Anode Performance Enhancement with Metal Powders in EV Batteries

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Metal Powder Anode Technology Evolution and Objectives

The evolution of anode technology in lithium-ion batteries has undergone significant transformation since the commercialization of these energy storage systems in the early 1990s. Initially dominated by graphite-based materials, anode technology has progressively expanded to incorporate various metal powders to address the increasing energy density demands of electric vehicles (EVs). This technological progression has been driven by the fundamental limitations of traditional graphite anodes, which possess a theoretical capacity of only 372 mAh/g, insufficient for next-generation high-energy-density applications.

Metal powder incorporation into anode materials represents a pivotal advancement in battery technology, with silicon, tin, aluminum, and lithium metal emerging as prominent candidates. Silicon, with its remarkable theoretical capacity of approximately 4,200 mAh/g, has attracted substantial research attention despite challenges related to volume expansion and cycling stability. The integration of metal powders into anode formulations has evolved from simple mixing approaches to sophisticated nanostructuring and composite formation techniques.

The technological trajectory has witnessed several distinct phases: early experimentation with metal additives (2000-2010), development of nano-engineered metal-carbon composites (2010-2015), advancement of stabilized metal-silicon alloys (2015-2020), and the current focus on hierarchical multi-metal systems with tailored interfaces (2020-present). Each phase has contributed to incremental improvements in capacity, cycle life, and rate capability of EV battery systems.

The primary objective of metal powder anode technology development is to achieve a balance between high energy density and operational stability. Specifically, researchers aim to develop anodes with practical capacities exceeding 1,000 mAh/g while maintaining 80% capacity retention over 1,000 cycles—a benchmark necessary for widespread EV adoption. Additional technical goals include improving fast-charging capabilities, enhancing low-temperature performance, and ensuring safety under various operational conditions.

Current research trends indicate a convergence toward multi-component systems that leverage synergistic effects between different metal powders. These advanced formulations seek to mitigate the individual limitations of each metal while capitalizing on their respective strengths. The integration of nanoscale engineering with precise control over particle morphology, size distribution, and surface chemistry has emerged as a critical approach to optimizing metal powder performance in anode applications.

Looking forward, the technology roadmap for metal powder anodes in EV batteries aims to achieve commercial viability of silicon-dominant anodes by 2025, with metal alloy systems projected to enter mass production by 2030. These developments align with the broader industry objective of doubling current EV ranges while reducing battery costs by 40% within the next decade.

Metal powder incorporation into anode materials represents a pivotal advancement in battery technology, with silicon, tin, aluminum, and lithium metal emerging as prominent candidates. Silicon, with its remarkable theoretical capacity of approximately 4,200 mAh/g, has attracted substantial research attention despite challenges related to volume expansion and cycling stability. The integration of metal powders into anode formulations has evolved from simple mixing approaches to sophisticated nanostructuring and composite formation techniques.

The technological trajectory has witnessed several distinct phases: early experimentation with metal additives (2000-2010), development of nano-engineered metal-carbon composites (2010-2015), advancement of stabilized metal-silicon alloys (2015-2020), and the current focus on hierarchical multi-metal systems with tailored interfaces (2020-present). Each phase has contributed to incremental improvements in capacity, cycle life, and rate capability of EV battery systems.

The primary objective of metal powder anode technology development is to achieve a balance between high energy density and operational stability. Specifically, researchers aim to develop anodes with practical capacities exceeding 1,000 mAh/g while maintaining 80% capacity retention over 1,000 cycles—a benchmark necessary for widespread EV adoption. Additional technical goals include improving fast-charging capabilities, enhancing low-temperature performance, and ensuring safety under various operational conditions.

Current research trends indicate a convergence toward multi-component systems that leverage synergistic effects between different metal powders. These advanced formulations seek to mitigate the individual limitations of each metal while capitalizing on their respective strengths. The integration of nanoscale engineering with precise control over particle morphology, size distribution, and surface chemistry has emerged as a critical approach to optimizing metal powder performance in anode applications.

Looking forward, the technology roadmap for metal powder anodes in EV batteries aims to achieve commercial viability of silicon-dominant anodes by 2025, with metal alloy systems projected to enter mass production by 2030. These developments align with the broader industry objective of doubling current EV ranges while reducing battery costs by 40% within the next decade.

EV Battery Market Demand Analysis

The global electric vehicle (EV) battery market is experiencing unprecedented growth, driven by increasing consumer adoption of electric vehicles and supportive government policies worldwide. Current market valuations place the EV battery sector at approximately 46.6 billion USD in 2022, with projections indicating a compound annual growth rate (CAGR) of 18.9% through 2030. This remarkable expansion reflects the accelerating transition away from internal combustion engines toward electrified transportation solutions.

Consumer demand for EVs with extended range capabilities has emerged as a critical market driver, placing significant pressure on battery manufacturers to enhance energy density and overall performance. Market research indicates that range anxiety remains the primary concern for potential EV buyers, with 78% of consumers citing driving range as a decisive factor in purchase decisions. This consumer preference has created substantial market pull for advanced anode materials that can increase energy storage capacity.

The industrial landscape is responding to these demands through intensified research into metal powder additives for anode enhancement. Market analysis reveals that silicon-based anode materials are gaining particular traction, with market share increasing from 8% in 2020 to approximately 15% in 2022. Additionally, lithium metal powder technologies are attracting significant investment, with venture capital funding in this segment reaching 1.2 billion USD in 2022 alone.

Regional market analysis demonstrates varying adoption rates and preferences. The Asia-Pacific region dominates manufacturing capacity, with China accounting for 75% of global EV battery production. However, European and North American markets are showing stronger consumer preference for premium battery technologies with enhanced performance characteristics, creating distinct market segments for advanced anode solutions.

Price sensitivity analysis indicates that consumers are willing to pay a premium of up to 12% for vehicles offering 20% greater range, creating a viable commercial pathway for enhanced anode technologies despite potentially higher material costs. This price tolerance is particularly evident in the luxury and performance vehicle segments, where battery performance directly impacts brand positioning and competitive advantage.

Industry forecasts suggest that the market for advanced anode materials incorporating metal powders will grow at 24.3% CAGR through 2028, outpacing the broader EV battery market. This accelerated growth trajectory reflects both the technical advantages of metal powder enhancement strategies and the strong market pull from consumers and automotive manufacturers seeking differentiated battery performance.

Consumer demand for EVs with extended range capabilities has emerged as a critical market driver, placing significant pressure on battery manufacturers to enhance energy density and overall performance. Market research indicates that range anxiety remains the primary concern for potential EV buyers, with 78% of consumers citing driving range as a decisive factor in purchase decisions. This consumer preference has created substantial market pull for advanced anode materials that can increase energy storage capacity.

The industrial landscape is responding to these demands through intensified research into metal powder additives for anode enhancement. Market analysis reveals that silicon-based anode materials are gaining particular traction, with market share increasing from 8% in 2020 to approximately 15% in 2022. Additionally, lithium metal powder technologies are attracting significant investment, with venture capital funding in this segment reaching 1.2 billion USD in 2022 alone.

Regional market analysis demonstrates varying adoption rates and preferences. The Asia-Pacific region dominates manufacturing capacity, with China accounting for 75% of global EV battery production. However, European and North American markets are showing stronger consumer preference for premium battery technologies with enhanced performance characteristics, creating distinct market segments for advanced anode solutions.

Price sensitivity analysis indicates that consumers are willing to pay a premium of up to 12% for vehicles offering 20% greater range, creating a viable commercial pathway for enhanced anode technologies despite potentially higher material costs. This price tolerance is particularly evident in the luxury and performance vehicle segments, where battery performance directly impacts brand positioning and competitive advantage.

Industry forecasts suggest that the market for advanced anode materials incorporating metal powders will grow at 24.3% CAGR through 2028, outpacing the broader EV battery market. This accelerated growth trajectory reflects both the technical advantages of metal powder enhancement strategies and the strong market pull from consumers and automotive manufacturers seeking differentiated battery performance.

Current Anode Technology Limitations and Challenges

Despite significant advancements in lithium-ion battery technology, current anode materials face substantial limitations that hinder the overall performance of electric vehicle batteries. Graphite, the predominant anode material, exhibits a theoretical capacity limit of 372 mAh/g, which falls significantly short of meeting the energy density requirements for next-generation EVs. This fundamental capacity constraint represents a critical bottleneck in the advancement of battery technology, particularly as consumer and regulatory demands for longer-range electric vehicles intensify.

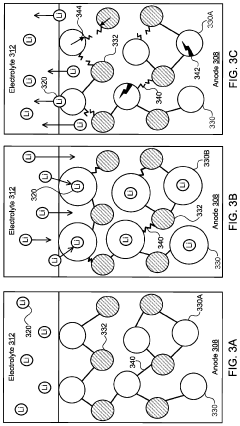

Cycle stability presents another major challenge, with conventional anodes experiencing capacity degradation of 15-20% after 500-1000 cycles under standard operating conditions. This degradation accelerates further under fast charging protocols, where lithium plating and dendrite formation become pronounced, creating both performance and safety concerns. The structural integrity of traditional anodes also deteriorates during repeated charge-discharge cycles, leading to particle cracking, electrode pulverization, and loss of electrical contact.

Charging rate limitations constitute a significant barrier to widespread EV adoption. Current graphite anodes demonstrate poor lithium-ion diffusion kinetics, resulting in substantial capacity losses at high C-rates (>2C). This limitation directly impacts the practical feasibility of fast charging, with most commercial EVs requiring 30-60 minutes to reach 80% charge—considerably longer than the refueling time for conventional vehicles.

Temperature sensitivity further complicates anode performance, with efficiency dropping dramatically at temperatures below 0°C and above 45°C. This narrow operational window restricts EV functionality in extreme climate conditions and necessitates complex thermal management systems that add weight, cost, and complexity to battery packs.

Manufacturing challenges also persist, with current anode production processes involving environmentally problematic solvents like NMP (N-Methyl-2-pyrrolidone) and energy-intensive drying steps. These processes contribute significantly to the carbon footprint and cost structure of battery production, undermining the environmental benefits of electric mobility.

Resource constraints and supply chain vulnerabilities represent emerging concerns, particularly regarding natural graphite supplies. With over 70% of natural graphite production concentrated in China, geopolitical tensions and trade disruptions pose substantial risks to the EV battery supply chain. Synthetic graphite alternatives, while offering more consistent quality, require energy-intensive production processes that further increase costs and environmental impact.

These multifaceted challenges underscore the urgent need for innovative approaches to anode technology, with metal powder incorporation emerging as a promising strategy to overcome the fundamental limitations of current materials while leveraging existing manufacturing infrastructure.

Cycle stability presents another major challenge, with conventional anodes experiencing capacity degradation of 15-20% after 500-1000 cycles under standard operating conditions. This degradation accelerates further under fast charging protocols, where lithium plating and dendrite formation become pronounced, creating both performance and safety concerns. The structural integrity of traditional anodes also deteriorates during repeated charge-discharge cycles, leading to particle cracking, electrode pulverization, and loss of electrical contact.

Charging rate limitations constitute a significant barrier to widespread EV adoption. Current graphite anodes demonstrate poor lithium-ion diffusion kinetics, resulting in substantial capacity losses at high C-rates (>2C). This limitation directly impacts the practical feasibility of fast charging, with most commercial EVs requiring 30-60 minutes to reach 80% charge—considerably longer than the refueling time for conventional vehicles.

Temperature sensitivity further complicates anode performance, with efficiency dropping dramatically at temperatures below 0°C and above 45°C. This narrow operational window restricts EV functionality in extreme climate conditions and necessitates complex thermal management systems that add weight, cost, and complexity to battery packs.

Manufacturing challenges also persist, with current anode production processes involving environmentally problematic solvents like NMP (N-Methyl-2-pyrrolidone) and energy-intensive drying steps. These processes contribute significantly to the carbon footprint and cost structure of battery production, undermining the environmental benefits of electric mobility.

Resource constraints and supply chain vulnerabilities represent emerging concerns, particularly regarding natural graphite supplies. With over 70% of natural graphite production concentrated in China, geopolitical tensions and trade disruptions pose substantial risks to the EV battery supply chain. Synthetic graphite alternatives, while offering more consistent quality, require energy-intensive production processes that further increase costs and environmental impact.

These multifaceted challenges underscore the urgent need for innovative approaches to anode technology, with metal powder incorporation emerging as a promising strategy to overcome the fundamental limitations of current materials while leveraging existing manufacturing infrastructure.

Current Metal Powder Integration Solutions

01 Metal powder composition for anode performance enhancement

Various metal powder compositions can be used to enhance anode performance in battery and electrochemical applications. These compositions typically include specific metal alloys, particle sizes, and distributions that optimize electrical conductivity, energy density, and charge-discharge efficiency. The careful selection of metal powder composition can significantly improve the overall performance and lifespan of anodes in energy storage devices.- Metal powder composition for improved anode performance: Various metal powder compositions can be used to enhance anode performance in batteries and electrochemical cells. These compositions often include specific metal alloys, particle sizes, and distributions that optimize electrical conductivity and electrochemical reactions. The careful selection of metal powder composition can significantly improve energy density, cycle life, and overall efficiency of the anode.

- Manufacturing processes for metal powder anodes: Specialized manufacturing techniques are employed to produce high-performance metal powder anodes. These processes include powder metallurgy methods, sintering, pressing, and various surface treatments that enhance the structural integrity and electrochemical properties of the anode. Advanced manufacturing processes can control particle morphology, porosity, and surface area, which are critical factors affecting anode performance.

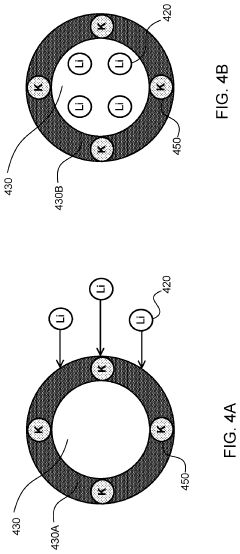

- Composite anodes with metal powders and other materials: Composite anodes that combine metal powders with other materials such as carbon, polymers, or ceramic components demonstrate enhanced performance characteristics. These composite structures can improve stability, conductivity, and capacity retention while mitigating issues like volume expansion during cycling. The synergistic effects between metal powders and complementary materials result in anodes with superior electrochemical properties.

- Surface modification of metal powder anodes: Surface treatments and modifications of metal powder particles can significantly enhance anode performance. These modifications include coatings, dopants, and functional surface groups that improve interfacial stability, reduce unwanted side reactions, and enhance ion transport. Surface-modified metal powder anodes often exhibit improved cycling stability, reduced irreversible capacity loss, and enhanced rate capability.

- Novel metal powder anode architectures for next-generation batteries: Innovative anode architectures utilizing metal powders are being developed for next-generation energy storage systems. These designs include 3D structures, hierarchical porous frameworks, and nanostructured configurations that maximize active surface area and facilitate efficient ion transport. Novel architectures can address limitations of conventional anodes by accommodating volume changes, enhancing reaction kinetics, and improving overall electrochemical performance.

02 Manufacturing processes for metal powder anodes

Specialized manufacturing techniques are employed to produce high-performance metal powder anodes. These processes include powder metallurgy methods, sintering, pressing, and various surface treatment techniques that affect the microstructure and electrochemical properties of the anode. Advanced manufacturing processes can control particle morphology, porosity, and surface area, which are critical factors in determining anode performance.Expand Specific Solutions03 Composite anodes with metal powders and carbon materials

Composite anodes that combine metal powders with carbon-based materials show enhanced electrochemical performance. These hybrid structures leverage the high capacity of metals and the stability of carbon materials to create anodes with improved cycling performance and conductivity. The synergistic effect between metal particles and carbon matrices can mitigate volume expansion issues and enhance electron transport within the anode structure.Expand Specific Solutions04 Surface modification of metal powder anodes

Surface modification techniques are applied to metal powder anodes to improve their electrochemical stability and performance. These modifications include coatings, dopants, and surface treatments that create protective layers, enhance conductivity, or facilitate ion transport. Modified surfaces can prevent unwanted side reactions, reduce capacity fading, and extend the cycle life of metal powder anodes in various applications.Expand Specific Solutions05 Novel metal powder anode architectures for next-generation batteries

Innovative anode architectures utilizing metal powders are being developed for next-generation energy storage systems. These designs include 3D structures, nanostructured materials, and hierarchical porous frameworks that maximize active surface area and optimize ion diffusion pathways. Advanced anode architectures aim to achieve higher energy densities, faster charging capabilities, and improved cycling stability compared to conventional designs.Expand Specific Solutions

Key Industry Players in Metal Powder Anode Technology

The EV battery anode enhancement market is in a growth phase, with increasing demand driven by the need for higher energy density and faster charging capabilities. Metal powder additives represent a promising technological approach to overcome current lithium-ion battery limitations. Key players include established electronics giants (Sony, Panasonic, LG Energy Solution), specialized battery manufacturers (CATL, StoreDot, Sila Nanotechnologies), and automotive companies (BMW, Toyota) pursuing vertical integration. Research institutions like Northwestern University and Cornell University are advancing fundamental science, while companies like OneD Material and Pure Lithium are developing specialized metal powder technologies. The competitive landscape reflects a mix of incremental improvements from incumbents and potentially disruptive innovations from newer entrants focused specifically on metal powder integration for enhanced anode performance.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed advanced anode technologies incorporating metal powders to enhance performance in their EV batteries. Their approach utilizes a composite anode structure with silicon-graphite materials enhanced by metal additives that improve conductivity and structural integrity. The company employs nano-structured metal particles (primarily copper and silver) that form conductive networks throughout the anode, facilitating electron transport while mitigating silicon's volume expansion issues[7]. LG's metal-enhanced anodes demonstrate up to 30% higher energy density compared to conventional graphite anodes while maintaining thermal stability. Their technology incorporates gradient concentration of metal additives that optimize performance at the electrode-electrolyte interface. LG Energy Solution has implemented this technology in their latest generation of pouch cells for EVs, achieving energy densities exceeding 700 Wh/L while maintaining 80% capacity retention after 1000 cycles[8]. The company has established supply agreements with multiple automotive manufacturers including General Motors for their Ultium platform.

Strengths: Established mass production capabilities for metal-enhanced anodes; Comprehensive cell design optimization including electrolyte compatibility; Strong integration with automotive supply chains. Weaknesses: More conservative approach with lower silicon content than some competitors; Higher material costs due to precious metal additives; Requires sophisticated quality control systems to ensure uniform metal distribution.

Ningde Amperex Technology Ltd.

Technical Solution: CATL (Ningde Amperex Technology Ltd.) has developed innovative anode technologies incorporating metal powders to enhance performance in EV batteries. Their approach focuses on silicon-carbon composite anodes with precisely engineered metal additives that improve conductivity and structural stability. CATL's technology utilizes nano-copper and aluminum particles dispersed throughout the anode structure to create conductive pathways that maintain performance during silicon's volume changes[9]. Their metal-enhanced anodes achieve specific capacities of 600-800 mAh/g while demonstrating excellent cycle stability. CATL has implemented a gradient distribution of metal additives that concentrates conductive materials near the current collector interface, optimizing electron transport while minimizing unnecessary metal content. The company's latest generation batteries featuring these enhanced anodes deliver energy densities exceeding 300 Wh/kg at the cell level while maintaining 80% capacity after 1500 cycles[10]. CATL has integrated this technology into their cell-to-pack systems that eliminate module housings, further increasing energy density at the pack level.

Strengths: Massive production scale enables cost-effective implementation; Comprehensive integration from materials to pack-level design; Balanced approach prioritizing cycle life and safety alongside energy density. Weaknesses: More incremental improvements compared to some silicon-dominant approaches; Complex manufacturing process requiring precise control of metal additive distribution; Higher sensitivity to charging protocol adherence for maximum longevity.

Critical Patents and Research in Metal Anode Enhancement

Systems and methods for potassium enhancing silicon-containing anodes for improved cyclability

PatentActiveUS20210343994A1

Innovation

- Enhancing the silicon-containing anode by enriching its surface layer with sodium ions and then displacing them with potassium ions to form a compression layer, placing the silicon atoms in a pre-compressive state to counteract internal stresses and prevent damage from swelling.

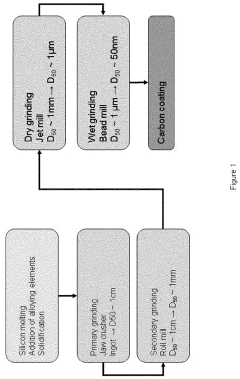

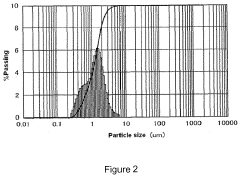

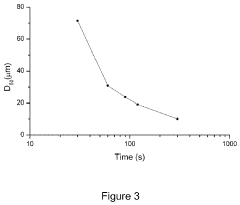

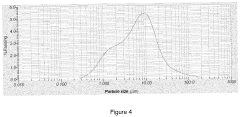

Particulate anode materials and methods for their preparation

PatentActiveEP3546093A1

Innovation

- A method involving dry and wet grinding steps to produce nanometer-sized particles of silicon or its alloys, followed by coating with conductive carbon to enhance electrical conductivity and stability, utilizing a carbon precursor for pyrolysis to form a conductive carbon layer on the particles.

Supply Chain Considerations for Metal Powder Anodes

The global supply chain for metal powder anodes represents a complex ecosystem that directly impacts the scalability and economic viability of enhanced EV battery technologies. Raw material sourcing constitutes the first critical link, with lithium, silicon, aluminum, and transition metals like nickel and copper forming the backbone of advanced anode formulations. Geographic concentration of these resources presents significant vulnerabilities, as over 60% of lithium reserves are located in the "Lithium Triangle" of South America, while China dominates processing capabilities for most battery metals.

Processing infrastructure represents another crucial consideration, as metal powder production requires specialized equipment for atomization, ball milling, and particle size classification. Current global capacity remains concentrated in East Asia, with China accounting for approximately 75% of metal powder processing for battery applications. This geographic imbalance creates potential bottlenecks as demand scales with EV market growth.

Quality control and standardization across the supply chain present ongoing challenges. Metal powders for anodes require precise particle size distribution, surface area specifications, and purity levels exceeding 99.9% for optimal electrochemical performance. Variations in these parameters can significantly impact battery capacity, cycle life, and safety characteristics. The industry currently lacks unified global standards for metal powder specifications in battery applications.

Logistics and transportation considerations add further complexity, as metal powders often require specialized handling due to reactivity concerns, particularly with aluminum and silicon powders that may present combustion risks when exposed to moisture. This necessitates specialized packaging, storage conditions, and transportation protocols that increase supply chain costs and complexity.

Supply chain resilience strategies are emerging as manufacturers seek to mitigate risks. These include vertical integration efforts by major battery manufacturers, development of alternative material sources, and recycling initiatives to recover valuable metals from end-of-life batteries. Companies like Tesla and CATL have invested in direct mining partnerships to secure raw material access, while research into alternative anode materials continues to expand potential supply options.

Cost implications remain significant, with metal powder processing representing 15-25% of total anode material costs. Price volatility in raw materials markets directly impacts production economics, with lithium prices fluctuating by over 400% between 2020 and 2023. Establishing stable, diversified supply chains will be essential for maintaining cost competitiveness as the industry scales to meet projected demand growth of 25-30% annually through 2030.

Processing infrastructure represents another crucial consideration, as metal powder production requires specialized equipment for atomization, ball milling, and particle size classification. Current global capacity remains concentrated in East Asia, with China accounting for approximately 75% of metal powder processing for battery applications. This geographic imbalance creates potential bottlenecks as demand scales with EV market growth.

Quality control and standardization across the supply chain present ongoing challenges. Metal powders for anodes require precise particle size distribution, surface area specifications, and purity levels exceeding 99.9% for optimal electrochemical performance. Variations in these parameters can significantly impact battery capacity, cycle life, and safety characteristics. The industry currently lacks unified global standards for metal powder specifications in battery applications.

Logistics and transportation considerations add further complexity, as metal powders often require specialized handling due to reactivity concerns, particularly with aluminum and silicon powders that may present combustion risks when exposed to moisture. This necessitates specialized packaging, storage conditions, and transportation protocols that increase supply chain costs and complexity.

Supply chain resilience strategies are emerging as manufacturers seek to mitigate risks. These include vertical integration efforts by major battery manufacturers, development of alternative material sources, and recycling initiatives to recover valuable metals from end-of-life batteries. Companies like Tesla and CATL have invested in direct mining partnerships to secure raw material access, while research into alternative anode materials continues to expand potential supply options.

Cost implications remain significant, with metal powder processing representing 15-25% of total anode material costs. Price volatility in raw materials markets directly impacts production economics, with lithium prices fluctuating by over 400% between 2020 and 2023. Establishing stable, diversified supply chains will be essential for maintaining cost competitiveness as the industry scales to meet projected demand growth of 25-30% annually through 2030.

Environmental Impact and Recycling Strategies

The integration of metal powders in EV battery anodes presents significant environmental considerations that must be addressed throughout the product lifecycle. The extraction and processing of metals like silicon, lithium, and copper for battery components generate substantial carbon emissions and require extensive water usage. Mining operations often result in habitat destruction, soil erosion, and potential contamination of local water sources with heavy metals and processing chemicals. These environmental impacts are particularly concerning as global demand for EV batteries continues to accelerate.

Manufacturing processes for metal powder-enhanced anodes typically involve energy-intensive milling, alloying, and heat treatment steps that further contribute to the carbon footprint of battery production. The use of solvents and binders in electrode manufacturing also introduces potential environmental hazards if not properly managed. As battery production scales up to meet growing demand, these cumulative impacts require careful assessment and mitigation strategies.

End-of-life management represents another critical environmental challenge. Without proper recycling infrastructure, valuable and potentially hazardous materials in metal-enhanced anodes may end up in landfills, creating long-term environmental liabilities. However, several promising recycling approaches are emerging to address these concerns. Hydrometallurgical processes can selectively recover high-value metals from spent batteries through leaching and precipitation techniques, while pyrometallurgical methods employ high-temperature treatment to separate and recover metallic components.

Direct recycling approaches that preserve the structural integrity of anode materials show particular promise for metal powder components. These methods aim to recover materials with minimal reprocessing, potentially retaining the enhanced performance characteristics of specialized metal powders. Several battery manufacturers have begun implementing closed-loop systems where production scrap and end-of-life materials are reintegrated into new battery manufacturing.

Regulatory frameworks are evolving to support these recycling initiatives. The European Union's Battery Directive and similar regulations in China and North America are establishing collection targets, recycling efficiency standards, and extended producer responsibility requirements. These policies create economic incentives for developing more efficient recycling technologies specifically designed for advanced battery materials including metal-enhanced anodes.

Future environmental improvements will likely come from designing anodes with recycling in mind from the outset. This "design for recyclability" approach includes considerations such as easier disassembly, reduced use of problematic adhesives, and standardization of metal powder compositions to facilitate more efficient material recovery and reuse in next-generation battery systems.

Manufacturing processes for metal powder-enhanced anodes typically involve energy-intensive milling, alloying, and heat treatment steps that further contribute to the carbon footprint of battery production. The use of solvents and binders in electrode manufacturing also introduces potential environmental hazards if not properly managed. As battery production scales up to meet growing demand, these cumulative impacts require careful assessment and mitigation strategies.

End-of-life management represents another critical environmental challenge. Without proper recycling infrastructure, valuable and potentially hazardous materials in metal-enhanced anodes may end up in landfills, creating long-term environmental liabilities. However, several promising recycling approaches are emerging to address these concerns. Hydrometallurgical processes can selectively recover high-value metals from spent batteries through leaching and precipitation techniques, while pyrometallurgical methods employ high-temperature treatment to separate and recover metallic components.

Direct recycling approaches that preserve the structural integrity of anode materials show particular promise for metal powder components. These methods aim to recover materials with minimal reprocessing, potentially retaining the enhanced performance characteristics of specialized metal powders. Several battery manufacturers have begun implementing closed-loop systems where production scrap and end-of-life materials are reintegrated into new battery manufacturing.

Regulatory frameworks are evolving to support these recycling initiatives. The European Union's Battery Directive and similar regulations in China and North America are establishing collection targets, recycling efficiency standards, and extended producer responsibility requirements. These policies create economic incentives for developing more efficient recycling technologies specifically designed for advanced battery materials including metal-enhanced anodes.

Future environmental improvements will likely come from designing anodes with recycling in mind from the outset. This "design for recyclability" approach includes considerations such as easier disassembly, reduced use of problematic adhesives, and standardization of metal powder compositions to facilitate more efficient material recovery and reuse in next-generation battery systems.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!