Roadmap For Industrial Adoption Of Liquid Metal Thermal Technology

AUG 22, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Liquid Metal Thermal Technology Background and Objectives

Liquid metal thermal technology represents a revolutionary approach to thermal management that has evolved significantly over the past decades. Initially conceptualized in the mid-20th century for nuclear reactor cooling applications, these materials—primarily gallium-based alloys like Galinstan (Ga-In-Sn) and eutectic gallium-indium (EGaIn)—have gained renewed interest due to their exceptional thermal properties. With thermal conductivities ranging from 16-84 W/m·K, these materials significantly outperform conventional thermal interface materials while maintaining fluidity at room temperature.

The evolution of this technology has been marked by several key milestones, including the transition from mercury-based solutions to safer gallium alloys in the 1990s, and more recently, the development of novel surface treatments to address the inherent oxidation and corrosion challenges. The current technological trajectory points toward increasingly sophisticated applications in electronics cooling, particularly as computing densities continue to increase exponentially according to Moore's Law projections.

The primary objective of liquid metal thermal technology development is to establish reliable, scalable, and cost-effective thermal management solutions capable of addressing the thermal challenges in next-generation electronic devices, high-performance computing systems, and power electronics. Specifically, the technology aims to overcome the thermal bottlenecks that currently limit computational performance and energy efficiency in advanced semiconductor applications.

Secondary objectives include developing manufacturing processes suitable for mass production, addressing compatibility issues with various substrate materials, and creating standardized application methodologies that can be widely adopted across industries. These objectives align with the broader industry goal of enabling more powerful, energy-efficient electronic systems while maintaining reliability and extending operational lifespans.

From a sustainability perspective, liquid metal thermal solutions also aim to reduce overall energy consumption in computing infrastructure by improving thermal efficiency. This aligns with global initiatives to reduce carbon footprints in the technology sector, which currently accounts for approximately 2% of global carbon emissions with projections indicating significant increases in the coming decades.

The technology's development is currently at an inflection point, transitioning from specialized niche applications to potential mainstream adoption. This transition is driven by increasing thermal management requirements in consumer electronics, data centers, electric vehicles, and renewable energy systems, all of which face significant thermal challenges as performance demands intensify.

The evolution of this technology has been marked by several key milestones, including the transition from mercury-based solutions to safer gallium alloys in the 1990s, and more recently, the development of novel surface treatments to address the inherent oxidation and corrosion challenges. The current technological trajectory points toward increasingly sophisticated applications in electronics cooling, particularly as computing densities continue to increase exponentially according to Moore's Law projections.

The primary objective of liquid metal thermal technology development is to establish reliable, scalable, and cost-effective thermal management solutions capable of addressing the thermal challenges in next-generation electronic devices, high-performance computing systems, and power electronics. Specifically, the technology aims to overcome the thermal bottlenecks that currently limit computational performance and energy efficiency in advanced semiconductor applications.

Secondary objectives include developing manufacturing processes suitable for mass production, addressing compatibility issues with various substrate materials, and creating standardized application methodologies that can be widely adopted across industries. These objectives align with the broader industry goal of enabling more powerful, energy-efficient electronic systems while maintaining reliability and extending operational lifespans.

From a sustainability perspective, liquid metal thermal solutions also aim to reduce overall energy consumption in computing infrastructure by improving thermal efficiency. This aligns with global initiatives to reduce carbon footprints in the technology sector, which currently accounts for approximately 2% of global carbon emissions with projections indicating significant increases in the coming decades.

The technology's development is currently at an inflection point, transitioning from specialized niche applications to potential mainstream adoption. This transition is driven by increasing thermal management requirements in consumer electronics, data centers, electric vehicles, and renewable energy systems, all of which face significant thermal challenges as performance demands intensify.

Market Demand Analysis for Industrial Thermal Management Solutions

The global industrial thermal management market is experiencing significant growth, driven by increasing demands for efficient cooling solutions across multiple sectors. Current market valuations indicate a thermal management industry worth over 11 billion USD in 2023, with projections suggesting a compound annual growth rate exceeding 8% through 2030. This growth trajectory is particularly pronounced in high-performance computing, power electronics, and advanced manufacturing sectors where traditional cooling methods are reaching their physical limitations.

Industrial adoption of liquid metal thermal technology is being accelerated by several converging market factors. Data centers, which currently consume approximately 1-2% of global electricity, face critical thermal challenges as computing densities increase. The industry's push toward higher performance computing has created thermal densities exceeding 500 W/cm², far beyond the capabilities of conventional air cooling or water-based solutions. This performance gap represents a substantial market opportunity for liquid metal cooling technologies, which can manage heat fluxes up to 10 times greater than traditional methods.

The automotive and aerospace industries present another significant market segment, particularly with the rapid expansion of electric vehicles. The global EV market, growing at over 25% annually, requires advanced battery thermal management systems to address safety concerns, extend battery life, and enable faster charging capabilities. Liquid metal cooling solutions offer compelling advantages in these applications due to their superior thermal conductivity and ability to maintain consistent operating temperatures across battery packs.

Manufacturing sectors, particularly semiconductor fabrication, metal processing, and glass production, represent additional high-potential markets. These industries operate equipment generating extreme heat loads that compromise production efficiency and product quality. Market research indicates that even a 5% improvement in thermal management efficiency can translate to millions in annual energy savings for large industrial operations, creating strong economic incentives for adoption of advanced cooling technologies.

Renewable energy systems, particularly concentrated solar power and next-generation nuclear facilities, also demonstrate substantial demand for high-performance thermal management. These applications require heat transfer media capable of operating reliably at elevated temperatures, often exceeding 700°C, where liquid metals offer unique advantages over conventional heat transfer fluids.

The market landscape is further shaped by increasing regulatory pressures on energy efficiency and carbon emissions. Industrial operations face stricter environmental compliance requirements, with many regions implementing carbon pricing mechanisms that directly impact operational costs. This regulatory environment creates additional market pull for thermal management technologies that can significantly reduce energy consumption and associated emissions.

Industrial adoption of liquid metal thermal technology is being accelerated by several converging market factors. Data centers, which currently consume approximately 1-2% of global electricity, face critical thermal challenges as computing densities increase. The industry's push toward higher performance computing has created thermal densities exceeding 500 W/cm², far beyond the capabilities of conventional air cooling or water-based solutions. This performance gap represents a substantial market opportunity for liquid metal cooling technologies, which can manage heat fluxes up to 10 times greater than traditional methods.

The automotive and aerospace industries present another significant market segment, particularly with the rapid expansion of electric vehicles. The global EV market, growing at over 25% annually, requires advanced battery thermal management systems to address safety concerns, extend battery life, and enable faster charging capabilities. Liquid metal cooling solutions offer compelling advantages in these applications due to their superior thermal conductivity and ability to maintain consistent operating temperatures across battery packs.

Manufacturing sectors, particularly semiconductor fabrication, metal processing, and glass production, represent additional high-potential markets. These industries operate equipment generating extreme heat loads that compromise production efficiency and product quality. Market research indicates that even a 5% improvement in thermal management efficiency can translate to millions in annual energy savings for large industrial operations, creating strong economic incentives for adoption of advanced cooling technologies.

Renewable energy systems, particularly concentrated solar power and next-generation nuclear facilities, also demonstrate substantial demand for high-performance thermal management. These applications require heat transfer media capable of operating reliably at elevated temperatures, often exceeding 700°C, where liquid metals offer unique advantages over conventional heat transfer fluids.

The market landscape is further shaped by increasing regulatory pressures on energy efficiency and carbon emissions. Industrial operations face stricter environmental compliance requirements, with many regions implementing carbon pricing mechanisms that directly impact operational costs. This regulatory environment creates additional market pull for thermal management technologies that can significantly reduce energy consumption and associated emissions.

Current State and Challenges in Liquid Metal Thermal Technology

Liquid metal thermal technology has gained significant attention in recent years due to its exceptional thermal conductivity properties. Currently, the global research landscape is dominated by institutions in North America, Europe, and East Asia, with China and the United States leading in patent applications. The technology has progressed from laboratory experiments to limited commercial applications, particularly in high-performance computing and specialized industrial cooling systems.

The current state of liquid metal thermal technology faces several technical challenges that impede widespread industrial adoption. Material compatibility remains a primary concern, as gallium-based liquid metals exhibit corrosive properties when in contact with aluminum and certain other common industrial metals. This necessitates specialized containment solutions and protective coatings, increasing implementation costs and complexity.

Oxidation presents another significant challenge, as liquid metals rapidly form oxide layers when exposed to oxygen, affecting their flow characteristics and thermal performance. While this can be mitigated in controlled environments, maintaining these conditions in industrial settings proves difficult. The development of anti-oxidation additives has shown promise but requires further refinement for industrial-scale applications.

Pumping and circulation mechanisms represent a technical hurdle due to the high surface tension and density of liquid metals. Traditional pumping systems often experience efficiency losses and reliability issues when handling these materials. Electromagnetic pumping solutions offer advantages but add complexity and cost to thermal management systems.

Manufacturing scalability remains limited, with current production methods for liquid metal thermal interfaces being predominantly manual or semi-automated. The lack of standardized mass production techniques contributes to high costs and inconsistent quality, restricting adoption beyond premium applications.

Regulatory frameworks and safety standards specific to liquid metal thermal technologies are still evolving. The potential toxicity of certain liquid metal compounds, particularly those containing gallium and indium, raises environmental and workplace safety concerns that must be addressed before widespread industrial implementation.

Market acceptance faces resistance due to the relatively high cost of liquid metal thermal materials compared to conventional alternatives. The price premium, combined with concerns about long-term reliability and maintenance requirements, has limited adoption to high-value applications where traditional cooling solutions are inadequate.

Despite these challenges, recent advancements in alloy formulations have improved stability and reduced corrosivity. Research into microstructured surfaces and engineered interfaces has enhanced wetting properties and thermal contact, while innovations in encapsulation technologies have addressed some of the handling and oxidation concerns, pointing toward potential solutions for broader industrial implementation.

The current state of liquid metal thermal technology faces several technical challenges that impede widespread industrial adoption. Material compatibility remains a primary concern, as gallium-based liquid metals exhibit corrosive properties when in contact with aluminum and certain other common industrial metals. This necessitates specialized containment solutions and protective coatings, increasing implementation costs and complexity.

Oxidation presents another significant challenge, as liquid metals rapidly form oxide layers when exposed to oxygen, affecting their flow characteristics and thermal performance. While this can be mitigated in controlled environments, maintaining these conditions in industrial settings proves difficult. The development of anti-oxidation additives has shown promise but requires further refinement for industrial-scale applications.

Pumping and circulation mechanisms represent a technical hurdle due to the high surface tension and density of liquid metals. Traditional pumping systems often experience efficiency losses and reliability issues when handling these materials. Electromagnetic pumping solutions offer advantages but add complexity and cost to thermal management systems.

Manufacturing scalability remains limited, with current production methods for liquid metal thermal interfaces being predominantly manual or semi-automated. The lack of standardized mass production techniques contributes to high costs and inconsistent quality, restricting adoption beyond premium applications.

Regulatory frameworks and safety standards specific to liquid metal thermal technologies are still evolving. The potential toxicity of certain liquid metal compounds, particularly those containing gallium and indium, raises environmental and workplace safety concerns that must be addressed before widespread industrial implementation.

Market acceptance faces resistance due to the relatively high cost of liquid metal thermal materials compared to conventional alternatives. The price premium, combined with concerns about long-term reliability and maintenance requirements, has limited adoption to high-value applications where traditional cooling solutions are inadequate.

Despite these challenges, recent advancements in alloy formulations have improved stability and reduced corrosivity. Research into microstructured surfaces and engineered interfaces has enhanced wetting properties and thermal contact, while innovations in encapsulation technologies have addressed some of the handling and oxidation concerns, pointing toward potential solutions for broader industrial implementation.

Current Industrial Applications and Implementation Methods

01 Liquid metal thermal interface materials

Liquid metals are used as thermal interface materials to enhance heat transfer between components in electronic devices. These materials offer excellent thermal conductivity and can conform to surface irregularities, providing superior thermal contact. Gallium-based alloys are commonly used due to their low melting points and high thermal conductivity. These liquid metal thermal interfaces help reduce thermal resistance and improve overall cooling efficiency in high-performance electronic systems.- Liquid metal thermal interface materials: Liquid metals are used as thermal interface materials to enhance heat transfer between components in electronic devices. These materials offer superior thermal conductivity compared to traditional thermal pastes or greases. The liquid nature allows for better surface contact, reducing thermal resistance at interfaces. These materials can be applied between heat sources (like processors) and heat sinks to improve overall thermal management and prevent overheating of electronic components.

- Liquid metal cooling systems for electronics: Advanced cooling systems utilize liquid metals as coolants for high-performance electronic components. These systems can include pumps, channels, and heat exchangers specifically designed to circulate liquid metal through electronic devices. The high thermal conductivity of liquid metals enables efficient heat removal from processors, graphics cards, and other heat-generating components. These cooling solutions are particularly valuable in applications requiring intensive computing power where traditional air or water cooling may be insufficient.

- Gallium-based liquid metal alloys: Gallium-based alloys, including combinations with indium, tin, and other metals, are commonly used in thermal management applications. These alloys remain liquid at or near room temperature while offering excellent thermal conductivity. Their low melting point, non-toxicity compared to mercury, and ability to form thin layers make them ideal for thermal interfaces. These materials can conform to surface irregularities, creating efficient thermal pathways between components while maintaining electrical isolation when properly formulated.

- Encapsulation and containment technologies: Specialized techniques for containing liquid metals are essential due to their potential for corrosion and migration. These include polymer encapsulation, surface treatments, and barrier materials that prevent liquid metal from contacting sensitive components while maintaining thermal performance. Containment systems may use micro-channels, sealed chambers, or specially designed reservoirs to keep liquid metal in designated thermal pathways. These technologies address challenges related to the high surface tension and potential reactivity of liquid metals with certain materials.

- Manufacturing processes for liquid metal thermal solutions: Advanced manufacturing techniques are employed to integrate liquid metal thermal solutions into electronic devices. These processes include precision dispensing methods, vacuum filling techniques, and specialized bonding procedures to ensure optimal thermal contact. Manufacturing considerations address challenges such as preventing oxidation, ensuring uniform distribution, and maintaining long-term stability of the liquid metal interface. Quality control measures are implemented to verify proper application and performance of liquid metal thermal solutions in production environments.

02 Liquid metal cooling systems for electronics

Liquid metal cooling systems utilize the high thermal conductivity of liquid metals to dissipate heat from electronic components. These systems can include liquid metal heat pipes, vapor chambers, or direct immersion cooling solutions. The superior thermal properties of liquid metals allow for more efficient heat removal compared to conventional coolants, making them suitable for high-power density applications such as data centers, gaming computers, and advanced computing systems.Expand Specific Solutions03 Manufacturing and application methods for liquid metal thermal solutions

Various manufacturing techniques and application methods have been developed for liquid metal thermal solutions. These include encapsulation methods to prevent gallium-based liquid metals from corroding certain metals, specialized dispensing techniques to ensure proper coverage, and surface treatment processes to improve wetting characteristics. Advanced manufacturing approaches enable the integration of liquid metal thermal interfaces into complex electronic assemblies while maintaining reliability and performance.Expand Specific Solutions04 Composite liquid metal thermal materials

Composite materials combining liquid metals with other substances have been developed to enhance thermal performance while addressing challenges like metal corrosion and stability. These composites may incorporate nanoparticles, polymers, or other materials to modify viscosity, thermal conductivity, or wetting properties. The resulting materials offer tailored thermal management solutions that can be optimized for specific applications while mitigating some of the drawbacks associated with pure liquid metals.Expand Specific Solutions05 Liquid metal thermal management in semiconductor packaging

Liquid metals are increasingly used in semiconductor packaging for thermal management. These applications include die-attach materials, thermal interface layers between chips and heat spreaders, and advanced cooling solutions for 3D-stacked integrated circuits. The implementation of liquid metal thermal technology in semiconductor packaging helps address thermal challenges associated with increasing power densities and enables the development of more compact and powerful electronic devices.Expand Specific Solutions

Key Industry Players in Liquid Metal Thermal Solutions

The liquid metal thermal technology market is currently in an early growth phase, characterized by increasing industrial adoption across sectors requiring advanced thermal management solutions. The global market size is expanding rapidly, driven by demands in electronics cooling, renewable energy, and automotive applications, with projections suggesting significant growth over the next decade. Technologically, the field shows varying maturity levels, with companies like Intel and Siemens leading commercial applications, while specialized players such as Yunnan Zhongxuan Liquid Metal Technology and Indium Corporation focus on material innovations. Academic-industrial partnerships involving Harbin Institute of Technology, Shenzhen University, and Korea Institute of Industrial Technology are accelerating R&D progress. The competitive landscape features both established industrial giants leveraging their manufacturing capabilities and agile startups developing proprietary formulations, creating a dynamic ecosystem poised for technological breakthroughs in thermal interface materials.

Yunnan Zhongxuan Liquid Metal Technology Co., Ltd.

Technical Solution: Yunnan Zhongxuan has pioneered the industrial application of gallium-based liquid metal thermal interface materials (TIMs) with their proprietary manufacturing process that ensures high purity and consistent thermal performance. Their technology roadmap focuses on developing liquid metal TIMs with thermal conductivity exceeding 80 W/m·K, significantly outperforming traditional thermal pastes. The company has implemented automated production lines capable of producing over 500,000 units monthly with precise dosing control systems that maintain ±0.5mg accuracy. Their liquid metal formulations incorporate anti-corrosion additives and surface treatment technologies to address compatibility issues with aluminum and copper substrates commonly used in electronics cooling. Yunnan Zhongxuan has also developed specialized packaging solutions that extend shelf life to over 24 months while maintaining material properties, addressing a key challenge for industrial adoption.

Strengths: Industry-leading thermal conductivity (73-86 W/m·K) provides superior cooling performance for high-power electronics. Their anti-corrosion formulations solve traditional liquid metal compatibility issues with common metals. Weaknesses: Higher production costs compared to conventional thermal compounds limit mass market penetration. Application requires specialized training and equipment for optimal results.

Intel Corp.

Technical Solution: Intel has developed a comprehensive liquid metal thermal solution roadmap focused on high-performance computing applications. Their approach centers on gallium-indium-tin alloys specifically engineered for CPU thermal interfaces, with thermal conductivity values reaching 73 W/m·K. Intel's industrial adoption strategy includes specialized application methods using automated precision dispensing equipment that maintains consistent coverage and thickness across processor dies. Their technology incorporates protective barrier layers to prevent gallium migration and potential corrosion of aluminum heat sinks. Intel has established rigorous reliability testing protocols including thermal cycling (-40°C to 125°C), mechanical shock testing, and accelerated aging tests demonstrating stable thermal performance over 7+ years of simulated use. The company has integrated liquid metal TIMs into their high-end processor manufacturing, with custom formulations optimized for different product lines and thermal requirements.

Strengths: Extensive R&D resources and manufacturing infrastructure enable rapid scaling and integration into existing product lines. Their protective barrier technology effectively mitigates corrosion concerns. Weaknesses: Solutions are primarily optimized for Intel's own processors rather than broader industrial applications. Higher implementation costs compared to traditional thermal compounds limit application to premium products.

Core Patents and Technical Literature in Liquid Metal Thermal Transfer

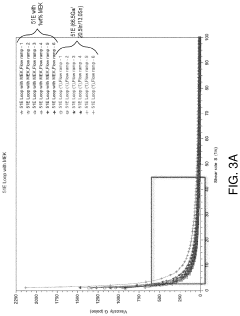

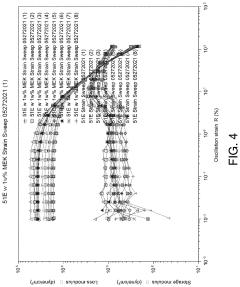

Liquid metal composites containing organic additive as thermal interface materials, and methods of their use

PatentPendingUS20230142030A1

Innovation

- A liquid metal composite comprising 90 wt % to 99.9 wt % of a liquid metal or liquid metal alloy, combined with 0.1 wt % to 10 wt % of organic additives like methyl ethyl ketone, methoxyperfluorobutane, or ethanol, which prevents oxidation and enhances adhesion and wettability on substrates, allowing for consistent dispensing and jetting with improved thermal conductivity.

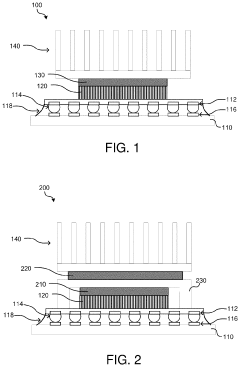

Liquid metal thermal interface material system

PatentWO2008073707A3

Innovation

- Development of a liquid metal thermal interface system that remains in liquid state throughout the operating temperature range of electronic components, enabling efficient thermal energy transfer.

- Integration of design features that absorb thermomechanical stresses caused by thermal expansion differences between electronic components and heat exchangers, improving reliability and longevity.

- Incorporation of oxygen gettering elements in the metallic interface composition to promote wetting to oxide layers, enhancing thermal contact and heat transfer efficiency.

Manufacturing Scalability and Cost Analysis

The scalability of liquid metal thermal technology manufacturing represents a critical factor in its industrial adoption trajectory. Current production methods primarily rely on laboratory-scale processes that yield limited quantities at relatively high costs. The transition to industrial-scale manufacturing faces several challenges, including the need for specialized equipment capable of handling the unique properties of liquid metals such as gallium-based alloys. Conventional metal processing equipment often proves inadequate due to the reactive nature and specific temperature requirements of these materials.

Cost analysis reveals that raw material expenses constitute approximately 40-60% of total production costs, with gallium being the primary cost driver. Recent market fluctuations have seen gallium prices range from $250-600 per kilogram, creating significant cost variability. Manufacturing processes add another 25-35% to costs, while quality control and testing contribute an additional 10-15%. These figures translate to current production costs of $800-1,200 per liter for high-purity liquid metal thermal interface materials.

Economies of scale present promising opportunities for cost reduction. Industry projections suggest that scaling production from laboratory (1-10 liters monthly) to pilot (100-500 liters monthly) could reduce unit costs by 30-40%. Full industrial scale production (1,000+ liters monthly) could potentially achieve 50-65% cost reductions through optimized processes and supply chain efficiencies.

Automation represents another critical factor in manufacturing scalability. Current production methods often involve manual handling steps that limit throughput and consistency. Automated systems for alloy preparation, purification, and packaging could increase production rates by 3-5 times while improving quality consistency. Initial investment for such automation systems ranges from $500,000 to $2 million, with ROI achievable within 2-3 years at moderate production volumes.

Quality control scalability presents unique challenges, as liquid metal thermal materials require specialized testing protocols that must be maintained across larger production volumes. Inline quality monitoring systems capable of real-time assessment of thermal conductivity, viscosity, and contaminant levels are under development but remain costly at $150,000-300,000 per production line.

Supply chain considerations also impact scalability, with gallium production currently concentrated in China (80% of global supply), creating potential vulnerabilities. Diversification efforts are underway in Australia, Germany, and Canada, which may stabilize supply and pricing in the 3-5 year timeframe, potentially reducing raw material costs by 15-25%.

Cost analysis reveals that raw material expenses constitute approximately 40-60% of total production costs, with gallium being the primary cost driver. Recent market fluctuations have seen gallium prices range from $250-600 per kilogram, creating significant cost variability. Manufacturing processes add another 25-35% to costs, while quality control and testing contribute an additional 10-15%. These figures translate to current production costs of $800-1,200 per liter for high-purity liquid metal thermal interface materials.

Economies of scale present promising opportunities for cost reduction. Industry projections suggest that scaling production from laboratory (1-10 liters monthly) to pilot (100-500 liters monthly) could reduce unit costs by 30-40%. Full industrial scale production (1,000+ liters monthly) could potentially achieve 50-65% cost reductions through optimized processes and supply chain efficiencies.

Automation represents another critical factor in manufacturing scalability. Current production methods often involve manual handling steps that limit throughput and consistency. Automated systems for alloy preparation, purification, and packaging could increase production rates by 3-5 times while improving quality consistency. Initial investment for such automation systems ranges from $500,000 to $2 million, with ROI achievable within 2-3 years at moderate production volumes.

Quality control scalability presents unique challenges, as liquid metal thermal materials require specialized testing protocols that must be maintained across larger production volumes. Inline quality monitoring systems capable of real-time assessment of thermal conductivity, viscosity, and contaminant levels are under development but remain costly at $150,000-300,000 per production line.

Supply chain considerations also impact scalability, with gallium production currently concentrated in China (80% of global supply), creating potential vulnerabilities. Diversification efforts are underway in Australia, Germany, and Canada, which may stabilize supply and pricing in the 3-5 year timeframe, potentially reducing raw material costs by 15-25%.

Environmental Impact and Safety Considerations

The adoption of liquid metal thermal technology in industrial settings necessitates thorough consideration of environmental impacts and safety protocols. Gallium-based liquid metals, while offering superior thermal conductivity, present unique environmental challenges compared to traditional cooling solutions. These materials typically have lower toxicity profiles than mercury-based alternatives, yet their environmental fate and transport mechanisms remain inadequately characterized in industrial release scenarios.

Environmental risk assessment for liquid metal thermal systems must address potential contamination pathways including accidental spills, disposal of end-of-life components, and gradual leaching during operation. Current research indicates minimal bioaccumulation potential for gallium alloys, though long-term ecosystem effects require further investigation. Particularly concerning is the interaction between liquid metals and water systems, where oxidation processes may alter mobility and bioavailability characteristics.

Regulatory frameworks governing liquid metal handling vary significantly across jurisdictions, creating compliance challenges for multinational industrial implementation. The European Union's REACH regulations and similar frameworks in North America impose stringent documentation requirements for novel thermal management materials. Companies pursuing liquid metal thermal solutions must develop comprehensive environmental management plans that address the entire technology lifecycle from raw material sourcing to decommissioning.

Worker safety considerations represent another critical dimension of industrial adoption. Liquid metal thermal systems operate at elevated temperatures with materials that may cause thermal burns upon contact with skin. Additionally, certain gallium alloys can exhibit corrosive properties when exposed to specific metals, necessitating careful material selection for containment systems and handling equipment. Comprehensive training protocols and appropriate personal protective equipment standards must be established before widespread deployment.

Lifecycle assessment studies comparing liquid metal thermal technologies with conventional alternatives demonstrate potential sustainability advantages, particularly regarding energy efficiency and operational longevity. However, end-of-life recovery and recycling infrastructure for gallium-based materials remains underdeveloped in most regions, creating potential waste management challenges as adoption scales. The establishment of specialized recycling pathways represents a critical enabling factor for environmentally responsible implementation.

Emerging research into biologically-inspired containment systems and environmentally benign liquid metal formulations offers promising pathways to mitigate environmental and safety concerns. These innovations, coupled with standardized handling protocols and regulatory harmonization efforts, will be essential to facilitate responsible industrial adoption while maximizing the sustainability benefits of liquid metal thermal technology.

Environmental risk assessment for liquid metal thermal systems must address potential contamination pathways including accidental spills, disposal of end-of-life components, and gradual leaching during operation. Current research indicates minimal bioaccumulation potential for gallium alloys, though long-term ecosystem effects require further investigation. Particularly concerning is the interaction between liquid metals and water systems, where oxidation processes may alter mobility and bioavailability characteristics.

Regulatory frameworks governing liquid metal handling vary significantly across jurisdictions, creating compliance challenges for multinational industrial implementation. The European Union's REACH regulations and similar frameworks in North America impose stringent documentation requirements for novel thermal management materials. Companies pursuing liquid metal thermal solutions must develop comprehensive environmental management plans that address the entire technology lifecycle from raw material sourcing to decommissioning.

Worker safety considerations represent another critical dimension of industrial adoption. Liquid metal thermal systems operate at elevated temperatures with materials that may cause thermal burns upon contact with skin. Additionally, certain gallium alloys can exhibit corrosive properties when exposed to specific metals, necessitating careful material selection for containment systems and handling equipment. Comprehensive training protocols and appropriate personal protective equipment standards must be established before widespread deployment.

Lifecycle assessment studies comparing liquid metal thermal technologies with conventional alternatives demonstrate potential sustainability advantages, particularly regarding energy efficiency and operational longevity. However, end-of-life recovery and recycling infrastructure for gallium-based materials remains underdeveloped in most regions, creating potential waste management challenges as adoption scales. The establishment of specialized recycling pathways represents a critical enabling factor for environmentally responsible implementation.

Emerging research into biologically-inspired containment systems and environmentally benign liquid metal formulations offers promising pathways to mitigate environmental and safety concerns. These innovations, coupled with standardized handling protocols and regulatory harmonization efforts, will be essential to facilitate responsible industrial adoption while maximizing the sustainability benefits of liquid metal thermal technology.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!