Self-cleaning Surfaces and the Impact of Global Market Trends

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Self-cleaning Surface Technology Background and Objectives

Self-cleaning surfaces represent a revolutionary advancement in materials science, drawing inspiration from natural phenomena such as the lotus leaf effect discovered in the 1970s. This biomimetic approach has evolved significantly over the past three decades, transitioning from academic curiosity to commercial application. The technology leverages either hydrophobic (water-repelling) or hydrophilic (water-attracting) properties to create surfaces that can effectively shed contaminants with minimal external intervention.

The evolution of self-cleaning surface technology has followed three distinct waves. The first wave (1990-2005) focused primarily on fundamental research into superhydrophobic surfaces. The second wave (2005-2015) saw the development of photocatalytic materials, particularly TiO2-based coatings that could break down organic matter under UV light exposure. The current third wave (2015-present) is characterized by multifunctional surfaces that combine self-cleaning with additional properties such as anti-icing, anti-fogging, or antimicrobial capabilities.

Global research interest in self-cleaning surfaces has grown exponentially, with annual publications increasing from fewer than 50 in 2000 to over 2,000 in 2022. This surge reflects both scientific curiosity and market demand for maintenance-reducing technologies across various sectors. The primary technical objectives in this field now center on developing solutions that maintain effectiveness under real-world conditions, overcome durability challenges, and achieve cost-effective scalable manufacturing processes.

The technological goals for self-cleaning surfaces include enhancing durability to withstand mechanical abrasion and environmental exposure, reducing manufacturing costs to enable mass-market adoption, and expanding functionality to address specific industry requirements. Particular emphasis is being placed on environmentally sustainable solutions that avoid harmful chemicals while maintaining performance standards.

Recent advancements in nanotechnology and materials science have accelerated progress, enabling more precise control over surface structures at the nanoscale. This has opened new possibilities for creating hierarchical surface textures that optimize self-cleaning performance. Additionally, the integration of smart materials that can respond to environmental changes represents an emerging frontier, potentially leading to adaptive self-cleaning surfaces that modify their properties based on external conditions.

The convergence of self-cleaning technology with other emerging fields such as Internet of Things (IoT) and artificial intelligence presents opportunities for developing intelligent surfaces that can monitor their own cleanliness and performance, potentially revolutionizing maintenance protocols across industries from construction to healthcare.

The evolution of self-cleaning surface technology has followed three distinct waves. The first wave (1990-2005) focused primarily on fundamental research into superhydrophobic surfaces. The second wave (2005-2015) saw the development of photocatalytic materials, particularly TiO2-based coatings that could break down organic matter under UV light exposure. The current third wave (2015-present) is characterized by multifunctional surfaces that combine self-cleaning with additional properties such as anti-icing, anti-fogging, or antimicrobial capabilities.

Global research interest in self-cleaning surfaces has grown exponentially, with annual publications increasing from fewer than 50 in 2000 to over 2,000 in 2022. This surge reflects both scientific curiosity and market demand for maintenance-reducing technologies across various sectors. The primary technical objectives in this field now center on developing solutions that maintain effectiveness under real-world conditions, overcome durability challenges, and achieve cost-effective scalable manufacturing processes.

The technological goals for self-cleaning surfaces include enhancing durability to withstand mechanical abrasion and environmental exposure, reducing manufacturing costs to enable mass-market adoption, and expanding functionality to address specific industry requirements. Particular emphasis is being placed on environmentally sustainable solutions that avoid harmful chemicals while maintaining performance standards.

Recent advancements in nanotechnology and materials science have accelerated progress, enabling more precise control over surface structures at the nanoscale. This has opened new possibilities for creating hierarchical surface textures that optimize self-cleaning performance. Additionally, the integration of smart materials that can respond to environmental changes represents an emerging frontier, potentially leading to adaptive self-cleaning surfaces that modify their properties based on external conditions.

The convergence of self-cleaning technology with other emerging fields such as Internet of Things (IoT) and artificial intelligence presents opportunities for developing intelligent surfaces that can monitor their own cleanliness and performance, potentially revolutionizing maintenance protocols across industries from construction to healthcare.

Market Demand Analysis for Self-cleaning Solutions

The global market for self-cleaning surfaces has experienced significant growth in recent years, driven by increasing awareness of hygiene and cleanliness across various sectors. Consumer demand for low-maintenance products has surged, particularly in urban environments where time constraints and higher disposable incomes create favorable conditions for premium self-cleaning solutions. Market research indicates that the self-cleaning surfaces market was valued at approximately $8 billion in 2022 and is projected to grow at a compound annual growth rate of 5.7% through 2030.

The construction and building sector represents the largest market segment, accounting for nearly 40% of the total demand. Self-cleaning glass for windows, facades, and solar panels has gained substantial traction due to its ability to reduce maintenance costs and improve energy efficiency. The automotive industry follows as the second-largest consumer, with self-cleaning coatings for vehicle exteriors and windshields becoming increasingly standard features in premium vehicle models.

Healthcare facilities have emerged as a rapidly growing market segment, with hospitals and clinics seeking antimicrobial and self-cleaning surfaces to reduce the risk of hospital-acquired infections. This trend has accelerated following the COVID-19 pandemic, which heightened awareness of surface contamination and disease transmission. Market analysis shows that healthcare applications are expected to grow at a rate exceeding 8% annually over the next five years.

Regional analysis reveals that North America and Europe currently dominate the market, collectively accounting for over 60% of global demand. However, the Asia-Pacific region is witnessing the fastest growth rate, driven by rapid urbanization, increasing disposable incomes, and growing awareness of hygiene benefits in countries like China, Japan, and South Korea.

Consumer behavior studies indicate a willingness to pay a premium of 15-25% for products with self-cleaning properties, particularly in high-touch applications such as electronic devices, household appliances, and bathroom fixtures. This price tolerance is supported by the perceived value of reduced cleaning time and improved hygiene standards.

Environmental regulations are also influencing market dynamics, with increasing restrictions on traditional cleaning chemicals driving interest in alternative solutions. Self-cleaning technologies that reduce water consumption and eliminate the need for harsh chemicals align with sustainability goals, creating additional market pull from environmentally conscious consumers and businesses.

Industry forecasts suggest that technological innovations, particularly in the field of nanotechnology and advanced materials, will continue to expand application possibilities and drive market growth. The development of more durable, effective, and affordable self-cleaning solutions is expected to further accelerate market penetration across various industries in the coming decade.

The construction and building sector represents the largest market segment, accounting for nearly 40% of the total demand. Self-cleaning glass for windows, facades, and solar panels has gained substantial traction due to its ability to reduce maintenance costs and improve energy efficiency. The automotive industry follows as the second-largest consumer, with self-cleaning coatings for vehicle exteriors and windshields becoming increasingly standard features in premium vehicle models.

Healthcare facilities have emerged as a rapidly growing market segment, with hospitals and clinics seeking antimicrobial and self-cleaning surfaces to reduce the risk of hospital-acquired infections. This trend has accelerated following the COVID-19 pandemic, which heightened awareness of surface contamination and disease transmission. Market analysis shows that healthcare applications are expected to grow at a rate exceeding 8% annually over the next five years.

Regional analysis reveals that North America and Europe currently dominate the market, collectively accounting for over 60% of global demand. However, the Asia-Pacific region is witnessing the fastest growth rate, driven by rapid urbanization, increasing disposable incomes, and growing awareness of hygiene benefits in countries like China, Japan, and South Korea.

Consumer behavior studies indicate a willingness to pay a premium of 15-25% for products with self-cleaning properties, particularly in high-touch applications such as electronic devices, household appliances, and bathroom fixtures. This price tolerance is supported by the perceived value of reduced cleaning time and improved hygiene standards.

Environmental regulations are also influencing market dynamics, with increasing restrictions on traditional cleaning chemicals driving interest in alternative solutions. Self-cleaning technologies that reduce water consumption and eliminate the need for harsh chemicals align with sustainability goals, creating additional market pull from environmentally conscious consumers and businesses.

Industry forecasts suggest that technological innovations, particularly in the field of nanotechnology and advanced materials, will continue to expand application possibilities and drive market growth. The development of more durable, effective, and affordable self-cleaning solutions is expected to further accelerate market penetration across various industries in the coming decade.

Current State and Challenges in Self-cleaning Technology

Self-cleaning surface technology has witnessed significant advancements globally over the past decade. Currently, the field is dominated by two primary approaches: hydrophobic (water-repelling) and hydrophilic (water-attracting) self-cleaning surfaces. The hydrophobic approach, inspired by the lotus leaf effect, creates surfaces where water droplets roll off easily, carrying dirt particles away. Conversely, hydrophilic surfaces use water films to wash away contaminants when exposed to water.

In the international arena, countries like Japan, Germany, and the United States lead research and development efforts, with China rapidly closing the gap. Japanese companies have pioneered photocatalytic coatings, while German manufacturers excel in nano-structured hydrophobic surfaces for automotive applications. The United States maintains strength in advanced materials research, particularly in the integration of self-cleaning properties with other functional characteristics.

Despite impressive progress, several significant technical challenges persist. Durability remains a primary concern, as many self-cleaning coatings deteriorate under prolonged UV exposure, mechanical abrasion, or chemical attack. Most current solutions demonstrate effective performance for only 1-3 years in outdoor applications, falling short of the 5-10 year durability required for widespread commercial adoption.

Another critical challenge is the limited functionality across diverse environmental conditions. Many hydrophobic coatings lose effectiveness in high humidity or extremely dry environments, while photocatalytic surfaces require sufficient UV exposure to maintain their self-cleaning properties. This environmental dependency restricts application versatility and market penetration.

Cost-effective scalable manufacturing presents another substantial hurdle. Current production methods for high-performance self-cleaning surfaces often involve complex multi-step processes or expensive nanomaterials, resulting in prohibitive costs for mass-market applications. The industry struggles to balance performance with economical production techniques suitable for large-scale implementation.

Regulatory and safety concerns further complicate advancement, particularly regarding nanoparticle-based solutions. Environmental persistence, potential ecological impacts, and human health considerations have prompted increased scrutiny from regulatory bodies worldwide, creating uncertainty in product development pathways.

The geographical distribution of self-cleaning technology development shows concentration in East Asia, Western Europe, and North America, with emerging research clusters in countries like South Korea, Israel, and Singapore. This distribution largely correlates with regions possessing strong materials science infrastructure and established coating technology industries.

In the international arena, countries like Japan, Germany, and the United States lead research and development efforts, with China rapidly closing the gap. Japanese companies have pioneered photocatalytic coatings, while German manufacturers excel in nano-structured hydrophobic surfaces for automotive applications. The United States maintains strength in advanced materials research, particularly in the integration of self-cleaning properties with other functional characteristics.

Despite impressive progress, several significant technical challenges persist. Durability remains a primary concern, as many self-cleaning coatings deteriorate under prolonged UV exposure, mechanical abrasion, or chemical attack. Most current solutions demonstrate effective performance for only 1-3 years in outdoor applications, falling short of the 5-10 year durability required for widespread commercial adoption.

Another critical challenge is the limited functionality across diverse environmental conditions. Many hydrophobic coatings lose effectiveness in high humidity or extremely dry environments, while photocatalytic surfaces require sufficient UV exposure to maintain their self-cleaning properties. This environmental dependency restricts application versatility and market penetration.

Cost-effective scalable manufacturing presents another substantial hurdle. Current production methods for high-performance self-cleaning surfaces often involve complex multi-step processes or expensive nanomaterials, resulting in prohibitive costs for mass-market applications. The industry struggles to balance performance with economical production techniques suitable for large-scale implementation.

Regulatory and safety concerns further complicate advancement, particularly regarding nanoparticle-based solutions. Environmental persistence, potential ecological impacts, and human health considerations have prompted increased scrutiny from regulatory bodies worldwide, creating uncertainty in product development pathways.

The geographical distribution of self-cleaning technology development shows concentration in East Asia, Western Europe, and North America, with emerging research clusters in countries like South Korea, Israel, and Singapore. This distribution largely correlates with regions possessing strong materials science infrastructure and established coating technology industries.

Current Technical Solutions for Self-cleaning Surfaces

01 Hydrophobic and superhydrophobic coatings

Self-cleaning surfaces can be created using hydrophobic or superhydrophobic coatings that repel water and prevent dirt adhesion. These coatings typically contain nanoparticles or specialized polymers that create a micro or nano-textured surface with high water contact angles. When water droplets roll off these surfaces, they carry away dust and contaminants, mimicking the natural lotus leaf effect. These coatings can be applied to various materials including glass, metal, and plastic surfaces.- Hydrophobic and self-cleaning coatings: Hydrophobic coatings can be applied to surfaces to create self-cleaning properties. These coatings typically have low surface energy which causes water to bead up and roll off, carrying away dirt and contaminants. The hydrophobic effect can be enhanced by incorporating nanoparticles or specific polymers that create micro or nano-scale roughness on the surface, further improving the water repellency and self-cleaning capabilities.

- Photocatalytic self-cleaning surfaces: Photocatalytic materials, particularly titanium dioxide (TiO2), can be incorporated into surface coatings to provide self-cleaning properties. When exposed to UV light, these materials generate reactive oxygen species that break down organic contaminants on the surface. The photocatalytic reaction converts dirt, pollutants, and microorganisms into harmless byproducts that can be easily washed away by rain or water, maintaining the cleanliness of the surface over time.

- Self-cleaning electronic devices and displays: Electronic devices and displays can incorporate self-cleaning technologies to maintain clarity and functionality. These may include oleophobic coatings that repel fingerprints and oils, or electrostatic systems that repel dust particles. Some advanced designs incorporate automated cleaning mechanisms or materials that respond to environmental triggers to maintain cleanliness without manual intervention, extending the lifespan and performance of electronic interfaces.

- Self-cleaning heating and cooling systems: Heating, ventilation, and air conditioning (HVAC) systems can be designed with self-cleaning capabilities to maintain efficiency and air quality. These systems may incorporate features such as automated filter cleaning mechanisms, UV sterilization to prevent microbial growth, or special coatings on heat exchangers that prevent dust and contaminant buildup. Self-cleaning features in these systems reduce maintenance requirements while maintaining optimal performance and energy efficiency.

- Self-cleaning industrial equipment and machinery: Industrial equipment and machinery can be designed with self-cleaning mechanisms to maintain operational efficiency and reduce downtime. These may include automated spray systems, mechanical scrapers, vibration-based cleaning, or specialized surface treatments that prevent adhesion of contaminants. Self-cleaning industrial equipment is particularly valuable in environments where continuous operation is critical or where manual cleaning is difficult, dangerous, or time-consuming.

02 Photocatalytic self-cleaning materials

Photocatalytic materials, particularly those containing titanium dioxide (TiO2), can break down organic contaminants when exposed to UV light. These materials create reactive oxygen species that decompose dirt, bacteria, and other organic matter on the surface. The photocatalytic reaction converts harmful substances into harmless compounds like water and carbon dioxide. This technology is particularly effective for outdoor applications where surfaces receive regular sunlight exposure, such as building facades, windows, and solar panels.Expand Specific Solutions03 Self-cleaning electronic devices and displays

Electronic devices and displays can incorporate self-cleaning technologies to maintain clarity and functionality. These solutions include specialized coatings that resist fingerprints, oils, and smudges, as well as automated cleaning mechanisms. Some implementations use electrostatic repulsion to prevent dust accumulation on screens and sensors. Advanced systems may incorporate microfluidic channels or vibration mechanisms to dislodge contaminants from sensitive electronic components without human intervention.Expand Specific Solutions04 Self-cleaning household appliances and fixtures

Household appliances and fixtures can be designed with self-cleaning capabilities to reduce maintenance and improve hygiene. These designs incorporate features such as non-stick surfaces, automated cleaning cycles, and specialized materials that resist staining and contamination. Some implementations use water jets, steam, or ultrasonic vibrations to dislodge dirt and residues. Smart systems may detect contamination levels and initiate cleaning processes automatically, improving efficiency and extending the lifespan of the appliance.Expand Specific Solutions05 Industrial self-cleaning systems

Industrial applications employ robust self-cleaning systems designed for harsh environments and continuous operation. These systems include automated cleaning mechanisms for manufacturing equipment, processing lines, and industrial sensors. Some implementations use high-pressure sprays, mechanical scrapers, or specialized cleaning agents to maintain operational efficiency. Advanced systems may incorporate real-time monitoring to detect fouling and contamination, triggering cleaning cycles only when necessary to minimize downtime and resource consumption.Expand Specific Solutions

Key Industry Players in Self-cleaning Surface Market

The self-cleaning surfaces market is currently in a growth phase, with an estimated global market size of $10-12 billion and projected annual growth of 5-7%. The competitive landscape features diverse players across multiple sectors: chemical companies (Evonik, Wacker Chemie, Merck Patent GmbH) lead in material development; aerospace and defense organizations (Airbus, Naval Research Laboratory) focus on specialized applications; while research institutions (Industrial Technology Research Institute, Penn State Research Foundation) drive innovation. The technology demonstrates varying maturity levels across applications, with hydrophobic coatings being most commercially established. Companies like 3M and Evonik have achieved significant commercialization success, while academic institutions such as Sichuan University and University of Liverpool are advancing fundamental research in biomimetic surfaces. Market growth is primarily driven by increasing demand in solar panels, automotive, and building sectors.

Evonik Operations GmbH

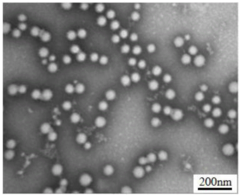

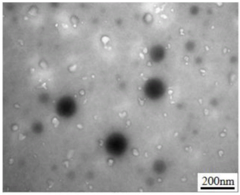

Technical Solution: Evonik has developed advanced self-cleaning surface technologies based on their expertise in specialty chemicals. Their approach combines hydrophobic and oleophobic coatings with nanostructured surfaces to create multi-functional self-cleaning materials. The company's AEROSIL® and AEROXIDE® nanoparticle technologies are incorporated into coating formulations to create superhydrophobic surfaces with water contact angles exceeding 150°. These surfaces utilize the "lotus effect" where water droplets roll off, carrying away contaminants. Additionally, Evonik has developed photocatalytic coatings using titanium dioxide nanoparticles that break down organic contaminants when exposed to UV light. Their proprietary silicone-based formulations provide long-lasting protection against environmental degradation while maintaining self-cleaning properties across various substrates including glass, metals, and polymers.

Strengths: Superior durability compared to competitors, with coatings maintaining functionality for 3+ years in outdoor applications. Their chemical expertise allows for customization across diverse industries. Weaknesses: Higher production costs compared to conventional coatings, and some formulations require specific application conditions that limit widespread adoption in developing markets.

Technical Institute of Physics & Chemistry CAS

Technical Solution: The Technical Institute of Physics & Chemistry of the Chinese Academy of Sciences has developed innovative self-cleaning surface technologies based on biomimetic principles and advanced materials science. Their research focuses on creating multi-functional surfaces that combine superhydrophobicity with other properties such as anti-icing, anti-fouling, and self-healing capabilities. The institute has pioneered methods for fabricating hierarchical micro/nano structures on various substrates using techniques such as layer-by-layer assembly, electrospinning, and controlled etching processes. Their technology incorporates modified silica nanoparticles and carbon nanomaterials to create surfaces with water contact angles exceeding 170° and extremely low sliding angles below 2°. Additionally, they have developed photocatalytic self-cleaning coatings using visible-light-responsive materials such as nitrogen-doped titanium dioxide and graphene-based composites, significantly expanding the practical applications of self-cleaning technology beyond UV-dependent systems.

Strengths: Cutting-edge research capabilities have produced novel materials with multifunctional properties beyond simple self-cleaning. Their solutions often require minimal raw materials, potentially enabling cost-effective scaling. Weaknesses: Limited commercialization infrastructure compared to industrial players restricts market penetration, and some of their advanced fabrication techniques are difficult to scale to industrial production volumes.

Core Patents and Innovations in Self-cleaning Technology

Preparation method for casein-based nanometer TiO2 hybrid composite emulsion and coating material

PatentInactiveCN104530329A

Innovation

- Using the preparation method of casein-based nano-TiO2 hybrid composite emulsion, through the combination of caprolactam-modified casein/nano-TiO2 two-component Pickering emulsifier and acrylate monomer, an anti-UV self-cleaning casein-based nano-TiO2 hybrid is formed. Chemical coating materials, improve film-forming properties and give the coating self-cleaning properties.

Environmental Impact and Sustainability Considerations

Self-cleaning surfaces represent a significant advancement in sustainable technology, offering substantial environmental benefits across multiple sectors. These surfaces reduce the need for chemical cleaning agents, many of which contain harmful compounds that contaminate water systems and contribute to environmental degradation. Research indicates that buildings and infrastructure utilizing self-cleaning technologies can decrease cleaning chemical usage by up to 70%, substantially reducing the chemical burden on ecosystems.

Water conservation presents another critical environmental advantage. Traditional cleaning methods for large surfaces such as building facades, solar panels, and windows require significant water resources. Self-cleaning surfaces can reduce water consumption for maintenance by approximately 80-90%, representing a substantial conservation opportunity in water-stressed regions. This reduction becomes increasingly important as global water scarcity intensifies due to climate change.

Energy efficiency improvements constitute a third major environmental benefit. Self-cleaning surfaces applied to solar panels prevent dust and debris accumulation that typically reduces energy generation efficiency. Studies demonstrate that self-cleaning coatings can maintain optimal solar panel performance, increasing energy output by 25-30% compared to untreated panels in dusty environments. This enhancement directly contributes to renewable energy goals and carbon emission reduction targets.

The life cycle assessment (LCA) of self-cleaning technologies reveals complex sustainability considerations. While manufacturing processes for advanced materials like titanium dioxide nanoparticles require significant energy inputs, the extended maintenance-free periods and reduced cleaning resource requirements generally result in net positive environmental impacts over product lifetimes. However, concerns remain regarding potential nanoparticle release into ecosystems, necessitating ongoing research into long-term environmental fate and effects.

Regulatory frameworks worldwide are increasingly acknowledging these technologies' sustainability potential. The European Union's Green Deal and similar initiatives in North America and Asia are creating favorable conditions for self-cleaning surface adoption through green building standards and sustainability certifications. These frameworks recognize the technology's contribution to reducing chemical pollution, conserving water, and improving energy efficiency.

Market trends indicate growing consumer preference for environmentally responsible products, driving manufacturers to incorporate sustainability metrics into product development and marketing strategies. This shift is particularly evident in construction materials, automotive finishes, and consumer electronics, where environmental performance increasingly influences purchasing decisions alongside traditional factors like cost and durability.

Water conservation presents another critical environmental advantage. Traditional cleaning methods for large surfaces such as building facades, solar panels, and windows require significant water resources. Self-cleaning surfaces can reduce water consumption for maintenance by approximately 80-90%, representing a substantial conservation opportunity in water-stressed regions. This reduction becomes increasingly important as global water scarcity intensifies due to climate change.

Energy efficiency improvements constitute a third major environmental benefit. Self-cleaning surfaces applied to solar panels prevent dust and debris accumulation that typically reduces energy generation efficiency. Studies demonstrate that self-cleaning coatings can maintain optimal solar panel performance, increasing energy output by 25-30% compared to untreated panels in dusty environments. This enhancement directly contributes to renewable energy goals and carbon emission reduction targets.

The life cycle assessment (LCA) of self-cleaning technologies reveals complex sustainability considerations. While manufacturing processes for advanced materials like titanium dioxide nanoparticles require significant energy inputs, the extended maintenance-free periods and reduced cleaning resource requirements generally result in net positive environmental impacts over product lifetimes. However, concerns remain regarding potential nanoparticle release into ecosystems, necessitating ongoing research into long-term environmental fate and effects.

Regulatory frameworks worldwide are increasingly acknowledging these technologies' sustainability potential. The European Union's Green Deal and similar initiatives in North America and Asia are creating favorable conditions for self-cleaning surface adoption through green building standards and sustainability certifications. These frameworks recognize the technology's contribution to reducing chemical pollution, conserving water, and improving energy efficiency.

Market trends indicate growing consumer preference for environmentally responsible products, driving manufacturers to incorporate sustainability metrics into product development and marketing strategies. This shift is particularly evident in construction materials, automotive finishes, and consumer electronics, where environmental performance increasingly influences purchasing decisions alongside traditional factors like cost and durability.

Global Supply Chain and Manufacturing Challenges

The global supply chain for self-cleaning surface technologies faces significant challenges that impact both manufacturing processes and market penetration. Raw material sourcing represents a primary concern, particularly for advanced nanomaterials such as titanium dioxide, zinc oxide, and specialized polymers essential for hydrophobic and photocatalytic surfaces. These materials often originate from geographically concentrated regions, creating vulnerability to supply disruptions from geopolitical tensions, natural disasters, or regulatory changes.

Manufacturing scalability presents another substantial hurdle for self-cleaning surface technologies. While laboratory-scale production demonstrates impressive performance characteristics, transitioning to industrial-scale manufacturing introduces quality control issues, particularly in maintaining consistent nanostructure formation and surface properties across large production batches. The precision equipment required for nanoscale fabrication demands substantial capital investment, limiting market entry for smaller manufacturers.

Regulatory compliance across different global markets adds complexity to supply chain management. Varying environmental and safety standards regarding nanomaterials usage require manufacturers to adapt formulations for different regions, complicating inventory management and increasing production costs. The European Union's REACH regulations and similar frameworks in other jurisdictions necessitate extensive testing and documentation, extending time-to-market for innovative self-cleaning products.

The COVID-19 pandemic exposed critical vulnerabilities in global supply chains, with self-cleaning surface manufacturers experiencing disruptions in component availability and shipping delays. This has accelerated regionalization trends, with companies increasingly establishing localized production facilities to mitigate future disruption risks. However, this approach introduces challenges in maintaining consistent quality standards across distributed manufacturing sites.

Sustainability considerations are reshaping supply chain strategies for self-cleaning surface technologies. Growing consumer and regulatory pressure for environmentally responsible products has prompted manufacturers to seek alternatives to potentially harmful chemicals and energy-intensive processes. This transition requires significant research investment and supply chain reconfiguration, potentially disrupting established manufacturing networks.

Labor skill requirements present an ongoing challenge, as advanced manufacturing of self-cleaning surfaces demands specialized expertise in nanotechnology, materials science, and precision manufacturing. The global distribution of this talent is uneven, creating bottlenecks in production expansion and technology transfer to emerging markets where manufacturing costs might otherwise be advantageous.

Manufacturing scalability presents another substantial hurdle for self-cleaning surface technologies. While laboratory-scale production demonstrates impressive performance characteristics, transitioning to industrial-scale manufacturing introduces quality control issues, particularly in maintaining consistent nanostructure formation and surface properties across large production batches. The precision equipment required for nanoscale fabrication demands substantial capital investment, limiting market entry for smaller manufacturers.

Regulatory compliance across different global markets adds complexity to supply chain management. Varying environmental and safety standards regarding nanomaterials usage require manufacturers to adapt formulations for different regions, complicating inventory management and increasing production costs. The European Union's REACH regulations and similar frameworks in other jurisdictions necessitate extensive testing and documentation, extending time-to-market for innovative self-cleaning products.

The COVID-19 pandemic exposed critical vulnerabilities in global supply chains, with self-cleaning surface manufacturers experiencing disruptions in component availability and shipping delays. This has accelerated regionalization trends, with companies increasingly establishing localized production facilities to mitigate future disruption risks. However, this approach introduces challenges in maintaining consistent quality standards across distributed manufacturing sites.

Sustainability considerations are reshaping supply chain strategies for self-cleaning surface technologies. Growing consumer and regulatory pressure for environmentally responsible products has prompted manufacturers to seek alternatives to potentially harmful chemicals and energy-intensive processes. This transition requires significant research investment and supply chain reconfiguration, potentially disrupting established manufacturing networks.

Labor skill requirements present an ongoing challenge, as advanced manufacturing of self-cleaning surfaces demands specialized expertise in nanotechnology, materials science, and precision manufacturing. The global distribution of this talent is uneven, creating bottlenecks in production expansion and technology transfer to emerging markets where manufacturing costs might otherwise be advantageous.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!