What Are the Supply Chain Challenges for Neuromorphic Chips?

OCT 9, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Neuromorphic Chip Evolution and Objectives

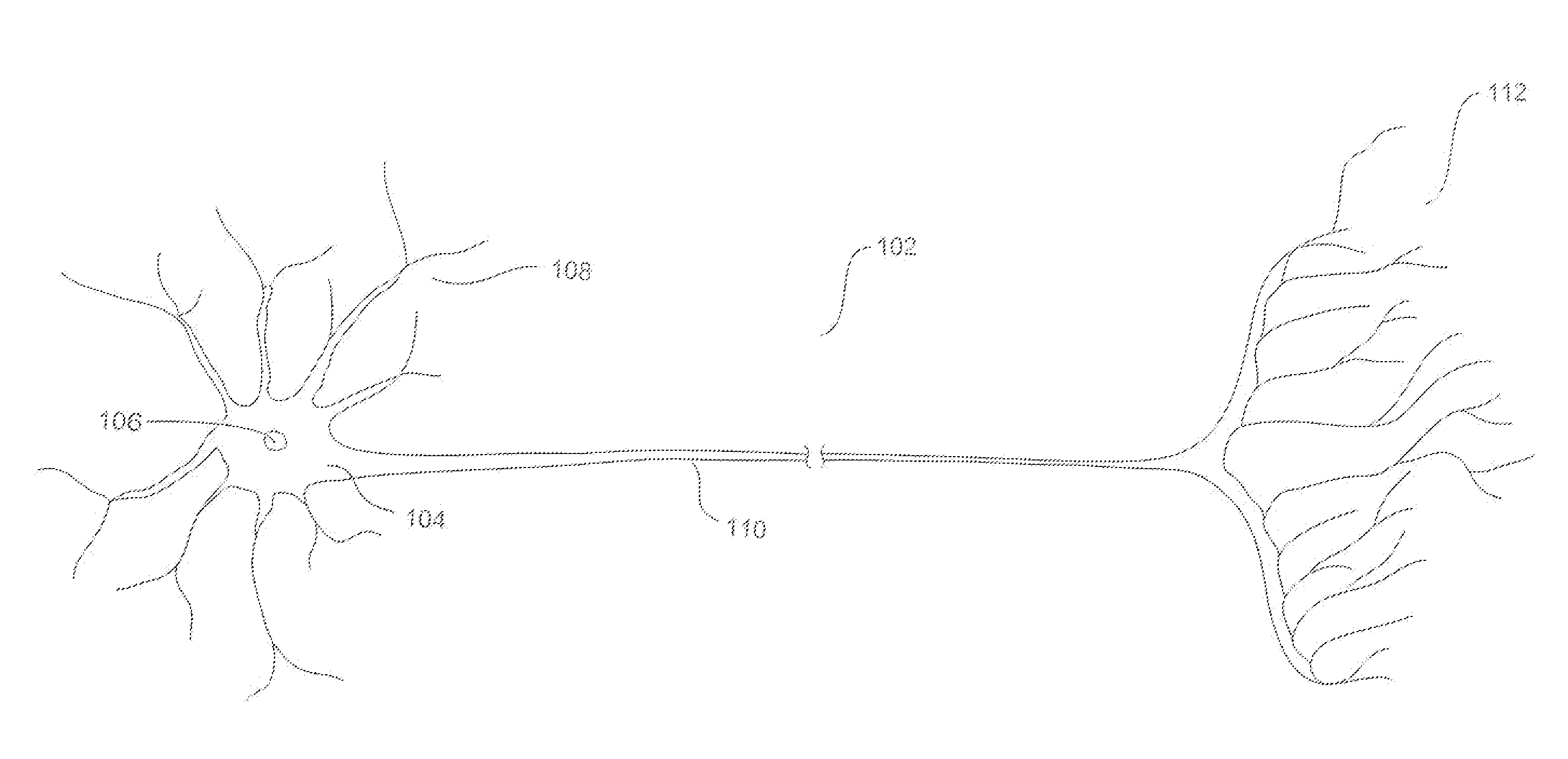

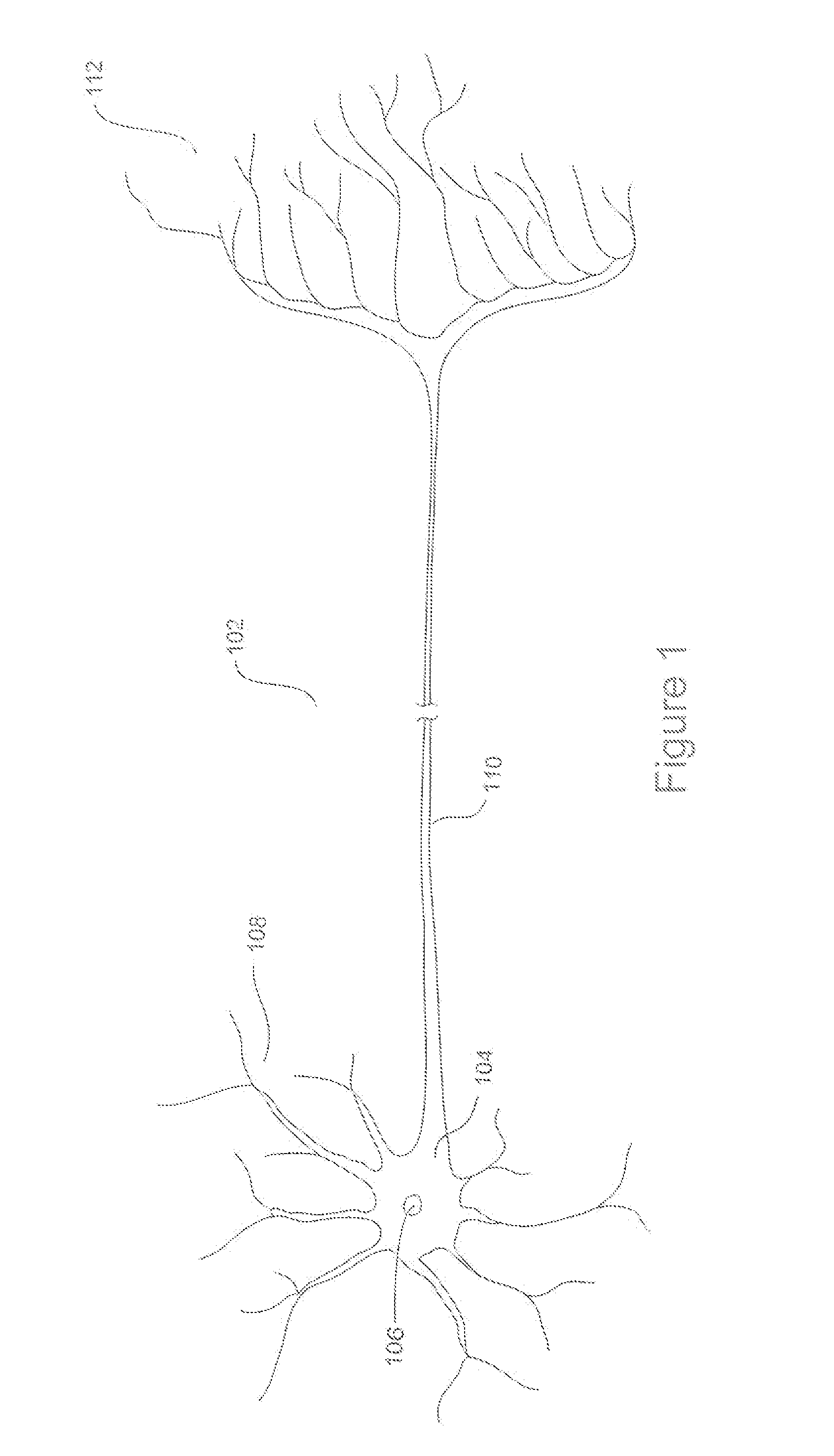

Neuromorphic computing represents a paradigm shift in computational architecture, drawing inspiration from the human brain's neural networks to create more efficient and powerful computing systems. The evolution of neuromorphic chips began in the late 1980s with Carver Mead's pioneering work at Caltech, introducing the concept of using analog circuits to mimic neural functions. This marked the first significant departure from traditional von Neumann architecture toward brain-inspired computing.

The 1990s witnessed limited progress due to manufacturing constraints and insufficient understanding of neural mechanisms. However, the 2000s brought renewed interest as conventional computing faced scaling challenges and power consumption issues. By 2010, major research institutions and technology companies began investing substantially in neuromorphic research, leading to breakthrough projects like IBM's TrueNorth and Intel's Loihi.

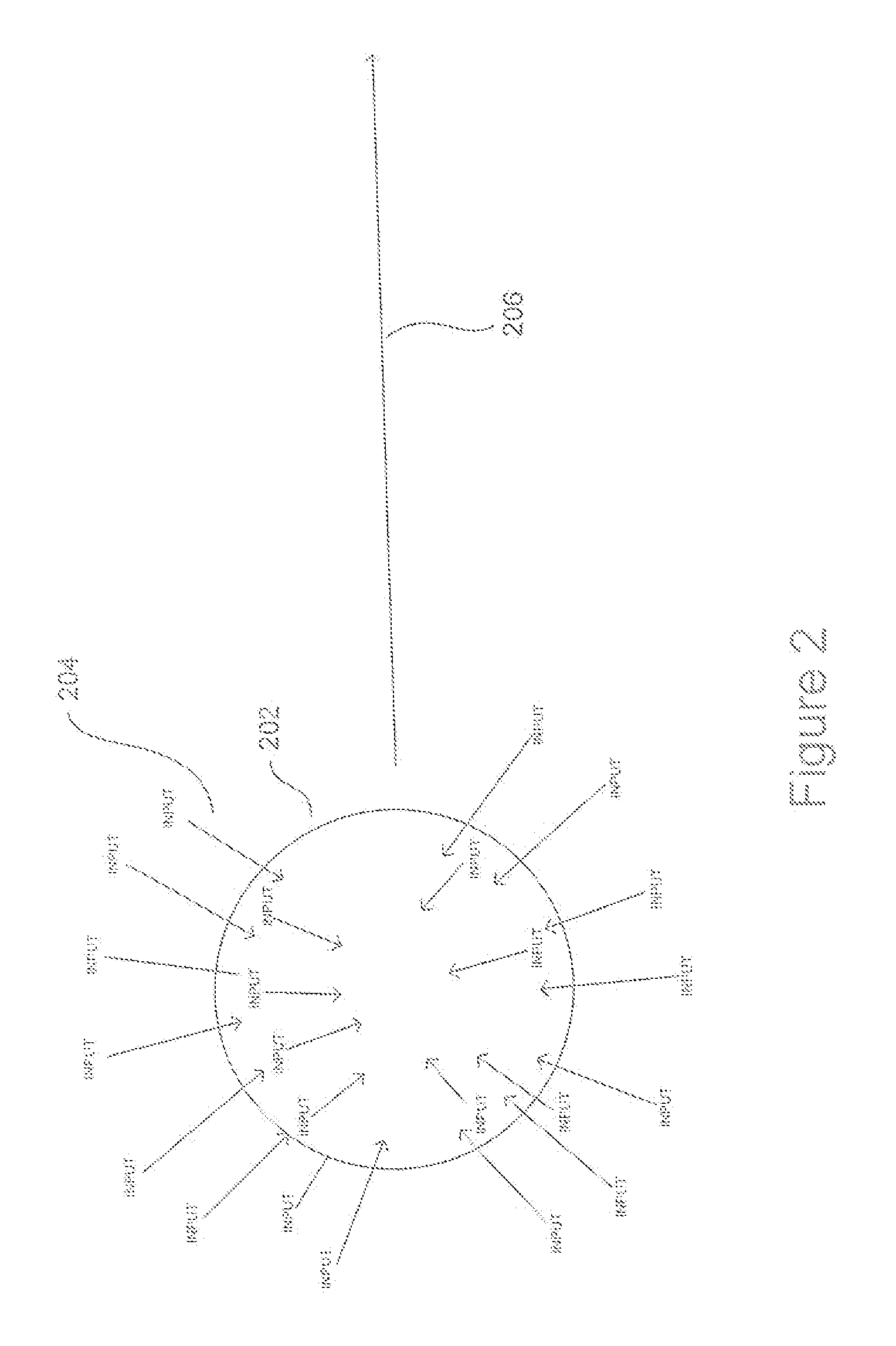

Today's neuromorphic chips aim to address fundamental limitations in traditional computing architectures, particularly for AI applications. While conventional processors separate memory and processing units, neuromorphic designs integrate these functions, significantly reducing energy consumption and latency for neural network operations. This approach offers particular advantages for edge computing applications where power efficiency is critical.

The primary technical objectives of neuromorphic chip development include achieving orders-of-magnitude improvements in energy efficiency compared to conventional processors for neural network tasks. Current targets aim for 1000x better energy efficiency while maintaining competitive performance. Additionally, researchers seek to enable real-time processing of sensory data with minimal latency, crucial for applications like autonomous vehicles and advanced robotics.

Another key objective involves developing scalable architectures that can efficiently handle increasingly complex neural networks while maintaining power efficiency advantages. This includes creating flexible designs that support various neural network models and learning paradigms beyond today's predominant approaches.

Supply chain considerations have become increasingly critical in neuromorphic chip evolution. Unlike traditional semiconductor manufacturing, neuromorphic chips often require specialized materials, novel fabrication techniques, and unique testing methodologies. The industry faces challenges in establishing reliable supply chains for these specialized components, particularly as research transitions toward commercial deployment.

Looking forward, neuromorphic computing aims to enable entirely new applications impossible with conventional computing, including ultra-low-power AI at the edge, brain-computer interfaces, and advanced sensory processing systems that mimic biological capabilities. The field's evolution continues to accelerate as researchers overcome manufacturing challenges and develop more sophisticated neural models.

The 1990s witnessed limited progress due to manufacturing constraints and insufficient understanding of neural mechanisms. However, the 2000s brought renewed interest as conventional computing faced scaling challenges and power consumption issues. By 2010, major research institutions and technology companies began investing substantially in neuromorphic research, leading to breakthrough projects like IBM's TrueNorth and Intel's Loihi.

Today's neuromorphic chips aim to address fundamental limitations in traditional computing architectures, particularly for AI applications. While conventional processors separate memory and processing units, neuromorphic designs integrate these functions, significantly reducing energy consumption and latency for neural network operations. This approach offers particular advantages for edge computing applications where power efficiency is critical.

The primary technical objectives of neuromorphic chip development include achieving orders-of-magnitude improvements in energy efficiency compared to conventional processors for neural network tasks. Current targets aim for 1000x better energy efficiency while maintaining competitive performance. Additionally, researchers seek to enable real-time processing of sensory data with minimal latency, crucial for applications like autonomous vehicles and advanced robotics.

Another key objective involves developing scalable architectures that can efficiently handle increasingly complex neural networks while maintaining power efficiency advantages. This includes creating flexible designs that support various neural network models and learning paradigms beyond today's predominant approaches.

Supply chain considerations have become increasingly critical in neuromorphic chip evolution. Unlike traditional semiconductor manufacturing, neuromorphic chips often require specialized materials, novel fabrication techniques, and unique testing methodologies. The industry faces challenges in establishing reliable supply chains for these specialized components, particularly as research transitions toward commercial deployment.

Looking forward, neuromorphic computing aims to enable entirely new applications impossible with conventional computing, including ultra-low-power AI at the edge, brain-computer interfaces, and advanced sensory processing systems that mimic biological capabilities. The field's evolution continues to accelerate as researchers overcome manufacturing challenges and develop more sophisticated neural models.

Market Analysis for Brain-Inspired Computing

The brain-inspired computing market is experiencing significant growth, driven by the increasing demand for efficient AI processing and the limitations of traditional computing architectures. Current market valuations place neuromorphic computing at approximately $2.5 billion, with projections indicating a compound annual growth rate of 20-25% over the next five years. This growth trajectory is supported by substantial investments from both private and public sectors, with government initiatives like the EU's Human Brain Project and the US BRAIN Initiative allocating dedicated funding for neuromorphic research.

The market segmentation reveals distinct application clusters where neuromorphic chips are gaining traction. Edge computing represents the fastest-growing segment, as these chips offer significant power efficiency advantages for AI processing in resource-constrained environments. The automotive sector is emerging as a key adopter, particularly for advanced driver assistance systems and autonomous driving functions that require real-time pattern recognition with minimal power consumption.

Healthcare applications constitute another substantial market segment, with neuromorphic solutions being explored for medical imaging analysis, brain-computer interfaces, and prosthetic control systems. The defense sector also demonstrates strong interest, primarily for surveillance systems, signal processing, and autonomous vehicles operating in communication-restricted environments.

From a geographical perspective, North America currently leads the market with approximately 40% share, housing major research institutions and commercial players like IBM, Intel, and BrainChip. Asia-Pacific represents the fastest-growing region, with significant investments from China, Japan, and South Korea in developing domestic neuromorphic capabilities to reduce dependency on Western semiconductor technologies.

Customer demand analysis indicates a shifting priority from pure performance metrics toward energy efficiency and specialized task optimization. End-users increasingly value neuromorphic solutions for their ability to perform complex pattern recognition tasks with orders of magnitude less power than conventional GPU-based systems.

Market barriers remain significant, with supply chain vulnerabilities representing a critical challenge. The specialized materials and manufacturing processes required for neuromorphic chips create dependencies on limited supplier networks. Additionally, the lack of standardized development frameworks and programming models restricts broader market adoption, as potential customers face steep learning curves when implementing these novel architectures.

Competition is intensifying as both established semiconductor companies and specialized startups enter the space. This competitive landscape is driving innovation while simultaneously creating market fragmentation through incompatible architectural approaches, which may delay widespread commercial adoption until dominant design paradigms emerge.

The market segmentation reveals distinct application clusters where neuromorphic chips are gaining traction. Edge computing represents the fastest-growing segment, as these chips offer significant power efficiency advantages for AI processing in resource-constrained environments. The automotive sector is emerging as a key adopter, particularly for advanced driver assistance systems and autonomous driving functions that require real-time pattern recognition with minimal power consumption.

Healthcare applications constitute another substantial market segment, with neuromorphic solutions being explored for medical imaging analysis, brain-computer interfaces, and prosthetic control systems. The defense sector also demonstrates strong interest, primarily for surveillance systems, signal processing, and autonomous vehicles operating in communication-restricted environments.

From a geographical perspective, North America currently leads the market with approximately 40% share, housing major research institutions and commercial players like IBM, Intel, and BrainChip. Asia-Pacific represents the fastest-growing region, with significant investments from China, Japan, and South Korea in developing domestic neuromorphic capabilities to reduce dependency on Western semiconductor technologies.

Customer demand analysis indicates a shifting priority from pure performance metrics toward energy efficiency and specialized task optimization. End-users increasingly value neuromorphic solutions for their ability to perform complex pattern recognition tasks with orders of magnitude less power than conventional GPU-based systems.

Market barriers remain significant, with supply chain vulnerabilities representing a critical challenge. The specialized materials and manufacturing processes required for neuromorphic chips create dependencies on limited supplier networks. Additionally, the lack of standardized development frameworks and programming models restricts broader market adoption, as potential customers face steep learning curves when implementing these novel architectures.

Competition is intensifying as both established semiconductor companies and specialized startups enter the space. This competitive landscape is driving innovation while simultaneously creating market fragmentation through incompatible architectural approaches, which may delay widespread commercial adoption until dominant design paradigms emerge.

Supply Chain Bottlenecks and Technical Barriers

The neuromorphic chip supply chain faces significant bottlenecks that impede widespread adoption and commercialization. Material sourcing represents a primary challenge, as these chips require specialized materials including rare earth elements and novel compounds for memristive devices. The limited availability of these materials, combined with geopolitical tensions affecting global supply chains, creates vulnerability in the production pipeline. Additionally, many of these materials are sourced from regions with unstable political environments, further complicating consistent procurement.

Manufacturing complexity presents another substantial barrier. Neuromorphic architectures demand advanced fabrication processes that differ significantly from conventional CMOS manufacturing. The integration of analog components, memristors, and other novel devices requires specialized equipment and expertise that few semiconductor foundries currently possess. This manufacturing gap has created a dependency on a small number of facilities capable of producing these chips at scale, resulting in production bottlenecks and increased costs.

Quality control and yield management pose particular challenges for neuromorphic chips. The inherent variability in analog components and novel materials leads to inconsistent performance across manufactured units. This variability, while sometimes leveraged as a feature in neuromorphic computing, becomes problematic when attempting to ensure reliable operation across applications. Current testing methodologies developed for digital chips are often inadequate for neuromorphic architectures, necessitating new approaches to quality assurance.

The equipment supply chain represents another critical bottleneck. Specialized tools for neuromorphic chip fabrication are produced by a limited number of equipment manufacturers, creating dependencies and potential single points of failure. The long lead times for this equipment—often 12-18 months—significantly impacts production scaling and responsiveness to market demands.

Intellectual property fragmentation further complicates the supply chain landscape. The neuromorphic chip ecosystem involves patents and proprietary technologies distributed across numerous entities, including startups, established semiconductor companies, and research institutions. This fragmentation creates licensing complexities and potential legal barriers to commercialization, slowing down innovation and market entry.

Workforce limitations represent a human capital bottleneck in the supply chain. The interdisciplinary nature of neuromorphic computing requires expertise spanning neuroscience, electrical engineering, materials science, and computer architecture. The scarcity of professionals with this cross-domain knowledge restricts research advancement, manufacturing capabilities, and ultimately market growth.

Manufacturing complexity presents another substantial barrier. Neuromorphic architectures demand advanced fabrication processes that differ significantly from conventional CMOS manufacturing. The integration of analog components, memristors, and other novel devices requires specialized equipment and expertise that few semiconductor foundries currently possess. This manufacturing gap has created a dependency on a small number of facilities capable of producing these chips at scale, resulting in production bottlenecks and increased costs.

Quality control and yield management pose particular challenges for neuromorphic chips. The inherent variability in analog components and novel materials leads to inconsistent performance across manufactured units. This variability, while sometimes leveraged as a feature in neuromorphic computing, becomes problematic when attempting to ensure reliable operation across applications. Current testing methodologies developed for digital chips are often inadequate for neuromorphic architectures, necessitating new approaches to quality assurance.

The equipment supply chain represents another critical bottleneck. Specialized tools for neuromorphic chip fabrication are produced by a limited number of equipment manufacturers, creating dependencies and potential single points of failure. The long lead times for this equipment—often 12-18 months—significantly impacts production scaling and responsiveness to market demands.

Intellectual property fragmentation further complicates the supply chain landscape. The neuromorphic chip ecosystem involves patents and proprietary technologies distributed across numerous entities, including startups, established semiconductor companies, and research institutions. This fragmentation creates licensing complexities and potential legal barriers to commercialization, slowing down innovation and market entry.

Workforce limitations represent a human capital bottleneck in the supply chain. The interdisciplinary nature of neuromorphic computing requires expertise spanning neuroscience, electrical engineering, materials science, and computer architecture. The scarcity of professionals with this cross-domain knowledge restricts research advancement, manufacturing capabilities, and ultimately market growth.

Current Supply Chain Management Solutions

01 Manufacturing and fabrication of neuromorphic chips

The manufacturing and fabrication of neuromorphic chips involve specialized processes that integrate neural network architectures into semiconductor devices. These processes include the development of memristive devices, integration of synaptic elements, and implementation of spiking neural networks on silicon substrates. Advanced fabrication techniques enable the creation of chips that mimic the brain's neural structure and function, allowing for efficient processing of complex patterns and data.- Manufacturing and fabrication of neuromorphic chips: The manufacturing process of neuromorphic chips involves specialized fabrication techniques that integrate neural network architectures into semiconductor devices. These processes include the development of memristive devices, synaptic elements, and neural processing units that mimic brain functions. Advanced fabrication methods enable the creation of energy-efficient neuromorphic hardware that can perform complex cognitive tasks with lower power consumption compared to traditional computing architectures.

- Supply chain management for neuromorphic computing systems: Supply chain management for neuromorphic chips encompasses the sourcing of specialized materials, component integration, and distribution networks. This includes strategies for securing critical materials, managing semiconductor foundry relationships, and establishing resilient supply networks. The complexity of neuromorphic chip supply chains requires coordination between material suppliers, chip designers, manufacturers, and end-users to ensure consistent quality and availability of these advanced computing components.

- Integration of neuromorphic chips in AI systems: Neuromorphic chips are increasingly being integrated into artificial intelligence systems to enable more efficient processing of neural networks and machine learning algorithms. These chips provide specialized hardware acceleration for AI workloads, particularly for edge computing applications where power efficiency is critical. The integration process involves hardware-software co-design approaches that optimize neural network implementations for the unique architecture of neuromorphic processors.

- Memory systems for neuromorphic computing: Advanced memory systems are essential components in the neuromorphic chip supply chain, providing the necessary storage and processing capabilities for neural network operations. These memory architectures include non-volatile memory technologies, in-memory computing structures, and specialized memory hierarchies designed to support the parallel processing requirements of neuromorphic computing. The development of these memory systems focuses on reducing the energy consumption associated with data movement while maintaining high computational throughput.

- Testing and quality control in neuromorphic chip production: Testing and quality control processes are critical in the neuromorphic chip supply chain to ensure reliability and performance. These processes include specialized testing methodologies for neural network functionality, power efficiency verification, and fault tolerance assessment. Quality control systems monitor manufacturing variations that could affect the behavior of neuromorphic circuits, with particular attention to the analog components that implement synaptic functions. Advanced testing frameworks help identify defects early in the production process, reducing costs and improving yield rates.

02 Supply chain management and logistics for neuromorphic computing

Supply chain management for neuromorphic chips encompasses the coordination of raw materials, component sourcing, and distribution networks. This includes securing specialized materials for memristive elements, managing semiconductor foundry relationships, and establishing quality control processes throughout the production pipeline. Effective supply chain strategies address challenges such as material scarcity, geopolitical constraints, and the need for specialized testing equipment to ensure reliable neuromorphic chip production.Expand Specific Solutions03 Integration of neuromorphic chips in computing systems

The integration of neuromorphic chips into computing systems requires specialized hardware interfaces, software frameworks, and system architectures. These integration approaches enable neuromorphic processors to work alongside conventional computing components, facilitating applications in artificial intelligence, pattern recognition, and real-time data processing. The integration process addresses challenges related to power management, data transfer protocols, and compatibility with existing computing infrastructures.Expand Specific Solutions04 Design and architecture of neuromorphic processors

Neuromorphic processor design focuses on creating architectures that efficiently implement neural network principles in hardware. These designs incorporate elements such as artificial synapses, neurons, and learning mechanisms that mimic biological neural systems. Key architectural considerations include spike-based processing, parallel computation structures, and energy-efficient signal propagation. Advanced designs may incorporate features like on-chip learning, adaptive connectivity, and specialized memory structures to support neuromorphic computing paradigms.Expand Specific Solutions05 Testing and quality assurance for neuromorphic hardware

Testing and quality assurance for neuromorphic chips involve specialized methodologies to verify functionality, performance, and reliability. These processes include neural network benchmark testing, power efficiency evaluation, and verification of learning capabilities. Quality assurance frameworks address unique challenges in neuromorphic computing, such as validating stochastic behavior, measuring synaptic plasticity, and ensuring consistent performance across variable operating conditions. Advanced testing approaches may incorporate automated verification tools specifically designed for neural hardware.Expand Specific Solutions

Key Industry Players and Ecosystem Mapping

The neuromorphic chip supply chain landscape is evolving within an emerging market characterized by significant growth potential but facing complex challenges. Currently in its early development stage, the market is witnessing increasing competition among established technology giants (IBM, Intel, Samsung, Qualcomm) and specialized startups (Syntiant). Technical maturity varies considerably across players, with research institutions like Tsinghua University, KAIST, and Fudan University driving fundamental innovations, while companies like HPE, IBM, and Samsung lead in commercialization efforts. The supply chain faces critical bottlenecks in specialized materials, manufacturing processes, and integration with conventional computing systems. Geopolitical tensions and export controls further complicate the global supply network, creating regional development disparities and forcing companies to develop localized supply strategies.

SYNTIANT CORP

Technical Solution: Syntiant has developed a unique approach to neuromorphic chip supply chain management through their Neural Decision Processors (NDPs). The company focuses on ultra-low-power edge AI applications, implementing neuromorphic principles in a supply chain-conscious design. Syntiant has pioneered a fabless semiconductor model specifically optimized for neuromorphic computing, partnering with established foundries to manufacture their chips while maintaining tight control over their proprietary architecture. Their supply chain strategy emphasizes standardized components and processes compatible with existing semiconductor manufacturing infrastructure. Syntiant's neuromorphic chips are designed with supply chain resilience in mind, using analog-digital hybrid architectures that can be manufactured using mature process nodes (40nm and 28nm), avoiding the supply bottlenecks associated with leading-edge nodes. The company has implemented a just-in-time inventory system with multiple supplier relationships to ensure component availability despite global semiconductor shortages.

Strengths: Fabless model provides manufacturing flexibility; designs compatible with mature process nodes reduce supply chain risks and costs. Weaknesses: Limited vertical integration may create dependencies on external manufacturing partners; specialized analog components still present supply chain vulnerabilities.

International Business Machines Corp.

Technical Solution: IBM's TrueNorth neuromorphic chip architecture represents one of the most mature neuromorphic computing platforms addressing supply chain challenges. IBM has developed a modular approach to neuromorphic chip manufacturing, using a tiled architecture that allows for scalable production. Their supply chain strategy involves standardizing core neuromorphic components while maintaining flexibility in integration. IBM has established partnerships with semiconductor manufacturers to ensure reliable chip production despite global supply constraints. They've implemented a multi-sourcing strategy for critical materials and components to mitigate supply disruptions. IBM's neuromorphic chips utilize a 28nm process technology, balancing performance requirements with manufacturing practicality to avoid the extreme supply constraints faced by cutting-edge nodes. The company has also invested in advanced packaging technologies to optimize neuromorphic chip integration while reducing dependency on scarce materials.

Strengths: Established semiconductor industry relationships provide IBM with supply chain resilience; modular architecture allows for manufacturing flexibility and yield optimization. Weaknesses: Reliance on traditional CMOS fabrication limits some neuromorphic capabilities; scaling production remains challenging due to specialized integration requirements.

Critical Patents and Technologies Analysis

Neuromorphic Circuit

PatentInactiveUS20110004579A1

Innovation

- The development of neuromorphic circuits with memristive synapses that utilize synchronized signal transmission and pulse-width modulation to control the physical properties of synapse-like junctions, allowing for deterministic changes and efficient signal propagation, thereby enabling flexible and low-power learning.

Geopolitical Factors Affecting Neuromorphic Chip Production

The geopolitical landscape significantly impacts the development and production of neuromorphic chips, creating a complex web of challenges for the global supply chain. The concentration of semiconductor manufacturing capabilities in specific regions, particularly Taiwan, South Korea, and increasingly China, introduces substantial geopolitical vulnerabilities. Taiwan's TSMC, which controls over 50% of the global semiconductor foundry market, represents a critical chokepoint in neuromorphic chip production, especially given the ongoing tensions between China and Taiwan.

Trade restrictions and technology export controls have emerged as powerful tools in the geopolitical arsenal affecting neuromorphic computing. The United States has implemented extensive export controls targeting China's access to advanced semiconductor technologies, including those essential for neuromorphic chip development. These restrictions limit access to critical intellectual property, manufacturing equipment, and design tools, fragmenting the global supply chain and forcing companies to navigate complex compliance requirements.

National security concerns have prompted governments worldwide to prioritize semiconductor sovereignty, leading to substantial investments in domestic chip production capabilities. The U.S. CHIPS Act ($52 billion), EU Chips Act (€43 billion), and China's semiconductor self-sufficiency initiatives represent significant efforts to reduce dependency on foreign suppliers. However, these initiatives require years to mature and cannot immediately address supply chain vulnerabilities for neuromorphic chips.

The competition for rare earth elements and specialized materials essential for neuromorphic chip production introduces another layer of geopolitical complexity. China controls approximately 85% of the global rare earth processing capacity, creating potential bottlenecks for Western manufacturers. Strategic resource nationalism is increasingly evident as countries seek to secure access to these critical materials through diplomatic alliances, strategic investments, and alternative sourcing strategies.

International standards and intellectual property regimes are becoming battlegrounds for technological influence. Countries are actively seeking to shape emerging standards for neuromorphic computing to favor their domestic industries. This standards competition creates interoperability challenges and market fragmentation, potentially slowing global adoption of neuromorphic technologies and complicating supply chain management.

The talent pool for neuromorphic computing is also subject to geopolitical forces, with immigration policies and international research collaboration restrictions impacting knowledge transfer and innovation. Countries with more restrictive policies risk falling behind in the race to develop advanced neuromorphic solutions, while those with open research environments may gain competitive advantages through knowledge diversity and cross-pollination of ideas.

Trade restrictions and technology export controls have emerged as powerful tools in the geopolitical arsenal affecting neuromorphic computing. The United States has implemented extensive export controls targeting China's access to advanced semiconductor technologies, including those essential for neuromorphic chip development. These restrictions limit access to critical intellectual property, manufacturing equipment, and design tools, fragmenting the global supply chain and forcing companies to navigate complex compliance requirements.

National security concerns have prompted governments worldwide to prioritize semiconductor sovereignty, leading to substantial investments in domestic chip production capabilities. The U.S. CHIPS Act ($52 billion), EU Chips Act (€43 billion), and China's semiconductor self-sufficiency initiatives represent significant efforts to reduce dependency on foreign suppliers. However, these initiatives require years to mature and cannot immediately address supply chain vulnerabilities for neuromorphic chips.

The competition for rare earth elements and specialized materials essential for neuromorphic chip production introduces another layer of geopolitical complexity. China controls approximately 85% of the global rare earth processing capacity, creating potential bottlenecks for Western manufacturers. Strategic resource nationalism is increasingly evident as countries seek to secure access to these critical materials through diplomatic alliances, strategic investments, and alternative sourcing strategies.

International standards and intellectual property regimes are becoming battlegrounds for technological influence. Countries are actively seeking to shape emerging standards for neuromorphic computing to favor their domestic industries. This standards competition creates interoperability challenges and market fragmentation, potentially slowing global adoption of neuromorphic technologies and complicating supply chain management.

The talent pool for neuromorphic computing is also subject to geopolitical forces, with immigration policies and international research collaboration restrictions impacting knowledge transfer and innovation. Countries with more restrictive policies risk falling behind in the race to develop advanced neuromorphic solutions, while those with open research environments may gain competitive advantages through knowledge diversity and cross-pollination of ideas.

Sustainability and Resource Constraints in Manufacturing

The manufacturing of neuromorphic chips faces significant sustainability challenges due to the specialized materials and complex processes involved. These chips require rare earth elements and precious metals that are often sourced from geopolitically sensitive regions, creating supply vulnerabilities. The extraction of these materials frequently involves environmentally damaging processes, including habitat destruction, water pollution, and high carbon emissions. As demand for neuromorphic computing grows, these environmental impacts will likely intensify unless alternative approaches are developed.

Energy consumption represents another critical constraint in neuromorphic chip production. The fabrication process is extremely energy-intensive, with semiconductor foundries consuming vast amounts of electricity and water. While neuromorphic chips are designed to be energy-efficient during operation, their manufacturing footprint remains substantial. This creates a paradoxical situation where environmentally beneficial technology requires environmentally costly production methods.

Water usage presents a particular concern, as semiconductor manufacturing requires ultra-pure water in quantities that strain local resources. A typical fabrication facility may use millions of gallons daily, competing with agricultural and residential needs in water-stressed regions. This dependency creates both environmental and operational risks as climate change exacerbates water scarcity globally.

Chemical waste management adds another layer of complexity to neuromorphic chip production. The manufacturing process generates hazardous byproducts requiring specialized disposal procedures. Improper handling can lead to soil and groundwater contamination, creating long-term environmental liabilities. The industry faces increasing regulatory pressure to minimize these impacts through closed-loop systems and waste reduction initiatives.

Resource circularity remains underdeveloped in neuromorphic computing. Unlike conventional electronics, the specialized nature of these chips complicates recycling efforts. Current end-of-life recovery rates for critical materials remain low, creating a linear rather than circular resource flow. Developing effective recycling technologies specifically for neuromorphic components represents a significant opportunity to improve sustainability metrics.

Manufacturing scalability is further constrained by these sustainability factors. As production volumes increase to meet growing demand, resource limitations become more pronounced. Companies must balance performance requirements against material availability, potentially leading to design compromises or supply bottlenecks. This tension between technological advancement and resource constraints will shape the evolution of neuromorphic computing architectures.

Energy consumption represents another critical constraint in neuromorphic chip production. The fabrication process is extremely energy-intensive, with semiconductor foundries consuming vast amounts of electricity and water. While neuromorphic chips are designed to be energy-efficient during operation, their manufacturing footprint remains substantial. This creates a paradoxical situation where environmentally beneficial technology requires environmentally costly production methods.

Water usage presents a particular concern, as semiconductor manufacturing requires ultra-pure water in quantities that strain local resources. A typical fabrication facility may use millions of gallons daily, competing with agricultural and residential needs in water-stressed regions. This dependency creates both environmental and operational risks as climate change exacerbates water scarcity globally.

Chemical waste management adds another layer of complexity to neuromorphic chip production. The manufacturing process generates hazardous byproducts requiring specialized disposal procedures. Improper handling can lead to soil and groundwater contamination, creating long-term environmental liabilities. The industry faces increasing regulatory pressure to minimize these impacts through closed-loop systems and waste reduction initiatives.

Resource circularity remains underdeveloped in neuromorphic computing. Unlike conventional electronics, the specialized nature of these chips complicates recycling efforts. Current end-of-life recovery rates for critical materials remain low, creating a linear rather than circular resource flow. Developing effective recycling technologies specifically for neuromorphic components represents a significant opportunity to improve sustainability metrics.

Manufacturing scalability is further constrained by these sustainability factors. As production volumes increase to meet growing demand, resource limitations become more pronounced. Companies must balance performance requirements against material availability, potentially leading to design compromises or supply bottlenecks. This tension between technological advancement and resource constraints will shape the evolution of neuromorphic computing architectures.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!