Sodium Alginate: Revolutionizing Food Industry Stabilizers

JUL 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Sodium Alginate Evolution

Sodium alginate has undergone a remarkable evolution since its discovery in the late 19th century. Initially identified as a component of brown algae, it took several decades before its potential as a food industry stabilizer was fully recognized. The journey of sodium alginate from a seaweed extract to a revolutionary food additive is marked by significant milestones and technological advancements.

In the early 20th century, researchers began to explore the unique properties of sodium alginate, particularly its ability to form gels in the presence of calcium ions. This discovery laid the foundation for its use in various industries, including food processing. The 1930s saw the first commercial production of sodium alginate, primarily for textile printing applications.

The food industry's interest in sodium alginate intensified during the 1950s and 1960s. As food processing techniques became more sophisticated, manufacturers sought new ways to improve texture, stability, and shelf life of their products. Sodium alginate's versatility as a thickener, stabilizer, and emulsifier made it an ideal candidate for these purposes.

The 1970s marked a turning point in sodium alginate's evolution. Advances in extraction and purification techniques led to higher quality and more consistent products. This period also saw the development of new applications, such as the use of sodium alginate in restructured foods and as an encapsulation agent for flavors and nutrients.

In the 1980s and 1990s, the focus shifted towards understanding the molecular structure and behavior of sodium alginate in different food systems. This knowledge enabled food scientists to fine-tune its functionality for specific applications, leading to improved product quality and expanded use across various food categories.

The 21st century has brought about further innovations in sodium alginate technology. The advent of nanotechnology has opened up new possibilities for creating novel food textures and delivery systems. Additionally, the growing demand for clean label and natural ingredients has spurred research into optimizing alginate extraction processes and exploring new algal sources.

Recent years have seen an increased interest in sodium alginate's potential beyond traditional food applications. Its use in 3D food printing, edible packaging, and as a fat replacer in low-calorie foods demonstrates its continued evolution and adaptability to changing consumer preferences and technological advancements.

As we look to the future, the evolution of sodium alginate in the food industry shows no signs of slowing down. Ongoing research into its bioactive properties, sustainability, and synergistic effects with other ingredients promises to unlock new applications and further cement its status as a revolutionary food industry stabilizer.

In the early 20th century, researchers began to explore the unique properties of sodium alginate, particularly its ability to form gels in the presence of calcium ions. This discovery laid the foundation for its use in various industries, including food processing. The 1930s saw the first commercial production of sodium alginate, primarily for textile printing applications.

The food industry's interest in sodium alginate intensified during the 1950s and 1960s. As food processing techniques became more sophisticated, manufacturers sought new ways to improve texture, stability, and shelf life of their products. Sodium alginate's versatility as a thickener, stabilizer, and emulsifier made it an ideal candidate for these purposes.

The 1970s marked a turning point in sodium alginate's evolution. Advances in extraction and purification techniques led to higher quality and more consistent products. This period also saw the development of new applications, such as the use of sodium alginate in restructured foods and as an encapsulation agent for flavors and nutrients.

In the 1980s and 1990s, the focus shifted towards understanding the molecular structure and behavior of sodium alginate in different food systems. This knowledge enabled food scientists to fine-tune its functionality for specific applications, leading to improved product quality and expanded use across various food categories.

The 21st century has brought about further innovations in sodium alginate technology. The advent of nanotechnology has opened up new possibilities for creating novel food textures and delivery systems. Additionally, the growing demand for clean label and natural ingredients has spurred research into optimizing alginate extraction processes and exploring new algal sources.

Recent years have seen an increased interest in sodium alginate's potential beyond traditional food applications. Its use in 3D food printing, edible packaging, and as a fat replacer in low-calorie foods demonstrates its continued evolution and adaptability to changing consumer preferences and technological advancements.

As we look to the future, the evolution of sodium alginate in the food industry shows no signs of slowing down. Ongoing research into its bioactive properties, sustainability, and synergistic effects with other ingredients promises to unlock new applications and further cement its status as a revolutionary food industry stabilizer.

Food Stabilizer Market

The food stabilizer market has experienced significant growth in recent years, driven by the increasing demand for processed and convenience foods. This market segment is characterized by a diverse range of products, including emulsifiers, thickeners, gelling agents, and texturizers, with sodium alginate emerging as a key player in revolutionizing the industry.

The global food stabilizer market size was valued at several billion dollars in recent years, with projections indicating continued growth at a steady compound annual growth rate (CAGR) over the next decade. This growth is attributed to factors such as changing consumer lifestyles, rising disposable incomes, and the expanding food and beverage industry.

Geographically, North America and Europe have traditionally dominated the food stabilizer market, owing to their well-established food processing industries and consumer preferences for convenience foods. However, the Asia-Pacific region is emerging as a lucrative market, driven by rapid urbanization, changing dietary habits, and increasing awareness of food quality and safety.

The market is segmented based on source, with natural stabilizers gaining traction due to the growing consumer preference for clean-label products. Plant-based stabilizers, including sodium alginate derived from seaweed, are witnessing increased adoption across various food applications. This trend aligns with the rising demand for vegan and vegetarian food options.

In terms of application, the bakery and confectionery segment holds a significant market share, followed by dairy and frozen products, beverages, and convenience foods. Sodium alginate, in particular, has found extensive use in these segments due to its versatile stabilizing properties and ability to improve texture and mouthfeel.

The competitive landscape of the food stabilizer market is characterized by the presence of both multinational corporations and regional players. Key market players are focusing on product innovation, strategic partnerships, and mergers and acquisitions to strengthen their market position. The introduction of novel stabilizer blends and customized solutions tailored to specific food applications is a notable trend in the industry.

Regulatory factors play a crucial role in shaping the food stabilizer market. Stringent food safety regulations and increasing scrutiny of food additives have led to a growing emphasis on natural and clean-label stabilizers. This regulatory environment has further propelled the adoption of sodium alginate and other naturally derived stabilizers in food formulations.

The global food stabilizer market size was valued at several billion dollars in recent years, with projections indicating continued growth at a steady compound annual growth rate (CAGR) over the next decade. This growth is attributed to factors such as changing consumer lifestyles, rising disposable incomes, and the expanding food and beverage industry.

Geographically, North America and Europe have traditionally dominated the food stabilizer market, owing to their well-established food processing industries and consumer preferences for convenience foods. However, the Asia-Pacific region is emerging as a lucrative market, driven by rapid urbanization, changing dietary habits, and increasing awareness of food quality and safety.

The market is segmented based on source, with natural stabilizers gaining traction due to the growing consumer preference for clean-label products. Plant-based stabilizers, including sodium alginate derived from seaweed, are witnessing increased adoption across various food applications. This trend aligns with the rising demand for vegan and vegetarian food options.

In terms of application, the bakery and confectionery segment holds a significant market share, followed by dairy and frozen products, beverages, and convenience foods. Sodium alginate, in particular, has found extensive use in these segments due to its versatile stabilizing properties and ability to improve texture and mouthfeel.

The competitive landscape of the food stabilizer market is characterized by the presence of both multinational corporations and regional players. Key market players are focusing on product innovation, strategic partnerships, and mergers and acquisitions to strengthen their market position. The introduction of novel stabilizer blends and customized solutions tailored to specific food applications is a notable trend in the industry.

Regulatory factors play a crucial role in shaping the food stabilizer market. Stringent food safety regulations and increasing scrutiny of food additives have led to a growing emphasis on natural and clean-label stabilizers. This regulatory environment has further propelled the adoption of sodium alginate and other naturally derived stabilizers in food formulations.

Technical Challenges

Despite the widespread use of sodium alginate in the food industry, several technical challenges persist in its application as a stabilizer. One of the primary issues is the sensitivity of sodium alginate to pH levels. In acidic environments, the stability of alginate gels can be compromised, leading to reduced effectiveness in food products with low pH values. This limitation restricts its use in certain acidic food applications and necessitates careful formulation to maintain desired stability.

Another significant challenge is the variability in the quality and composition of sodium alginate derived from different seaweed sources. The molecular weight distribution and ratio of mannuronic to guluronic acid residues can vary considerably, affecting the gelling properties and overall performance of the stabilizer. This inconsistency makes it difficult for food manufacturers to maintain uniform product quality across batches and requires extensive quality control measures.

The interaction of sodium alginate with other food components, particularly proteins and calcium ions, presents additional complexities. While these interactions can be beneficial in some applications, they can also lead to undesired texture changes or reduced functionality in others. Balancing these interactions to achieve optimal stabilization without compromising other product attributes remains a technical hurdle for food scientists and formulators.

Temperature sensitivity is another challenge in the use of sodium alginate. High-temperature processing can degrade the polymer structure, potentially reducing its stabilizing efficacy. Conversely, low temperatures can affect the solubility and hydration of sodium alginate, impacting its performance in cold-processed foods. Developing temperature-resistant formulations or processing techniques that preserve the functional properties of sodium alginate across a wide temperature range is an ongoing area of research.

The control of gelation kinetics poses yet another technical challenge. Rapid gelation can lead to inhomogeneous gel structures, while slow gelation may not provide the desired stabilizing effect in time-sensitive food processing operations. Fine-tuning the gelation rate to match specific product requirements and processing conditions requires sophisticated formulation strategies and precise control over environmental factors.

Lastly, the clean label trend in the food industry has put pressure on manufacturers to find natural alternatives to synthetic stabilizers. While sodium alginate is derived from natural sources, its extraction and processing methods may not always align with consumer perceptions of "clean label" ingredients. Developing more sustainable and environmentally friendly extraction methods, as well as improving the transparency of the production process, are ongoing challenges in meeting consumer demands for natural stabilizers.

Another significant challenge is the variability in the quality and composition of sodium alginate derived from different seaweed sources. The molecular weight distribution and ratio of mannuronic to guluronic acid residues can vary considerably, affecting the gelling properties and overall performance of the stabilizer. This inconsistency makes it difficult for food manufacturers to maintain uniform product quality across batches and requires extensive quality control measures.

The interaction of sodium alginate with other food components, particularly proteins and calcium ions, presents additional complexities. While these interactions can be beneficial in some applications, they can also lead to undesired texture changes or reduced functionality in others. Balancing these interactions to achieve optimal stabilization without compromising other product attributes remains a technical hurdle for food scientists and formulators.

Temperature sensitivity is another challenge in the use of sodium alginate. High-temperature processing can degrade the polymer structure, potentially reducing its stabilizing efficacy. Conversely, low temperatures can affect the solubility and hydration of sodium alginate, impacting its performance in cold-processed foods. Developing temperature-resistant formulations or processing techniques that preserve the functional properties of sodium alginate across a wide temperature range is an ongoing area of research.

The control of gelation kinetics poses yet another technical challenge. Rapid gelation can lead to inhomogeneous gel structures, while slow gelation may not provide the desired stabilizing effect in time-sensitive food processing operations. Fine-tuning the gelation rate to match specific product requirements and processing conditions requires sophisticated formulation strategies and precise control over environmental factors.

Lastly, the clean label trend in the food industry has put pressure on manufacturers to find natural alternatives to synthetic stabilizers. While sodium alginate is derived from natural sources, its extraction and processing methods may not always align with consumer perceptions of "clean label" ingredients. Developing more sustainable and environmentally friendly extraction methods, as well as improving the transparency of the production process, are ongoing challenges in meeting consumer demands for natural stabilizers.

Current Applications

01 Sodium alginate as a stabilizer in food products

Sodium alginate is widely used as a stabilizer in various food products due to its ability to form gels and increase viscosity. It helps maintain the texture and consistency of foods, particularly in dairy products, sauces, and beverages. The stabilizing effect of sodium alginate can be enhanced by combining it with other hydrocolloids or adjusting processing conditions.- Stabilization of sodium alginate in food products: Sodium alginate is used as a stabilizer in various food products. It helps improve texture, consistency, and shelf life of foods such as dairy products, sauces, and beverages. The stabilization process often involves combining sodium alginate with other ingredients to create a stable gel or emulsion.

- Pharmaceutical applications of stabilized sodium alginate: Stabilized sodium alginate formulations are utilized in pharmaceutical applications. These formulations can be used for drug delivery systems, wound dressings, and as excipients in various dosage forms. The stabilization techniques aim to enhance the properties of sodium alginate for improved efficacy and stability in medical products.

- Sodium alginate stabilization in cosmetic products: Sodium alginate is employed as a stabilizer in cosmetic formulations. It helps improve the texture, viscosity, and stability of various cosmetic products such as creams, lotions, and gels. Stabilization techniques may involve combining sodium alginate with other ingredients to create stable emulsions or gels with desired properties.

- Industrial applications of stabilized sodium alginate: Stabilized sodium alginate finds applications in various industrial processes. It is used in textile printing, paper coating, and as a thickening agent in paints and adhesives. The stabilization techniques aim to enhance the performance and durability of sodium alginate in these industrial applications.

- Novel methods for sodium alginate stabilization: Researchers are developing new methods to stabilize sodium alginate for various applications. These methods may include chemical modifications, crosslinking techniques, or the use of novel additives to enhance the stability and functionality of sodium alginate. The goal is to improve its performance in existing applications and expand its use in new fields.

02 Sodium alginate in pharmaceutical formulations

In pharmaceutical applications, sodium alginate is utilized as a stabilizer for drug delivery systems and controlled release formulations. It can form protective coatings around active ingredients, improve drug solubility, and enhance the stability of suspensions and emulsions. The use of sodium alginate in pharmaceutical formulations can lead to improved bioavailability and extended shelf life of medications.Expand Specific Solutions03 Sodium alginate in cosmetic and personal care products

Sodium alginate serves as a stabilizer in various cosmetic and personal care formulations. It helps improve the texture, consistency, and stability of creams, lotions, and gels. In hair care products, sodium alginate can enhance the conditioning properties and provide a smooth feel. Its film-forming abilities make it useful in sunscreen formulations and other protective skincare products.Expand Specific Solutions04 Sodium alginate in industrial applications

In industrial settings, sodium alginate is used as a stabilizer for various processes and products. It can be employed in textile printing to improve color fastness and prevent dye migration. In paper manufacturing, sodium alginate helps stabilize coatings and improve paper quality. It is also used in the production of ceramics, where it acts as a binder and helps control rheological properties.Expand Specific Solutions05 Modification and optimization of sodium alginate stabilization

Research focuses on modifying and optimizing sodium alginate to enhance its stabilizing properties. This includes chemical modifications, blending with other polymers, and adjusting processing parameters. Cross-linking techniques are explored to improve gel strength and stability. Additionally, the use of nanoparticles or encapsulation methods in conjunction with sodium alginate is investigated to create advanced stabilization systems for various applications.Expand Specific Solutions

Key Industry Players

The sodium alginate market is experiencing significant growth, driven by increasing demand in the food industry for stabilizers and thickeners. The market is in a mature stage but continues to expand due to innovative applications. Key players like Fonterra, PepsiCo, and Shandong Jiejing Group are investing in R&D to enhance product quality and diversify applications. The technology's maturity is evident in its widespread use, but companies like BASF and Clariant are exploring new formulations to improve functionality. With a growing focus on natural ingredients, sodium alginate's plant-based origin positions it favorably for future market expansion.

Fonterra Co-operative Group Ltd.

Technical Solution: Fonterra Co-operative Group Ltd. has developed specialized sodium alginate solutions for dairy applications. Their technology focuses on enhancing the stability and texture of dairy products, particularly in low-fat and plant-based alternatives. Fonterra's research has resulted in sodium alginate formulations that improve the mouthfeel and creaminess of reduced-fat dairy products, mimicking the sensory properties of full-fat versions[9]. The company has also explored the use of sodium alginate in creating stable emulsions for dairy-based beverages and improving the freeze-thaw stability of frozen dairy desserts. Fonterra's sodium alginate applications extend to the development of novel dairy-based textures and structures, such as cheese analogues and yogurt alternatives[10].

Strengths: Specialized expertise in dairy applications, strong research and development capabilities, and global market presence. Weaknesses: Limited focus on non-dairy applications and potential challenges in adapting to rapidly changing consumer preferences in the dairy alternative market.

PepsiCo, Inc.

Technical Solution: PepsiCo, Inc. has developed proprietary sodium alginate-based stabilizer systems for its beverage and snack products. Their technology focuses on creating clean-label solutions that meet consumer demands for natural ingredients. PepsiCo's research has resulted in sodium alginate formulations that provide improved mouthfeel and texture in low-calorie beverages without compromising taste[7]. The company has also explored the use of sodium alginate in creating innovative textures for snack foods, such as fruit-based gummies with unique sensory properties. PepsiCo's sodium alginate applications extend to encapsulation technologies for flavor delivery and nutrient protection in fortified products[8].

Strengths: Extensive application knowledge in beverages and snacks, consumer insights-driven innovation, and large-scale implementation capabilities. Weaknesses: Limited focus on sodium alginate as a standalone product and potential dependency on external suppliers.

Innovative Formulations

Manufacturing method of food additive composition and food composition containing the same

PatentInactiveUS6808726B2

Innovation

- A manufacturing method involving a food additive composition comprising a polyvalent metal, phosphoric acid ion, organic acid with a carboxyl group, and alkali metal, prepared by specific mixing and addition sequences, followed by grinding and drying, to achieve superior dispersibility and stability.

Extrusion of agro-food industry byproducts and protein concentrates into value-added foods

PatentActiveUS12201136B2

Innovation

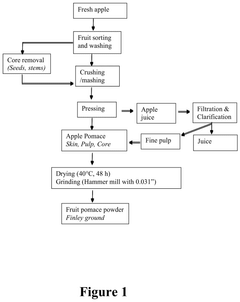

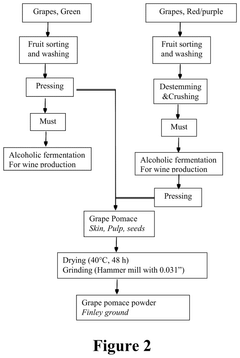

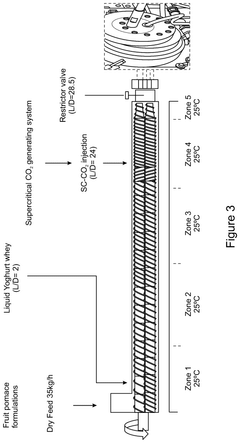

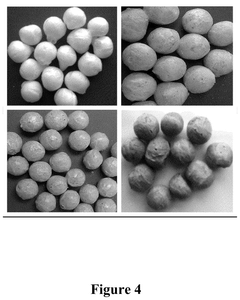

- The use of low-shear, low-temperature supercritical fluid extrusion (SCFX) processes to convert food industry byproducts, such as fruit pomace and whey, into edible, shelf-stable food products that are enriched in dietary fiber and phytochemicals, while preserving the natural color and bioactive compounds.

Regulatory Framework

The regulatory framework surrounding sodium alginate as a food industry stabilizer is complex and multifaceted, reflecting its widespread use and importance in food production. In the United States, the Food and Drug Administration (FDA) classifies sodium alginate as Generally Recognized as Safe (GRAS), allowing its use in various food applications. The FDA has established specific guidelines for its use, including maximum allowable levels in different food categories and labeling requirements.

In the European Union, sodium alginate is regulated under the E-number system as E401. The European Food Safety Authority (EFSA) has conducted extensive safety assessments and established Acceptable Daily Intake (ADI) levels for sodium alginate. The EU regulations also specify the types of foods in which sodium alginate can be used and the maximum permitted levels.

Globally, the Joint FAO/WHO Expert Committee on Food Additives (JECFA) has evaluated sodium alginate and provided recommendations for its safe use in food products. These recommendations serve as a reference for many countries developing their own regulatory frameworks.

In Japan, sodium alginate is approved as a food additive by the Ministry of Health, Labour and Welfare, with specific regulations governing its use in various food categories. Similarly, China's National Health Commission has established standards for sodium alginate use in food products, including maximum levels and labeling requirements.

Regulatory bodies worldwide are continuously monitoring and updating their guidelines based on new scientific evidence and technological advancements. This dynamic regulatory environment necessitates ongoing compliance efforts from food manufacturers using sodium alginate.

The regulatory framework also extends to the sourcing and production of sodium alginate. Many countries have implemented regulations to ensure sustainable harvesting of seaweed, the primary source of alginate. These regulations aim to protect marine ecosystems while ensuring a stable supply for the food industry.

As consumer demand for clean label and natural ingredients grows, some regulatory bodies are considering revisions to their frameworks. This may include more stringent requirements for labeling sodium alginate as a natural ingredient or potential restrictions on its use in certain product categories.

Manufacturers must navigate these diverse regulatory landscapes when developing and marketing products containing sodium alginate. Compliance with local, regional, and international regulations is crucial for market access and consumer trust. As such, staying informed about regulatory changes and proactively adapting to new requirements is essential for companies operating in this space.

In the European Union, sodium alginate is regulated under the E-number system as E401. The European Food Safety Authority (EFSA) has conducted extensive safety assessments and established Acceptable Daily Intake (ADI) levels for sodium alginate. The EU regulations also specify the types of foods in which sodium alginate can be used and the maximum permitted levels.

Globally, the Joint FAO/WHO Expert Committee on Food Additives (JECFA) has evaluated sodium alginate and provided recommendations for its safe use in food products. These recommendations serve as a reference for many countries developing their own regulatory frameworks.

In Japan, sodium alginate is approved as a food additive by the Ministry of Health, Labour and Welfare, with specific regulations governing its use in various food categories. Similarly, China's National Health Commission has established standards for sodium alginate use in food products, including maximum levels and labeling requirements.

Regulatory bodies worldwide are continuously monitoring and updating their guidelines based on new scientific evidence and technological advancements. This dynamic regulatory environment necessitates ongoing compliance efforts from food manufacturers using sodium alginate.

The regulatory framework also extends to the sourcing and production of sodium alginate. Many countries have implemented regulations to ensure sustainable harvesting of seaweed, the primary source of alginate. These regulations aim to protect marine ecosystems while ensuring a stable supply for the food industry.

As consumer demand for clean label and natural ingredients grows, some regulatory bodies are considering revisions to their frameworks. This may include more stringent requirements for labeling sodium alginate as a natural ingredient or potential restrictions on its use in certain product categories.

Manufacturers must navigate these diverse regulatory landscapes when developing and marketing products containing sodium alginate. Compliance with local, regional, and international regulations is crucial for market access and consumer trust. As such, staying informed about regulatory changes and proactively adapting to new requirements is essential for companies operating in this space.

Sustainability Aspects

Sodium alginate, derived from brown seaweed, has emerged as a sustainable alternative to traditional stabilizers in the food industry. Its eco-friendly nature aligns with the growing consumer demand for environmentally responsible products. The production of sodium alginate involves minimal environmental impact compared to synthetic stabilizers, as it utilizes renewable marine resources.

The harvesting of seaweed for sodium alginate production can be managed sustainably, promoting the conservation of marine ecosystems. Responsible harvesting practices ensure the regeneration of seaweed beds, maintaining biodiversity and protecting coastal habitats. Furthermore, seaweed cultivation for alginate extraction can contribute to carbon sequestration, potentially mitigating climate change effects.

Sodium alginate's biodegradability is a significant advantage in terms of sustainability. Unlike many synthetic stabilizers, it naturally decomposes without leaving harmful residues in the environment. This characteristic reduces the burden on waste management systems and minimizes the risk of long-term environmental contamination.

The use of sodium alginate in food products can lead to extended shelf life, thereby reducing food waste. This aspect is crucial in addressing global sustainability challenges, as food waste contributes significantly to greenhouse gas emissions and resource depletion. By improving food preservation, sodium alginate indirectly supports more sustainable food consumption patterns.

From a manufacturing perspective, the production of sodium alginate generally requires less energy and fewer chemical inputs compared to synthetic alternatives. This translates to a lower carbon footprint and reduced environmental impact throughout the product lifecycle. Additionally, the versatility of sodium alginate allows for its use across various food applications, potentially simplifying supply chains and reducing the need for multiple stabilizer types.

The adoption of sodium alginate aligns with circular economy principles. The seaweed industry, which supplies the raw material for alginate production, can integrate with other sectors, such as agriculture, where seaweed byproducts can be used as fertilizers or animal feed. This integration promotes resource efficiency and waste reduction across industries.

As regulations around environmental protection and sustainability become more stringent, the use of natural, renewable ingredients like sodium alginate positions food manufacturers favorably. It demonstrates a commitment to sustainable practices, potentially enhancing brand reputation and meeting evolving consumer expectations for environmentally responsible products.

The harvesting of seaweed for sodium alginate production can be managed sustainably, promoting the conservation of marine ecosystems. Responsible harvesting practices ensure the regeneration of seaweed beds, maintaining biodiversity and protecting coastal habitats. Furthermore, seaweed cultivation for alginate extraction can contribute to carbon sequestration, potentially mitigating climate change effects.

Sodium alginate's biodegradability is a significant advantage in terms of sustainability. Unlike many synthetic stabilizers, it naturally decomposes without leaving harmful residues in the environment. This characteristic reduces the burden on waste management systems and minimizes the risk of long-term environmental contamination.

The use of sodium alginate in food products can lead to extended shelf life, thereby reducing food waste. This aspect is crucial in addressing global sustainability challenges, as food waste contributes significantly to greenhouse gas emissions and resource depletion. By improving food preservation, sodium alginate indirectly supports more sustainable food consumption patterns.

From a manufacturing perspective, the production of sodium alginate generally requires less energy and fewer chemical inputs compared to synthetic alternatives. This translates to a lower carbon footprint and reduced environmental impact throughout the product lifecycle. Additionally, the versatility of sodium alginate allows for its use across various food applications, potentially simplifying supply chains and reducing the need for multiple stabilizer types.

The adoption of sodium alginate aligns with circular economy principles. The seaweed industry, which supplies the raw material for alginate production, can integrate with other sectors, such as agriculture, where seaweed byproducts can be used as fertilizers or animal feed. This integration promotes resource efficiency and waste reduction across industries.

As regulations around environmental protection and sustainability become more stringent, the use of natural, renewable ingredients like sodium alginate positions food manufacturers favorably. It demonstrates a commitment to sustainable practices, potentially enhancing brand reputation and meeting evolving consumer expectations for environmentally responsible products.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!