What New Regulations are Affecting Self-cleaning Surfaces

OCT 14, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Self-Cleaning Surface Regulatory Background and Objectives

Self-cleaning surfaces have evolved significantly over the past two decades, drawing inspiration from natural phenomena such as the lotus leaf effect discovered in the 1970s. This biomimetic approach has led to the development of various surface technologies that minimize maintenance requirements and enhance hygiene across multiple sectors including construction, automotive, healthcare, and consumer electronics.

The regulatory landscape governing self-cleaning surfaces has undergone substantial transformation in recent years, primarily driven by increasing environmental concerns and public health considerations. Early regulations focused mainly on chemical composition, particularly regarding the use of photocatalytic materials like titanium dioxide (TiO2), which dominated first-generation self-cleaning technologies.

Between 2010 and 2020, regulatory frameworks expanded to address nanomaterial safety, as many self-cleaning surfaces incorporate nanostructured components. The EU's REACH regulation and similar frameworks in North America and Asia have established specific provisions for nanomaterials used in consumer-facing applications, creating a complex compliance environment for manufacturers.

Recent regulatory developments have shifted toward a more holistic approach, considering the entire lifecycle impact of self-cleaning surfaces. This includes manufacturing processes, durability, degradation byproducts, and end-of-life disposal considerations. The 2022 amendments to several international standards now require comprehensive environmental impact assessments for commercial self-cleaning products.

The primary technical objective in this evolving regulatory context is to develop self-cleaning surfaces that maintain high performance while meeting increasingly stringent environmental and health standards. This necessitates innovation in both material science and application methodologies to reduce reliance on potentially harmful chemicals or processes.

A secondary objective involves standardizing testing protocols for self-cleaning efficacy and durability. Current regulations exhibit significant regional variations in performance metrics and testing requirements, creating market fragmentation and compliance challenges for global manufacturers. The International Organization for Standardization (ISO) has initiated efforts to harmonize these standards, with draft proposals expected by late 2023.

The long-term regulatory trajectory points toward integration with broader sustainability frameworks, including circular economy principles and carbon footprint considerations. Future regulations will likely require self-cleaning surfaces to demonstrate not only functional performance but also quantifiable environmental benefits throughout their lifecycle, potentially through reduced water consumption, extended product lifespans, or decreased cleaning chemical usage.

Understanding this regulatory evolution is essential for strategic technology development, as compliance requirements increasingly shape innovation pathways and market access conditions for self-cleaning surface technologies.

The regulatory landscape governing self-cleaning surfaces has undergone substantial transformation in recent years, primarily driven by increasing environmental concerns and public health considerations. Early regulations focused mainly on chemical composition, particularly regarding the use of photocatalytic materials like titanium dioxide (TiO2), which dominated first-generation self-cleaning technologies.

Between 2010 and 2020, regulatory frameworks expanded to address nanomaterial safety, as many self-cleaning surfaces incorporate nanostructured components. The EU's REACH regulation and similar frameworks in North America and Asia have established specific provisions for nanomaterials used in consumer-facing applications, creating a complex compliance environment for manufacturers.

Recent regulatory developments have shifted toward a more holistic approach, considering the entire lifecycle impact of self-cleaning surfaces. This includes manufacturing processes, durability, degradation byproducts, and end-of-life disposal considerations. The 2022 amendments to several international standards now require comprehensive environmental impact assessments for commercial self-cleaning products.

The primary technical objective in this evolving regulatory context is to develop self-cleaning surfaces that maintain high performance while meeting increasingly stringent environmental and health standards. This necessitates innovation in both material science and application methodologies to reduce reliance on potentially harmful chemicals or processes.

A secondary objective involves standardizing testing protocols for self-cleaning efficacy and durability. Current regulations exhibit significant regional variations in performance metrics and testing requirements, creating market fragmentation and compliance challenges for global manufacturers. The International Organization for Standardization (ISO) has initiated efforts to harmonize these standards, with draft proposals expected by late 2023.

The long-term regulatory trajectory points toward integration with broader sustainability frameworks, including circular economy principles and carbon footprint considerations. Future regulations will likely require self-cleaning surfaces to demonstrate not only functional performance but also quantifiable environmental benefits throughout their lifecycle, potentially through reduced water consumption, extended product lifespans, or decreased cleaning chemical usage.

Understanding this regulatory evolution is essential for strategic technology development, as compliance requirements increasingly shape innovation pathways and market access conditions for self-cleaning surface technologies.

Market Demand Analysis for Compliant Self-Cleaning Technologies

The global market for self-cleaning surfaces is experiencing significant growth driven by increasing regulatory focus on hygiene standards, environmental protection, and sustainable manufacturing practices. Recent regulations across North America, Europe, and Asia have created both challenges and opportunities for manufacturers and developers of self-cleaning technologies. These regulations primarily address chemical composition restrictions, environmental impact considerations, and performance certification requirements.

In the healthcare sector, demand for compliant self-cleaning surfaces has surged following stricter hospital-acquired infection prevention protocols implemented in the wake of the COVID-19 pandemic. Healthcare facilities are increasingly seeking solutions that meet both antimicrobial efficacy standards and comply with restrictions on certain biocidal chemicals previously used in self-cleaning coatings. The European Medical Device Regulation (MDR) and updated FDA guidelines have specifically addressed surface technologies in medical environments, creating a specialized market segment estimated to grow at 12% annually through 2028.

The construction industry represents another significant market driver, with green building certifications like LEED and BREEAM now incorporating points for sustainable self-cleaning building materials. Recent amendments to these certification systems have created preference for photocatalytic and hydrophobic technologies over traditional chemical-intensive solutions. This shift has opened opportunities for companies developing TiO2-based coatings and advanced hydrophobic materials that meet VOC emission standards while delivering effective self-cleaning properties.

Consumer electronics manufacturers face particularly complex compliance challenges as regulations in different markets diverge. While the EU's RoHS and REACH regulations restrict certain compounds used in oleophobic coatings, similar restrictions in Asian markets vary significantly. This regulatory fragmentation has created demand for universally compliant solutions that can be deployed across global supply chains without modification.

Transportation sector applications, particularly in automotive and aerospace, show strong growth potential as fuel efficiency regulations indirectly benefit self-cleaning technologies. Reduced drag from cleaner surfaces contributes to efficiency gains, while maintenance cost reductions provide additional economic incentives. Recent EPA and European environmental standards have specifically acknowledged surface maintenance technologies as contributing factors to overall emissions reduction strategies.

Water conservation regulations in drought-prone regions have created another market opportunity, as self-cleaning surfaces can significantly reduce water consumption in maintenance operations. Several municipalities in water-stressed regions have implemented incentive programs for commercial buildings utilizing certified water-efficient cleaning technologies, including self-cleaning surfaces that meet specific performance standards.

The competitive landscape is evolving rapidly as companies reformulate products to meet new regulatory requirements while maintaining performance characteristics. This has accelerated innovation in bio-based and naturally derived self-cleaning technologies, creating opportunities for new market entrants with compliant solutions.

In the healthcare sector, demand for compliant self-cleaning surfaces has surged following stricter hospital-acquired infection prevention protocols implemented in the wake of the COVID-19 pandemic. Healthcare facilities are increasingly seeking solutions that meet both antimicrobial efficacy standards and comply with restrictions on certain biocidal chemicals previously used in self-cleaning coatings. The European Medical Device Regulation (MDR) and updated FDA guidelines have specifically addressed surface technologies in medical environments, creating a specialized market segment estimated to grow at 12% annually through 2028.

The construction industry represents another significant market driver, with green building certifications like LEED and BREEAM now incorporating points for sustainable self-cleaning building materials. Recent amendments to these certification systems have created preference for photocatalytic and hydrophobic technologies over traditional chemical-intensive solutions. This shift has opened opportunities for companies developing TiO2-based coatings and advanced hydrophobic materials that meet VOC emission standards while delivering effective self-cleaning properties.

Consumer electronics manufacturers face particularly complex compliance challenges as regulations in different markets diverge. While the EU's RoHS and REACH regulations restrict certain compounds used in oleophobic coatings, similar restrictions in Asian markets vary significantly. This regulatory fragmentation has created demand for universally compliant solutions that can be deployed across global supply chains without modification.

Transportation sector applications, particularly in automotive and aerospace, show strong growth potential as fuel efficiency regulations indirectly benefit self-cleaning technologies. Reduced drag from cleaner surfaces contributes to efficiency gains, while maintenance cost reductions provide additional economic incentives. Recent EPA and European environmental standards have specifically acknowledged surface maintenance technologies as contributing factors to overall emissions reduction strategies.

Water conservation regulations in drought-prone regions have created another market opportunity, as self-cleaning surfaces can significantly reduce water consumption in maintenance operations. Several municipalities in water-stressed regions have implemented incentive programs for commercial buildings utilizing certified water-efficient cleaning technologies, including self-cleaning surfaces that meet specific performance standards.

The competitive landscape is evolving rapidly as companies reformulate products to meet new regulatory requirements while maintaining performance characteristics. This has accelerated innovation in bio-based and naturally derived self-cleaning technologies, creating opportunities for new market entrants with compliant solutions.

Regulatory Landscape and Technical Challenges

The regulatory landscape for self-cleaning surfaces has evolved significantly in recent years, driven by increasing environmental concerns and public health considerations. Globally, regulatory bodies have begun implementing stricter guidelines regarding the chemical composition of self-cleaning coatings, particularly those containing nanoparticles and photocatalytic materials like titanium dioxide (TiO2). The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation now requires comprehensive safety assessments for nanomaterials used in self-cleaning applications, with particular emphasis on potential environmental leaching and bioaccumulation.

In North America, the EPA has introduced new frameworks specifically addressing the antimicrobial claims of self-cleaning surfaces, requiring manufacturers to provide substantial scientific evidence supporting such claims before marketing. These regulations have created significant technical challenges for developers, as traditional testing protocols often fail to adequately measure the long-term efficacy of self-cleaning properties under real-world conditions.

The regulatory focus on sustainability has also intensified, with several jurisdictions implementing restrictions on volatile organic compounds (VOCs) and persistent organic pollutants (POPs) in surface treatments. This has necessitated reformulation of many existing self-cleaning technologies, particularly those based on hydrophobic fluorinated compounds which face increasing scrutiny due to their environmental persistence.

A major technical challenge emerging from these regulatory shifts is the development of standardized testing methodologies that can reliably quantify self-cleaning performance across different environmental conditions. Current standards vary significantly between regions, creating compliance complexities for global manufacturers. The International Organization for Standardization (ISO) is working to address this through initiatives like ISO 27448 and ISO 27447, but harmonization remains incomplete.

Another significant challenge lies in the toxicological assessment requirements for novel self-cleaning materials. Regulators increasingly demand comprehensive ecotoxicity data, including potential impacts on aquatic organisms and soil microbiota. This presents both technical and economic hurdles, as generating such data requires sophisticated analytical capabilities and substantial investment.

The medical device sector faces particularly stringent regulations, with the FDA and European Medical Device Regulation (MDR) imposing rigorous requirements on self-cleaning surfaces intended for healthcare applications. These include demonstrating not only efficacy but also the absence of harmful byproducts from photocatalytic or other reactive cleaning mechanisms.

Emerging regulations around end-of-life management and circular economy principles are creating additional technical challenges, with requirements for recyclability or biodegradability of self-cleaning coatings. This has spurred research into bio-based alternatives to traditional synthetic polymers, though achieving comparable performance remains difficult.

In North America, the EPA has introduced new frameworks specifically addressing the antimicrobial claims of self-cleaning surfaces, requiring manufacturers to provide substantial scientific evidence supporting such claims before marketing. These regulations have created significant technical challenges for developers, as traditional testing protocols often fail to adequately measure the long-term efficacy of self-cleaning properties under real-world conditions.

The regulatory focus on sustainability has also intensified, with several jurisdictions implementing restrictions on volatile organic compounds (VOCs) and persistent organic pollutants (POPs) in surface treatments. This has necessitated reformulation of many existing self-cleaning technologies, particularly those based on hydrophobic fluorinated compounds which face increasing scrutiny due to their environmental persistence.

A major technical challenge emerging from these regulatory shifts is the development of standardized testing methodologies that can reliably quantify self-cleaning performance across different environmental conditions. Current standards vary significantly between regions, creating compliance complexities for global manufacturers. The International Organization for Standardization (ISO) is working to address this through initiatives like ISO 27448 and ISO 27447, but harmonization remains incomplete.

Another significant challenge lies in the toxicological assessment requirements for novel self-cleaning materials. Regulators increasingly demand comprehensive ecotoxicity data, including potential impacts on aquatic organisms and soil microbiota. This presents both technical and economic hurdles, as generating such data requires sophisticated analytical capabilities and substantial investment.

The medical device sector faces particularly stringent regulations, with the FDA and European Medical Device Regulation (MDR) imposing rigorous requirements on self-cleaning surfaces intended for healthcare applications. These include demonstrating not only efficacy but also the absence of harmful byproducts from photocatalytic or other reactive cleaning mechanisms.

Emerging regulations around end-of-life management and circular economy principles are creating additional technical challenges, with requirements for recyclability or biodegradability of self-cleaning coatings. This has spurred research into bio-based alternatives to traditional synthetic polymers, though achieving comparable performance remains difficult.

Current Compliance Solutions for Self-Cleaning Surfaces

01 Environmental regulations for self-cleaning surfaces

Environmental regulations govern the use of self-cleaning surface technologies, particularly regarding the chemicals and materials used in these surfaces. These regulations ensure that self-cleaning surfaces do not release harmful substances into the environment during their lifecycle. Compliance with these regulations is essential for manufacturers to market their self-cleaning products globally, with specific attention to biodegradability and eco-friendliness of the cleaning mechanisms.- Environmental and safety regulations for self-cleaning surfaces: Self-cleaning surfaces must comply with environmental and safety regulations that govern the use of chemicals and materials. These regulations ensure that the self-cleaning technologies do not pose risks to human health or the environment. Compliance requirements may include restrictions on certain chemicals, emission standards, and safety testing protocols for surfaces that come into contact with food or are used in public spaces.

- Standards for testing and certification of self-cleaning properties: Regulatory frameworks establish standards for testing and certifying the self-cleaning properties of surfaces. These standards define the methodologies for evaluating the effectiveness, durability, and performance of self-cleaning technologies under various conditions. Certification processes may involve laboratory testing, field trials, and periodic inspections to ensure continued compliance with established performance criteria.

- Industry-specific regulations for self-cleaning applications: Different industries have specific regulations governing the use of self-cleaning surfaces in their respective domains. For example, medical facilities have stringent requirements for antimicrobial self-cleaning surfaces, while the food industry has regulations for surfaces that come into contact with consumables. Building codes may also include provisions for self-cleaning facades and architectural elements, specifying acceptable technologies and implementation methods.

- Intellectual property and patent regulations: Self-cleaning surface technologies are subject to intellectual property regulations and patent laws. These regulations govern the protection of innovative self-cleaning methods, materials, and applications. Patent frameworks provide temporary monopolies to inventors while ensuring that technical information is disclosed to the public. Licensing agreements and cross-border patent protections are also regulated to facilitate technology transfer and commercialization of self-cleaning innovations.

- Energy efficiency and sustainability requirements: Regulations increasingly focus on the energy efficiency and sustainability aspects of self-cleaning surfaces. These requirements may mandate life cycle assessments, recyclability of materials, and energy consumption during manufacturing and operation. Some regulations promote self-cleaning technologies that reduce the need for water, detergents, and maintenance resources, thereby contributing to overall environmental sustainability goals and green building certifications.

02 Safety standards for self-cleaning coatings

Safety standards for self-cleaning coatings focus on ensuring these surfaces do not pose health risks to users. These standards regulate the toxicity levels of photocatalytic materials, nanoparticles, and other active ingredients used in self-cleaning formulations. Manufacturers must demonstrate that their self-cleaning technologies meet established safety thresholds for indoor and outdoor applications, particularly for surfaces that may come into contact with food or be used in medical settings.Expand Specific Solutions03 Certification requirements for self-cleaning technologies

Certification requirements establish standardized testing protocols and performance criteria for self-cleaning surfaces. These requirements ensure that products claiming self-cleaning properties actually deliver the advertised functionality under real-world conditions. Certification processes typically evaluate factors such as durability, cleaning efficiency, and longevity of the self-cleaning effect. Products meeting these requirements can receive industry-recognized certifications that help consumers identify reliable self-cleaning solutions.Expand Specific Solutions04 Industry-specific regulations for self-cleaning applications

Different industries have specific regulations governing the implementation of self-cleaning surfaces in their products and facilities. For example, the food industry has strict requirements regarding materials that can be used in food processing equipment, while the healthcare sector regulates antimicrobial self-cleaning surfaces used in medical devices and facilities. The automotive and construction industries also have their own standards for self-cleaning windows, facades, and other components, focusing on durability and performance under various environmental conditions.Expand Specific Solutions05 Intellectual property regulations for self-cleaning innovations

Intellectual property regulations protect novel self-cleaning technologies through patents and other forms of IP protection. These regulations govern how innovations in self-cleaning surfaces can be protected, licensed, and commercialized. Companies developing new self-cleaning technologies must navigate patent landscapes to ensure freedom to operate while protecting their own innovations. The regulatory framework also addresses issues related to technology transfer, cross-licensing, and enforcement of patent rights in the self-cleaning surfaces market.Expand Specific Solutions

Key Industry Players and Regulatory Stakeholders

The self-cleaning surfaces market is currently in a growth phase, with increasing regulatory attention focusing on environmental impact, antimicrobial properties, and chemical safety standards. The market is projected to reach approximately $12-15 billion by 2027, driven by applications in construction, automotive, and healthcare sectors. Technologically, the field shows varying maturity levels, with companies at different development stages. Industry leaders like Evonik Operations, S.C. Johnson, and Unilever are advancing commercial applications, while research institutions such as Naval Research Laboratory, MIT, and Sichuan University focus on fundamental innovations. Companies like 3M Innovative Properties and Gree Electric are developing proprietary technologies for consumer applications, while specialized players like Beneq Group and Trina Solar are adapting self-cleaning technologies for specific industry applications to meet emerging regulatory requirements.

Evonik Operations GmbH

Technical Solution: Evonik has developed advanced self-cleaning surface technologies that comply with the latest environmental regulations. Their approach focuses on nano-structured coatings that create superhydrophobic surfaces without using harmful fluorinated compounds which are increasingly restricted by global regulations. The company has pioneered silica-based nanoparticle coatings that achieve water contact angles exceeding 150° while meeting VOC (Volatile Organic Compounds) emission standards[1]. In response to the EU's REACH regulation restrictions on certain chemicals, Evonik has reformulated their self-cleaning products to eliminate substances of very high concern (SVHCs) while maintaining performance. Their regulatory compliance strategy includes comprehensive lifecycle assessments to ensure their products meet sustainability criteria across global markets[3].

Strengths: Strong expertise in environmentally compliant nano-coatings; extensive regulatory affairs department that anticipates legislative changes; global compliance capabilities. Weaknesses: Higher production costs compared to conventional technologies; some performance trade-offs when replacing restricted chemicals; longer development cycles due to rigorous compliance testing.

Unilever IP Holdings BV

Technical Solution: Unilever has developed a regulatory-forward approach to self-cleaning surfaces, particularly for consumer applications. Their technology focuses on biodegradable surfactant systems that create temporary self-cleaning effects on household surfaces without persistent chemicals targeted by recent regulations. In response to the EU's Chemical Strategy for Sustainability, Unilever has pioneered "green chemistry" alternatives to traditional hydrophobic coatings, utilizing plant-derived compounds that achieve water-repellency through biomimetic structures rather than persistent synthetic chemicals[1]. Their regulatory compliance strategy includes a "Clean Future" initiative that systematically eliminates chemicals of concern from their formulations while maintaining functionality. Unilever's self-cleaning technologies now incorporate carbon capture-derived surfactants that comply with circular economy regulations, allowing their products to meet emerging Extended Producer Responsibility requirements across multiple jurisdictions[5].

Strengths: Strong consumer safety focus; excellent understanding of household regulatory requirements; innovative green chemistry approaches. Weaknesses: Limited durability of solutions compared to industrial alternatives; regional formulation variations increase complexity; higher ingredient costs for compliant formulations.

Critical Regulatory Standards and Technical Documentation

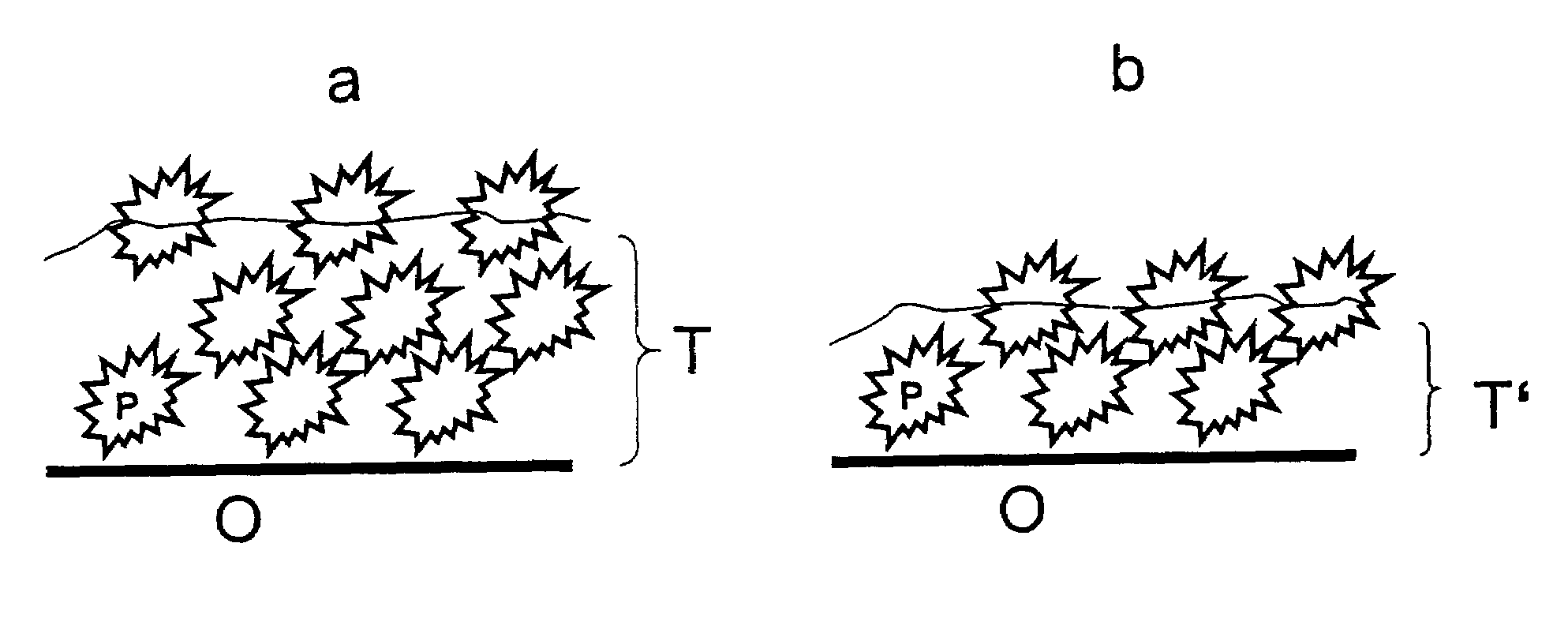

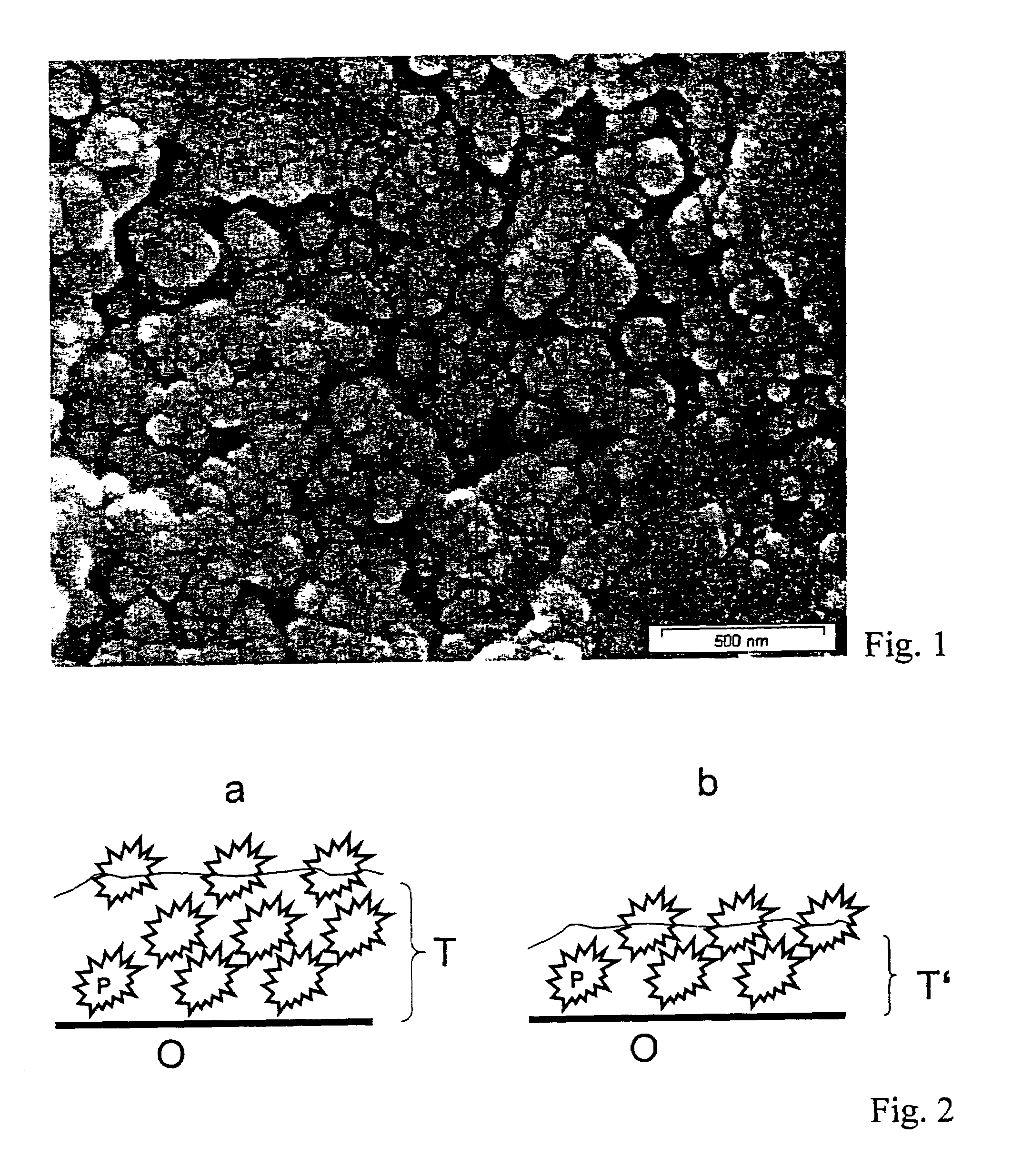

Surfaces rendered self-cleaning by hydrophobic structures and a process for their production

PatentInactiveUS7211313B2

Innovation

- A self-cleaning surface with a hydrophobic, structured surface formed by particles secured to a carrier mixture of particles and binder, where the carrier system allows for the release of new structure-forming particles during erosion, maintaining the self-cleaning effect through self-regeneration.

Surfaces rendered self-cleaning by hydrophobic structures and a process for their production

PatentInactiveUS7211313B2

Innovation

- A self-cleaning surface with a hydrophobic, structured surface formed by particles secured to a carrier mixture of particles and binder, where the carrier system allows for the release of new structure-forming particles during erosion, maintaining the self-cleaning effect through self-regeneration.

Environmental Impact Assessment of Self-Cleaning Technologies

The environmental impact of self-cleaning technologies represents a critical dimension in the regulatory landscape governing these innovative surfaces. Recent environmental assessments have revealed that traditional cleaning methods consume substantial water resources and often involve chemical agents that can contaminate water systems and harm aquatic ecosystems. Self-cleaning surfaces, by contrast, can significantly reduce water usage by up to 70% compared to conventional cleaning processes, presenting a compelling environmental advantage.

However, emerging regulations are increasingly focused on the potential ecological consequences of the nanomaterials commonly employed in self-cleaning technologies. Titanium dioxide (TiO2), a prevalent photocatalytic component, has come under regulatory scrutiny due to concerns about nanoparticle release into the environment. Studies indicate that these particles may accumulate in soil and water systems, with potential bioaccumulation effects in the food chain that remain incompletely understood.

Life cycle assessments (LCAs) of self-cleaning surfaces have become a regulatory requirement in several jurisdictions, particularly in the European Union under the updated REACH regulations. These assessments evaluate environmental impacts from raw material extraction through manufacturing, use, and disposal phases. Recent LCA studies demonstrate that while self-cleaning surfaces reduce environmental burdens during the use phase, their production may involve energy-intensive processes and specialized materials that carry their own environmental footprint.

Regulatory bodies are now implementing more stringent requirements for biodegradability and end-of-life management of self-cleaning technologies. The EU's Circular Economy Action Plan specifically addresses nanomaterial-enhanced products, mandating recyclability considerations and limiting persistent substances. Manufacturers must now demonstrate that their self-cleaning products can be safely reintegrated into material streams or biodegraded without releasing harmful substances.

Air quality impacts represent another regulatory focus area, with particular attention to volatile organic compound (VOC) emissions. While photocatalytic surfaces can potentially improve ambient air quality by breaking down pollutants, regulatory frameworks now require comprehensive testing to verify these claims and ensure no unintended byproducts are generated. The EPA's recent guidelines specifically address testing protocols for air purification claims associated with self-cleaning surfaces.

Water conservation benefits of self-cleaning technologies are increasingly recognized in green building standards and water efficiency regulations. Several municipalities have introduced incentive programs for buildings incorporating certified water-saving technologies, including appropriate self-cleaning surfaces. However, these incentives typically require verification of performance claims through standardized testing protocols that assess actual water savings under real-world conditions.

However, emerging regulations are increasingly focused on the potential ecological consequences of the nanomaterials commonly employed in self-cleaning technologies. Titanium dioxide (TiO2), a prevalent photocatalytic component, has come under regulatory scrutiny due to concerns about nanoparticle release into the environment. Studies indicate that these particles may accumulate in soil and water systems, with potential bioaccumulation effects in the food chain that remain incompletely understood.

Life cycle assessments (LCAs) of self-cleaning surfaces have become a regulatory requirement in several jurisdictions, particularly in the European Union under the updated REACH regulations. These assessments evaluate environmental impacts from raw material extraction through manufacturing, use, and disposal phases. Recent LCA studies demonstrate that while self-cleaning surfaces reduce environmental burdens during the use phase, their production may involve energy-intensive processes and specialized materials that carry their own environmental footprint.

Regulatory bodies are now implementing more stringent requirements for biodegradability and end-of-life management of self-cleaning technologies. The EU's Circular Economy Action Plan specifically addresses nanomaterial-enhanced products, mandating recyclability considerations and limiting persistent substances. Manufacturers must now demonstrate that their self-cleaning products can be safely reintegrated into material streams or biodegraded without releasing harmful substances.

Air quality impacts represent another regulatory focus area, with particular attention to volatile organic compound (VOC) emissions. While photocatalytic surfaces can potentially improve ambient air quality by breaking down pollutants, regulatory frameworks now require comprehensive testing to verify these claims and ensure no unintended byproducts are generated. The EPA's recent guidelines specifically address testing protocols for air purification claims associated with self-cleaning surfaces.

Water conservation benefits of self-cleaning technologies are increasingly recognized in green building standards and water efficiency regulations. Several municipalities have introduced incentive programs for buildings incorporating certified water-saving technologies, including appropriate self-cleaning surfaces. However, these incentives typically require verification of performance claims through standardized testing protocols that assess actual water savings under real-world conditions.

Cross-Border Regulatory Harmonization Strategies

The global landscape for self-cleaning surface regulations presents significant challenges for manufacturers and innovators operating across multiple jurisdictions. Achieving regulatory harmonization requires strategic approaches that balance regional compliance requirements while maintaining consistent product standards. Currently, major regulatory bodies including the EU's European Chemicals Agency (ECHA), the U.S. Environmental Protection Agency (EPA), and Japan's Ministry of Economy, Trade and Industry (METI) have established divergent frameworks governing self-cleaning surface technologies, particularly regarding nanomaterials and photocatalytic substances.

Successful cross-border harmonization strategies begin with comprehensive regulatory mapping across target markets. Companies must identify common denominators in safety standards, environmental impact assessments, and performance testing protocols. The establishment of a unified compliance matrix that addresses the strictest requirements across all jurisdictions can serve as a foundation for global product development, effectively creating a "compliance ceiling" that satisfies all regional demands simultaneously.

Industry consortia and public-private partnerships have emerged as effective vehicles for advancing regulatory alignment. Organizations such as the International Organization for Standardization (ISO) Technical Committee 206 on Fine Ceramics and the Global Self-Cleaning Surfaces Alliance have successfully advocated for standardized testing methodologies and classification systems that transcend national boundaries. These collaborative efforts have resulted in the development of ISO 27448 and ISO 27447, which provide internationally recognized frameworks for evaluating photocatalytic self-cleaning performance.

Mutual recognition agreements (MRAs) between regulatory authorities represent another promising avenue for harmonization. The recent bilateral agreement between the EPA and Health Canada regarding antimicrobial surface technologies demonstrates how regulatory cooperation can reduce duplicate testing requirements and accelerate market access. Similar frameworks could be expanded to include self-cleaning surface technologies, particularly those utilizing similar active ingredients or mechanisms.

Digital compliance management systems have become essential tools for navigating complex regulatory landscapes. Advanced regulatory intelligence platforms that monitor real-time changes across jurisdictions enable companies to anticipate regulatory shifts and adapt product formulations proactively. These systems can identify opportunities for strategic product positioning that leverages regulatory advantages in certain markets while maintaining global compliance standards.

Looking forward, the development of international reference standards for self-cleaning surface technologies will be crucial for long-term regulatory harmonization. Establishing globally accepted benchmarks for efficacy, durability, and environmental impact would provide regulators with common frameworks for assessment while giving manufacturers clear targets for product development. The World Health Organization's recent initiative to develop guidance on antimicrobial surfaces could serve as a model for similar efforts focused specifically on self-cleaning technologies.

Successful cross-border harmonization strategies begin with comprehensive regulatory mapping across target markets. Companies must identify common denominators in safety standards, environmental impact assessments, and performance testing protocols. The establishment of a unified compliance matrix that addresses the strictest requirements across all jurisdictions can serve as a foundation for global product development, effectively creating a "compliance ceiling" that satisfies all regional demands simultaneously.

Industry consortia and public-private partnerships have emerged as effective vehicles for advancing regulatory alignment. Organizations such as the International Organization for Standardization (ISO) Technical Committee 206 on Fine Ceramics and the Global Self-Cleaning Surfaces Alliance have successfully advocated for standardized testing methodologies and classification systems that transcend national boundaries. These collaborative efforts have resulted in the development of ISO 27448 and ISO 27447, which provide internationally recognized frameworks for evaluating photocatalytic self-cleaning performance.

Mutual recognition agreements (MRAs) between regulatory authorities represent another promising avenue for harmonization. The recent bilateral agreement between the EPA and Health Canada regarding antimicrobial surface technologies demonstrates how regulatory cooperation can reduce duplicate testing requirements and accelerate market access. Similar frameworks could be expanded to include self-cleaning surface technologies, particularly those utilizing similar active ingredients or mechanisms.

Digital compliance management systems have become essential tools for navigating complex regulatory landscapes. Advanced regulatory intelligence platforms that monitor real-time changes across jurisdictions enable companies to anticipate regulatory shifts and adapt product formulations proactively. These systems can identify opportunities for strategic product positioning that leverages regulatory advantages in certain markets while maintaining global compliance standards.

Looking forward, the development of international reference standards for self-cleaning surface technologies will be crucial for long-term regulatory harmonization. Establishing globally accepted benchmarks for efficacy, durability, and environmental impact would provide regulators with common frameworks for assessment while giving manufacturers clear targets for product development. The World Health Organization's recent initiative to develop guidance on antimicrobial surfaces could serve as a model for similar efforts focused specifically on self-cleaning technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!