Sodium Alginate: Driving Innovations in Oral Care Products

JUL 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Sodium Alginate Evolution

Sodium alginate has undergone significant evolution in its application to oral care products since its initial discovery in the late 19th century. Originally extracted from brown seaweed, this natural polysaccharide has transitioned from a mere thickening agent to a multifunctional ingredient driving innovation in dental hygiene.

In the early stages of its use in oral care, sodium alginate primarily served as a stabilizer and viscosity modifier in toothpaste formulations. Its ability to form stable gels and emulsions made it an ideal candidate for improving the texture and consistency of dental products. This basic functionality laid the groundwork for more advanced applications in subsequent decades.

The 1960s and 1970s saw a surge in research exploring sodium alginate's potential in dental impressions and wound dressings. These studies revealed its biocompatibility and ability to form hydrogels, properties that would later prove crucial in developing advanced oral care solutions. During this period, scientists began to recognize sodium alginate's potential for controlled release of active ingredients, a characteristic that would revolutionize oral care product formulations.

The 1980s and 1990s marked a turning point in sodium alginate's evolution within oral care. Researchers discovered its ability to form a protective layer on tooth surfaces, leading to its incorporation in products designed to combat tooth sensitivity. This period also saw the development of alginate-based dental impression materials, which offered improved accuracy and patient comfort compared to traditional materials.

The early 2000s brought about a new era of innovation, with sodium alginate being explored for its potential in remineralization therapies. Studies demonstrated its capacity to enhance the delivery of calcium and phosphate ions to tooth surfaces, opening up new possibilities for non-invasive caries treatment and prevention. This discovery sparked a wave of research into alginate-based systems for controlled release of various oral care actives.

In recent years, the focus has shifted towards leveraging sodium alginate's unique properties in advanced drug delivery systems for oral care. Researchers are exploring its potential in creating mucoadhesive formulations that can prolong the retention of active ingredients in the oral cavity. This approach promises to enhance the efficacy of treatments for conditions such as periodontal disease and oral infections.

The latest frontier in sodium alginate's evolution involves its integration with nanotechnology. Scientists are investigating alginate nanoparticles as carriers for antimicrobial agents and remineralizing compounds, aiming to develop more targeted and efficient oral care treatments. This cutting-edge research represents the convergence of material science and biotechnology, promising to usher in a new generation of innovative oral care products.

In the early stages of its use in oral care, sodium alginate primarily served as a stabilizer and viscosity modifier in toothpaste formulations. Its ability to form stable gels and emulsions made it an ideal candidate for improving the texture and consistency of dental products. This basic functionality laid the groundwork for more advanced applications in subsequent decades.

The 1960s and 1970s saw a surge in research exploring sodium alginate's potential in dental impressions and wound dressings. These studies revealed its biocompatibility and ability to form hydrogels, properties that would later prove crucial in developing advanced oral care solutions. During this period, scientists began to recognize sodium alginate's potential for controlled release of active ingredients, a characteristic that would revolutionize oral care product formulations.

The 1980s and 1990s marked a turning point in sodium alginate's evolution within oral care. Researchers discovered its ability to form a protective layer on tooth surfaces, leading to its incorporation in products designed to combat tooth sensitivity. This period also saw the development of alginate-based dental impression materials, which offered improved accuracy and patient comfort compared to traditional materials.

The early 2000s brought about a new era of innovation, with sodium alginate being explored for its potential in remineralization therapies. Studies demonstrated its capacity to enhance the delivery of calcium and phosphate ions to tooth surfaces, opening up new possibilities for non-invasive caries treatment and prevention. This discovery sparked a wave of research into alginate-based systems for controlled release of various oral care actives.

In recent years, the focus has shifted towards leveraging sodium alginate's unique properties in advanced drug delivery systems for oral care. Researchers are exploring its potential in creating mucoadhesive formulations that can prolong the retention of active ingredients in the oral cavity. This approach promises to enhance the efficacy of treatments for conditions such as periodontal disease and oral infections.

The latest frontier in sodium alginate's evolution involves its integration with nanotechnology. Scientists are investigating alginate nanoparticles as carriers for antimicrobial agents and remineralizing compounds, aiming to develop more targeted and efficient oral care treatments. This cutting-edge research represents the convergence of material science and biotechnology, promising to usher in a new generation of innovative oral care products.

Oral Care Market Analysis

The global oral care market has been experiencing steady growth, driven by increasing awareness of dental hygiene, rising disposable incomes, and technological advancements in oral care products. As of 2021, the market was valued at approximately $31.7 billion, with projections indicating a compound annual growth rate (CAGR) of 5.8% from 2022 to 2030.

Within this market, toothpaste remains the dominant segment, accounting for over 35% of the total market share. Mouthwashes and dental floss are also significant contributors, with growing popularity in both developed and developing markets. The increasing prevalence of dental caries and periodontal diseases has been a key factor in driving demand for advanced oral care products.

Geographically, North America and Europe lead the market, owing to high consumer awareness and well-established healthcare infrastructure. However, the Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid urbanization, increasing disposable incomes, and changing lifestyles in countries like China and India.

The oral care market is characterized by intense competition among major players such as Colgate-Palmolive, Procter & Gamble, GlaxoSmithKline, and Unilever. These companies are continuously investing in research and development to introduce innovative products that cater to evolving consumer needs and preferences.

A notable trend in the market is the growing demand for natural and organic oral care products. Consumers are increasingly seeking alternatives to traditional chemical-based products, driving manufacturers to incorporate natural ingredients like sodium alginate into their formulations. This shift is particularly evident in premium and niche product segments.

The COVID-19 pandemic has had a mixed impact on the oral care market. While it initially disrupted supply chains and retail sales, it also heightened consumer awareness about overall health and hygiene, including oral care. This has led to increased adoption of oral care routines and a surge in demand for products with antibacterial and antiviral properties.

Looking ahead, the oral care market is poised for further growth and innovation. The integration of advanced technologies such as artificial intelligence and IoT in oral care devices, coupled with the development of personalized oral care solutions, is expected to reshape the market landscape. Additionally, the increasing focus on preventive dental care and the rising popularity of cosmetic dentistry are likely to create new opportunities for market expansion and product development in the coming years.

Within this market, toothpaste remains the dominant segment, accounting for over 35% of the total market share. Mouthwashes and dental floss are also significant contributors, with growing popularity in both developed and developing markets. The increasing prevalence of dental caries and periodontal diseases has been a key factor in driving demand for advanced oral care products.

Geographically, North America and Europe lead the market, owing to high consumer awareness and well-established healthcare infrastructure. However, the Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid urbanization, increasing disposable incomes, and changing lifestyles in countries like China and India.

The oral care market is characterized by intense competition among major players such as Colgate-Palmolive, Procter & Gamble, GlaxoSmithKline, and Unilever. These companies are continuously investing in research and development to introduce innovative products that cater to evolving consumer needs and preferences.

A notable trend in the market is the growing demand for natural and organic oral care products. Consumers are increasingly seeking alternatives to traditional chemical-based products, driving manufacturers to incorporate natural ingredients like sodium alginate into their formulations. This shift is particularly evident in premium and niche product segments.

The COVID-19 pandemic has had a mixed impact on the oral care market. While it initially disrupted supply chains and retail sales, it also heightened consumer awareness about overall health and hygiene, including oral care. This has led to increased adoption of oral care routines and a surge in demand for products with antibacterial and antiviral properties.

Looking ahead, the oral care market is poised for further growth and innovation. The integration of advanced technologies such as artificial intelligence and IoT in oral care devices, coupled with the development of personalized oral care solutions, is expected to reshape the market landscape. Additionally, the increasing focus on preventive dental care and the rising popularity of cosmetic dentistry are likely to create new opportunities for market expansion and product development in the coming years.

Technical Challenges

The integration of sodium alginate into oral care products presents several technical challenges that researchers and manufacturers must address. One primary obstacle is achieving optimal viscosity and stability in formulations. Sodium alginate's thickening properties can vary depending on factors such as pH, temperature, and the presence of other ingredients, making it difficult to maintain consistent product texture and performance across different oral care applications.

Another significant challenge lies in controlling the release rate of active ingredients when sodium alginate is used as a delivery system. While its gel-forming ability is advantageous for sustained release, fine-tuning the release profile to match specific oral care needs requires extensive research and formulation adjustments. This is particularly crucial for products aimed at prolonged fluoride retention or gradual antimicrobial agent release.

Compatibility with other oral care ingredients poses an additional hurdle. Sodium alginate's interactions with common components such as abrasives, surfactants, and preservatives can affect product stability and efficacy. Formulating a balanced composition that maintains the benefits of sodium alginate without compromising the function of other ingredients demands careful consideration and extensive testing.

The taste and mouthfeel of sodium alginate-containing products present another technical challenge. While the polymer can improve texture, its natural flavor may not be appealing to all consumers. Masking any undesirable taste without affecting the product's functionality or introducing additional complications to the formulation is a complex task that requires innovative flavor technologies.

Ensuring the long-term stability of sodium alginate in oral care products is also challenging. Factors such as temperature fluctuations, exposure to light, and microbial contamination can potentially degrade the polymer or alter its properties over time. Developing robust preservation systems and packaging solutions that maintain product integrity throughout its shelf life is crucial for commercial success.

Manufacturing processes present their own set of challenges. Incorporating sodium alginate into oral care formulations may require specialized equipment or modifications to existing production lines. Achieving uniform dispersion and hydration of the polymer during manufacturing, while avoiding the formation of lumps or inconsistencies, demands precise control over mixing conditions and ingredient addition sequences.

Lastly, regulatory compliance and safety assessments pose ongoing challenges. As sodium alginate finds new applications in oral care, demonstrating its safety and efficacy in various product formats to meet regulatory standards across different markets requires extensive clinical studies and documentation. This process can be time-consuming and resource-intensive, potentially slowing down innovation and product launches in the oral care sector.

Another significant challenge lies in controlling the release rate of active ingredients when sodium alginate is used as a delivery system. While its gel-forming ability is advantageous for sustained release, fine-tuning the release profile to match specific oral care needs requires extensive research and formulation adjustments. This is particularly crucial for products aimed at prolonged fluoride retention or gradual antimicrobial agent release.

Compatibility with other oral care ingredients poses an additional hurdle. Sodium alginate's interactions with common components such as abrasives, surfactants, and preservatives can affect product stability and efficacy. Formulating a balanced composition that maintains the benefits of sodium alginate without compromising the function of other ingredients demands careful consideration and extensive testing.

The taste and mouthfeel of sodium alginate-containing products present another technical challenge. While the polymer can improve texture, its natural flavor may not be appealing to all consumers. Masking any undesirable taste without affecting the product's functionality or introducing additional complications to the formulation is a complex task that requires innovative flavor technologies.

Ensuring the long-term stability of sodium alginate in oral care products is also challenging. Factors such as temperature fluctuations, exposure to light, and microbial contamination can potentially degrade the polymer or alter its properties over time. Developing robust preservation systems and packaging solutions that maintain product integrity throughout its shelf life is crucial for commercial success.

Manufacturing processes present their own set of challenges. Incorporating sodium alginate into oral care formulations may require specialized equipment or modifications to existing production lines. Achieving uniform dispersion and hydration of the polymer during manufacturing, while avoiding the formation of lumps or inconsistencies, demands precise control over mixing conditions and ingredient addition sequences.

Lastly, regulatory compliance and safety assessments pose ongoing challenges. As sodium alginate finds new applications in oral care, demonstrating its safety and efficacy in various product formats to meet regulatory standards across different markets requires extensive clinical studies and documentation. This process can be time-consuming and resource-intensive, potentially slowing down innovation and product launches in the oral care sector.

Current Alginate Solutions

01 Use of sodium alginate in drug delivery systems

Sodium alginate is utilized in various drug delivery systems due to its biocompatibility and ability to form hydrogels. It can be used to encapsulate drugs, control release rates, and improve drug stability. This versatile polymer is particularly useful in developing oral, topical, and injectable formulations.- Use of sodium alginate in cosmetic formulations: Sodium alginate is widely used in cosmetic formulations due to its thickening, stabilizing, and film-forming properties. It can improve the texture and consistency of various cosmetic products, including creams, lotions, and gels. Sodium alginate also helps in moisture retention, making it beneficial for skincare products.

- Sodium alginate in drug delivery systems: Sodium alginate is utilized in pharmaceutical applications, particularly in drug delivery systems. It can form hydrogels that encapsulate drugs, allowing for controlled release. This property makes it useful in developing oral, topical, and injectable drug formulations with improved bioavailability and targeted delivery.

- Sodium alginate in wound healing applications: Sodium alginate is employed in wound dressings and healing applications due to its biocompatibility and ability to maintain a moist environment. It can absorb wound exudates and form a protective gel, promoting faster healing and reducing the risk of infection. These properties make it valuable in advanced wound care products.

- Use of sodium alginate in food industry: In the food industry, sodium alginate is used as a thickening agent, stabilizer, and emulsifier. It can improve the texture and stability of various food products, including ice cream, sauces, and beverages. Sodium alginate is also used in molecular gastronomy for creating unique food textures and presentations.

- Sodium alginate in 3D bioprinting and tissue engineering: Sodium alginate is utilized in 3D bioprinting and tissue engineering applications due to its biocompatibility and ability to form hydrogels. It can be used as a bioink for printing cell-laden structures, supporting cell growth and differentiation. This makes it valuable in creating artificial tissues and organs for regenerative medicine.

02 Sodium alginate in wound healing applications

Sodium alginate is employed in wound dressings and healing products due to its moisture-retaining properties and ability to create a protective barrier. It can absorb wound exudates, maintain a moist environment conducive to healing, and facilitate the removal of dressings without damaging newly formed tissue.Expand Specific Solutions03 Sodium alginate as a thickening and stabilizing agent

In food and cosmetic industries, sodium alginate serves as an effective thickening and stabilizing agent. It can improve texture, viscosity, and emulsion stability in various products such as sauces, creams, and lotions. Its ability to form gels in the presence of calcium ions is particularly useful in creating unique textures.Expand Specific Solutions04 Sodium alginate in 3D bioprinting and tissue engineering

Sodium alginate is utilized in 3D bioprinting and tissue engineering applications due to its biocompatibility and ability to form hydrogels. It can be used to create scaffolds for cell growth, encapsulate cells for transplantation, and develop complex tissue-like structures in regenerative medicine.Expand Specific Solutions05 Sodium alginate in environmental applications

Sodium alginate finds use in environmental applications such as water treatment and soil remediation. It can act as a flocculant to remove contaminants from water, serve as a carrier for beneficial microorganisms in bioremediation processes, and improve soil structure and water retention in agriculture.Expand Specific Solutions

Key Industry Players

The sodium alginate market in oral care products is in a growth phase, driven by increasing consumer demand for natural and sustainable ingredients. The market size is expanding, with major players like Colgate-Palmolive, Unilever, and Procter & Gamble incorporating sodium alginate into their product lines. Technologically, the field is advancing, with companies such as Henkel AG & Co. KGaA and LG H&H Co., Ltd. investing in research and development to enhance the efficacy and applications of sodium alginate in oral care. Regional players like Hindustan Unilever Ltd. and Guangzhou Saky Industrial Co., Ltd. are also contributing to market diversification and innovation, indicating a competitive and evolving landscape in this sector.

Colgate-Palmolive Co.

Technical Solution: Colgate-Palmolive has developed innovative oral care products utilizing sodium alginate's unique properties. Their technology incorporates sodium alginate into toothpaste formulations to create a protective biofilm on teeth and gums. This biofilm acts as a barrier against acid attacks and helps remineralize enamel[1]. The company has also explored using sodium alginate in mouthwashes to enhance the delivery of active ingredients and prolong their effects in the oral cavity[2]. Additionally, Colgate-Palmolive has patented a method of using sodium alginate in dental floss to improve plaque removal and deliver therapeutic agents[3].

Strengths: Extensive research and development capabilities, global market presence, and a strong patent portfolio. Weaknesses: Potential higher production costs and the need for consumer education on new technologies.

Unilever NV

Technical Solution: Unilever has developed a range of oral care products leveraging sodium alginate's properties. Their technology focuses on creating long-lasting protective coatings on teeth and gums using sodium alginate-based formulations. These coatings help prevent tooth sensitivity, reduce plaque formation, and promote remineralization[4]. Unilever has also incorporated sodium alginate into their mouthwash products to enhance the delivery of fluoride and other active ingredients, providing prolonged protection against cavities and gum diseases[5]. Furthermore, the company has explored using sodium alginate in combination with other natural polymers to create advanced oral care solutions with improved efficacy and sustainability profiles[6].

Strengths: Strong research capabilities, diverse product portfolio, and global distribution network. Weaknesses: Potential challenges in differentiating products in a competitive market and balancing natural ingredient trends with efficacy.

Alginate Innovations

Oral care product and methods of use and manufacture thereof

PatentWO2012023936A1

Innovation

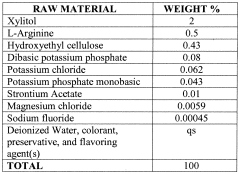

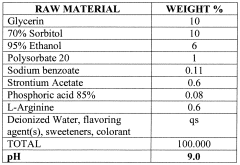

- An oral care composition comprising an effective amount of a basic amino acid, such as arginine, combined with a water-soluble strontium salt and a fluoride ion source, along with additional ingredients like potassium ions, abrasives, and surfactants, which helps in maintaining stability and enhancing delivery and effectiveness of the active agents.

Oral care product

PatentActiveUS12102701B2

Innovation

- Combining chlorhexidine with sodium DNA in oral care products, such as mouthwashes, gels, or toothpastes, to counteract the irritating effects of chlorhexidine, promote healing, and reduce oxidative stress, thereby minimizing side effects and enhancing mucosal trophism.

Regulatory Considerations

The regulatory landscape for sodium alginate in oral care products is complex and multifaceted, requiring careful consideration by manufacturers and product developers. In the United States, the Food and Drug Administration (FDA) classifies sodium alginate as Generally Recognized as Safe (GRAS) for use in food and cosmetic products. However, its use in oral care products falls under more stringent regulations, particularly when making specific health claims.

For oral care products containing sodium alginate, manufacturers must comply with the FDA's regulations for cosmetics or over-the-counter (OTC) drugs, depending on the product's intended use and marketing claims. If the product is marketed with therapeutic claims, such as preventing tooth decay or treating gingivitis, it may be classified as an OTC drug and subject to additional regulatory requirements, including pre-market approval and adherence to good manufacturing practices (GMPs).

In the European Union, sodium alginate is regulated under the Cosmetic Products Regulation (EC) No 1223/2009. This regulation sets safety standards, labeling requirements, and restrictions on certain ingredients used in cosmetic products, including oral care items. Manufacturers must ensure that their products comply with these regulations and undergo safety assessments before being placed on the market.

Globally, the use of sodium alginate in oral care products must also adhere to international standards set by organizations such as the International Organization for Standardization (ISO). These standards often focus on quality control, safety testing, and manufacturing processes to ensure consistency and safety across different markets.

Environmental regulations are increasingly relevant for sodium alginate-based products. As sustainability becomes a key concern, manufacturers must consider regulations related to biodegradability, packaging materials, and waste management. This includes compliance with local and international environmental protection laws and adherence to sustainable sourcing practices for alginate raw materials.

Labeling and marketing regulations are another critical aspect of regulatory compliance for oral care products containing sodium alginate. Manufacturers must ensure that product labels accurately reflect the ingredients, usage instructions, and any potential allergen warnings. Claims made about the product's efficacy or benefits must be substantiated by scientific evidence and comply with advertising standards set by regulatory bodies in different markets.

As the regulatory landscape continues to evolve, companies developing sodium alginate-based oral care products must stay informed about changes in regulations across different regions. This may involve ongoing monitoring of regulatory updates, participation in industry associations, and regular consultation with regulatory experts to ensure continued compliance and market access for their innovative products.

For oral care products containing sodium alginate, manufacturers must comply with the FDA's regulations for cosmetics or over-the-counter (OTC) drugs, depending on the product's intended use and marketing claims. If the product is marketed with therapeutic claims, such as preventing tooth decay or treating gingivitis, it may be classified as an OTC drug and subject to additional regulatory requirements, including pre-market approval and adherence to good manufacturing practices (GMPs).

In the European Union, sodium alginate is regulated under the Cosmetic Products Regulation (EC) No 1223/2009. This regulation sets safety standards, labeling requirements, and restrictions on certain ingredients used in cosmetic products, including oral care items. Manufacturers must ensure that their products comply with these regulations and undergo safety assessments before being placed on the market.

Globally, the use of sodium alginate in oral care products must also adhere to international standards set by organizations such as the International Organization for Standardization (ISO). These standards often focus on quality control, safety testing, and manufacturing processes to ensure consistency and safety across different markets.

Environmental regulations are increasingly relevant for sodium alginate-based products. As sustainability becomes a key concern, manufacturers must consider regulations related to biodegradability, packaging materials, and waste management. This includes compliance with local and international environmental protection laws and adherence to sustainable sourcing practices for alginate raw materials.

Labeling and marketing regulations are another critical aspect of regulatory compliance for oral care products containing sodium alginate. Manufacturers must ensure that product labels accurately reflect the ingredients, usage instructions, and any potential allergen warnings. Claims made about the product's efficacy or benefits must be substantiated by scientific evidence and comply with advertising standards set by regulatory bodies in different markets.

As the regulatory landscape continues to evolve, companies developing sodium alginate-based oral care products must stay informed about changes in regulations across different regions. This may involve ongoing monitoring of regulatory updates, participation in industry associations, and regular consultation with regulatory experts to ensure continued compliance and market access for their innovative products.

Sustainability Aspects

Sodium alginate, derived from brown seaweed, has emerged as a sustainable and eco-friendly ingredient in oral care products. Its use aligns with the growing consumer demand for environmentally responsible personal care items. The sustainability aspects of sodium alginate in oral care innovations are multifaceted and offer significant advantages over traditional synthetic alternatives.

One of the primary sustainability benefits of sodium alginate is its renewable sourcing. Brown seaweed, the raw material for sodium alginate, is a fast-growing marine resource that does not require freshwater, fertilizers, or arable land for cultivation. This characteristic reduces the environmental footprint associated with ingredient production and helps preserve terrestrial ecosystems.

The harvesting of seaweed for sodium alginate production can also contribute to marine ecosystem health. When done responsibly, seaweed farming can help mitigate ocean acidification by absorbing excess carbon dioxide from seawater. Additionally, seaweed cultivation can provide habitats for various marine species, promoting biodiversity in coastal areas.

In terms of product formulation, sodium alginate's versatility allows for the reduction or elimination of less sustainable ingredients in oral care products. Its natural thickening and stabilizing properties can replace synthetic additives, contributing to cleaner and more environmentally friendly product compositions. This shift towards natural ingredients resonates with eco-conscious consumers and supports the broader trend of green chemistry in personal care products.

The biodegradability of sodium alginate is another crucial sustainability aspect. Unlike many synthetic polymers used in oral care products, sodium alginate breaks down naturally in the environment without leaving harmful residues. This characteristic reduces the long-term environmental impact of oral care products, particularly in aquatic ecosystems where many personal care product residues eventually end up.

From a lifecycle perspective, the use of sodium alginate in oral care products can lead to reduced energy consumption and greenhouse gas emissions compared to the production of synthetic alternatives. The relatively simple extraction process of sodium alginate from seaweed requires less energy-intensive manufacturing steps, contributing to a lower carbon footprint for the final products.

Furthermore, the potential for local sourcing of sodium alginate, especially in coastal regions, can shorten supply chains and reduce transportation-related emissions. This localization of ingredient production aligns with sustainability goals and can also support local economies in seaweed-producing regions.

As the oral care industry continues to innovate, the sustainability aspects of sodium alginate position it as a key ingredient for future product development. Its natural origin, renewable sourcing, biodegradability, and potential for positive environmental impact make it an attractive option for companies looking to enhance their sustainability credentials while meeting consumer demands for effective and eco-friendly oral care solutions.

One of the primary sustainability benefits of sodium alginate is its renewable sourcing. Brown seaweed, the raw material for sodium alginate, is a fast-growing marine resource that does not require freshwater, fertilizers, or arable land for cultivation. This characteristic reduces the environmental footprint associated with ingredient production and helps preserve terrestrial ecosystems.

The harvesting of seaweed for sodium alginate production can also contribute to marine ecosystem health. When done responsibly, seaweed farming can help mitigate ocean acidification by absorbing excess carbon dioxide from seawater. Additionally, seaweed cultivation can provide habitats for various marine species, promoting biodiversity in coastal areas.

In terms of product formulation, sodium alginate's versatility allows for the reduction or elimination of less sustainable ingredients in oral care products. Its natural thickening and stabilizing properties can replace synthetic additives, contributing to cleaner and more environmentally friendly product compositions. This shift towards natural ingredients resonates with eco-conscious consumers and supports the broader trend of green chemistry in personal care products.

The biodegradability of sodium alginate is another crucial sustainability aspect. Unlike many synthetic polymers used in oral care products, sodium alginate breaks down naturally in the environment without leaving harmful residues. This characteristic reduces the long-term environmental impact of oral care products, particularly in aquatic ecosystems where many personal care product residues eventually end up.

From a lifecycle perspective, the use of sodium alginate in oral care products can lead to reduced energy consumption and greenhouse gas emissions compared to the production of synthetic alternatives. The relatively simple extraction process of sodium alginate from seaweed requires less energy-intensive manufacturing steps, contributing to a lower carbon footprint for the final products.

Furthermore, the potential for local sourcing of sodium alginate, especially in coastal regions, can shorten supply chains and reduce transportation-related emissions. This localization of ingredient production aligns with sustainability goals and can also support local economies in seaweed-producing regions.

As the oral care industry continues to innovate, the sustainability aspects of sodium alginate position it as a key ingredient for future product development. Its natural origin, renewable sourcing, biodegradability, and potential for positive environmental impact make it an attractive option for companies looking to enhance their sustainability credentials while meeting consumer demands for effective and eco-friendly oral care solutions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!