Advancements in Metal Powders for High-Performance Electronics

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Metal Powder Technology Evolution and Objectives

Metal powder technology has undergone significant evolution since its inception in the early 20th century. Initially limited to basic metallurgical applications, metal powders have transformed into sophisticated engineered materials with precisely controlled properties. The 1950s marked the beginning of metal powders in electronics, primarily as conductive fillers in rudimentary circuits. By the 1980s, advancements in powder metallurgy enabled the production of finer particles with improved purity, expanding their application in printed circuit boards and rudimentary components.

The last two decades have witnessed revolutionary progress in metal powder technology, driven by nanotechnology breakthroughs. The ability to manipulate particles at the nanoscale has led to metal powders with unprecedented electrical conductivity, thermal management capabilities, and integration potential. Modern manufacturing techniques such as gas atomization, electrochemical deposition, and mechanical alloying have enabled the production of powders with particle sizes ranging from several microns down to nanometers, with precisely controlled morphology and composition.

Current technological objectives focus on developing metal powders that can meet the increasingly demanding requirements of next-generation electronics. These include achieving higher conductivity-to-weight ratios, enhanced thermal stability at miniaturized scales, and compatibility with flexible and stretchable substrates. Particular emphasis is placed on powders that can maintain performance integrity under extreme conditions such as high temperatures, mechanical stress, and electromagnetic interference.

Research is actively pursuing metal powders with self-healing properties to enhance device longevity and reliability. Additionally, environmental sustainability has emerged as a critical objective, with efforts directed toward developing powders that require less energy to produce, incorporate recycled materials, and minimize the use of rare or toxic elements. The industry is also exploring bio-compatible metal powders for wearable and implantable electronic devices.

The convergence of metal powder technology with other advanced materials science fields presents promising opportunities. Integration with polymer science is enabling the development of metal-polymer composites with tailored electrical and mechanical properties. Similarly, the combination of metal powders with ceramic materials is yielding composites that offer exceptional thermal management capabilities crucial for high-performance computing applications.

Looking forward, the field aims to achieve precise control over powder characteristics at the atomic level, enabling the creation of materials with properties that can be dynamically tuned based on application requirements. This evolution trajectory positions metal powders as a cornerstone technology for the next generation of electronic devices, from quantum computing components to neuromorphic systems and beyond.

The last two decades have witnessed revolutionary progress in metal powder technology, driven by nanotechnology breakthroughs. The ability to manipulate particles at the nanoscale has led to metal powders with unprecedented electrical conductivity, thermal management capabilities, and integration potential. Modern manufacturing techniques such as gas atomization, electrochemical deposition, and mechanical alloying have enabled the production of powders with particle sizes ranging from several microns down to nanometers, with precisely controlled morphology and composition.

Current technological objectives focus on developing metal powders that can meet the increasingly demanding requirements of next-generation electronics. These include achieving higher conductivity-to-weight ratios, enhanced thermal stability at miniaturized scales, and compatibility with flexible and stretchable substrates. Particular emphasis is placed on powders that can maintain performance integrity under extreme conditions such as high temperatures, mechanical stress, and electromagnetic interference.

Research is actively pursuing metal powders with self-healing properties to enhance device longevity and reliability. Additionally, environmental sustainability has emerged as a critical objective, with efforts directed toward developing powders that require less energy to produce, incorporate recycled materials, and minimize the use of rare or toxic elements. The industry is also exploring bio-compatible metal powders for wearable and implantable electronic devices.

The convergence of metal powder technology with other advanced materials science fields presents promising opportunities. Integration with polymer science is enabling the development of metal-polymer composites with tailored electrical and mechanical properties. Similarly, the combination of metal powders with ceramic materials is yielding composites that offer exceptional thermal management capabilities crucial for high-performance computing applications.

Looking forward, the field aims to achieve precise control over powder characteristics at the atomic level, enabling the creation of materials with properties that can be dynamically tuned based on application requirements. This evolution trajectory positions metal powders as a cornerstone technology for the next generation of electronic devices, from quantum computing components to neuromorphic systems and beyond.

Market Analysis for Advanced Electronic Materials

The global market for advanced electronic materials, particularly metal powders for high-performance electronics, has experienced significant growth over the past decade. This expansion is primarily driven by the increasing demand for miniaturization, enhanced functionality, and improved reliability in electronic devices across various industries. The current market size for specialized metal powders in electronics applications is estimated at $4.2 billion, with projections indicating a compound annual growth rate of 6.8% through 2028.

Consumer electronics represents the largest application segment, accounting for approximately 38% of the total market share. This dominance stems from the continuous innovation in smartphones, tablets, and wearable devices that require advanced conductive materials for compact circuit designs. The automotive sector follows closely at 24% market share, with the rapid adoption of electric vehicles and advanced driver-assistance systems creating substantial demand for high-performance electronic components that can withstand harsh operating conditions.

Regional analysis reveals that Asia-Pacific dominates the market with 52% share, primarily due to the concentration of electronics manufacturing facilities in countries like China, Taiwan, South Korea, and Japan. North America and Europe hold 23% and 18% respectively, with their market positions strengthened by research initiatives and high-end applications in aerospace and defense sectors.

The pricing trends for advanced metal powders show considerable variation based on material composition and performance characteristics. Silver-based conductive powders command premium pricing due to their superior conductivity, while copper-based alternatives are gaining traction as cost-effective solutions. The average price point for specialized nano-metal powders has decreased by 12% over the past three years, making these materials more accessible for broader applications.

Customer segmentation analysis indicates that tier-one electronics manufacturers constitute 45% of the buyer base, followed by specialized component suppliers at 30% and research institutions at 15%. The remaining 10% comprises emerging startups focused on next-generation electronic applications. This distribution highlights the importance of establishing strategic partnerships with key industry players to secure market position.

Market barriers include stringent quality requirements, complex supply chain dynamics, and significant capital investments needed for production facilities. Additionally, environmental regulations regarding the processing and disposal of metal powders present compliance challenges that impact market entry and operational costs. Despite these obstacles, the growing demand for high-performance electronics across multiple industries continues to drive market expansion and technological innovation in metal powder development.

Consumer electronics represents the largest application segment, accounting for approximately 38% of the total market share. This dominance stems from the continuous innovation in smartphones, tablets, and wearable devices that require advanced conductive materials for compact circuit designs. The automotive sector follows closely at 24% market share, with the rapid adoption of electric vehicles and advanced driver-assistance systems creating substantial demand for high-performance electronic components that can withstand harsh operating conditions.

Regional analysis reveals that Asia-Pacific dominates the market with 52% share, primarily due to the concentration of electronics manufacturing facilities in countries like China, Taiwan, South Korea, and Japan. North America and Europe hold 23% and 18% respectively, with their market positions strengthened by research initiatives and high-end applications in aerospace and defense sectors.

The pricing trends for advanced metal powders show considerable variation based on material composition and performance characteristics. Silver-based conductive powders command premium pricing due to their superior conductivity, while copper-based alternatives are gaining traction as cost-effective solutions. The average price point for specialized nano-metal powders has decreased by 12% over the past three years, making these materials more accessible for broader applications.

Customer segmentation analysis indicates that tier-one electronics manufacturers constitute 45% of the buyer base, followed by specialized component suppliers at 30% and research institutions at 15%. The remaining 10% comprises emerging startups focused on next-generation electronic applications. This distribution highlights the importance of establishing strategic partnerships with key industry players to secure market position.

Market barriers include stringent quality requirements, complex supply chain dynamics, and significant capital investments needed for production facilities. Additionally, environmental regulations regarding the processing and disposal of metal powders present compliance challenges that impact market entry and operational costs. Despite these obstacles, the growing demand for high-performance electronics across multiple industries continues to drive market expansion and technological innovation in metal powder development.

Current Challenges in Metal Powder Processing

Despite significant advancements in metal powder technology for electronics applications, several critical challenges persist in processing methods that limit broader implementation and performance optimization. Particle size control remains a fundamental issue, as achieving consistent ultra-fine powders below 10 microns with narrow size distribution is technically demanding. Current atomization and mechanical milling techniques often produce particles with considerable size variation, leading to inconsistent electrical and thermal properties in final components.

Surface oxidation presents another significant barrier, particularly for highly reactive metals like aluminum and copper. Even minimal oxide layers can dramatically increase electrical resistance at particle interfaces, degrading overall conductivity. Conventional processing environments struggle to maintain the oxygen-free conditions necessary throughout the entire production chain, from powder creation to component fabrication.

Morphology control continues to challenge manufacturers, as irregular particle shapes create inconsistent packing densities and flow characteristics. This irregularity directly impacts the quality of printed or sintered electronic components, creating variability in performance metrics. While spherical particles are ideal for most applications, producing them consistently at scale remains costly and technically complex.

Contamination control represents a persistent challenge, with even trace impurities significantly affecting electrical performance. Current filtration and purification methods cannot always eliminate contaminants to the parts-per-billion levels required for cutting-edge electronics. Cross-contamination during handling and processing further complicates quality control efforts.

Energy consumption in metal powder production presents both economic and environmental challenges. Traditional atomization techniques require substantial energy input, with gas atomization consuming approximately 8-12 kWh per kilogram of powder produced. This high energy demand increases production costs and carbon footprint, limiting sustainability.

Scalability issues persist across the industry, as laboratory-scale processes that produce excellent powders often encounter significant challenges during industrial scaling. The complex interplay of process parameters becomes increasingly difficult to control at larger volumes, resulting in quality inconsistencies and yield reductions.

Safety concerns also remain prominent, particularly regarding the pyrophoric nature of ultra-fine metal powders. Current handling protocols and equipment designs must balance safety requirements with processing efficiency, often resulting in compromises that affect final powder quality or production rates.

Surface oxidation presents another significant barrier, particularly for highly reactive metals like aluminum and copper. Even minimal oxide layers can dramatically increase electrical resistance at particle interfaces, degrading overall conductivity. Conventional processing environments struggle to maintain the oxygen-free conditions necessary throughout the entire production chain, from powder creation to component fabrication.

Morphology control continues to challenge manufacturers, as irregular particle shapes create inconsistent packing densities and flow characteristics. This irregularity directly impacts the quality of printed or sintered electronic components, creating variability in performance metrics. While spherical particles are ideal for most applications, producing them consistently at scale remains costly and technically complex.

Contamination control represents a persistent challenge, with even trace impurities significantly affecting electrical performance. Current filtration and purification methods cannot always eliminate contaminants to the parts-per-billion levels required for cutting-edge electronics. Cross-contamination during handling and processing further complicates quality control efforts.

Energy consumption in metal powder production presents both economic and environmental challenges. Traditional atomization techniques require substantial energy input, with gas atomization consuming approximately 8-12 kWh per kilogram of powder produced. This high energy demand increases production costs and carbon footprint, limiting sustainability.

Scalability issues persist across the industry, as laboratory-scale processes that produce excellent powders often encounter significant challenges during industrial scaling. The complex interplay of process parameters becomes increasingly difficult to control at larger volumes, resulting in quality inconsistencies and yield reductions.

Safety concerns also remain prominent, particularly regarding the pyrophoric nature of ultra-fine metal powders. Current handling protocols and equipment designs must balance safety requirements with processing efficiency, often resulting in compromises that affect final powder quality or production rates.

State-of-the-Art Metal Powder Solutions

01 Production methods for metal powders

Various techniques are employed to produce metal powders with specific characteristics. These methods include atomization, mechanical milling, chemical reduction, and electrolytic deposition. Each production method yields powders with different particle sizes, shapes, and surface properties, which are crucial for their subsequent applications. The choice of production method significantly influences the final properties of the metal powder, such as flowability, compressibility, and sinterability.- Production methods for metal powders: Various methods are employed for producing metal powders, including atomization, reduction, electrolysis, and mechanical processing. These techniques control particle size, shape, and purity of the resulting powders. The production method significantly influences the properties of the final metal powder, making it suitable for specific applications in industries such as additive manufacturing, metallurgy, and electronics.

- Metal powder compositions and alloys: Metal powders can be formulated as pure metals or as alloys combining multiple metallic elements to achieve specific properties. These compositions may include iron, aluminum, copper, titanium, and precious metals, often with additives to enhance performance characteristics. The specific composition determines mechanical properties, electrical conductivity, magnetic behavior, and corrosion resistance of the final product.

- Applications in additive manufacturing and 3D printing: Metal powders are extensively used in additive manufacturing processes such as selective laser melting, electron beam melting, and direct metal laser sintering. These powders require specific flow characteristics, particle size distribution, and purity levels to ensure successful printing operations. The technology enables production of complex geometries and customized metal components with reduced material waste.

- Surface treatment and coating of metal powders: Metal powders can undergo various surface treatments to improve their properties and performance. These treatments include coating with polymers, oxides, or other metals to enhance flowability, prevent oxidation, improve sintering behavior, or add functionality. Surface-modified metal powders find applications in electronics, catalysis, and specialized industrial processes where specific surface properties are required.

- Processing and handling of metal powders: Specialized techniques for processing and handling metal powders include mixing, blending, compaction, sintering, and heat treatment. These processes require careful control of environmental conditions to prevent contamination, oxidation, or safety hazards. Equipment and methodologies have been developed to manage the unique challenges of working with fine metal particles, including dust control, explosion prevention, and uniform processing.

02 Metal powder compositions and alloys

Metal powders can be formulated as pure metals or as alloys combining multiple metallic elements to achieve enhanced properties. These compositions may include additives, binders, or surface treatments to improve specific characteristics. The alloying elements and their proportions determine key properties such as strength, corrosion resistance, magnetic properties, and thermal conductivity. Specialized compositions are developed for specific industrial applications, balancing performance requirements with processing considerations.Expand Specific Solutions03 Applications in additive manufacturing and 3D printing

Metal powders are extensively used in additive manufacturing technologies, including selective laser melting, electron beam melting, and binder jetting. The powder characteristics, such as particle size distribution, flowability, and packing density, significantly impact the quality of 3D printed parts. Specialized powders are developed to optimize build speed, surface finish, and mechanical properties of the final components. This technology enables the production of complex geometries that would be difficult or impossible to achieve with traditional manufacturing methods.Expand Specific Solutions04 Processing and treatment of metal powders

Metal powders undergo various processing and treatment steps to enhance their properties for specific applications. These processes include heat treatment, surface modification, coating, and compaction. Such treatments can improve flowability, reduce oxidation, enhance sintering behavior, or modify surface chemistry. Advanced processing techniques allow for precise control over powder characteristics, enabling the development of materials with tailored properties for demanding applications in aerospace, automotive, and medical industries.Expand Specific Solutions05 Energy storage and battery applications

Metal powders play a crucial role in energy storage technologies, particularly in battery manufacturing. Fine metal powders are used as active materials, current collectors, and conductive additives in various battery chemistries. The particle size, morphology, and surface area of these powders significantly influence battery performance metrics such as capacity, charge/discharge rates, and cycle life. Specialized metal powder formulations are developed to meet the increasing demands for higher energy density and longer-lasting energy storage solutions.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The metal powders for high-performance electronics market is currently in a growth phase, driven by increasing demand for miniaturized electronic components with enhanced performance capabilities. The global market size is expanding rapidly, estimated to reach several billion dollars by 2025, with Asia-Pacific dominating production. Technologically, the field is advancing from mature conventional powders toward innovative nanoscale materials with specialized properties. Leading players include established Japanese manufacturers like Shoei Chemical, TDK Corp., and Sumitomo Metal Mining, who possess advanced powder processing technologies. Samsung Electronics and Murata Manufacturing are driving innovation in application-specific powders, while research institutions such as Swiss Federal Institute of Technology and Shanghai Jiao Tong University are pioneering next-generation materials. The competitive landscape features increasing collaboration between material suppliers and electronics manufacturers to develop customized solutions for emerging applications.

Shoei Chemical, Inc.

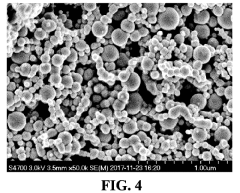

Technical Solution: Shoei Chemical has developed advanced metal powder technologies specifically engineered for high-performance electronic applications. Their proprietary manufacturing process creates ultra-fine nickel and copper particles with tightly controlled size distributions (typically 0.2-2.0μm) and spherical morphology, enabling the production of dense, uniform electrode layers in MLCCs and other electronic components. Shoei's metal powders feature specialized surface treatments that prevent agglomeration and oxidation during processing while maintaining excellent electrical conductivity. Their technology includes innovative composite metal powders that combine base metals with precisely controlled amounts of additives to enhance sintering behavior and electrical properties. Shoei Chemical has pioneered environmentally conscious production methods that reduce energy consumption by approximately 25% compared to conventional processes. Their metal powders enable the production of electronic components with up to 30% higher volumetric efficiency than previous generations, directly supporting the ongoing miniaturization trend in consumer electronics, automotive systems, and medical devices.

Strengths: Superior particle size control and morphology consistency leading to higher component reliability; advanced surface treatment technology preventing oxidation while maintaining electrical properties; cost-effective production methods enabling competitive pricing. Weaknesses: Smaller production capacity compared to some larger competitors; limited portfolio breadth compared to fully integrated electronic component manufacturers; challenges in certain emerging applications requiring novel metal compositions.

TDK Corp.

Technical Solution: TDK has developed sophisticated metal powder technologies focused on magnetic applications and electrode materials for advanced electronics. Their proprietary manufacturing processes create metal powders with precisely controlled magnetic properties, including customized coercivity values ranging from 5-500 Oe and saturation magnetization exceeding 150 emu/g. For electronic component applications, TDK produces nickel and copper-based powders with particle sizes as small as 50nm, enabling ultra-thin electrode layers in MLCCs and other passive components. Their metal powders incorporate specialized additives that enhance sintering behavior at temperatures below 900°C while maintaining excellent electrical properties. TDK has pioneered environmentally friendly powder production methods that reduce solvent usage by approximately 40% compared to conventional processes. Their advanced surface treatment technologies prevent oxidation during processing while maintaining excellent electrical conductivity (typically achieving >90% IACS). TDK's metal powders enable the production of components with up to 50% higher volumetric efficiency compared to previous generations, directly supporting the miniaturization trends in consumer electronics and automotive applications.

Strengths: Exceptional control of magnetic properties for specialized applications; advanced surface treatment technologies preventing oxidation; strong vertical integration with component manufacturing providing direct application feedback. Weaknesses: Higher production costs for specialized powder grades; some formulations remain dependent on rare earth elements; challenges in scaling production for certain advanced powder types.

Key Patents and Innovations in Powder Metallurgy

Metallic powders for use as electrode material in multilayer ceramic capacitors and methods of manufacturing and using the same

PatentPendingJP2024079671A

Innovation

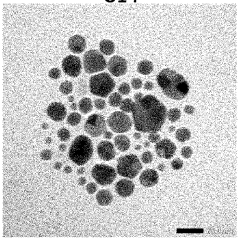

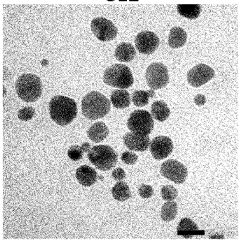

- Development of metal-based spherical particles doped with a dopant to achieve a carbon content of less than 1000 ppm, with controlled particle sizes ranging from 20 nm to 350 nm, and optimized sintering temperatures, using methods like vaporization and controlled cooling to produce compositions for MLCC electrodes.

Metal powder, method for producing said metal powder, and metal paste

PatentWO2024095821A1

Innovation

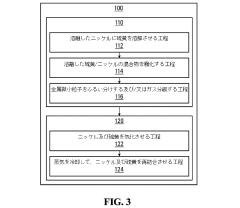

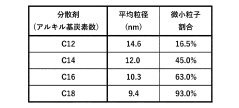

- A metal powder with a high purity of 99.9% and an average particle diameter of 0.1 μm to 0.4 μm, characterized by a non-spherical particle ratio of 1% or less, produced using a wet reduction method with optimized surfactant dispersants to minimize non-spherical and coarse particle formation.

Environmental Impact and Sustainability Considerations

The rapid advancement of metal powders in high-performance electronics brings significant environmental considerations that must be addressed for sustainable industry development. Traditional metal powder production methods often involve energy-intensive processes with substantial carbon footprints. Mining operations for raw materials can lead to habitat destruction, soil erosion, and water pollution, while refining processes frequently generate hazardous waste and emit greenhouse gases. As the electronics industry expands, these environmental impacts are increasingly scrutinized by regulators, consumers, and investors alike.

Recent innovations in metal powder manufacturing have begun addressing these concerns through more efficient production techniques. Hydrometallurgical processes are replacing pyrometallurgical methods in some applications, reducing energy consumption by up to 30% and decreasing associated carbon emissions. Additionally, closed-loop recycling systems are being implemented to recover valuable metals from electronic waste, minimizing the need for virgin material extraction and reducing landfill burden.

Water usage represents another critical environmental consideration in metal powder production. Conventional methods can consume between 10-15 gallons of water per pound of metal powder produced. Advanced filtration and water recycling technologies are now being deployed, achieving water reuse rates of 80-90% in leading facilities. These improvements significantly reduce both consumption and contaminated discharge volumes.

The toxicity of certain metal powders poses additional environmental challenges. Metals such as beryllium, cadmium, and lead present serious health and ecological risks if improperly handled or disposed of. The industry is responding by developing less toxic alternatives and implementing stricter handling protocols. For instance, copper-silver alloys are increasingly replacing beryllium copper in certain applications, offering comparable performance with reduced environmental hazards.

Life cycle assessment (LCA) studies indicate that the environmental footprint of metal powders extends beyond production to include transportation, application, and end-of-life considerations. The industry is addressing these broader impacts through initiatives like localized production to reduce transportation emissions, development of biodegradable packaging, and design for recyclability principles that facilitate material recovery at product end-of-life.

Regulatory frameworks worldwide are evolving to address these environmental concerns. The European Union's Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have significantly influenced global standards for metal powder production and application in electronics. Companies investing in environmentally responsible practices are finding competitive advantages through regulatory compliance, reduced operational costs, and enhanced brand reputation in increasingly eco-conscious markets.

Recent innovations in metal powder manufacturing have begun addressing these concerns through more efficient production techniques. Hydrometallurgical processes are replacing pyrometallurgical methods in some applications, reducing energy consumption by up to 30% and decreasing associated carbon emissions. Additionally, closed-loop recycling systems are being implemented to recover valuable metals from electronic waste, minimizing the need for virgin material extraction and reducing landfill burden.

Water usage represents another critical environmental consideration in metal powder production. Conventional methods can consume between 10-15 gallons of water per pound of metal powder produced. Advanced filtration and water recycling technologies are now being deployed, achieving water reuse rates of 80-90% in leading facilities. These improvements significantly reduce both consumption and contaminated discharge volumes.

The toxicity of certain metal powders poses additional environmental challenges. Metals such as beryllium, cadmium, and lead present serious health and ecological risks if improperly handled or disposed of. The industry is responding by developing less toxic alternatives and implementing stricter handling protocols. For instance, copper-silver alloys are increasingly replacing beryllium copper in certain applications, offering comparable performance with reduced environmental hazards.

Life cycle assessment (LCA) studies indicate that the environmental footprint of metal powders extends beyond production to include transportation, application, and end-of-life considerations. The industry is addressing these broader impacts through initiatives like localized production to reduce transportation emissions, development of biodegradable packaging, and design for recyclability principles that facilitate material recovery at product end-of-life.

Regulatory frameworks worldwide are evolving to address these environmental concerns. The European Union's Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have significantly influenced global standards for metal powder production and application in electronics. Companies investing in environmentally responsible practices are finding competitive advantages through regulatory compliance, reduced operational costs, and enhanced brand reputation in increasingly eco-conscious markets.

Supply Chain Resilience for Critical Metal Powders

The global supply chain for critical metal powders used in high-performance electronics faces significant vulnerabilities that require strategic management. Recent disruptions, including the COVID-19 pandemic, geopolitical tensions, and natural disasters, have exposed the fragility of existing supply networks for rare earth elements, precious metals, and specialized alloy powders essential for advanced electronic components.

Key vulnerabilities in the supply chain include geographic concentration of production, with China controlling approximately 85% of rare earth processing capacity and significant portions of other critical metal powder production. This concentration creates single points of failure that can cascade through the entire electronics manufacturing ecosystem when disrupted.

Trade restrictions and export controls have emerged as additional risk factors, with nations increasingly viewing metal powders as strategic resources. The semiconductor industry, which relies heavily on specialized metal powders for interconnects and packaging, has experienced severe shortages resulting in production delays and price volatility across the electronics sector.

Environmental regulations present another challenge, as extraction and processing of metal powders often involve environmentally intensive processes. Stricter regulations in various jurisdictions create regulatory arbitrage opportunities but also compliance challenges for global supply chains.

Industry leaders are implementing multi-faceted resilience strategies in response. Diversification of suppliers across multiple geographic regions has become standard practice, with companies developing relationships with producers in Australia, Vietnam, and African nations to reduce dependence on traditional sources. Strategic stockpiling of critical metal powders has increased, with manufacturers maintaining 6-12 month reserves of essential materials, compared to the previous just-in-time inventory models.

Recycling and circular economy initiatives are gaining traction, with advanced recovery techniques now able to reclaim up to 95% of certain precious metals from electronic waste. These approaches not only enhance supply security but also address sustainability concerns.

Vertical integration has emerged as another resilience strategy, with major electronics manufacturers acquiring stakes in mining operations and processing facilities to ensure preferential access to critical materials. This approach provides greater control over quality specifications critical for high-performance applications.

International cooperation frameworks are developing to address supply chain vulnerabilities collectively, including the EU's Critical Raw Materials Act and similar initiatives in North America and the Indo-Pacific region, which aim to coordinate stockpiling, investment, and emergency response mechanisms for critical metal powders.

Key vulnerabilities in the supply chain include geographic concentration of production, with China controlling approximately 85% of rare earth processing capacity and significant portions of other critical metal powder production. This concentration creates single points of failure that can cascade through the entire electronics manufacturing ecosystem when disrupted.

Trade restrictions and export controls have emerged as additional risk factors, with nations increasingly viewing metal powders as strategic resources. The semiconductor industry, which relies heavily on specialized metal powders for interconnects and packaging, has experienced severe shortages resulting in production delays and price volatility across the electronics sector.

Environmental regulations present another challenge, as extraction and processing of metal powders often involve environmentally intensive processes. Stricter regulations in various jurisdictions create regulatory arbitrage opportunities but also compliance challenges for global supply chains.

Industry leaders are implementing multi-faceted resilience strategies in response. Diversification of suppliers across multiple geographic regions has become standard practice, with companies developing relationships with producers in Australia, Vietnam, and African nations to reduce dependence on traditional sources. Strategic stockpiling of critical metal powders has increased, with manufacturers maintaining 6-12 month reserves of essential materials, compared to the previous just-in-time inventory models.

Recycling and circular economy initiatives are gaining traction, with advanced recovery techniques now able to reclaim up to 95% of certain precious metals from electronic waste. These approaches not only enhance supply security but also address sustainability concerns.

Vertical integration has emerged as another resilience strategy, with major electronics manufacturers acquiring stakes in mining operations and processing facilities to ensure preferential access to critical materials. This approach provides greater control over quality specifications critical for high-performance applications.

International cooperation frameworks are developing to address supply chain vulnerabilities collectively, including the EU's Critical Raw Materials Act and similar initiatives in North America and the Indo-Pacific region, which aim to coordinate stockpiling, investment, and emergency response mechanisms for critical metal powders.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!