Safety And Standards Considerations For Liquid Metal Use In Electronics

AUG 22, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Liquid Metal Electronics: Background and Objectives

Liquid metal electronics represent a revolutionary frontier in the field of flexible and stretchable electronics, with roots dating back to the early 2000s. The evolution of this technology has been driven by the limitations of conventional rigid electronic components and the growing demand for devices that can conform to complex surfaces or withstand mechanical deformation. Gallium-based alloys, particularly gallium-indium-tin (Galinstan) and gallium-indium eutectic (EGaIn), have emerged as the primary materials of interest due to their low toxicity and liquid state at room temperature.

The technological trajectory has accelerated significantly over the past decade, with research publications in this domain increasing by approximately 300% between 2010 and 2020. This growth reflects both the expanding scientific interest and the potential commercial applications across multiple industries, from healthcare monitoring to advanced computing systems.

Safety considerations have become increasingly prominent as liquid metal technologies transition from laboratory research to practical applications. The unique properties that make liquid metals valuable—such as their fluidity and electrical conductivity—also present distinct safety challenges related to containment, environmental exposure, and long-term stability in electronic systems.

Current technical objectives in this field focus on addressing several key areas: developing robust encapsulation methods to prevent leakage or environmental contamination, establishing comprehensive toxicological profiles for various liquid metal alloys, and creating standardized testing protocols to evaluate the safety of liquid metal components under various operating conditions and failure scenarios.

The regulatory landscape surrounding liquid metal electronics remains fragmented, with no unified international standards specifically addressing these materials in electronic applications. Instead, manufacturers and researchers must navigate a complex web of regulations drawn from adjacent fields such as hazardous materials handling, electronic waste management, and consumer product safety.

Looking forward, the field aims to establish clear safety benchmarks and standardized testing methodologies that can facilitate broader commercial adoption. This includes developing accelerated aging tests to predict long-term containment integrity, standardizing methods for evaluating biocompatibility in wearable applications, and creating industry-wide protocols for handling and disposal of liquid metal electronic components.

The convergence of materials science, electrical engineering, and safety engineering will be essential to realizing the full potential of liquid metal electronics while ensuring appropriate safeguards are in place to protect users, manufacturers, and the environment throughout the product lifecycle.

The technological trajectory has accelerated significantly over the past decade, with research publications in this domain increasing by approximately 300% between 2010 and 2020. This growth reflects both the expanding scientific interest and the potential commercial applications across multiple industries, from healthcare monitoring to advanced computing systems.

Safety considerations have become increasingly prominent as liquid metal technologies transition from laboratory research to practical applications. The unique properties that make liquid metals valuable—such as their fluidity and electrical conductivity—also present distinct safety challenges related to containment, environmental exposure, and long-term stability in electronic systems.

Current technical objectives in this field focus on addressing several key areas: developing robust encapsulation methods to prevent leakage or environmental contamination, establishing comprehensive toxicological profiles for various liquid metal alloys, and creating standardized testing protocols to evaluate the safety of liquid metal components under various operating conditions and failure scenarios.

The regulatory landscape surrounding liquid metal electronics remains fragmented, with no unified international standards specifically addressing these materials in electronic applications. Instead, manufacturers and researchers must navigate a complex web of regulations drawn from adjacent fields such as hazardous materials handling, electronic waste management, and consumer product safety.

Looking forward, the field aims to establish clear safety benchmarks and standardized testing methodologies that can facilitate broader commercial adoption. This includes developing accelerated aging tests to predict long-term containment integrity, standardizing methods for evaluating biocompatibility in wearable applications, and creating industry-wide protocols for handling and disposal of liquid metal electronic components.

The convergence of materials science, electrical engineering, and safety engineering will be essential to realizing the full potential of liquid metal electronics while ensuring appropriate safeguards are in place to protect users, manufacturers, and the environment throughout the product lifecycle.

Market Analysis for Liquid Metal Electronic Applications

The liquid metal electronics market is experiencing significant growth, driven by the unique properties these materials offer for next-generation electronic applications. The global market for liquid metal-based electronics was valued at approximately $2.3 billion in 2022 and is projected to reach $5.7 billion by 2028, representing a compound annual growth rate of 16.4%. This growth trajectory is supported by increasing demand for flexible, stretchable, and self-healing electronic components across multiple industries.

Consumer electronics represents the largest market segment, accounting for roughly 38% of the total market share. The demand for wearable devices, flexible displays, and advanced thermal management solutions has created substantial opportunities for liquid metal applications. Major smartphone manufacturers have begun incorporating liquid metal thermal interface materials to address heat dissipation challenges in increasingly powerful mobile processors.

The medical device sector is emerging as the fastest-growing application area, with a projected growth rate of 22.7% through 2028. Biocompatible liquid metal alloys are being developed for implantable devices, biosensors, and soft robotics applications. The ability of certain liquid metal formulations to maintain conductivity while conforming to human tissue makes them particularly valuable for next-generation medical technologies.

Automotive electronics constitutes another significant market segment, currently representing approximately 17% of the total market. As vehicles become increasingly electrified and autonomous, the demand for advanced thermal management systems and flexible interconnects is rising. Liquid metal cooling solutions are being explored for electric vehicle battery systems, where thermal management directly impacts performance, safety, and longevity.

Regionally, North America leads the market with approximately 42% share, followed by Asia-Pacific at 36% and Europe at 18%. However, the Asia-Pacific region is expected to witness the highest growth rate of 19.3% annually, driven by extensive electronics manufacturing infrastructure and increasing R&D investments in countries like China, South Korea, and Japan.

Market challenges include high material costs, with gallium-based liquid metals currently priced at $300-500 per kilogram, limiting mass-market adoption. Additionally, concerns regarding toxicity, environmental impact, and long-term reliability have slowed commercialization in certain applications. Regulatory uncertainties surrounding novel materials in consumer products also present market barriers that industry participants must navigate.

Despite these challenges, the liquid metal electronics market presents substantial opportunities for innovation and growth, particularly as manufacturing processes mature and economies of scale reduce production costs. Strategic partnerships between material developers and device manufacturers will be crucial for accelerating market penetration and addressing application-specific requirements.

Consumer electronics represents the largest market segment, accounting for roughly 38% of the total market share. The demand for wearable devices, flexible displays, and advanced thermal management solutions has created substantial opportunities for liquid metal applications. Major smartphone manufacturers have begun incorporating liquid metal thermal interface materials to address heat dissipation challenges in increasingly powerful mobile processors.

The medical device sector is emerging as the fastest-growing application area, with a projected growth rate of 22.7% through 2028. Biocompatible liquid metal alloys are being developed for implantable devices, biosensors, and soft robotics applications. The ability of certain liquid metal formulations to maintain conductivity while conforming to human tissue makes them particularly valuable for next-generation medical technologies.

Automotive electronics constitutes another significant market segment, currently representing approximately 17% of the total market. As vehicles become increasingly electrified and autonomous, the demand for advanced thermal management systems and flexible interconnects is rising. Liquid metal cooling solutions are being explored for electric vehicle battery systems, where thermal management directly impacts performance, safety, and longevity.

Regionally, North America leads the market with approximately 42% share, followed by Asia-Pacific at 36% and Europe at 18%. However, the Asia-Pacific region is expected to witness the highest growth rate of 19.3% annually, driven by extensive electronics manufacturing infrastructure and increasing R&D investments in countries like China, South Korea, and Japan.

Market challenges include high material costs, with gallium-based liquid metals currently priced at $300-500 per kilogram, limiting mass-market adoption. Additionally, concerns regarding toxicity, environmental impact, and long-term reliability have slowed commercialization in certain applications. Regulatory uncertainties surrounding novel materials in consumer products also present market barriers that industry participants must navigate.

Despite these challenges, the liquid metal electronics market presents substantial opportunities for innovation and growth, particularly as manufacturing processes mature and economies of scale reduce production costs. Strategic partnerships between material developers and device manufacturers will be crucial for accelerating market penetration and addressing application-specific requirements.

Current Safety Challenges in Liquid Metal Technology

The integration of liquid metal technology in electronics presents significant safety challenges that must be addressed before widespread commercial adoption. Gallium-based liquid metals, particularly gallium-indium alloys (EGaIn), pose toxicity concerns despite being less hazardous than mercury. Research indicates that while gallium has low acute toxicity, prolonged exposure may lead to respiratory irritation and potential neurological effects. Indium compounds have been linked to lung damage in occupational settings, necessitating careful handling protocols.

Material compatibility represents another critical safety challenge. Liquid metals exhibit highly corrosive properties when in contact with certain metals, particularly aluminum, where they can cause catastrophic structural degradation through liquid metal embrittlement (LME). This phenomenon occurs as liquid metals penetrate grain boundaries in solid metals, weakening their structural integrity and potentially leading to device failure or safety incidents.

Electrical safety concerns are paramount in electronic applications. Though liquid metals offer excellent conductivity, their fluid nature creates risks of unintended electrical connections or shorts if containment fails. Current encapsulation methods have not been standardized for long-term reliability, presenting challenges for devices intended for extended use or deployment in variable environmental conditions.

Environmental considerations further complicate implementation. The potential environmental impact of liquid metal disposal remains inadequately studied, with limited protocols for handling waste or recycling these materials. The bioaccumulation potential of gallium and indium compounds in ecosystems represents an emerging concern requiring further investigation before large-scale deployment.

Regulatory frameworks for liquid metal use in consumer electronics remain underdeveloped globally. The absence of comprehensive safety standards specifically addressing liquid metal technologies creates uncertainty for manufacturers and potential liability issues. Current regulations primarily treat these materials under broader hazardous substance frameworks, without addressing their unique properties and risks.

Manufacturing safety presents additional challenges, with inadequate standardized protocols for handling liquid metals during production processes. Workers may face exposure risks through skin contact or inhalation of metal particles or vapors, particularly during high-temperature processing. The lack of established occupational exposure limits specifically for gallium-indium alloys complicates workplace safety management.

Thermal management issues also pose safety concerns, as liquid metals can experience significant volume changes with temperature fluctuations. This property creates risks of containment failure in devices experiencing thermal cycling, potentially leading to leakage and subsequent electrical or material damage. Current encapsulation technologies have not been sufficiently validated for thermal reliability across the full operational range of modern electronic devices.

Material compatibility represents another critical safety challenge. Liquid metals exhibit highly corrosive properties when in contact with certain metals, particularly aluminum, where they can cause catastrophic structural degradation through liquid metal embrittlement (LME). This phenomenon occurs as liquid metals penetrate grain boundaries in solid metals, weakening their structural integrity and potentially leading to device failure or safety incidents.

Electrical safety concerns are paramount in electronic applications. Though liquid metals offer excellent conductivity, their fluid nature creates risks of unintended electrical connections or shorts if containment fails. Current encapsulation methods have not been standardized for long-term reliability, presenting challenges for devices intended for extended use or deployment in variable environmental conditions.

Environmental considerations further complicate implementation. The potential environmental impact of liquid metal disposal remains inadequately studied, with limited protocols for handling waste or recycling these materials. The bioaccumulation potential of gallium and indium compounds in ecosystems represents an emerging concern requiring further investigation before large-scale deployment.

Regulatory frameworks for liquid metal use in consumer electronics remain underdeveloped globally. The absence of comprehensive safety standards specifically addressing liquid metal technologies creates uncertainty for manufacturers and potential liability issues. Current regulations primarily treat these materials under broader hazardous substance frameworks, without addressing their unique properties and risks.

Manufacturing safety presents additional challenges, with inadequate standardized protocols for handling liquid metals during production processes. Workers may face exposure risks through skin contact or inhalation of metal particles or vapors, particularly during high-temperature processing. The lack of established occupational exposure limits specifically for gallium-indium alloys complicates workplace safety management.

Thermal management issues also pose safety concerns, as liquid metals can experience significant volume changes with temperature fluctuations. This property creates risks of containment failure in devices experiencing thermal cycling, potentially leading to leakage and subsequent electrical or material damage. Current encapsulation technologies have not been sufficiently validated for thermal reliability across the full operational range of modern electronic devices.

Existing Safety Protocols and Compliance Frameworks

01 Safety standards for liquid metal handling and containment

Safety standards for handling and containing liquid metals are essential to prevent accidents and ensure worker safety. These standards include specifications for containment vessels, handling procedures, and protective measures. Proper containment systems must be designed to withstand the high temperatures and reactive properties of liquid metals, while handling procedures must minimize the risk of spills or exposure.- Safety standards for liquid metal handling and containment: Safety standards for handling and containing liquid metals are essential to prevent accidents and ensure worker safety. These standards include specifications for containment vessels, handling procedures, and emergency protocols. Proper containment systems must be designed to withstand the high temperatures and reactive properties of liquid metals, with appropriate sealing mechanisms to prevent leakage. Regular inspection and maintenance procedures are also specified to ensure ongoing safety compliance.

- Thermal management and heat transfer safety in liquid metal applications: Liquid metals often operate at high temperatures, requiring specific safety standards for thermal management. These standards address heat transfer properties, cooling systems, and thermal isolation to prevent overheating and potential fire hazards. Safety measures include temperature monitoring systems, thermal barriers, and emergency cooling mechanisms. Standards also specify maximum operating temperatures and thermal cycling limitations to prevent material degradation that could lead to safety incidents.

- Environmental and health safety regulations for liquid metals: Environmental and health safety regulations for liquid metals focus on preventing contamination and protecting human health. These standards address toxicity concerns, exposure limits, and proper disposal methods. Requirements include ventilation systems to remove harmful vapors, personal protective equipment specifications, and decontamination procedures. Environmental standards also cover spill containment, waste management, and long-term storage to prevent soil and water contamination.

- Electrical safety standards for liquid metal applications: Liquid metals used in electrical applications require specific safety standards to prevent electrical hazards. These standards address insulation requirements, grounding procedures, and protection against electrical shorts. Safety measures include isolation of liquid metal components from electrical systems, specialized connectors and interfaces, and monitoring systems to detect potential electrical failures. Standards also specify testing procedures to verify electrical safety compliance before system operation.

- Transportation and storage safety standards for liquid metals: Transportation and storage of liquid metals require specific safety standards to prevent accidents during movement and long-term containment. These standards specify container requirements, temperature control during transport, and vibration resistance. Safety measures include specialized transport vessels, monitoring systems during transit, and secure storage facilities. Standards also address labeling requirements, documentation, and emergency response procedures specific to liquid metal incidents during transportation and storage.

02 Temperature monitoring and control systems for liquid metals

Temperature monitoring and control systems are critical for maintaining liquid metals within safe operating parameters. These systems include sensors, controllers, and safety mechanisms that prevent overheating or rapid cooling, which could lead to dangerous situations. Advanced monitoring technologies provide real-time data on temperature conditions, allowing for immediate response to potential safety issues.Expand Specific Solutions03 Protective equipment and emergency response protocols

Specialized protective equipment and emergency response protocols are necessary when working with liquid metals. This includes heat-resistant clothing, face shields, and respiratory protection designed to shield workers from potential splashes, fumes, or vapors. Emergency response protocols outline procedures for addressing spills, fires, or other incidents involving liquid metals to minimize harm and contain hazards.Expand Specific Solutions04 Environmental and disposal safety requirements

Environmental and disposal safety requirements for liquid metals address the potential ecological impacts of these materials. Standards specify proper disposal methods, containment during transport, and remediation procedures for contaminated areas. These requirements aim to prevent environmental contamination and ensure that liquid metal waste is handled in accordance with regulations protecting both human health and ecosystems.Expand Specific Solutions05 Testing and certification standards for liquid metal applications

Testing and certification standards ensure that liquid metal applications meet safety requirements before implementation. These standards include performance testing under various conditions, material compatibility assessments, and certification processes that verify compliance with safety regulations. Regular inspection and recertification may be required to maintain safety standards throughout the operational life of liquid metal systems.Expand Specific Solutions

Leading Companies and Research Institutions in Liquid Metal Electronics

The liquid metal electronics market is currently in an early growth phase, characterized by increasing research activities and emerging commercial applications. The global market size is estimated to be relatively modest but growing rapidly, driven by demand for flexible and stretchable electronics. From a technical maturity perspective, the field remains in development with significant challenges in safety standardization and industrial scalability. Key players include established electronics giants like Apple, Sony, and Panasonic who are investing in liquid metal patents, alongside specialized innovators such as Beijing Dream Ink Technology and Yunnan Kewei Liquid Metal Valley R&D. Academic institutions including Karlsruher Institut für Technologie and Xiamen University are contributing fundamental research, while materials companies like Furuya Metal and Senju Metal Industry are developing specialized alloys and manufacturing processes to address safety concerns.

Yunnan Kewei Liquid Metal Valley R & D Co., Ltd.

Technical Solution: Yunnan Kewei has developed a comprehensive safety framework for liquid metal applications in electronics, focusing on gallium-based alloys. Their approach includes encapsulation technologies that prevent liquid metal leakage and oxidation, utilizing specialized polymer coatings that maintain electrical conductivity while isolating the liquid metal from environmental factors. The company has pioneered temperature-controlled processing methods that minimize risks during manufacturing, maintaining precise thermal conditions to prevent splashing or unexpected phase transitions. Their safety protocols include real-time monitoring systems that detect potential leaks or abnormal behavior in liquid metal components, with automatic shutdown mechanisms to prevent cascading failures. Kewei has also worked extensively with regulatory bodies to establish industry standards specifically for liquid metal electronics, contributing to both Chinese GB standards and international ISO frameworks for safety certification.

Strengths: Industry-leading encapsulation technology prevents environmental contamination while maintaining electrical performance. Their established relationships with Chinese regulatory authorities give them advantage in standards development. Weakness: Their safety solutions may add cost and complexity to manufacturing processes, potentially limiting adoption in cost-sensitive consumer electronics applications.

Apple, Inc.

Technical Solution: Apple has developed proprietary safety protocols for liquid metal integration in consumer electronics, focusing on zirconium-based bulk metallic glass alloys. Their approach emphasizes hermetic sealing technologies that completely isolate liquid metal components from user contact while maintaining thermal performance. Apple's safety framework includes multi-layer containment systems with redundant barriers to prevent any potential leakage even under extreme conditions or device damage. The company has implemented specialized manufacturing processes that minimize worker exposure during production, utilizing automated handling systems and closed-loop recycling to reduce environmental impact. Apple has also developed comprehensive testing protocols that exceed standard regulatory requirements, subjecting liquid metal components to accelerated aging, thermal cycling, and physical stress tests to ensure long-term stability and safety compliance. Their standards work includes collaboration with UL and other certification bodies to establish consumer electronics-specific safety parameters for liquid metal applications.

Strengths: Exceptional integration of safety features with premium design aesthetics, allowing liquid metal use without compromising user experience. Comprehensive end-to-end control of supply chain ensures consistent safety implementation. Weaknesses: Highly proprietary approach limits industry-wide adoption of their safety standards, and their solutions typically require premium materials that may not be cost-effective for broader market applications.

Critical Patents and Research on Liquid Metal Safety

Electrochemical energy storage devices

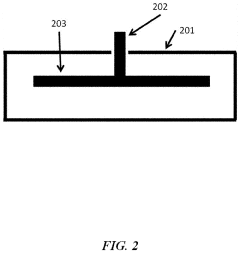

PatentActiveUS20230282891A1

Innovation

- A seal comprising a ceramic material resistant to reactive metals and molten salts, combined with a metal collar and active metal braze, provides chemical resistance and thermal stability, ensuring the containment of reactive materials at elevated temperatures.

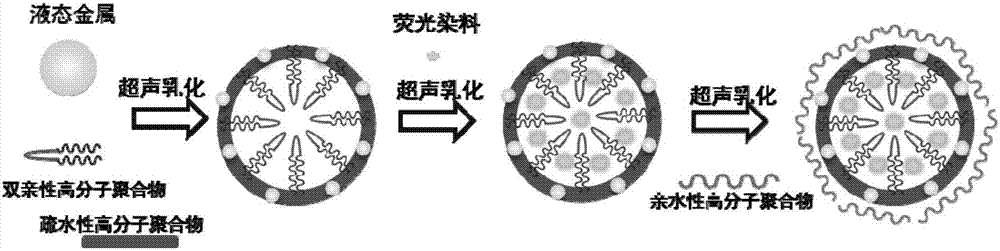

Water-soluble fluorescent liquid metal material and preparation method thereof

PatentActiveCN107962180A

Innovation

- Water-soluble liquid metal fluorescent materials are prepared by using liquid metal as a base material, coating it with fluorescent dyes, and using high molecular polymer materials for surface modification to enhance the hydrophilicity and stability of the material. Specific steps include preparing a polymer solution, adding liquid metal and performing ultrasonic oscillation, dissolving the fluorescent dye and adding it dropwise to the mixed solution, preparing a hydrophilic polymer material solution and continuing ultrasonic oscillation, and finally removing the organic solvent and deionized water. A water-soluble fluorescent liquid metal material is obtained.

Environmental Impact Assessment of Liquid Metal Electronics

The environmental impact of liquid metal electronics represents a critical dimension in evaluating their sustainability and long-term viability. Gallium-based liquid metals, particularly gallium-indium alloys (GaIn), have emerged as promising alternatives to traditional mercury, which has been largely phased out due to its severe environmental toxicity.

Liquid metal electronics present a complex environmental profile throughout their lifecycle. During production, the extraction and refinement of gallium and other constituent metals can lead to habitat disruption, energy consumption, and potential water contamination. However, compared to conventional electronics manufacturing, liquid metal processing typically requires fewer harsh chemicals and generates less hazardous waste.

In the usage phase, liquid metal electronics demonstrate several environmental advantages. Their self-healing properties and mechanical flexibility contribute to extended product lifespans, potentially reducing electronic waste generation. Additionally, the operational efficiency of liquid metal components often results in lower energy consumption compared to conventional alternatives, particularly in applications like thermal management systems.

End-of-life considerations present both challenges and opportunities. While gallium-based liquid metals are significantly less toxic than mercury, improper disposal can still lead to environmental contamination. Current recycling infrastructure is inadequately equipped to handle liquid metal components, creating a recovery gap in the circular economy for these materials.

Risk assessment studies indicate that accidental releases of gallium-based liquid metals pose substantially lower environmental hazards than mercury, with limited bioaccumulation potential. However, the long-term ecological effects of these materials remain incompletely understood, particularly regarding their behavior in aquatic ecosystems and potential for soil contamination.

Regulatory frameworks for liquid metal electronics are evolving but remain inconsistent globally. The European Union's RoHS and WEEE directives address certain aspects of liquid metal handling, while the United States EPA has established preliminary guidelines for gallium compound disposal. International standardization efforts are underway to harmonize environmental protocols for these emerging materials.

Future research priorities should include comprehensive lifecycle assessments, development of specialized recycling technologies, and long-term ecotoxicological studies. Industry stakeholders are increasingly implementing voluntary environmental stewardship programs, recognizing that proactive management of environmental impacts will be crucial for market acceptance and regulatory compliance.

Liquid metal electronics present a complex environmental profile throughout their lifecycle. During production, the extraction and refinement of gallium and other constituent metals can lead to habitat disruption, energy consumption, and potential water contamination. However, compared to conventional electronics manufacturing, liquid metal processing typically requires fewer harsh chemicals and generates less hazardous waste.

In the usage phase, liquid metal electronics demonstrate several environmental advantages. Their self-healing properties and mechanical flexibility contribute to extended product lifespans, potentially reducing electronic waste generation. Additionally, the operational efficiency of liquid metal components often results in lower energy consumption compared to conventional alternatives, particularly in applications like thermal management systems.

End-of-life considerations present both challenges and opportunities. While gallium-based liquid metals are significantly less toxic than mercury, improper disposal can still lead to environmental contamination. Current recycling infrastructure is inadequately equipped to handle liquid metal components, creating a recovery gap in the circular economy for these materials.

Risk assessment studies indicate that accidental releases of gallium-based liquid metals pose substantially lower environmental hazards than mercury, with limited bioaccumulation potential. However, the long-term ecological effects of these materials remain incompletely understood, particularly regarding their behavior in aquatic ecosystems and potential for soil contamination.

Regulatory frameworks for liquid metal electronics are evolving but remain inconsistent globally. The European Union's RoHS and WEEE directives address certain aspects of liquid metal handling, while the United States EPA has established preliminary guidelines for gallium compound disposal. International standardization efforts are underway to harmonize environmental protocols for these emerging materials.

Future research priorities should include comprehensive lifecycle assessments, development of specialized recycling technologies, and long-term ecotoxicological studies. Industry stakeholders are increasingly implementing voluntary environmental stewardship programs, recognizing that proactive management of environmental impacts will be crucial for market acceptance and regulatory compliance.

Risk Management Strategies for Liquid Metal Implementation

Implementing liquid metal technologies in electronics requires comprehensive risk management strategies to address the unique challenges these materials present. A multi-layered approach combining engineering controls, administrative protocols, and emergency response planning is essential for safe implementation. Organizations should begin by conducting thorough risk assessments specific to liquid metal applications, identifying potential failure modes, exposure pathways, and environmental impacts throughout the product lifecycle.

Engineering controls represent the first line of defense, including specialized containment systems designed specifically for the physical properties of gallium-based alloys and other liquid metals. These should incorporate redundant barriers, temperature monitoring systems, and specialized materials resistant to liquid metal corrosion. Automated handling systems can minimize direct human contact, while dedicated ventilation systems with appropriate filtration capabilities help manage potential airborne exposures during manufacturing processes.

Administrative controls complement physical safeguards through comprehensive staff training programs focused on liquid metal handling procedures, recognition of hazardous situations, and appropriate response protocols. Standard operating procedures should be developed specifically for each liquid metal application, with clear documentation of safety parameters and operational boundaries. Regular safety audits and compliance reviews ensure ongoing adherence to established protocols.

Personal protective equipment strategies must be tailored to the specific liquid metals in use, as conventional PPE may be inadequate for certain liquid metal exposures. Specialized gloves, face shields, and protective clothing made from materials resistant to liquid metal penetration and chemical interaction should be standard requirements in handling areas.

Emergency response planning requires particular attention, with detailed protocols for containing and neutralizing liquid metal spills. Response teams should be equipped with specialized cleanup materials and trained in proper disposal methods that comply with hazardous waste regulations. Medical response protocols should address the unique health impacts of specific liquid metals, with appropriate first aid procedures and medical surveillance programs for regularly exposed personnel.

Supply chain risk management extends these protections beyond immediate operations, requiring suppliers to demonstrate appropriate safety protocols and quality control measures for liquid metal components. Transportation and storage protocols must address the unique physical properties of these materials, particularly for alloys with low melting points or reactive characteristics.

Insurance and liability considerations represent the final layer of risk management, with organizations needing specialized coverage for potential environmental impacts, worker exposures, and product liability related to liquid metal technologies. Documentation of comprehensive risk management practices can help secure appropriate coverage and demonstrate regulatory compliance.

Engineering controls represent the first line of defense, including specialized containment systems designed specifically for the physical properties of gallium-based alloys and other liquid metals. These should incorporate redundant barriers, temperature monitoring systems, and specialized materials resistant to liquid metal corrosion. Automated handling systems can minimize direct human contact, while dedicated ventilation systems with appropriate filtration capabilities help manage potential airborne exposures during manufacturing processes.

Administrative controls complement physical safeguards through comprehensive staff training programs focused on liquid metal handling procedures, recognition of hazardous situations, and appropriate response protocols. Standard operating procedures should be developed specifically for each liquid metal application, with clear documentation of safety parameters and operational boundaries. Regular safety audits and compliance reviews ensure ongoing adherence to established protocols.

Personal protective equipment strategies must be tailored to the specific liquid metals in use, as conventional PPE may be inadequate for certain liquid metal exposures. Specialized gloves, face shields, and protective clothing made from materials resistant to liquid metal penetration and chemical interaction should be standard requirements in handling areas.

Emergency response planning requires particular attention, with detailed protocols for containing and neutralizing liquid metal spills. Response teams should be equipped with specialized cleanup materials and trained in proper disposal methods that comply with hazardous waste regulations. Medical response protocols should address the unique health impacts of specific liquid metals, with appropriate first aid procedures and medical surveillance programs for regularly exposed personnel.

Supply chain risk management extends these protections beyond immediate operations, requiring suppliers to demonstrate appropriate safety protocols and quality control measures for liquid metal components. Transportation and storage protocols must address the unique physical properties of these materials, particularly for alloys with low melting points or reactive characteristics.

Insurance and liability considerations represent the final layer of risk management, with organizations needing specialized coverage for potential environmental impacts, worker exposures, and product liability related to liquid metal technologies. Documentation of comprehensive risk management practices can help secure appropriate coverage and demonstrate regulatory compliance.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!