Why Metal Powders Are Critical in Developing Smart Materials

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Metal Powder Technology Background and Objectives

Metal powder technology has evolved significantly over the past century, transforming from simple metallurgical applications to becoming a cornerstone of advanced materials science. The journey began in the early 20th century with basic powder metallurgy processes primarily focused on manufacturing simple components. By the mid-century, technological advancements enabled more sophisticated applications in aerospace and defense industries, where high-performance metal components were critical.

The evolution accelerated dramatically in the 1980s and 1990s with the development of specialized powder production methods such as gas atomization, water atomization, and mechanical alloying. These techniques allowed for unprecedented control over particle size, shape, and composition, opening new possibilities for material design. The early 2000s witnessed further refinement with the emergence of nanoscale metal powders, pushing the boundaries of what could be achieved with these materials.

Today, metal powders stand at the intersection of multiple technological revolutions, particularly in the development of smart materials. These advanced materials can respond to environmental stimuli such as temperature, pressure, electric fields, or magnetic fields in predetermined ways. The unique properties of metal powders—including their tunable particle size, surface area, and composition—make them ideal building blocks for such responsive systems.

The primary objective in this field is to harness the inherent properties of metal powders to create materials with programmable functionalities. This includes developing powders with specific magnetic, electrical, thermal, or mechanical characteristics that can be precisely controlled during manufacturing and application. A parallel goal is to enhance the scalability of production processes to make these advanced materials commercially viable across various industries.

Research trends indicate growing interest in multi-functional metal powders that can simultaneously exhibit several smart properties. For instance, powders that combine magnetic responsiveness with electrical conductivity and shape memory effects are being actively pursued. Additionally, there is significant focus on sustainability, with efforts directed toward developing recycling methods for metal powders and reducing the environmental impact of their production.

Looking forward, the technology roadmap for metal powders in smart materials development aims to achieve greater precision in controlling material responses, improved integration with other material systems, and expanded application areas beyond traditional sectors. The convergence of metal powder technology with digital manufacturing methods like additive manufacturing represents a particularly promising direction, potentially enabling on-demand production of customized smart materials with unprecedented properties.

The evolution accelerated dramatically in the 1980s and 1990s with the development of specialized powder production methods such as gas atomization, water atomization, and mechanical alloying. These techniques allowed for unprecedented control over particle size, shape, and composition, opening new possibilities for material design. The early 2000s witnessed further refinement with the emergence of nanoscale metal powders, pushing the boundaries of what could be achieved with these materials.

Today, metal powders stand at the intersection of multiple technological revolutions, particularly in the development of smart materials. These advanced materials can respond to environmental stimuli such as temperature, pressure, electric fields, or magnetic fields in predetermined ways. The unique properties of metal powders—including their tunable particle size, surface area, and composition—make them ideal building blocks for such responsive systems.

The primary objective in this field is to harness the inherent properties of metal powders to create materials with programmable functionalities. This includes developing powders with specific magnetic, electrical, thermal, or mechanical characteristics that can be precisely controlled during manufacturing and application. A parallel goal is to enhance the scalability of production processes to make these advanced materials commercially viable across various industries.

Research trends indicate growing interest in multi-functional metal powders that can simultaneously exhibit several smart properties. For instance, powders that combine magnetic responsiveness with electrical conductivity and shape memory effects are being actively pursued. Additionally, there is significant focus on sustainability, with efforts directed toward developing recycling methods for metal powders and reducing the environmental impact of their production.

Looking forward, the technology roadmap for metal powders in smart materials development aims to achieve greater precision in controlling material responses, improved integration with other material systems, and expanded application areas beyond traditional sectors. The convergence of metal powder technology with digital manufacturing methods like additive manufacturing represents a particularly promising direction, potentially enabling on-demand production of customized smart materials with unprecedented properties.

Smart Materials Market Analysis and Demand

The smart materials market has witnessed substantial growth in recent years, driven by increasing applications across multiple industries including aerospace, automotive, healthcare, and consumer electronics. Current market valuations place the global smart materials sector at approximately $65 billion as of 2023, with projections indicating a compound annual growth rate (CAGR) of 13.5% through 2030, potentially reaching $155 billion by the end of the decade.

Metal powder-based smart materials represent one of the fastest-growing segments within this market, with particular demand acceleration in shape memory alloys, magnetorheological materials, and self-healing metal composites. These materials are experiencing heightened interest due to their unique ability to respond to environmental stimuli while maintaining structural integrity and mechanical properties that traditional materials cannot match.

Industry analysis reveals that aerospace and defense sectors currently account for the largest market share at 28% of total smart materials consumption, followed by automotive (23%), biomedical applications (18%), and electronics (15%). The remaining 16% is distributed across various industries including construction, energy, and consumer goods. This distribution highlights the versatility and cross-industry applicability of metal powder-based smart materials.

Regional market assessment shows North America leading with 35% market share, followed closely by Europe (30%) and Asia-Pacific (25%). However, the Asia-Pacific region demonstrates the highest growth rate at 15.8% annually, primarily driven by rapid industrialization in China, Japan, South Korea, and India, along with increasing R&D investments in smart material technologies.

Consumer demand patterns indicate a growing preference for multifunctional materials that can simultaneously address multiple performance requirements. This trend is particularly evident in the automotive sector, where manufacturers seek materials that combine lightweight properties with strength, thermal management capabilities, and adaptive responses to changing conditions.

Market research identifies several key demand drivers for metal powder-based smart materials: increasing focus on energy efficiency, growing need for miniaturization in electronics, rising demand for non-invasive medical devices, and stringent regulatory requirements for safety and environmental sustainability across industries.

Supply chain analysis reveals potential constraints in the availability of specialized metal powders, particularly rare earth elements and high-purity transition metals required for advanced smart material formulations. This supply limitation represents both a market challenge and an opportunity for companies that can develop alternative material compositions or more efficient processing technologies.

Metal powder-based smart materials represent one of the fastest-growing segments within this market, with particular demand acceleration in shape memory alloys, magnetorheological materials, and self-healing metal composites. These materials are experiencing heightened interest due to their unique ability to respond to environmental stimuli while maintaining structural integrity and mechanical properties that traditional materials cannot match.

Industry analysis reveals that aerospace and defense sectors currently account for the largest market share at 28% of total smart materials consumption, followed by automotive (23%), biomedical applications (18%), and electronics (15%). The remaining 16% is distributed across various industries including construction, energy, and consumer goods. This distribution highlights the versatility and cross-industry applicability of metal powder-based smart materials.

Regional market assessment shows North America leading with 35% market share, followed closely by Europe (30%) and Asia-Pacific (25%). However, the Asia-Pacific region demonstrates the highest growth rate at 15.8% annually, primarily driven by rapid industrialization in China, Japan, South Korea, and India, along with increasing R&D investments in smart material technologies.

Consumer demand patterns indicate a growing preference for multifunctional materials that can simultaneously address multiple performance requirements. This trend is particularly evident in the automotive sector, where manufacturers seek materials that combine lightweight properties with strength, thermal management capabilities, and adaptive responses to changing conditions.

Market research identifies several key demand drivers for metal powder-based smart materials: increasing focus on energy efficiency, growing need for miniaturization in electronics, rising demand for non-invasive medical devices, and stringent regulatory requirements for safety and environmental sustainability across industries.

Supply chain analysis reveals potential constraints in the availability of specialized metal powders, particularly rare earth elements and high-purity transition metals required for advanced smart material formulations. This supply limitation represents both a market challenge and an opportunity for companies that can develop alternative material compositions or more efficient processing technologies.

Current State and Challenges in Metal Powder Metallurgy

Metal powder metallurgy has witnessed significant advancements globally, with the market reaching approximately $3.2 billion in 2022 and projected to grow at a CAGR of 6.8% through 2030. This growth is primarily driven by increasing demand for smart materials across aerospace, automotive, healthcare, and electronics sectors. However, the field faces several critical challenges that impede broader adoption and technological advancement.

Production scalability remains a fundamental challenge, particularly for high-performance metal powders required in smart material applications. Current atomization techniques struggle to maintain consistent particle size distribution and morphology at industrial scales, leading to variability in final material properties. This inconsistency significantly impacts the reliability of smart materials that depend on precise microstructural characteristics.

Material purity represents another significant hurdle, as even minor contamination can dramatically alter the functional properties of smart materials. Oxygen content in particular remains problematic for reactive metals like titanium and aluminum, which are essential components in many smart material systems. Advanced vacuum processing techniques are being developed but add substantial cost to production.

Cost factors continue to constrain widespread implementation, with specialized metal powders for smart materials often costing 5-10 times more than conventional engineering materials. This price premium limits adoption in price-sensitive markets and hinders commercialization of promising research developments.

Technical limitations in powder characterization present additional challenges. Current analytical methods struggle to accurately assess critical parameters such as surface chemistry, internal defects, and particle morphology at the nanoscale—all crucial factors for smart material performance. This knowledge gap complicates quality control and predictive modeling efforts.

Sustainability concerns are increasingly prominent, with metal powder production typically requiring significant energy input and generating substantial carbon emissions. The industry faces growing pressure to develop greener production methods and recycling pathways for metal powders, particularly as regulatory frameworks evolve globally.

Geographically, metal powder technology development shows distinct patterns. North America and Europe lead in research innovation and high-value applications, while Asia (particularly China and Japan) dominates in production volume and cost-competitive manufacturing. This distribution creates supply chain vulnerabilities that became evident during recent global disruptions.

The integration of metal powders into advanced manufacturing processes like additive manufacturing presents additional challenges, including powder flowability issues, oxidation during processing, and limited understanding of process-structure-property relationships in complex smart material systems.

Production scalability remains a fundamental challenge, particularly for high-performance metal powders required in smart material applications. Current atomization techniques struggle to maintain consistent particle size distribution and morphology at industrial scales, leading to variability in final material properties. This inconsistency significantly impacts the reliability of smart materials that depend on precise microstructural characteristics.

Material purity represents another significant hurdle, as even minor contamination can dramatically alter the functional properties of smart materials. Oxygen content in particular remains problematic for reactive metals like titanium and aluminum, which are essential components in many smart material systems. Advanced vacuum processing techniques are being developed but add substantial cost to production.

Cost factors continue to constrain widespread implementation, with specialized metal powders for smart materials often costing 5-10 times more than conventional engineering materials. This price premium limits adoption in price-sensitive markets and hinders commercialization of promising research developments.

Technical limitations in powder characterization present additional challenges. Current analytical methods struggle to accurately assess critical parameters such as surface chemistry, internal defects, and particle morphology at the nanoscale—all crucial factors for smart material performance. This knowledge gap complicates quality control and predictive modeling efforts.

Sustainability concerns are increasingly prominent, with metal powder production typically requiring significant energy input and generating substantial carbon emissions. The industry faces growing pressure to develop greener production methods and recycling pathways for metal powders, particularly as regulatory frameworks evolve globally.

Geographically, metal powder technology development shows distinct patterns. North America and Europe lead in research innovation and high-value applications, while Asia (particularly China and Japan) dominates in production volume and cost-competitive manufacturing. This distribution creates supply chain vulnerabilities that became evident during recent global disruptions.

The integration of metal powders into advanced manufacturing processes like additive manufacturing presents additional challenges, including powder flowability issues, oxidation during processing, and limited understanding of process-structure-property relationships in complex smart material systems.

Current Metal Powder Solutions for Smart Materials

01 Production methods for metal powders

Various methods are employed to produce metal powders with specific characteristics. These include atomization techniques, reduction processes, electrolytic deposition, and mechanical milling. Each method yields powders with different particle sizes, shapes, and properties suitable for various applications. The production process significantly influences the final powder characteristics, which in turn affects their performance in subsequent manufacturing processes.- Production methods for metal powders: Various methods are employed for producing metal powders, including atomization, reduction, and electrolytic processes. These techniques allow for control over particle size, shape, and purity of the resulting powders. The production method significantly influences the properties of the metal powders, making them suitable for specific applications in industries such as additive manufacturing, powder metallurgy, and electronics.

- Metal powder compositions and alloys: Metal powders can be formulated as pure metals or as alloys combining multiple metallic elements to achieve specific properties. These compositions may include iron, aluminum, copper, titanium, and other metals or their alloys. The specific composition determines characteristics such as melting point, strength, conductivity, and corrosion resistance, making them suitable for various industrial applications.

- Applications in additive manufacturing and 3D printing: Metal powders are extensively used in additive manufacturing processes such as selective laser melting, electron beam melting, and direct metal laser sintering. These powders must possess specific characteristics including flowability, particle size distribution, and packing density to ensure successful printing operations. The resulting 3D-printed components find applications in aerospace, automotive, medical, and other high-performance industries.

- Surface treatments and coatings for metal powders: Metal powders can be surface-treated or coated to enhance their properties and performance. These treatments may include oxidation prevention coatings, functionalization for improved dispersion, or surface modifications to enhance bonding in composite materials. Surface treatments can significantly improve the stability, reactivity, and compatibility of metal powders in various applications.

- Metal powder processing and sintering techniques: Processing techniques for metal powders include compaction, sintering, and heat treatment methods that transform loose powder into solid components. These processes control the final density, microstructure, and mechanical properties of the finished parts. Advanced sintering techniques allow for the production of complex shapes with precise dimensions and excellent mechanical properties, making them suitable for demanding applications.

02 Metal powder compositions and alloys

Metal powders can be formulated as pure metals or as alloys combining multiple metallic elements to achieve enhanced properties. These compositions may include iron-based, aluminum-based, copper-based, or nickel-based alloys, among others. Specific additives and alloying elements are incorporated to improve characteristics such as strength, corrosion resistance, magnetic properties, or thermal conductivity, making them suitable for specialized applications.Expand Specific Solutions03 Applications in additive manufacturing and 3D printing

Metal powders are extensively used in additive manufacturing processes, including selective laser melting, electron beam melting, and direct metal laser sintering. The powders must possess specific flow characteristics, particle size distribution, and purity levels to ensure successful printing operations. These technologies enable the production of complex geometries and customized metal components with reduced material waste compared to traditional manufacturing methods.Expand Specific Solutions04 Surface treatments and coatings for metal powders

Metal powders can be surface-treated or coated to enhance their properties and performance. These treatments may include passivation to prevent oxidation, application of organic or inorganic coatings to improve flowability, or functionalization to promote better bonding in composite materials. Surface modifications can also improve dispersion characteristics, reduce health hazards associated with fine particles, and extend shelf life of the powders.Expand Specific Solutions05 Metal powder processing and sintering techniques

Processing techniques for metal powders include compaction, sintering, and heat treatment to transform loose powder into solid components. Sintering parameters such as temperature, time, and atmosphere significantly affect the final properties of the parts. Advanced sintering methods like spark plasma sintering, hot isostatic pressing, and microwave sintering can achieve higher densities and improved mechanical properties compared to conventional techniques.Expand Specific Solutions

Leading Companies in Metal Powder and Smart Materials

The smart materials market is currently in a growth phase, with metal powders playing a crucial role in their development. The global market is expanding rapidly due to increasing applications in automotive, electronics, and aerospace industries. Technologically, the field shows varying maturity levels across applications. Leading players like Höganäs AB and Materion Corp. have established strong positions in powder metallurgy, while research institutions such as Battelle Memorial Institute and Korea Advanced Institute of Science & Technology drive innovation. Companies including ArcelorMittal, Sumitomo Electric, and Robert Bosch are leveraging metal powder technologies to develop advanced smart materials. EOS GmbH and NCC Nano represent the emerging additive manufacturing segment, where metal powders enable novel smart material applications through 3D printing technologies.

Höganäs AB

Technical Solution: Höganäs AB has pioneered the development of specialized metal powders critical for smart materials applications. Their technology focuses on tailored powder metallurgy solutions that enable the creation of materials with programmable properties. Their Astaloy series of pre-alloyed powders provides precise control over material composition, enabling the development of components with specific magnetic, thermal, and mechanical properties[1]. Höganäs has developed proprietary atomization processes that yield spherical metal powders with exceptional flowability and packing density, critical for additive manufacturing of smart components. Their Digital Metal technology enables the production of high-precision metal components with complex geometries and embedded functionalities[3]. Additionally, their soft magnetic composite (SMC) powders allow for the creation of components with 3D magnetic flux properties, essential for advanced sensors and actuators in smart material systems.

Strengths: Industry-leading powder atomization technology providing superior particle morphology and size distribution; extensive R&D capabilities with over 70 years of experience in metal powder production. Weaknesses: Higher production costs compared to conventional materials; requires specialized processing equipment for optimal results in smart material applications.

Sumitomo Electric Industries Ltd.

Technical Solution: Sumitomo Electric Industries has developed advanced metal powder technologies critical for smart material applications. Their approach focuses on specialized powder metallurgy processes that enable the creation of materials with unique electrical, magnetic, and mechanical properties. Sumitomo's proprietary water atomization technology produces irregular-shaped metal powders with high surface area and enhanced sinterability, ideal for creating porous smart materials with large active surface areas[9]. They have pioneered the development of ultra-fine metal powders with particle sizes below 10 microns, enabling the creation of components with exceptional detail and embedded functionalities. Their technology includes specialized copper alloy powders with tailored thermal and electrical conductivity properties essential for thermal management in smart systems[10]. Additionally, Sumitomo has developed composite metal powders that combine different materials at the particle level, enabling the creation of components with gradient properties that can respond to environmental changes.

Strengths: Extensive experience in powder metallurgy with specialized production facilities; strong integration with electronic component manufacturing expertise. Weaknesses: Some specialized powders have limited availability and higher costs; certain processing techniques require significant technical expertise to achieve optimal properties.

Key Innovations in Metal Powder Formulations

Metal powder composed of spherical particles

PatentWO2016158687A1

Innovation

- A metal powder comprising a high percentage of spherical particles, specifically containing Ni, Fe, and Co, with optimized particle size distribution, circularity, and low oxygen concentration, which enhances fluidity, strength, and wear resistance, allowing for the production of complex-shaped objects with improved properties.

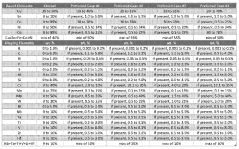

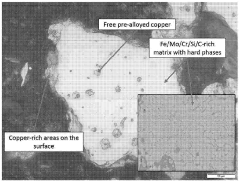

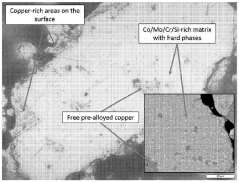

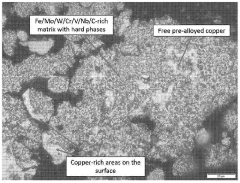

Hard powder particles with improved compressibility and green strength

PatentPendingCA3125489A1

Innovation

- Incorporating a copper-rich constituent within the powder metal material, ranging from 10 wt.% to 50 wt.%, which provides improved compressibility and green strength by allowing for deformation during compaction and enhancing mechanical bonds between particles, thereby increasing the amount of hard phases that can be included without compromising processability.

Sustainability Aspects of Metal Powder Technologies

The sustainability of metal powder technologies has become a critical consideration in the development of smart materials. As industries increasingly adopt metal powders for advanced applications, the environmental impact of their production, use, and disposal requires thorough examination. Traditional metal powder manufacturing processes are energy-intensive, often relying on fossil fuels and generating significant carbon emissions. Recent advancements have focused on reducing this environmental footprint through more efficient production methods, including renewable energy integration and process optimization.

Material efficiency represents another key sustainability aspect, with research showing that powder metallurgy can achieve up to 95% material utilization compared to conventional manufacturing methods. This reduction in waste not only conserves valuable resources but also minimizes the environmental impact associated with mining and processing raw materials. Additionally, the development of recycling technologies specifically designed for metal powders has gained momentum, enabling the recovery and reuse of these materials from end-of-life products.

Water consumption in metal powder production presents significant sustainability challenges, particularly in regions facing water scarcity. Innovative approaches such as closed-loop water systems and dry processing techniques are being implemented to address this issue. These technologies can reduce water usage by up to 60% compared to traditional methods, contributing to more sustainable manufacturing practices.

The life cycle assessment (LCA) of metal powder technologies reveals both advantages and areas for improvement. While powder-based manufacturing often demonstrates lower environmental impact during production and use phases, end-of-life management remains challenging. Recent research indicates that smart materials developed using metal powders can have extended service lives, potentially offsetting initial production impacts through longer product lifespans.

Regulatory frameworks worldwide are increasingly addressing the sustainability aspects of metal powder technologies. The European Union's Circular Economy Action Plan and similar initiatives in North America and Asia are driving industries toward more sustainable practices. These regulations often mandate reduced emissions, improved resource efficiency, and responsible end-of-life management for materials used in smart technology applications.

Future sustainability improvements in metal powder technologies will likely focus on bio-derived binders, energy-efficient atomization processes, and advanced recycling technologies. Research indicates that implementing these innovations could reduce the overall environmental footprint of metal powder-based smart materials by up to 40% in the next decade, positioning these technologies as environmentally responsible options for next-generation materials development.

Material efficiency represents another key sustainability aspect, with research showing that powder metallurgy can achieve up to 95% material utilization compared to conventional manufacturing methods. This reduction in waste not only conserves valuable resources but also minimizes the environmental impact associated with mining and processing raw materials. Additionally, the development of recycling technologies specifically designed for metal powders has gained momentum, enabling the recovery and reuse of these materials from end-of-life products.

Water consumption in metal powder production presents significant sustainability challenges, particularly in regions facing water scarcity. Innovative approaches such as closed-loop water systems and dry processing techniques are being implemented to address this issue. These technologies can reduce water usage by up to 60% compared to traditional methods, contributing to more sustainable manufacturing practices.

The life cycle assessment (LCA) of metal powder technologies reveals both advantages and areas for improvement. While powder-based manufacturing often demonstrates lower environmental impact during production and use phases, end-of-life management remains challenging. Recent research indicates that smart materials developed using metal powders can have extended service lives, potentially offsetting initial production impacts through longer product lifespans.

Regulatory frameworks worldwide are increasingly addressing the sustainability aspects of metal powder technologies. The European Union's Circular Economy Action Plan and similar initiatives in North America and Asia are driving industries toward more sustainable practices. These regulations often mandate reduced emissions, improved resource efficiency, and responsible end-of-life management for materials used in smart technology applications.

Future sustainability improvements in metal powder technologies will likely focus on bio-derived binders, energy-efficient atomization processes, and advanced recycling technologies. Research indicates that implementing these innovations could reduce the overall environmental footprint of metal powder-based smart materials by up to 40% in the next decade, positioning these technologies as environmentally responsible options for next-generation materials development.

Supply Chain Considerations for Critical Metal Powders

The global supply chain for critical metal powders represents a complex ecosystem that directly impacts the development and commercialization of smart materials. Rare earth elements, titanium, aluminum, and specialized alloy powders form the backbone of many advanced smart material applications, making their sourcing and distribution strategically important for technology companies and national economies alike.

Geographic concentration of metal powder production presents significant supply chain vulnerabilities. China currently dominates the production of rare earth metals, controlling approximately 85% of global processing capacity. This concentration creates potential bottlenecks and geopolitical risks that can disrupt the consistent supply needed for smart materials manufacturing. Similarly, titanium powder production is concentrated among a limited number of suppliers in Russia, Japan, and the United States.

Price volatility represents another critical supply chain consideration. Metal powder markets frequently experience significant fluctuations due to changing extraction costs, processing technologies, and geopolitical factors. For instance, neodymium prices have experienced swings of over 200% within single calendar years, creating challenges for long-term product planning and cost management in smart materials development.

Environmental and regulatory considerations increasingly impact supply chain reliability. Extraction and processing of metal powders often involve environmentally intensive processes that face growing regulatory scrutiny. Companies developing smart materials must navigate complex compliance landscapes that vary significantly across jurisdictions, potentially affecting production timelines and material availability.

Vertical integration strategies are emerging as a response to these supply chain challenges. Leading technology companies are increasingly investing in direct relationships with mining operations or developing proprietary recycling technologies to secure stable access to critical metal powders. This trend toward supply chain ownership represents a significant shift in how smart materials developers approach material sourcing.

Quality consistency across the supply chain remains paramount for smart materials applications. Powder characteristics such as particle size distribution, morphology, and purity significantly impact final material performance. Establishing robust quality control protocols throughout the supply chain is essential for ensuring that metal powders meet the exacting specifications required for advanced smart material applications.

Geographic concentration of metal powder production presents significant supply chain vulnerabilities. China currently dominates the production of rare earth metals, controlling approximately 85% of global processing capacity. This concentration creates potential bottlenecks and geopolitical risks that can disrupt the consistent supply needed for smart materials manufacturing. Similarly, titanium powder production is concentrated among a limited number of suppliers in Russia, Japan, and the United States.

Price volatility represents another critical supply chain consideration. Metal powder markets frequently experience significant fluctuations due to changing extraction costs, processing technologies, and geopolitical factors. For instance, neodymium prices have experienced swings of over 200% within single calendar years, creating challenges for long-term product planning and cost management in smart materials development.

Environmental and regulatory considerations increasingly impact supply chain reliability. Extraction and processing of metal powders often involve environmentally intensive processes that face growing regulatory scrutiny. Companies developing smart materials must navigate complex compliance landscapes that vary significantly across jurisdictions, potentially affecting production timelines and material availability.

Vertical integration strategies are emerging as a response to these supply chain challenges. Leading technology companies are increasingly investing in direct relationships with mining operations or developing proprietary recycling technologies to secure stable access to critical metal powders. This trend toward supply chain ownership represents a significant shift in how smart materials developers approach material sourcing.

Quality consistency across the supply chain remains paramount for smart materials applications. Powder characteristics such as particle size distribution, morphology, and purity significantly impact final material performance. Establishing robust quality control protocols throughout the supply chain is essential for ensuring that metal powders meet the exacting specifications required for advanced smart material applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!