Metal Powders as Key Enablers in Additive Manufacturing

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Metal Powder AM Evolution and Objectives

Additive Manufacturing (AM) has evolved significantly since its inception in the 1980s, transforming from a prototyping technology into a viable manufacturing process for end-use parts. Metal powders have been at the forefront of this evolution, serving as the fundamental building blocks that enable the creation of complex metal components with unprecedented design freedom. The journey began with rudimentary powder bed fusion techniques and has progressed to sophisticated multi-material systems capable of producing parts with tailored properties.

The historical trajectory of metal powder-based AM shows distinct phases of development. Initially, research focused on establishing basic process parameters and understanding the relationship between powder characteristics and final part properties. The early 2000s witnessed increased industrial adoption, particularly in aerospace and medical sectors, driving demand for higher quality metal powders with consistent properties. Recent years have seen exponential growth in both powder production technologies and AM system capabilities, enabling more precise control over microstructure and mechanical properties.

Current technological objectives in metal powder AM center around several key areas. Powder manufacturers aim to develop materials with enhanced flowability, packing density, and thermal properties to improve process stability and part quality. There is a growing emphasis on expanding the range of available alloys, including high-performance materials such as refractory metals, superalloys, and novel compositions specifically designed for AM processes.

Another critical objective is the reduction of powder costs, which remain a significant barrier to wider AM adoption. This involves optimizing production methods, increasing yields, and developing recycling protocols to minimize waste. Simultaneously, there is a push toward more sustainable powder production techniques with reduced energy consumption and environmental impact.

The standardization of powder characterization methods represents another important goal, as inconsistent testing procedures have led to variability in reported properties and performance. Industry consortia and standards organizations are working to establish unified protocols for evaluating powder morphology, size distribution, flowability, and chemical composition.

Looking forward, the field is moving toward intelligent powder systems with in-situ monitoring capabilities, allowing real-time adjustments during the build process. Research is also exploring functionalized powders with enhanced properties such as improved laser absorption, reduced oxidation susceptibility, and better thermal conductivity. These advancements aim to address current limitations in build speed, part quality, and material property consistency.

The historical trajectory of metal powder-based AM shows distinct phases of development. Initially, research focused on establishing basic process parameters and understanding the relationship between powder characteristics and final part properties. The early 2000s witnessed increased industrial adoption, particularly in aerospace and medical sectors, driving demand for higher quality metal powders with consistent properties. Recent years have seen exponential growth in both powder production technologies and AM system capabilities, enabling more precise control over microstructure and mechanical properties.

Current technological objectives in metal powder AM center around several key areas. Powder manufacturers aim to develop materials with enhanced flowability, packing density, and thermal properties to improve process stability and part quality. There is a growing emphasis on expanding the range of available alloys, including high-performance materials such as refractory metals, superalloys, and novel compositions specifically designed for AM processes.

Another critical objective is the reduction of powder costs, which remain a significant barrier to wider AM adoption. This involves optimizing production methods, increasing yields, and developing recycling protocols to minimize waste. Simultaneously, there is a push toward more sustainable powder production techniques with reduced energy consumption and environmental impact.

The standardization of powder characterization methods represents another important goal, as inconsistent testing procedures have led to variability in reported properties and performance. Industry consortia and standards organizations are working to establish unified protocols for evaluating powder morphology, size distribution, flowability, and chemical composition.

Looking forward, the field is moving toward intelligent powder systems with in-situ monitoring capabilities, allowing real-time adjustments during the build process. Research is also exploring functionalized powders with enhanced properties such as improved laser absorption, reduced oxidation susceptibility, and better thermal conductivity. These advancements aim to address current limitations in build speed, part quality, and material property consistency.

Market Analysis for Metal AM Applications

The global metal additive manufacturing (AM) market has experienced significant growth in recent years, reaching approximately $2.73 billion in 2021 and is projected to expand at a CAGR of 18.2% through 2030. This robust growth is primarily driven by increasing adoption across aerospace, automotive, healthcare, and industrial manufacturing sectors seeking lightweight components, complex geometries, and customized solutions.

Aerospace remains the dominant application segment, accounting for roughly 31% of the metal AM market. The industry's demand for high-performance, lightweight components with complex geometries that reduce fuel consumption and emissions continues to drive adoption. Major aerospace manufacturers have integrated metal AM into their production processes for critical components like turbine blades, fuel nozzles, and structural brackets.

The medical and dental sectors represent the fastest-growing application segment with a CAGR exceeding 22%. The ability to produce patient-specific implants, prosthetics, and surgical instruments has revolutionized healthcare manufacturing. Titanium alloys dominate this segment due to their biocompatibility and mechanical properties.

Automotive applications are gaining momentum as manufacturers explore metal AM for prototyping, tooling, and increasingly for end-use parts in high-performance and luxury vehicles. The focus on lightweighting and parts consolidation aligns perfectly with metal AM capabilities, though cost considerations still limit mass-market adoption.

Regionally, North America leads the market with approximately 40% share, followed by Europe at 35% and Asia-Pacific at 20%. However, the Asia-Pacific region is experiencing the fastest growth rate, driven by significant investments in AM technologies in China, Japan, and South Korea.

By material type, titanium powders command the largest market share (approximately 28%), followed by nickel alloys (23%), aluminum alloys (18%), and stainless steel (17%). Specialized alloys for specific applications represent the remaining market share and are expected to see increased adoption as the technology matures.

Key market challenges include high material costs, with metal powders typically costing 3-10 times more than conventional manufacturing materials. Quality consistency, certification processes, and limited build volumes also restrict broader adoption. However, ongoing developments in powder production technologies are gradually addressing these barriers by improving powder quality while reducing costs.

The market is witnessing a shift from prototyping to production applications, with end-use parts now representing over 65% of the metal AM market value. This transition is accelerating as industries develop confidence in the technology and establish comprehensive quality assurance protocols.

Aerospace remains the dominant application segment, accounting for roughly 31% of the metal AM market. The industry's demand for high-performance, lightweight components with complex geometries that reduce fuel consumption and emissions continues to drive adoption. Major aerospace manufacturers have integrated metal AM into their production processes for critical components like turbine blades, fuel nozzles, and structural brackets.

The medical and dental sectors represent the fastest-growing application segment with a CAGR exceeding 22%. The ability to produce patient-specific implants, prosthetics, and surgical instruments has revolutionized healthcare manufacturing. Titanium alloys dominate this segment due to their biocompatibility and mechanical properties.

Automotive applications are gaining momentum as manufacturers explore metal AM for prototyping, tooling, and increasingly for end-use parts in high-performance and luxury vehicles. The focus on lightweighting and parts consolidation aligns perfectly with metal AM capabilities, though cost considerations still limit mass-market adoption.

Regionally, North America leads the market with approximately 40% share, followed by Europe at 35% and Asia-Pacific at 20%. However, the Asia-Pacific region is experiencing the fastest growth rate, driven by significant investments in AM technologies in China, Japan, and South Korea.

By material type, titanium powders command the largest market share (approximately 28%), followed by nickel alloys (23%), aluminum alloys (18%), and stainless steel (17%). Specialized alloys for specific applications represent the remaining market share and are expected to see increased adoption as the technology matures.

Key market challenges include high material costs, with metal powders typically costing 3-10 times more than conventional manufacturing materials. Quality consistency, certification processes, and limited build volumes also restrict broader adoption. However, ongoing developments in powder production technologies are gradually addressing these barriers by improving powder quality while reducing costs.

The market is witnessing a shift from prototyping to production applications, with end-use parts now representing over 65% of the metal AM market value. This transition is accelerating as industries develop confidence in the technology and establish comprehensive quality assurance protocols.

Metal Powder Challenges and Global Development Status

Metal powder technology faces significant challenges in the additive manufacturing (AM) industry despite its rapid global development. One primary obstacle is achieving consistent powder quality across batches, as variations in particle size distribution, morphology, and chemical composition directly impact final part properties. Manufacturers struggle with powder recyclability, as repeated use can lead to oxidation, contamination, and degradation of mechanical properties in finished components.

Production costs remain prohibitively high for many potential applications, with specialized metal powders often costing 3-10 times more than conventional manufacturing materials. This economic barrier has limited widespread adoption, particularly in cost-sensitive industries. Additionally, the limited range of available metal powders restricts innovation, with only about 30 alloy compositions commonly available compared to thousands in traditional metallurgy.

Safety and environmental concerns present another significant challenge. Metal powders, especially reactive materials like aluminum and titanium, pose explosion and fire hazards during handling and processing. Proper containment systems and handling protocols add complexity and cost to AM operations.

Globally, metal powder development for AM shows distinct regional patterns. North America leads in research and development, with substantial government funding supporting innovations in specialized alloys for aerospace and defense applications. The United States maintains approximately 35% of global metal powder production capacity for AM applications.

Europe excels in standardization efforts, with countries like Germany and Sweden pioneering powder characterization techniques and quality control methodologies. The European market focuses heavily on high-performance alloys for automotive and medical applications, representing about 30% of the global market share.

Asia-Pacific, particularly China and Japan, has rapidly expanded production capacity, focusing on cost reduction and mass production capabilities. China has increased its metal powder production facilities by over 200% in the past five years, primarily targeting titanium and aluminum alloy powders for industrial applications.

Emerging economies are gradually entering the market, with countries like India and Brazil developing specialized capabilities in specific alloy systems. These regions typically focus on adapting existing technologies rather than pioneering new powder development approaches.

The global metal powder market for AM is projected to grow at a CAGR of 22% through 2026, reaching approximately $1.2 billion, driven primarily by aerospace, medical, and automotive applications requiring high-performance metal components with complex geometries.

Production costs remain prohibitively high for many potential applications, with specialized metal powders often costing 3-10 times more than conventional manufacturing materials. This economic barrier has limited widespread adoption, particularly in cost-sensitive industries. Additionally, the limited range of available metal powders restricts innovation, with only about 30 alloy compositions commonly available compared to thousands in traditional metallurgy.

Safety and environmental concerns present another significant challenge. Metal powders, especially reactive materials like aluminum and titanium, pose explosion and fire hazards during handling and processing. Proper containment systems and handling protocols add complexity and cost to AM operations.

Globally, metal powder development for AM shows distinct regional patterns. North America leads in research and development, with substantial government funding supporting innovations in specialized alloys for aerospace and defense applications. The United States maintains approximately 35% of global metal powder production capacity for AM applications.

Europe excels in standardization efforts, with countries like Germany and Sweden pioneering powder characterization techniques and quality control methodologies. The European market focuses heavily on high-performance alloys for automotive and medical applications, representing about 30% of the global market share.

Asia-Pacific, particularly China and Japan, has rapidly expanded production capacity, focusing on cost reduction and mass production capabilities. China has increased its metal powder production facilities by over 200% in the past five years, primarily targeting titanium and aluminum alloy powders for industrial applications.

Emerging economies are gradually entering the market, with countries like India and Brazil developing specialized capabilities in specific alloy systems. These regions typically focus on adapting existing technologies rather than pioneering new powder development approaches.

The global metal powder market for AM is projected to grow at a CAGR of 22% through 2026, reaching approximately $1.2 billion, driven primarily by aerospace, medical, and automotive applications requiring high-performance metal components with complex geometries.

Current Metal Powder Production Methods

01 Production methods for metal powders

Various techniques are employed to produce metal powders with specific characteristics. These methods include atomization, mechanical milling, chemical reduction, and electrolytic deposition. Each production method yields powders with different particle sizes, shapes, and surface properties, which influence their subsequent applications. The choice of production method depends on the desired powder characteristics and end-use requirements.- Production methods for metal powders: Various methods are employed to produce metal powders with specific characteristics. These include atomization techniques, chemical reduction processes, electrolytic deposition, and mechanical milling. Each method yields powders with different particle sizes, shapes, and surface properties, which are crucial for their subsequent applications. The production method significantly influences the powder's behavior in further processing steps such as sintering or compaction.

- Metal powder compositions and alloys: Metal powders can be formulated as pure metals or as alloys combining multiple metallic elements to achieve enhanced properties. These compositions may include iron-based, copper-based, aluminum-based, or precious metal alloys. Specific additives or dopants can be incorporated to modify characteristics such as oxidation resistance, magnetic properties, or mechanical strength. The precise control of composition is essential for achieving desired performance in the final application.

- Processing and treatment of metal powders: Metal powders undergo various processing and treatment steps to enhance their properties. These include heat treatment, surface modification, coating, and particle size classification. Such processes can improve flowability, compressibility, sinterability, and other functional characteristics. Treatments may also involve passivation to prevent oxidation or the application of lubricants to facilitate subsequent forming operations.

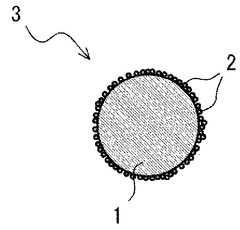

- Applications in additive manufacturing and 3D printing: Metal powders are extensively used in additive manufacturing technologies such as selective laser melting, electron beam melting, and direct metal laser sintering. The powders must possess specific characteristics including spherical morphology, controlled particle size distribution, and high purity to ensure good flowability and consistent layer formation. These technologies enable the production of complex geometries and customized metal components with reduced material waste.

- Energy storage and battery applications: Metal powders serve as critical materials in energy storage systems, particularly in battery technologies. They function as active electrode materials, current collectors, or conductive additives. The specific surface area, particle morphology, and purity of these powders significantly impact battery performance metrics such as capacity, cycle life, and rate capability. Novel metal powder formulations are being developed to address challenges in next-generation energy storage systems.

02 Metal powder compositions and alloys

Metal powders can be formulated as pure metals or as alloys combining multiple metallic elements to achieve enhanced properties. These compositions may include iron-based, aluminum-based, copper-based, or nickel-based alloys, among others. The specific composition affects characteristics such as melting point, strength, corrosion resistance, and magnetic properties. Additives and dopants may be incorporated to further modify the powder's behavior during processing and in final applications.Expand Specific Solutions03 Applications in additive manufacturing and 3D printing

Metal powders are extensively used in additive manufacturing processes such as selective laser melting, electron beam melting, and direct metal laser sintering. These powders must possess specific flow characteristics, particle size distributions, and packing densities to ensure uniform layer formation and consistent part quality. The powder properties significantly influence the microstructure, mechanical properties, and surface finish of the printed components.Expand Specific Solutions04 Surface treatment and coating of metal powders

Metal powders can undergo various surface treatments to enhance their properties and performance. These treatments include coating with polymers, oxides, or other metals to improve flowability, reduce oxidation, enhance sintering behavior, or provide specialized functionalities. Surface-modified powders exhibit improved compatibility with binder systems, enhanced dispersion characteristics, and better resistance to environmental degradation during storage and processing.Expand Specific Solutions05 Energy storage and battery applications

Metal powders are utilized in various energy storage applications, particularly in battery technologies. Fine metal powders serve as active materials in electrodes, providing high surface area for electrochemical reactions. The particle size, morphology, and purity of these powders significantly impact battery performance metrics such as capacity, cycle life, and rate capability. Advanced powder processing techniques enable the development of high-performance battery materials with tailored properties.Expand Specific Solutions

Leading Metal Powder Manufacturers and AM Companies

The additive manufacturing metal powders market is currently in a growth phase, with increasing adoption across aerospace, automotive, and industrial sectors. The market size is expanding rapidly, projected to reach significant value due to rising demand for complex metal components with reduced lead times. Technologically, the field shows varying maturity levels, with established players like ArcelorMittal, Carpenter Technology, and Air Liquide providing industrial-scale solutions, while innovative companies such as Relativity Space and Heraeus Additive Manufacturing push boundaries with specialized applications. Research institutions including Xi'an Jiaotong University and HRL Laboratories are advancing powder metallurgy science, while automotive giants Volkswagen and Honda explore integration opportunities, indicating the technology's transition toward mainstream manufacturing adoption.

Relativity Space, Inc.

Technical Solution: Relativity Space has developed a revolutionary approach to metal powder utilization in their proprietary Stargate additive manufacturing system for aerospace applications. Rather than focusing solely on powder development, Relativity has created an integrated system that optimizes existing aluminum alloy powders for large-scale rocket manufacturing. Their technology employs machine learning algorithms that continuously analyze the powder bed conditions, melt pool dynamics, and resulting microstructures to adaptively control the printing parameters in real-time. Relativity's system incorporates multiple sensors including thermal cameras and spectrometers to monitor powder quality during the build process, automatically adjusting laser parameters to compensate for variations in powder characteristics. Their approach allows for the use of lower-cost aluminum alloy powders while still achieving aerospace-grade mechanical properties through precise process control. Relativity has also developed specialized post-processing techniques including hot isostatic pressing and proprietary heat treatments specifically designed for their additively manufactured rocket components[9][10].

Strengths: AI-driven process optimization enables use of more economical powder feedstocks; integrated sensing systems ensure consistent quality regardless of minor powder variations; scalable to extremely large structures. Weaknesses: System highly specialized for aerospace applications rather than general manufacturing; requires significant computational resources for real-time monitoring and control; optimization focused primarily on aluminum alloys rather than broader material portfolio.

Heraeus Additive Manufacturing GmbH

Technical Solution: Heraeus has developed specialized metal powder production technologies focusing on high-purity spherical powders for additive manufacturing. Their Amperprint® portfolio includes precious metals (gold, silver, platinum) and refractory metals (tungsten, molybdenum) specifically engineered for AM processes. Their proprietary atomization process creates highly spherical particles with excellent flowability and packing density, critical for consistent layer formation in powder bed fusion processes. Heraeus employs vacuum induction melting followed by inert gas atomization to produce powders with oxygen content below 100 ppm, significantly reducing defects in final parts. Their powders feature customized particle size distributions (typically 15-45μm) optimized for specific AM technologies, and undergo rigorous quality control including laser diffraction analysis, flow rate testing, and chemical composition verification to ensure batch-to-batch consistency[1][3].

Strengths: Superior powder sphericity and flowability; ultra-high purity levels reducing defects; specialized expertise in precious and refractory metals that few competitors can match. Weaknesses: Higher cost compared to conventional metal powders; limited to specialized applications rather than mass production; requires specific parameter optimization for each powder type.

Critical Patents in Metal Powder Technology

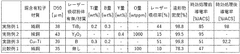

Additive manufacturing metal powder and method for producing additive manufacturing metal powder

PatentWO2024202310A1

Innovation

- A method involving the attachment of laser-absorbing powders such as TiB2 or Y2O3 to the surface of copper-containing particles to enhance the laser absorption rate, promoting efficient melting and sintering, and improving the electrical conductivity of the produced objects.

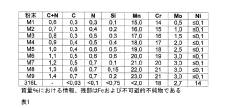

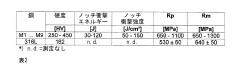

Metal powders for additive manufacturing processes, uses thereof, methods of making parts, and parts thereof

PatentInactiveJP2023511877A

Innovation

- Development of metal powders with controlled carbon and nitrogen content, combined with manganese and other elements, optimized for additive manufacturing, ensuring a predominantly austenitic structure and high mechanical properties through precise atomization and heat treatment, avoiding chromium carbide formation.

Sustainability in Metal Powder Production

Sustainability in metal powder production has become a critical focus area as additive manufacturing continues to expand across industries. The environmental impact of traditional metal powder manufacturing processes is significant, with high energy consumption and substantial carbon emissions. Current production methods typically require 85-100 kWh of energy per kilogram of powder produced, resulting in approximately 25-30 kg CO2 emissions per kilogram of metal powder.

Recent advancements in sustainable powder production technologies have shown promising results. Water atomization processes have been optimized to reduce energy consumption by up to 30% compared to gas atomization methods. Additionally, plasma spheroidization techniques are emerging as energy-efficient alternatives, potentially reducing the carbon footprint by 40-45% when powered by renewable energy sources.

Circular economy principles are increasingly being applied to metal powder production. Closed-loop recycling systems can now recover up to 95-98% of unused powder from additive manufacturing processes. This represents a significant improvement from the 70-80% recovery rates common just five years ago. Furthermore, post-processing waste streams are being integrated into production cycles, with specialized filtration and purification technologies enabling the conversion of manufacturing scrap into high-quality powder feedstock.

Water usage optimization has become another sustainability priority. Modern powder production facilities have implemented advanced water recycling systems that reduce freshwater consumption by 60-70%. Dry processing techniques are also gaining traction, particularly for aluminum and titanium alloys, eliminating water usage entirely for certain powder types while maintaining required particle morphology and size distribution.

Renewable energy integration represents perhaps the most transformative trend in sustainable powder production. Several leading manufacturers have established facilities powered predominantly by solar and wind energy, reducing operational carbon emissions by up to 85%. Hydrogen-based reduction processes, when coupled with green hydrogen production, offer a pathway to near-zero emission powder manufacturing for certain metal types, particularly iron-based alloys.

Regulatory frameworks are evolving to support these sustainability initiatives. The EU's Carbon Border Adjustment Mechanism and similar policies emerging globally are creating economic incentives for powder producers to adopt cleaner technologies. Industry consortia have established sustainability certification standards specifically for metal powders used in additive manufacturing, with lifecycle assessment methodologies tailored to the unique aspects of powder production and utilization.

Recent advancements in sustainable powder production technologies have shown promising results. Water atomization processes have been optimized to reduce energy consumption by up to 30% compared to gas atomization methods. Additionally, plasma spheroidization techniques are emerging as energy-efficient alternatives, potentially reducing the carbon footprint by 40-45% when powered by renewable energy sources.

Circular economy principles are increasingly being applied to metal powder production. Closed-loop recycling systems can now recover up to 95-98% of unused powder from additive manufacturing processes. This represents a significant improvement from the 70-80% recovery rates common just five years ago. Furthermore, post-processing waste streams are being integrated into production cycles, with specialized filtration and purification technologies enabling the conversion of manufacturing scrap into high-quality powder feedstock.

Water usage optimization has become another sustainability priority. Modern powder production facilities have implemented advanced water recycling systems that reduce freshwater consumption by 60-70%. Dry processing techniques are also gaining traction, particularly for aluminum and titanium alloys, eliminating water usage entirely for certain powder types while maintaining required particle morphology and size distribution.

Renewable energy integration represents perhaps the most transformative trend in sustainable powder production. Several leading manufacturers have established facilities powered predominantly by solar and wind energy, reducing operational carbon emissions by up to 85%. Hydrogen-based reduction processes, when coupled with green hydrogen production, offer a pathway to near-zero emission powder manufacturing for certain metal types, particularly iron-based alloys.

Regulatory frameworks are evolving to support these sustainability initiatives. The EU's Carbon Border Adjustment Mechanism and similar policies emerging globally are creating economic incentives for powder producers to adopt cleaner technologies. Industry consortia have established sustainability certification standards specifically for metal powders used in additive manufacturing, with lifecycle assessment methodologies tailored to the unique aspects of powder production and utilization.

Quality Control Standards for AM Metal Powders

Quality control standards for metal powders used in additive manufacturing (AM) have evolved significantly as the industry has matured. The establishment of comprehensive standards is crucial for ensuring consistency, reliability, and safety in AM processes. Currently, several international organizations including ASTM International, ISO, and NIST have developed specific standards addressing various aspects of metal powder quality for AM applications.

The primary quality parameters monitored in AM metal powders include particle size distribution, morphology, flowability, apparent and tap density, chemical composition, and oxygen content. ASTM F3049 provides standard guidelines for characterizing metal powders used in AM processes, while ASTM F3301 focuses specifically on powder flowability testing. ISO/ASTM 52907 establishes technical specifications for metal powders used in AM systems.

Powder sampling protocols represent another critical aspect of quality control. Standards such as ASTM B215 outline procedures for obtaining representative samples from powder batches, ensuring that testing results accurately reflect the entire batch characteristics. This is particularly important as powder properties can vary significantly within a single production lot.

Recycling considerations have also been incorporated into quality standards, as powder reuse is common in AM operations. ASTM F3456 addresses the qualification of powder recycling for laser powder bed fusion processes, providing guidelines for assessing how repeated use affects powder properties and final part quality. These standards typically specify maximum allowable changes in key powder characteristics before virgin powder must be introduced.

Traceability requirements form an integral component of modern quality control frameworks. Standards now mandate detailed documentation of powder provenance, processing history, and testing results. This documentation must follow the powder through its entire lifecycle, from manufacturing through recycling and eventual disposal, creating an auditable trail particularly important for critical applications in aerospace and medical industries.

Emerging standards are beginning to address advanced characterization techniques such as rheological testing, dynamic flow analysis, and in-process monitoring of powder condition. These newer approaches aim to provide more comprehensive understanding of powder behavior during the actual AM process, rather than relying solely on static pre-process testing. Additionally, industry-specific standards are being developed to address the unique requirements of sectors like aerospace (SAE AMS7000 series) and medical implants (ASTM F3335).

The primary quality parameters monitored in AM metal powders include particle size distribution, morphology, flowability, apparent and tap density, chemical composition, and oxygen content. ASTM F3049 provides standard guidelines for characterizing metal powders used in AM processes, while ASTM F3301 focuses specifically on powder flowability testing. ISO/ASTM 52907 establishes technical specifications for metal powders used in AM systems.

Powder sampling protocols represent another critical aspect of quality control. Standards such as ASTM B215 outline procedures for obtaining representative samples from powder batches, ensuring that testing results accurately reflect the entire batch characteristics. This is particularly important as powder properties can vary significantly within a single production lot.

Recycling considerations have also been incorporated into quality standards, as powder reuse is common in AM operations. ASTM F3456 addresses the qualification of powder recycling for laser powder bed fusion processes, providing guidelines for assessing how repeated use affects powder properties and final part quality. These standards typically specify maximum allowable changes in key powder characteristics before virgin powder must be introduced.

Traceability requirements form an integral component of modern quality control frameworks. Standards now mandate detailed documentation of powder provenance, processing history, and testing results. This documentation must follow the powder through its entire lifecycle, from manufacturing through recycling and eventual disposal, creating an auditable trail particularly important for critical applications in aerospace and medical industries.

Emerging standards are beginning to address advanced characterization techniques such as rheological testing, dynamic flow analysis, and in-process monitoring of powder condition. These newer approaches aim to provide more comprehensive understanding of powder behavior during the actual AM process, rather than relying solely on static pre-process testing. Additionally, industry-specific standards are being developed to address the unique requirements of sectors like aerospace (SAE AMS7000 series) and medical implants (ASTM F3335).

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!