Self-cleaning Surface Development: Challenges in Intellectual Property

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Self-cleaning Surface Technology Background and Objectives

Self-cleaning surfaces represent a revolutionary advancement in materials science, drawing inspiration from natural phenomena such as the lotus leaf effect discovered in the 1970s. This biomimetic approach has evolved significantly over the past three decades, transitioning from academic curiosity to commercial application across multiple industries. The fundamental principle involves creating surfaces that repel water, dirt, and other contaminants through specific micro and nano-scale structures combined with chemical properties that minimize adhesion forces.

The technological evolution of self-cleaning surfaces has followed three distinct generations. First-generation technologies focused primarily on hydrophobic coatings with limited durability. Second-generation approaches incorporated more sophisticated nano-structures and photocatalytic properties, while current third-generation technologies integrate multiple mechanisms including superhydrophobicity, photocatalysis, and antimicrobial properties into unified systems with enhanced longevity.

Market projections indicate the global self-cleaning surfaces market will reach approximately $13 billion by 2025, with a compound annual growth rate exceeding 8%. This growth is driven by increasing applications in construction, automotive, solar panels, and healthcare sectors, where maintenance cost reduction and performance enhancement are critical factors.

The primary technical objectives in self-cleaning surface development include improving durability under harsh environmental conditions, reducing manufacturing costs for mass-market adoption, and developing environmentally sustainable formulations that comply with increasingly stringent regulations worldwide. Additionally, there is significant focus on creating multi-functional surfaces that combine self-cleaning with other desirable properties such as anti-icing, anti-fogging, or self-healing capabilities.

Intellectual property challenges have become increasingly prominent as the technology matures. Patent landscapes show concentrated ownership among major chemical and materials companies, creating potential barriers for new entrants. The fundamental nature of many self-cleaning mechanisms has led to complex patent disputes regarding the scope of protection for basic principles versus specific implementations.

Research objectives now center on developing next-generation surfaces with programmable or stimuli-responsive behaviors, transparent coatings for optical applications, and scalable manufacturing processes suitable for large-area applications. Particular emphasis is being placed on environmentally benign formulations that eliminate fluorinated compounds while maintaining performance characteristics.

The convergence of nanotechnology, materials science, and surface engineering continues to drive innovation in this field, with interdisciplinary approaches yielding the most promising advances. As commercial applications expand, the balance between intellectual property protection and technological advancement remains a critical consideration for industry stakeholders.

The technological evolution of self-cleaning surfaces has followed three distinct generations. First-generation technologies focused primarily on hydrophobic coatings with limited durability. Second-generation approaches incorporated more sophisticated nano-structures and photocatalytic properties, while current third-generation technologies integrate multiple mechanisms including superhydrophobicity, photocatalysis, and antimicrobial properties into unified systems with enhanced longevity.

Market projections indicate the global self-cleaning surfaces market will reach approximately $13 billion by 2025, with a compound annual growth rate exceeding 8%. This growth is driven by increasing applications in construction, automotive, solar panels, and healthcare sectors, where maintenance cost reduction and performance enhancement are critical factors.

The primary technical objectives in self-cleaning surface development include improving durability under harsh environmental conditions, reducing manufacturing costs for mass-market adoption, and developing environmentally sustainable formulations that comply with increasingly stringent regulations worldwide. Additionally, there is significant focus on creating multi-functional surfaces that combine self-cleaning with other desirable properties such as anti-icing, anti-fogging, or self-healing capabilities.

Intellectual property challenges have become increasingly prominent as the technology matures. Patent landscapes show concentrated ownership among major chemical and materials companies, creating potential barriers for new entrants. The fundamental nature of many self-cleaning mechanisms has led to complex patent disputes regarding the scope of protection for basic principles versus specific implementations.

Research objectives now center on developing next-generation surfaces with programmable or stimuli-responsive behaviors, transparent coatings for optical applications, and scalable manufacturing processes suitable for large-area applications. Particular emphasis is being placed on environmentally benign formulations that eliminate fluorinated compounds while maintaining performance characteristics.

The convergence of nanotechnology, materials science, and surface engineering continues to drive innovation in this field, with interdisciplinary approaches yielding the most promising advances. As commercial applications expand, the balance between intellectual property protection and technological advancement remains a critical consideration for industry stakeholders.

Market Analysis for Self-cleaning Surface Applications

The self-cleaning surfaces market has witnessed substantial growth in recent years, driven by increasing awareness of hygiene and cleanliness across various sectors. The global market for self-cleaning surfaces was valued at approximately $3.5 billion in 2021 and is projected to reach $6.7 billion by 2027, representing a compound annual growth rate (CAGR) of 11.4%. This growth trajectory is supported by rising applications across construction, automotive, solar panels, and healthcare industries.

In the construction sector, self-cleaning glass and coatings for exterior building surfaces have gained significant traction, particularly in commercial buildings and skyscrapers in urban areas. The market share for self-cleaning construction materials accounts for nearly 38% of the total market, with photocatalytic coatings leading the segment. The reduced maintenance costs and extended lifespan of these materials provide compelling value propositions for property developers and owners.

The automotive industry represents another substantial market for self-cleaning technologies, with applications in windshields, body paints, and interior surfaces. Consumer demand for convenience features in premium vehicles has driven adoption, with approximately 15% of new luxury vehicles incorporating some form of self-cleaning technology. Market research indicates that consumers are willing to pay a premium of 5-8% for vehicles with self-cleaning capabilities.

Solar energy represents one of the fastest-growing application areas, with self-cleaning panels addressing the critical issue of efficiency loss due to dust and dirt accumulation. Studies show that self-cleaning solar panels can improve energy generation efficiency by up to 30% in dusty environments, translating to significant economic benefits over the installation lifetime. This segment is growing at 14.2% annually, outpacing the overall market.

Healthcare applications have gained prominence, particularly following the COVID-19 pandemic. Self-cleaning surfaces in hospitals, clinics, and public health facilities have seen demand surge by 27% since 2020. The market for antimicrobial self-cleaning surfaces in healthcare settings is expected to double by 2025, driven by stringent infection control protocols and increased healthcare spending.

Regional analysis reveals that North America and Europe currently dominate the market with combined share of 58%, though Asia-Pacific represents the fastest-growing region with 16.3% annual growth. China and India are emerging as significant markets due to rapid urbanization, increasing construction activities, and growing environmental awareness. The Middle East region shows particular interest in self-cleaning technologies for solar applications due to abundant sunshine coupled with dusty conditions.

In the construction sector, self-cleaning glass and coatings for exterior building surfaces have gained significant traction, particularly in commercial buildings and skyscrapers in urban areas. The market share for self-cleaning construction materials accounts for nearly 38% of the total market, with photocatalytic coatings leading the segment. The reduced maintenance costs and extended lifespan of these materials provide compelling value propositions for property developers and owners.

The automotive industry represents another substantial market for self-cleaning technologies, with applications in windshields, body paints, and interior surfaces. Consumer demand for convenience features in premium vehicles has driven adoption, with approximately 15% of new luxury vehicles incorporating some form of self-cleaning technology. Market research indicates that consumers are willing to pay a premium of 5-8% for vehicles with self-cleaning capabilities.

Solar energy represents one of the fastest-growing application areas, with self-cleaning panels addressing the critical issue of efficiency loss due to dust and dirt accumulation. Studies show that self-cleaning solar panels can improve energy generation efficiency by up to 30% in dusty environments, translating to significant economic benefits over the installation lifetime. This segment is growing at 14.2% annually, outpacing the overall market.

Healthcare applications have gained prominence, particularly following the COVID-19 pandemic. Self-cleaning surfaces in hospitals, clinics, and public health facilities have seen demand surge by 27% since 2020. The market for antimicrobial self-cleaning surfaces in healthcare settings is expected to double by 2025, driven by stringent infection control protocols and increased healthcare spending.

Regional analysis reveals that North America and Europe currently dominate the market with combined share of 58%, though Asia-Pacific represents the fastest-growing region with 16.3% annual growth. China and India are emerging as significant markets due to rapid urbanization, increasing construction activities, and growing environmental awareness. The Middle East region shows particular interest in self-cleaning technologies for solar applications due to abundant sunshine coupled with dusty conditions.

Global Self-cleaning Technology Landscape and Barriers

The global self-cleaning technology landscape has evolved significantly over the past decade, with major advancements emerging from research institutions and corporations across North America, Europe, and East Asia. The United States, Japan, Germany, and China currently lead in patent filings related to self-cleaning surfaces, collectively accounting for approximately 70% of global intellectual property in this domain. This geographic concentration creates significant barriers for new market entrants, particularly from developing economies.

The technological landscape is characterized by several distinct approaches, including hydrophobic/superhydrophobic surfaces, photocatalytic coatings, and biomimetic designs. Lotus leaf-inspired superhydrophobic surfaces dominate commercial applications, while TiO2-based photocatalytic solutions have gained traction in architectural and automotive sectors. Recent innovations in hybrid technologies combining multiple self-cleaning mechanisms represent the cutting edge of development but face complex IP protection challenges.

A critical barrier in the self-cleaning technology space is the fragmented patent landscape, with overlapping claims and cross-licensing requirements creating a complex web of intellectual property rights. Major corporations like Saint-Gobain, 3M, BASF, and Pilkington hold foundational patents covering broad application areas, effectively controlling access to key markets through strategic IP portfolios. This concentration of patent ownership has created significant entry barriers for smaller innovators and startups.

Technical barriers also persist across the sector. Durability remains a primary challenge, with most self-cleaning surfaces demonstrating performance degradation under real-world conditions after 1-3 years. Cost-effective manufacturing at scale presents another significant hurdle, particularly for technologies requiring precise nano-scale surface patterning or complex chemical treatments. The trade-off between production cost and performance effectiveness continues to limit widespread adoption beyond premium market segments.

Regulatory frameworks present additional barriers, with varying environmental and safety standards across regions creating compliance challenges for global deployment. Particularly stringent regulations in the European Union regarding nanomaterials and chemical substances have slowed commercialization pathways for certain self-cleaning technologies. The lack of standardized testing protocols for self-cleaning performance further complicates market development and technology comparison.

Market acceptance barriers should not be underestimated, as consumer skepticism regarding performance claims and price premiums has limited mass-market penetration. The absence of clear value proposition communication and quantifiable benefits has restricted self-cleaning technologies primarily to specialized industrial applications rather than consumer products.

The technological landscape is characterized by several distinct approaches, including hydrophobic/superhydrophobic surfaces, photocatalytic coatings, and biomimetic designs. Lotus leaf-inspired superhydrophobic surfaces dominate commercial applications, while TiO2-based photocatalytic solutions have gained traction in architectural and automotive sectors. Recent innovations in hybrid technologies combining multiple self-cleaning mechanisms represent the cutting edge of development but face complex IP protection challenges.

A critical barrier in the self-cleaning technology space is the fragmented patent landscape, with overlapping claims and cross-licensing requirements creating a complex web of intellectual property rights. Major corporations like Saint-Gobain, 3M, BASF, and Pilkington hold foundational patents covering broad application areas, effectively controlling access to key markets through strategic IP portfolios. This concentration of patent ownership has created significant entry barriers for smaller innovators and startups.

Technical barriers also persist across the sector. Durability remains a primary challenge, with most self-cleaning surfaces demonstrating performance degradation under real-world conditions after 1-3 years. Cost-effective manufacturing at scale presents another significant hurdle, particularly for technologies requiring precise nano-scale surface patterning or complex chemical treatments. The trade-off between production cost and performance effectiveness continues to limit widespread adoption beyond premium market segments.

Regulatory frameworks present additional barriers, with varying environmental and safety standards across regions creating compliance challenges for global deployment. Particularly stringent regulations in the European Union regarding nanomaterials and chemical substances have slowed commercialization pathways for certain self-cleaning technologies. The lack of standardized testing protocols for self-cleaning performance further complicates market development and technology comparison.

Market acceptance barriers should not be underestimated, as consumer skepticism regarding performance claims and price premiums has limited mass-market penetration. The absence of clear value proposition communication and quantifiable benefits has restricted self-cleaning technologies primarily to specialized industrial applications rather than consumer products.

Current Self-cleaning Surface Technical Solutions

01 Patent protection for self-cleaning surface technologies

Various patents cover technologies related to self-cleaning surfaces, including specific materials, coatings, and manufacturing processes. These patents protect intellectual property rights for innovations in hydrophobic, photocatalytic, and other self-cleaning mechanisms. Companies and research institutions secure these patents to maintain competitive advantage in the growing market for self-cleaning products across industries such as construction, automotive, and consumer goods.- Patent protection for self-cleaning surface technologies: Patents covering self-cleaning surface technologies focus on various methods and compositions that enable surfaces to repel dirt, water, and other contaminants. These technologies often involve hydrophobic coatings, photocatalytic materials, or nanostructured surfaces that minimize adhesion of particles. The intellectual property in this area typically protects specific formulations, manufacturing processes, and applications across industries including construction, automotive, and consumer goods.

- Licensing and commercialization of self-cleaning technologies: Intellectual property related to self-cleaning surfaces often involves licensing agreements and commercialization strategies. These arrangements allow technology transfer between research institutions and commercial entities, enabling market deployment of innovative self-cleaning solutions. The licensing frameworks typically address royalty structures, exclusivity terms, and territorial rights while protecting the core intellectual property of the self-cleaning technology.

- IP management systems for self-cleaning surface innovations: Specialized intellectual property management systems have been developed to handle patents related to self-cleaning surfaces and other technological innovations. These systems facilitate patent portfolio management, track licensing agreements, monitor infringement, and support strategic decision-making regarding IP assets. Such systems are particularly valuable for organizations with extensive self-cleaning technology portfolios spanning multiple jurisdictions.

- International patent protection for self-cleaning surface technologies: Self-cleaning surface technologies often require international patent protection strategies due to their global market potential. Companies and inventors seek protection across multiple jurisdictions through mechanisms like the Patent Cooperation Treaty (PCT) and regional patent systems. This approach ensures comprehensive coverage for innovative self-cleaning technologies in key markets while navigating different national patent requirements and enforcement mechanisms.

- Recent innovations in self-cleaning surface technologies: Recent patent applications reveal ongoing innovation in self-cleaning surface technologies. These innovations include advanced nanomaterials with enhanced self-cleaning properties, environmentally friendly formulations, smart surfaces that respond to environmental changes, and integration with other functional properties such as antimicrobial activity. The intellectual property landscape continues to evolve with applications in new sectors including healthcare, electronics, and renewable energy.

02 Licensing and commercialization of self-cleaning technologies

Intellectual property strategies for commercializing self-cleaning surface technologies often involve licensing agreements between patent holders and manufacturers. These arrangements allow for technology transfer while generating revenue streams for inventors. The licensing models may include exclusive or non-exclusive rights, territorial limitations, and royalty structures tailored to market applications and commercial potential of the self-cleaning technology.Expand Specific Solutions03 IP management systems for self-cleaning surface innovations

Specialized intellectual property management systems have been developed to handle the complex landscape of self-cleaning surface technologies. These systems facilitate patent portfolio management, competitive analysis, and strategic decision-making regarding IP assets. They enable organizations to track patent applications, monitor infringement, identify licensing opportunities, and optimize R&D investments in the self-cleaning surfaces domain.Expand Specific Solutions04 International patent protection for self-cleaning surfaces

Self-cleaning surface technologies often require global intellectual property protection strategies due to their international market potential. Companies pursue patent protection across multiple jurisdictions through mechanisms like the Patent Cooperation Treaty (PCT) and regional patent systems. This international approach helps secure rights in key markets while navigating different national patent laws and examination procedures for self-cleaning surface innovations.Expand Specific Solutions05 Emerging IP trends in self-cleaning surface technologies

Recent intellectual property trends in self-cleaning surfaces show increased focus on environmentally friendly formulations, multifunctional surfaces, and smart self-cleaning systems. Patent applications are growing for technologies that combine self-cleaning with antimicrobial, anti-fogging, or self-healing properties. Additionally, there is rising interest in protecting manufacturing methods that enable cost-effective mass production of self-cleaning surfaces for consumer applications.Expand Specific Solutions

Key Industry Players and Competitive Analysis

The self-cleaning surface technology market is currently in a growth phase, characterized by increasing intellectual property activity across diverse sectors. The global market is projected to reach significant scale, driven by consumer demand for low-maintenance products and sustainability concerns. From a technological maturity perspective, the landscape shows varied development levels with established chemical companies like Evonik Operations, S.C. Johnson, and Wacker Chemie leading with mature commercial solutions, while aerospace players (Airbus Operations) and emerging robotics firms (Avidbots, 3irobotix) pursue specialized applications. Academic institutions (University of Houston, Zhejiang University) are contributing fundamental research, creating a competitive environment where cross-sector collaboration and strategic IP positioning are becoming increasingly critical for market advantage.

Evonik Operations GmbH

Technical Solution: Evonik Operations has pioneered silica-based self-cleaning coatings utilizing their proprietary AEROSIL® nanoparticle technology. Their approach combines hydrophobic silica nanoparticles with specialized silane coupling agents to create durable self-cleaning surfaces applicable to various substrates. The company has developed a comprehensive IP strategy protecting both their material compositions and application methods. Their technology focuses on creating surfaces with controlled roughness at multiple scales to achieve superhydrophobicity while maintaining optical clarity. Evonik has addressed IP challenges through strategic patent filing covering both composition of matter and manufacturing processes, particularly focusing on industrial scalability[2]. Their recent innovations include self-healing capabilities in their coatings, where surface functionality can be restored after mechanical damage through embedded reactive components that migrate to damaged areas.

Strengths: Robust manufacturing capabilities for commercial-scale production; strong existing IP portfolio in specialty chemicals; established distribution channels for industrial applications. Weaknesses: Higher production costs compared to conventional coatings; performance degradation under severe abrasion conditions; complex application processes requiring specialized equipment in some cases.

Airbus Operations Ltd.

Technical Solution: Airbus Operations has developed specialized self-cleaning surface technologies for aerospace applications, focusing on drag reduction and ice prevention. Their approach utilizes hierarchically structured surfaces with both hydrophobic and oleophobic properties to repel a wide range of contaminants encountered during flight. Airbus has created a sophisticated IP strategy that addresses the unique challenges of aviation applications, including resistance to extreme temperature variations, UV exposure, and high-speed airflow. Their technology incorporates nano-silica particles in fluoropolymer matrices with proprietary adhesion promoters to ensure long-term durability on aircraft surfaces[5][6]. Airbus has particularly focused on addressing the weight constraints critical in aerospace applications, developing ultra-thin coatings (under 10 microns) that maintain self-cleaning functionality without adding significant weight. Their patent portfolio includes specific methods for applying these coatings to complex curved surfaces and leading edges where contamination issues are most critical.

Strengths: Extensive testing capabilities under extreme environmental conditions; strong integration with other aircraft systems; established certification pathways for aviation applications. Weaknesses: Extremely high durability requirements limit material options; high cost acceptable in aerospace but limits transfer to other industries; complex regulatory approval process for new surface technologies in aviation.

Patent Analysis of Core Self-cleaning Technologies

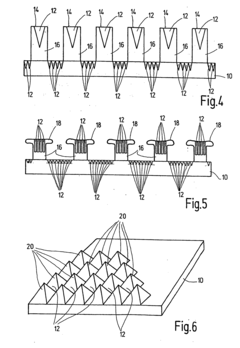

Self-cleaning surfaces comprising elevations formed by hydrophobic particles and having improved mechanical strength

PatentActiveUS20060147675A1

Innovation

- A self-cleaning surface is created using a mixture of hydrophobic metal oxide particles and wax particles, fixed to a substrate, which enhances mechanical stability by providing a supporting effect similar to fins, allowing for higher abrasion resistance without compromising the self-cleaning properties.

Surface

PatentInactiveUS20050153096A1

Innovation

- A surface with capillary structures that exhibit negative capillary rise, where the capillary work quotient is greater than 1, utilizing hydrophilic materials and fastening elements like hook and loop fasteners, allowing for effective self-cleaning and antisoiling properties, and can be produced through cost-effective methods such as chill roll and drop deposition processes.

IP Strategy and Protection Mechanisms

In the realm of self-cleaning surface development, intellectual property protection represents a critical strategic consideration. Companies investing in this technology must establish comprehensive IP strategies that align with their business objectives and market positioning. The primary protection mechanisms include patents, trade secrets, and strategic licensing agreements, each offering distinct advantages depending on the specific innovation and competitive landscape.

Patents provide the most robust protection for novel self-cleaning technologies, granting exclusive rights for up to 20 years. For companies developing unique hydrophobic coatings or nano-structured surfaces, patent portfolios create significant market barriers against competitors. However, the patent application process requires detailed disclosure of the technology, potentially exposing valuable information to competitors once published.

Trade secret protection offers an alternative approach, particularly suitable for proprietary manufacturing processes or formulations that cannot be easily reverse-engineered. Unlike patents, trade secrets can theoretically provide indefinite protection, though they remain vulnerable to independent discovery or legitimate reverse engineering by competitors.

Strategic licensing represents another vital component of IP management in self-cleaning surface technology. Cross-licensing agreements between industry players can facilitate access to complementary technologies while generating revenue streams. Exclusive licensing arrangements with academic institutions or research organizations may secure access to foundational technologies developed in non-commercial settings.

Geographic considerations significantly impact IP strategy development. Companies must prioritize protection in key markets while balancing cost constraints, particularly given the global nature of manufacturing and distribution in surface technology applications. Defensive publication strategies may be employed in secondary markets to prevent competitors from obtaining patents on similar technologies.

The timing of IP filings presents another strategic challenge. Early filing secures priority dates but may occur before the technology is fully optimized, while delayed filing risks competitors establishing prior art. Many successful companies in the self-cleaning surface sector implement staged filing approaches, protecting core innovations early while developing improvement patents as the technology matures.

Enforcement capabilities must also factor into IP strategy development. The resources required to monitor infringement and pursue litigation can be substantial, necessitating careful assessment of which technologies warrant aggressive protection and which might benefit from more collaborative approaches.

Patents provide the most robust protection for novel self-cleaning technologies, granting exclusive rights for up to 20 years. For companies developing unique hydrophobic coatings or nano-structured surfaces, patent portfolios create significant market barriers against competitors. However, the patent application process requires detailed disclosure of the technology, potentially exposing valuable information to competitors once published.

Trade secret protection offers an alternative approach, particularly suitable for proprietary manufacturing processes or formulations that cannot be easily reverse-engineered. Unlike patents, trade secrets can theoretically provide indefinite protection, though they remain vulnerable to independent discovery or legitimate reverse engineering by competitors.

Strategic licensing represents another vital component of IP management in self-cleaning surface technology. Cross-licensing agreements between industry players can facilitate access to complementary technologies while generating revenue streams. Exclusive licensing arrangements with academic institutions or research organizations may secure access to foundational technologies developed in non-commercial settings.

Geographic considerations significantly impact IP strategy development. Companies must prioritize protection in key markets while balancing cost constraints, particularly given the global nature of manufacturing and distribution in surface technology applications. Defensive publication strategies may be employed in secondary markets to prevent competitors from obtaining patents on similar technologies.

The timing of IP filings presents another strategic challenge. Early filing secures priority dates but may occur before the technology is fully optimized, while delayed filing risks competitors establishing prior art. Many successful companies in the self-cleaning surface sector implement staged filing approaches, protecting core innovations early while developing improvement patents as the technology matures.

Enforcement capabilities must also factor into IP strategy development. The resources required to monitor infringement and pursue litigation can be substantial, necessitating careful assessment of which technologies warrant aggressive protection and which might benefit from more collaborative approaches.

Environmental Impact and Sustainability Considerations

The development of self-cleaning surfaces represents a significant advancement in materials science, yet their environmental impact and sustainability considerations warrant careful examination. Traditional cleaning methods often rely on chemical agents that can be harmful to ecosystems when discharged into water systems. Self-cleaning surfaces offer a promising alternative by reducing or eliminating the need for these chemicals, potentially decreasing water pollution and environmental degradation.

The life cycle assessment (LCA) of self-cleaning technologies reveals varying environmental footprints depending on the approach used. Hydrophobic coatings derived from fluorinated compounds, while effective, raise concerns due to their persistence in the environment and potential bioaccumulation. Conversely, TiO2-based photocatalytic surfaces demonstrate more favorable environmental profiles, particularly when the titanium dioxide is sourced and manufactured using sustainable practices.

Energy consumption represents another critical environmental factor. Photocatalytic self-cleaning surfaces require light activation, ideally utilizing renewable solar energy rather than artificial lighting. This passive energy requirement contrasts favorably with conventional cleaning methods that often demand significant water, electricity, and chemical inputs. However, the manufacturing processes for these advanced materials may involve energy-intensive steps that offset some environmental benefits.

Resource efficiency extends beyond energy considerations to material sourcing and end-of-life management. The durability of self-cleaning surfaces directly impacts their sustainability profile—longer-lasting coatings reduce replacement frequency and associated resource consumption. Innovations in biomimetic approaches, inspired by natural self-cleaning mechanisms like the lotus leaf effect, offer particularly promising sustainability prospects by employing biodegradable materials and less toxic manufacturing processes.

Intellectual property developments in this field increasingly reflect environmental considerations. Patent applications now commonly address biodegradability, reduced toxicity, and improved resource efficiency alongside performance metrics. This trend indicates growing market recognition of sustainability as a competitive advantage rather than merely a regulatory requirement.

Regulatory frameworks worldwide are evolving to incorporate stricter environmental standards for surface treatments. The EU's REACH regulations and similar initiatives globally have particular implications for self-cleaning technologies, potentially limiting certain chemical approaches while creating opportunities for more sustainable innovations. Companies developing intellectual property in this space must navigate these evolving requirements, which can significantly impact commercialization pathways and market access.

The intersection of environmental sustainability and intellectual property protection presents both challenges and opportunities. Balancing robust patent protection with transparent environmental impact disclosure will likely become increasingly important as consumers and regulators demand greater accountability regarding the ecological footprint of self-cleaning technologies.

The life cycle assessment (LCA) of self-cleaning technologies reveals varying environmental footprints depending on the approach used. Hydrophobic coatings derived from fluorinated compounds, while effective, raise concerns due to their persistence in the environment and potential bioaccumulation. Conversely, TiO2-based photocatalytic surfaces demonstrate more favorable environmental profiles, particularly when the titanium dioxide is sourced and manufactured using sustainable practices.

Energy consumption represents another critical environmental factor. Photocatalytic self-cleaning surfaces require light activation, ideally utilizing renewable solar energy rather than artificial lighting. This passive energy requirement contrasts favorably with conventional cleaning methods that often demand significant water, electricity, and chemical inputs. However, the manufacturing processes for these advanced materials may involve energy-intensive steps that offset some environmental benefits.

Resource efficiency extends beyond energy considerations to material sourcing and end-of-life management. The durability of self-cleaning surfaces directly impacts their sustainability profile—longer-lasting coatings reduce replacement frequency and associated resource consumption. Innovations in biomimetic approaches, inspired by natural self-cleaning mechanisms like the lotus leaf effect, offer particularly promising sustainability prospects by employing biodegradable materials and less toxic manufacturing processes.

Intellectual property developments in this field increasingly reflect environmental considerations. Patent applications now commonly address biodegradability, reduced toxicity, and improved resource efficiency alongside performance metrics. This trend indicates growing market recognition of sustainability as a competitive advantage rather than merely a regulatory requirement.

Regulatory frameworks worldwide are evolving to incorporate stricter environmental standards for surface treatments. The EU's REACH regulations and similar initiatives globally have particular implications for self-cleaning technologies, potentially limiting certain chemical approaches while creating opportunities for more sustainable innovations. Companies developing intellectual property in this space must navigate these evolving requirements, which can significantly impact commercialization pathways and market access.

The intersection of environmental sustainability and intellectual property protection presents both challenges and opportunities. Balancing robust patent protection with transparent environmental impact disclosure will likely become increasingly important as consumers and regulators demand greater accountability regarding the ecological footprint of self-cleaning technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!