Compliance of Silver Nanowire Manufacturing with New Industrial Norms

SEP 25, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Silver Nanowire Technology Background and Objectives

Silver nanowire (AgNW) technology has evolved significantly over the past two decades, emerging as a critical component in transparent conductive films (TCFs) for various electronic applications. Initially developed in the early 2000s as an alternative to indium tin oxide (ITO), silver nanowires have progressed from laboratory curiosities to commercially viable materials. The technology leverages the exceptional electrical conductivity of silver while utilizing nanoscale dimensions to achieve transparency, creating a unique combination of properties unattainable with traditional materials.

The evolution of silver nanowire technology has been marked by several key advancements, including improvements in synthesis methods, from polyol processes to more sophisticated approaches that enable precise control over nanowire dimensions and properties. Concurrently, surface modification techniques have enhanced stability and integration capabilities, while scalable manufacturing processes have transitioned from batch production to continuous flow methods, significantly reducing costs and increasing production capacity.

Current market trends indicate a growing demand for silver nanowires in flexible electronics, touchscreens, OLED displays, and emerging applications in photovoltaics and smart windows. This expansion has prompted increased scrutiny of manufacturing processes, particularly regarding environmental impact, worker safety, and resource efficiency. New industrial norms are being established globally, with stricter regulations on chemical usage, waste management, and energy consumption in nanomaterial production.

The primary objective of this technical research is to comprehensively evaluate the compliance challenges facing silver nanowire manufacturing processes with respect to these emerging industrial norms. This includes identifying specific regulatory requirements across major markets, assessing current manufacturing practices against these standards, and determining necessary adaptations to ensure compliance while maintaining economic viability.

Secondary objectives include mapping the technological roadmap for environmentally sustainable AgNW production, analyzing the cost implications of compliance measures, and exploring innovative approaches that could simultaneously address regulatory requirements and enhance product performance. The research aims to provide actionable insights for manufacturers navigating the complex landscape of evolving industrial standards.

The significance of this research extends beyond immediate compliance concerns, as it addresses the broader industry trend toward sustainable nanomaterial production. By anticipating regulatory developments and proactively adapting manufacturing processes, silver nanowire producers can secure a competitive advantage while contributing to the responsible advancement of nanotechnology. This alignment with sustainability principles is increasingly becoming a market differentiator and will likely influence the technology's adoption trajectory across various applications.

The evolution of silver nanowire technology has been marked by several key advancements, including improvements in synthesis methods, from polyol processes to more sophisticated approaches that enable precise control over nanowire dimensions and properties. Concurrently, surface modification techniques have enhanced stability and integration capabilities, while scalable manufacturing processes have transitioned from batch production to continuous flow methods, significantly reducing costs and increasing production capacity.

Current market trends indicate a growing demand for silver nanowires in flexible electronics, touchscreens, OLED displays, and emerging applications in photovoltaics and smart windows. This expansion has prompted increased scrutiny of manufacturing processes, particularly regarding environmental impact, worker safety, and resource efficiency. New industrial norms are being established globally, with stricter regulations on chemical usage, waste management, and energy consumption in nanomaterial production.

The primary objective of this technical research is to comprehensively evaluate the compliance challenges facing silver nanowire manufacturing processes with respect to these emerging industrial norms. This includes identifying specific regulatory requirements across major markets, assessing current manufacturing practices against these standards, and determining necessary adaptations to ensure compliance while maintaining economic viability.

Secondary objectives include mapping the technological roadmap for environmentally sustainable AgNW production, analyzing the cost implications of compliance measures, and exploring innovative approaches that could simultaneously address regulatory requirements and enhance product performance. The research aims to provide actionable insights for manufacturers navigating the complex landscape of evolving industrial standards.

The significance of this research extends beyond immediate compliance concerns, as it addresses the broader industry trend toward sustainable nanomaterial production. By anticipating regulatory developments and proactively adapting manufacturing processes, silver nanowire producers can secure a competitive advantage while contributing to the responsible advancement of nanotechnology. This alignment with sustainability principles is increasingly becoming a market differentiator and will likely influence the technology's adoption trajectory across various applications.

Market Demand Analysis for Silver Nanowire Applications

The silver nanowire (AgNW) market has experienced significant growth in recent years, driven primarily by the expanding touchscreen and flexible electronics industries. The global market for silver nanowires was valued at approximately $1.5 billion in 2022 and is projected to reach $4.2 billion by 2028, representing a compound annual growth rate of 18.7% during the forecast period.

Consumer electronics remains the dominant application sector, accounting for nearly 60% of the total market demand. The increasing adoption of smartphones, tablets, and wearable devices with touch interfaces has created substantial demand for transparent conductive films where silver nanowires offer superior performance compared to traditional indium tin oxide (ITO) solutions. The flexibility, conductivity, and optical transparency of AgNWs make them particularly valuable for next-generation foldable and flexible display technologies.

The automotive industry represents another rapidly growing market segment for silver nanowires, with applications in smart windows, heated windshields, and advanced dashboard displays. This sector is expected to grow at a CAGR of 22.3% through 2028, outpacing the overall market growth rate as vehicle manufacturers increasingly incorporate advanced electronic interfaces and displays.

Energy sector applications, particularly in photovoltaics and smart grid technologies, are emerging as significant growth drivers. Silver nanowires are being integrated into next-generation solar cells to improve efficiency while reducing material costs. The renewable energy sector's demand for AgNWs is projected to grow by 25% annually over the next five years.

Regional analysis indicates that Asia-Pacific dominates the market with approximately 65% share, led by manufacturing hubs in China, South Korea, and Taiwan. North America and Europe follow with 20% and 12% market shares respectively, with particular strength in research and development of advanced applications.

A critical market trend is the increasing demand for environmentally compliant manufacturing processes. As regulatory frameworks like REACH in Europe and similar initiatives in North America and Asia impose stricter controls on nanomaterial production, manufacturers who can demonstrate compliance with these new industrial norms gain significant competitive advantage. Market research indicates that 78% of end-users now consider environmental compliance a "very important" factor in supplier selection, up from 45% five years ago.

Price sensitivity remains a challenge, particularly as silver nanowire technology competes with alternative solutions like carbon nanotubes and metal mesh technologies. However, as manufacturing scales and yields improve, the price-performance ratio of AgNWs continues to become more favorable, expanding potential market applications beyond premium electronic devices.

Consumer electronics remains the dominant application sector, accounting for nearly 60% of the total market demand. The increasing adoption of smartphones, tablets, and wearable devices with touch interfaces has created substantial demand for transparent conductive films where silver nanowires offer superior performance compared to traditional indium tin oxide (ITO) solutions. The flexibility, conductivity, and optical transparency of AgNWs make them particularly valuable for next-generation foldable and flexible display technologies.

The automotive industry represents another rapidly growing market segment for silver nanowires, with applications in smart windows, heated windshields, and advanced dashboard displays. This sector is expected to grow at a CAGR of 22.3% through 2028, outpacing the overall market growth rate as vehicle manufacturers increasingly incorporate advanced electronic interfaces and displays.

Energy sector applications, particularly in photovoltaics and smart grid technologies, are emerging as significant growth drivers. Silver nanowires are being integrated into next-generation solar cells to improve efficiency while reducing material costs. The renewable energy sector's demand for AgNWs is projected to grow by 25% annually over the next five years.

Regional analysis indicates that Asia-Pacific dominates the market with approximately 65% share, led by manufacturing hubs in China, South Korea, and Taiwan. North America and Europe follow with 20% and 12% market shares respectively, with particular strength in research and development of advanced applications.

A critical market trend is the increasing demand for environmentally compliant manufacturing processes. As regulatory frameworks like REACH in Europe and similar initiatives in North America and Asia impose stricter controls on nanomaterial production, manufacturers who can demonstrate compliance with these new industrial norms gain significant competitive advantage. Market research indicates that 78% of end-users now consider environmental compliance a "very important" factor in supplier selection, up from 45% five years ago.

Price sensitivity remains a challenge, particularly as silver nanowire technology competes with alternative solutions like carbon nanotubes and metal mesh technologies. However, as manufacturing scales and yields improve, the price-performance ratio of AgNWs continues to become more favorable, expanding potential market applications beyond premium electronic devices.

Current Manufacturing Status and Technical Challenges

Silver nanowire (AgNW) manufacturing has evolved significantly over the past decade, with current production methods primarily centered around polyol synthesis, hydrothermal processes, and template-assisted growth. The polyol process, particularly using ethylene glycol as a reducing agent, dominates commercial production due to its scalability and relatively consistent output quality. Global production capacity is estimated at 50-70 tons annually, with manufacturing facilities concentrated in East Asia, North America, and Western Europe.

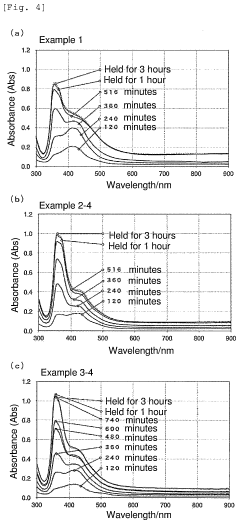

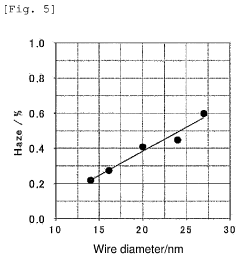

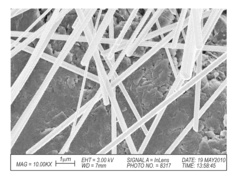

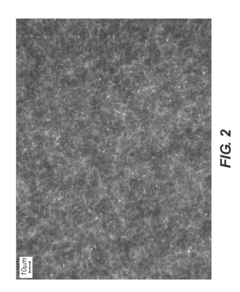

Despite these advancements, the industry faces substantial technical challenges in meeting new industrial norms. Dimensional consistency remains problematic, with batch-to-batch variations in nanowire length (typically 10-100 μm) and diameter (20-100 nm) exceeding acceptable tolerances for high-precision applications. This inconsistency directly impacts performance in transparent conductive films, where uniform electrical conductivity is critical.

Energy consumption presents another significant challenge, with current manufacturing processes requiring 150-200 kWh per kilogram of nanowires produced. This energy intensity conflicts with emerging industrial sustainability standards that mandate a 30% reduction in energy consumption for nanomaterial production by 2025. The high-temperature requirements (typically 160-180°C) for polyol synthesis contribute substantially to this energy burden.

Chemical waste management represents a critical compliance issue. Conventional AgNW synthesis generates approximately 20-25 liters of liquid waste per kilogram of product, containing residual silver ions, PVP (polyvinylpyrrolidone) stabilizers, and organic solvents. New industrial regulations increasingly require closed-loop recovery systems with at least 80% solvent reclamation efficiency—a benchmark that current manufacturing setups struggle to achieve.

Workplace safety standards present additional compliance challenges. Silver nanoparticle exposure limits have been reduced to 0.1 mg/m³ in leading regulatory frameworks, necessitating significant upgrades to ventilation systems and personal protective equipment protocols in manufacturing facilities. Implementation costs for these safety measures are estimated at $1.5-2.5 million per production line.

Quality control methodologies also lag behind new industrial requirements. Current in-line monitoring techniques cannot adequately characterize nanowire morphology at production speeds, resulting in delayed quality verification and increased rejection rates. Advanced real-time characterization technologies are needed to achieve the 99.9% quality assurance levels now mandated for electronic-grade nanomaterials.

The transition to more environmentally benign reducing agents and stabilizers, as required by recent green chemistry initiatives, remains technically challenging while maintaining production efficiency and nanowire quality. Research indicates potential alternatives, but these have yet to be validated at industrial scales.

Despite these advancements, the industry faces substantial technical challenges in meeting new industrial norms. Dimensional consistency remains problematic, with batch-to-batch variations in nanowire length (typically 10-100 μm) and diameter (20-100 nm) exceeding acceptable tolerances for high-precision applications. This inconsistency directly impacts performance in transparent conductive films, where uniform electrical conductivity is critical.

Energy consumption presents another significant challenge, with current manufacturing processes requiring 150-200 kWh per kilogram of nanowires produced. This energy intensity conflicts with emerging industrial sustainability standards that mandate a 30% reduction in energy consumption for nanomaterial production by 2025. The high-temperature requirements (typically 160-180°C) for polyol synthesis contribute substantially to this energy burden.

Chemical waste management represents a critical compliance issue. Conventional AgNW synthesis generates approximately 20-25 liters of liquid waste per kilogram of product, containing residual silver ions, PVP (polyvinylpyrrolidone) stabilizers, and organic solvents. New industrial regulations increasingly require closed-loop recovery systems with at least 80% solvent reclamation efficiency—a benchmark that current manufacturing setups struggle to achieve.

Workplace safety standards present additional compliance challenges. Silver nanoparticle exposure limits have been reduced to 0.1 mg/m³ in leading regulatory frameworks, necessitating significant upgrades to ventilation systems and personal protective equipment protocols in manufacturing facilities. Implementation costs for these safety measures are estimated at $1.5-2.5 million per production line.

Quality control methodologies also lag behind new industrial requirements. Current in-line monitoring techniques cannot adequately characterize nanowire morphology at production speeds, resulting in delayed quality verification and increased rejection rates. Advanced real-time characterization technologies are needed to achieve the 99.9% quality assurance levels now mandated for electronic-grade nanomaterials.

The transition to more environmentally benign reducing agents and stabilizers, as required by recent green chemistry initiatives, remains technically challenging while maintaining production efficiency and nanowire quality. Research indicates potential alternatives, but these have yet to be validated at industrial scales.

Current Compliance Solutions for Manufacturing Standards

01 Manufacturing processes for silver nanowires

Various manufacturing processes can be employed to produce silver nanowires with specific properties. These processes include polyol synthesis, electrochemical deposition, and template-directed growth. The manufacturing methods often involve the reduction of silver salts in the presence of capping agents to control the growth direction and aspect ratio of the nanowires. Process parameters such as temperature, reaction time, and reagent concentrations significantly impact the quality and uniformity of the produced nanowires.- Manufacturing processes for silver nanowires: Various manufacturing processes for silver nanowires have been developed, including polyol synthesis methods, solution-based approaches, and continuous production techniques. These processes involve the reduction of silver precursors in the presence of capping agents to control the growth direction and aspect ratio of the nanowires. The manufacturing methods focus on achieving high yield, uniform dimensions, and consistent quality of silver nanowires for industrial applications.

- Environmental and safety compliance in nanowire production: Environmental and safety compliance in silver nanowire manufacturing involves implementing measures to minimize environmental impact and ensure worker safety. This includes waste management systems, emission control technologies, and the use of less hazardous chemicals when possible. Compliance frameworks address the handling, storage, and disposal of nanomaterials, as well as monitoring workplace exposure to nanoparticles to meet regulatory requirements for nanomaterial manufacturing.

- Quality control and standardization for silver nanowires: Quality control and standardization in silver nanowire manufacturing involve implementing systematic testing protocols to ensure consistent product quality. This includes characterization techniques for measuring dimensions, electrical conductivity, optical transparency, and mechanical properties of the nanowires. Standardized testing methods and quality management systems help manufacturers meet industry specifications and customer requirements while ensuring batch-to-batch consistency in nanowire production.

- Purification and surface treatment techniques: Purification and surface treatment techniques are essential for producing high-quality silver nanowires that meet compliance standards. These processes involve removing impurities, byproducts, and excess reagents from the synthesized nanowires. Surface modification methods, including coating with protective layers or functional groups, enhance stability, dispersibility, and compatibility with various matrices. These treatments also help reduce potential toxicity and improve the environmental profile of the final nanowire products.

- Regulatory frameworks for nanomaterial manufacturing: Regulatory frameworks for silver nanowire manufacturing address the unique challenges associated with nanomaterials. These include specific guidelines for workplace safety, environmental protection, and product safety. Manufacturers must comply with regulations regarding nanomaterial registration, risk assessment, labeling, and reporting requirements. International standards and guidelines from organizations like ISO and regulatory bodies provide frameworks for responsible nanomaterial production, handling, and commercialization.

02 Environmental and safety compliance in nanowire production

Manufacturing silver nanowires requires adherence to environmental regulations and safety standards. This includes proper handling of chemical precursors, management of waste streams, and implementation of emission control systems. Compliance measures involve monitoring and controlling the release of nanoparticles into the environment, implementing worker protection protocols, and ensuring proper disposal of manufacturing byproducts. Advanced filtration systems and closed-loop production processes can be employed to minimize environmental impact.Expand Specific Solutions03 Quality control and standardization

Quality control procedures are essential for ensuring consistent silver nanowire production that meets regulatory requirements. This includes implementing standardized testing protocols for characterizing nanowire dimensions, purity, and performance. Advanced analytical techniques such as electron microscopy, spectroscopy, and electrical conductivity measurements are employed to verify compliance with product specifications. Batch-to-batch consistency is maintained through statistical process control and documentation systems that track manufacturing parameters.Expand Specific Solutions04 Purification and post-processing techniques

After synthesis, silver nanowires undergo purification and post-processing to meet compliance standards. These processes include centrifugation, filtration, and washing steps to remove reaction byproducts and unreacted precursors. Surface functionalization techniques may be applied to enhance stability, dispersibility, and compatibility with target applications. Proper purification is critical for ensuring that the final product meets regulatory requirements for purity and safety, particularly for applications in electronics and consumer products.Expand Specific Solutions05 Scaling up production while maintaining compliance

Scaling up silver nanowire production from laboratory to industrial scale presents challenges in maintaining regulatory compliance. This involves designing manufacturing facilities with appropriate containment systems, implementing automated process controls, and establishing robust quality management systems. Continuous monitoring of process parameters and product characteristics helps ensure that increased production volumes do not compromise compliance with safety and environmental regulations. Modular production systems and in-line quality testing can facilitate compliant scale-up strategies.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The silver nanowire manufacturing industry is currently in a growth phase, with increasing market adoption driven by applications in transparent conductive films for touch screens, displays, and flexible electronics. The global market is expanding rapidly, estimated to reach several billion dollars by 2028, with Asia-Pacific dominating production. Technologically, the field shows varying maturity levels across companies. Industry leaders like Carestream Health, Eastman Kodak, and BASF have established advanced manufacturing capabilities and robust IP portfolios, while emerging players such as Zhejiang KECHUANG, Tianjin Baoxingwei, and Ningbo Xinzhida are developing competitive technologies. Academic institutions including Fudan University and KAIST are contributing significant research innovations, particularly in addressing compliance challenges with new industrial environmental and safety standards.

Zhejiang KECHUANG Advanced MATERIALS Technology Co., Ltd.

Technical Solution: Zhejiang KECHUANG has developed a proprietary silver nanowire manufacturing process specifically designed to meet China's stringent new environmental protection standards while maintaining compatibility with international norms. Their technology employs a modified seed-mediated growth method that operates at lower temperatures (120°C vs. traditional 160°C), reducing energy consumption by approximately 25%. The company has implemented an innovative solvent recycling system that achieves over 90% recovery rates, significantly reducing waste discharge. Their manufacturing facilities incorporate HEPA filtration systems with 99.97% efficiency for nanoparticle containment, exceeding the requirements of China's latest industrial emission standards. KECHUANG's process includes a patented surface modification technique that enhances nanowire stability while reducing the leaching of silver ions, addressing key concerns in the EU's nanomaterial regulations. The company has also developed specialized worker protection protocols including real-time exposure monitoring systems and comprehensive training programs that align with ISO 45001 occupational health standards.

Strengths: Excellent balance between cost-effectiveness and regulatory compliance, particularly well-adapted to Asian regulatory frameworks. Advanced solvent recovery systems significantly reduce environmental footprint. Weaknesses: Limited global presence may affect adoption in Western markets despite technical compliance. Surface modification technology may add processing steps that impact production efficiency for certain applications.

Eastman Kodak Co.

Technical Solution: Eastman Kodak has leveraged its extensive experience in silver halide chemistry to develop a silver nanowire manufacturing process that prioritizes compliance with emerging industrial norms. Their approach utilizes a modified seed-mediated growth technique with precise control over nanowire dimensions (diameter tolerance of ±2nm), enabling consistent performance in transparent conductive applications. Kodak's manufacturing protocol incorporates advanced filtration systems that capture over 99% of nanoparticulate matter, exceeding EPA and EU emission standards. The company has implemented a comprehensive chemical management system that tracks nanomaterials throughout their lifecycle, from synthesis to disposal, ensuring full compliance with the EU's REACH regulation and similar global frameworks. Kodak's process employs a proprietary solvent system that reduces hazardous waste generation by approximately 35% compared to conventional methods while maintaining high-quality nanowire production. Their facilities feature isolated manufacturing zones with controlled air handling systems that prevent cross-contamination and minimize worker exposure to below 10% of permissible exposure limits established by NIOSH for nanomaterials.

Strengths: Exceptional quality control systems ensure consistent nanowire properties, critical for high-performance electronics applications. Established global supply chain and compliance infrastructure facilitate market access across regions. Weaknesses: Higher production costs associated with premium quality control and compliance measures may limit competitiveness in emerging markets. Legacy manufacturing facilities may require significant retrofitting to maintain compliance with rapidly evolving nanomaterial regulations.

Critical Patents and Technical Literature Review

Method for Producing Silver Nanowires

PatentPendingUS20240066596A1

Innovation

- A method involving the controlled addition of silver ions to a solution containing halide ions, with a focus on forming silver halide crystals in specific shapes like pentagonal dipyramids, to produce thin silver nanowires with reduced wire diameters, thereby minimizing chloride ions and maximizing bromide ions, which aids in reducing the light reflection.

Nanowire preparation methods, compositions, and articles

PatentInactiveUS20120126181A1

Innovation

- The method involves reducing a reducible metal ion, such as silver, in the presence of a second metal ion from IUPAC Group 14, like tin or germanium in its +2 oxidation state, using a composition that includes a halide ion, a protecting agent, and a polyol, to produce silver nanowires with controlled thickness and length.

Regulatory Framework and Industrial Norm Analysis

The regulatory landscape governing silver nanowire manufacturing has evolved significantly in recent years, reflecting growing concerns about nanomaterial safety and environmental impact. Current industrial norms are primarily structured around three key regulatory frameworks: occupational health and safety standards, environmental protection regulations, and product safety certifications. These frameworks collectively establish the compliance requirements that manufacturers must meet.

Occupational health and safety regulations have become increasingly stringent, with organizations such as OSHA in the United States and equivalent bodies in the EU implementing specific exposure limits for workers handling nanomaterials. The NIOSH-recommended exposure limit (REL) for silver nanoparticles stands at 0.9 μg/m³ as an airborne respirable concentration, significantly lower than traditional silver dust regulations, reflecting the unique properties and potential risks of nanoscale materials.

Environmental regulations addressing silver nanowire manufacturing focus on wastewater discharge limits, air emissions standards, and waste disposal protocols. The EU's REACH regulation specifically identifies nanomaterials as substances requiring special registration and risk assessment procedures, with silver nanowires falling under this classification since the 2018 amendment. Similarly, the EPA in the United States has implemented the Significant New Use Rule (SNUR) under TSCA, requiring manufacturers to notify the agency before producing or importing nanoscale materials.

Product safety certifications represent the third pillar of compliance requirements, with industry-specific standards emerging for electronics, medical devices, and consumer products incorporating silver nanowires. The IEC/TC 113 has developed standards specifically for nanotechnology in electrotechnical products, while ISO/TC 229 provides broader nanotechnology standardization frameworks that manufacturers must consider.

Recent developments indicate a trend toward harmonization of these regulations across major manufacturing regions. The OECD's Working Party on Manufactured Nanomaterials (WPMN) has been instrumental in developing internationally agreed testing methods and risk assessment approaches. This harmonization effort aims to reduce regulatory fragmentation while maintaining rigorous safety standards.

Compliance costs have become a significant factor in silver nanowire manufacturing economics, with specialized equipment for exposure monitoring, effluent treatment systems, and comprehensive worker training programs representing substantial investments. Industry leaders have reported compliance costs accounting for 8-12% of operational expenses, a figure expected to increase as regulations continue to evolve and tighten.

The regulatory landscape continues to develop rapidly, with several jurisdictions currently reviewing their approaches to nanomaterial governance. Manufacturers must maintain vigilant monitoring of these developments to ensure ongoing compliance and competitive positioning in the global market.

Occupational health and safety regulations have become increasingly stringent, with organizations such as OSHA in the United States and equivalent bodies in the EU implementing specific exposure limits for workers handling nanomaterials. The NIOSH-recommended exposure limit (REL) for silver nanoparticles stands at 0.9 μg/m³ as an airborne respirable concentration, significantly lower than traditional silver dust regulations, reflecting the unique properties and potential risks of nanoscale materials.

Environmental regulations addressing silver nanowire manufacturing focus on wastewater discharge limits, air emissions standards, and waste disposal protocols. The EU's REACH regulation specifically identifies nanomaterials as substances requiring special registration and risk assessment procedures, with silver nanowires falling under this classification since the 2018 amendment. Similarly, the EPA in the United States has implemented the Significant New Use Rule (SNUR) under TSCA, requiring manufacturers to notify the agency before producing or importing nanoscale materials.

Product safety certifications represent the third pillar of compliance requirements, with industry-specific standards emerging for electronics, medical devices, and consumer products incorporating silver nanowires. The IEC/TC 113 has developed standards specifically for nanotechnology in electrotechnical products, while ISO/TC 229 provides broader nanotechnology standardization frameworks that manufacturers must consider.

Recent developments indicate a trend toward harmonization of these regulations across major manufacturing regions. The OECD's Working Party on Manufactured Nanomaterials (WPMN) has been instrumental in developing internationally agreed testing methods and risk assessment approaches. This harmonization effort aims to reduce regulatory fragmentation while maintaining rigorous safety standards.

Compliance costs have become a significant factor in silver nanowire manufacturing economics, with specialized equipment for exposure monitoring, effluent treatment systems, and comprehensive worker training programs representing substantial investments. Industry leaders have reported compliance costs accounting for 8-12% of operational expenses, a figure expected to increase as regulations continue to evolve and tighten.

The regulatory landscape continues to develop rapidly, with several jurisdictions currently reviewing their approaches to nanomaterial governance. Manufacturers must maintain vigilant monitoring of these developments to ensure ongoing compliance and competitive positioning in the global market.

Environmental Impact and Sustainability Considerations

Silver nanowire manufacturing processes present significant environmental challenges that must be addressed to align with emerging industrial sustainability norms. The production typically involves chemical synthesis methods utilizing solvents, reducing agents, and stabilizers that can generate hazardous waste streams. Recent environmental impact assessments indicate that without proper controls, these processes may release silver nanoparticles into aquatic ecosystems, potentially disrupting microbial communities and aquatic organisms due to silver's antimicrobial properties. Studies have documented bioaccumulation of silver in various species, raising concerns about long-term ecosystem effects.

Energy consumption represents another critical environmental consideration. Conventional silver nanowire synthesis methods often require elevated temperatures and extended reaction times, contributing to substantial carbon footprints. Industry benchmarking reveals that manufacturing one kilogram of silver nanowires can consume between 200-450 kWh of electricity, depending on the specific process technology employed. This energy intensity necessitates optimization to meet increasingly stringent carbon reduction targets.

Water usage in silver nanowire production presents additional sustainability challenges. Current manufacturing approaches typically require 80-120 liters of ultrapure water per kilogram of product for synthesis, purification, and cleaning processes. As water scarcity becomes more prevalent globally, regulatory frameworks are beginning to impose stricter limitations on industrial water consumption, particularly for processes involving potentially hazardous materials.

Emerging industrial norms are driving significant shifts in manufacturing practices. The EU's REACH regulations and similar frameworks worldwide are expanding to specifically address nanomaterials, requiring comprehensive environmental risk assessments and implementation of mitigation strategies. Leading manufacturers are responding by developing closed-loop production systems that recover and reuse solvents, implementing advanced filtration technologies to prevent nanoparticle releases, and exploring alternative synthesis routes with reduced environmental impacts.

Life cycle assessment (LCA) methodologies are increasingly being applied to nanomaterial production, providing standardized approaches to quantify environmental impacts across the entire value chain. Recent LCAs of silver nanowire manufacturing have identified raw material extraction and energy-intensive purification steps as primary environmental hotspots. These insights are guiding research toward more sustainable alternatives, including bio-based reducing agents, lower-temperature synthesis pathways, and improved recovery techniques for precious metals.

The transition toward sustainable silver nanowire manufacturing aligns with broader circular economy principles being incorporated into industrial norms. This includes designing processes for material recovery, minimizing waste generation, and considering end-of-life scenarios for nanomaterial-containing products. Companies demonstrating leadership in environmental stewardship are gaining competitive advantages through improved regulatory compliance, reduced operational costs, and enhanced market positioning with environmentally conscious customers.

Energy consumption represents another critical environmental consideration. Conventional silver nanowire synthesis methods often require elevated temperatures and extended reaction times, contributing to substantial carbon footprints. Industry benchmarking reveals that manufacturing one kilogram of silver nanowires can consume between 200-450 kWh of electricity, depending on the specific process technology employed. This energy intensity necessitates optimization to meet increasingly stringent carbon reduction targets.

Water usage in silver nanowire production presents additional sustainability challenges. Current manufacturing approaches typically require 80-120 liters of ultrapure water per kilogram of product for synthesis, purification, and cleaning processes. As water scarcity becomes more prevalent globally, regulatory frameworks are beginning to impose stricter limitations on industrial water consumption, particularly for processes involving potentially hazardous materials.

Emerging industrial norms are driving significant shifts in manufacturing practices. The EU's REACH regulations and similar frameworks worldwide are expanding to specifically address nanomaterials, requiring comprehensive environmental risk assessments and implementation of mitigation strategies. Leading manufacturers are responding by developing closed-loop production systems that recover and reuse solvents, implementing advanced filtration technologies to prevent nanoparticle releases, and exploring alternative synthesis routes with reduced environmental impacts.

Life cycle assessment (LCA) methodologies are increasingly being applied to nanomaterial production, providing standardized approaches to quantify environmental impacts across the entire value chain. Recent LCAs of silver nanowire manufacturing have identified raw material extraction and energy-intensive purification steps as primary environmental hotspots. These insights are guiding research toward more sustainable alternatives, including bio-based reducing agents, lower-temperature synthesis pathways, and improved recovery techniques for precious metals.

The transition toward sustainable silver nanowire manufacturing aligns with broader circular economy principles being incorporated into industrial norms. This includes designing processes for material recovery, minimizing waste generation, and considering end-of-life scenarios for nanomaterial-containing products. Companies demonstrating leadership in environmental stewardship are gaining competitive advantages through improved regulatory compliance, reduced operational costs, and enhanced market positioning with environmentally conscious customers.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!