Comparative Analysis of Metal Powders in Catalytic Reactions

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Metal Powder Catalysis Background and Objectives

Metal powder catalysis has evolved significantly over the past century, transforming from rudimentary applications in early chemical processes to sophisticated catalytic systems that drive modern industrial reactions. The journey began in the early 20th century when researchers first recognized the unique surface properties of metal powders that enable them to accelerate chemical reactions without being consumed. This discovery laid the foundation for heterogeneous catalysis, which has since become a cornerstone of chemical manufacturing processes worldwide.

The evolution of metal powder catalysis has been marked by several pivotal developments, including the introduction of supported catalysts in the 1940s, the development of high-surface-area metal powders in the 1960s, and the recent emergence of nanoscale metal catalysts with unprecedented activity and selectivity. These advancements have been driven by the growing demand for more efficient, sustainable, and economically viable chemical processes across various industries.

Current technological trends in metal powder catalysis focus on enhancing catalytic performance through precise control of particle size, morphology, and composition. The field is witnessing a shift toward bimetallic and multimetallic systems that offer synergistic effects and improved stability. Additionally, there is increasing interest in developing catalysts that can operate under milder conditions, reducing energy consumption and environmental impact.

The primary objective of this comparative analysis is to evaluate the performance of different metal powders in catalytic reactions, with particular emphasis on activity, selectivity, stability, and cost-effectiveness. By systematically comparing various metal catalysts, we aim to identify optimal materials for specific reaction types and conditions, thereby enabling more rational catalyst design and selection.

Further objectives include understanding the fundamental mechanisms that govern catalytic behavior across different metal systems, exploring structure-property relationships that influence catalytic performance, and identifying promising directions for future catalyst development. This analysis will also assess the scalability and industrial applicability of various metal powder catalysts, considering factors such as availability, cost, and environmental impact.

By achieving these objectives, this research seeks to contribute to the advancement of metal powder catalysis technology, ultimately facilitating the development of more efficient and sustainable chemical processes. The findings will provide valuable insights for researchers and industry practitioners working in fields ranging from fine chemical synthesis to energy conversion and environmental remediation.

The evolution of metal powder catalysis has been marked by several pivotal developments, including the introduction of supported catalysts in the 1940s, the development of high-surface-area metal powders in the 1960s, and the recent emergence of nanoscale metal catalysts with unprecedented activity and selectivity. These advancements have been driven by the growing demand for more efficient, sustainable, and economically viable chemical processes across various industries.

Current technological trends in metal powder catalysis focus on enhancing catalytic performance through precise control of particle size, morphology, and composition. The field is witnessing a shift toward bimetallic and multimetallic systems that offer synergistic effects and improved stability. Additionally, there is increasing interest in developing catalysts that can operate under milder conditions, reducing energy consumption and environmental impact.

The primary objective of this comparative analysis is to evaluate the performance of different metal powders in catalytic reactions, with particular emphasis on activity, selectivity, stability, and cost-effectiveness. By systematically comparing various metal catalysts, we aim to identify optimal materials for specific reaction types and conditions, thereby enabling more rational catalyst design and selection.

Further objectives include understanding the fundamental mechanisms that govern catalytic behavior across different metal systems, exploring structure-property relationships that influence catalytic performance, and identifying promising directions for future catalyst development. This analysis will also assess the scalability and industrial applicability of various metal powder catalysts, considering factors such as availability, cost, and environmental impact.

By achieving these objectives, this research seeks to contribute to the advancement of metal powder catalysis technology, ultimately facilitating the development of more efficient and sustainable chemical processes. The findings will provide valuable insights for researchers and industry practitioners working in fields ranging from fine chemical synthesis to energy conversion and environmental remediation.

Market Demand Analysis for Catalytic Metal Powders

The global market for catalytic metal powders has witnessed substantial growth in recent years, driven primarily by increasing industrial applications across chemical manufacturing, automotive, pharmaceuticals, and environmental sectors. Current market valuations indicate that the catalytic metal powders market reached approximately $5.2 billion in 2022, with projections suggesting a compound annual growth rate (CAGR) of 6.8% through 2028.

Demand for precious metal catalysts, particularly platinum, palladium, and rhodium, remains robust despite their high costs, owing to their superior catalytic performance in critical applications. However, market trends indicate a growing shift toward more cost-effective alternatives such as nickel, copper, and iron-based catalysts, especially in price-sensitive industries and regions.

The automotive sector represents the largest end-user segment, accounting for nearly 40% of the total market share. This is primarily attributed to the essential role of catalytic converters in reducing harmful emissions from vehicles. Stringent environmental regulations worldwide, particularly in Europe, North America, and increasingly in Asia, are significantly boosting demand for more efficient catalytic solutions.

Pharmaceutical manufacturing constitutes another rapidly expanding application area, with demand growing at approximately 8.2% annually. The synthesis of active pharmaceutical ingredients (APIs) frequently requires highly specific catalytic processes, driving innovation in specialized metal powder formulations.

Regional analysis reveals that Asia-Pacific dominates the market with a 42% share, led by China's expanding chemical and automotive industries. North America and Europe follow with 28% and 24% market shares respectively, where demand is primarily driven by environmental applications and specialty chemicals production.

Emerging market trends indicate increasing interest in nanocatalysts, which offer enhanced surface area and catalytic efficiency. The market for nano-sized metal powder catalysts is growing at nearly twice the rate of conventional catalysts, reflecting industry recognition of their superior performance characteristics.

Sustainability concerns are reshaping market demands, with growing interest in recyclable catalysts and processes that minimize metal leaching. This trend is particularly evident in the fine chemicals sector, where catalyst recovery and reuse significantly impact production economics.

Supply chain vulnerabilities, exposed during recent global disruptions, have prompted industries to diversify their catalytic metal sources and explore alternatives to traditionally dominant materials. This has accelerated research into novel alloy formulations and composite catalysts that can deliver comparable performance with reduced dependency on scarce resources.

Demand for precious metal catalysts, particularly platinum, palladium, and rhodium, remains robust despite their high costs, owing to their superior catalytic performance in critical applications. However, market trends indicate a growing shift toward more cost-effective alternatives such as nickel, copper, and iron-based catalysts, especially in price-sensitive industries and regions.

The automotive sector represents the largest end-user segment, accounting for nearly 40% of the total market share. This is primarily attributed to the essential role of catalytic converters in reducing harmful emissions from vehicles. Stringent environmental regulations worldwide, particularly in Europe, North America, and increasingly in Asia, are significantly boosting demand for more efficient catalytic solutions.

Pharmaceutical manufacturing constitutes another rapidly expanding application area, with demand growing at approximately 8.2% annually. The synthesis of active pharmaceutical ingredients (APIs) frequently requires highly specific catalytic processes, driving innovation in specialized metal powder formulations.

Regional analysis reveals that Asia-Pacific dominates the market with a 42% share, led by China's expanding chemical and automotive industries. North America and Europe follow with 28% and 24% market shares respectively, where demand is primarily driven by environmental applications and specialty chemicals production.

Emerging market trends indicate increasing interest in nanocatalysts, which offer enhanced surface area and catalytic efficiency. The market for nano-sized metal powder catalysts is growing at nearly twice the rate of conventional catalysts, reflecting industry recognition of their superior performance characteristics.

Sustainability concerns are reshaping market demands, with growing interest in recyclable catalysts and processes that minimize metal leaching. This trend is particularly evident in the fine chemicals sector, where catalyst recovery and reuse significantly impact production economics.

Supply chain vulnerabilities, exposed during recent global disruptions, have prompted industries to diversify their catalytic metal sources and explore alternatives to traditionally dominant materials. This has accelerated research into novel alloy formulations and composite catalysts that can deliver comparable performance with reduced dependency on scarce resources.

Current State and Challenges in Metal Powder Catalysis

Metal powder catalysis has witnessed significant advancements globally, with research institutions and industrial entities making substantial progress in understanding reaction mechanisms and improving catalytic efficiency. Currently, noble metal powders such as platinum, palladium, and rhodium dominate high-performance catalytic applications due to their exceptional activity and selectivity. However, their scarcity and high cost present major limitations for widespread industrial implementation.

Base metal catalysts including nickel, copper, and iron have emerged as promising alternatives, demonstrating improved performance through various modification techniques. Despite progress, these alternatives still face challenges in matching the catalytic activity and stability of noble metals, particularly in harsh reaction environments or when long-term durability is required.

A significant technical hurdle in metal powder catalysis involves controlling particle size distribution and morphology. Nanoscale metal powders exhibit superior catalytic properties due to their high surface area-to-volume ratio, but maintaining uniform size distribution during synthesis and preventing agglomeration during catalytic reactions remain problematic. Advanced characterization techniques such as high-resolution transmission electron microscopy and X-ray absorption spectroscopy have improved understanding of these issues, yet practical solutions for large-scale applications are still developing.

Surface poisoning and deactivation represent another critical challenge. Catalyst poisoning by sulfur compounds, carbon deposition, and other contaminants significantly reduces catalytic efficiency and lifespan. While protective strategies like core-shell structures and alloying have shown promise in laboratory settings, their industrial implementation faces scalability and cost barriers.

Geographically, metal powder catalysis research exhibits distinct patterns. North America and Europe lead in fundamental research and high-end applications, while Asia, particularly China and Japan, dominates in production capacity and application-oriented research. Recent years have seen emerging contributions from countries like South Korea, India, and Brazil, especially in sustainable catalysis applications.

Environmental and regulatory challenges increasingly influence the field. Stricter emissions standards and sustainability requirements drive research toward greener synthesis methods and recovery processes. The development of catalysts with reduced environmental footprint, improved recyclability, and decreased reliance on critical raw materials has become a priority, though technical solutions meeting all these criteria remain elusive.

The integration of computational methods with experimental approaches represents both a current trend and a challenge. While computational catalysis has accelerated catalyst design through predictive modeling, the gap between theoretical predictions and practical performance persists, highlighting the need for improved models that account for real-world complexities in catalytic systems.

Base metal catalysts including nickel, copper, and iron have emerged as promising alternatives, demonstrating improved performance through various modification techniques. Despite progress, these alternatives still face challenges in matching the catalytic activity and stability of noble metals, particularly in harsh reaction environments or when long-term durability is required.

A significant technical hurdle in metal powder catalysis involves controlling particle size distribution and morphology. Nanoscale metal powders exhibit superior catalytic properties due to their high surface area-to-volume ratio, but maintaining uniform size distribution during synthesis and preventing agglomeration during catalytic reactions remain problematic. Advanced characterization techniques such as high-resolution transmission electron microscopy and X-ray absorption spectroscopy have improved understanding of these issues, yet practical solutions for large-scale applications are still developing.

Surface poisoning and deactivation represent another critical challenge. Catalyst poisoning by sulfur compounds, carbon deposition, and other contaminants significantly reduces catalytic efficiency and lifespan. While protective strategies like core-shell structures and alloying have shown promise in laboratory settings, their industrial implementation faces scalability and cost barriers.

Geographically, metal powder catalysis research exhibits distinct patterns. North America and Europe lead in fundamental research and high-end applications, while Asia, particularly China and Japan, dominates in production capacity and application-oriented research. Recent years have seen emerging contributions from countries like South Korea, India, and Brazil, especially in sustainable catalysis applications.

Environmental and regulatory challenges increasingly influence the field. Stricter emissions standards and sustainability requirements drive research toward greener synthesis methods and recovery processes. The development of catalysts with reduced environmental footprint, improved recyclability, and decreased reliance on critical raw materials has become a priority, though technical solutions meeting all these criteria remain elusive.

The integration of computational methods with experimental approaches represents both a current trend and a challenge. While computational catalysis has accelerated catalyst design through predictive modeling, the gap between theoretical predictions and practical performance persists, highlighting the need for improved models that account for real-world complexities in catalytic systems.

Current Metal Powder Catalytic Solutions Comparison

01 Catalytic properties of metal powders in chemical reactions

Metal powders exhibit excellent catalytic properties in various chemical reactions due to their high surface area and active sites. These powders can catalyze oxidation, reduction, and coupling reactions with high efficiency and selectivity. The catalytic performance can be enhanced by controlling the particle size, morphology, and composition of the metal powders, leading to improved reaction rates and product yields.- Metal powder composition for enhanced catalytic activity: Specific compositions of metal powders can significantly enhance catalytic performance. These compositions often include precious metals, transition metals, or alloys designed with precise particle sizes and surface characteristics. The formulations are engineered to maximize active surface area and optimize electron transfer during catalytic reactions, resulting in higher conversion rates and selectivity for target reactions.

- Manufacturing processes for catalytic metal powders: Various manufacturing techniques can be employed to produce metal powders with superior catalytic properties. These include precipitation methods, mechanical alloying, chemical vapor deposition, and specialized heat treatments. The processing conditions significantly influence the powder's microstructure, surface area, and catalytic activity, allowing for tailored performance in specific applications.

- Surface modification of metal powders for catalysis: Surface modification techniques can enhance the catalytic performance of metal powders. These include controlled oxidation, functionalization with specific ligands, doping with promoters, and creating core-shell structures. Such modifications can increase active site density, improve selectivity, enhance stability against sintering, and optimize adsorption-desorption characteristics of reactants and products.

- Support systems for metal powder catalysts: Metal powder catalysts often require appropriate support materials to maximize their performance. These supports can include ceramics, carbon-based materials, zeolites, or other metal oxides that provide high surface area, mechanical stability, and sometimes additional catalytic functionality. The interaction between the metal powder and its support can create synergistic effects that enhance overall catalytic activity and selectivity.

- Application-specific metal powder catalysts: Metal powder catalysts can be specifically designed for particular applications such as automotive emissions control, fuel cells, petrochemical processing, or fine chemical synthesis. These specialized formulations consider factors like operating temperature, pressure conditions, potential contaminants, and desired reaction pathways. The tailored approach ensures optimal catalytic performance in the intended application environment.

02 Preparation methods for catalytic metal powders

Various preparation methods can significantly influence the catalytic performance of metal powders. Techniques such as chemical reduction, precipitation, sol-gel processing, and mechanical alloying are commonly used to synthesize metal powder catalysts with controlled properties. The synthesis conditions, including temperature, pressure, and reducing agents, play crucial roles in determining the final catalytic activity by affecting the particle size distribution, surface area, and crystal structure of the metal powders.Expand Specific Solutions03 Metal powder composites and supported catalysts

Metal powders can be combined with support materials or other metals to create composite catalysts with enhanced performance. These supported catalysts often show improved stability, selectivity, and activity compared to pure metal powders. Common support materials include carbon, alumina, silica, and zeolites, which can prevent agglomeration of metal particles and provide additional functional sites for catalytic reactions. Bimetallic and multi-metallic powder systems can exhibit synergistic effects that enhance catalytic performance beyond what individual metals can achieve.Expand Specific Solutions04 Applications of metal powder catalysts in energy and environmental technologies

Metal powder catalysts play crucial roles in energy conversion and environmental remediation technologies. They are widely used in fuel cells, hydrogen production, CO2 reduction, and pollutant removal processes. The catalytic performance of these metal powders determines the efficiency of energy conversion systems and the effectiveness of environmental treatment processes. Recent advances focus on developing metal powder catalysts with high activity, durability, and selectivity for specific applications in sustainable energy and green chemistry.Expand Specific Solutions05 Surface modification and activation of metal powders

Surface modification and activation techniques can significantly enhance the catalytic performance of metal powders. Methods such as acid treatment, plasma processing, thermal activation, and chemical functionalization can create more active sites on the metal powder surface. These treatments can remove surface oxides, introduce defects, or add functional groups that improve the adsorption and activation of reactant molecules. The modified metal powders often show higher catalytic activity, better selectivity, and improved resistance to deactivation compared to untreated powders.Expand Specific Solutions

Key Industry Players in Catalytic Metal Powder Development

The catalytic metal powder market is in a growth phase, characterized by increasing demand across automotive, chemical, and pharmaceutical sectors. The market size is expanding due to rising applications in emission control, petrochemical processing, and sustainable energy solutions. Technologically, established players like Johnson Matthey, Evonik, and DuPont demonstrate mature capabilities in precious metal catalysts, while emerging innovations are being driven by research collaborations between industry leaders (Toyota, ExxonMobil) and academic institutions (Shanghai Jiao Tong University, CNRS). Chinese entities like Sinopec are rapidly advancing their technical capabilities, particularly in petroleum catalysis applications. The competitive landscape shows a balance between traditional chemical manufacturers and specialized catalyst developers, with increasing focus on sustainable and energy-efficient catalytic processes.

Johnson Matthey Plc

Technical Solution: Johnson Matthey has developed advanced platinum group metal (PGM) catalysts for various chemical processes. Their technology focuses on precise control of metal particle size and distribution on support materials, achieving higher catalytic activity with lower metal loadings. Their proprietary preparation methods include controlled precipitation and impregnation techniques that result in uniform metal dispersion[1]. The company has pioneered the development of bimetallic catalysts where two metals work synergistically to enhance reaction selectivity and reduce catalyst deactivation[3]. Their recent innovations include core-shell structured metal catalysts where precious metals are concentrated on the particle surface, maximizing atom efficiency while maintaining performance. Johnson Matthey has also developed advanced characterization techniques to monitor catalyst performance in real-time during reactions, allowing for optimization of reaction conditions and catalyst formulations[5].

Strengths: Exceptional expertise in precious metal catalysts with superior activity and selectivity; advanced manufacturing capabilities ensuring consistent quality; strong intellectual property portfolio. Weaknesses: Higher cost associated with precious metal catalysts; potential supply chain vulnerabilities for rare metals; environmental concerns related to mining of catalyst materials.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed proprietary metal powder catalysts focusing on hydroprocessing and hydrocracking applications. Their technology employs hierarchical pore structures in catalyst supports that optimize diffusion pathways for reactants and products[2]. Sinopec's catalysts feature precisely controlled metal-support interactions that enhance stability during high-temperature operations. Their innovative preparation methods include controlled precipitation and spray drying techniques that yield uniform metal particle size distribution in the 2-5 nm range, critical for maximizing catalytic activity[4]. The company has pioneered the development of trimetallic catalyst systems (typically combining Ni-Mo-W) that demonstrate superior resistance to sulfur and nitrogen poisoning in petroleum refining applications. Recent advancements include the incorporation of rare earth elements as promoters to enhance catalyst lifetime and activity maintenance under severe reaction conditions[7].

Strengths: Extensive experience in large-scale catalyst manufacturing; strong capabilities in catalyst customization for specific refinery processes; cost-effective solutions compared to precious metal alternatives. Weaknesses: Catalysts may require more frequent regeneration than precious metal alternatives; performance in some fine chemical applications may be less selective; higher metal loadings sometimes required to achieve desired activity.

Critical Patents and Innovations in Metal Powder Catalysis

Fast filtering powder catalytic mixtures

PatentInactiveEP2203249A1

Innovation

- A mixture of metal powder catalysts with a solid reaction aid, such as sibunit or activated carbon, is formed to enhance filtering properties without interfering with the reaction or recycling processes, allowing for easier separation and metal recovery.

Catalyst composition for conversion of sulfur trioxide and hydrogen production process

PatentInactiveUS20210220806A1

Innovation

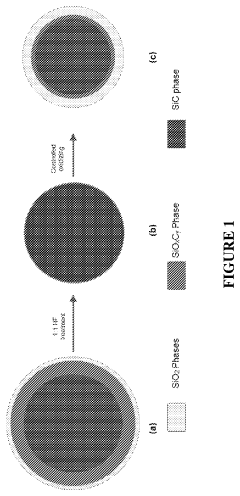

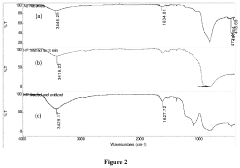

- A catalyst composition comprising transitional metal oxides (such as Cu, Cr, and Fe) supported on high-surface-area porous β-silicon carbide (β-SiC) or silicated porous silicon carbide, with a weight ratio of active material to support material in the range of 0.1 to 25 wt%, which is prepared by contacting transitional metal salts with the support material and calcining at specific temperatures to enhance stability and activity.

Environmental Impact and Sustainability Considerations

The environmental footprint of metal powder catalysts represents a critical consideration in modern industrial processes. Traditional catalytic systems often involve rare and precious metals such as platinum, palladium, and rhodium, which present significant sustainability challenges due to their limited natural abundance and environmentally destructive mining practices. Recent life cycle assessments reveal that extraction of these metals can generate up to 50 times more carbon emissions per kilogram compared to common industrial metals.

Metal powder catalysts derived from more abundant elements such as iron, nickel, and copper demonstrate promising environmental advantages. These alternatives typically require 30-40% less energy during production and generate substantially lower greenhouse gas emissions throughout their lifecycle. Furthermore, their greater natural abundance reduces the geopolitical and supply chain vulnerabilities associated with rare metal catalysts.

Recovery and recycling processes for spent metal catalysts have evolved significantly in recent years. Advanced hydrometallurgical techniques now achieve recovery rates exceeding 95% for precious metal catalysts, while pyrometallurgical methods have improved energy efficiency by approximately 25% compared to previous generation technologies. These developments substantially extend the effective lifecycle of metal catalysts and minimize waste generation.

Toxicity profiles vary considerably among different metal powder catalysts. Nickel and chromium-based catalysts present notable occupational health concerns due to their carcinogenic potential, while copper and iron-based alternatives generally exhibit lower toxicity. Recent innovations in catalyst design have focused on encapsulation techniques that minimize metal leaching, reducing environmental contamination risks by up to 80% compared to unmodified catalysts.

Water consumption represents another significant environmental consideration. Platinum group metal mining operations typically consume 7,000-9,000 liters of water per kilogram of metal produced, whereas base metal extraction generally requires 40-60% less water. Additionally, catalyst preparation processes involving aqueous solutions can be optimized through closed-loop systems that reduce freshwater requirements by up to 75%.

Emerging green chemistry approaches are transforming catalyst development. Biomass-derived supports, solvent-free synthesis methods, and ambient temperature preparation techniques collectively reduce the environmental impact of catalyst production. These innovations align with circular economy principles and contribute to meeting increasingly stringent environmental regulations in chemical manufacturing sectors worldwide.

Metal powder catalysts derived from more abundant elements such as iron, nickel, and copper demonstrate promising environmental advantages. These alternatives typically require 30-40% less energy during production and generate substantially lower greenhouse gas emissions throughout their lifecycle. Furthermore, their greater natural abundance reduces the geopolitical and supply chain vulnerabilities associated with rare metal catalysts.

Recovery and recycling processes for spent metal catalysts have evolved significantly in recent years. Advanced hydrometallurgical techniques now achieve recovery rates exceeding 95% for precious metal catalysts, while pyrometallurgical methods have improved energy efficiency by approximately 25% compared to previous generation technologies. These developments substantially extend the effective lifecycle of metal catalysts and minimize waste generation.

Toxicity profiles vary considerably among different metal powder catalysts. Nickel and chromium-based catalysts present notable occupational health concerns due to their carcinogenic potential, while copper and iron-based alternatives generally exhibit lower toxicity. Recent innovations in catalyst design have focused on encapsulation techniques that minimize metal leaching, reducing environmental contamination risks by up to 80% compared to unmodified catalysts.

Water consumption represents another significant environmental consideration. Platinum group metal mining operations typically consume 7,000-9,000 liters of water per kilogram of metal produced, whereas base metal extraction generally requires 40-60% less water. Additionally, catalyst preparation processes involving aqueous solutions can be optimized through closed-loop systems that reduce freshwater requirements by up to 75%.

Emerging green chemistry approaches are transforming catalyst development. Biomass-derived supports, solvent-free synthesis methods, and ambient temperature preparation techniques collectively reduce the environmental impact of catalyst production. These innovations align with circular economy principles and contribute to meeting increasingly stringent environmental regulations in chemical manufacturing sectors worldwide.

Scalability and Industrial Application Assessment

The scalability of metal powder catalysts from laboratory to industrial scale represents a critical consideration in their commercial viability. Current industrial applications demonstrate varying degrees of success in scaling metal powder catalytic processes. Precious metal catalysts like platinum and palladium show excellent scalability in automotive catalytic converters, with well-established manufacturing protocols enabling consistent performance across production volumes. However, these systems face challenges in maintaining uniform catalyst distribution and preventing agglomeration during scale-up.

Base metal catalysts (iron, nickel, copper) offer more economical alternatives for large-scale operations, particularly in petrochemical and bulk chemical synthesis. Their scalability benefits from abundant supply chains and established handling protocols, though they typically require higher loadings to achieve comparable activity to precious metal counterparts. Recent innovations in reactor design, particularly structured reactors with enhanced heat management capabilities, have significantly improved the industrial applicability of these catalysts.

Cost-benefit analyses reveal that while noble metal catalysts entail higher initial investment, their superior activity and longevity often justify the expense in high-value applications. Conversely, base metals present lower upfront costs but may incur higher operational expenses due to more frequent replacement cycles and higher energy requirements. This economic balance shifts dramatically with production scale, favoring different metal catalysts depending on throughput requirements.

Environmental considerations increasingly influence industrial adoption decisions. Life cycle assessments indicate that despite their resource-intensive production, platinum group metal catalysts often demonstrate superior environmental performance over complete operational lifetimes due to their longevity and efficiency. However, recovery and recycling infrastructure remains a critical factor in their overall sustainability profile.

Regulatory frameworks present varying challenges for different metal powder catalysts. Precious metals face stringent tracking requirements due to their value, while base metals must address workplace exposure limits and waste disposal regulations. These regulatory considerations significantly impact implementation timelines and compliance costs across different regions.

Future industrial applications will likely leverage hybrid approaches, combining multiple metal catalysts in structured arrangements to optimize performance while managing costs. Emerging technologies in additive manufacturing offer promising avenues for creating precisely engineered catalyst structures with optimized metal distribution, potentially revolutionizing industrial-scale implementation of metal powder catalysts across chemical manufacturing sectors.

Base metal catalysts (iron, nickel, copper) offer more economical alternatives for large-scale operations, particularly in petrochemical and bulk chemical synthesis. Their scalability benefits from abundant supply chains and established handling protocols, though they typically require higher loadings to achieve comparable activity to precious metal counterparts. Recent innovations in reactor design, particularly structured reactors with enhanced heat management capabilities, have significantly improved the industrial applicability of these catalysts.

Cost-benefit analyses reveal that while noble metal catalysts entail higher initial investment, their superior activity and longevity often justify the expense in high-value applications. Conversely, base metals present lower upfront costs but may incur higher operational expenses due to more frequent replacement cycles and higher energy requirements. This economic balance shifts dramatically with production scale, favoring different metal catalysts depending on throughput requirements.

Environmental considerations increasingly influence industrial adoption decisions. Life cycle assessments indicate that despite their resource-intensive production, platinum group metal catalysts often demonstrate superior environmental performance over complete operational lifetimes due to their longevity and efficiency. However, recovery and recycling infrastructure remains a critical factor in their overall sustainability profile.

Regulatory frameworks present varying challenges for different metal powder catalysts. Precious metals face stringent tracking requirements due to their value, while base metals must address workplace exposure limits and waste disposal regulations. These regulatory considerations significantly impact implementation timelines and compliance costs across different regions.

Future industrial applications will likely leverage hybrid approaches, combining multiple metal catalysts in structured arrangements to optimize performance while managing costs. Emerging technologies in additive manufacturing offer promising avenues for creating precisely engineered catalyst structures with optimized metal distribution, potentially revolutionizing industrial-scale implementation of metal powder catalysts across chemical manufacturing sectors.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!