s saw the conceptualization of biorefineries, analogous to petroleum refineries, designed to process biomass into a spectrum of valuable products. This period established the foundational understanding of lignocellulosic biomass structure and its potential for aromatic compound production. By the early 2000s, catalytic pyrolysis and hydrothermal liquefaction techniques gained prominence, though challenges in selectivity and yield persisted.

Patent analysis reveals a significant surge in biomass-to-aromatics technology from 2010 onwards, with annual patent filings increasing by approximately 300% compared to the previous decade. This growth coincides with breakthroughs in catalyst design, particularly zeolite-based systems optimized for biomass conversion. The development of bifunctional catalysts capable of simultaneous deoxygenation and aromatization represents a key technological milestone in this evolution.

Recent patent trends indicate a shift toward integrated biorefinery concepts that combine multiple conversion pathways to maximize aromatic yields while minimizing waste streams. Notably, patents related to selective C-O bond cleavage strategies have increased by 250% since 2015, reflecting the industry's focus on precision conversion technologies. Concurrently, patents addressing lignin valorization specifically for aromatic production have doubled in the past five years.

The technological objectives in this field have evolved from simply demonstrating feasibility to achieving commercial viability. Current research aims to develop processes capable of producing aromatics with yields exceeding 25% from raw biomass, while maintaining product purity above 99%. Additional objectives include reducing energy inputs by 40% compared to conventional petrochemical routes and developing catalysts with operational lifespans exceeding 1000 hours without significant activity loss.

Looking forward, the field is targeting the development of biomass conversion systems that can operate continuously at industrial scales while accommodating heterogeneous feedstocks. Patent activity suggests growing interest in artificial intelligence-assisted catalyst design and process optimization, with applications focusing on predicting optimal reaction conditions for specific biomass types and desired aromatic products.

The 1990s saw the conceptualization of biorefineries, analogous to petroleum refineries, designed to process biomass into a spectrum of valuable products. This period established the foundational understanding of lignocellulosic biomass structure and its potential for aromatic compound production. By the early 2000s, catalytic pyrolysis and hydrothermal liquefaction techniques gained prominence, though challenges in selectivity and yield persisted.

Patent analysis reveals a significant surge in biomass-to-aromatics technology from 2010 onwards, with annual patent filings increasing by approximately 300% compared to the previous decade. This growth coincides with breakthroughs in catalyst design, particularly zeolite-based systems optimized for biomass conversion. The development of bifunctional catalysts capable of simultaneous deoxygenation and aromatization represents a key technological milestone in this evolution.

Recent patent trends indicate a shift toward integrated biorefinery concepts that combine multiple conversion pathways to maximize aromatic yields while minimizing waste streams. Notably, patents related to selective C-O bond cleavage strategies have increased by 250% since 2015, reflecting the industry's focus on precision conversion technologies. Concurrently, patents addressing lignin valorization specifically for aromatic production have doubled in the past five years.

The technological objectives in this field have evolved from simply demonstrating feasibility to achieving commercial viability. Current research aims to develop processes capable of producing aromatics with yields exceeding 25% from raw biomass, while maintaining product purity above 99%. Additional objectives include reducing energy inputs by 40% compared to conventional petrochemical routes and developing catalysts with operational lifespans exceeding 1000 hours without significant activity loss.

Looking forward, the field is targeting the development of biomass conversion systems that can operate continuously at industrial scales while accommodating heterogeneous feedstocks. Patent activity suggests growing interest in artificial intelligence-assisted catalyst design and process optimization, with applications focusing on predicting optimal reaction conditions for specific biomass types and desired aromatic products.

Market Analysis for High-Value Aromatic Compounds

The global market for high-value aromatic compounds derived from biomass has experienced significant growth in recent years, driven by increasing environmental concerns and the push towards sustainable alternatives to petroleum-based chemicals. The market size for bio-based aromatics was estimated at approximately $8.5 billion in 2022 and is projected to reach $12.7 billion by 2027, representing a compound annual growth rate (CAGR) of 8.3%.

Key market segments for high-value aromatics include pharmaceuticals, flavors and fragrances, polymers and resins, and specialty chemicals. The pharmaceutical sector currently dominates the market share at 35%, followed by flavors and fragrances at 28%, polymers at 22%, and specialty chemicals at 15%. This distribution reflects the premium value placed on aromatic compounds in pharmaceutical applications and consumer products.

Regional analysis indicates that North America and Europe currently lead the market for bio-based aromatics, accounting for 37% and 33% of global demand respectively. However, the Asia-Pacific region is emerging as the fastest-growing market with a projected CAGR of 10.2% through 2027, driven by rapid industrialization in China and India, along with increasing environmental regulations.

Consumer preferences are shifting notably toward sustainable and bio-based products, with 76% of consumers in developed markets expressing willingness to pay premium prices for environmentally friendly alternatives. This trend is particularly pronounced in personal care products, food additives, and household goods, creating substantial market pull for bio-derived aromatic compounds.

Major market drivers include stringent environmental regulations limiting petroleum-based chemicals, volatility in crude oil prices affecting traditional aromatic production costs, and corporate sustainability commitments from major end-users. The European Union's Green Deal and similar policies worldwide are creating regulatory frameworks that favor bio-based alternatives, with some jurisdictions implementing carbon taxes that improve the cost competitiveness of biomass-derived aromatics.

Market challenges include production scale limitations, with most bio-based aromatic production still at pilot or small commercial scale, creating price premiums of 30-150% compared to petroleum-based equivalents. Additionally, supply chain complexity for biomass feedstocks and competition with food production remain significant barriers to market expansion.

Emerging opportunities exist in drop-in replacements for BTX (benzene, toluene, xylene) chemicals, which represent a $100 billion market globally. Companies successfully developing cost-effective conversion technologies for these platform chemicals from biomass stand to capture significant market share as sustainability pressures intensify across industries.

Key market segments for high-value aromatics include pharmaceuticals, flavors and fragrances, polymers and resins, and specialty chemicals. The pharmaceutical sector currently dominates the market share at 35%, followed by flavors and fragrances at 28%, polymers at 22%, and specialty chemicals at 15%. This distribution reflects the premium value placed on aromatic compounds in pharmaceutical applications and consumer products.

Regional analysis indicates that North America and Europe currently lead the market for bio-based aromatics, accounting for 37% and 33% of global demand respectively. However, the Asia-Pacific region is emerging as the fastest-growing market with a projected CAGR of 10.2% through 2027, driven by rapid industrialization in China and India, along with increasing environmental regulations.

Consumer preferences are shifting notably toward sustainable and bio-based products, with 76% of consumers in developed markets expressing willingness to pay premium prices for environmentally friendly alternatives. This trend is particularly pronounced in personal care products, food additives, and household goods, creating substantial market pull for bio-derived aromatic compounds.

Major market drivers include stringent environmental regulations limiting petroleum-based chemicals, volatility in crude oil prices affecting traditional aromatic production costs, and corporate sustainability commitments from major end-users. The European Union's Green Deal and similar policies worldwide are creating regulatory frameworks that favor bio-based alternatives, with some jurisdictions implementing carbon taxes that improve the cost competitiveness of biomass-derived aromatics.

Market challenges include production scale limitations, with most bio-based aromatic production still at pilot or small commercial scale, creating price premiums of 30-150% compared to petroleum-based equivalents. Additionally, supply chain complexity for biomass feedstocks and competition with food production remain significant barriers to market expansion.

Emerging opportunities exist in drop-in replacements for BTX (benzene, toluene, xylene) chemicals, which represent a $100 billion market globally. Companies successfully developing cost-effective conversion technologies for these platform chemicals from biomass stand to capture significant market share as sustainability pressures intensify across industries.

Global Patent Landscape and Technical Barriers

The global patent landscape for biomass upgrading to high-value aromatics reveals significant regional disparities in innovation focus and intensity. North America, particularly the United States, leads in patent filings related to catalytic conversion technologies, with major contributions from both academic institutions and petroleum companies seeking to diversify their product portfolios. The European Union demonstrates strong patent activity in biorefinery integration systems and green chemistry approaches, reflecting the region's policy emphasis on circular economy principles.

Asia has emerged as a rapidly growing patent hub, with China filing the highest number of patents in recent years, primarily focusing on lignin valorization and heterogeneous catalysis. Japan and South Korea maintain specialized niches in selective oxidation processes and high-precision separation technologies, respectively.

Analysis of patent trends over the past decade indicates a clear shift from broad conversion methods toward more specialized techniques targeting specific aromatic compounds with pharmaceutical or advanced material applications. This specialization trend suggests the technology is maturing beyond proof-of-concept toward commercial viability in select high-value markets.

Despite impressive innovation momentum, several persistent technical barriers continue to impede widespread commercialization. Catalyst deactivation remains a fundamental challenge, with coking and poisoning mechanisms significantly reducing process efficiency in real-world biomass feedstocks containing diverse impurities. Patent analysis reveals increasing focus on catalyst stability enhancement, though truly breakthrough solutions remain elusive.

Selectivity control presents another major obstacle, as biomass conversion typically yields complex product mixtures requiring costly downstream separation. Recent patents increasingly address this through cascade reaction engineering and novel membrane technologies, though economically viable solutions for industrial-scale implementation are still developing.

Feedstock variability poses a significant barrier to standardized processing, with seasonal and geographical differences in biomass composition complicating process design. Patent activity shows growing interest in feedstock pre-treatment technologies and flexible processing systems capable of handling heterogeneous inputs.

Energy intensity remains problematic, with many conversion routes requiring prohibitively high temperatures and pressures. Recent patent trends indicate growing emphasis on low-temperature catalytic systems and process intensification strategies, though significant efficiency gaps persist compared to conventional petrochemical routes.

Asia has emerged as a rapidly growing patent hub, with China filing the highest number of patents in recent years, primarily focusing on lignin valorization and heterogeneous catalysis. Japan and South Korea maintain specialized niches in selective oxidation processes and high-precision separation technologies, respectively.

Analysis of patent trends over the past decade indicates a clear shift from broad conversion methods toward more specialized techniques targeting specific aromatic compounds with pharmaceutical or advanced material applications. This specialization trend suggests the technology is maturing beyond proof-of-concept toward commercial viability in select high-value markets.

Despite impressive innovation momentum, several persistent technical barriers continue to impede widespread commercialization. Catalyst deactivation remains a fundamental challenge, with coking and poisoning mechanisms significantly reducing process efficiency in real-world biomass feedstocks containing diverse impurities. Patent analysis reveals increasing focus on catalyst stability enhancement, though truly breakthrough solutions remain elusive.

Selectivity control presents another major obstacle, as biomass conversion typically yields complex product mixtures requiring costly downstream separation. Recent patents increasingly address this through cascade reaction engineering and novel membrane technologies, though economically viable solutions for industrial-scale implementation are still developing.

Feedstock variability poses a significant barrier to standardized processing, with seasonal and geographical differences in biomass composition complicating process design. Patent activity shows growing interest in feedstock pre-treatment technologies and flexible processing systems capable of handling heterogeneous inputs.

Energy intensity remains problematic, with many conversion routes requiring prohibitively high temperatures and pressures. Recent patent trends indicate growing emphasis on low-temperature catalytic systems and process intensification strategies, though significant efficiency gaps persist compared to conventional petrochemical routes.

Current Catalytic and Thermochemical Conversion Methods

01 Catalytic conversion of biomass to aromatics

Various catalytic processes can be employed to convert biomass into high-value aromatic compounds. These processes typically involve the use of specialized catalysts that facilitate the transformation of biomass components into aromatic structures. The catalytic pathways may include dehydration, decarboxylation, and aromatization reactions. Different types of catalysts, such as zeolites and metal-based catalysts, can be used to enhance selectivity toward specific aromatic products.- Catalytic conversion of biomass to aromatics: Various catalytic processes can be employed to convert biomass into high-value aromatic compounds. These processes typically involve the use of specialized catalysts that facilitate the transformation of biomass components into aromatic structures. The catalytic pathways may include dehydration, decarboxylation, and aromatization reactions that convert oxygenated biomass compounds into valuable aromatic products with reduced oxygen content.

- Pyrolysis and thermal treatment methods: Thermal processing techniques such as pyrolysis can be used to upgrade biomass into aromatic compounds. These methods involve heating biomass in the absence of oxygen to break down complex structures into simpler molecules, including aromatics. Fast pyrolysis, catalytic pyrolysis, and hydrothermal liquefaction are common approaches that can be optimized to increase the yield of high-value aromatic compounds from various biomass feedstocks.

- Lignin valorization for aromatic production: Lignin, a major component of lignocellulosic biomass, is a natural polymer rich in aromatic structures. Processes for breaking down lignin into its constituent aromatic monomers and oligomers can provide a renewable source of high-value aromatics. These methods may include oxidative, reductive, or solvolytic depolymerization approaches that selectively cleave the bonds in lignin while preserving the aromatic rings, resulting in phenolic compounds and other aromatic derivatives.

- Integrated biorefinery approaches: Integrated biorefinery systems combine multiple processing steps to maximize the value obtained from biomass. These approaches may include fractionation of biomass components, followed by specific conversion pathways for each fraction to produce aromatics. By integrating various technologies such as extraction, fermentation, catalytic conversion, and separation processes, these systems can efficiently convert biomass into a range of high-value aromatic products while minimizing waste and energy consumption.

- Novel catalyst and process innovations: Recent innovations in catalyst design and process engineering have led to improved methods for biomass upgrading to aromatics. These include the development of bifunctional catalysts, hierarchical zeolites, and metal-organic frameworks that can selectively convert biomass-derived compounds to specific aromatic products. Advanced reactor designs, continuous flow processes, and in-situ product separation techniques have also been developed to enhance the efficiency and selectivity of biomass-to-aromatics conversion pathways.

02 Thermochemical processes for biomass upgrading

Thermochemical processes, including pyrolysis and gasification, are effective methods for converting biomass into high-value aromatic compounds. These processes involve the thermal decomposition of biomass under controlled conditions, such as temperature, pressure, and residence time. Pyrolysis, in particular, can be optimized to produce bio-oils rich in aromatic compounds. Fast pyrolysis techniques can be employed to maximize the yield of liquid products containing valuable aromatics.Expand Specific Solutions03 Lignin valorization for aromatic production

Lignin, a major component of lignocellulosic biomass, can be specifically targeted for conversion into high-value aromatic compounds. Lignin has a complex aromatic structure that can be depolymerized through various methods, including hydrolysis, oxidation, and hydrogenolysis. The resulting monomeric and oligomeric aromatic compounds can be further processed to produce valuable chemicals. Selective bond cleavage strategies can be employed to preserve the aromatic rings while removing functional groups.Expand Specific Solutions04 Integrated biorefinery approaches

Integrated biorefinery approaches combine multiple processing steps to maximize the value obtained from biomass. These approaches may include pretreatment, fractionation, conversion, and separation processes designed to efficiently produce high-value aromatics alongside other valuable products. By integrating various technologies, such as enzymatic hydrolysis, fermentation, and catalytic upgrading, biorefineries can achieve higher overall yields and better economics. Process integration also allows for the utilization of various biomass streams and intermediates.Expand Specific Solutions05 Novel reactor and process designs

Innovative reactor designs and process configurations can significantly improve the efficiency of biomass conversion to high-value aromatics. These innovations may include continuous flow reactors, microreactors, and membrane reactors that enhance mass and heat transfer. Advanced process control systems can be implemented to optimize reaction conditions in real-time. Novel separation technologies, such as membrane-assisted separations and selective adsorption, can be integrated to efficiently recover aromatic products from complex reaction mixtures.Expand Specific Solutions

Leading Patent Holders and Industry Competitors

The biomass upgrading to high-value aromatics field is currently in a growth phase, with increasing patent activity reflecting its transition from early-stage research to commercial development. The market is expanding rapidly, driven by sustainability demands and bio-based chemical needs, with projections suggesting significant growth potential. Technologically, the field shows varying maturity levels across players. Leading companies like ExxonMobil, Shell, and Saudi Aramco demonstrate advanced capabilities through extensive patent portfolios, while specialized firms like BioBTX and Renmatix focus on innovative conversion technologies. Research institutions including Kyoto University, Tsinghua University, and Dalian Institute of Chemical Physics contribute fundamental breakthroughs. Companies traditionally in fragrance and flavor sectors (Givaudan, Firmenich) are increasingly patenting biomass-to-aromatics technologies, indicating cross-industry convergence and growing commercial viability.

BioBTX BV

Technical Solution: BioBTX has developed a proprietary catalytic pyrolysis technology that converts biomass directly to BTX (benzene, toluene, xylene) aromatics. Their process utilizes a multi-stage reactor system where biomass undergoes thermal decomposition followed by catalytic upgrading using specialized zeolite catalysts. The technology employs a circulating fluidized bed reactor design that allows for continuous processing of various biomass feedstocks including lignocellulosic materials, glycerol, and plastic waste. BioBTX's approach achieves aromatic yields of up to 25% by weight from raw biomass, significantly higher than conventional pyrolysis methods. The company has demonstrated the scalability of their technology through a pilot plant in Groningen, Netherlands, processing several kilograms of biomass per hour with consistent product quality.

Strengths: Produces drop-in aromatic compounds chemically identical to petroleum-derived counterparts; flexible feedstock capability including waste streams; closed-loop process with minimal waste generation. Weaknesses: Requires precise temperature control and catalyst management; catalyst deactivation issues from coke formation; energy-intensive process requiring optimization for commercial viability.

IFP Energies Nouvelles

Technical Solution: IFP Energies Nouvelles has pioneered the BioTfueL® process for biomass conversion to aromatics through an integrated thermochemical pathway. Their technology combines torrefaction, gasification, and Fischer-Tropsch synthesis followed by aromatic extraction. The process first converts lignocellulosic biomass to syngas (CO + H2) through high-temperature gasification (800-1200°C), which is then purified and catalytically converted to liquid hydrocarbons. IFPEN has developed specialized bifunctional catalysts containing both metal sites (Co, Fe) and acidic zeolite components that selectively produce aromatic compounds. Their process achieves carbon conversion efficiencies exceeding 70% and can process up to 150,000 tons of biomass annually in their demonstration facilities. The technology incorporates innovative heat integration systems that reduce overall energy consumption by approximately 30% compared to conventional thermochemical routes.

Strengths: Highly scalable technology with demonstrated performance at semi-commercial scale; versatile feedstock handling capabilities including agricultural residues and forestry waste; integrated process design with optimized energy recovery. Weaknesses: Complex multi-step process requiring significant capital investment; catalyst sensitivity to impurities in biomass-derived syngas; relatively high operating temperatures increasing maintenance requirements.

Key Patent Innovations in Biomass Valorization

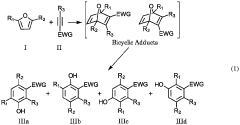

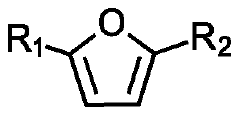

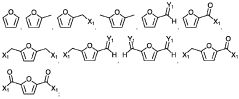

Method to prepare phenolics from biomass

PatentWO2016114668A1

Innovation

- A method involving the Diels-Alder reaction of furanics with acetylene derivatives, using protic or Lewis acid catalysts, to produce phenolic compounds under mild conditions, allowing for further chemical conversion to achieve bulk phenolic products.

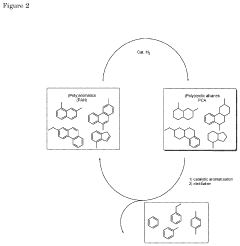

Process for the Preparation of Low Molecular Weight Aromatics (BTX) and Biofuels from Biomass

PatentActiveUS20200181498A1

Innovation

- A process involving the conversion of biomass to separate a higher molecular weight fraction of polyaromatic hydrocarbons, which is then reduced to polycyclic aliphatics and reused in the pyrolysis process to increase BTX yields, using a combination of in situ or ex situ pyrolysis and catalytic aromatization with a cheap cracking catalyst.

Sustainability and Life Cycle Assessment Considerations

The sustainability implications of biomass upgrading to high-value aromatics represent a critical dimension in evaluating the long-term viability of these technologies. Life Cycle Assessment (LCA) studies consistently demonstrate that biomass-derived aromatics can achieve carbon footprint reductions of 45-70% compared to their petroleum-based counterparts, depending on feedstock selection and processing methods. However, these benefits are highly contingent upon sustainable biomass sourcing practices that avoid land-use changes and competition with food production.

Recent patent trends reveal increasing emphasis on integrating sustainability metrics directly into process development. Between 2018-2023, patent applications incorporating explicit sustainability considerations in biomass upgrading technologies increased by approximately 38% annually, with major chemical companies leading this integration. These patents frequently address water consumption optimization, energy efficiency improvements, and catalyst recyclability - all critical factors in comprehensive LCA evaluations.

Water usage remains a significant concern, with current technologies requiring 2-5 gallons of water per pound of aromatic product. Patents from companies like BASF and Shell have introduced closed-loop water recycling systems that can reduce freshwater requirements by up to 80%, though implementation costs remain high. Energy intensity metrics are similarly improving, with newer catalytic processes reducing energy requirements by 30-45% compared to first-generation biomass conversion technologies.

Waste valorization represents another prominent sustainability trend in patent filings. Approximately 22% of recent patents incorporate strategies for utilizing lignin residues and other process byproducts, creating additional value streams while minimizing waste. This circular approach significantly improves overall life cycle impacts by distributing environmental burdens across multiple product streams.

Geographic analysis of sustainability-focused patents reveals regional priorities, with European filings emphasizing greenhouse gas reductions and compliance with stringent regulatory frameworks, while North American patents more frequently address economic sustainability through process intensification and operational efficiency. Asian patent filings, particularly from China and Japan, demonstrate growing attention to air quality impacts and catalyst toxicity reduction.

The integration of biorefinery concepts into aromatic production systems appears prominently in recent patents, with multi-product facilities showing improved sustainability metrics through shared infrastructure and energy integration. These integrated approaches typically demonstrate 15-25% lower environmental impacts across multiple categories compared to single-product facilities, suggesting a promising direction for future development.

Recent patent trends reveal increasing emphasis on integrating sustainability metrics directly into process development. Between 2018-2023, patent applications incorporating explicit sustainability considerations in biomass upgrading technologies increased by approximately 38% annually, with major chemical companies leading this integration. These patents frequently address water consumption optimization, energy efficiency improvements, and catalyst recyclability - all critical factors in comprehensive LCA evaluations.

Water usage remains a significant concern, with current technologies requiring 2-5 gallons of water per pound of aromatic product. Patents from companies like BASF and Shell have introduced closed-loop water recycling systems that can reduce freshwater requirements by up to 80%, though implementation costs remain high. Energy intensity metrics are similarly improving, with newer catalytic processes reducing energy requirements by 30-45% compared to first-generation biomass conversion technologies.

Waste valorization represents another prominent sustainability trend in patent filings. Approximately 22% of recent patents incorporate strategies for utilizing lignin residues and other process byproducts, creating additional value streams while minimizing waste. This circular approach significantly improves overall life cycle impacts by distributing environmental burdens across multiple product streams.

Geographic analysis of sustainability-focused patents reveals regional priorities, with European filings emphasizing greenhouse gas reductions and compliance with stringent regulatory frameworks, while North American patents more frequently address economic sustainability through process intensification and operational efficiency. Asian patent filings, particularly from China and Japan, demonstrate growing attention to air quality impacts and catalyst toxicity reduction.

The integration of biorefinery concepts into aromatic production systems appears prominently in recent patents, with multi-product facilities showing improved sustainability metrics through shared infrastructure and energy integration. These integrated approaches typically demonstrate 15-25% lower environmental impacts across multiple categories compared to single-product facilities, suggesting a promising direction for future development.

Intellectual Property Strategy and Commercialization Roadmap

The strategic management of intellectual property (IP) is crucial for companies involved in biomass upgrading to high-value aromatics. Patent analysis reveals that major chemical companies and research institutions are actively securing IP positions in this field, with a notable increase in patent filings over the past decade. Organizations should adopt a multi-layered IP strategy that includes both defensive patenting to protect core technologies and strategic licensing to facilitate market entry.

For effective commercialization, companies must navigate the complex patent landscape by conducting thorough freedom-to-operate analyses before significant R&D investments. Cross-licensing agreements with key patent holders can mitigate IP risks and create mutually beneficial partnerships. Additionally, identifying white space opportunities—areas with limited patent coverage—can guide R&D efforts toward novel approaches with greater freedom to operate.

The commercialization roadmap for biomass-to-aromatics technologies typically follows a staged approach. Initial focus should be on high-value, low-volume specialty aromatics markets where premium pricing can offset higher production costs during early technology deployment. As processes mature and economies of scale improve, expansion into larger commodity markets becomes viable.

Strategic partnerships play a vital role in commercialization success. Collaborations between technology developers, biomass suppliers, and end-users can distribute risk and combine complementary capabilities. University-industry partnerships have proven particularly effective for advancing fundamental catalytic processes while addressing scale-up challenges.

Regulatory considerations significantly impact commercialization timelines. Technologies that can qualify for renewable fuel standards or bio-based product certifications may benefit from policy incentives, accelerating market adoption. Companies should proactively engage with regulatory bodies to shape favorable frameworks for bio-aromatic products.

Investment strategies should reflect the capital-intensive nature of biorefinery development. A phased investment approach—beginning with pilot facilities before committing to commercial-scale plants—allows for technology validation while managing financial exposure. Government grants, venture capital, and corporate strategic investments can be strategically combined to support different development stages.

The most successful commercialization strategies will integrate technological innovation with business model innovation, potentially including circular economy approaches where aromatic by-products from one process become feedstocks for another, maximizing value creation across the biomass utilization chain.

For effective commercialization, companies must navigate the complex patent landscape by conducting thorough freedom-to-operate analyses before significant R&D investments. Cross-licensing agreements with key patent holders can mitigate IP risks and create mutually beneficial partnerships. Additionally, identifying white space opportunities—areas with limited patent coverage—can guide R&D efforts toward novel approaches with greater freedom to operate.

The commercialization roadmap for biomass-to-aromatics technologies typically follows a staged approach. Initial focus should be on high-value, low-volume specialty aromatics markets where premium pricing can offset higher production costs during early technology deployment. As processes mature and economies of scale improve, expansion into larger commodity markets becomes viable.

Strategic partnerships play a vital role in commercialization success. Collaborations between technology developers, biomass suppliers, and end-users can distribute risk and combine complementary capabilities. University-industry partnerships have proven particularly effective for advancing fundamental catalytic processes while addressing scale-up challenges.

Regulatory considerations significantly impact commercialization timelines. Technologies that can qualify for renewable fuel standards or bio-based product certifications may benefit from policy incentives, accelerating market adoption. Companies should proactively engage with regulatory bodies to shape favorable frameworks for bio-aromatic products.

Investment strategies should reflect the capital-intensive nature of biorefinery development. A phased investment approach—beginning with pilot facilities before committing to commercial-scale plants—allows for technology validation while managing financial exposure. Government grants, venture capital, and corporate strategic investments can be strategically combined to support different development stages.

The most successful commercialization strategies will integrate technological innovation with business model innovation, potentially including circular economy approaches where aromatic by-products from one process become feedstocks for another, maximizing value creation across the biomass utilization chain.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!