Metal Powders in Reducing Environmental Footprint of Aerospace

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Metal Powder Technology Background and Objectives

Metal powder technology has evolved significantly over the past decades, transforming from conventional manufacturing methods to advanced powder metallurgy techniques. The aerospace industry has traditionally been characterized by high material waste rates, energy-intensive manufacturing processes, and significant carbon emissions. Metal powder technologies emerged in the mid-20th century primarily for specialized applications but have gained substantial momentum since the early 2000s with the advancement of additive manufacturing technologies.

The evolution trajectory shows a clear shift from simple sintering processes to sophisticated powder bed fusion and directed energy deposition methods. This progression has been driven by increasing demands for lightweight components, complex geometries, and improved material performance in aerospace applications. The technology has matured considerably, with powder characteristics such as particle size distribution, morphology, and chemical composition becoming increasingly controlled and tailored for specific applications.

Current market trends indicate a growing adoption of metal powder technologies across various aerospace subsectors, including propulsion systems, structural components, and thermal management systems. The global push toward more sustainable aviation has accelerated research and development in this field, with particular emphasis on reducing material waste and energy consumption during manufacturing processes.

The primary objective of metal powder technology in aerospace applications is to significantly reduce the environmental footprint while maintaining or enhancing performance characteristics. Specific goals include achieving near-net-shape manufacturing to minimize material waste, reducing energy consumption during component production by at least 30% compared to traditional methods, and enabling design optimization for weight reduction without compromising structural integrity.

Additional objectives include developing closed-loop material recycling systems for metal powders, extending component lifecycles through improved material properties, and creating manufacturing processes with lower overall carbon emissions. These goals align with broader industry initiatives such as the Air Transport Action Group's commitment to reduce aviation's net carbon emissions by 50% by 2050.

The technology aims to address critical environmental challenges in aerospace manufacturing, including the high buy-to-fly ratios (often exceeding 10:1) in conventional machining processes, energy-intensive heat treatments, and limited recyclability of complex alloy systems. By leveraging the precise material placement capabilities of powder-based technologies, the industry seeks to create a more sustainable manufacturing paradigm.

Future technological objectives include developing new alloy systems specifically designed for powder-based processes, improving powder production methods to reduce energy requirements, and creating integrated computational tools for optimizing both component design and manufacturing parameters simultaneously.

The evolution trajectory shows a clear shift from simple sintering processes to sophisticated powder bed fusion and directed energy deposition methods. This progression has been driven by increasing demands for lightweight components, complex geometries, and improved material performance in aerospace applications. The technology has matured considerably, with powder characteristics such as particle size distribution, morphology, and chemical composition becoming increasingly controlled and tailored for specific applications.

Current market trends indicate a growing adoption of metal powder technologies across various aerospace subsectors, including propulsion systems, structural components, and thermal management systems. The global push toward more sustainable aviation has accelerated research and development in this field, with particular emphasis on reducing material waste and energy consumption during manufacturing processes.

The primary objective of metal powder technology in aerospace applications is to significantly reduce the environmental footprint while maintaining or enhancing performance characteristics. Specific goals include achieving near-net-shape manufacturing to minimize material waste, reducing energy consumption during component production by at least 30% compared to traditional methods, and enabling design optimization for weight reduction without compromising structural integrity.

Additional objectives include developing closed-loop material recycling systems for metal powders, extending component lifecycles through improved material properties, and creating manufacturing processes with lower overall carbon emissions. These goals align with broader industry initiatives such as the Air Transport Action Group's commitment to reduce aviation's net carbon emissions by 50% by 2050.

The technology aims to address critical environmental challenges in aerospace manufacturing, including the high buy-to-fly ratios (often exceeding 10:1) in conventional machining processes, energy-intensive heat treatments, and limited recyclability of complex alloy systems. By leveraging the precise material placement capabilities of powder-based technologies, the industry seeks to create a more sustainable manufacturing paradigm.

Future technological objectives include developing new alloy systems specifically designed for powder-based processes, improving powder production methods to reduce energy requirements, and creating integrated computational tools for optimizing both component design and manufacturing parameters simultaneously.

Aerospace Industry Demand Analysis

The aerospace industry is experiencing a significant shift towards more sustainable practices, driven by increasing environmental regulations, corporate sustainability goals, and consumer demand for greener transportation options. This transformation has created a substantial market demand for metal powder technologies that can reduce the environmental footprint of aerospace manufacturing and operations.

Current market analysis indicates that the global aerospace industry, valued at approximately $298 billion in 2022, is projected to grow at a compound annual growth rate of 7.2% through 2030. Within this expanding market, the demand for sustainable materials and manufacturing processes is growing at an even faster rate of 9.5% annually, highlighting the industry's commitment to environmental stewardship.

The primary market drivers for metal powder technologies in aerospace include weight reduction requirements, fuel efficiency improvements, and emissions regulations. Aircraft manufacturers are under increasing pressure to meet stringent environmental targets, with the International Air Transport Association (IATA) committing to net-zero carbon emissions by 2050. This has created immediate demand for materials and processes that can contribute to these goals.

Metal powder applications, particularly in additive manufacturing, are seeing strong demand growth due to their ability to create complex, lightweight components that reduce aircraft weight and consequently fuel consumption. Market research indicates that for every 1% reduction in aircraft weight, fuel consumption decreases by approximately 0.75%, translating to significant emissions reductions over an aircraft's operational lifetime.

Regional market analysis shows varying adoption rates, with North America and Europe leading in implementation of metal powder technologies, while Asia-Pacific represents the fastest-growing market segment with 11.3% annual growth. This regional variation is largely influenced by differences in regulatory frameworks and industry maturity.

Customer segmentation reveals that major aircraft manufacturers (OEMs) constitute 62% of the market demand for metal powder technologies, followed by tier-one suppliers at 28%, and maintenance, repair, and overhaul (MRO) services at 10%. This distribution highlights the importance of targeting OEMs in market entry strategies.

Future market projections indicate that demand for metal powder technologies in aerospace will continue to accelerate as sustainability becomes increasingly central to industry operations. The market for sustainable aerospace materials is expected to triple by 2030, with metal powders playing a crucial role in this growth due to their versatility and environmental benefits compared to traditional manufacturing methods.

Current market analysis indicates that the global aerospace industry, valued at approximately $298 billion in 2022, is projected to grow at a compound annual growth rate of 7.2% through 2030. Within this expanding market, the demand for sustainable materials and manufacturing processes is growing at an even faster rate of 9.5% annually, highlighting the industry's commitment to environmental stewardship.

The primary market drivers for metal powder technologies in aerospace include weight reduction requirements, fuel efficiency improvements, and emissions regulations. Aircraft manufacturers are under increasing pressure to meet stringent environmental targets, with the International Air Transport Association (IATA) committing to net-zero carbon emissions by 2050. This has created immediate demand for materials and processes that can contribute to these goals.

Metal powder applications, particularly in additive manufacturing, are seeing strong demand growth due to their ability to create complex, lightweight components that reduce aircraft weight and consequently fuel consumption. Market research indicates that for every 1% reduction in aircraft weight, fuel consumption decreases by approximately 0.75%, translating to significant emissions reductions over an aircraft's operational lifetime.

Regional market analysis shows varying adoption rates, with North America and Europe leading in implementation of metal powder technologies, while Asia-Pacific represents the fastest-growing market segment with 11.3% annual growth. This regional variation is largely influenced by differences in regulatory frameworks and industry maturity.

Customer segmentation reveals that major aircraft manufacturers (OEMs) constitute 62% of the market demand for metal powder technologies, followed by tier-one suppliers at 28%, and maintenance, repair, and overhaul (MRO) services at 10%. This distribution highlights the importance of targeting OEMs in market entry strategies.

Future market projections indicate that demand for metal powder technologies in aerospace will continue to accelerate as sustainability becomes increasingly central to industry operations. The market for sustainable aerospace materials is expected to triple by 2030, with metal powders playing a crucial role in this growth due to their versatility and environmental benefits compared to traditional manufacturing methods.

Current Status and Technical Challenges

The global aerospace industry is currently experiencing a significant shift towards more sustainable manufacturing processes, with metal powder technologies emerging as a key enabler in reducing environmental footprints. Current adoption rates of metal powders in aerospace applications vary significantly across different regions, with North America and Europe leading implementation, while Asia-Pacific markets are rapidly accelerating their adoption curves.

Metal powder technologies have reached varying levels of maturity across different aerospace applications. Powder metallurgy processes for non-critical components have achieved widespread commercial implementation, while more advanced applications such as additive manufacturing for critical structural components remain in developmental or early adoption phases. Recent advancements in powder characterization and quality control have significantly improved reliability, addressing previous concerns about mechanical property consistency.

Despite promising progress, several technical challenges persist in the widespread adoption of metal powders for environmentally sustainable aerospace manufacturing. Powder production methods still require substantial energy inputs, with atomization processes consuming significant electricity. The environmental benefits gained in final product lifecycle must be balanced against the energy-intensive powder production phase. Additionally, the aerospace industry faces challenges in recycling and reusing metal powders without compromising material integrity, particularly for safety-critical applications.

Material property variability remains a significant technical hurdle, especially for high-performance aerospace applications. Inconsistencies in particle size distribution, morphology, and chemical composition can lead to unpredictable mechanical properties in final components. This variability is particularly problematic for flight-critical parts subject to extreme operational conditions and stringent certification requirements.

Scaling production while maintaining quality presents another major challenge. Current high-quality powder production capacities struggle to meet increasing demand from aerospace manufacturers transitioning to more sustainable manufacturing methods. The specialized equipment required for aerospace-grade powder production represents a significant capital investment barrier for new market entrants.

Regulatory frameworks and certification pathways for components manufactured using metal powder technologies remain underdeveloped in many jurisdictions. The aerospace industry's necessarily conservative approach to new materials and processes creates additional barriers to rapid adoption, even when environmental benefits are clearly demonstrated. Certification processes typically require extensive testing and validation, adding significant time and cost to implementation timelines.

Metal powder technologies have reached varying levels of maturity across different aerospace applications. Powder metallurgy processes for non-critical components have achieved widespread commercial implementation, while more advanced applications such as additive manufacturing for critical structural components remain in developmental or early adoption phases. Recent advancements in powder characterization and quality control have significantly improved reliability, addressing previous concerns about mechanical property consistency.

Despite promising progress, several technical challenges persist in the widespread adoption of metal powders for environmentally sustainable aerospace manufacturing. Powder production methods still require substantial energy inputs, with atomization processes consuming significant electricity. The environmental benefits gained in final product lifecycle must be balanced against the energy-intensive powder production phase. Additionally, the aerospace industry faces challenges in recycling and reusing metal powders without compromising material integrity, particularly for safety-critical applications.

Material property variability remains a significant technical hurdle, especially for high-performance aerospace applications. Inconsistencies in particle size distribution, morphology, and chemical composition can lead to unpredictable mechanical properties in final components. This variability is particularly problematic for flight-critical parts subject to extreme operational conditions and stringent certification requirements.

Scaling production while maintaining quality presents another major challenge. Current high-quality powder production capacities struggle to meet increasing demand from aerospace manufacturers transitioning to more sustainable manufacturing methods. The specialized equipment required for aerospace-grade powder production represents a significant capital investment barrier for new market entrants.

Regulatory frameworks and certification pathways for components manufactured using metal powder technologies remain underdeveloped in many jurisdictions. The aerospace industry's necessarily conservative approach to new materials and processes creates additional barriers to rapid adoption, even when environmental benefits are clearly demonstrated. Certification processes typically require extensive testing and validation, adding significant time and cost to implementation timelines.

Current Metal Powder Solutions for Aerospace

01 Life Cycle Assessment of Metal Powder Production

Methods and systems for evaluating the environmental impact of metal powder manufacturing processes through life cycle assessment (LCA). These approaches analyze energy consumption, resource utilization, emissions, and waste generation throughout the production chain. The assessment helps identify environmental hotspots and opportunities for reducing the environmental footprint of metal powder production.- Life cycle assessment of metal powder production: Life cycle assessment methodologies are used to evaluate the environmental footprint of metal powder production processes. These assessments consider various environmental impacts including energy consumption, greenhouse gas emissions, resource depletion, and waste generation throughout the entire production chain. By analyzing these factors, manufacturers can identify opportunities to reduce environmental impacts and develop more sustainable metal powder production methods.

- Sustainable metal powder manufacturing techniques: Innovative manufacturing techniques have been developed to reduce the environmental footprint of metal powder production. These include energy-efficient atomization processes, recycling of process water, waste heat recovery systems, and optimization of particle size distribution to minimize material waste. These sustainable manufacturing approaches help to decrease energy consumption, reduce emissions, and minimize resource utilization in metal powder production.

- Recycling and reuse of metal powders: Recycling and reuse strategies for metal powders significantly reduce their environmental footprint. These approaches include collection systems for unused powders, reconditioning processes for partially used materials, and methods to reprocess manufacturing scrap. By implementing closed-loop recycling systems, manufacturers can decrease raw material consumption, reduce waste generation, and lower the overall environmental impact of metal powder applications.

- Environmental monitoring and reporting systems: Advanced monitoring and reporting systems have been developed to track the environmental footprint of metal powder production and use. These systems collect data on energy consumption, emissions, waste generation, and resource utilization throughout the production process. The collected information enables manufacturers to identify environmental hotspots, implement targeted improvements, and demonstrate compliance with environmental regulations and sustainability standards.

- Alternative production methods with reduced environmental impact: Alternative methods for metal powder production have been developed to reduce environmental impact. These include water-based processes that eliminate the need for harmful solvents, low-temperature production techniques that reduce energy consumption, and direct reduction processes that minimize CO2 emissions. These innovative approaches offer significant environmental benefits compared to conventional metal powder production methods while maintaining or improving product quality and performance characteristics.

02 Sustainable Metal Powder Manufacturing Processes

Innovative manufacturing techniques for metal powders that reduce environmental impact through improved energy efficiency, reduced emissions, and minimized waste generation. These processes include optimized atomization methods, recycling of process materials, and utilization of renewable energy sources. The sustainable manufacturing approaches aim to decrease the carbon footprint associated with metal powder production.Expand Specific Solutions03 Recycling and Recovery of Metal Powders

Technologies and methods for recycling and recovering metal powders from manufacturing waste, end-of-life products, and industrial byproducts. These approaches include collection systems, separation techniques, purification processes, and reprocessing methods that enable the reuse of metal powders. Recycling reduces the need for virgin material extraction and processing, thereby lowering the overall environmental footprint.Expand Specific Solutions04 Environmental Impact Monitoring and Reporting Systems

Systems and methods for monitoring, measuring, and reporting the environmental impact of metal powder production and use. These include sensors, data collection platforms, analytics tools, and reporting frameworks that track emissions, energy use, waste generation, and other environmental parameters. Such systems enable companies to document their environmental performance and identify areas for improvement.Expand Specific Solutions05 Eco-friendly Metal Powder Formulations

Development of metal powder formulations with reduced environmental impact, including powders with lower toxicity, improved biodegradability, or enhanced functional properties that reduce resource consumption during use. These formulations may incorporate alternative materials, additives that reduce environmental harm, or compositions that enable more efficient application while maintaining or improving performance characteristics.Expand Specific Solutions

Key Industry Players and Competition

The metal powder market for aerospace environmental footprint reduction is in a growth phase, with increasing adoption driven by sustainability demands. The market is expanding as aerospace manufacturers seek lightweight, durable materials to reduce fuel consumption and emissions. Technologically, the field shows varying maturity levels across applications. Leading players include RTX Corp. and Safran SA, who leverage metal powders for advanced manufacturing, while Carpenter Technology and Höganäs AB provide specialized powder materials. Desktop Metal and Divergent Technologies are advancing additive manufacturing capabilities, with research institutions like National Research Council of Canada and Korea Institute of Industrial Technology supporting innovation through collaborative R&D efforts to optimize metal powder applications for aerospace sustainability.

RTX Corp.

Technical Solution: RTX Corp. (formerly Raytheon Technologies) has developed advanced metal powder technologies specifically for aerospace applications with environmental benefits. Their approach centers on additive manufacturing using specialized metal powders that enable significant weight reduction in aircraft components. RTX's Pratt & Whitney division has pioneered the use of titanium and nickel-based superalloy powders in additive manufacturing processes that reduce material waste by up to 90% compared to traditional subtractive manufacturing methods[1]. The company has also developed proprietary powder processing techniques that allow for the creation of complex geometries impossible with conventional manufacturing, resulting in components that are 30-40% lighter while maintaining or exceeding performance requirements[2]. Their metal powder solutions incorporate recycled content where possible, and their manufacturing processes are designed to capture and reuse unused powder, creating a more circular material flow system within aerospace manufacturing.

Strengths: Extensive aerospace industry expertise and established supply chains; proprietary powder formulations optimized for high-performance applications; integrated approach combining materials science with manufacturing technology. Weaknesses: Higher initial costs compared to conventional materials; requires specialized equipment and training; some proprietary powders have limited recyclability at end-of-life.

Safran SA

Technical Solution: Safran SA has developed innovative metal powder solutions specifically targeting environmental footprint reduction in aerospace applications. Their technology centers on advanced aluminum-lithium and titanium-based powder metallurgy processes that enable the production of complex, lightweight components with minimal waste. Safran's LEAP engine program incorporates metal powder-based components that contribute to a 15% reduction in fuel consumption and CO2 emissions compared to previous generation engines[3]. The company utilizes a proprietary atomization process that produces spherical metal powders with optimal flow characteristics for additive manufacturing, resulting in components with superior mechanical properties while using 25-30% less raw material than conventional manufacturing methods[4]. Safran has also pioneered closed-loop recycling systems for their metal powders, recovering and reprocessing unused powder and manufacturing scrap to minimize environmental impact throughout the product lifecycle.

Strengths: Deep integration with aerospace supply chains; proven implementation in commercial aircraft engines; comprehensive lifecycle approach to material management. Weaknesses: High energy requirements for powder production; limited application in certain high-stress components; technology requires significant capital investment for implementation.

Critical Patents and Technical Innovations

Surface Additive For Three-Dimensional Metal Printing Compositions

PatentActiveUS20200306830A1

Innovation

- A polymeric surface additive prepared by emulsion polymerization is applied to the 3D metal printing powder, which improves flow and blocking performance, and is compatible with the powder's chemistry, allowing for high-density and strong parts without leaving contaminants behind during the sintering process.

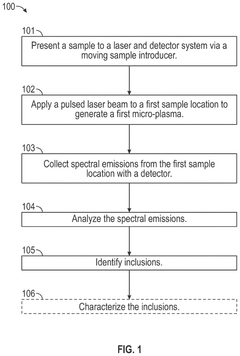

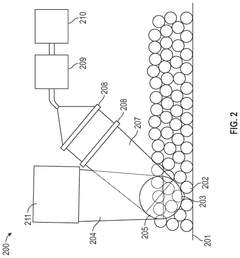

Method for rapid characterization of metallic powders

PatentPendingUS20250231113A1

Innovation

- A method utilizing a laser and detector system to generate micro-plasmas in metallic powder samples, analyze spectral emissions, and identify inclusions, including non-metallic and off-chemistry particles, with optional additional spectroscopy systems for enhanced characterization.

Sustainability Metrics and Environmental Impact Assessment

Assessing the sustainability impact of metal powders in aerospace applications requires comprehensive metrics and evaluation frameworks. Life Cycle Assessment (LCA) serves as the primary methodology for quantifying environmental impacts across the entire value chain, from raw material extraction to end-of-life disposal. When evaluating metal powder technologies, key indicators include greenhouse gas emissions (measured in CO2 equivalent), energy consumption (MJ), water usage (gallons), and waste generation (kg). These metrics provide a standardized approach to compare traditional manufacturing with powder metallurgy processes.

Carbon footprint analysis reveals that metal powder-based additive manufacturing can reduce CO2 emissions by 25-40% compared to conventional aerospace manufacturing methods. This reduction stems primarily from material efficiency improvements and the elimination of energy-intensive intermediate processing steps. Energy intensity metrics further demonstrate that powder-based processes typically consume 15-30% less energy across the production lifecycle, with particularly significant savings during the component fabrication phase.

Resource efficiency indicators show promising results for metal powder applications, with material utilization rates reaching 95-98% in advanced powder bed fusion systems, compared to 60-70% in traditional subtractive manufacturing. Water consumption metrics indicate a 30-50% reduction in water usage, particularly significant in titanium and nickel-based superalloy processing chains where conventional methods require substantial cooling and cleaning operations.

Environmental toxicity assessments must consider the potential hazards associated with fine metal powders, including specialized metrics for particulate emissions and occupational exposure limits. However, closed-loop powder recycling systems have demonstrated the ability to recover and reuse up to 95% of unused powders, significantly reducing waste generation and associated environmental impacts.

Standardization efforts by organizations such as ASTM International and the International Organization for Standardization (ISO) have established frameworks for sustainability reporting in aerospace manufacturing. These include the Aerospace Sector Supplement to the Global Reporting Initiative (GRI) and the recently developed ISO 14064 standards for quantifying and reporting greenhouse gas emissions specific to advanced manufacturing processes.

Economic sustainability metrics complement environmental assessments by evaluating total cost of ownership, including considerations for reduced material waste, decreased energy consumption, and potential weight savings in final components. These integrated metrics demonstrate that metal powder technologies can deliver both environmental and economic benefits when properly implemented in aerospace applications.

Carbon footprint analysis reveals that metal powder-based additive manufacturing can reduce CO2 emissions by 25-40% compared to conventional aerospace manufacturing methods. This reduction stems primarily from material efficiency improvements and the elimination of energy-intensive intermediate processing steps. Energy intensity metrics further demonstrate that powder-based processes typically consume 15-30% less energy across the production lifecycle, with particularly significant savings during the component fabrication phase.

Resource efficiency indicators show promising results for metal powder applications, with material utilization rates reaching 95-98% in advanced powder bed fusion systems, compared to 60-70% in traditional subtractive manufacturing. Water consumption metrics indicate a 30-50% reduction in water usage, particularly significant in titanium and nickel-based superalloy processing chains where conventional methods require substantial cooling and cleaning operations.

Environmental toxicity assessments must consider the potential hazards associated with fine metal powders, including specialized metrics for particulate emissions and occupational exposure limits. However, closed-loop powder recycling systems have demonstrated the ability to recover and reuse up to 95% of unused powders, significantly reducing waste generation and associated environmental impacts.

Standardization efforts by organizations such as ASTM International and the International Organization for Standardization (ISO) have established frameworks for sustainability reporting in aerospace manufacturing. These include the Aerospace Sector Supplement to the Global Reporting Initiative (GRI) and the recently developed ISO 14064 standards for quantifying and reporting greenhouse gas emissions specific to advanced manufacturing processes.

Economic sustainability metrics complement environmental assessments by evaluating total cost of ownership, including considerations for reduced material waste, decreased energy consumption, and potential weight savings in final components. These integrated metrics demonstrate that metal powder technologies can deliver both environmental and economic benefits when properly implemented in aerospace applications.

Supply Chain Resilience and Raw Material Considerations

The aerospace industry's reliance on metal powders for additive manufacturing and other applications necessitates a robust supply chain strategy to ensure operational continuity while meeting environmental objectives. Current supply chains for critical metal powders such as titanium, aluminum alloys, and nickel-based superalloys face significant vulnerabilities due to geopolitical tensions, trade restrictions, and concentration of raw material sources in specific regions. For instance, titanium extraction is predominantly controlled by a handful of countries, creating potential bottlenecks during global disruptions.

Raw material considerations must balance performance requirements with environmental impact. The extraction and processing of metals for aerospace-grade powders traditionally involves energy-intensive processes with substantial carbon footprints. Companies are increasingly implementing diversification strategies, establishing relationships with multiple suppliers across different geographical regions to mitigate supply risks. This approach, while effective for resilience, can sometimes conflict with environmental goals if it increases transportation emissions or involves suppliers with less stringent environmental standards.

Vertical integration has emerged as a strategic approach for leading aerospace manufacturers, with companies investing in their own powder production facilities to ensure quality control and supply security. This integration allows for greater oversight of environmental practices throughout the value chain. Simultaneously, the industry is witnessing the development of circular economy initiatives focused on metal powder recycling and reuse, which significantly reduces the need for virgin materials while maintaining the high-quality standards required for aerospace applications.

Advanced inventory management systems utilizing predictive analytics are being deployed to optimize stock levels of critical metal powders, reducing waste while ensuring availability. These systems can anticipate supply disruptions and adjust procurement strategies accordingly, balancing just-in-time manufacturing needs with supply security concerns.

The qualification and certification of alternative suppliers and materials represents another critical aspect of supply chain resilience. Aerospace manufacturers are working with regulatory bodies to streamline approval processes for new material sources without compromising safety standards, potentially opening doors to more environmentally responsible suppliers. This includes developing standardized testing protocols for recycled metal powders to verify their suitability for critical aerospace applications.

Long-term supply agreements with sustainability clauses are becoming more common, incentivizing suppliers to reduce their environmental impact through renewable energy adoption, water conservation, and waste reduction initiatives. These agreements provide stability for both parties while advancing industry-wide environmental goals and creating a more resilient, sustainable supply ecosystem for the aerospace sector's metal powder requirements.

Raw material considerations must balance performance requirements with environmental impact. The extraction and processing of metals for aerospace-grade powders traditionally involves energy-intensive processes with substantial carbon footprints. Companies are increasingly implementing diversification strategies, establishing relationships with multiple suppliers across different geographical regions to mitigate supply risks. This approach, while effective for resilience, can sometimes conflict with environmental goals if it increases transportation emissions or involves suppliers with less stringent environmental standards.

Vertical integration has emerged as a strategic approach for leading aerospace manufacturers, with companies investing in their own powder production facilities to ensure quality control and supply security. This integration allows for greater oversight of environmental practices throughout the value chain. Simultaneously, the industry is witnessing the development of circular economy initiatives focused on metal powder recycling and reuse, which significantly reduces the need for virgin materials while maintaining the high-quality standards required for aerospace applications.

Advanced inventory management systems utilizing predictive analytics are being deployed to optimize stock levels of critical metal powders, reducing waste while ensuring availability. These systems can anticipate supply disruptions and adjust procurement strategies accordingly, balancing just-in-time manufacturing needs with supply security concerns.

The qualification and certification of alternative suppliers and materials represents another critical aspect of supply chain resilience. Aerospace manufacturers are working with regulatory bodies to streamline approval processes for new material sources without compromising safety standards, potentially opening doors to more environmentally responsible suppliers. This includes developing standardized testing protocols for recycled metal powders to verify their suitability for critical aerospace applications.

Long-term supply agreements with sustainability clauses are becoming more common, incentivizing suppliers to reduce their environmental impact through renewable energy adoption, water conservation, and waste reduction initiatives. These agreements provide stability for both parties while advancing industry-wide environmental goals and creating a more resilient, sustainable supply ecosystem for the aerospace sector's metal powder requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!