Silver Nanowire Applications in Automotive Displays

SEP 25, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Automotive Display Evolution and Silver Nanowire Objectives

The automotive display industry has undergone remarkable transformation over the past decades, evolving from simple monochromatic instrument clusters to sophisticated multi-functional interfaces that integrate entertainment, navigation, climate control, and vehicle diagnostics. This evolution has been driven by consumer expectations for smartphone-like experiences in vehicles, regulatory requirements for safety features, and automotive manufacturers' desire to differentiate through technology.

Early automotive displays in the 1980s and 1990s primarily utilized vacuum fluorescent displays (VFDs) and liquid crystal displays (LCDs) with limited functionality. The 2000s witnessed a shift toward color TFT-LCDs with improved resolution and touch capabilities. The current generation of automotive displays features high-resolution OLED and flexible displays with curved surfaces that seamlessly integrate into vehicle interiors.

The industry now faces critical challenges including harsh automotive environmental requirements (temperature range -40°C to 85°C), durability expectations (10+ years lifespan), stringent safety standards, and the need for displays that can conform to increasingly complex interior designs. Traditional indium tin oxide (ITO) transparent conductors, while effective in consumer electronics, struggle to meet these automotive-specific demands, particularly in terms of flexibility and reliability under extreme conditions.

Silver nanowire (AgNW) technology has emerged as a promising solution to address these challenges. These ultra-thin conductive structures, typically 20-100 nm in diameter and several micrometers in length, offer exceptional electrical conductivity while maintaining optical transparency. The primary objective of AgNW implementation in automotive displays is to enable next-generation flexible, conformable, and curved displays that can be integrated into non-traditional surfaces within vehicle interiors.

Additional objectives include improving display performance in extreme temperature conditions, enhancing touch sensitivity and response time, reducing overall display thickness and weight, and potentially lowering manufacturing costs through simplified production processes. AgNW technology also aims to support the automotive industry's sustainability goals by reducing reliance on rare earth elements like indium used in traditional ITO solutions.

The technology roadmap for AgNW in automotive applications envisions progressive implementation, beginning with premium vehicle models and gradually expanding to mass-market vehicles as manufacturing processes mature and costs decrease. The ultimate goal is to enable completely new display form factors and functionalities that transform the driving experience while meeting the rigorous quality and safety standards of the automotive industry.

Early automotive displays in the 1980s and 1990s primarily utilized vacuum fluorescent displays (VFDs) and liquid crystal displays (LCDs) with limited functionality. The 2000s witnessed a shift toward color TFT-LCDs with improved resolution and touch capabilities. The current generation of automotive displays features high-resolution OLED and flexible displays with curved surfaces that seamlessly integrate into vehicle interiors.

The industry now faces critical challenges including harsh automotive environmental requirements (temperature range -40°C to 85°C), durability expectations (10+ years lifespan), stringent safety standards, and the need for displays that can conform to increasingly complex interior designs. Traditional indium tin oxide (ITO) transparent conductors, while effective in consumer electronics, struggle to meet these automotive-specific demands, particularly in terms of flexibility and reliability under extreme conditions.

Silver nanowire (AgNW) technology has emerged as a promising solution to address these challenges. These ultra-thin conductive structures, typically 20-100 nm in diameter and several micrometers in length, offer exceptional electrical conductivity while maintaining optical transparency. The primary objective of AgNW implementation in automotive displays is to enable next-generation flexible, conformable, and curved displays that can be integrated into non-traditional surfaces within vehicle interiors.

Additional objectives include improving display performance in extreme temperature conditions, enhancing touch sensitivity and response time, reducing overall display thickness and weight, and potentially lowering manufacturing costs through simplified production processes. AgNW technology also aims to support the automotive industry's sustainability goals by reducing reliance on rare earth elements like indium used in traditional ITO solutions.

The technology roadmap for AgNW in automotive applications envisions progressive implementation, beginning with premium vehicle models and gradually expanding to mass-market vehicles as manufacturing processes mature and costs decrease. The ultimate goal is to enable completely new display form factors and functionalities that transform the driving experience while meeting the rigorous quality and safety standards of the automotive industry.

Market Demand Analysis for Advanced Automotive Display Technologies

The automotive display market is experiencing unprecedented growth driven by increasing consumer demand for connected, intelligent vehicles with enhanced user interfaces. Current market analysis indicates that the global automotive display market is projected to reach $30.8 billion by 2025, growing at a CAGR of 8.2% from 2020. This growth is primarily fueled by the rising integration of advanced driver assistance systems (ADAS), infotainment systems, and digital instrument clusters in modern vehicles.

Silver nanowire (AgNW) technology is emerging as a critical enabler in this expanding market. Traditional display technologies like LCD and OLED face significant challenges in automotive applications, including limited flexibility, high power consumption, and performance degradation in extreme temperature conditions common in automotive environments. These limitations create substantial market opportunities for AgNW-based solutions.

Consumer preferences are shifting dramatically toward larger, curved, and irregularly shaped displays that seamlessly integrate with vehicle interiors. Market research indicates that 78% of new car buyers consider the quality and functionality of in-vehicle displays as a decisive factor in purchasing decisions. Premium automakers are leading this trend, with luxury vehicles now featuring up to 12 square feet of display area across multiple screens.

The demand for transparent displays in heads-up display (HUD) applications represents another significant market opportunity for AgNW technology. The automotive HUD market is expected to grow at 23.5% CAGR through 2027, with transparent conductive materials like silver nanowires playing a crucial role in enabling advanced augmented reality features.

Regulatory factors are also driving market demand. Safety regulations in major automotive markets increasingly mandate camera monitoring systems and digital mirrors, which require high-performance, reliable display technologies. Additionally, sustainability considerations are becoming more prominent, with automakers seeking display technologies that reduce overall vehicle weight and power consumption to meet stringent emissions standards.

Regional analysis reveals varying adoption rates and preferences. European premium automakers are prioritizing aesthetic integration and curved displays, while Asian manufacturers focus on cost-effective solutions for mass-market vehicles. North American consumers show strong preference for larger display sizes and advanced connectivity features.

The COVID-19 pandemic temporarily disrupted supply chains but simultaneously accelerated the transition to digital interfaces within vehicles, as touchless and voice-controlled systems gained importance. This shift has created additional momentum for next-generation display technologies like those enabled by silver nanowires.

Market forecasts indicate that flexible, transparent, and conformable displays will represent the fastest-growing segment within automotive displays, with a projected 35% annual growth rate through 2026, presenting a prime opportunity for silver nanowire applications to capture significant market share.

Silver nanowire (AgNW) technology is emerging as a critical enabler in this expanding market. Traditional display technologies like LCD and OLED face significant challenges in automotive applications, including limited flexibility, high power consumption, and performance degradation in extreme temperature conditions common in automotive environments. These limitations create substantial market opportunities for AgNW-based solutions.

Consumer preferences are shifting dramatically toward larger, curved, and irregularly shaped displays that seamlessly integrate with vehicle interiors. Market research indicates that 78% of new car buyers consider the quality and functionality of in-vehicle displays as a decisive factor in purchasing decisions. Premium automakers are leading this trend, with luxury vehicles now featuring up to 12 square feet of display area across multiple screens.

The demand for transparent displays in heads-up display (HUD) applications represents another significant market opportunity for AgNW technology. The automotive HUD market is expected to grow at 23.5% CAGR through 2027, with transparent conductive materials like silver nanowires playing a crucial role in enabling advanced augmented reality features.

Regulatory factors are also driving market demand. Safety regulations in major automotive markets increasingly mandate camera monitoring systems and digital mirrors, which require high-performance, reliable display technologies. Additionally, sustainability considerations are becoming more prominent, with automakers seeking display technologies that reduce overall vehicle weight and power consumption to meet stringent emissions standards.

Regional analysis reveals varying adoption rates and preferences. European premium automakers are prioritizing aesthetic integration and curved displays, while Asian manufacturers focus on cost-effective solutions for mass-market vehicles. North American consumers show strong preference for larger display sizes and advanced connectivity features.

The COVID-19 pandemic temporarily disrupted supply chains but simultaneously accelerated the transition to digital interfaces within vehicles, as touchless and voice-controlled systems gained importance. This shift has created additional momentum for next-generation display technologies like those enabled by silver nanowires.

Market forecasts indicate that flexible, transparent, and conformable displays will represent the fastest-growing segment within automotive displays, with a projected 35% annual growth rate through 2026, presenting a prime opportunity for silver nanowire applications to capture significant market share.

Silver Nanowire Technology Status and Implementation Challenges

Silver nanowire (AgNW) technology has emerged as a promising alternative to indium tin oxide (ITO) for transparent conductive electrodes in automotive displays. Currently, the global implementation of AgNW technology faces several significant challenges despite its theoretical advantages. The primary technical limitation remains the long-term stability of silver nanowires in harsh automotive environments, where temperature fluctuations can range from -40°C to 85°C, causing mechanical stress that compromises wire integrity and conductivity over time.

Manufacturing scalability presents another substantial hurdle. While laboratory-scale production demonstrates excellent results, transitioning to mass production introduces consistency issues in nanowire distribution, junction resistance, and overall film uniformity. Industry reports indicate yield rates for high-quality AgNW films suitable for automotive applications remain below 70%, compared to ITO's 90%+ yield rates in established manufacturing lines.

Haze and optical performance challenges persist in AgNW implementations. Current silver nanowire networks exhibit haze values of 1.5-3%, exceeding the automotive industry's preferred maximum of 1% for premium display applications. This optical limitation becomes particularly problematic in high-brightness conditions typical in automotive environments.

Integration complexity with existing display manufacturing processes represents a significant barrier to adoption. AgNW requires specialized handling protocols and modified lamination techniques that are not fully compatible with established automotive display production lines. The additional process modifications increase production costs by approximately 15-20% compared to traditional ITO-based manufacturing.

Corrosion resistance remains problematic for AgNW technology in automotive applications. Silver nanowires are susceptible to sulfidation and oxidation, particularly in the presence of airborne pollutants common in automotive environments. Current encapsulation methods provide protection for 3-5 years, falling short of the 7-10 year durability standard expected in automotive components.

Cost considerations present a mixed picture. While raw material costs for AgNW have decreased by approximately 30% over the past five years, the specialized processing requirements and higher defect rates currently offset these savings. Industry analysis suggests AgNW solutions remain 10-15% more expensive than ITO alternatives when considering total implementation costs.

Standardization issues further complicate widespread adoption. Unlike ITO, which benefits from decades of established specifications and testing protocols, AgNW technology lacks comprehensive industry standards for performance metrics, reliability testing, and quality control parameters specific to automotive applications.

Manufacturing scalability presents another substantial hurdle. While laboratory-scale production demonstrates excellent results, transitioning to mass production introduces consistency issues in nanowire distribution, junction resistance, and overall film uniformity. Industry reports indicate yield rates for high-quality AgNW films suitable for automotive applications remain below 70%, compared to ITO's 90%+ yield rates in established manufacturing lines.

Haze and optical performance challenges persist in AgNW implementations. Current silver nanowire networks exhibit haze values of 1.5-3%, exceeding the automotive industry's preferred maximum of 1% for premium display applications. This optical limitation becomes particularly problematic in high-brightness conditions typical in automotive environments.

Integration complexity with existing display manufacturing processes represents a significant barrier to adoption. AgNW requires specialized handling protocols and modified lamination techniques that are not fully compatible with established automotive display production lines. The additional process modifications increase production costs by approximately 15-20% compared to traditional ITO-based manufacturing.

Corrosion resistance remains problematic for AgNW technology in automotive applications. Silver nanowires are susceptible to sulfidation and oxidation, particularly in the presence of airborne pollutants common in automotive environments. Current encapsulation methods provide protection for 3-5 years, falling short of the 7-10 year durability standard expected in automotive components.

Cost considerations present a mixed picture. While raw material costs for AgNW have decreased by approximately 30% over the past five years, the specialized processing requirements and higher defect rates currently offset these savings. Industry analysis suggests AgNW solutions remain 10-15% more expensive than ITO alternatives when considering total implementation costs.

Standardization issues further complicate widespread adoption. Unlike ITO, which benefits from decades of established specifications and testing protocols, AgNW technology lacks comprehensive industry standards for performance metrics, reliability testing, and quality control parameters specific to automotive applications.

Current Silver Nanowire Integration Solutions for Automotive Displays

01 Synthesis and preparation methods of silver nanowires

Various methods for synthesizing and preparing silver nanowires with controlled dimensions and properties. These methods include chemical reduction, polyol process, and template-assisted growth techniques. The synthesis parameters such as temperature, reaction time, and precursor concentrations can be adjusted to control the length, diameter, and aspect ratio of the silver nanowires, which directly affect their electrical and optical properties.- Synthesis and preparation methods of silver nanowires: Various methods for synthesizing and preparing silver nanowires with controlled dimensions and properties. These methods include chemical reduction, polyol process, and template-directed synthesis. The preparation techniques focus on achieving high aspect ratios, uniform diameters, and specific crystalline structures to enhance the electrical and optical properties of the nanowires.

- Silver nanowire transparent conductive films: Applications of silver nanowires in transparent conductive films for electronic devices such as touch screens, displays, and solar cells. These films combine high electrical conductivity with optical transparency, making them suitable alternatives to indium tin oxide (ITO). The fabrication processes include coating, printing, and embedding techniques to create flexible and durable conductive layers.

- Silver nanowire composites and hybrid materials: Development of composite and hybrid materials incorporating silver nanowires with polymers, other nanomaterials, or functional compounds. These composites exhibit enhanced properties such as improved mechanical strength, thermal conductivity, and antimicrobial activity. Applications include flexible electronics, sensors, and protective coatings with multifunctional capabilities.

- Surface modification and functionalization of silver nanowires: Techniques for modifying the surface of silver nanowires to improve their stability, dispersibility, and compatibility with various matrices. Surface functionalization methods include coating with protective layers, attaching functional groups, and creating core-shell structures. These modifications enhance the performance and extend the applications of silver nanowires in different environments.

- Silver nanowire-based sensors and devices: Integration of silver nanowires into various sensing platforms and electronic devices. The high electrical conductivity, large surface area, and plasmonic properties of silver nanowires make them excellent candidates for chemical sensors, biosensors, pressure sensors, and wearable electronics. These devices offer advantages such as high sensitivity, flexibility, and real-time monitoring capabilities.

02 Transparent conductive films using silver nanowires

Silver nanowires are used to create transparent conductive films for applications in touch screens, displays, and photovoltaic devices. These films combine high electrical conductivity with optical transparency, making them suitable alternatives to indium tin oxide (ITO). The fabrication processes include coating, printing, or embedding silver nanowires onto various substrates, followed by post-treatments to enhance conductivity and adhesion.Expand Specific Solutions03 Silver nanowire-based flexible electronics

Integration of silver nanowires into flexible and stretchable electronic devices. Silver nanowires can maintain electrical conductivity under mechanical deformation, making them ideal for wearable electronics, flexible displays, and sensors. The nanowires are typically embedded in polymer matrices or deposited on elastic substrates to create conductive networks that can withstand bending, folding, and stretching while maintaining functionality.Expand Specific Solutions04 Surface modification and functionalization of silver nanowires

Methods for modifying the surface of silver nanowires to enhance their properties and compatibility with various matrices. Surface functionalization can improve dispersion stability, prevent aggregation, enhance adhesion to substrates, and protect against oxidation. Techniques include coating with polymers, metal oxides, or other functional materials, as well as chemical treatments to introduce specific functional groups on the nanowire surface.Expand Specific Solutions05 Silver nanowire composites for enhanced performance

Development of composite materials incorporating silver nanowires to achieve enhanced electrical, thermal, or mechanical properties. These composites combine silver nanowires with polymers, carbon materials (such as graphene or carbon nanotubes), or other nanomaterials to create hybrid structures with synergistic effects. Applications include electromagnetic shielding, thermal management materials, and high-performance electrodes for energy storage devices.Expand Specific Solutions

Key Industry Players in Automotive Display and Silver Nanowire Sectors

The silver nanowire market for automotive displays is in a growth phase, with increasing adoption driven by demand for flexible, transparent conductive films that outperform traditional ITO technology. The market is projected to expand significantly as automotive manufacturers transition to larger, curved, and touch-enabled displays. Leading players include established materials companies like C3 Nano, Cambrios Film Solutions, and FUJIFILM, alongside emerging specialists such as Zhejiang KECHUANG and Shenzhen Huake Chuangzhi. Major display manufacturers including BOE Technology, TCL China Star, and Samsung Electronics are integrating silver nanowire technology into their automotive product lines. The technology has reached commercial maturity for certain applications, though ongoing R&D focuses on improving durability, reducing costs, and enhancing performance in extreme automotive environments.

Cambrios Film Solutions Corporation

Technical Solution: Cambrios has pioneered ClearOhm® silver nanowire technology specifically optimized for automotive display applications. Their solution features silver nanowires with precisely controlled dimensions (typically 30-40nm diameter and 10-20μm length) suspended in a proprietary formulation that enables uniform deposition on various substrates. For automotive displays, Cambrios has developed specialized formulations that withstand temperature cycling from -40°C to 95°C and maintain performance after 1000+ hours of high-humidity testing. Their automotive-grade films achieve sheet resistance below 50 ohms/square while maintaining over 90% transparency, enabling responsive touch displays even with gloved operation. Cambrios' manufacturing process incorporates patented surface treatments that enhance adhesion to display substrates and improve resistance to environmental factors specific to automotive environments, including UV exposure and chemical contaminants from cleaning agents.

Strengths: Extensive experience with silver nanowire technology; established manufacturing processes with high yield rates; strong intellectual property portfolio; films demonstrate excellent optical clarity with minimal haze. Weaknesses: Faces competition from alternative transparent conductive technologies; requires specialized handling during display integration; potential for higher cost compared to some competing solutions.

FUJIFILM Corp.

Technical Solution: FUJIFILM has developed an advanced silver nanowire technology platform called "Silver Halide Imaging Technology" that leverages their decades of expertise in silver-based photographic materials. For automotive displays, FUJIFILM's approach involves precisely controlled synthesis of silver nanowires with uniform dimensions and aspect ratios, combined with proprietary surface modification techniques that enhance durability in harsh automotive environments. Their manufacturing process incorporates specialized coating technologies that enable consistent film formation with sheet resistance below 30 ohms/square while maintaining transparency above 92%. FUJIFILM's automotive-grade silver nanowire films feature enhanced adhesion to various substrates, improved resistance to oxidation, and specialized encapsulation layers that protect against humidity and temperature fluctuations common in automotive applications. The company has also developed specialized silver nanowire formulations that maintain conductivity performance after exposure to UV radiation and temperature cycling tests required for automotive qualification.

Strengths: Extensive experience with silver-based materials manufacturing; established global supply chain and production capacity; strong integration with existing display manufacturing processes; excellent quality control systems. Weaknesses: Relatively newer entrant to automotive display components compared to established automotive suppliers; may face challenges with industry-specific qualification requirements.

Critical Patents and Technical Innovations in Silver Nanowire Displays

Nitrogen-containing compounds as additives for transparent conductive films

PatentWO2015156911A1

Innovation

- Incorporating nitrogen-containing compounds, such as amine compounds and nitrogen heterocyclic compounds, into the transparent conductive films to enhance electrical conductivity and reduce haze, with silver nanowires dispersed within polymer binders, and using specific polymer binders like cellulose esters for improved mechanical and optical properties.

Display device

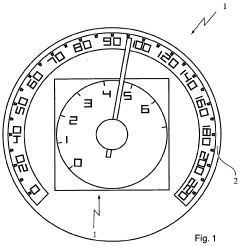

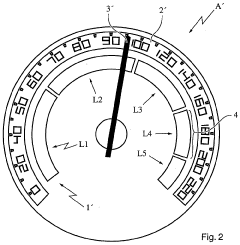

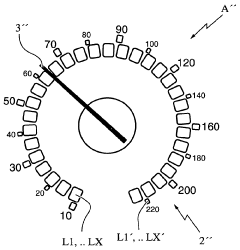

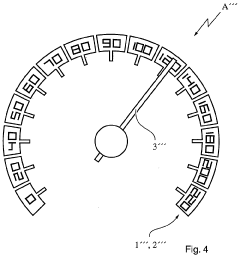

PatentWO2010017877A1

Innovation

- A single-pointer display device with two scales allows for the simultaneous analog display of vehicle speed and engine speed, with dynamic scaling and segment illumination to convey both values efficiently, reducing overall size and enabling additional information display without a pointer.

Environmental Impact and Sustainability of Silver Nanowire Technologies

The environmental impact of silver nanowire (AgNW) technologies in automotive displays represents a critical consideration as the industry moves toward more sustainable manufacturing practices. Silver mining operations traditionally involve significant environmental disruption, including habitat destruction, soil erosion, and water pollution from chemical leaching processes. The extraction phase alone accounts for approximately 40% of the total environmental footprint of silver nanowire production.

Manufacturing processes for silver nanowires require substantial energy inputs and utilize potentially harmful chemicals such as polyvinylpyrrolidone (PVP) and ethylene glycol as reducing and capping agents. These chemicals, if improperly managed, can contribute to environmental contamination. However, recent advancements in green synthesis methods have demonstrated up to 30% reduction in toxic chemical usage while maintaining nanowire performance characteristics.

Waste management presents another significant challenge. The disposal of silver nanowire-containing components can lead to silver nanoparticle release into ecosystems, with potential bioaccumulation effects in aquatic environments. Research indicates that silver ions released from nanowires can be toxic to certain microorganisms at concentrations as low as 0.1 ppm, disrupting natural ecological balances.

On the sustainability front, several promising developments are emerging. Closed-loop recycling systems for silver recovery from manufacturing waste have achieved efficiency rates of 85-90%, significantly reducing the need for virgin silver mining. Additionally, alternative synthesis routes utilizing plant-based reducing agents and biodegradable polymers are showing promise in laboratory settings, potentially offering more environmentally benign production pathways.

Life cycle assessments comparing silver nanowire displays to traditional ITO-based technologies reveal a complex sustainability profile. While AgNW displays consume less energy during operation and manufacturing (approximately 15-20% less), the environmental intensity of silver extraction partially offsets these gains. However, the extended lifespan of AgNW displays in harsh automotive environments (typically 20-30% longer than conventional alternatives) improves their overall sustainability profile.

Industry leaders are increasingly adopting responsible sourcing practices for silver, with several major manufacturers committing to supply chain transparency and ethical mining standards. Certification programs tracking silver from mine to finished product have grown by 35% annually over the past three years, indicating strengthening industry commitment to environmental stewardship.

The regulatory landscape is also evolving, with the European Union's End-of-Life Vehicle Directive and similar frameworks in other regions increasingly focusing on nanomaterial recovery and recycling. These regulations are driving innovation in design-for-disassembly approaches that facilitate more effective material recovery at end-of-life, potentially reducing the environmental footprint of automotive display technologies by up to 25% over their complete lifecycle.

Manufacturing processes for silver nanowires require substantial energy inputs and utilize potentially harmful chemicals such as polyvinylpyrrolidone (PVP) and ethylene glycol as reducing and capping agents. These chemicals, if improperly managed, can contribute to environmental contamination. However, recent advancements in green synthesis methods have demonstrated up to 30% reduction in toxic chemical usage while maintaining nanowire performance characteristics.

Waste management presents another significant challenge. The disposal of silver nanowire-containing components can lead to silver nanoparticle release into ecosystems, with potential bioaccumulation effects in aquatic environments. Research indicates that silver ions released from nanowires can be toxic to certain microorganisms at concentrations as low as 0.1 ppm, disrupting natural ecological balances.

On the sustainability front, several promising developments are emerging. Closed-loop recycling systems for silver recovery from manufacturing waste have achieved efficiency rates of 85-90%, significantly reducing the need for virgin silver mining. Additionally, alternative synthesis routes utilizing plant-based reducing agents and biodegradable polymers are showing promise in laboratory settings, potentially offering more environmentally benign production pathways.

Life cycle assessments comparing silver nanowire displays to traditional ITO-based technologies reveal a complex sustainability profile. While AgNW displays consume less energy during operation and manufacturing (approximately 15-20% less), the environmental intensity of silver extraction partially offsets these gains. However, the extended lifespan of AgNW displays in harsh automotive environments (typically 20-30% longer than conventional alternatives) improves their overall sustainability profile.

Industry leaders are increasingly adopting responsible sourcing practices for silver, with several major manufacturers committing to supply chain transparency and ethical mining standards. Certification programs tracking silver from mine to finished product have grown by 35% annually over the past three years, indicating strengthening industry commitment to environmental stewardship.

The regulatory landscape is also evolving, with the European Union's End-of-Life Vehicle Directive and similar frameworks in other regions increasingly focusing on nanomaterial recovery and recycling. These regulations are driving innovation in design-for-disassembly approaches that facilitate more effective material recovery at end-of-life, potentially reducing the environmental footprint of automotive display technologies by up to 25% over their complete lifecycle.

Supply Chain Considerations for Silver Nanowire Display Manufacturing

The silver nanowire (AgNW) supply chain for automotive display manufacturing presents unique challenges and opportunities that require careful consideration. The automotive industry's stringent requirements for reliability, longevity, and performance under extreme conditions significantly impact sourcing decisions and manufacturing processes.

Raw material sourcing represents a critical vulnerability in the AgNW supply chain. Silver, as a precious metal, experiences price volatility and supply constraints. Currently, major silver mining operations are concentrated in Mexico, Peru, China, and Australia, creating potential geopolitical dependencies. Manufacturers must develop strategic relationships with multiple suppliers across different regions to mitigate supply disruptions.

Processing and nanowire production capabilities remain concentrated among specialized manufacturers, primarily in East Asia. This geographic concentration creates potential bottlenecks, especially as automotive display demand increases. Leading AgNW suppliers include Cambrios Advanced Materials, C3Nano, and Nuovo Film, though automotive-grade certification requirements limit qualified vendors.

Quality control presents another significant challenge. Automotive displays must maintain functionality across temperature ranges from -40°C to 85°C and withstand vibration, humidity, and UV exposure for 10+ years. This necessitates specialized testing protocols and quality assurance measures throughout the supply chain, increasing production costs and lead times.

Integration capabilities represent another constraint, as display manufacturers must develop expertise in handling and integrating AgNW materials into production processes. The transition from traditional ITO-based manufacturing to AgNW requires significant capital investment and process engineering, creating barriers to rapid adoption.

Recycling and sustainability considerations are increasingly important as automotive manufacturers commit to environmental targets. Silver recovery systems must be implemented to recapture precious metals from manufacturing waste and end-of-life products. The European Union's End-of-Life Vehicle Directive and similar regulations worldwide are driving investment in closed-loop manufacturing systems.

Just-in-time manufacturing practices common in automotive production create additional pressure on the AgNW supply chain. Display manufacturers must maintain buffer inventories while balancing cash flow considerations, particularly challenging given silver's value and price volatility.

To address these challenges, vertical integration strategies are emerging among larger display manufacturers, with companies like LG Display and Samsung investing in AgNW production capabilities to secure supply. Simultaneously, collaborative industry initiatives are developing standardized specifications for automotive-grade AgNW materials to expand the supplier ecosystem and improve supply chain resilience.

Raw material sourcing represents a critical vulnerability in the AgNW supply chain. Silver, as a precious metal, experiences price volatility and supply constraints. Currently, major silver mining operations are concentrated in Mexico, Peru, China, and Australia, creating potential geopolitical dependencies. Manufacturers must develop strategic relationships with multiple suppliers across different regions to mitigate supply disruptions.

Processing and nanowire production capabilities remain concentrated among specialized manufacturers, primarily in East Asia. This geographic concentration creates potential bottlenecks, especially as automotive display demand increases. Leading AgNW suppliers include Cambrios Advanced Materials, C3Nano, and Nuovo Film, though automotive-grade certification requirements limit qualified vendors.

Quality control presents another significant challenge. Automotive displays must maintain functionality across temperature ranges from -40°C to 85°C and withstand vibration, humidity, and UV exposure for 10+ years. This necessitates specialized testing protocols and quality assurance measures throughout the supply chain, increasing production costs and lead times.

Integration capabilities represent another constraint, as display manufacturers must develop expertise in handling and integrating AgNW materials into production processes. The transition from traditional ITO-based manufacturing to AgNW requires significant capital investment and process engineering, creating barriers to rapid adoption.

Recycling and sustainability considerations are increasingly important as automotive manufacturers commit to environmental targets. Silver recovery systems must be implemented to recapture precious metals from manufacturing waste and end-of-life products. The European Union's End-of-Life Vehicle Directive and similar regulations worldwide are driving investment in closed-loop manufacturing systems.

Just-in-time manufacturing practices common in automotive production create additional pressure on the AgNW supply chain. Display manufacturers must maintain buffer inventories while balancing cash flow considerations, particularly challenging given silver's value and price volatility.

To address these challenges, vertical integration strategies are emerging among larger display manufacturers, with companies like LG Display and Samsung investing in AgNW production capabilities to secure supply. Simultaneously, collaborative industry initiatives are developing standardized specifications for automotive-grade AgNW materials to expand the supplier ecosystem and improve supply chain resilience.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!