Acrylic Resin vs Epoxy Resin: Strength and Flexibility Comparison

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Resin Technology Background and Objectives

Resin materials have evolved significantly over the past century, with acrylic and epoxy resins emerging as two dominant formulations in various industrial applications. Acrylic resins, first developed in the 1930s, gained commercial prominence in the 1940s as polymethyl methacrylate (PMMA), while epoxy resins were introduced commercially in the late 1940s and saw rapid adoption in the 1950s. The technological evolution of these materials has been driven by increasing demands for improved mechanical properties, environmental resistance, and processing capabilities.

The fundamental chemical structures of these resins dictate their performance characteristics. Acrylic resins are thermoplastic polymers based on acrylic acid derivatives, featuring linear molecular chains that provide inherent flexibility. In contrast, epoxy resins are thermosetting polymers containing epoxide groups that form highly cross-linked structures during curing, resulting in superior strength but reduced flexibility compared to acrylics.

Recent technological advancements have focused on enhancing the inherent properties of both resin types. For acrylics, developments include impact-modified formulations, UV-resistant variants, and hybrid systems that incorporate silicone or polyurethane components to improve flexibility while maintaining transparency. Epoxy technology has evolved toward faster curing systems, toughened formulations with improved impact resistance, and bio-based alternatives derived from renewable resources.

The global resin market has witnessed a compound annual growth rate of approximately 5-7% over the past decade, with specialized high-performance formulations growing at even higher rates. This growth trajectory reflects the expanding applications across industries including construction, automotive, electronics, and medical devices, where specific strength-to-flexibility ratios are critical performance parameters.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of acrylic and epoxy resin systems, specifically focusing on their strength and flexibility characteristics across various formulations and applications. This analysis aims to identify optimal material selection criteria for different use cases, evaluate potential hybrid systems that combine the advantages of both resin types, and explore emerging technologies that may bridge the traditional performance gap between these materials.

Additionally, this research seeks to establish quantitative benchmarks for mechanical properties including tensile strength, flexural modulus, impact resistance, and elongation at break across standardized testing protocols. These benchmarks will provide valuable reference points for material selection and development of next-generation resin systems with optimized strength-flexibility profiles tailored to specific application requirements.

The fundamental chemical structures of these resins dictate their performance characteristics. Acrylic resins are thermoplastic polymers based on acrylic acid derivatives, featuring linear molecular chains that provide inherent flexibility. In contrast, epoxy resins are thermosetting polymers containing epoxide groups that form highly cross-linked structures during curing, resulting in superior strength but reduced flexibility compared to acrylics.

Recent technological advancements have focused on enhancing the inherent properties of both resin types. For acrylics, developments include impact-modified formulations, UV-resistant variants, and hybrid systems that incorporate silicone or polyurethane components to improve flexibility while maintaining transparency. Epoxy technology has evolved toward faster curing systems, toughened formulations with improved impact resistance, and bio-based alternatives derived from renewable resources.

The global resin market has witnessed a compound annual growth rate of approximately 5-7% over the past decade, with specialized high-performance formulations growing at even higher rates. This growth trajectory reflects the expanding applications across industries including construction, automotive, electronics, and medical devices, where specific strength-to-flexibility ratios are critical performance parameters.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of acrylic and epoxy resin systems, specifically focusing on their strength and flexibility characteristics across various formulations and applications. This analysis aims to identify optimal material selection criteria for different use cases, evaluate potential hybrid systems that combine the advantages of both resin types, and explore emerging technologies that may bridge the traditional performance gap between these materials.

Additionally, this research seeks to establish quantitative benchmarks for mechanical properties including tensile strength, flexural modulus, impact resistance, and elongation at break across standardized testing protocols. These benchmarks will provide valuable reference points for material selection and development of next-generation resin systems with optimized strength-flexibility profiles tailored to specific application requirements.

Market Demand Analysis for High-Performance Resins

The global high-performance resin market has witnessed substantial growth in recent years, driven primarily by increasing demand across construction, automotive, aerospace, and electronics industries. The market for specialized resins, particularly acrylic and epoxy variants, reached approximately $24.3 billion in 2022 and is projected to grow at a compound annual growth rate of 7.2% through 2028.

Construction and infrastructure development represent the largest application segment for high-performance resins, accounting for nearly 35% of total consumption. Within this sector, epoxy resins dominate due to their superior strength characteristics and excellent adhesion properties, making them ideal for structural applications, concrete repair, and protective coatings.

The automotive industry has emerged as a rapidly expanding market for both acrylic and epoxy resins, driven by the ongoing shift toward lightweight materials to improve fuel efficiency and reduce emissions. Manufacturers increasingly replace metal components with high-performance resin composites, with the automotive resin market expanding at 8.5% annually—outpacing the overall industry growth rate.

Electronics manufacturing constitutes another significant demand driver, particularly for acrylic resins. The miniaturization trend in consumer electronics requires materials with precise dimensional stability and optical clarity, areas where acrylic resins excel. The electronics segment currently represents 22% of high-performance resin consumption.

Regional analysis reveals Asia-Pacific as the dominant market, accounting for 42% of global consumption, followed by North America (27%) and Europe (21%). China and India demonstrate the highest growth rates, supported by rapid industrialization and infrastructure development projects.

Consumer preferences are increasingly shifting toward environmentally sustainable options, creating a growing niche for bio-based and recyclable high-performance resins. This segment, though currently representing only 8% of the market, is expanding at 12.3% annually—significantly faster than petroleum-based alternatives.

Market research indicates a clear differentiation in demand patterns between acrylic and epoxy resins based on performance requirements. Applications demanding superior impact resistance and flexibility favor acrylic formulations, while those requiring maximum tensile strength and chemical resistance predominantly utilize epoxy systems. This performance-based segmentation has created distinct market opportunities for manufacturers specializing in either resin technology.

Industry forecasts suggest continued strong demand growth for both resin types, with particular acceleration in high-value applications requiring customized performance characteristics combining both strength and flexibility attributes.

Construction and infrastructure development represent the largest application segment for high-performance resins, accounting for nearly 35% of total consumption. Within this sector, epoxy resins dominate due to their superior strength characteristics and excellent adhesion properties, making them ideal for structural applications, concrete repair, and protective coatings.

The automotive industry has emerged as a rapidly expanding market for both acrylic and epoxy resins, driven by the ongoing shift toward lightweight materials to improve fuel efficiency and reduce emissions. Manufacturers increasingly replace metal components with high-performance resin composites, with the automotive resin market expanding at 8.5% annually—outpacing the overall industry growth rate.

Electronics manufacturing constitutes another significant demand driver, particularly for acrylic resins. The miniaturization trend in consumer electronics requires materials with precise dimensional stability and optical clarity, areas where acrylic resins excel. The electronics segment currently represents 22% of high-performance resin consumption.

Regional analysis reveals Asia-Pacific as the dominant market, accounting for 42% of global consumption, followed by North America (27%) and Europe (21%). China and India demonstrate the highest growth rates, supported by rapid industrialization and infrastructure development projects.

Consumer preferences are increasingly shifting toward environmentally sustainable options, creating a growing niche for bio-based and recyclable high-performance resins. This segment, though currently representing only 8% of the market, is expanding at 12.3% annually—significantly faster than petroleum-based alternatives.

Market research indicates a clear differentiation in demand patterns between acrylic and epoxy resins based on performance requirements. Applications demanding superior impact resistance and flexibility favor acrylic formulations, while those requiring maximum tensile strength and chemical resistance predominantly utilize epoxy systems. This performance-based segmentation has created distinct market opportunities for manufacturers specializing in either resin technology.

Industry forecasts suggest continued strong demand growth for both resin types, with particular acceleration in high-value applications requiring customized performance characteristics combining both strength and flexibility attributes.

Current State and Challenges in Resin Development

The global resin market is experiencing significant technological evolution, with acrylic and epoxy resins representing two dominant formulations with distinct property profiles. Current development in resin technology faces several critical challenges that impact both research directions and commercial applications. The market is witnessing a growing demand for resins with enhanced mechanical properties, particularly in terms of strength-to-flexibility ratios that can meet increasingly specialized industrial requirements.

Acrylic resins currently demonstrate superior flexibility characteristics, with elongation at break values typically ranging from 5-10% compared to conventional epoxy's 1-3%. However, they generally exhibit lower tensile strength (41-62 MPa) than standard epoxy formulations (55-130 MPa). This fundamental trade-off between strength and flexibility represents one of the primary technical challenges in the field.

Recent advancements in hybrid resin systems have shown promising results in balancing these properties, but scalability and cost-effectiveness remain significant hurdles. Research indicates that modified epoxy systems incorporating elastomeric components can achieve flexibility improvements of 30-50% while maintaining 80-90% of their original strength properties. However, these modifications often introduce processing complexities and thermal stability concerns.

Environmental factors present another substantial challenge in resin development. Traditional formulations of both resin types contain volatile organic compounds (VOCs) and potentially hazardous components. Regulatory pressures worldwide are driving the industry toward water-based and bio-derived alternatives, which currently struggle to match the performance characteristics of conventional systems. Water-based acrylic resins have made significant progress, achieving 70-85% of the performance of solvent-based counterparts, while bio-based epoxy alternatives remain at approximately 60-75% performance parity.

Cure time optimization represents another significant technical barrier, particularly for epoxy systems which typically require longer cure cycles than acrylics. Industry benchmarks show that standard epoxy formulations require 12-24 hours for full cure at room temperature, while acrylics can achieve functional cure in 30-60 minutes. Accelerated cure systems exist but often compromise the final mechanical properties or introduce thermal management challenges during processing.

The geographical distribution of resin technology development shows concentration in North America, Western Europe, and East Asia, with China emerging as the fastest-growing research hub. Patent analysis reveals that approximately 65% of recent innovations focus on modifying base resin chemistry, while 35% explore novel curing mechanisms and additives to overcome the strength-flexibility compromise.

Cross-linking density control remains a fundamental challenge, as it directly impacts the mechanical property balance. Current research indicates that precisely controlled heterogeneous cross-linking structures may offer the most promising path forward for achieving optimal strength-flexibility combinations in next-generation resin systems.

Acrylic resins currently demonstrate superior flexibility characteristics, with elongation at break values typically ranging from 5-10% compared to conventional epoxy's 1-3%. However, they generally exhibit lower tensile strength (41-62 MPa) than standard epoxy formulations (55-130 MPa). This fundamental trade-off between strength and flexibility represents one of the primary technical challenges in the field.

Recent advancements in hybrid resin systems have shown promising results in balancing these properties, but scalability and cost-effectiveness remain significant hurdles. Research indicates that modified epoxy systems incorporating elastomeric components can achieve flexibility improvements of 30-50% while maintaining 80-90% of their original strength properties. However, these modifications often introduce processing complexities and thermal stability concerns.

Environmental factors present another substantial challenge in resin development. Traditional formulations of both resin types contain volatile organic compounds (VOCs) and potentially hazardous components. Regulatory pressures worldwide are driving the industry toward water-based and bio-derived alternatives, which currently struggle to match the performance characteristics of conventional systems. Water-based acrylic resins have made significant progress, achieving 70-85% of the performance of solvent-based counterparts, while bio-based epoxy alternatives remain at approximately 60-75% performance parity.

Cure time optimization represents another significant technical barrier, particularly for epoxy systems which typically require longer cure cycles than acrylics. Industry benchmarks show that standard epoxy formulations require 12-24 hours for full cure at room temperature, while acrylics can achieve functional cure in 30-60 minutes. Accelerated cure systems exist but often compromise the final mechanical properties or introduce thermal management challenges during processing.

The geographical distribution of resin technology development shows concentration in North America, Western Europe, and East Asia, with China emerging as the fastest-growing research hub. Patent analysis reveals that approximately 65% of recent innovations focus on modifying base resin chemistry, while 35% explore novel curing mechanisms and additives to overcome the strength-flexibility compromise.

Cross-linking density control remains a fundamental challenge, as it directly impacts the mechanical property balance. Current research indicates that precisely controlled heterogeneous cross-linking structures may offer the most promising path forward for achieving optimal strength-flexibility combinations in next-generation resin systems.

Current Technical Solutions for Strength-Flexibility Balance

01 Modification of acrylic resins for improved flexibility

Acrylic resins can be modified to enhance their flexibility while maintaining strength. This can be achieved by incorporating plasticizers, elastomeric components, or through copolymerization with flexible monomers. These modifications help to reduce brittleness and improve impact resistance, making the acrylic resin more suitable for applications requiring both strength and flexibility.- Epoxy-acrylic hybrid resins for enhanced properties: Hybrid resins combining epoxy and acrylic components offer improved mechanical properties including both strength and flexibility. These hybrid systems leverage the structural integrity of epoxy resins with the flexibility of acrylic polymers. The combination results in materials with better impact resistance, adhesion, and durability compared to either resin type alone. Various synthesis methods can be employed to create these hybrids, including grafting, interpenetrating networks, and copolymerization techniques.

- Modification of epoxy resins with flexible additives: Epoxy resins can be modified with various flexible additives to overcome their inherent brittleness while maintaining their high strength. Common modifiers include elastomeric compounds, plasticizers, and flexible chain extenders that increase the distance between crosslinking points. These modifications result in improved impact resistance and crack resistance while preserving the desirable mechanical strength and chemical resistance of epoxy systems. The balance between flexibility and strength can be tailored by adjusting the type and amount of modifiers used.

- Acrylic resin formulations for improved flexibility: Specific formulations of acrylic resins can be developed to enhance flexibility while maintaining adequate strength. These formulations often involve copolymerization with softer monomers, control of molecular weight, and optimization of crosslinking density. The glass transition temperature can be adjusted through monomer selection to achieve the desired balance of properties. Additionally, the incorporation of functional groups that promote internal plasticization can improve flexibility without compromising other mechanical properties.

- Reinforcement technologies for resin systems: Various reinforcement technologies can be applied to both acrylic and epoxy resin systems to enhance their mechanical properties. These include the incorporation of fibers, nanoparticles, and other fillers that can significantly improve strength while maintaining or enhancing flexibility. The interface between the reinforcement and the resin matrix plays a crucial role in determining the final properties. Surface treatments of reinforcements and coupling agents are often employed to optimize this interface and achieve the desired balance of strength and flexibility.

- Curing and processing methods affecting mechanical properties: The curing and processing methods used for epoxy and acrylic resins significantly impact their final mechanical properties. Factors such as cure temperature, cure time, catalyst selection, and post-cure treatments can be optimized to achieve the desired balance of strength and flexibility. Controlled curing processes can help minimize internal stresses that lead to brittleness. Additionally, techniques such as staged curing and the use of specific hardeners or initiators can be employed to tailor the crosslinking density and network structure, directly affecting the mechanical performance of the final product.

02 Epoxy resin formulations with enhanced mechanical properties

Specific formulations of epoxy resins can be developed to optimize both strength and flexibility. This includes the selection of appropriate hardeners, curing agents, and the incorporation of modifiers such as rubber particles or thermoplastic polymers. These formulations can achieve a balance between rigidity for structural integrity and flexibility to prevent cracking under stress.Expand Specific Solutions03 Hybrid acrylic-epoxy resin systems

Combining acrylic and epoxy resins creates hybrid systems that leverage the advantages of both materials. These hybrid systems can exhibit superior mechanical properties compared to either resin alone, including improved tensile strength, impact resistance, and flexibility. The ratio of acrylic to epoxy components can be adjusted to tailor the final properties for specific applications.Expand Specific Solutions04 Nanocomposite reinforcement for resin systems

Incorporating nanomaterials such as carbon nanotubes, graphene, or nanosilica into acrylic or epoxy resins can significantly enhance both strength and flexibility. These nanocomposites create a reinforced matrix structure that distributes stress more effectively throughout the material, resulting in improved mechanical properties without sacrificing flexibility.Expand Specific Solutions05 Curing and processing techniques for optimized properties

The mechanical properties of acrylic and epoxy resins are highly dependent on curing conditions and processing techniques. Controlled temperature profiles, UV curing methods, and multi-stage curing processes can be employed to achieve an optimal balance between strength and flexibility. Post-curing treatments can also be used to further enhance the mechanical properties of the final product.Expand Specific Solutions

Major Manufacturers and Competitive Landscape

The acrylic resin versus epoxy resin market is currently in a mature growth phase, with global market size estimated at $15-20 billion and expanding at 5-7% CAGR. Technologically, epoxy resins demonstrate superior strength characteristics while acrylic resins offer better flexibility and weathering resistance. Leading players like Shin-Etsu Chemical, Mitsubishi Gas Chemical, and DIC Corp have established strong positions in acrylic resin development, while Kaneka Corp, Nippon Kayaku, and KCC Corp dominate epoxy innovations. RESONAC and LG Chem are advancing hybrid solutions combining properties of both materials. The competitive landscape is increasingly focused on developing eco-friendly formulations with reduced VOCs and enhanced performance characteristics, with Asian manufacturers gaining market share through cost-effective production capabilities.

Kansai Paint Co., Ltd.

Technical Solution: Kansai Paint has developed comprehensive comparative analysis between acrylic and epoxy resin systems for coating applications. Their ALMATEX™ acrylic technology demonstrates superior flexibility with elongation values of 80-120% versus 1-8% for conventional epoxies, while their EPOTEC™ epoxy systems show higher tensile strength (70-90 MPa compared to 35-55 MPa for acrylics). Kansai's research indicates that acrylic systems maintain 85-90% of their mechanical properties after 5000 hours of accelerated weathering, while epoxies typically retain only 40-60%. Their proprietary hybrid coating systems incorporate silicone-modified acrylics with epoxy functionalities to achieve balanced performance profiles. Kansai has pioneered water-based versions of both technologies that maintain 80-85% of the performance of solvent-based systems while reducing VOC emissions by 70-80%. Their comparative testing methodology has become an industry benchmark for evaluating coating flexibility and strength relationships.

Strengths: Extensive application expertise in architectural and industrial coatings, strong position in Asian markets, and advanced testing capabilities for performance validation. Weaknesses: More limited presence in North American markets and higher cost structure for specialty formulations compared to local competitors.

Nippon Shokubai Co., Ltd.

Technical Solution: Nippon Shokubai has pioneered specialized acrylic resin technologies through their ARONIX™ line, featuring unique molecular architectures that enhance flexibility while maintaining good mechanical properties. Their comparative studies between acrylic and epoxy systems demonstrate that their modified acrylic resins achieve elongation values of 100-150% compared to standard epoxies at 2-7%. Their epoxy portfolio includes EPOCROS™ systems with controlled crosslinking density that balances rigidity and impact resistance. Nippon Shokubai's research indicates that while their epoxy systems exhibit higher tensile strength (65-85 MPa versus 30-50 MPa for acrylics), their proprietary acrylic formulations demonstrate superior thermal cycling resistance with 3-4x better performance in thermal shock tests. Their dual-functionality monomers enable the development of hybrid systems that combine the weatherability of acrylics with the adhesion strength of epoxies.

Strengths: Industry-leading expertise in acrylic chemistry, strong intellectual property portfolio, and specialized formulations for demanding applications. Weaknesses: Higher production costs for specialty monomers and limited global manufacturing footprint compared to larger competitors.

Key Innovations in Resin Mechanical Properties

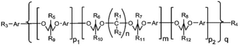

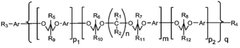

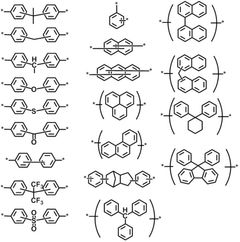

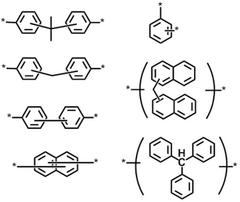

Epoxy resin composition

PatentInactiveTW201809128A

Innovation

- A specific epoxy resin composition comprising epoxy resin, hardener, and a liquid acrylic resin with controlled molecular weight, reactive functional groups, and low solvent content, ensuring compatibility and reducing modulus without impairing adhesion.

Resin composition, cured object, and laminate

PatentWO2020059305A1

Innovation

- A resin composition comprising two types of epoxy compounds with specific structures: epoxy compound A with a long alkyl chain and epoxy compound B with a low epoxy equivalent weight, providing a flexible cured product with high elongation and adhesiveness that can withstand thermal expansion differences.

Environmental Impact and Sustainability Considerations

The environmental impact of resins has become a critical consideration in material selection processes across industries. When comparing acrylic and epoxy resins from a sustainability perspective, several key differences emerge. Acrylic resins generally have a lower environmental footprint during production, requiring less energy input and generating fewer toxic byproducts. The manufacturing process for acrylics typically emits lower levels of volatile organic compounds (VOCs) compared to traditional epoxy production methods, which often involve bisphenol A (BPA) and epichlorohydrin—chemicals with recognized environmental concerns.

Waste management presents another significant distinction between these materials. Acrylic resins are thermoplastic in nature, meaning they can be melted and reformed multiple times, offering greater recyclability potential. In contrast, epoxy resins are thermoset materials that undergo irreversible chemical changes during curing, making them extremely difficult to recycle through conventional methods. This fundamental difference has substantial implications for end-of-life management and circular economy initiatives.

Water-based acrylic formulations have gained prominence as environmentally preferable alternatives, producing minimal hazardous waste and reducing worker exposure to harmful chemicals. However, these formulations typically demonstrate lower performance characteristics in terms of strength and chemical resistance compared to their epoxy counterparts, presenting a sustainability-performance tradeoff that must be carefully evaluated for specific applications.

Biodegradability remains a challenge for both resin types, with standard formulations showing high persistence in natural environments. Recent innovations have introduced partially bio-based epoxy resins derived from plant sources such as soybean oil or pine oil, reducing reliance on petroleum-based raw materials. Similarly, bio-acrylic alternatives are emerging, though they currently represent a small market segment and often come with higher production costs.

The carbon footprint analysis reveals that epoxy resins typically embody more carbon due to energy-intensive production processes and petroleum-derived raw materials. However, this higher initial environmental cost may be offset in certain applications where epoxy's superior durability significantly extends product lifespan, reducing replacement frequency and associated resource consumption. Life cycle assessment (LCA) studies indicate that application context ultimately determines which resin system offers the better environmental profile over complete product lifecycles.

Regulatory frameworks worldwide are increasingly restricting certain chemicals found in traditional epoxy formulations, particularly those containing BPA. This regulatory pressure is driving innovation toward greener alternatives in both resin categories, with manufacturers investing in research to develop formulations with reduced environmental impact while maintaining performance characteristics.

Waste management presents another significant distinction between these materials. Acrylic resins are thermoplastic in nature, meaning they can be melted and reformed multiple times, offering greater recyclability potential. In contrast, epoxy resins are thermoset materials that undergo irreversible chemical changes during curing, making them extremely difficult to recycle through conventional methods. This fundamental difference has substantial implications for end-of-life management and circular economy initiatives.

Water-based acrylic formulations have gained prominence as environmentally preferable alternatives, producing minimal hazardous waste and reducing worker exposure to harmful chemicals. However, these formulations typically demonstrate lower performance characteristics in terms of strength and chemical resistance compared to their epoxy counterparts, presenting a sustainability-performance tradeoff that must be carefully evaluated for specific applications.

Biodegradability remains a challenge for both resin types, with standard formulations showing high persistence in natural environments. Recent innovations have introduced partially bio-based epoxy resins derived from plant sources such as soybean oil or pine oil, reducing reliance on petroleum-based raw materials. Similarly, bio-acrylic alternatives are emerging, though they currently represent a small market segment and often come with higher production costs.

The carbon footprint analysis reveals that epoxy resins typically embody more carbon due to energy-intensive production processes and petroleum-derived raw materials. However, this higher initial environmental cost may be offset in certain applications where epoxy's superior durability significantly extends product lifespan, reducing replacement frequency and associated resource consumption. Life cycle assessment (LCA) studies indicate that application context ultimately determines which resin system offers the better environmental profile over complete product lifecycles.

Regulatory frameworks worldwide are increasingly restricting certain chemicals found in traditional epoxy formulations, particularly those containing BPA. This regulatory pressure is driving innovation toward greener alternatives in both resin categories, with manufacturers investing in research to develop formulations with reduced environmental impact while maintaining performance characteristics.

Application-Specific Performance Requirements

Different applications of resins demand specific performance characteristics that must be carefully evaluated when choosing between acrylic and epoxy resins. In marine environments, materials must withstand constant exposure to moisture, salt, and UV radiation. Epoxy resins demonstrate superior water resistance and long-term durability in these conditions, while acrylic resins may experience faster degradation despite their initial UV stability advantage.

For automotive applications, temperature resistance becomes critical. Epoxy resins maintain structural integrity across a wider temperature range (-60°C to 150°C typically) compared to acrylics (-30°C to 85°C), making them preferred for under-hood components. However, acrylics offer better impact resistance at moderate temperatures, making them suitable for exterior body panels and trim pieces where flexibility prevents cracking during minor impacts.

In construction and architectural applications, weather resistance and aesthetic longevity are paramount. Epoxy flooring systems provide exceptional chemical resistance and durability in industrial settings, while acrylic-based coatings offer better breathability and UV stability for exterior facades. The dimensional stability of epoxy makes it ideal for precision applications like countertops, while acrylics' faster curing time benefits time-sensitive construction projects.

Electronics manufacturing requires materials with specific electrical insulation properties. Epoxy resins excel in this domain with superior dielectric strength and thermal conductivity options, making them standard for circuit board encapsulation. Acrylic resins find their niche in optical applications where clarity and light transmission are essential, such as LED encapsulation and display components.

Medical device manufacturing presents unique requirements where biocompatibility is non-negotiable. Certain medical-grade acrylic formulations offer better tissue compatibility and optical clarity for implantable devices and diagnostic equipment. Epoxy systems, meanwhile, provide superior sterilization resistance for reusable medical equipment and instruments.

Aerospace applications demand exceptional strength-to-weight ratios and resistance to extreme conditions. Epoxy composites dominate this sector due to their superior mechanical properties when reinforced with carbon or glass fibers. Acrylic resins find limited use in non-structural components where their ease of processing and impact resistance provide advantages without compromising safety requirements.

For automotive applications, temperature resistance becomes critical. Epoxy resins maintain structural integrity across a wider temperature range (-60°C to 150°C typically) compared to acrylics (-30°C to 85°C), making them preferred for under-hood components. However, acrylics offer better impact resistance at moderate temperatures, making them suitable for exterior body panels and trim pieces where flexibility prevents cracking during minor impacts.

In construction and architectural applications, weather resistance and aesthetic longevity are paramount. Epoxy flooring systems provide exceptional chemical resistance and durability in industrial settings, while acrylic-based coatings offer better breathability and UV stability for exterior facades. The dimensional stability of epoxy makes it ideal for precision applications like countertops, while acrylics' faster curing time benefits time-sensitive construction projects.

Electronics manufacturing requires materials with specific electrical insulation properties. Epoxy resins excel in this domain with superior dielectric strength and thermal conductivity options, making them standard for circuit board encapsulation. Acrylic resins find their niche in optical applications where clarity and light transmission are essential, such as LED encapsulation and display components.

Medical device manufacturing presents unique requirements where biocompatibility is non-negotiable. Certain medical-grade acrylic formulations offer better tissue compatibility and optical clarity for implantable devices and diagnostic equipment. Epoxy systems, meanwhile, provide superior sterilization resistance for reusable medical equipment and instruments.

Aerospace applications demand exceptional strength-to-weight ratios and resistance to extreme conditions. Epoxy composites dominate this sector due to their superior mechanical properties when reinforced with carbon or glass fibers. Acrylic resins find limited use in non-structural components where their ease of processing and impact resistance provide advantages without compromising safety requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!