Exploring Metal Powders in the Development of Next-Gen Alloys

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Metal Powder Alloy Evolution and Objectives

Metal powder metallurgy has evolved significantly over the past century, transforming from rudimentary powder compaction techniques to sophisticated additive manufacturing processes. The journey began in the 1920s with simple press-and-sinter methods primarily used for tungsten filaments and porous bearings. By mid-century, the field expanded to include hot isostatic pressing (HIP) and metal injection molding (MIM), enabling more complex geometries and improved material properties.

The 1980s and 1990s witnessed revolutionary advancements with the emergence of rapid solidification technologies, allowing for the creation of amorphous and nanocrystalline structures previously unattainable through conventional metallurgy. This period marked a pivotal shift in understanding how powder characteristics directly influence final alloy properties.

Recent decades have seen exponential growth in metal powder applications, driven largely by additive manufacturing technologies. Powder bed fusion, directed energy deposition, and binder jetting have fundamentally changed how engineers approach alloy design and manufacturing. The ability to create previously impossible geometries has opened new frontiers in materials science.

Current technological trends indicate a convergence of computational materials science with experimental powder metallurgy. Machine learning algorithms now predict optimal powder characteristics and processing parameters, accelerating alloy development cycles from years to months. High-throughput experimentation platforms further enable rapid prototyping and testing of novel compositions.

The primary objective in next-generation alloy development centers on creating materials with previously unattainable property combinations. Researchers aim to develop alloys that simultaneously exhibit high strength, ductility, corrosion resistance, and thermal stability—properties traditionally considered mutually exclusive. Additionally, there is growing emphasis on designing alloys specifically optimized for additive manufacturing processes.

Another critical goal involves developing sustainable metal powder production methods with reduced energy consumption and environmental impact. This includes exploring recycling pathways for metal powders and implementing closed-loop manufacturing systems that minimize material waste.

Looking forward, the field aims to establish standardized characterization methods for metal powders to ensure reproducibility across different manufacturing platforms. The development of in-situ monitoring technologies for powder-based processes represents another key objective, enabling real-time quality control and process optimization.

The ultimate vision encompasses creating "smart" alloys with programmable microstructures and properties that can be tailored for specific applications through precise control of powder characteristics and processing parameters. This paradigm shift from traditional alloy design to powder-enabled property engineering promises to revolutionize industries from aerospace to biomedical implants.

The 1980s and 1990s witnessed revolutionary advancements with the emergence of rapid solidification technologies, allowing for the creation of amorphous and nanocrystalline structures previously unattainable through conventional metallurgy. This period marked a pivotal shift in understanding how powder characteristics directly influence final alloy properties.

Recent decades have seen exponential growth in metal powder applications, driven largely by additive manufacturing technologies. Powder bed fusion, directed energy deposition, and binder jetting have fundamentally changed how engineers approach alloy design and manufacturing. The ability to create previously impossible geometries has opened new frontiers in materials science.

Current technological trends indicate a convergence of computational materials science with experimental powder metallurgy. Machine learning algorithms now predict optimal powder characteristics and processing parameters, accelerating alloy development cycles from years to months. High-throughput experimentation platforms further enable rapid prototyping and testing of novel compositions.

The primary objective in next-generation alloy development centers on creating materials with previously unattainable property combinations. Researchers aim to develop alloys that simultaneously exhibit high strength, ductility, corrosion resistance, and thermal stability—properties traditionally considered mutually exclusive. Additionally, there is growing emphasis on designing alloys specifically optimized for additive manufacturing processes.

Another critical goal involves developing sustainable metal powder production methods with reduced energy consumption and environmental impact. This includes exploring recycling pathways for metal powders and implementing closed-loop manufacturing systems that minimize material waste.

Looking forward, the field aims to establish standardized characterization methods for metal powders to ensure reproducibility across different manufacturing platforms. The development of in-situ monitoring technologies for powder-based processes represents another key objective, enabling real-time quality control and process optimization.

The ultimate vision encompasses creating "smart" alloys with programmable microstructures and properties that can be tailored for specific applications through precise control of powder characteristics and processing parameters. This paradigm shift from traditional alloy design to powder-enabled property engineering promises to revolutionize industries from aerospace to biomedical implants.

Market Demand Analysis for Advanced Metal Powder Alloys

The global market for advanced metal powder alloys is experiencing robust growth, driven primarily by increasing demand from aerospace, automotive, healthcare, and industrial manufacturing sectors. Current market valuations indicate that the metal powder industry for advanced alloys reached approximately $2.3 billion in 2022, with projections suggesting a compound annual growth rate (CAGR) of 6.8% through 2028, potentially reaching $3.4 billion by that time.

Aerospace and defense sectors remain the largest consumers of advanced metal powder alloys, accounting for roughly 35% of market demand. These industries require materials with exceptional strength-to-weight ratios, heat resistance, and durability under extreme conditions. The shift toward more fuel-efficient aircraft and the growing space exploration initiatives have intensified the need for specialized titanium, nickel, and aluminum-based alloy powders.

The automotive industry represents the fastest-growing segment, with demand increasing at approximately 8.2% annually. This surge is largely attributed to the transition toward electric vehicles and lightweight construction to improve fuel efficiency and reduce emissions. Manufacturers are increasingly adopting metal powder-based components for critical applications including powertrain systems, structural components, and heat management solutions.

Healthcare applications, particularly in medical devices and implants, constitute another significant market segment with steady growth. The biocompatibility of certain metal alloy powders, such as titanium-based materials, makes them ideal for orthopedic implants, dental applications, and surgical instruments. This sector is expected to grow at 7.5% annually through 2028.

Regional analysis reveals that North America and Europe currently dominate the market with a combined share of 58%, though Asia-Pacific is emerging as the fastest-growing region with a projected CAGR of 9.3%. China, Japan, and South Korea are making substantial investments in advanced manufacturing capabilities, driving regional demand for high-performance metal powder alloys.

Consumer trends indicate increasing preference for customized, high-performance materials with specific property profiles. This has led to growing demand for metal powders that can be precisely engineered at the microstructural level. Additionally, sustainability concerns are reshaping market dynamics, with greater emphasis on recyclable alloys and energy-efficient production methods.

Supply chain challenges, including raw material availability and price volatility, remain significant market constraints. The critical nature of certain alloying elements, particularly rare earth metals, creates potential bottlenecks in production scaling. These factors are driving research into alternative compositions and more efficient processing technologies to ensure market stability and growth.

Aerospace and defense sectors remain the largest consumers of advanced metal powder alloys, accounting for roughly 35% of market demand. These industries require materials with exceptional strength-to-weight ratios, heat resistance, and durability under extreme conditions. The shift toward more fuel-efficient aircraft and the growing space exploration initiatives have intensified the need for specialized titanium, nickel, and aluminum-based alloy powders.

The automotive industry represents the fastest-growing segment, with demand increasing at approximately 8.2% annually. This surge is largely attributed to the transition toward electric vehicles and lightweight construction to improve fuel efficiency and reduce emissions. Manufacturers are increasingly adopting metal powder-based components for critical applications including powertrain systems, structural components, and heat management solutions.

Healthcare applications, particularly in medical devices and implants, constitute another significant market segment with steady growth. The biocompatibility of certain metal alloy powders, such as titanium-based materials, makes them ideal for orthopedic implants, dental applications, and surgical instruments. This sector is expected to grow at 7.5% annually through 2028.

Regional analysis reveals that North America and Europe currently dominate the market with a combined share of 58%, though Asia-Pacific is emerging as the fastest-growing region with a projected CAGR of 9.3%. China, Japan, and South Korea are making substantial investments in advanced manufacturing capabilities, driving regional demand for high-performance metal powder alloys.

Consumer trends indicate increasing preference for customized, high-performance materials with specific property profiles. This has led to growing demand for metal powders that can be precisely engineered at the microstructural level. Additionally, sustainability concerns are reshaping market dynamics, with greater emphasis on recyclable alloys and energy-efficient production methods.

Supply chain challenges, including raw material availability and price volatility, remain significant market constraints. The critical nature of certain alloying elements, particularly rare earth metals, creates potential bottlenecks in production scaling. These factors are driving research into alternative compositions and more efficient processing technologies to ensure market stability and growth.

Current Technological Landscape and Challenges in Metal Powder Metallurgy

The global metal powder metallurgy landscape has witnessed significant technological advancements in recent years, with market value reaching approximately $3.4 billion in 2022 and projected to grow at a CAGR of 6.5% through 2030. This growth is primarily driven by increasing demand for high-performance alloys in aerospace, automotive, and medical industries. Currently, gas atomization dominates commercial powder production methods, accounting for nearly 70% of high-quality metal powder manufacturing, while water atomization remains prevalent for cost-effective production of iron-based powders.

Despite these advancements, several critical challenges persist in metal powder metallurgy. Powder quality inconsistency remains a significant issue, with variations in particle size distribution, morphology, and chemical composition affecting final part properties. Current production methods struggle to achieve uniform oxygen content below 100 ppm for reactive metals like titanium and aluminum alloys, limiting their application in critical components.

Cost factors present another substantial barrier, particularly for advanced powders used in additive manufacturing. Production costs for specialized powders such as titanium alloys and nickel superalloys range from $200-500 per kilogram, significantly higher than conventional manufacturing materials. This economic constraint restricts broader industrial adoption, especially in price-sensitive sectors.

Technical limitations in powder characterization represent another challenge. Current analytical techniques provide insufficient real-time monitoring capabilities during powder production and processing. Advanced characterization methods like X-ray microtomography and electron backscatter diffraction are primarily confined to research settings due to high costs and specialized expertise requirements.

Geographically, powder metallurgy technology development shows distinct regional patterns. North America and Europe lead in high-performance specialty powders for aerospace and medical applications, while Asia-Pacific dominates in production volume, particularly for automotive and consumer electronics applications. China has rapidly expanded its capabilities, increasing its global market share from 15% to approximately 30% over the past decade.

Environmental and safety concerns also pose significant challenges. Traditional powder production methods consume substantial energy, with gas atomization requiring 8-12 kWh per kilogram of powder produced. Additionally, fine metal powders present explosion and health hazards, necessitating sophisticated containment systems that add complexity and cost to manufacturing operations.

Recycling and sustainability remain underdeveloped areas, with current powder reuse rates in additive manufacturing typically below 30% due to degradation concerns. This inefficiency contributes to higher production costs and environmental impact, highlighting the need for improved powder recycling technologies and circular economy approaches in metal powder metallurgy.

Despite these advancements, several critical challenges persist in metal powder metallurgy. Powder quality inconsistency remains a significant issue, with variations in particle size distribution, morphology, and chemical composition affecting final part properties. Current production methods struggle to achieve uniform oxygen content below 100 ppm for reactive metals like titanium and aluminum alloys, limiting their application in critical components.

Cost factors present another substantial barrier, particularly for advanced powders used in additive manufacturing. Production costs for specialized powders such as titanium alloys and nickel superalloys range from $200-500 per kilogram, significantly higher than conventional manufacturing materials. This economic constraint restricts broader industrial adoption, especially in price-sensitive sectors.

Technical limitations in powder characterization represent another challenge. Current analytical techniques provide insufficient real-time monitoring capabilities during powder production and processing. Advanced characterization methods like X-ray microtomography and electron backscatter diffraction are primarily confined to research settings due to high costs and specialized expertise requirements.

Geographically, powder metallurgy technology development shows distinct regional patterns. North America and Europe lead in high-performance specialty powders for aerospace and medical applications, while Asia-Pacific dominates in production volume, particularly for automotive and consumer electronics applications. China has rapidly expanded its capabilities, increasing its global market share from 15% to approximately 30% over the past decade.

Environmental and safety concerns also pose significant challenges. Traditional powder production methods consume substantial energy, with gas atomization requiring 8-12 kWh per kilogram of powder produced. Additionally, fine metal powders present explosion and health hazards, necessitating sophisticated containment systems that add complexity and cost to manufacturing operations.

Recycling and sustainability remain underdeveloped areas, with current powder reuse rates in additive manufacturing typically below 30% due to degradation concerns. This inefficiency contributes to higher production costs and environmental impact, highlighting the need for improved powder recycling technologies and circular economy approaches in metal powder metallurgy.

Current Metal Powder Processing and Alloying Techniques

01 Production methods for metal powders

Various methods are employed for producing metal powders, including atomization, reduction, and electrolytic processes. These techniques control particle size, shape, and purity which are critical for downstream applications. The production methods can be optimized to yield powders with specific characteristics such as spherical morphology, narrow size distribution, or enhanced surface properties.- Production methods for metal powders: Various methods are employed for producing metal powders, including atomization, reduction, electrolysis, and mechanical processing. These techniques control particle size, shape, and purity of the resulting powders. The production method significantly influences the powder's properties and subsequent applications in industries such as additive manufacturing, powder metallurgy, and electronics.

- Metal powder compositions and alloys: Metal powder compositions include pure metals, alloys, and composite materials with specific elemental ratios designed for particular applications. These compositions may incorporate elements such as iron, aluminum, copper, titanium, and various rare earth metals. The specific composition determines properties like melting point, strength, conductivity, and magnetic characteristics of the final product.

- Applications in additive manufacturing and 3D printing: Metal powders are extensively used in additive manufacturing processes such as selective laser melting, electron beam melting, and direct metal laser sintering. These powders require specific characteristics including flowability, particle size distribution, and spherical morphology to ensure consistent layer formation and final part quality. The technology enables production of complex geometries and customized components for aerospace, medical, and automotive industries.

- Surface treatments and coatings for metal powders: Surface treatments and coatings are applied to metal powders to enhance their properties and performance. These treatments may include oxidation prevention, improved flowability, enhanced sintering characteristics, or functionalization for specific applications. Coated metal powders demonstrate better stability, reduced agglomeration, and improved compatibility with binding materials in various manufacturing processes.

- Metal powder processing and handling techniques: Specialized techniques for processing and handling metal powders include mixing, blending, compaction, sintering, and heat treatment. These processes are critical for achieving desired microstructures and properties in the final products. Safety considerations are paramount due to the potential reactivity and flammability of fine metal powders, requiring controlled environments and specialized equipment to prevent hazards during processing.

02 Metal powder applications in additive manufacturing

Metal powders are extensively used in additive manufacturing processes such as selective laser melting and electron beam melting. The powders must possess specific characteristics including flowability, particle size distribution, and chemical composition to ensure successful printing. These powders enable the production of complex geometries and customized metal parts with reduced material waste compared to traditional manufacturing methods.Expand Specific Solutions03 Metal powder compositions and alloys

Specialized metal powder compositions and alloys are developed for specific applications. These include high-performance alloys, composite powders, and powders with enhanced properties such as corrosion resistance, high-temperature stability, or magnetic characteristics. The composition can be tailored by adjusting elemental ratios, incorporating additives, or creating core-shell structures to achieve desired performance attributes.Expand Specific Solutions04 Surface treatment and coating of metal powders

Surface treatments and coatings are applied to metal powders to modify their properties and performance. These treatments can enhance oxidation resistance, improve flowability, increase compatibility with binders, or provide functional surface characteristics. Techniques include passivation, polymer coating, chemical functionalization, and deposition of thin films on the powder particles.Expand Specific Solutions05 Processing and sintering of metal powders

Metal powders undergo various processing and sintering techniques to create solid components. These processes include conventional press-and-sinter methods, hot isostatic pressing, spark plasma sintering, and metal injection molding. The sintering parameters such as temperature, pressure, and atmosphere significantly influence the final properties of the components, including density, strength, and microstructure.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The metal powder market for next-generation alloys is currently in a growth phase, with increasing applications across aerospace, automotive, and industrial sectors. The market is projected to expand significantly due to rising demand for lightweight, high-performance materials. Technologically, the field shows varying maturity levels, with companies like Höganäs AB and Sandvik leading in conventional powder metallurgy, while newer entrants such as EOS GmbH and The NanoSteel Company are advancing additive manufacturing applications. Research institutions including The University of Queensland and ETH Zurich collaborate with industrial players like Mitsubishi Materials and JFE Steel to develop novel compositions and processing techniques. The competitive landscape features traditional metallurgical companies expanding their capabilities alongside specialized powder manufacturers and technology-focused startups exploring nanostructured materials and advanced manufacturing processes.

Höganäs AB

Technical Solution: Höganäs AB has pioneered advanced metal powder technologies for next-generation alloy development through their proprietary water atomization process. Their technology enables production of high-purity spherical metal powders with controlled particle size distribution (typically 15-45μm) and excellent flowability characteristics. Their Digital Metal® binder jetting technology allows for precise manufacturing of complex metal components with exceptional surface finish (Ra<4μm) and dimensional accuracy (±0.1%). Höganäs has developed specialized powder metallurgy techniques for creating novel alloy compositions that cannot be produced through conventional casting methods, including gradient materials with varying compositions throughout a single component. Their Astaloy® series represents customized pre-alloyed powders specifically designed for high-performance applications requiring enhanced mechanical properties and corrosion resistance. Recent developments include their environmentally-friendly sponge iron process that reduces CO2 emissions by approximately 30% compared to traditional powder production methods.

Strengths: Industry-leading powder atomization technology producing highly spherical particles with excellent flowability; extensive R&D capabilities with over 70 years of powder metallurgy experience; proprietary alloy formulations optimized for specific applications. Weaknesses: Higher production costs compared to conventional metallurgy; limited maximum component size in certain applications; some specialized powders require careful handling due to oxidation sensitivity.

Mitsubishi Materials Corp.

Technical Solution: Mitsubishi Materials Corporation has developed an innovative gas atomization process for producing ultra-fine metal powders specifically engineered for next-generation alloy development. Their EIGA (Electrode Induction-melting Gas Atomization) technology enables production of high-purity, spherical metal powders with particle sizes ranging from 15-53μm with oxygen content below 200ppm. This process is particularly effective for reactive metals and specialized superalloys. Mitsubishi has pioneered a proprietary mechanical alloying technique that creates nanostructured powder materials with enhanced mechanical properties through controlled solid-state diffusion. Their research has yielded breakthrough developments in oxide dispersion strengthened (ODS) alloys, demonstrating 40% higher creep resistance at elevated temperatures compared to conventional superalloys. Mitsubishi's metal powder portfolio includes specialized compositions for additive manufacturing, with their MAM-X series designed specifically for aerospace applications requiring exceptional high-temperature performance and oxidation resistance. Their recent innovations include development of amorphous metal powders with unique magnetic properties and corrosion resistance approximately 100 times greater than conventional crystalline counterparts.

Strengths: Exceptional powder quality with high sphericity and controlled particle size distribution; advanced capabilities in reactive and refractory metal powder production; strong integration with downstream manufacturing processes including additive manufacturing. Weaknesses: Higher production costs for specialized powders; limited production capacity for certain exotic compositions; some powder formulations require specialized handling and storage conditions to prevent degradation.

Critical Patents and Research in Next-Generation Metal Powder Alloys

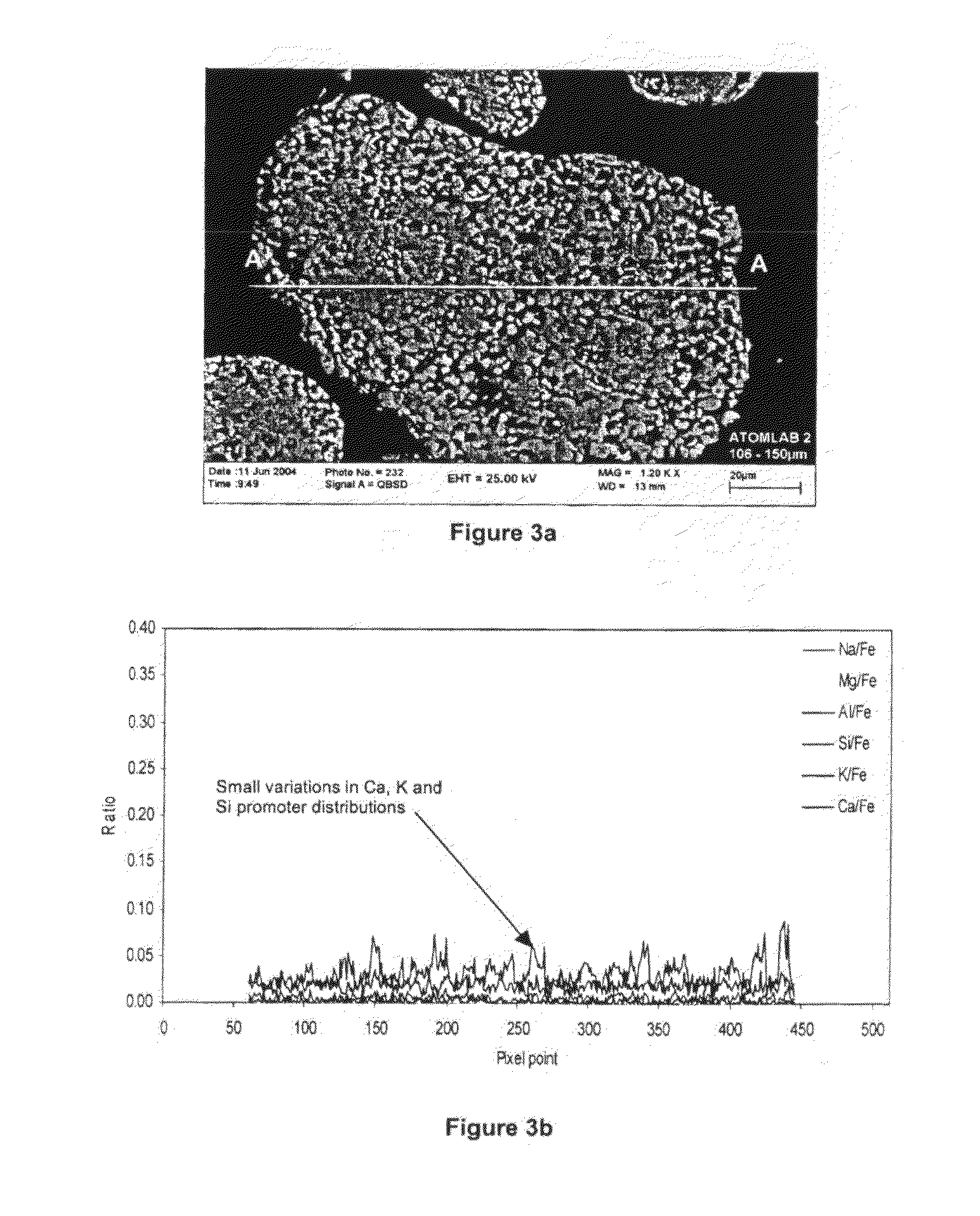

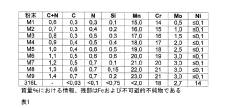

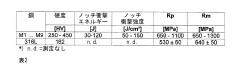

Method for the preparation of a hydrocarbon synthesis catalyst and the use thereof in a hydrocarbon synthesis process

PatentInactiveUS20110213042A1

Innovation

- Rapid Solidification Processing (RSP) is employed to disperse a melt of iron oxide and catalyst promoters into droplets, which are then quenched to form solid particles with homogeneous promoter distribution, eliminating segregation and improving mechanical strength and selectivity.

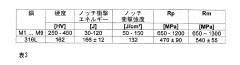

Metal powders for additive manufacturing processes, uses thereof, methods of making parts, and parts thereof

PatentInactiveJP2023511877A

Innovation

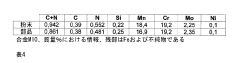

- Development of metal powders with controlled carbon and nitrogen content, combined with manganese and other elements, optimized for additive manufacturing, ensuring a predominantly austenitic structure and high mechanical properties through precise atomization and heat treatment, avoiding chromium carbide formation.

Sustainability Factors in Advanced Metal Powder Production

The sustainability landscape in metal powder production has evolved significantly in recent years, driven by increasing environmental regulations and corporate social responsibility initiatives. Traditional metal powder manufacturing processes are energy-intensive and often generate substantial waste, prompting the industry to seek more sustainable alternatives. Life cycle assessment (LCA) studies indicate that the production phase accounts for approximately 60-70% of the environmental footprint of metal powders, highlighting the importance of sustainable production methods.

Water consumption represents a critical sustainability factor, with conventional atomization techniques requiring 2,000-4,000 liters of water per ton of metal powder produced. Advanced recycling systems have demonstrated potential to reduce this consumption by up to 85%, while simultaneously preventing contamination of local water sources with metal particulates and processing chemicals.

Energy efficiency improvements have become paramount in modern powder metallurgy. The transition from conventional gas atomization to plasma rotating electrode processes (PREP) has yielded energy savings of 30-45% in some applications. Furthermore, the implementation of waste heat recovery systems in atomization towers has enabled facilities to recapture up to 25% of thermal energy that would otherwise be lost.

Raw material sourcing presents both challenges and opportunities for sustainability enhancement. The industry is increasingly adopting certified responsible sourcing practices, with leading manufacturers now sourcing 40-60% of their raw materials from recycled streams. This shift not only reduces environmental impact but also mitigates supply chain vulnerabilities associated with critical elements like cobalt, tungsten, and rare earth metals.

Carbon footprint reduction strategies have gained traction across the sector. Several major powder producers have committed to science-based targets for emissions reduction, with the most ambitious aiming for carbon neutrality by 2040. Technologies such as hydrogen-based reduction processes for iron powders have demonstrated potential to decrease CO2 emissions by up to 90% compared to conventional coal-based reduction methods.

Waste minimization represents another frontier in sustainable powder production. Advanced classification and recovery systems now enable manufacturers to reclaim up to 98% of off-specification powder for reprocessing. Additionally, the development of closed-loop production systems has reduced hazardous waste generation by 50-70% in best-practice facilities, significantly lowering environmental impact and compliance costs.

Water consumption represents a critical sustainability factor, with conventional atomization techniques requiring 2,000-4,000 liters of water per ton of metal powder produced. Advanced recycling systems have demonstrated potential to reduce this consumption by up to 85%, while simultaneously preventing contamination of local water sources with metal particulates and processing chemicals.

Energy efficiency improvements have become paramount in modern powder metallurgy. The transition from conventional gas atomization to plasma rotating electrode processes (PREP) has yielded energy savings of 30-45% in some applications. Furthermore, the implementation of waste heat recovery systems in atomization towers has enabled facilities to recapture up to 25% of thermal energy that would otherwise be lost.

Raw material sourcing presents both challenges and opportunities for sustainability enhancement. The industry is increasingly adopting certified responsible sourcing practices, with leading manufacturers now sourcing 40-60% of their raw materials from recycled streams. This shift not only reduces environmental impact but also mitigates supply chain vulnerabilities associated with critical elements like cobalt, tungsten, and rare earth metals.

Carbon footprint reduction strategies have gained traction across the sector. Several major powder producers have committed to science-based targets for emissions reduction, with the most ambitious aiming for carbon neutrality by 2040. Technologies such as hydrogen-based reduction processes for iron powders have demonstrated potential to decrease CO2 emissions by up to 90% compared to conventional coal-based reduction methods.

Waste minimization represents another frontier in sustainable powder production. Advanced classification and recovery systems now enable manufacturers to reclaim up to 98% of off-specification powder for reprocessing. Additionally, the development of closed-loop production systems has reduced hazardous waste generation by 50-70% in best-practice facilities, significantly lowering environmental impact and compliance costs.

Standardization and Quality Control Frameworks

The standardization and quality control frameworks for metal powders in alloy development have become increasingly critical as the industry moves toward more sophisticated manufacturing processes. International standards organizations such as ASTM International, ISO, and SAE have established comprehensive guidelines specifically addressing the unique requirements of metal powder characterization, handling, and processing. These standards cover particle size distribution, chemical composition, flowability, apparent density, and contamination levels—all crucial parameters that directly impact the final alloy properties.

Quality control systems for metal powders typically implement a multi-tiered approach, beginning with raw material inspection and continuing through production monitoring to final product verification. Statistical Process Control (SPC) methodologies have been widely adopted, allowing manufacturers to detect variations in powder characteristics before they affect production outcomes. Advanced analytical techniques including laser diffraction, scanning electron microscopy (SEM), and X-ray diffraction (XRD) serve as cornerstone technologies in these quality frameworks, providing precise measurements of powder attributes.

Traceability requirements have become more stringent, particularly for applications in aerospace, medical devices, and automotive industries where performance reliability is paramount. Each batch of metal powder must maintain complete documentation from sourcing through processing, with digital systems increasingly replacing paper-based records to enhance data integrity and accessibility. This digital transformation facilitates real-time monitoring and faster response to quality deviations.

Certification programs specific to metal powder production have emerged as industry differentiators. These programs often require manufacturers to demonstrate consistent adherence to established protocols through regular third-party audits. The aerospace industry, through standards like AS9100, has been particularly influential in driving higher quality benchmarks for metal powder suppliers, establishing practices that have subsequently been adopted across other sectors.

Emerging technologies are reshaping quality control frameworks, with in-line monitoring systems capable of continuous powder assessment during production and processing. Machine learning algorithms are being integrated to predict quality issues before they manifest, analyzing patterns in production data to identify potential anomalies. These predictive capabilities represent a significant advancement over traditional reactive quality control approaches.

Harmonization efforts between different standards bodies are underway to address inconsistencies in testing methodologies and acceptance criteria across global markets. This convergence aims to reduce compliance costs for manufacturers while ensuring consistent quality regardless of geographic location. The development of these unified standards represents a collaborative effort between industry stakeholders, research institutions, and regulatory bodies to establish scientifically sound and practically implementable quality frameworks.

Quality control systems for metal powders typically implement a multi-tiered approach, beginning with raw material inspection and continuing through production monitoring to final product verification. Statistical Process Control (SPC) methodologies have been widely adopted, allowing manufacturers to detect variations in powder characteristics before they affect production outcomes. Advanced analytical techniques including laser diffraction, scanning electron microscopy (SEM), and X-ray diffraction (XRD) serve as cornerstone technologies in these quality frameworks, providing precise measurements of powder attributes.

Traceability requirements have become more stringent, particularly for applications in aerospace, medical devices, and automotive industries where performance reliability is paramount. Each batch of metal powder must maintain complete documentation from sourcing through processing, with digital systems increasingly replacing paper-based records to enhance data integrity and accessibility. This digital transformation facilitates real-time monitoring and faster response to quality deviations.

Certification programs specific to metal powder production have emerged as industry differentiators. These programs often require manufacturers to demonstrate consistent adherence to established protocols through regular third-party audits. The aerospace industry, through standards like AS9100, has been particularly influential in driving higher quality benchmarks for metal powder suppliers, establishing practices that have subsequently been adopted across other sectors.

Emerging technologies are reshaping quality control frameworks, with in-line monitoring systems capable of continuous powder assessment during production and processing. Machine learning algorithms are being integrated to predict quality issues before they manifest, analyzing patterns in production data to identify potential anomalies. These predictive capabilities represent a significant advancement over traditional reactive quality control approaches.

Harmonization efforts between different standards bodies are underway to address inconsistencies in testing methodologies and acceptance criteria across global markets. This convergence aims to reduce compliance costs for manufacturers while ensuring consistent quality regardless of geographic location. The development of these unified standards represents a collaborative effort between industry stakeholders, research institutions, and regulatory bodies to establish scientifically sound and practically implementable quality frameworks.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!