Standards and regulations on biomass upgrading for biofuels

OCT 9, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Biomass Upgrading Technology Background and Objectives

Biomass upgrading technologies have evolved significantly over the past decades as a response to growing environmental concerns and the need for sustainable energy sources. The journey began in the 1970s during the oil crisis, which prompted initial research into alternative fuels. By the 1990s, biomass conversion had gained scientific momentum, with fundamental research establishing the theoretical frameworks for various conversion pathways including thermochemical, biochemical, and chemical processes.

The technological evolution accelerated in the early 2000s with the development of first-generation biofuels, primarily derived from food crops. However, concerns about food security and land use quickly shifted focus toward second-generation technologies utilizing lignocellulosic biomass from agricultural and forestry residues. This transition marked a critical turning point, as it addressed sustainability concerns while expanding the potential feedstock base.

Third-generation technologies emerged in the 2010s, focusing on algal biomass and advanced conversion techniques. Most recently, fourth-generation approaches have begun integrating carbon capture technologies with biomass processing, aiming for carbon-negative fuel production systems. This progression reflects the industry's response to increasingly stringent environmental standards and the global push toward decarbonization.

Current technological trends indicate a convergence of multiple upgrading pathways, with integrated biorefineries becoming the dominant model. These facilities combine various conversion technologies to maximize resource efficiency and product diversity. Artificial intelligence and machine learning are increasingly being applied to optimize process parameters and feedstock selection, while advances in catalyst design are improving conversion efficiencies and reducing energy requirements.

The primary objectives of biomass upgrading technologies center on overcoming the inherent limitations of raw biomass as a fuel source. These include reducing oxygen content, increasing energy density, improving storage stability, and enhancing compatibility with existing fuel infrastructure. Additionally, modern upgrading processes aim to minimize water consumption, reduce greenhouse gas emissions throughout the production lifecycle, and ensure economic viability at commercial scales.

Looking forward, the field is moving toward standardized quality parameters for upgraded biomass products, which will facilitate market acceptance and regulatory approval. The ultimate goal remains the development of cost-effective, scalable technologies that can produce drop-in biofuels capable of seamlessly integrating with existing transportation infrastructure while delivering substantial environmental benefits compared to fossil alternatives.

The technological evolution accelerated in the early 2000s with the development of first-generation biofuels, primarily derived from food crops. However, concerns about food security and land use quickly shifted focus toward second-generation technologies utilizing lignocellulosic biomass from agricultural and forestry residues. This transition marked a critical turning point, as it addressed sustainability concerns while expanding the potential feedstock base.

Third-generation technologies emerged in the 2010s, focusing on algal biomass and advanced conversion techniques. Most recently, fourth-generation approaches have begun integrating carbon capture technologies with biomass processing, aiming for carbon-negative fuel production systems. This progression reflects the industry's response to increasingly stringent environmental standards and the global push toward decarbonization.

Current technological trends indicate a convergence of multiple upgrading pathways, with integrated biorefineries becoming the dominant model. These facilities combine various conversion technologies to maximize resource efficiency and product diversity. Artificial intelligence and machine learning are increasingly being applied to optimize process parameters and feedstock selection, while advances in catalyst design are improving conversion efficiencies and reducing energy requirements.

The primary objectives of biomass upgrading technologies center on overcoming the inherent limitations of raw biomass as a fuel source. These include reducing oxygen content, increasing energy density, improving storage stability, and enhancing compatibility with existing fuel infrastructure. Additionally, modern upgrading processes aim to minimize water consumption, reduce greenhouse gas emissions throughout the production lifecycle, and ensure economic viability at commercial scales.

Looking forward, the field is moving toward standardized quality parameters for upgraded biomass products, which will facilitate market acceptance and regulatory approval. The ultimate goal remains the development of cost-effective, scalable technologies that can produce drop-in biofuels capable of seamlessly integrating with existing transportation infrastructure while delivering substantial environmental benefits compared to fossil alternatives.

Biofuel Market Demand Analysis

The global biofuel market has experienced significant growth over the past decade, driven by increasing environmental concerns, energy security issues, and government mandates for renewable energy adoption. Current market analysis indicates that the global biofuel market was valued at approximately $141 billion in 2022 and is projected to reach $218 billion by 2030, growing at a CAGR of around 5.8% during the forecast period.

Regional demand patterns show distinct characteristics across different markets. North America, particularly the United States, remains a dominant player with robust demand for corn-based ethanol and an expanding market for advanced biofuels. The European Union demonstrates strong demand for biodiesel, supported by stringent renewable energy directives and carbon reduction targets. Meanwhile, emerging economies in Asia-Pacific, especially China, India, and Indonesia, are witnessing accelerated demand growth due to rapid industrialization and increasing energy consumption.

Sector-specific analysis reveals that transportation remains the primary end-use segment for biofuels, accounting for over 70% of total consumption. Aviation biofuels represent a rapidly growing niche market, with major airlines increasingly committing to sustainable aviation fuel (SAF) adoption to reduce their carbon footprint. The maritime sector is also emerging as a potential growth area following the International Maritime Organization's regulations on sulfur emissions.

Consumer behavior studies indicate growing awareness and acceptance of biofuels, particularly in environmentally conscious markets. However, price sensitivity remains a critical factor influencing adoption rates, with consumers generally unwilling to pay significant premiums for biofuel products compared to conventional fuels.

Market barriers include feedstock availability constraints, competition with food production, and infrastructure limitations. The "food versus fuel" debate continues to impact public perception and policy decisions, particularly regarding first-generation biofuels. Additionally, the volatility of crude oil prices significantly influences the economic competitiveness of biofuels, with lower petroleum prices often undermining biofuel market growth.

Future demand projections suggest a shift toward advanced biofuels derived from non-food biomass sources, including agricultural residues, forestry waste, and algae. This transition is expected to be driven by evolving regulations that increasingly favor lower carbon intensity fuels and technologies that minimize land-use impacts. The implementation of carbon pricing mechanisms in various regions is anticipated to further strengthen the competitive position of biofuels against fossil alternatives.

Regional demand patterns show distinct characteristics across different markets. North America, particularly the United States, remains a dominant player with robust demand for corn-based ethanol and an expanding market for advanced biofuels. The European Union demonstrates strong demand for biodiesel, supported by stringent renewable energy directives and carbon reduction targets. Meanwhile, emerging economies in Asia-Pacific, especially China, India, and Indonesia, are witnessing accelerated demand growth due to rapid industrialization and increasing energy consumption.

Sector-specific analysis reveals that transportation remains the primary end-use segment for biofuels, accounting for over 70% of total consumption. Aviation biofuels represent a rapidly growing niche market, with major airlines increasingly committing to sustainable aviation fuel (SAF) adoption to reduce their carbon footprint. The maritime sector is also emerging as a potential growth area following the International Maritime Organization's regulations on sulfur emissions.

Consumer behavior studies indicate growing awareness and acceptance of biofuels, particularly in environmentally conscious markets. However, price sensitivity remains a critical factor influencing adoption rates, with consumers generally unwilling to pay significant premiums for biofuel products compared to conventional fuels.

Market barriers include feedstock availability constraints, competition with food production, and infrastructure limitations. The "food versus fuel" debate continues to impact public perception and policy decisions, particularly regarding first-generation biofuels. Additionally, the volatility of crude oil prices significantly influences the economic competitiveness of biofuels, with lower petroleum prices often undermining biofuel market growth.

Future demand projections suggest a shift toward advanced biofuels derived from non-food biomass sources, including agricultural residues, forestry waste, and algae. This transition is expected to be driven by evolving regulations that increasingly favor lower carbon intensity fuels and technologies that minimize land-use impacts. The implementation of carbon pricing mechanisms in various regions is anticipated to further strengthen the competitive position of biofuels against fossil alternatives.

Global Biomass Conversion Technical Status and Barriers

The global biomass conversion landscape presents a complex array of technical challenges and barriers that significantly impact the widespread adoption of biofuel technologies. Currently, biomass conversion technologies face efficiency limitations, with many processes achieving only 30-50% energy conversion rates compared to the theoretical maximum. This inefficiency stems from recalcitrance of lignocellulosic materials, which require extensive pretreatment processes that consume substantial energy and chemicals.

Feedstock variability represents another significant barrier, as biomass sources differ widely in composition, moisture content, and energy density. This heterogeneity complicates standardization of conversion processes and necessitates flexible technologies capable of handling diverse inputs, increasing both technical complexity and operational costs.

Scale-up challenges persist throughout the industry, with many promising technologies demonstrating success at laboratory scale but encountering significant engineering and economic barriers during commercial implementation. The capital expenditure for industrial-scale biomass conversion facilities typically ranges from $200-500 million, creating substantial financial risk for investors and developers.

Catalyst performance and longevity remain problematic in thermochemical conversion pathways. Current catalysts often suffer from rapid deactivation due to contaminants in biomass feedstocks, requiring frequent regeneration or replacement and increasing operational costs. Research indicates catalyst lifespans in biomass applications are typically 50-70% shorter than in conventional petrochemical applications.

Water consumption presents both a technical and sustainability barrier, with many conversion processes requiring 2-10 gallons of water per gallon of biofuel produced. This high water demand limits deployment in water-stressed regions and raises environmental concerns about the sustainability of large-scale operations.

Energy integration inefficiencies further constrain commercial viability. Many current facilities fail to optimize heat recovery and process integration, resulting in energy losses of 15-25% that could theoretically be recaptured with improved system design and operation.

Globally, technical development is unevenly distributed, with North America, Europe, and parts of Asia leading in advanced conversion technologies while many regions with abundant biomass resources lack technical capacity for implementation. This geographic disparity creates challenges for technology transfer and global deployment.

Regulatory frameworks across different regions impose varying technical requirements for emissions control, safety standards, and product quality, creating additional compliance burdens that increase technical complexity and operational costs for international developers.

Feedstock variability represents another significant barrier, as biomass sources differ widely in composition, moisture content, and energy density. This heterogeneity complicates standardization of conversion processes and necessitates flexible technologies capable of handling diverse inputs, increasing both technical complexity and operational costs.

Scale-up challenges persist throughout the industry, with many promising technologies demonstrating success at laboratory scale but encountering significant engineering and economic barriers during commercial implementation. The capital expenditure for industrial-scale biomass conversion facilities typically ranges from $200-500 million, creating substantial financial risk for investors and developers.

Catalyst performance and longevity remain problematic in thermochemical conversion pathways. Current catalysts often suffer from rapid deactivation due to contaminants in biomass feedstocks, requiring frequent regeneration or replacement and increasing operational costs. Research indicates catalyst lifespans in biomass applications are typically 50-70% shorter than in conventional petrochemical applications.

Water consumption presents both a technical and sustainability barrier, with many conversion processes requiring 2-10 gallons of water per gallon of biofuel produced. This high water demand limits deployment in water-stressed regions and raises environmental concerns about the sustainability of large-scale operations.

Energy integration inefficiencies further constrain commercial viability. Many current facilities fail to optimize heat recovery and process integration, resulting in energy losses of 15-25% that could theoretically be recaptured with improved system design and operation.

Globally, technical development is unevenly distributed, with North America, Europe, and parts of Asia leading in advanced conversion technologies while many regions with abundant biomass resources lack technical capacity for implementation. This geographic disparity creates challenges for technology transfer and global deployment.

Regulatory frameworks across different regions impose varying technical requirements for emissions control, safety standards, and product quality, creating additional compliance burdens that increase technical complexity and operational costs for international developers.

Current Biomass Upgrading Processes and Methods

01 Thermochemical conversion processes for biomass upgrading

Thermochemical processes such as pyrolysis, gasification, and hydrothermal liquefaction are used to convert biomass into higher-value fuels and chemicals. These processes involve the application of heat and sometimes pressure to break down biomass components into more valuable products. The resulting bio-oils, syngas, or char can be further refined into transportation fuels, chemicals, or other energy products with improved properties compared to raw biomass.- Thermochemical conversion processes for biomass upgrading: Various thermochemical processes can be used to convert biomass into higher-value products. These include pyrolysis, gasification, and hydrothermal liquefaction, which break down biomass at high temperatures with or without oxygen. These processes can transform agricultural residues, forestry waste, and other biomass feedstocks into bio-oils, syngas, and solid biochar that can be further refined into fuels and chemicals.

- Catalytic upgrading of biomass-derived compounds: Catalysts play a crucial role in biomass upgrading by facilitating specific chemical transformations at lower temperatures and pressures. Various catalytic systems, including metal catalysts, zeolites, and metal-organic frameworks, can be employed to convert biomass-derived intermediates into fuels and chemicals. These catalytic processes can improve selectivity, increase yields, and reduce energy requirements in biomass conversion pathways.

- Biological and enzymatic biomass conversion methods: Biological approaches utilize microorganisms or enzymes to break down complex biomass components into simpler molecules. Fermentation processes can convert sugars derived from biomass into biofuels like ethanol and butanol. Enzymatic hydrolysis can efficiently decompose cellulose and hemicellulose into fermentable sugars. These biological methods often operate under mild conditions and can be highly selective for specific transformations.

- Integrated biorefinery approaches for biomass valorization: Integrated biorefineries combine multiple conversion technologies to maximize the value extracted from biomass feedstocks. These facilities can simultaneously produce biofuels, biochemicals, and biomaterials from different components of the biomass. Cascading utilization strategies ensure that high-value components are extracted first, followed by conversion of remaining fractions into energy or lower-value products, improving overall economic viability and sustainability.

- Pretreatment methods for enhanced biomass conversion: Pretreatment processes are essential for breaking down the recalcitrant structure of lignocellulosic biomass to improve accessibility for subsequent conversion steps. Physical methods include grinding and milling, while chemical pretreatments may involve acids, bases, or organic solvents. Physicochemical approaches like steam explosion and ammonia fiber expansion can disrupt the biomass structure. Effective pretreatment can significantly increase conversion efficiency and product yields in downstream processes.

02 Catalytic upgrading of biomass

Catalysts play a crucial role in biomass upgrading by facilitating specific chemical reactions that convert biomass components into desired products. Various catalysts including zeolites, metal oxides, and supported noble metals are employed to enhance reaction rates, improve selectivity, and operate under milder conditions. Catalytic processes can deoxygenate bio-oils, crack large molecules, and reform biomass-derived compounds to produce higher-quality fuels and chemicals with properties similar to petroleum-derived products.Expand Specific Solutions03 Biological and enzymatic biomass conversion

Biological methods utilize microorganisms or enzymes to break down biomass components into valuable products. These processes include fermentation, anaerobic digestion, and enzymatic hydrolysis which can convert biomass into biofuels, biochemicals, and other high-value products. Compared to thermochemical methods, biological approaches often operate under milder conditions and can be more selective, though they may require longer processing times and careful control of reaction environments.Expand Specific Solutions04 Integrated biorefinery approaches

Integrated biorefineries combine multiple biomass processing technologies to maximize resource utilization and product value. These facilities process biomass through various pathways simultaneously or sequentially to produce a spectrum of products including fuels, chemicals, materials, and power. By integrating different conversion technologies, biorefineries can optimize efficiency, reduce waste, and improve economic viability through the production of multiple value streams from a single biomass feedstock.Expand Specific Solutions05 Pretreatment methods for biomass upgrading

Pretreatment processes are essential for improving the accessibility and reactivity of biomass components prior to conversion. These methods include physical (grinding, milling), chemical (acid, alkali, solvent treatments), physicochemical (steam explosion, ammonia fiber explosion), and biological pretreatments. Effective pretreatment can disrupt the recalcitrant structure of lignocellulosic biomass, increase surface area, and improve the efficiency of subsequent conversion processes, leading to higher yields and better-quality products.Expand Specific Solutions

Leading Companies and Research Institutions in Biofuel Industry

The biomass upgrading for biofuels sector is currently in a transitional growth phase, with the global biofuels market expected to reach $218 billion by 2026. Technical maturity varies significantly across different conversion pathways, with major oil companies like Shell, ExxonMobil, and Chevron leading commercial deployment while specialized firms such as Iogen, KiOR, and Vertoro focus on innovative technologies. Research institutions including Battelle Memorial Institute and IFP Energies Nouvelles are advancing fundamental science, while regulatory frameworks are evolving unevenly across regions. The competitive landscape shows increasing collaboration between traditional energy companies and biotech specialists, with Phillips 66, Sinopec, and Reliance Industries making strategic investments to secure positions in this emerging market that bridges energy, agriculture, and chemical sectors.

Shell Internationale Research Maatschappij BV

Technical Solution: Shell has developed comprehensive biofuel standardization frameworks through their Biofuels Technology Program. Their approach focuses on advanced biomass upgrading pathways including hydrothermal liquefaction (HTL) and catalytic pyrolysis to produce drop-in biofuels that meet existing fuel specifications. Shell's regulatory compliance strategy involves developing biofuels that can seamlessly integrate with existing infrastructure while meeting stringent quality standards such as EN 14214 for biodiesel and ASTM D7566 for aviation biofuels. They've pioneered co-processing technologies that allow biomass-derived intermediates to be processed alongside conventional petroleum streams in existing refineries, which simplifies regulatory approval processes by producing fuels chemically identical to conventional counterparts. Shell has also established partnerships with regulatory bodies to develop certification schemes for sustainable biomass sourcing and processing.

Strengths: Global infrastructure and extensive experience in fuel standardization; ability to influence regulatory development through industry leadership position; integrated approach from feedstock to final product. Weaknesses: Heavy focus on drop-in fuels may limit innovation in novel biofuel categories; regulatory strategies primarily designed for developed markets with established fuel standards.

IFP Energies Nouvelles

Technical Solution: IFP Energies Nouvelles has developed the BioTfueL® technology platform specifically addressing biomass upgrading standardization challenges. Their approach integrates torrefaction, gasification, and Fischer-Tropsch synthesis to produce advanced biofuels that comply with European fuel quality directives. IFP has pioneered standardized methodologies for biomass characterization and quality control throughout the conversion process, establishing parameters for moisture content, ash composition, and energy density that have influenced European Committee for Standardization (CEN) technical specifications. Their regulatory framework addresses sustainability criteria through life cycle assessment methodologies aligned with the Renewable Energy Directive (RED II), particularly focusing on greenhouse gas emission reduction thresholds. IFP has also developed standardized protocols for catalyst performance evaluation in biomass upgrading processes, which has contributed to harmonized testing procedures across the industry.

Strengths: Deep technical expertise in thermochemical conversion pathways; strong connections with European regulatory bodies; comprehensive approach to sustainability certification. Weaknesses: Technologies primarily optimized for woody biomass feedstocks; regulatory focus heavily centered on European markets rather than global standards harmonization.

Key Patents and Innovations in Biomass Conversion Technologies

Upgrading of bio-oil using synthesis gas

PatentInactiveUS20140073827A1

Innovation

- The method involves using synthesis gas or the water gas shift reaction to provide hydrogen for the hydrodeoxygenation process, allowing for the upgrading of bio-oil into hydrocarbons and other fuel products, utilizing a dual catalyst system and pressurized syngas produced from biomass or other sources, which replaces hydrogen from fossil fuels and enhances fuel stability and heating value.

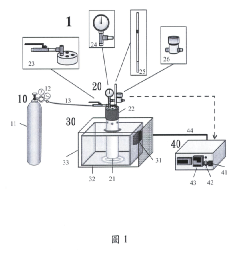

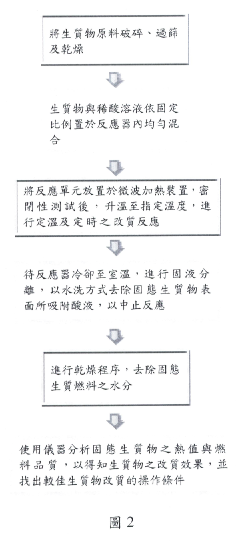

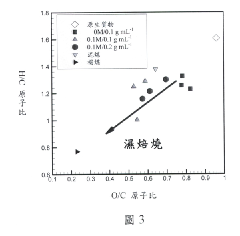

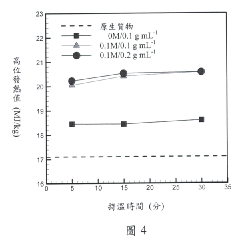

A method of upgrading biomass for solid fuel

PatentInactiveTW201348431A

Innovation

- A method involving mixing biomass with a dilute acid solution and using microwave heating to rapidly upgrade biomass fuel by controlling reaction temperature and time, followed by solid-liquid separation and drying, to improve calorific value and quality.

Regulatory Framework and Compliance Requirements for Biofuels

The regulatory landscape for biofuels is complex and multifaceted, encompassing international agreements, regional frameworks, and national policies. At the international level, the United Nations Framework Convention on Climate Change (UNFCCC) and the Paris Agreement provide overarching guidance on reducing greenhouse gas emissions, indirectly influencing biofuel standards. The International Organization for Standardization (ISO) has developed specific standards such as ISO 13065 for sustainability criteria in bioenergy, establishing benchmarks for environmental performance and social responsibility.

In the European Union, the Renewable Energy Directive II (RED II) mandates that 14% of transportation fuel must come from renewable sources by 2030, with specific sustainability criteria for biofuels. These include minimum greenhouse gas emission savings compared to fossil fuels (50-65% depending on installation date), restrictions on land use change, and biodiversity protection measures. The Fuel Quality Directive complements RED II by requiring a 6% reduction in the carbon intensity of transport fuels.

The United States regulatory framework centers around the Renewable Fuel Standard (RFS) program, which establishes annual volume requirements for different categories of biofuels. The program classifies biofuels based on their feedstock and greenhouse gas reduction potential, with advanced biofuels requiring at least 50% emissions reduction compared to petroleum-based fuels. California's Low Carbon Fuel Standard (LCFS) takes a more technology-neutral approach, focusing on carbon intensity reduction targets rather than specific fuel types.

Compliance requirements typically include lifecycle assessment of greenhouse gas emissions, chain of custody documentation, and third-party verification. Producers must demonstrate adherence to sustainability criteria, including protection of high biodiversity areas, carbon stock preservation, and responsible agricultural practices. Certification schemes like the International Sustainability and Carbon Certification (ISCC), Roundtable on Sustainable Biomaterials (RSB), and Bonsucro provide frameworks for demonstrating compliance.

Emerging economies like Brazil, India, and China are developing their own regulatory frameworks, often balancing environmental concerns with economic development priorities. Brazil's RenovaBio program incentivizes biofuel production through tradable carbon credits, while China's ethanol mandate aims to utilize agricultural waste and address air pollution concerns.

Key compliance challenges include harmonization of standards across jurisdictions, accurate carbon accounting methodologies, and verification of sustainability claims throughout complex supply chains. As technology evolves, regulatory frameworks must adapt to accommodate novel feedstocks, conversion processes, and end products while maintaining environmental safeguards.

In the European Union, the Renewable Energy Directive II (RED II) mandates that 14% of transportation fuel must come from renewable sources by 2030, with specific sustainability criteria for biofuels. These include minimum greenhouse gas emission savings compared to fossil fuels (50-65% depending on installation date), restrictions on land use change, and biodiversity protection measures. The Fuel Quality Directive complements RED II by requiring a 6% reduction in the carbon intensity of transport fuels.

The United States regulatory framework centers around the Renewable Fuel Standard (RFS) program, which establishes annual volume requirements for different categories of biofuels. The program classifies biofuels based on their feedstock and greenhouse gas reduction potential, with advanced biofuels requiring at least 50% emissions reduction compared to petroleum-based fuels. California's Low Carbon Fuel Standard (LCFS) takes a more technology-neutral approach, focusing on carbon intensity reduction targets rather than specific fuel types.

Compliance requirements typically include lifecycle assessment of greenhouse gas emissions, chain of custody documentation, and third-party verification. Producers must demonstrate adherence to sustainability criteria, including protection of high biodiversity areas, carbon stock preservation, and responsible agricultural practices. Certification schemes like the International Sustainability and Carbon Certification (ISCC), Roundtable on Sustainable Biomaterials (RSB), and Bonsucro provide frameworks for demonstrating compliance.

Emerging economies like Brazil, India, and China are developing their own regulatory frameworks, often balancing environmental concerns with economic development priorities. Brazil's RenovaBio program incentivizes biofuel production through tradable carbon credits, while China's ethanol mandate aims to utilize agricultural waste and address air pollution concerns.

Key compliance challenges include harmonization of standards across jurisdictions, accurate carbon accounting methodologies, and verification of sustainability claims throughout complex supply chains. As technology evolves, regulatory frameworks must adapt to accommodate novel feedstocks, conversion processes, and end products while maintaining environmental safeguards.

Sustainability and Environmental Impact Assessment

The sustainability assessment of biomass upgrading processes for biofuel production requires comprehensive evaluation frameworks that address environmental, social, and economic dimensions. Current Life Cycle Assessment (LCA) methodologies have been adapted specifically for biofuel pathways, with standards such as ISO 14040 and 14044 providing the foundational framework for evaluating environmental impacts across the entire value chain. These assessments typically measure greenhouse gas emissions, water consumption, land use changes, biodiversity impacts, and air quality effects.

Regulatory frameworks worldwide have established sustainability criteria that biofuel production must meet. The European Union's Renewable Energy Directive (RED II) mandates that biofuels must demonstrate at least 65% greenhouse gas savings compared to fossil fuels and cannot be produced from high carbon stock or high biodiversity lands. Similarly, the U.S. Renewable Fuel Standard (RFS) program requires biofuels to achieve specific greenhouse gas reduction thresholds relative to petroleum baseline.

Water footprint analysis has become increasingly important in sustainability assessments, with methodologies developed to quantify both direct and indirect water consumption throughout the biomass-to-biofuel supply chain. The Water Footprint Network's assessment manual provides standardized approaches that have been incorporated into biofuel certification schemes.

Carbon accounting methodologies for biofuels continue to evolve, with particular attention to indirect land use change (ILUC) factors. The California Low Carbon Fuel Standard (LCFS) and similar programs have developed sophisticated models to account for these indirect effects, though significant uncertainties remain in quantification approaches.

Biodiversity impact assessment frameworks for biofuel production systems are less standardized but increasingly required by certification schemes. The Roundtable on Sustainable Biomaterials (RSB) and International Sustainability and Carbon Certification (ISCC) have developed criteria that address habitat conversion, ecosystem services, and species protection.

Social impact assessments are becoming more integrated into sustainability frameworks, with standards like the RSB incorporating requirements for human rights protection, labor conditions, food security considerations, and community engagement. These social dimensions are particularly important in regions where biomass production may compete with food crops or affect local communities.

Emerging approaches include the development of sustainability indicators that can be monitored throughout the supply chain using digital technologies and remote sensing. These tools enable more dynamic and continuous assessment of environmental impacts rather than point-in-time certifications, potentially transforming how compliance with sustainability standards is verified and reported.

Regulatory frameworks worldwide have established sustainability criteria that biofuel production must meet. The European Union's Renewable Energy Directive (RED II) mandates that biofuels must demonstrate at least 65% greenhouse gas savings compared to fossil fuels and cannot be produced from high carbon stock or high biodiversity lands. Similarly, the U.S. Renewable Fuel Standard (RFS) program requires biofuels to achieve specific greenhouse gas reduction thresholds relative to petroleum baseline.

Water footprint analysis has become increasingly important in sustainability assessments, with methodologies developed to quantify both direct and indirect water consumption throughout the biomass-to-biofuel supply chain. The Water Footprint Network's assessment manual provides standardized approaches that have been incorporated into biofuel certification schemes.

Carbon accounting methodologies for biofuels continue to evolve, with particular attention to indirect land use change (ILUC) factors. The California Low Carbon Fuel Standard (LCFS) and similar programs have developed sophisticated models to account for these indirect effects, though significant uncertainties remain in quantification approaches.

Biodiversity impact assessment frameworks for biofuel production systems are less standardized but increasingly required by certification schemes. The Roundtable on Sustainable Biomaterials (RSB) and International Sustainability and Carbon Certification (ISCC) have developed criteria that address habitat conversion, ecosystem services, and species protection.

Social impact assessments are becoming more integrated into sustainability frameworks, with standards like the RSB incorporating requirements for human rights protection, labor conditions, food security considerations, and community engagement. These social dimensions are particularly important in regions where biomass production may compete with food crops or affect local communities.

Emerging approaches include the development of sustainability indicators that can be monitored throughout the supply chain using digital technologies and remote sensing. These tools enable more dynamic and continuous assessment of environmental impacts rather than point-in-time certifications, potentially transforming how compliance with sustainability standards is verified and reported.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!