Advances in Silver Nanowire Manufacturing Techniques

SEP 25, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Silver Nanowire Technology Background and Objectives

Silver nanowires (AgNWs) have emerged as a revolutionary material in the field of transparent conductive films, offering a compelling alternative to traditional indium tin oxide (ITO). The development of AgNWs can be traced back to the early 2000s, when researchers began exploring nanoscale silver structures for electronic applications. Since then, the technology has evolved significantly, driven by increasing demand for flexible electronics, touch screens, solar cells, and other optoelectronic devices.

The evolution of silver nanowire technology has been characterized by continuous improvements in synthesis methods, from early polyol processes to more sophisticated techniques incorporating microwave assistance, hydrothermal approaches, and template-directed synthesis. Each advancement has aimed to address critical challenges in nanowire morphology control, length-to-diameter ratio optimization, and production scalability.

Market trends indicate a growing shift toward flexible, lightweight, and energy-efficient electronic devices, creating an expanding opportunity space for AgNW technology. The global push toward renewable energy solutions has further accelerated interest in AgNWs for photovoltaic applications, where their superior flexibility and comparable conductivity make them attractive alternatives to brittle ITO films.

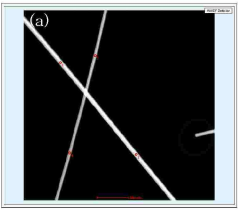

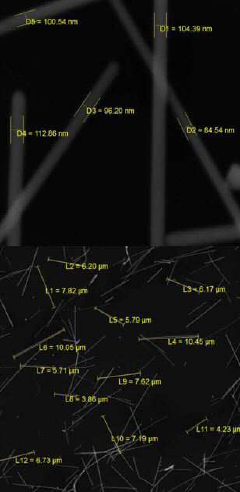

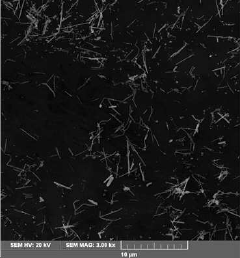

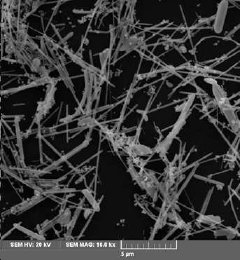

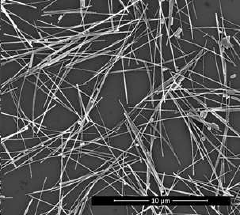

The primary technical objectives in silver nanowire manufacturing advancement include achieving greater control over nanowire dimensions, particularly length and diameter uniformity, which directly impact performance in transparent conductive applications. Researchers aim to develop manufacturing techniques that can consistently produce high-aspect-ratio nanowires with minimal diameter variation and controlled surface properties.

Cost reduction represents another critical objective, as current AgNW production methods often involve expensive precursors and energy-intensive processes. Developing economically viable manufacturing routes that maintain quality while reducing resource consumption remains a significant focus area for researchers and industry players alike.

Scalability presents perhaps the most significant challenge and objective in AgNW manufacturing. Laboratory-scale synthesis methods have demonstrated impressive results, but translating these achievements to industrial-scale production while maintaining quality and performance characteristics requires substantial innovation in reactor design, process control, and quality assurance methodologies.

Environmental considerations have also become increasingly important objectives in AgNW manufacturing development. Reducing the use of toxic reagents, minimizing waste generation, and developing greener synthesis routes align with global sustainability goals and regulatory trends toward environmentally responsible manufacturing practices.

The convergence of these objectives drives current research and development efforts, with the ultimate goal of establishing AgNW technology as a mainstream solution for next-generation electronic devices and systems that demand both high performance and form factor flexibility.

The evolution of silver nanowire technology has been characterized by continuous improvements in synthesis methods, from early polyol processes to more sophisticated techniques incorporating microwave assistance, hydrothermal approaches, and template-directed synthesis. Each advancement has aimed to address critical challenges in nanowire morphology control, length-to-diameter ratio optimization, and production scalability.

Market trends indicate a growing shift toward flexible, lightweight, and energy-efficient electronic devices, creating an expanding opportunity space for AgNW technology. The global push toward renewable energy solutions has further accelerated interest in AgNWs for photovoltaic applications, where their superior flexibility and comparable conductivity make them attractive alternatives to brittle ITO films.

The primary technical objectives in silver nanowire manufacturing advancement include achieving greater control over nanowire dimensions, particularly length and diameter uniformity, which directly impact performance in transparent conductive applications. Researchers aim to develop manufacturing techniques that can consistently produce high-aspect-ratio nanowires with minimal diameter variation and controlled surface properties.

Cost reduction represents another critical objective, as current AgNW production methods often involve expensive precursors and energy-intensive processes. Developing economically viable manufacturing routes that maintain quality while reducing resource consumption remains a significant focus area for researchers and industry players alike.

Scalability presents perhaps the most significant challenge and objective in AgNW manufacturing. Laboratory-scale synthesis methods have demonstrated impressive results, but translating these achievements to industrial-scale production while maintaining quality and performance characteristics requires substantial innovation in reactor design, process control, and quality assurance methodologies.

Environmental considerations have also become increasingly important objectives in AgNW manufacturing development. Reducing the use of toxic reagents, minimizing waste generation, and developing greener synthesis routes align with global sustainability goals and regulatory trends toward environmentally responsible manufacturing practices.

The convergence of these objectives drives current research and development efforts, with the ultimate goal of establishing AgNW technology as a mainstream solution for next-generation electronic devices and systems that demand both high performance and form factor flexibility.

Market Demand Analysis for Silver Nanowire Applications

The global market for silver nanowires has experienced significant growth in recent years, driven primarily by the expanding touchscreen industry and the increasing adoption of flexible electronics. Market research indicates that the silver nanowire market was valued at approximately $400 million in 2022 and is projected to reach $1.2 billion by 2028, representing a compound annual growth rate (CAGR) of over 20%.

Consumer electronics remains the dominant application sector, accounting for nearly 60% of the total market demand. The proliferation of smartphones, tablets, and wearable devices has created substantial demand for transparent conductive films where silver nanowires offer superior performance compared to traditional indium tin oxide (ITO) solutions. The automotive industry has also emerged as a rapidly growing market segment, with silver nanowires being increasingly incorporated into advanced display systems and smart glass applications.

Energy sector applications represent another significant growth area, particularly in photovoltaics. Silver nanowires are being utilized in next-generation solar cells, including perovskite and organic photovoltaic technologies, where they serve as transparent electrodes. This segment is expected to grow at a CAGR of approximately 25% through 2028, outpacing the overall market growth rate.

Regional analysis reveals that Asia-Pacific dominates the silver nanowire market, accounting for over 65% of global demand. This concentration is primarily due to the region's robust electronics manufacturing ecosystem, particularly in China, South Korea, Japan, and Taiwan. North America and Europe follow with market shares of approximately 18% and 12% respectively, with growth primarily driven by research activities and high-end applications in aerospace and medical devices.

Market challenges include price sensitivity and competition from alternative materials. While silver nanowires offer superior performance in terms of conductivity and flexibility, their relatively higher cost compared to alternatives like carbon nanotubes and graphene presents adoption barriers in price-sensitive applications. Material stability and long-term reliability concerns also affect market penetration in certain sectors.

Supply chain considerations have become increasingly important, with recent global disruptions highlighting vulnerabilities in the nanomaterials ecosystem. The concentration of silver mining in specific geographic regions and the specialized nature of nanowire manufacturing processes create potential bottlenecks that market participants must navigate.

Future market growth is expected to be driven by emerging applications in healthcare (biosensors and medical devices), smart textiles, and advanced optoelectronic devices. The development of more cost-effective manufacturing techniques for silver nanowires will be crucial in expanding market penetration across these diverse application domains.

Consumer electronics remains the dominant application sector, accounting for nearly 60% of the total market demand. The proliferation of smartphones, tablets, and wearable devices has created substantial demand for transparent conductive films where silver nanowires offer superior performance compared to traditional indium tin oxide (ITO) solutions. The automotive industry has also emerged as a rapidly growing market segment, with silver nanowires being increasingly incorporated into advanced display systems and smart glass applications.

Energy sector applications represent another significant growth area, particularly in photovoltaics. Silver nanowires are being utilized in next-generation solar cells, including perovskite and organic photovoltaic technologies, where they serve as transparent electrodes. This segment is expected to grow at a CAGR of approximately 25% through 2028, outpacing the overall market growth rate.

Regional analysis reveals that Asia-Pacific dominates the silver nanowire market, accounting for over 65% of global demand. This concentration is primarily due to the region's robust electronics manufacturing ecosystem, particularly in China, South Korea, Japan, and Taiwan. North America and Europe follow with market shares of approximately 18% and 12% respectively, with growth primarily driven by research activities and high-end applications in aerospace and medical devices.

Market challenges include price sensitivity and competition from alternative materials. While silver nanowires offer superior performance in terms of conductivity and flexibility, their relatively higher cost compared to alternatives like carbon nanotubes and graphene presents adoption barriers in price-sensitive applications. Material stability and long-term reliability concerns also affect market penetration in certain sectors.

Supply chain considerations have become increasingly important, with recent global disruptions highlighting vulnerabilities in the nanomaterials ecosystem. The concentration of silver mining in specific geographic regions and the specialized nature of nanowire manufacturing processes create potential bottlenecks that market participants must navigate.

Future market growth is expected to be driven by emerging applications in healthcare (biosensors and medical devices), smart textiles, and advanced optoelectronic devices. The development of more cost-effective manufacturing techniques for silver nanowires will be crucial in expanding market penetration across these diverse application domains.

Current Manufacturing Challenges and Global Development Status

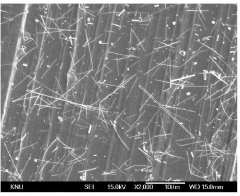

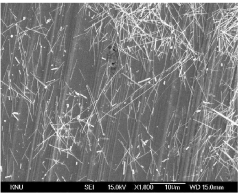

Silver nanowire (AgNW) manufacturing faces several critical challenges that impede widespread industrial adoption. The polyol synthesis method, while predominant, struggles with scalability issues and batch-to-batch consistency. Temperature control during synthesis remains problematic, as even minor fluctuations can significantly alter nanowire morphology and electrical properties. Additionally, the purification process to remove unwanted silver nanoparticles and shorter nanowires is labor-intensive and often results in material loss, reducing overall yield.

Chemical waste management presents another substantial challenge, as traditional manufacturing methods generate considerable amounts of toxic byproducts. The industry is under increasing regulatory pressure to develop greener synthesis routes that minimize environmental impact while maintaining nanowire quality. Furthermore, the high cost of silver as a raw material necessitates manufacturing processes with exceptional yield rates to ensure economic viability.

From a global development perspective, silver nanowire manufacturing exhibits distinct regional characteristics. Asia-Pacific, particularly China and South Korea, dominates mass production capabilities, leveraging cost advantages and established electronics manufacturing ecosystems. Companies like Cambrios Advanced Materials (China) and C3Nano have established significant production facilities in this region. These manufacturers primarily focus on high-volume, moderate-quality nanowires for consumer electronics applications.

North American and European manufacturers, including Novarials Corporation (USA) and Seashell Technology, have positioned themselves differently, concentrating on high-quality, specialized nanowires with precisely controlled dimensions and superior performance characteristics. These products command premium prices in niche markets such as advanced optoelectronics and specialized sensing applications.

Recent technological advancements have emerged from research institutions worldwide. Japanese researchers have pioneered continuous flow synthesis methods that promise improved scalability. German institutes have developed novel purification techniques using selective precipitation that significantly reduce waste. Meanwhile, American universities have made progress in ambient temperature synthesis methods that could substantially lower energy requirements.

The global silver nanowire market remains fragmented, with no single manufacturing approach achieving dominance across all application sectors. This fragmentation reflects the technology's transitional state, where traditional batch processes are gradually being supplemented or replaced by more sophisticated continuous manufacturing techniques. The industry is witnessing increased collaboration between academic institutions and commercial entities to overcome persistent manufacturing challenges.

Standardization efforts are underway globally, though progress remains uneven. The lack of universally accepted quality metrics and characterization protocols continues to hamper market development, as manufacturers and end-users often employ different evaluation criteria for nanowire performance and quality.

Chemical waste management presents another substantial challenge, as traditional manufacturing methods generate considerable amounts of toxic byproducts. The industry is under increasing regulatory pressure to develop greener synthesis routes that minimize environmental impact while maintaining nanowire quality. Furthermore, the high cost of silver as a raw material necessitates manufacturing processes with exceptional yield rates to ensure economic viability.

From a global development perspective, silver nanowire manufacturing exhibits distinct regional characteristics. Asia-Pacific, particularly China and South Korea, dominates mass production capabilities, leveraging cost advantages and established electronics manufacturing ecosystems. Companies like Cambrios Advanced Materials (China) and C3Nano have established significant production facilities in this region. These manufacturers primarily focus on high-volume, moderate-quality nanowires for consumer electronics applications.

North American and European manufacturers, including Novarials Corporation (USA) and Seashell Technology, have positioned themselves differently, concentrating on high-quality, specialized nanowires with precisely controlled dimensions and superior performance characteristics. These products command premium prices in niche markets such as advanced optoelectronics and specialized sensing applications.

Recent technological advancements have emerged from research institutions worldwide. Japanese researchers have pioneered continuous flow synthesis methods that promise improved scalability. German institutes have developed novel purification techniques using selective precipitation that significantly reduce waste. Meanwhile, American universities have made progress in ambient temperature synthesis methods that could substantially lower energy requirements.

The global silver nanowire market remains fragmented, with no single manufacturing approach achieving dominance across all application sectors. This fragmentation reflects the technology's transitional state, where traditional batch processes are gradually being supplemented or replaced by more sophisticated continuous manufacturing techniques. The industry is witnessing increased collaboration between academic institutions and commercial entities to overcome persistent manufacturing challenges.

Standardization efforts are underway globally, though progress remains uneven. The lack of universally accepted quality metrics and characterization protocols continues to hamper market development, as manufacturers and end-users often employ different evaluation criteria for nanowire performance and quality.

Current Manufacturing Techniques and Process Solutions

01 Polyol synthesis method for silver nanowires

The polyol synthesis method is a widely used technique for manufacturing silver nanowires. This process typically involves the reduction of silver nitrate in a polyol medium, such as ethylene glycol, at elevated temperatures. The method often incorporates polyvinylpyrrolidone (PVP) as a structure-directing agent that selectively adsorbs onto specific crystal facets, promoting one-dimensional growth. Various parameters including temperature, reaction time, and reagent concentrations can be optimized to control the dimensions and properties of the resulting nanowires.- Chemical reduction synthesis methods: Chemical reduction is a common method for manufacturing silver nanowires, involving the reduction of silver ions in solution to form nanowires. This process typically uses reducing agents such as polyol (often ethylene glycol) to convert silver nitrate into silver nanowires. The method can be controlled by adjusting reaction parameters like temperature, concentration, and the presence of structure-directing agents to achieve desired nanowire dimensions and properties.

- Template-assisted fabrication techniques: Template-assisted methods use pre-existing structures as guides for silver nanowire growth. These techniques involve depositing silver into nanoporous templates or using soft templates like micelles or polymer structures to direct growth. After nanowire formation, the template can be selectively removed, leaving freestanding silver nanowires. This approach allows for precise control over nanowire dimensions and alignment, which is crucial for applications requiring uniform nanowire arrays.

- Continuous production and scale-up methods: Continuous flow and large-scale production techniques have been developed to manufacture silver nanowires at industrial scale. These methods include continuous flow reactors, roll-to-roll processing, and automated synthesis systems that allow for consistent production of high-quality nanowires. These approaches focus on improving yield, reducing production time, and maintaining quality consistency while minimizing costs for commercial applications.

- Surface modification and functionalization: Post-synthesis surface treatments are applied to silver nanowires to enhance their properties and stability. These techniques include coating with protective layers, functionalization with specific chemical groups, and surface passivation to prevent oxidation. Such modifications can improve the nanowires' conductivity, transparency, flexibility, and compatibility with various substrates, making them more suitable for applications in flexible electronics, touch screens, and conductive films.

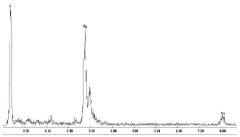

- Purification and quality control techniques: Advanced purification and quality control methods are essential in silver nanowire manufacturing to ensure consistent product quality. These techniques include centrifugation, filtration, and selective precipitation to remove byproducts and impurities. Quality control processes involve characterization techniques such as electron microscopy, spectroscopy, and electrical testing to verify nanowire dimensions, purity, and performance characteristics before application in devices.

02 Continuous flow manufacturing processes

Continuous flow manufacturing processes have been developed to scale up silver nanowire production. These methods involve the continuous introduction of reactants into a reaction chamber or flow system, allowing for consistent production of nanowires with uniform properties. Continuous processes offer advantages over batch methods, including better control over reaction parameters, reduced batch-to-batch variations, and increased production efficiency. These techniques often incorporate specialized reactor designs and precise control systems to maintain optimal reaction conditions throughout the manufacturing process.Expand Specific Solutions03 Surface modification and functionalization techniques

Various techniques have been developed to modify and functionalize the surface of silver nanowires to enhance their properties and compatibility with different applications. These methods include coating with protective layers to improve oxidation resistance, functionalization with specific chemical groups to enhance dispersion in various media, and surface treatments to improve electrical conductivity and mechanical stability. Surface modification can be achieved through chemical treatments, plasma processing, or the application of thin films of other materials onto the nanowire surfaces.Expand Specific Solutions04 Purification and separation methods

After synthesis, silver nanowires typically require purification to remove reaction byproducts, excess reagents, and unwanted nanoparticles. Various purification and separation techniques have been developed, including centrifugation, filtration, and selective precipitation. These methods can be optimized to isolate nanowires with specific dimensions or properties, allowing for the production of high-purity nanowire dispersions with consistent characteristics. Advanced separation techniques may employ density gradient centrifugation or size-selective filtration to achieve narrow size distributions.Expand Specific Solutions05 Large-scale production and industrial manufacturing

Techniques for scaling up silver nanowire production from laboratory to industrial scale have been developed to meet commercial demands. These methods focus on process optimization, equipment design, and quality control to ensure consistent production of high-quality nanowires in large quantities. Industrial manufacturing approaches often incorporate automated systems, specialized reactors, and continuous monitoring to maintain product quality while maximizing yield and minimizing production costs. Considerations for environmental impact and worker safety are also integrated into these large-scale manufacturing processes.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The silver nanowire manufacturing landscape is currently in a growth phase, with the global market expanding rapidly due to increasing demand for transparent conductive films in touch screens, flexible displays, and photovoltaic applications. The market is projected to reach significant scale as electronics manufacturers seek alternatives to traditional indium tin oxide. Technologically, the field is advancing from laboratory-scale production to industrial manufacturing, with companies like Carestream Health, Shenzhen Huake Chuangzhi, and Zhejiang KECHUANG Advanced Materials leading commercial development. Academic institutions including Fudan University, Kyoto University, and Korea Advanced Institute of Science & Technology are driving fundamental research innovations. The competitive landscape features established materials companies like BASF and Eastman Kodak alongside specialized nanomaterial startups, with Asian manufacturers currently dominating production capacity and technological implementation.

Zhejiang KECHUANG Advanced MATERIALS Technology Co., Ltd.

Technical Solution: Zhejiang KECHUANG has developed an innovative polyol synthesis method for silver nanowires that significantly improves production efficiency and quality control. Their technique employs a modified polyol process with precisely controlled temperature gradients and reaction kinetics, allowing for the synthesis of ultra-long silver nanowires (up to 100 μm) with diameters as small as 20 nm. The company has engineered a proprietary reactor design that enables continuous production rather than traditional batch processing, increasing output by approximately 5-fold while reducing energy consumption by 30%. Their process incorporates real-time monitoring of reaction parameters using spectroscopic techniques to ensure consistent nanowire morphology. KECHUANG has also developed specialized surface functionalization protocols that enhance the nanowires' compatibility with various polymer matrices, improving dispersion stability by up to 200% compared to untreated nanowires. Their manufacturing facility implements advanced filtration and purification systems that achieve >99.8% purity with minimal chemical waste.

Strengths: High-throughput continuous production capability with excellent control over nanowire dimensions. Their surface functionalization technology enhances compatibility with various substrate materials, making their nanowires suitable for diverse applications. Weaknesses: The specialized reactor design and monitoring systems require significant capital investment. The process may be sensitive to raw material quality variations, potentially requiring higher-grade precursors.

Nanoenics, Inc.

Technical Solution: Nanoenics has developed a proprietary electrospinning-based manufacturing technique for silver nanowires that enables precise control over nanowire dimensions and morphology. Their process utilizes a modified coaxial electrospinning setup with optimized polymer templates that guide silver nanowire growth. The company's approach incorporates a two-stage synthesis method where silver ions are first complexed with specific ligands before being reduced in a controlled environment, resulting in nanowires with aspect ratios exceeding 1000. Nanoenics has also pioneered a continuous flow production system that increases throughput by approximately 300% compared to batch processes, while maintaining uniform quality. Their purification protocol employs centrifugation combined with selective precipitation techniques to achieve >99.9% purity silver nanowires with minimal aggregation. The company has recently implemented automated quality control systems using machine vision to detect and remove defective nanowires during production.

Strengths: Superior control over nanowire dimensions and morphology, resulting in consistent electrical performance. Their continuous flow system enables industrial-scale production with reduced batch-to-batch variation. Weaknesses: The electrospinning approach requires specialized equipment and expertise, potentially increasing production costs compared to simpler methods. The process may also have limitations in terms of maximum achievable nanowire length.

Core Patents and Technical Innovations in Nanowire Synthesis

Mass Production Method of Ag NanoWire

PatentActiveKR1020120010198A

Innovation

- A method involving the use of specific surfactants and controlled heating and stirring conditions to produce silver nanowires with uniform diameter and length, allowing for high efficiency and rapid production in a non-stirred environment.

Silver nano wire manufacturing method

PatentInactiveKR1020200060181A

Innovation

- A method involving the use of a reducing solution prepared with a polyol and antifoaming agent, followed by a reaction solution with a capping agent, surfactant, and catalyst, and controlled injection of a silver source solution into the reaction mixture, along with specific conditions for temperature and time, to suppress nanoparticle formation and enhance dispersion.

Environmental Impact and Sustainability Considerations

The manufacturing of silver nanowires presents significant environmental challenges that must be addressed for sustainable industry development. Traditional synthesis methods often involve hazardous chemicals such as ethylene glycol, polyvinyl pyrrolidone (PVP), and various metal salts that can pose environmental risks if improperly managed. The release of these chemicals into water systems can lead to aquatic toxicity, while improper disposal of nanomaterial waste contributes to soil contamination. Furthermore, the energy-intensive nature of conventional manufacturing processes results in substantial carbon emissions, contradicting global sustainability goals.

Recent advancements in green synthesis approaches offer promising alternatives. Biogenic synthesis methods utilizing plant extracts, fungi, or bacteria as reducing agents have demonstrated potential to replace conventional chemical reducing agents. These bio-mediated processes operate at lower temperatures and pressures, significantly reducing energy consumption while eliminating the need for toxic chemicals. Additionally, continuous flow manufacturing systems have emerged as more environmentally friendly alternatives to batch processing, offering up to 40% reduction in solvent usage and improved energy efficiency.

Life cycle assessment (LCA) studies reveal that raw material extraction and processing account for approximately 60% of the environmental footprint of silver nanowire production. Consequently, recycling and recovery technologies have become critical focus areas. Advanced recovery methods can now reclaim up to 85% of silver from manufacturing waste and end-of-life products, substantially reducing the demand for virgin silver mining. Closed-loop manufacturing systems that reuse solvents and reagents have demonstrated potential to decrease water consumption by 70% and chemical waste by 65%.

Regulatory frameworks worldwide are increasingly addressing nanomaterial environmental impacts. The European Union's REACH regulations and similar initiatives in North America and Asia are establishing stricter guidelines for nanomaterial production and disposal. Forward-thinking manufacturers are proactively implementing ISO 14001 environmental management systems and pursuing green chemistry certifications to demonstrate commitment to sustainability principles.

The economic implications of sustainable manufacturing are increasingly favorable. While green synthesis methods may initially require higher capital investment, operational cost savings from reduced energy consumption, decreased waste management expenses, and potential regulatory compliance advantages often result in positive return on investment within 3-5 years. Market analysis indicates growing consumer preference for environmentally responsible technologies, creating additional incentives for manufacturers to adopt sustainable practices.

Recent advancements in green synthesis approaches offer promising alternatives. Biogenic synthesis methods utilizing plant extracts, fungi, or bacteria as reducing agents have demonstrated potential to replace conventional chemical reducing agents. These bio-mediated processes operate at lower temperatures and pressures, significantly reducing energy consumption while eliminating the need for toxic chemicals. Additionally, continuous flow manufacturing systems have emerged as more environmentally friendly alternatives to batch processing, offering up to 40% reduction in solvent usage and improved energy efficiency.

Life cycle assessment (LCA) studies reveal that raw material extraction and processing account for approximately 60% of the environmental footprint of silver nanowire production. Consequently, recycling and recovery technologies have become critical focus areas. Advanced recovery methods can now reclaim up to 85% of silver from manufacturing waste and end-of-life products, substantially reducing the demand for virgin silver mining. Closed-loop manufacturing systems that reuse solvents and reagents have demonstrated potential to decrease water consumption by 70% and chemical waste by 65%.

Regulatory frameworks worldwide are increasingly addressing nanomaterial environmental impacts. The European Union's REACH regulations and similar initiatives in North America and Asia are establishing stricter guidelines for nanomaterial production and disposal. Forward-thinking manufacturers are proactively implementing ISO 14001 environmental management systems and pursuing green chemistry certifications to demonstrate commitment to sustainability principles.

The economic implications of sustainable manufacturing are increasingly favorable. While green synthesis methods may initially require higher capital investment, operational cost savings from reduced energy consumption, decreased waste management expenses, and potential regulatory compliance advantages often result in positive return on investment within 3-5 years. Market analysis indicates growing consumer preference for environmentally responsible technologies, creating additional incentives for manufacturers to adopt sustainable practices.

Cost-Efficiency Analysis and Scalability Potential

The economic viability of silver nanowire (AgNW) manufacturing remains a critical factor determining its widespread industrial adoption. Current production costs for high-quality AgNWs range from $10-30 per gram, significantly higher than bulk silver prices, primarily due to complex synthesis processes and specialized equipment requirements. The cost structure analysis reveals that raw materials account for approximately 40-50% of total production expenses, with silver precursors being the dominant component. Processing costs, including energy consumption and chemical treatments, constitute 30-35%, while equipment depreciation and labor represent the remaining 20-25%.

Recent advancements in continuous flow synthesis methods have demonstrated potential cost reductions of 30-40% compared to traditional batch processes. These improvements stem from enhanced reaction efficiency, reduced solvent usage, and decreased energy consumption. Polyol synthesis optimization has further contributed to cost efficiency by enabling lower reaction temperatures and shorter synthesis times while maintaining nanowire quality and yield.

Scalability assessments indicate promising pathways for industrial-scale production. Laboratory-scale processes typically yield grams per day, while pilot-scale operations have achieved kilogram-level production. Industry projections suggest that optimized manufacturing lines could potentially reach annual production capacities of several tons within the next 3-5 years. This scaling trajectory aligns with the anticipated demand growth in transparent conductive film applications.

Key scalability challenges include maintaining consistent nanowire morphology across larger production volumes and addressing the increased complexity of purification and separation processes at industrial scales. Reactor design innovations, particularly in continuous flow systems with precise temperature and mixing control, have shown significant promise in overcoming these challenges. Additionally, automated quality control systems utilizing machine learning algorithms for real-time morphology assessment are emerging as critical components for scaled production.

Economic modeling suggests that AgNW manufacturing could reach price parity with competing technologies like ITO at production volumes exceeding 5 tons annually. This inflection point represents a critical threshold for market penetration across multiple application domains. Furthermore, recycling and silver recovery processes are increasingly being integrated into manufacturing workflows, potentially reducing raw material costs by 15-25% and addressing sustainability concerns.

The integration of green chemistry principles into manufacturing processes presents additional cost-efficiency opportunities through reduced waste treatment expenses and improved regulatory compliance. Water-based synthesis methods, while still in early development stages, show particular promise for both cost reduction and environmental impact minimization.

Recent advancements in continuous flow synthesis methods have demonstrated potential cost reductions of 30-40% compared to traditional batch processes. These improvements stem from enhanced reaction efficiency, reduced solvent usage, and decreased energy consumption. Polyol synthesis optimization has further contributed to cost efficiency by enabling lower reaction temperatures and shorter synthesis times while maintaining nanowire quality and yield.

Scalability assessments indicate promising pathways for industrial-scale production. Laboratory-scale processes typically yield grams per day, while pilot-scale operations have achieved kilogram-level production. Industry projections suggest that optimized manufacturing lines could potentially reach annual production capacities of several tons within the next 3-5 years. This scaling trajectory aligns with the anticipated demand growth in transparent conductive film applications.

Key scalability challenges include maintaining consistent nanowire morphology across larger production volumes and addressing the increased complexity of purification and separation processes at industrial scales. Reactor design innovations, particularly in continuous flow systems with precise temperature and mixing control, have shown significant promise in overcoming these challenges. Additionally, automated quality control systems utilizing machine learning algorithms for real-time morphology assessment are emerging as critical components for scaled production.

Economic modeling suggests that AgNW manufacturing could reach price parity with competing technologies like ITO at production volumes exceeding 5 tons annually. This inflection point represents a critical threshold for market penetration across multiple application domains. Furthermore, recycling and silver recovery processes are increasingly being integrated into manufacturing workflows, potentially reducing raw material costs by 15-25% and addressing sustainability concerns.

The integration of green chemistry principles into manufacturing processes presents additional cost-efficiency opportunities through reduced waste treatment expenses and improved regulatory compliance. Water-based synthesis methods, while still in early development stages, show particular promise for both cost reduction and environmental impact minimization.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!