Policy Instruments To Accelerate Second-Life Battery Uptake

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Second-Life Battery Technology Background and Objectives

Second-life battery technology has evolved significantly over the past decade, transitioning from experimental concepts to commercially viable solutions. Initially developed as a response to the growing waste management challenges posed by end-of-life electric vehicle (EV) batteries, this technology aims to extend battery utility beyond their primary automotive applications. The evolution began around 2010 when early EV models started reaching significant market penetration, creating a forward-looking need for battery lifecycle management strategies.

The fundamental principle behind second-life battery technology involves repurposing batteries that no longer meet the rigorous performance standards required for EVs (typically below 70-80% of original capacity) for less demanding stationary energy storage applications. This approach addresses multiple objectives simultaneously: extending the useful life of lithium-ion batteries, reducing electronic waste, creating additional value streams from existing assets, and supporting renewable energy integration.

From a technical perspective, the development trajectory has focused on overcoming several key challenges, including battery diagnostics, reconfiguration methodologies, management system adaptation, and safety protocol establishment. Early implementations primarily targeted simple backup power applications, but the technology has progressively advanced toward more sophisticated grid services, renewable energy integration, and commercial-scale energy storage systems.

The global market for second-life batteries has been significantly influenced by regional policy frameworks, with pioneering initiatives emerging from countries with early EV adoption such as Japan, South Korea, and parts of Europe. These regions established the initial technical standards and business models that have subsequently shaped global development patterns.

Current technical objectives in the field center around several critical areas: standardizing assessment protocols for determining battery state-of-health with greater precision; developing more efficient reconditioning processes; creating adaptive battery management systems capable of handling cells with varying degradation levels; and establishing comprehensive safety standards specific to repurposed energy storage systems.

Looking forward, the technology aims to achieve full integration with smart grid infrastructure, enabling second-life batteries to provide advanced grid services such as frequency regulation, peak shaving, and renewable energy time-shifting. Additional objectives include reducing reconditioning costs to enhance economic viability, extending the secondary operational lifespan to 7-10 years, and developing automated disassembly and testing systems to scale operations efficiently.

The acceleration of second-life battery uptake represents a critical component in the circular economy approach to energy storage, with potential to significantly reduce the environmental footprint of the rapidly expanding EV sector while simultaneously supporting renewable energy transition goals.

The fundamental principle behind second-life battery technology involves repurposing batteries that no longer meet the rigorous performance standards required for EVs (typically below 70-80% of original capacity) for less demanding stationary energy storage applications. This approach addresses multiple objectives simultaneously: extending the useful life of lithium-ion batteries, reducing electronic waste, creating additional value streams from existing assets, and supporting renewable energy integration.

From a technical perspective, the development trajectory has focused on overcoming several key challenges, including battery diagnostics, reconfiguration methodologies, management system adaptation, and safety protocol establishment. Early implementations primarily targeted simple backup power applications, but the technology has progressively advanced toward more sophisticated grid services, renewable energy integration, and commercial-scale energy storage systems.

The global market for second-life batteries has been significantly influenced by regional policy frameworks, with pioneering initiatives emerging from countries with early EV adoption such as Japan, South Korea, and parts of Europe. These regions established the initial technical standards and business models that have subsequently shaped global development patterns.

Current technical objectives in the field center around several critical areas: standardizing assessment protocols for determining battery state-of-health with greater precision; developing more efficient reconditioning processes; creating adaptive battery management systems capable of handling cells with varying degradation levels; and establishing comprehensive safety standards specific to repurposed energy storage systems.

Looking forward, the technology aims to achieve full integration with smart grid infrastructure, enabling second-life batteries to provide advanced grid services such as frequency regulation, peak shaving, and renewable energy time-shifting. Additional objectives include reducing reconditioning costs to enhance economic viability, extending the secondary operational lifespan to 7-10 years, and developing automated disassembly and testing systems to scale operations efficiently.

The acceleration of second-life battery uptake represents a critical component in the circular economy approach to energy storage, with potential to significantly reduce the environmental footprint of the rapidly expanding EV sector while simultaneously supporting renewable energy transition goals.

Market Analysis for Second-Life Battery Applications

The second-life battery market is experiencing significant growth driven by the rapid expansion of electric vehicle (EV) adoption worldwide. As EV batteries reach the end of their automotive life cycle (typically at 70-80% of original capacity), they retain substantial value for less demanding applications. Current market projections indicate the global second-life battery market could reach $4.2 billion by 2025 and potentially $7.8 billion by 2030, representing a compound annual growth rate exceeding 23%.

Energy storage systems (ESS) constitute the largest application segment, accounting for approximately 43% of the second-life battery market. These systems serve critical functions in grid stabilization, renewable energy integration, and peak shaving for utilities and commercial buildings. The residential energy storage segment follows with roughly 28% market share, where batteries provide backup power and enable greater self-consumption of rooftop solar generation.

Industrial applications represent another significant market segment at 18%, where second-life batteries power material handling equipment, backup systems, and other non-automotive mobile applications. The telecommunications sector utilizes these batteries for cell tower backup power, comprising about 11% of the market.

Geographically, Asia-Pacific dominates the second-life battery market with approximately 45% share, driven by China's massive EV fleet and supportive regulatory environment. Europe follows at 32%, with particularly strong growth in Germany, France, and the Nordic countries where renewable energy penetration is high. North America accounts for 20% of the market, with concentrated activity in California and other states with progressive energy policies.

Key market drivers include the widening price gap between new and repurposed batteries (currently 30-50% cost advantage for second-life units), increasing renewable energy deployment requiring storage solutions, and growing corporate sustainability initiatives. The economic value proposition is particularly compelling for stationary applications where energy density is less critical than in automotive uses.

Market barriers include inconsistent battery quality standards, fragmented supply chains, and regulatory uncertainty regarding end-of-life battery responsibility. Additionally, the rapid decline in new battery prices (averaging 13% annually over the past five years) threatens to erode the cost advantage of second-life solutions in certain applications.

Customer segments show varying adoption patterns, with commercial and industrial users currently representing the early majority adopters due to their ability to manage larger-scale implementations and longer payback periods. Residential customers remain largely in the early adopter phase, awaiting more standardized products and simplified installation processes.

Energy storage systems (ESS) constitute the largest application segment, accounting for approximately 43% of the second-life battery market. These systems serve critical functions in grid stabilization, renewable energy integration, and peak shaving for utilities and commercial buildings. The residential energy storage segment follows with roughly 28% market share, where batteries provide backup power and enable greater self-consumption of rooftop solar generation.

Industrial applications represent another significant market segment at 18%, where second-life batteries power material handling equipment, backup systems, and other non-automotive mobile applications. The telecommunications sector utilizes these batteries for cell tower backup power, comprising about 11% of the market.

Geographically, Asia-Pacific dominates the second-life battery market with approximately 45% share, driven by China's massive EV fleet and supportive regulatory environment. Europe follows at 32%, with particularly strong growth in Germany, France, and the Nordic countries where renewable energy penetration is high. North America accounts for 20% of the market, with concentrated activity in California and other states with progressive energy policies.

Key market drivers include the widening price gap between new and repurposed batteries (currently 30-50% cost advantage for second-life units), increasing renewable energy deployment requiring storage solutions, and growing corporate sustainability initiatives. The economic value proposition is particularly compelling for stationary applications where energy density is less critical than in automotive uses.

Market barriers include inconsistent battery quality standards, fragmented supply chains, and regulatory uncertainty regarding end-of-life battery responsibility. Additionally, the rapid decline in new battery prices (averaging 13% annually over the past five years) threatens to erode the cost advantage of second-life solutions in certain applications.

Customer segments show varying adoption patterns, with commercial and industrial users currently representing the early majority adopters due to their ability to manage larger-scale implementations and longer payback periods. Residential customers remain largely in the early adopter phase, awaiting more standardized products and simplified installation processes.

Technical Barriers and Global Development Status

Despite significant advancements in second-life battery technologies, several technical barriers continue to impede widespread adoption. Battery degradation assessment remains a primary challenge, as accurately determining the state of health (SOH) of used batteries requires sophisticated diagnostic tools and methodologies that are not yet standardized across the industry. This creates uncertainty regarding the remaining useful life of repurposed batteries, making it difficult for potential users to assess their value proposition.

Battery design heterogeneity presents another significant obstacle. The diverse range of battery chemistries, form factors, and management systems employed by different manufacturers complicates the development of universal repurposing solutions. This lack of standardization increases the complexity and cost of second-life battery integration, as each battery type may require custom adaptation for new applications.

Safety concerns also persist as a major technical barrier. Used batteries may have undergone various stress conditions during their first life, potentially leading to internal defects that are difficult to detect but could pose serious safety risks in second-life applications. The development of reliable non-destructive testing methods remains an ongoing challenge for the industry.

Globally, the development status of second-life battery technologies varies significantly. Europe leads in policy frameworks supporting battery reuse, with the European Union's Battery Directive and Circular Economy Action Plan providing regulatory foundations for second-life applications. Countries like Germany and the Netherlands have established industrial-scale pilot projects demonstrating the technical feasibility of battery repurposing for grid storage applications.

In Asia, China has emerged as a leader in electric vehicle battery recycling infrastructure, though its focus has traditionally been more on material recovery than repurposing. Japan and South Korea are advancing in second-life applications, with major battery manufacturers like LG Chem and Samsung SDI investing in research and development for battery repurposing technologies.

North America shows a more fragmented approach, with California leading state-level initiatives through its Advanced Clean Cars Program and energy storage mandates. However, the absence of comprehensive federal policies has resulted in slower adoption compared to European markets.

Emerging economies face additional challenges related to technical capacity and infrastructure limitations. While countries like India have ambitious electric vehicle adoption targets, they lack the specialized facilities and expertise required for large-scale battery repurposing operations, creating potential future bottlenecks as first-generation electric vehicle batteries reach end-of-life.

Battery design heterogeneity presents another significant obstacle. The diverse range of battery chemistries, form factors, and management systems employed by different manufacturers complicates the development of universal repurposing solutions. This lack of standardization increases the complexity and cost of second-life battery integration, as each battery type may require custom adaptation for new applications.

Safety concerns also persist as a major technical barrier. Used batteries may have undergone various stress conditions during their first life, potentially leading to internal defects that are difficult to detect but could pose serious safety risks in second-life applications. The development of reliable non-destructive testing methods remains an ongoing challenge for the industry.

Globally, the development status of second-life battery technologies varies significantly. Europe leads in policy frameworks supporting battery reuse, with the European Union's Battery Directive and Circular Economy Action Plan providing regulatory foundations for second-life applications. Countries like Germany and the Netherlands have established industrial-scale pilot projects demonstrating the technical feasibility of battery repurposing for grid storage applications.

In Asia, China has emerged as a leader in electric vehicle battery recycling infrastructure, though its focus has traditionally been more on material recovery than repurposing. Japan and South Korea are advancing in second-life applications, with major battery manufacturers like LG Chem and Samsung SDI investing in research and development for battery repurposing technologies.

North America shows a more fragmented approach, with California leading state-level initiatives through its Advanced Clean Cars Program and energy storage mandates. However, the absence of comprehensive federal policies has resulted in slower adoption compared to European markets.

Emerging economies face additional challenges related to technical capacity and infrastructure limitations. While countries like India have ambitious electric vehicle adoption targets, they lack the specialized facilities and expertise required for large-scale battery repurposing operations, creating potential future bottlenecks as first-generation electric vehicle batteries reach end-of-life.

Current Policy Frameworks Supporting Battery Reuse

01 Battery assessment and grading systems for second-life applications

Systems for evaluating and grading used batteries to determine their suitability for second-life applications. These systems analyze battery health, remaining capacity, and performance metrics to classify batteries for appropriate repurposing. Advanced diagnostic tools and algorithms help identify which batteries are suitable for specific second-life applications, accelerating the adoption process by ensuring reliability and performance in secondary uses.- Battery assessment and grading systems for second-life applications: Systems for evaluating and grading used batteries to determine their suitability for second-life applications. These systems analyze battery health, remaining capacity, and performance metrics to classify batteries for appropriate reuse scenarios. Advanced diagnostic tools and algorithms help identify which batteries can be repurposed effectively, accelerating the adoption of second-life batteries by providing reliable quality assurance to potential users.

- Battery repurposing technologies and refurbishment processes: Technologies and processes specifically designed for refurbishing and repurposing used batteries for second-life applications. These include disassembly methods, cell reconditioning techniques, and reassembly procedures that transform end-of-life vehicle batteries into energy storage systems. By streamlining these processes and making them more cost-effective, the barriers to second-life battery adoption are reduced, accelerating market uptake.

- Energy storage system integration and management: Solutions for integrating second-life batteries into energy storage systems with effective management capabilities. These innovations include battery management systems specifically designed for heterogeneous second-life batteries, grid integration technologies, and control systems that optimize performance. By addressing the technical challenges of using repurposed batteries in new applications, these solutions help accelerate the adoption of second-life batteries in stationary storage markets.

- Business models and market mechanisms for second-life batteries: Innovative business models and market mechanisms designed to accelerate the uptake of second-life batteries. These include battery-as-a-service offerings, leasing programs, incentive structures, and marketplace platforms that connect battery suppliers with potential users. By addressing economic barriers and creating viable commercial pathways, these approaches help stimulate demand for repurposed batteries and establish sustainable second-life battery ecosystems.

- Predictive analytics and lifecycle management: Advanced predictive analytics and lifecycle management tools that enhance the value proposition of second-life batteries. These technologies use artificial intelligence and machine learning to forecast battery degradation, optimize usage patterns, and extend useful life in second applications. By improving reliability and performance predictability, these innovations help overcome skepticism about repurposed batteries and accelerate their adoption across various sectors.

02 Battery management systems for repurposed batteries

Specialized battery management systems designed specifically for second-life batteries that monitor and optimize performance in their new applications. These systems account for the unique characteristics of aged batteries, managing charging/discharging cycles to extend usable life and ensure safety. Advanced BMS solutions help overcome concerns about reliability and performance variability in repurposed batteries, making them more attractive for secondary applications.Expand Specific Solutions03 Standardization and certification frameworks

Development of industry standards and certification processes for second-life batteries to build market confidence and accelerate adoption. These frameworks establish testing protocols, safety requirements, and performance benchmarks specific to repurposed batteries. Standardization helps create a more transparent marketplace, reduces technical barriers, and provides assurance to potential users about the quality and reliability of second-life battery products.Expand Specific Solutions04 Innovative repurposing technologies and processes

Novel technologies and processes that facilitate the efficient disassembly, testing, and reconfiguration of used batteries for second-life applications. These innovations include automated systems for battery pack disassembly, cell sorting technologies, and reconfiguration methods that optimize performance for specific secondary applications. By reducing the cost and complexity of repurposing batteries, these technologies help accelerate the uptake of second-life battery solutions.Expand Specific Solutions05 Market integration and business models

Innovative business models and market integration strategies that create economic incentives for second-life battery adoption. These approaches include battery-as-a-service offerings, value chain optimization, and digital platforms that connect battery suppliers with potential users. New financial models account for the full lifecycle value of batteries, creating economic frameworks that make second-life applications more financially attractive and accelerating market uptake.Expand Specific Solutions

Key Industry Stakeholders and Ecosystem Analysis

The second-life battery market is currently in an early growth phase, characterized by increasing momentum as the first wave of EV batteries reaches end-of-life status. Market size is projected to expand significantly, with estimates suggesting a multi-billion dollar opportunity by 2030 as battery volumes from first-generation EVs become available for repurposing. Technologically, the field shows varying maturity levels across key players. Leading battery manufacturers like CATL, LG Energy Solution, and Northvolt are developing standardized assessment protocols and refurbishment processes, while automotive companies including Toyota, Honda, and BMW are implementing pilot programs for energy storage applications. Traditional energy companies such as EDF are exploring integration with renewable energy systems, creating a competitive landscape that spans multiple industries with different approaches to battery lifecycle management.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has developed a comprehensive second-life battery management system called "Battery Rebirth" that integrates advanced battery testing, grading, and repurposing technologies. Their approach includes non-destructive testing methods to accurately assess remaining battery capacity and health without compromising the battery structure. CATL's system employs AI-driven algorithms to predict battery degradation patterns and optimize second-life applications based on the specific characteristics of each battery pack. The company has established partnerships with energy storage developers to create standardized battery modules that can be easily integrated into stationary storage systems. CATL has also implemented blockchain-based battery passport technology to track batteries throughout their lifecycle, providing transparent information about battery history, usage patterns, and performance metrics to facilitate second-life deployment.

Strengths: CATL's extensive battery manufacturing experience provides deep technical knowledge for accurate assessment of used batteries. Their global scale enables creation of standardized second-life solutions that can be deployed across multiple markets. Weaknesses: Their system requires significant infrastructure investment and may face challenges with batteries from competing manufacturers due to proprietary battery management systems.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed a comprehensive Battery-as-a-Service (BaaS) model specifically designed to facilitate second-life battery applications. Their approach begins with a sophisticated battery diagnostics system that employs electrochemical impedance spectroscopy to accurately determine the state of health of used EV batteries. The company has created a modular battery reconditioning process that allows for the replacement of damaged cells while preserving functional components, significantly extending overall battery life. LG's proprietary Battery Management System (BMS) has been adapted to support second-life applications with specialized algorithms that optimize performance based on the degradation profile of used batteries. The company has established partnerships with utility companies to deploy second-life batteries in grid stabilization projects, demonstrating practical implementation of their technology. LG has also developed standardized interfaces that allow their second-life battery systems to be integrated with various energy management platforms.

Strengths: LG's vertical integration from cell manufacturing to system integration enables complete lifecycle management. Their established relationships with major automakers provide a reliable stream of end-of-life batteries. Weaknesses: Their solutions may prioritize LG-manufactured batteries, potentially limiting applicability to the broader market of mixed-manufacturer battery waste streams.

Critical Patents and Research in Battery Repurposing

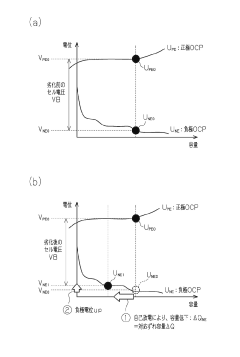

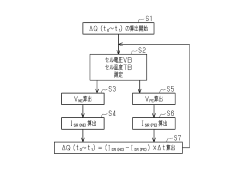

Secondary battery life evaluation device and method thereof

PatentPendingUS20240210487A1

Innovation

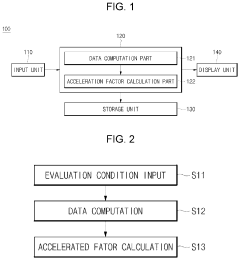

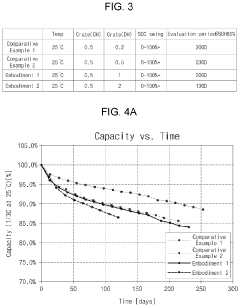

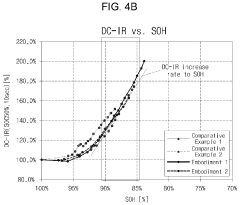

- A method and device that input temperature, charging, and discharging rates to compute an evaluation period, capacity degradation rate, and direct current internal resistance change rate, using an acceleration factor calculation to reduce the life evaluation period by increasing the discharging rate, allowing the state of health to reach a set range of 80% to 90%.

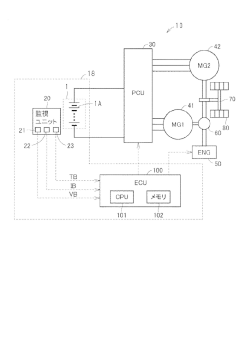

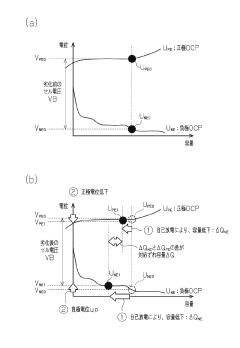

Secondary battery deterioration estimation method, life estimation method and control device

PatentActiveJP2021163632A

Innovation

- The method calculates the capacity reduction of both the negative and positive electrodes separately by considering the side reactions on each, using Tafel equations to determine the film formation current densities and overvoltage terms, and integrates these to accurately estimate the deviation capacity.

Economic Incentives and Business Models

The economic landscape for second-life battery adoption requires strategic incentives and innovative business models to overcome market barriers. Currently, the cost advantage of repurposed batteries over new ones remains insufficient to drive widespread adoption, necessitating financial mechanisms to bridge this gap.

Tax incentives represent a powerful tool for accelerating market uptake. Reduced VAT rates for second-life battery products, corporate tax credits for businesses investing in battery repurposing infrastructure, and accelerated depreciation allowances for second-life battery investments can significantly improve the financial equation. These measures effectively lower the cost barrier while stimulating private sector engagement.

Direct subsidies offer another critical pathway to market development. Purchase rebates for consumers and businesses acquiring second-life battery systems can stimulate demand, while production subsidies for remanufacturers help establish supply chain resilience. Grant programs targeting research and development in battery testing, refurbishment technologies, and standardization efforts address technical barriers that currently impede market growth.

Innovative business models are emerging as key enablers for second-life battery markets. Battery-as-a-Service (BaaS) arrangements decouple ownership from usage, allowing customers to pay for energy storage performance rather than the physical asset. This model distributes costs over time while providing performance guarantees that build market confidence.

Performance contracting represents another promising approach, where service providers guarantee specific energy storage outcomes, with compensation tied to actual performance metrics. This arrangement reduces perceived risk for end-users while creating accountability throughout the value chain.

Circular economy partnerships between original battery manufacturers, repurposing specialists, and end-users create closed-loop systems that optimize battery value across multiple life cycles. These collaborative ecosystems enable resource efficiency while distributing economic benefits among multiple stakeholders.

Market-based instruments such as tradable battery recycling credits can create additional revenue streams for second-life battery operators. By monetizing the environmental benefits of extended battery utilization, these mechanisms improve the overall economics while aligning with sustainability objectives.

The integration of these economic incentives and business models requires coordinated policy frameworks that address both supply and demand dynamics. Successful implementation depends on balancing short-term adoption incentives with long-term market sustainability, ensuring that second-life battery solutions can eventually compete without permanent subsidization.

Tax incentives represent a powerful tool for accelerating market uptake. Reduced VAT rates for second-life battery products, corporate tax credits for businesses investing in battery repurposing infrastructure, and accelerated depreciation allowances for second-life battery investments can significantly improve the financial equation. These measures effectively lower the cost barrier while stimulating private sector engagement.

Direct subsidies offer another critical pathway to market development. Purchase rebates for consumers and businesses acquiring second-life battery systems can stimulate demand, while production subsidies for remanufacturers help establish supply chain resilience. Grant programs targeting research and development in battery testing, refurbishment technologies, and standardization efforts address technical barriers that currently impede market growth.

Innovative business models are emerging as key enablers for second-life battery markets. Battery-as-a-Service (BaaS) arrangements decouple ownership from usage, allowing customers to pay for energy storage performance rather than the physical asset. This model distributes costs over time while providing performance guarantees that build market confidence.

Performance contracting represents another promising approach, where service providers guarantee specific energy storage outcomes, with compensation tied to actual performance metrics. This arrangement reduces perceived risk for end-users while creating accountability throughout the value chain.

Circular economy partnerships between original battery manufacturers, repurposing specialists, and end-users create closed-loop systems that optimize battery value across multiple life cycles. These collaborative ecosystems enable resource efficiency while distributing economic benefits among multiple stakeholders.

Market-based instruments such as tradable battery recycling credits can create additional revenue streams for second-life battery operators. By monetizing the environmental benefits of extended battery utilization, these mechanisms improve the overall economics while aligning with sustainability objectives.

The integration of these economic incentives and business models requires coordinated policy frameworks that address both supply and demand dynamics. Successful implementation depends on balancing short-term adoption incentives with long-term market sustainability, ensuring that second-life battery solutions can eventually compete without permanent subsidization.

Environmental Impact and Sustainability Metrics

The environmental impact assessment of second-life battery applications reveals significant sustainability benefits compared to new battery production. Life cycle analyses indicate that repurposing electric vehicle batteries can reduce carbon emissions by 15-70% depending on the application scenario and assessment methodology. These environmental advantages stem primarily from avoiding the energy-intensive manufacturing processes required for new batteries, particularly the extraction and processing of critical raw materials.

Material flow analysis demonstrates that effective second-life battery deployment could reduce primary lithium demand by approximately 10-25% by 2030, alleviating pressure on mining activities in ecologically sensitive regions. Furthermore, extending battery lifespans through second-life applications potentially reduces hazardous waste generation by 20-40% compared to direct recycling pathways, according to recent industry studies.

Quantifiable sustainability metrics for second-life battery systems include embodied carbon reduction (measured in kgCO2e), critical material displacement (kg of virgin materials avoided), and waste diversion rates (percentage of batteries diverted from immediate recycling). These metrics provide tangible measurements for policy effectiveness evaluation and industry benchmarking.

Energy return on investment (EROI) calculations for second-life systems demonstrate favorable ratios compared to new battery production, with studies indicating 2-3 times better energy efficiency when accounting for the full lifecycle. This translates to measurable reductions in primary energy consumption across the battery value chain.

Circular economy indicators specific to battery repurposing include material circularity index, component reuse rates, and value retention metrics. These indicators show that well-designed second-life pathways can retain 30-60% of a battery's original economic value while preserving up to 80% of the embodied energy and materials.

Water footprint analyses reveal additional environmental benefits, with second-life battery pathways requiring 40-70% less water consumption compared to new battery manufacturing. This represents a significant advantage in regions facing water scarcity challenges, where battery manufacturing facilities often compete with other water-intensive industries and community needs.

Material flow analysis demonstrates that effective second-life battery deployment could reduce primary lithium demand by approximately 10-25% by 2030, alleviating pressure on mining activities in ecologically sensitive regions. Furthermore, extending battery lifespans through second-life applications potentially reduces hazardous waste generation by 20-40% compared to direct recycling pathways, according to recent industry studies.

Quantifiable sustainability metrics for second-life battery systems include embodied carbon reduction (measured in kgCO2e), critical material displacement (kg of virgin materials avoided), and waste diversion rates (percentage of batteries diverted from immediate recycling). These metrics provide tangible measurements for policy effectiveness evaluation and industry benchmarking.

Energy return on investment (EROI) calculations for second-life systems demonstrate favorable ratios compared to new battery production, with studies indicating 2-3 times better energy efficiency when accounting for the full lifecycle. This translates to measurable reductions in primary energy consumption across the battery value chain.

Circular economy indicators specific to battery repurposing include material circularity index, component reuse rates, and value retention metrics. These indicators show that well-designed second-life pathways can retain 30-60% of a battery's original economic value while preserving up to 80% of the embodied energy and materials.

Water footprint analyses reveal additional environmental benefits, with second-life battery pathways requiring 40-70% less water consumption compared to new battery manufacturing. This represents a significant advantage in regions facing water scarcity challenges, where battery manufacturing facilities often compete with other water-intensive industries and community needs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!