What Lessons Can Be Learned from Patented Self-cleaning Technologies

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Self-cleaning Technology Evolution and Objectives

Self-cleaning technologies have evolved significantly over the past several decades, transitioning from simple mechanical solutions to sophisticated systems that leverage advanced materials science, nanotechnology, and biomimetic principles. The earliest documented self-cleaning innovations emerged in the 1970s with hydrophobic coatings, but the field gained substantial momentum in the 1990s with the discovery of the "lotus effect" - a natural phenomenon where lotus leaves repel water and contaminants through micro and nano-scale surface structures.

The technological evolution can be traced through patent filings, which show three distinct generations of development. First-generation technologies (1970s-1990s) focused primarily on hydrophobic and hydrophilic surface treatments. Second-generation innovations (2000s-2010s) introduced more sophisticated approaches including photocatalytic materials, particularly titanium dioxide coatings that break down organic matter when exposed to UV light. The current third-generation technologies (2010s-present) integrate multiple mechanisms, including smart materials that respond to environmental stimuli and self-healing capabilities.

Patent analysis reveals a clear shift from passive to active self-cleaning mechanisms. Early patents predominantly covered static surface modifications, while recent innovations incorporate dynamic systems that can adapt to different contaminants and environmental conditions. This progression reflects broader technological trends toward multifunctional materials and autonomous systems.

The objectives driving self-cleaning technology development have also evolved. Initial motivations centered on reducing maintenance costs and extending product lifespans. However, contemporary research increasingly emphasizes sustainability goals, including water conservation, chemical reduction, and energy efficiency. Patent documents from the last decade show growing interest in environmentally friendly self-cleaning solutions that minimize resource consumption.

Geographic distribution of patents indicates that early innovations originated primarily from Japan, Germany, and the United States. However, recent years have seen China emerge as a dominant force, particularly in applications for solar panels, architectural glass, and consumer electronics. This shift reflects changing global R&D investment patterns and market priorities.

Looking forward, the field appears to be converging on several key objectives: developing universal self-cleaning solutions effective across diverse environments, creating more durable technologies that maintain efficacy over extended periods, reducing implementation costs to enable mass-market adoption, and minimizing environmental impact throughout the product lifecycle. These objectives are increasingly reflected in patent claims and technical specifications, signaling the industry's recognition of both technical and commercial imperatives.

The technological evolution can be traced through patent filings, which show three distinct generations of development. First-generation technologies (1970s-1990s) focused primarily on hydrophobic and hydrophilic surface treatments. Second-generation innovations (2000s-2010s) introduced more sophisticated approaches including photocatalytic materials, particularly titanium dioxide coatings that break down organic matter when exposed to UV light. The current third-generation technologies (2010s-present) integrate multiple mechanisms, including smart materials that respond to environmental stimuli and self-healing capabilities.

Patent analysis reveals a clear shift from passive to active self-cleaning mechanisms. Early patents predominantly covered static surface modifications, while recent innovations incorporate dynamic systems that can adapt to different contaminants and environmental conditions. This progression reflects broader technological trends toward multifunctional materials and autonomous systems.

The objectives driving self-cleaning technology development have also evolved. Initial motivations centered on reducing maintenance costs and extending product lifespans. However, contemporary research increasingly emphasizes sustainability goals, including water conservation, chemical reduction, and energy efficiency. Patent documents from the last decade show growing interest in environmentally friendly self-cleaning solutions that minimize resource consumption.

Geographic distribution of patents indicates that early innovations originated primarily from Japan, Germany, and the United States. However, recent years have seen China emerge as a dominant force, particularly in applications for solar panels, architectural glass, and consumer electronics. This shift reflects changing global R&D investment patterns and market priorities.

Looking forward, the field appears to be converging on several key objectives: developing universal self-cleaning solutions effective across diverse environments, creating more durable technologies that maintain efficacy over extended periods, reducing implementation costs to enable mass-market adoption, and minimizing environmental impact throughout the product lifecycle. These objectives are increasingly reflected in patent claims and technical specifications, signaling the industry's recognition of both technical and commercial imperatives.

Market Demand Analysis for Self-cleaning Solutions

The self-cleaning technologies market has witnessed substantial growth in recent years, driven by increasing consumer demand for convenience, hygiene concerns, and sustainability considerations. Market research indicates that the global self-cleaning technologies market was valued at approximately 9.2 billion USD in 2022 and is projected to grow at a compound annual growth rate of 6.8% through 2030.

Consumer electronics and household appliances represent the largest segment for self-cleaning solutions, with particular demand for self-cleaning ovens, refrigerators, air conditioners, and washing machines. The COVID-19 pandemic significantly accelerated this trend, as heightened awareness of surface contamination drove consumer interest in touchless and self-sanitizing products. Post-pandemic, this behavior change appears to have become permanent rather than transitory.

The automotive sector presents another rapidly expanding market for self-cleaning technologies. Self-cleaning coatings for vehicle exteriors, windshields, and sensors (particularly important for autonomous vehicles) have seen increased adoption. Market surveys indicate that consumers are willing to pay a premium of 15-20% for vehicles incorporating these features, representing a significant value-add opportunity for manufacturers.

Construction and architectural applications constitute a growing segment, with self-cleaning building facades, windows, and solar panels gaining traction. The energy sector specifically benefits from self-cleaning solar panel technologies, which can improve energy generation efficiency by up to 30% by preventing dust and debris accumulation, thereby addressing a critical pain point in renewable energy deployment.

Healthcare facilities represent a high-value niche market with stringent requirements for self-cleaning and antimicrobial surfaces. The market demand in this sector is characterized by willingness to pay premium prices for solutions that can demonstrably reduce hospital-acquired infections and maintenance costs.

Regional analysis reveals that North America and Europe currently lead in adoption of self-cleaning technologies, primarily due to higher disposable incomes and greater environmental awareness. However, the Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid urbanization, increasing middle-class population, and growing awareness about hygiene and convenience.

Consumer behavior studies indicate that sustainability credentials are increasingly important in purchasing decisions. Self-cleaning technologies that reduce water consumption, minimize chemical cleaning agents, and extend product lifecycles align well with this trend. Market research suggests that 68% of consumers consider environmental impact when evaluating self-cleaning products, indicating that eco-friendly solutions have significant market potential.

Consumer electronics and household appliances represent the largest segment for self-cleaning solutions, with particular demand for self-cleaning ovens, refrigerators, air conditioners, and washing machines. The COVID-19 pandemic significantly accelerated this trend, as heightened awareness of surface contamination drove consumer interest in touchless and self-sanitizing products. Post-pandemic, this behavior change appears to have become permanent rather than transitory.

The automotive sector presents another rapidly expanding market for self-cleaning technologies. Self-cleaning coatings for vehicle exteriors, windshields, and sensors (particularly important for autonomous vehicles) have seen increased adoption. Market surveys indicate that consumers are willing to pay a premium of 15-20% for vehicles incorporating these features, representing a significant value-add opportunity for manufacturers.

Construction and architectural applications constitute a growing segment, with self-cleaning building facades, windows, and solar panels gaining traction. The energy sector specifically benefits from self-cleaning solar panel technologies, which can improve energy generation efficiency by up to 30% by preventing dust and debris accumulation, thereby addressing a critical pain point in renewable energy deployment.

Healthcare facilities represent a high-value niche market with stringent requirements for self-cleaning and antimicrobial surfaces. The market demand in this sector is characterized by willingness to pay premium prices for solutions that can demonstrably reduce hospital-acquired infections and maintenance costs.

Regional analysis reveals that North America and Europe currently lead in adoption of self-cleaning technologies, primarily due to higher disposable incomes and greater environmental awareness. However, the Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid urbanization, increasing middle-class population, and growing awareness about hygiene and convenience.

Consumer behavior studies indicate that sustainability credentials are increasingly important in purchasing decisions. Self-cleaning technologies that reduce water consumption, minimize chemical cleaning agents, and extend product lifecycles align well with this trend. Market research suggests that 68% of consumers consider environmental impact when evaluating self-cleaning products, indicating that eco-friendly solutions have significant market potential.

Current State and Challenges in Self-cleaning Technologies

Self-cleaning technologies have witnessed significant advancements globally, with various approaches emerging across different sectors. Currently, the market is dominated by hydrophobic and hydrophilic surface treatments, photocatalytic coatings, and mechanical self-cleaning systems. The hydrophobic approach, exemplified by lotus leaf-inspired technologies, creates water-repellent surfaces where water droplets roll off, carrying contaminants away. Conversely, hydrophilic technologies utilize water attraction to form thin sheets that wash away dirt particles. Photocatalytic methods, primarily using titanium dioxide (TiO2), break down organic matter through light-activated chemical reactions.

Despite these innovations, several technical challenges persist in the self-cleaning technology landscape. Durability remains a primary concern, as many coatings deteriorate under environmental stressors like UV radiation, temperature fluctuations, and mechanical abrasion. Patent analysis reveals that most solutions struggle to maintain efficacy beyond 2-3 years in outdoor applications, necessitating frequent reapplication or maintenance.

Scalability presents another significant hurdle. While laboratory demonstrations show promising results, translating these into cost-effective, large-scale manufacturing processes has proven difficult. Patents from major industrial players indicate ongoing efforts to develop economical production methods, but the cost-performance ratio remains suboptimal for widespread adoption across all potential application areas.

Environmental compatibility also poses challenges. Many early-generation self-cleaning technologies relied on fluorinated compounds with concerning environmental profiles. Recent patent trends show a shift toward more sustainable alternatives, though these often come with performance trade-offs that limit their commercial viability.

Geographically, self-cleaning technology development shows distinct patterns. Japan and Germany lead in photocatalytic coating patents, while the United States dominates in hydrophobic surface innovations. China has rapidly increased patent filings in recent years, particularly in low-cost manufacturing methods for existing technologies rather than fundamental breakthroughs.

Cross-industry standardization remains underdeveloped, with different sectors adopting varied performance metrics and testing protocols. This fragmentation complicates technology transfer and comparative assessment. Recent consortium efforts, as evidenced in joint patent applications, aim to establish unified standards, though consensus remains elusive.

The integration of self-cleaning technologies with other functional properties (such as antimicrobial activity, anti-icing, or self-healing capabilities) represents both a challenge and an opportunity. Multi-functional surfaces are increasingly appearing in patent literature, though achieving synergistic rather than competing properties requires sophisticated material design approaches that are still evolving.

Despite these innovations, several technical challenges persist in the self-cleaning technology landscape. Durability remains a primary concern, as many coatings deteriorate under environmental stressors like UV radiation, temperature fluctuations, and mechanical abrasion. Patent analysis reveals that most solutions struggle to maintain efficacy beyond 2-3 years in outdoor applications, necessitating frequent reapplication or maintenance.

Scalability presents another significant hurdle. While laboratory demonstrations show promising results, translating these into cost-effective, large-scale manufacturing processes has proven difficult. Patents from major industrial players indicate ongoing efforts to develop economical production methods, but the cost-performance ratio remains suboptimal for widespread adoption across all potential application areas.

Environmental compatibility also poses challenges. Many early-generation self-cleaning technologies relied on fluorinated compounds with concerning environmental profiles. Recent patent trends show a shift toward more sustainable alternatives, though these often come with performance trade-offs that limit their commercial viability.

Geographically, self-cleaning technology development shows distinct patterns. Japan and Germany lead in photocatalytic coating patents, while the United States dominates in hydrophobic surface innovations. China has rapidly increased patent filings in recent years, particularly in low-cost manufacturing methods for existing technologies rather than fundamental breakthroughs.

Cross-industry standardization remains underdeveloped, with different sectors adopting varied performance metrics and testing protocols. This fragmentation complicates technology transfer and comparative assessment. Recent consortium efforts, as evidenced in joint patent applications, aim to establish unified standards, though consensus remains elusive.

The integration of self-cleaning technologies with other functional properties (such as antimicrobial activity, anti-icing, or self-healing capabilities) represents both a challenge and an opportunity. Multi-functional surfaces are increasingly appearing in patent literature, though achieving synergistic rather than competing properties requires sophisticated material design approaches that are still evolving.

Current Patented Self-cleaning Technical Solutions

01 Self-cleaning surfaces with photocatalytic materials

Photocatalytic materials, particularly titanium dioxide (TiO2) coatings, can be applied to surfaces to create self-cleaning properties. When exposed to UV light, these materials generate reactive oxygen species that break down organic contaminants on the surface. This technology is particularly effective for exterior building materials, glass, and other surfaces exposed to sunlight, significantly improving cleaning efficiency by reducing manual cleaning requirements and maintaining cleanliness over extended periods.- Self-cleaning surfaces with photocatalytic materials: Photocatalytic materials, particularly titanium dioxide (TiO2), can be incorporated into surface coatings to create self-cleaning properties. When exposed to UV light, these materials trigger oxidation reactions that break down organic contaminants on the surface. This technology is particularly effective for exterior building materials, glass, and other surfaces exposed to sunlight, significantly improving cleaning efficiency by reducing manual cleaning requirements and maintaining cleanliness over extended periods.

- Hydrophobic and hydrophilic self-cleaning coatings: Advanced surface coatings with either extreme water-repellent (hydrophobic/superhydrophobic) or water-attracting (hydrophilic/superhydrophilic) properties enable self-cleaning capabilities. Hydrophobic coatings cause water to bead up and roll off surfaces, carrying away contaminants in a lotus leaf effect. Hydrophilic coatings spread water into thin sheets that wash away dirt. These technologies significantly improve cleaning efficiency by preventing contaminant adhesion and reducing the need for chemical cleaners and manual scrubbing.

- Self-cleaning technologies for heating elements and ovens: Self-cleaning technologies for heating elements and ovens utilize high-temperature pyrolytic processes to decompose food residues and contaminants. These systems typically operate by heating the interior to extremely high temperatures (400-500°C), converting organic matter to ash that can be easily wiped away. Some advanced systems incorporate catalytic converters to reduce smoke and odors during the cleaning process. These technologies significantly improve cleaning efficiency by eliminating the need for harsh chemical cleaners and reducing manual scrubbing.

- Automated self-cleaning systems with sensors and robotics: Automated self-cleaning systems incorporate sensors to detect contamination levels and intelligent control systems to initiate cleaning processes at optimal times. These systems may include robotic components that physically remove contaminants, spray cleaning solutions, or apply other cleaning mechanisms. The integration of artificial intelligence allows these systems to learn and adapt cleaning patterns based on usage patterns and contamination types. This technology significantly improves cleaning efficiency through precise application of cleaning resources and reduction of human intervention.

- Nanostructured materials for enhanced self-cleaning properties: Nanostructured materials and coatings provide enhanced self-cleaning properties through precisely engineered surface topographies at the nanoscale. These materials can create surfaces that resist contamination adhesion, repel liquids, or actively decompose contaminants. The nanoscale features can be designed to optimize the Cassie-Baxter or Wenzel states for superhydrophobicity or to maximize photocatalytic activity. These advanced materials significantly improve cleaning efficiency by maintaining cleanliness at the molecular level and reducing the frequency of cleaning interventions.

02 Hydrophobic and superhydrophobic self-cleaning coatings

Hydrophobic and superhydrophobic coatings create water-repellent surfaces that demonstrate excellent self-cleaning properties. These coatings minimize water adhesion, causing droplets to roll off surfaces while carrying away dirt particles. The lotus leaf-inspired technology creates micro and nano-structured surfaces that reduce cleaning frequency and improve efficiency. These coatings can be applied to various surfaces including textiles, glass, and automotive exteriors, providing long-lasting protection against contamination.Expand Specific Solutions03 Self-cleaning systems for ovens and cooking appliances

Advanced self-cleaning technologies for ovens and cooking appliances utilize high-temperature pyrolytic processes to decompose food residues and grease into ash. These systems typically operate at temperatures between 400-500°C, effectively eliminating the need for chemical cleaners and manual scrubbing. Some innovations include catalytic liners that continuously clean during normal cooking operations, steam-assisted cleaning for lower temperature options, and programmable cleaning cycles that optimize energy usage while maximizing cleaning efficiency.Expand Specific Solutions04 Automated robotic cleaning systems

Robotic cleaning systems employ sensors, artificial intelligence, and specialized mechanisms to autonomously clean various surfaces. These systems can navigate complex environments, detect dirt levels, and adjust cleaning parameters accordingly. Advanced models incorporate multiple cleaning methods such as vacuum suction, mopping, and scrubbing functions in a single unit. The technology significantly improves cleaning efficiency through optimized path planning, consistent performance, and the ability to reach difficult areas while reducing human labor requirements.Expand Specific Solutions05 Self-cleaning filtration and membrane technologies

Self-cleaning filtration systems incorporate mechanisms to automatically remove accumulated contaminants from filter surfaces, maintaining optimal flow rates and extending operational lifespans. These technologies include backwashing systems, ultrasonic cleaning, mechanical vibration, and air scouring methods that dislodge particulate matter. Advanced membrane technologies with anti-fouling properties prevent biofilm formation and scaling. These innovations significantly reduce maintenance requirements while ensuring consistent filtration performance across industrial, commercial, and residential applications.Expand Specific Solutions

Key Industry Players and Patent Holders

The self-cleaning technologies market is currently in a growth phase, characterized by increasing adoption across consumer appliances and industrial applications. The global market size is estimated to be expanding at a CAGR of 8-10%, driven by rising hygiene awareness and demand for maintenance-free products. Technologically, the field shows varying maturity levels, with companies like Haier Smart Home and Ecovacs Robotics leading in consumer applications through advanced robotics and AI integration. Established players such as S.C. Johnson, Alfred Kärcher, and Tennant Co. dominate industrial cleaning solutions with patented chemical and mechanical self-cleaning systems. Emerging innovators like Seeking Innovation Technology and Shunzao Technology are disrupting the market with ultra-high-speed motor technology and specialized surface treatments, while traditional manufacturers like Gree and KingClean are rapidly incorporating self-cleaning capabilities into their product portfolios.

Haier Smart Home Co., Ltd.

Technical Solution: Haier has developed extensive self-cleaning technologies across their appliance ecosystem, particularly in washing machines, refrigerators, and air conditioners. Their patented ABT (Anti-Bacterial Treatment) self-cleaning system for washing machines uses steam at temperatures up to 90°C to sanitize the drum and door seal, eliminating 99.9% of bacteria without chemical detergents. For refrigerators, Haier implemented Micro-Oxygen Technology that releases low concentrations of active oxygen to neutralize bacteria and eliminate odors, creating a self-purifying environment that extends food freshness by up to 8 days compared to conventional refrigeration. Their air conditioners feature a patented Self-Clean technology that freezes the evaporator with condensed water, then rapidly thaws it to flush away dust and contaminants, followed by a high-temperature sterilization phase reaching 56°C for 30 minutes. Haier's most recent innovation is their I-Fresh system that combines UV sterilization with photocatalyst technology to create self-cleaning surfaces in refrigerators, breaking down organic compounds and preventing bacterial colonization on interior surfaces.

Strengths: Comprehensive integration across multiple appliance categories creates a unified self-cleaning ecosystem. Their technologies effectively address both visible contamination and microbial growth without requiring additional chemical inputs. Weaknesses: Some self-cleaning cycles consume significant energy and water resources. The more advanced self-cleaning features are primarily available only in premium product lines, limiting accessibility for budget-conscious consumers.

Ecolab USA, Inc.

Technical Solution: Ecolab has developed comprehensive self-cleaning technologies focused on industrial and commercial applications. Their patented 3D TRASAR™ technology combines continuous monitoring, chemistry, and automated intervention for water treatment systems. This system uses fluorescent chemistry to detect scaling, corrosion, and biological fouling in real-time, then automatically adjusts chemical dosing to prevent buildup. For food processing environments, Ecolab's Clean-in-Place (CIP) systems utilize programmed cleaning cycles with specialized chemistries that remove protein, fat, and mineral deposits without manual intervention. Their patented Antimicrobial Fruit and Vegetable Treatment (AFVT) creates self-cleaning food contact surfaces through the application of electrolyzed water technology, which generates hypochlorous acid on-site to provide continuous antimicrobial protection. Ecolab's most recent innovation is their Marketguard™ 365 system, which combines UV-C light technology with hydrogen peroxide vapor to create self-sanitizing environments in retail and food service settings, reducing pathogen levels by up to 99.9999% on treated surfaces.

Strengths: Highly effective in industrial settings with documented water savings of 20-40% and energy reductions of 10-15% compared to conventional cleaning methods. Their integrated monitoring systems provide data-driven optimization of cleaning processes. Weaknesses: Many of their solutions require significant initial infrastructure investment and ongoing chemical supplies. Some technologies are limited to specific industry applications and cannot be easily adapted to consumer markets.

Critical Patent Analysis and Technical Insights

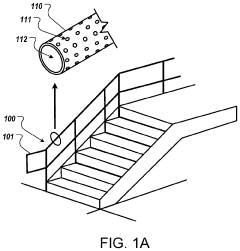

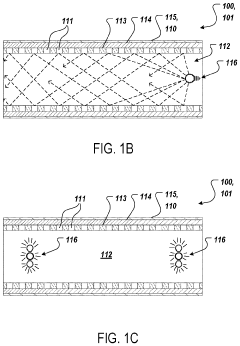

Self-cleaning device

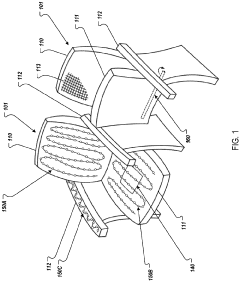

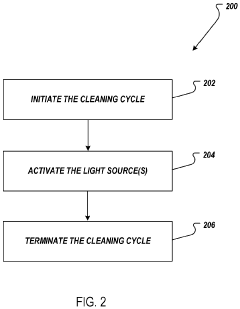

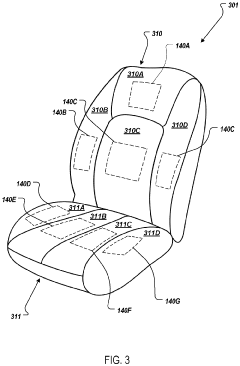

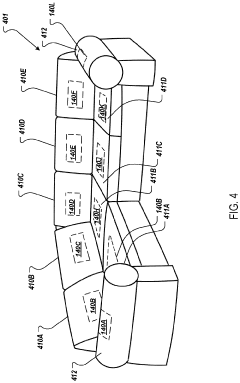

PatentPendingEP4079335A1

Innovation

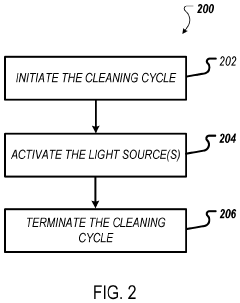

- Integration of photocatalytic materials like titanium dioxide into fabrics, activated by embedded light sources, including LEDs, which initiate a self-cleaning cycle upon activation, forming reactive substances to decompose organic compounds and kill bacteria, with a triggering mechanism to conserve energy by cleaning only when needed.

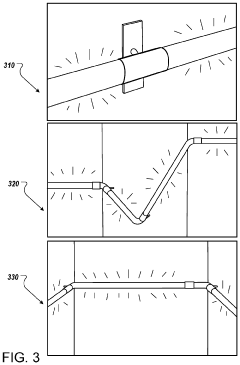

Self-cleaning devices using light sources arranged near the device surface

PatentInactiveUS20220008574A1

Innovation

- Self-cleaning devices with a rigid or semi-rigid surface coated with a photocatalyst that is activated by visible or ultraviolet light, utilizing light sources embedded under or above the surface to initiate a photocatalytic reaction that breaks down organic compounds and pathogens, with a triggering mechanism to initiate cleaning cycles automatically upon surface contact.

Environmental Impact and Sustainability Considerations

The environmental impact of self-cleaning technologies extends far beyond mere convenience, representing a significant advancement in sustainable development practices. Patented self-cleaning technologies demonstrate considerable potential for reducing water consumption, particularly in applications such as self-cleaning glass and photocatalytic surfaces. These innovations typically require 70-80% less water for maintenance compared to conventional cleaning methods, translating to substantial conservation of this increasingly scarce resource.

Chemical usage reduction constitutes another critical environmental benefit. Traditional cleaning processes often rely on harsh chemicals that contribute to water pollution and ecosystem degradation. Self-cleaning technologies minimize or eliminate these chemicals through mechanisms like photocatalysis, hydrophobic coatings, and mechanical self-shedding surfaces, thereby reducing harmful effluents entering waterways and soil systems.

Energy efficiency improvements represent a third pillar of environmental benefit. Many self-cleaning technologies incorporate passive mechanisms that require minimal or no energy input. For instance, lotus-effect surfaces maintain cleanliness through structural properties rather than active energy consumption. Even technologies requiring activation, such as photocatalytic surfaces, typically harness ambient light rather than dedicated energy sources.

The lifecycle assessment of self-cleaning technologies reveals complex sustainability considerations. While operational benefits are clear, manufacturing processes for specialized coatings and materials may involve energy-intensive procedures or rare materials. Recent patent trends show increasing focus on developing environmentally benign production methods and bio-based alternatives to synthetic compounds, addressing these concerns.

Waste reduction capabilities of self-cleaning technologies extend product lifespans significantly. Self-cleaning solar panels maintain optimal efficiency for 20-30% longer periods, while architectural applications reduce replacement and refurbishment frequencies. This translates to reduced material consumption and waste generation across multiple sectors.

The scalability of these technologies presents promising opportunities for broad environmental impact. As manufacturing costs decrease and application methods improve, implementation across urban infrastructure could substantially reduce municipal water usage, chemical runoff, and maintenance-related carbon emissions. Patents focusing on large-scale deployment methods suggest potential integration into smart city initiatives and sustainable urban planning frameworks.

Chemical usage reduction constitutes another critical environmental benefit. Traditional cleaning processes often rely on harsh chemicals that contribute to water pollution and ecosystem degradation. Self-cleaning technologies minimize or eliminate these chemicals through mechanisms like photocatalysis, hydrophobic coatings, and mechanical self-shedding surfaces, thereby reducing harmful effluents entering waterways and soil systems.

Energy efficiency improvements represent a third pillar of environmental benefit. Many self-cleaning technologies incorporate passive mechanisms that require minimal or no energy input. For instance, lotus-effect surfaces maintain cleanliness through structural properties rather than active energy consumption. Even technologies requiring activation, such as photocatalytic surfaces, typically harness ambient light rather than dedicated energy sources.

The lifecycle assessment of self-cleaning technologies reveals complex sustainability considerations. While operational benefits are clear, manufacturing processes for specialized coatings and materials may involve energy-intensive procedures or rare materials. Recent patent trends show increasing focus on developing environmentally benign production methods and bio-based alternatives to synthetic compounds, addressing these concerns.

Waste reduction capabilities of self-cleaning technologies extend product lifespans significantly. Self-cleaning solar panels maintain optimal efficiency for 20-30% longer periods, while architectural applications reduce replacement and refurbishment frequencies. This translates to reduced material consumption and waste generation across multiple sectors.

The scalability of these technologies presents promising opportunities for broad environmental impact. As manufacturing costs decrease and application methods improve, implementation across urban infrastructure could substantially reduce municipal water usage, chemical runoff, and maintenance-related carbon emissions. Patents focusing on large-scale deployment methods suggest potential integration into smart city initiatives and sustainable urban planning frameworks.

Cross-industry Application Potential

Self-cleaning technologies have demonstrated remarkable versatility across multiple industries, extending far beyond their original application domains. The lessons learned from patented self-cleaning solutions offer significant cross-pollination opportunities that can revolutionize product development across sectors.

In the healthcare industry, self-cleaning principles derived from hydrophobic coatings used in building facades can be adapted for medical devices and hospital surfaces to reduce healthcare-associated infections. The antimicrobial properties found in certain self-cleaning glass technologies could be integrated into surgical instruments, reducing sterilization time and improving patient safety outcomes.

The automotive sector stands to benefit substantially from advances in self-cleaning solar panels. These technologies, which utilize electrostatic repulsion to prevent dust accumulation, could be modified for vehicle windshields and sensors, particularly enhancing the reliability of autonomous driving systems in adverse weather conditions.

Consumer electronics manufacturers can implement lessons from self-cleaning toilet technologies that use ultraviolet light sanitization methods. Similar approaches could address the growing concern about bacterial contamination on frequently touched devices like smartphones and tablets, potentially creating a new product category of self-sanitizing consumer electronics.

The food processing industry could adopt principles from self-cleaning architectural surfaces to develop production lines that minimize contamination risks and reduce cleaning downtime. This application would address stringent food safety regulations while improving operational efficiency and reducing water consumption during cleaning processes.

Marine and underwater applications represent another promising frontier. Self-cleaning principles used in building exteriors could be adapted to prevent biofouling on ship hulls and underwater infrastructure, potentially saving billions in maintenance costs while reducing the environmental impact of anti-fouling chemicals.

Aerospace applications could benefit from the water and energy conservation aspects of self-cleaning technologies. Lightweight, durable self-cleaning surfaces could reduce the need for washing aircraft exteriors, saving water and minimizing corrosion risks while reducing ground time between flights.

The textile industry could incorporate hydrophobic and oleophobic properties from architectural self-cleaning coatings into fabric treatments, creating truly stain-resistant clothing that maintains appearance longer while requiring less frequent washing, thus conserving water and extending product lifespan.

In the healthcare industry, self-cleaning principles derived from hydrophobic coatings used in building facades can be adapted for medical devices and hospital surfaces to reduce healthcare-associated infections. The antimicrobial properties found in certain self-cleaning glass technologies could be integrated into surgical instruments, reducing sterilization time and improving patient safety outcomes.

The automotive sector stands to benefit substantially from advances in self-cleaning solar panels. These technologies, which utilize electrostatic repulsion to prevent dust accumulation, could be modified for vehicle windshields and sensors, particularly enhancing the reliability of autonomous driving systems in adverse weather conditions.

Consumer electronics manufacturers can implement lessons from self-cleaning toilet technologies that use ultraviolet light sanitization methods. Similar approaches could address the growing concern about bacterial contamination on frequently touched devices like smartphones and tablets, potentially creating a new product category of self-sanitizing consumer electronics.

The food processing industry could adopt principles from self-cleaning architectural surfaces to develop production lines that minimize contamination risks and reduce cleaning downtime. This application would address stringent food safety regulations while improving operational efficiency and reducing water consumption during cleaning processes.

Marine and underwater applications represent another promising frontier. Self-cleaning principles used in building exteriors could be adapted to prevent biofouling on ship hulls and underwater infrastructure, potentially saving billions in maintenance costs while reducing the environmental impact of anti-fouling chemicals.

Aerospace applications could benefit from the water and energy conservation aspects of self-cleaning technologies. Lightweight, durable self-cleaning surfaces could reduce the need for washing aircraft exteriors, saving water and minimizing corrosion risks while reducing ground time between flights.

The textile industry could incorporate hydrophobic and oleophobic properties from architectural self-cleaning coatings into fabric treatments, creating truly stain-resistant clothing that maintains appearance longer while requiring less frequent washing, thus conserving water and extending product lifespan.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!