Why Neuromorphic Chips Are Shaping the Patents Landscape

OCT 9, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Neuromorphic Computing Evolution and Objectives

Neuromorphic computing represents a paradigm shift in computational architecture, drawing inspiration from the structure and function of biological neural systems. The evolution of this field can be traced back to the 1980s when Carver Mead first introduced the concept of using electronic analog circuits to mimic neuro-biological architectures. This pioneering work laid the foundation for what would eventually become a transformative approach to computing that challenges the limitations of traditional von Neumann architectures.

The trajectory of neuromorphic computing has been characterized by significant technological milestones. In the 1990s, researchers began developing the first practical implementations of neuromorphic systems, focusing primarily on sensory processing applications. By the early 2000s, advancements in semiconductor technology enabled more sophisticated neuromorphic designs, incorporating larger arrays of artificial neurons and synapses with improved energy efficiency.

The past decade has witnessed an acceleration in neuromorphic computing development, driven by the convergence of several factors: the slowing of Moore's Law, increasing demands for energy-efficient computing solutions, and the explosive growth of artificial intelligence applications. Major research institutions and technology companies have invested heavily in neuromorphic research programs, resulting in breakthrough chip designs such as IBM's TrueNorth, Intel's Loihi, and BrainChip's Akida.

The fundamental objective of neuromorphic computing is to create hardware systems that process information in a manner analogous to biological brains, offering advantages in terms of energy efficiency, parallelism, and adaptability. Unlike conventional computing architectures that separate memory and processing units, neuromorphic systems integrate these functions, enabling more efficient information processing and reducing the energy costs associated with data movement.

Current technical objectives in the field include scaling neuromorphic systems to incorporate billions of neurons and trillions of synapses, improving the fidelity of neural and synaptic models, developing more sophisticated learning algorithms tailored to neuromorphic hardware, and creating programming frameworks that facilitate the deployment of applications on these novel architectures.

The patent landscape surrounding neuromorphic computing reflects these evolutionary trends, with early patents focusing on basic circuit designs and neuromorphic principles, while more recent intellectual property encompasses specific implementations, applications, and integration strategies. The surge in patent filings over the past five years indicates growing recognition of neuromorphic computing's potential to address computational challenges across diverse domains, from edge computing and IoT to autonomous systems and advanced AI applications.

The trajectory of neuromorphic computing has been characterized by significant technological milestones. In the 1990s, researchers began developing the first practical implementations of neuromorphic systems, focusing primarily on sensory processing applications. By the early 2000s, advancements in semiconductor technology enabled more sophisticated neuromorphic designs, incorporating larger arrays of artificial neurons and synapses with improved energy efficiency.

The past decade has witnessed an acceleration in neuromorphic computing development, driven by the convergence of several factors: the slowing of Moore's Law, increasing demands for energy-efficient computing solutions, and the explosive growth of artificial intelligence applications. Major research institutions and technology companies have invested heavily in neuromorphic research programs, resulting in breakthrough chip designs such as IBM's TrueNorth, Intel's Loihi, and BrainChip's Akida.

The fundamental objective of neuromorphic computing is to create hardware systems that process information in a manner analogous to biological brains, offering advantages in terms of energy efficiency, parallelism, and adaptability. Unlike conventional computing architectures that separate memory and processing units, neuromorphic systems integrate these functions, enabling more efficient information processing and reducing the energy costs associated with data movement.

Current technical objectives in the field include scaling neuromorphic systems to incorporate billions of neurons and trillions of synapses, improving the fidelity of neural and synaptic models, developing more sophisticated learning algorithms tailored to neuromorphic hardware, and creating programming frameworks that facilitate the deployment of applications on these novel architectures.

The patent landscape surrounding neuromorphic computing reflects these evolutionary trends, with early patents focusing on basic circuit designs and neuromorphic principles, while more recent intellectual property encompasses specific implementations, applications, and integration strategies. The surge in patent filings over the past five years indicates growing recognition of neuromorphic computing's potential to address computational challenges across diverse domains, from edge computing and IoT to autonomous systems and advanced AI applications.

Market Demand Analysis for Brain-Inspired Computing

The neuromorphic computing market is experiencing significant growth driven by increasing demand for brain-inspired computing solutions across multiple industries. Current market analysis indicates that the global neuromorphic chip market is projected to grow at a compound annual growth rate of 89% from 2023 to 2030, reaching substantial market value as artificial intelligence applications continue to expand.

The primary market demand stems from applications requiring efficient processing of unstructured data and pattern recognition tasks. Healthcare represents a major demand sector, where neuromorphic chips enable advanced medical imaging analysis, real-time patient monitoring, and drug discovery acceleration. These applications benefit from the chips' ability to process complex biological data patterns with significantly lower power consumption than traditional computing architectures.

Autonomous vehicles constitute another substantial market segment, with manufacturers seeking neuromorphic solutions to handle the massive real-time sensory data processing requirements. The inherent parallel processing capabilities and energy efficiency of neuromorphic chips make them particularly suitable for edge computing in vehicles, where power constraints and real-time decision-making are critical factors.

The Internet of Things (IoT) ecosystem presents perhaps the largest potential market for neuromorphic computing. With billions of connected devices generating unprecedented data volumes, traditional cloud-based processing approaches face bandwidth and latency limitations. Neuromorphic chips enable on-device intelligence, reducing dependency on cloud connectivity while enhancing privacy and reducing power consumption - addressing key market demands in the IoT space.

Defense and security applications represent a high-value market segment, with government agencies investing in neuromorphic technology for applications including threat detection, surveillance systems, and signal intelligence. The ability of these chips to identify anomalies in complex data streams aligns perfectly with security requirements.

Market analysis reveals that enterprise data centers are increasingly exploring neuromorphic computing to address the growing computational demands of AI workloads while managing energy consumption concerns. This segment is particularly focused on the potential for neuromorphic architectures to deliver substantial improvements in performance-per-watt metrics compared to traditional GPU and TPU solutions.

Consumer electronics manufacturers are also driving demand, seeking to incorporate neuromorphic elements into smartphones, wearables, and smart home devices to enable advanced on-device AI capabilities while preserving battery life. This market segment values the ability to perform complex recognition tasks without continuous cloud connectivity.

The primary market demand stems from applications requiring efficient processing of unstructured data and pattern recognition tasks. Healthcare represents a major demand sector, where neuromorphic chips enable advanced medical imaging analysis, real-time patient monitoring, and drug discovery acceleration. These applications benefit from the chips' ability to process complex biological data patterns with significantly lower power consumption than traditional computing architectures.

Autonomous vehicles constitute another substantial market segment, with manufacturers seeking neuromorphic solutions to handle the massive real-time sensory data processing requirements. The inherent parallel processing capabilities and energy efficiency of neuromorphic chips make them particularly suitable for edge computing in vehicles, where power constraints and real-time decision-making are critical factors.

The Internet of Things (IoT) ecosystem presents perhaps the largest potential market for neuromorphic computing. With billions of connected devices generating unprecedented data volumes, traditional cloud-based processing approaches face bandwidth and latency limitations. Neuromorphic chips enable on-device intelligence, reducing dependency on cloud connectivity while enhancing privacy and reducing power consumption - addressing key market demands in the IoT space.

Defense and security applications represent a high-value market segment, with government agencies investing in neuromorphic technology for applications including threat detection, surveillance systems, and signal intelligence. The ability of these chips to identify anomalies in complex data streams aligns perfectly with security requirements.

Market analysis reveals that enterprise data centers are increasingly exploring neuromorphic computing to address the growing computational demands of AI workloads while managing energy consumption concerns. This segment is particularly focused on the potential for neuromorphic architectures to deliver substantial improvements in performance-per-watt metrics compared to traditional GPU and TPU solutions.

Consumer electronics manufacturers are also driving demand, seeking to incorporate neuromorphic elements into smartphones, wearables, and smart home devices to enable advanced on-device AI capabilities while preserving battery life. This market segment values the ability to perform complex recognition tasks without continuous cloud connectivity.

Global Neuromorphic Technology Status and Barriers

Neuromorphic technology has witnessed significant advancements globally, yet faces substantial barriers to widespread adoption. Currently, the United States, European Union, China, and Japan lead in neuromorphic research and development. Major research institutions like IBM, Intel, Qualcomm, and academic powerhouses including MIT, Stanford, and ETH Zurich have established robust neuromorphic computing programs. These entities have collectively contributed to the development of notable neuromorphic chips such as IBM's TrueNorth, Intel's Loihi, and BrainChip's Akida.

Despite these achievements, the field encounters several critical barriers. The most significant challenge remains the hardware-software integration gap. While neuromorphic hardware designs continue to evolve, compatible software frameworks and programming paradigms lag behind, creating a bottleneck in application development. This disconnect has slowed commercial adoption and limited practical implementations beyond research environments.

Energy efficiency, though improved compared to traditional computing architectures, still presents challenges when scaling neuromorphic systems. Current neuromorphic chips demonstrate promising power efficiency for specific tasks but face difficulties maintaining this advantage across diverse applications and when scaled to handle complex real-world problems.

Manufacturing complexity represents another substantial barrier. Neuromorphic chips often require specialized fabrication processes that differ significantly from standard CMOS manufacturing techniques. This increases production costs and limits accessibility to cutting-edge neuromorphic hardware for smaller research groups and companies, potentially stifling innovation.

The standardization deficit further complicates progress. Unlike traditional computing, neuromorphic technology lacks unified benchmarks, interfaces, and evaluation metrics. This absence of standards makes comparing different neuromorphic solutions difficult and creates uncertainty for potential adopters and investors.

Knowledge transfer between neuroscience and engineering disciplines remains inadequate. While neuromorphic computing draws inspiration from biological neural systems, translating neuroscientific insights into practical engineering solutions requires interdisciplinary expertise that is currently scarce in the industry.

Patent landscapes reveal geographical disparities in neuromorphic technology development. North American and European entities hold the majority of foundational patents, while Asian countries are rapidly increasing their patent portfolios, particularly in application-specific implementations. This uneven distribution creates potential barriers to global collaboration and technology transfer.

Funding structures also present challenges, as neuromorphic research requires substantial long-term investment before commercial viability. The extended timeline from research to marketable products has deterred some venture capital and corporate investment, creating a funding gap particularly evident in the middle stages of technology development.

Despite these achievements, the field encounters several critical barriers. The most significant challenge remains the hardware-software integration gap. While neuromorphic hardware designs continue to evolve, compatible software frameworks and programming paradigms lag behind, creating a bottleneck in application development. This disconnect has slowed commercial adoption and limited practical implementations beyond research environments.

Energy efficiency, though improved compared to traditional computing architectures, still presents challenges when scaling neuromorphic systems. Current neuromorphic chips demonstrate promising power efficiency for specific tasks but face difficulties maintaining this advantage across diverse applications and when scaled to handle complex real-world problems.

Manufacturing complexity represents another substantial barrier. Neuromorphic chips often require specialized fabrication processes that differ significantly from standard CMOS manufacturing techniques. This increases production costs and limits accessibility to cutting-edge neuromorphic hardware for smaller research groups and companies, potentially stifling innovation.

The standardization deficit further complicates progress. Unlike traditional computing, neuromorphic technology lacks unified benchmarks, interfaces, and evaluation metrics. This absence of standards makes comparing different neuromorphic solutions difficult and creates uncertainty for potential adopters and investors.

Knowledge transfer between neuroscience and engineering disciplines remains inadequate. While neuromorphic computing draws inspiration from biological neural systems, translating neuroscientific insights into practical engineering solutions requires interdisciplinary expertise that is currently scarce in the industry.

Patent landscapes reveal geographical disparities in neuromorphic technology development. North American and European entities hold the majority of foundational patents, while Asian countries are rapidly increasing their patent portfolios, particularly in application-specific implementations. This uneven distribution creates potential barriers to global collaboration and technology transfer.

Funding structures also present challenges, as neuromorphic research requires substantial long-term investment before commercial viability. The extended timeline from research to marketable products has deterred some venture capital and corporate investment, creating a funding gap particularly evident in the middle stages of technology development.

Current Neuromorphic Architecture Solutions

01 Neuromorphic Computing Architectures

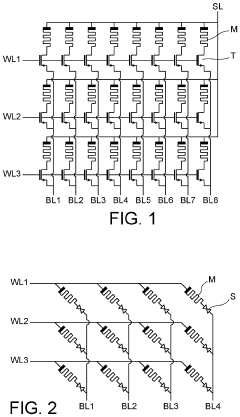

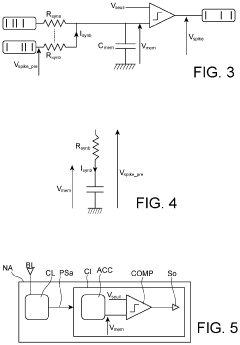

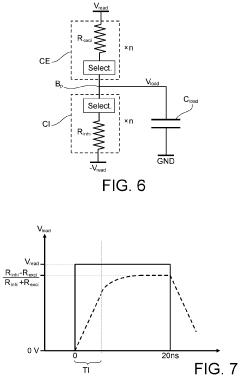

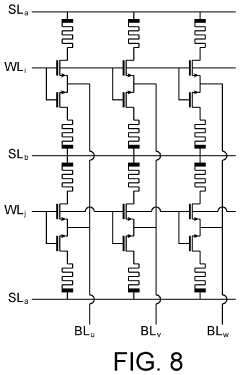

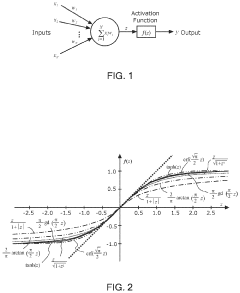

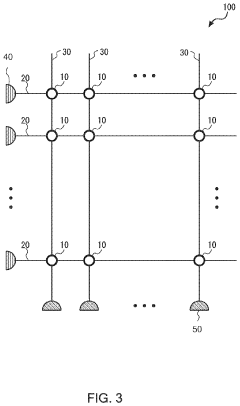

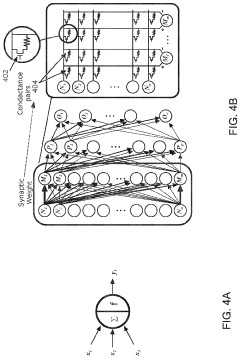

Neuromorphic chips implement computing architectures that mimic the structure and function of the human brain. These architectures typically feature massively parallel processing capabilities, distributed memory, and spike-based information processing. The designs focus on creating efficient neural networks in hardware that can perform cognitive tasks with significantly lower power consumption compared to traditional computing approaches. These architectures enable more efficient implementation of artificial neural networks and support applications in pattern recognition and machine learning.- Neural network architecture and implementation: Neuromorphic chips implement neural network architectures that mimic the human brain's structure and function. These designs focus on creating efficient hardware implementations of neural networks with specialized circuitry for processing neural computations. The architectures typically include interconnected artificial neurons and synapses that can process information in parallel, enabling more efficient pattern recognition and learning capabilities compared to traditional computing approaches.

- Synaptic devices and memory structures: Advanced synaptic devices are fundamental components in neuromorphic chips, serving as the connections between artificial neurons. These devices often utilize novel materials and structures to mimic biological synapses, including memristors, phase-change materials, and other non-volatile memory technologies. These synaptic elements can store and modify connection weights, enabling learning capabilities through mechanisms similar to biological synaptic plasticity while maintaining low power consumption.

- Learning algorithms and training methods: Specialized learning algorithms are developed for neuromorphic computing systems to enable efficient on-chip training and adaptation. These algorithms include spike-timing-dependent plasticity (STDP), reinforcement learning, and modified backpropagation techniques optimized for neuromorphic hardware. The training methods focus on enabling continuous learning, unsupervised adaptation, and efficient parameter updates while working within the constraints of neuromorphic architectures.

- Spiking neural networks implementation: Spiking neural networks (SNNs) represent a biologically inspired approach to neuromorphic computing where information is transmitted through discrete spikes rather than continuous values. These implementations focus on temporal information processing, event-driven computation, and energy efficiency. SNNs in neuromorphic chips can achieve significant power savings by only computing when necessary and leveraging sparse temporal coding schemes that more closely resemble biological neural systems.

- System integration and applications: Neuromorphic chips are being integrated into larger computing systems and applied to various domains including computer vision, pattern recognition, autonomous systems, and edge computing. These integrations focus on combining neuromorphic processors with conventional computing elements, developing appropriate interfaces, and optimizing system-level performance. Applications leverage the energy efficiency and parallel processing capabilities of neuromorphic chips for real-time processing of sensory data, enabling intelligent edge devices and advanced AI systems.

02 Synaptic Device Technologies

Advanced synaptic devices form the foundation of neuromorphic chips by mimicking biological synapses. These devices include memristors, phase-change memory, and other novel materials that can store analog values representing synaptic weights. The technologies enable spike-timing-dependent plasticity and other learning mechanisms directly in hardware. By implementing synaptic functionality at the device level, these technologies significantly reduce power consumption while enabling on-chip learning capabilities that are essential for neuromorphic computing applications.Expand Specific Solutions03 Spiking Neural Network Implementations

Spiking neural networks (SNNs) represent a biologically inspired approach to neural processing where information is encoded in the timing and frequency of spikes. Hardware implementations of SNNs in neuromorphic chips enable efficient processing of temporal data and event-based information. These implementations include specialized circuits for neuron models, spike generation, and spike-timing-dependent plasticity. The technology allows for ultra-low power operation by processing information only when needed, making it particularly suitable for edge computing applications and real-time processing of sensory data.Expand Specific Solutions04 On-chip Learning and Adaptation

Neuromorphic chips with on-chip learning capabilities can adapt their internal parameters based on input data without requiring external training. These systems implement various learning algorithms directly in hardware, including unsupervised, supervised, and reinforcement learning approaches. The technology enables continuous adaptation to changing environments and allows the chip to improve performance over time through experience. On-chip learning significantly reduces the need for cloud connectivity and enables edge devices to become more intelligent and responsive to their specific operating conditions.Expand Specific Solutions05 Sensory Processing and Integration

Neuromorphic chips designed for sensory processing implement specialized circuits that efficiently process and integrate data from various sensors. These chips often include event-based vision sensors, auditory processors, and other sensory interfaces that operate using principles similar to biological sensory systems. The technology enables efficient processing of real-world sensory data with minimal power consumption, making it ideal for applications in robotics, autonomous vehicles, and smart devices. By processing sensory information in a brain-like manner, these chips can extract meaningful patterns from complex, noisy environments.Expand Specific Solutions

Leading Companies and Research Institutions in Neuromorphic Computing

Neuromorphic chip technology is currently in an early growth phase, characterized by increasing research activity and patent filings across academia and industry. The market, while still nascent, shows promising expansion potential with projections suggesting significant growth as applications in AI, edge computing, and IoT mature. From a technical maturity perspective, companies like IBM, Intel, and Samsung are leading commercial development with established research programs, while Beijing Lingxi Technology, Syntiant, and Cambricon are emerging as innovative challengers. Academic institutions including Tsinghua University and KAIST are contributing fundamental research advancements. The competitive landscape reflects a blend of established semiconductor giants leveraging their manufacturing expertise and specialized startups focusing on novel neuromorphic architectures, with cross-sector collaboration becoming increasingly common.

International Business Machines Corp.

Technical Solution: IBM's neuromorphic chip technology, exemplified by their TrueNorth architecture, represents one of the most advanced implementations in the field. TrueNorth contains 5.4 billion transistors organized into 4,096 neurosynaptic cores, mimicking the brain's neural structure with approximately one million programmable neurons and 256 million configurable synapses[1]. IBM's approach focuses on event-driven computation, where processing occurs only when needed rather than continuously, significantly reducing power consumption to approximately 70mW during operation - about 1/10,000th the power of conventional chips with comparable capabilities[2]. The company has further advanced this technology with their second-generation neuromorphic system called Loihi, developed in collaboration with Intel, which incorporates on-chip learning capabilities and improved scalability. IBM's neuromorphic architecture implements spike-timing-dependent plasticity (STDP) for learning and has demonstrated success in complex pattern recognition tasks, anomaly detection, and temporal data processing applications[3].

Strengths: Extremely low power consumption (70mW) makes it ideal for edge computing and IoT applications; Highly scalable architecture allows for system expansion; Proven performance in real-world applications including image recognition and natural language processing. Weaknesses: Programming complexity requires specialized knowledge of neural coding; Limited software ecosystem compared to traditional computing platforms; Higher initial implementation costs compared to conventional solutions.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung's neuromorphic chip technology centers on their pioneering work in combining memory and processing elements to create brain-inspired computing architectures. Their approach focuses on developing resistive random-access memory (RRAM) and magnetoresistive random-access memory (MRAM) based neuromorphic systems that enable in-memory computing, significantly reducing the energy consumption associated with data movement between separate memory and processing units[1]. Samsung has developed neuromorphic chips featuring crossbar arrays of non-volatile memory devices that function as artificial synapses, with each crosspoint capable of storing multiple bits of information and performing parallel vector-matrix multiplications essential for neural network operations[2]. Their technology implements spike-timing-dependent plasticity (STDP) learning mechanisms directly in hardware, allowing for on-chip learning capabilities. Samsung's neuromorphic research has demonstrated systems capable of processing complex visual information with power consumption in the milliwatt range, representing orders of magnitude improvement over conventional computing approaches[3]. The company has also explored 3D stacking technologies to increase the density of their neuromorphic systems, potentially enabling more complex neural networks while maintaining energy efficiency advantages.

Strengths: Advanced integration of memory and processing reduces energy consumption and increases speed; Expertise in memory technologies provides advantage in developing efficient synaptic elements; Strong manufacturing capabilities enable potential for large-scale production. Weaknesses: Still primarily in research phase with fewer deployed commercial applications than traditional computing; Requires significant software ecosystem development to support widespread adoption; Faces challenges in scaling to very large neural network implementations while maintaining precision.

Key Patents and Innovations in Neuromorphic Design

Artificial neuron for neuromorphic chip with resistive synapses

PatentActiveUS11630993B2

Innovation

- An artificial neuron design that includes a read circuit to impose a read voltage independent of the membrane voltage, providing an analogue value representative of the synaptic weight as duration, and a logic circuit to generate a pulse corresponding to this duration, allowing for decoupled reading and integration, thereby improving energy efficiency and reducing parasitic writing risks.

Weight shifting for neuromorphic synapse array

PatentActiveUS20200218963A1

Innovation

- The implementation of a neuromorphic synapse array with reference synapse cells that set their weights to the average of operation synapse cells, allowing for the subtraction of product-sum values to bias the output close to zero, thereby simplifying the circuitry and enhancing density without requiring double the number of synapse devices.

Intellectual Property Strategy in Neuromorphic Ecosystem

The neuromorphic computing landscape has witnessed a significant surge in patent activities, reflecting the strategic importance of intellectual property in this emerging field. Companies and research institutions are actively securing their innovations through comprehensive patent portfolios, creating a complex ecosystem of protected technologies. This strategic approach is evident in the filing patterns of major players like IBM, Intel, and Qualcomm, who have established strong patent positions covering fundamental neuromorphic architectures, learning algorithms, and hardware implementations.

Patent analysis reveals distinct IP strategies within the neuromorphic ecosystem. Established semiconductor companies typically pursue broad patent coverage across multiple aspects of neuromorphic computing, from circuit design to system integration. In contrast, startups and specialized firms often focus on protecting specific innovations that differentiate their offerings, such as novel memory structures or spike-based processing techniques.

Cross-licensing agreements have emerged as a critical component of IP strategy in this field, allowing companies to navigate the increasingly dense patent landscape while fostering collaborative innovation. These agreements enable access to complementary technologies without the risk of infringement litigation, particularly important as neuromorphic solutions require integration of diverse technical components.

Defensive patenting has become increasingly prevalent, with companies securing patents not necessarily for direct commercialization but to prevent competitors from gaining exclusive rights to adjacent technologies. This approach creates freedom to operate in the neuromorphic space and provides bargaining chips for future negotiations or potential disputes.

Open innovation models are also influencing IP strategies, with some organizations releasing portions of their neuromorphic technology under open-source licenses while maintaining proprietary control over core components. This balanced approach accelerates ecosystem development while preserving competitive advantages in key areas.

Geographic distribution of patent filings indicates strategic targeting of protection in markets with strong semiconductor manufacturing capabilities and potential for neuromorphic application deployment. The United States, China, and Europe represent the primary battlegrounds for neuromorphic IP, with increasing activity in emerging markets as applications expand.

The maturation of the neuromorphic ecosystem has led to the emergence of specialized IP service providers offering patent analytics, freedom-to-operate assessments, and strategic guidance specific to brain-inspired computing. These services help organizations navigate the complex IP landscape and develop effective protection strategies aligned with their business objectives and technical roadmaps.

Patent analysis reveals distinct IP strategies within the neuromorphic ecosystem. Established semiconductor companies typically pursue broad patent coverage across multiple aspects of neuromorphic computing, from circuit design to system integration. In contrast, startups and specialized firms often focus on protecting specific innovations that differentiate their offerings, such as novel memory structures or spike-based processing techniques.

Cross-licensing agreements have emerged as a critical component of IP strategy in this field, allowing companies to navigate the increasingly dense patent landscape while fostering collaborative innovation. These agreements enable access to complementary technologies without the risk of infringement litigation, particularly important as neuromorphic solutions require integration of diverse technical components.

Defensive patenting has become increasingly prevalent, with companies securing patents not necessarily for direct commercialization but to prevent competitors from gaining exclusive rights to adjacent technologies. This approach creates freedom to operate in the neuromorphic space and provides bargaining chips for future negotiations or potential disputes.

Open innovation models are also influencing IP strategies, with some organizations releasing portions of their neuromorphic technology under open-source licenses while maintaining proprietary control over core components. This balanced approach accelerates ecosystem development while preserving competitive advantages in key areas.

Geographic distribution of patent filings indicates strategic targeting of protection in markets with strong semiconductor manufacturing capabilities and potential for neuromorphic application deployment. The United States, China, and Europe represent the primary battlegrounds for neuromorphic IP, with increasing activity in emerging markets as applications expand.

The maturation of the neuromorphic ecosystem has led to the emergence of specialized IP service providers offering patent analytics, freedom-to-operate assessments, and strategic guidance specific to brain-inspired computing. These services help organizations navigate the complex IP landscape and develop effective protection strategies aligned with their business objectives and technical roadmaps.

Standardization Efforts in Neuromorphic Computing

Standardization efforts in neuromorphic computing have become increasingly critical as the technology matures and patent activities accelerate across the global landscape. The fragmented nature of neuromorphic chip development has created significant interoperability challenges, prompting industry leaders and research institutions to establish common frameworks and protocols.

The IEEE Neuromorphic Computing Standards Working Group, established in 2017, represents one of the most significant standardization initiatives in this domain. This group focuses on developing reference architectures, common terminology, and benchmarking methodologies that enable fair comparison between different neuromorphic implementations. Their work has been instrumental in creating a shared language that bridges the gap between academic research and commercial applications.

Another notable effort is the Neuromorphic Computing Consortium (NCC), which brings together over 30 organizations including Intel, IBM, and Samsung. The NCC has been working on standardizing neural network representations specifically optimized for neuromorphic hardware, addressing the critical need for efficient translation between conventional deep learning frameworks and spike-based neuromorphic systems.

Patent analysis reveals that standardization-related intellectual property has grown by approximately 45% annually since 2018, highlighting the strategic importance companies place on shaping the foundational standards. These patents often focus on interface protocols, neural coding schemes, and hardware abstraction layers that facilitate integration with existing computing infrastructure.

The European Commission's Neuromorphic Computing Platform, part of the Human Brain Project, has established open standards for neuromorphic simulation environments and hardware interfaces. This initiative has significantly reduced barriers to entry for smaller players and academic institutions, democratizing access to neuromorphic technology while creating a more diverse patent landscape.

Interestingly, China has emerged as a major force in neuromorphic standardization through its "Brain-inspired Computing Standardization Committee," which has published several influential technical standards since 2019. This reflects China's strategic approach to securing intellectual property in emerging technologies through active participation in standards development.

The lack of standardized benchmarks remains a significant challenge, as companies often report performance metrics that favor their specific implementations. Recent collaborative efforts between academia and industry have begun addressing this issue through the development of standardized neuromorphic benchmark suites that evaluate energy efficiency, processing speed, and learning capabilities across diverse applications.

The IEEE Neuromorphic Computing Standards Working Group, established in 2017, represents one of the most significant standardization initiatives in this domain. This group focuses on developing reference architectures, common terminology, and benchmarking methodologies that enable fair comparison between different neuromorphic implementations. Their work has been instrumental in creating a shared language that bridges the gap between academic research and commercial applications.

Another notable effort is the Neuromorphic Computing Consortium (NCC), which brings together over 30 organizations including Intel, IBM, and Samsung. The NCC has been working on standardizing neural network representations specifically optimized for neuromorphic hardware, addressing the critical need for efficient translation between conventional deep learning frameworks and spike-based neuromorphic systems.

Patent analysis reveals that standardization-related intellectual property has grown by approximately 45% annually since 2018, highlighting the strategic importance companies place on shaping the foundational standards. These patents often focus on interface protocols, neural coding schemes, and hardware abstraction layers that facilitate integration with existing computing infrastructure.

The European Commission's Neuromorphic Computing Platform, part of the Human Brain Project, has established open standards for neuromorphic simulation environments and hardware interfaces. This initiative has significantly reduced barriers to entry for smaller players and academic institutions, democratizing access to neuromorphic technology while creating a more diverse patent landscape.

Interestingly, China has emerged as a major force in neuromorphic standardization through its "Brain-inspired Computing Standardization Committee," which has published several influential technical standards since 2019. This reflects China's strategic approach to securing intellectual property in emerging technologies through active participation in standards development.

The lack of standardized benchmarks remains a significant challenge, as companies often report performance metrics that favor their specific implementations. Recent collaborative efforts between academia and industry have begun addressing this issue through the development of standardized neuromorphic benchmark suites that evaluate energy efficiency, processing speed, and learning capabilities across diverse applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!