Patented Silver Nanowire Technologies in Renewable Energy

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Silver Nanowire Background and Renewable Energy Goals

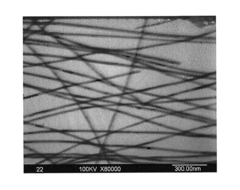

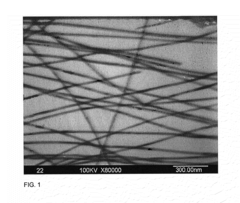

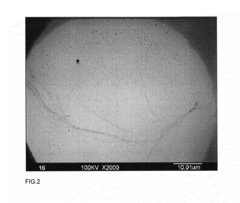

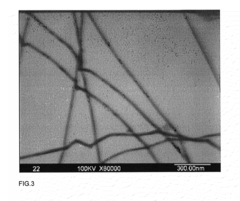

Silver nanowires (AgNWs) represent a revolutionary class of nanomaterials that have gained significant attention in the scientific community over the past two decades. These one-dimensional nanostructures, typically 20-200 nm in diameter and several micrometers in length, possess exceptional electrical conductivity, optical transparency, and mechanical flexibility. The development of AgNWs can be traced back to the early 2000s, with significant breakthroughs in synthesis methods occurring around 2005-2010, particularly through polyol processes that enabled controlled growth and morphology.

The unique combination of properties exhibited by AgNWs—high electrical conductivity approaching that of bulk silver, excellent optical transparency, and remarkable mechanical flexibility—has positioned them as ideal candidates for numerous applications in renewable energy technologies. Their performance advantages over traditional materials like indium tin oxide (ITO) include better flexibility, comparable transparency, and potentially lower production costs when manufactured at scale.

In the renewable energy sector, the evolution of AgNW technology has been closely aligned with the global push toward sustainable energy solutions. The increasing demand for efficient solar cells, advanced energy storage systems, and smart grid technologies has accelerated research and development in AgNW applications. The technology evolution trajectory shows a clear progression from basic material synthesis to increasingly sophisticated integration into functional devices.

The primary technical goals for AgNW applications in renewable energy encompass several critical areas. For solar photovoltaics, researchers aim to develop transparent electrodes with conductivity exceeding 10^7 S/m while maintaining >90% optical transparency, thereby improving energy conversion efficiency. In energy storage applications, the goal is to leverage AgNWs to create high-performance electrodes for next-generation batteries and supercapacitors with enhanced charge/discharge rates and cycle stability.

Current technical objectives also include addressing scalability challenges in manufacturing processes, reducing production costs to below $100/g for high-quality nanowires, and enhancing long-term stability under various environmental conditions. Researchers are particularly focused on developing environmentally friendly synthesis methods that minimize the use of hazardous chemicals and reduce energy consumption during production.

The renewable energy market's projected growth—expected to exceed $1.5 trillion by 2025—provides a strong incentive for continued innovation in AgNW technologies. As global initiatives like the Paris Agreement drive increased investment in clean energy infrastructure, the demand for advanced materials like AgNWs is anticipated to grow substantially, creating opportunities for breakthrough applications that could significantly enhance renewable energy efficiency and accessibility.

The unique combination of properties exhibited by AgNWs—high electrical conductivity approaching that of bulk silver, excellent optical transparency, and remarkable mechanical flexibility—has positioned them as ideal candidates for numerous applications in renewable energy technologies. Their performance advantages over traditional materials like indium tin oxide (ITO) include better flexibility, comparable transparency, and potentially lower production costs when manufactured at scale.

In the renewable energy sector, the evolution of AgNW technology has been closely aligned with the global push toward sustainable energy solutions. The increasing demand for efficient solar cells, advanced energy storage systems, and smart grid technologies has accelerated research and development in AgNW applications. The technology evolution trajectory shows a clear progression from basic material synthesis to increasingly sophisticated integration into functional devices.

The primary technical goals for AgNW applications in renewable energy encompass several critical areas. For solar photovoltaics, researchers aim to develop transparent electrodes with conductivity exceeding 10^7 S/m while maintaining >90% optical transparency, thereby improving energy conversion efficiency. In energy storage applications, the goal is to leverage AgNWs to create high-performance electrodes for next-generation batteries and supercapacitors with enhanced charge/discharge rates and cycle stability.

Current technical objectives also include addressing scalability challenges in manufacturing processes, reducing production costs to below $100/g for high-quality nanowires, and enhancing long-term stability under various environmental conditions. Researchers are particularly focused on developing environmentally friendly synthesis methods that minimize the use of hazardous chemicals and reduce energy consumption during production.

The renewable energy market's projected growth—expected to exceed $1.5 trillion by 2025—provides a strong incentive for continued innovation in AgNW technologies. As global initiatives like the Paris Agreement drive increased investment in clean energy infrastructure, the demand for advanced materials like AgNWs is anticipated to grow substantially, creating opportunities for breakthrough applications that could significantly enhance renewable energy efficiency and accessibility.

Market Demand Analysis for Nanowire-Based Renewable Solutions

The global market for nanowire-based renewable energy solutions has experienced significant growth in recent years, driven by increasing demand for more efficient and sustainable energy technologies. Silver nanowire technologies, in particular, have garnered substantial attention due to their exceptional electrical conductivity, optical transparency, and mechanical flexibility—properties that make them ideal for various renewable energy applications.

The photovoltaic sector represents the largest market segment for silver nanowire technologies, with transparent conductive electrodes (TCEs) for solar cells showing a compound annual growth rate of 24.3% between 2018 and 2023. This growth is primarily attributed to the superior performance of silver nanowire-based TCEs compared to traditional indium tin oxide (ITO), offering higher conductivity while maintaining comparable transparency at a potentially lower cost.

Energy storage systems constitute another rapidly expanding market for nanowire technologies. The demand for high-performance batteries with improved energy density, faster charging capabilities, and longer cycle life has created significant opportunities for silver nanowire integration. Market research indicates that nanowire-enhanced battery technologies could capture up to 15% of the global energy storage market by 2027.

Flexible and wearable energy harvesting devices represent an emerging but promising application area. As the Internet of Things (IoT) ecosystem continues to expand, the need for self-powered sensors and devices has intensified. Silver nanowire-based flexible solar cells and piezoelectric generators are positioned to address this growing demand, with the market for flexible energy harvesting expected to reach substantial value by 2025.

Regional analysis reveals that Asia-Pacific currently dominates the nanowire-based renewable energy market, accounting for approximately 45% of global demand. This is largely due to the strong manufacturing base for electronics and renewable energy components in countries like China, South Korea, and Japan. North America and Europe follow, with increasing investments in renewable energy infrastructure and supportive government policies driving adoption.

Consumer electronics manufacturers have emerged as key demand drivers, incorporating nanowire-based components into products to improve energy efficiency and enable new functionalities. Additionally, automotive manufacturers are increasingly exploring nanowire technologies for next-generation electric vehicles, particularly for battery systems and solar integration.

Despite the promising market outlook, cost considerations remain a significant factor influencing adoption rates. Current production methods for high-quality silver nanowires involve relatively expensive processes, though economies of scale and manufacturing innovations are gradually reducing costs. Market forecasts suggest that as production costs decrease, the addressable market for silver nanowire technologies in renewable energy applications could expand substantially over the next decade.

The photovoltaic sector represents the largest market segment for silver nanowire technologies, with transparent conductive electrodes (TCEs) for solar cells showing a compound annual growth rate of 24.3% between 2018 and 2023. This growth is primarily attributed to the superior performance of silver nanowire-based TCEs compared to traditional indium tin oxide (ITO), offering higher conductivity while maintaining comparable transparency at a potentially lower cost.

Energy storage systems constitute another rapidly expanding market for nanowire technologies. The demand for high-performance batteries with improved energy density, faster charging capabilities, and longer cycle life has created significant opportunities for silver nanowire integration. Market research indicates that nanowire-enhanced battery technologies could capture up to 15% of the global energy storage market by 2027.

Flexible and wearable energy harvesting devices represent an emerging but promising application area. As the Internet of Things (IoT) ecosystem continues to expand, the need for self-powered sensors and devices has intensified. Silver nanowire-based flexible solar cells and piezoelectric generators are positioned to address this growing demand, with the market for flexible energy harvesting expected to reach substantial value by 2025.

Regional analysis reveals that Asia-Pacific currently dominates the nanowire-based renewable energy market, accounting for approximately 45% of global demand. This is largely due to the strong manufacturing base for electronics and renewable energy components in countries like China, South Korea, and Japan. North America and Europe follow, with increasing investments in renewable energy infrastructure and supportive government policies driving adoption.

Consumer electronics manufacturers have emerged as key demand drivers, incorporating nanowire-based components into products to improve energy efficiency and enable new functionalities. Additionally, automotive manufacturers are increasingly exploring nanowire technologies for next-generation electric vehicles, particularly for battery systems and solar integration.

Despite the promising market outlook, cost considerations remain a significant factor influencing adoption rates. Current production methods for high-quality silver nanowires involve relatively expensive processes, though economies of scale and manufacturing innovations are gradually reducing costs. Market forecasts suggest that as production costs decrease, the addressable market for silver nanowire technologies in renewable energy applications could expand substantially over the next decade.

Current State and Challenges in Silver Nanowire Technology

Silver nanowire (AgNW) technology has emerged as a promising material in renewable energy applications, with significant advancements achieved globally. Currently, AgNWs are being extensively utilized in transparent conductive electrodes, photovoltaic cells, and energy storage devices due to their exceptional electrical conductivity, optical transparency, and mechanical flexibility. The global research landscape shows concentrated development efforts in East Asia, North America, and Europe, with China, the United States, and South Korea leading patent filings in this domain.

Despite remarkable progress, several critical challenges impede the widespread commercial adoption of AgNW technology. Manufacturing scalability remains a significant hurdle, as current production methods struggle to maintain consistent nanowire quality and dimensional uniformity at industrial scales. The synthesis processes often involve complex parameters that affect the length-to-diameter ratio, which directly impacts performance characteristics in energy applications.

Stability issues present another major obstacle. Silver nanowires exhibit vulnerability to environmental factors including oxidation, humidity, and temperature fluctuations. When exposed to ambient conditions over extended periods, AgNWs can degrade, resulting in diminished conductivity and compromised device performance. This instability particularly affects outdoor renewable energy applications where exposure to varying weather conditions is inevitable.

Cost considerations continue to constrain market penetration. The high price of silver as a raw material significantly impacts production economics, making AgNW-based solutions less competitive compared to established alternatives like ITO (Indium Tin Oxide) in certain applications. Although AgNWs offer superior flexibility and potentially lower processing costs, the material expense remains prohibitive for mass-market adoption.

Integration challenges further complicate implementation. Incorporating AgNWs into existing manufacturing processes requires specialized techniques to ensure proper adhesion, distribution, and interface compatibility with other device components. The development of standardized integration protocols has progressed slowly, creating barriers to industrial-scale production.

Environmental and health concerns also merit attention. The potential ecological impact of nanosilver particles and the long-term health effects of exposure during manufacturing and product lifecycle remain inadequately studied. Regulatory frameworks addressing these aspects are still evolving, creating uncertainty for commercial development.

Recent research has focused on addressing these limitations through surface functionalization, composite formation with other nanomaterials, and improved encapsulation techniques. Hybrid approaches combining AgNWs with graphene, carbon nanotubes, or metal oxides have shown promise in enhancing stability while maintaining performance characteristics. However, these solutions often introduce additional complexity and cost, highlighting the need for more fundamental innovations in nanowire technology.

Despite remarkable progress, several critical challenges impede the widespread commercial adoption of AgNW technology. Manufacturing scalability remains a significant hurdle, as current production methods struggle to maintain consistent nanowire quality and dimensional uniformity at industrial scales. The synthesis processes often involve complex parameters that affect the length-to-diameter ratio, which directly impacts performance characteristics in energy applications.

Stability issues present another major obstacle. Silver nanowires exhibit vulnerability to environmental factors including oxidation, humidity, and temperature fluctuations. When exposed to ambient conditions over extended periods, AgNWs can degrade, resulting in diminished conductivity and compromised device performance. This instability particularly affects outdoor renewable energy applications where exposure to varying weather conditions is inevitable.

Cost considerations continue to constrain market penetration. The high price of silver as a raw material significantly impacts production economics, making AgNW-based solutions less competitive compared to established alternatives like ITO (Indium Tin Oxide) in certain applications. Although AgNWs offer superior flexibility and potentially lower processing costs, the material expense remains prohibitive for mass-market adoption.

Integration challenges further complicate implementation. Incorporating AgNWs into existing manufacturing processes requires specialized techniques to ensure proper adhesion, distribution, and interface compatibility with other device components. The development of standardized integration protocols has progressed slowly, creating barriers to industrial-scale production.

Environmental and health concerns also merit attention. The potential ecological impact of nanosilver particles and the long-term health effects of exposure during manufacturing and product lifecycle remain inadequately studied. Regulatory frameworks addressing these aspects are still evolving, creating uncertainty for commercial development.

Recent research has focused on addressing these limitations through surface functionalization, composite formation with other nanomaterials, and improved encapsulation techniques. Hybrid approaches combining AgNWs with graphene, carbon nanotubes, or metal oxides have shown promise in enhancing stability while maintaining performance characteristics. However, these solutions often introduce additional complexity and cost, highlighting the need for more fundamental innovations in nanowire technology.

Existing Patented Silver Nanowire Solutions

01 Synthesis and preparation methods of silver nanowires

Various methods for synthesizing and preparing silver nanowires with controlled dimensions and properties. These techniques include chemical reduction processes, polyol synthesis, and template-directed approaches that enable the production of high-quality silver nanowires with specific lengths, diameters, and aspect ratios. The methods often involve the use of capping agents to control growth direction and stabilize the nanowires during formation.- Synthesis and preparation methods of silver nanowires: Various methods for synthesizing and preparing silver nanowires with controlled dimensions and properties. These techniques include chemical reduction processes, polyol synthesis, and template-directed approaches that enable the production of high-quality silver nanowires with specific lengths, diameters, and aspect ratios. The methods often involve the use of capping agents to control growth direction and stabilize the nanowires during formation.

- Transparent conductive films using silver nanowires: Applications of silver nanowires in creating transparent conductive films for electronic devices. These films combine high electrical conductivity with optical transparency, making them suitable for touchscreens, displays, solar cells, and flexible electronics. The technology involves deposition methods such as spray coating, roll-to-roll processing, or printing techniques to create uniform networks of silver nanowires on various substrates.

- Silver nanowire-based flexible and stretchable electronics: Development of flexible and stretchable electronic devices using silver nanowire networks. These technologies enable the creation of bendable, foldable, and stretchable circuits and sensors that maintain electrical performance under mechanical deformation. Applications include wearable electronics, biomedical devices, and next-generation displays that can conform to non-planar surfaces.

- Surface modification and functionalization of silver nanowires: Methods for modifying the surface properties of silver nanowires to enhance their performance and integration into various applications. These include coating with protective layers to improve stability against oxidation, functionalization with specific chemical groups to enable better dispersion or binding to other materials, and hybrid structures combining silver nanowires with other nanomaterials to create enhanced properties.

- Silver nanowire-based sensors and detection technologies: Applications of silver nanowires in sensing and detection technologies. The unique electrical, optical, and plasmonic properties of silver nanowires make them excellent candidates for highly sensitive sensors. These include pressure sensors, strain gauges, chemical sensors, biosensors, and gas detection systems that utilize changes in the electrical or optical properties of silver nanowire networks upon exposure to specific stimuli.

02 Transparent conductive films using silver nanowires

Applications of silver nanowires in creating transparent conductive films for electronic devices. These films combine high electrical conductivity with optical transparency, making them suitable for touchscreens, displays, solar cells, and flexible electronics. The technology involves deposition methods such as spray coating, roll-to-roll processing, or printing techniques to create uniform networks of silver nanowires on various substrates.Expand Specific Solutions03 Silver nanowire-based flexible and stretchable electronics

Development of flexible and stretchable electronic devices using silver nanowire networks. These technologies enable the creation of bendable, foldable, and stretchable electronic components that maintain functionality under mechanical deformation. Applications include wearable devices, flexible displays, electronic skin, and soft robotics. The technology often incorporates silver nanowires embedded in elastic polymers or arranged in specific patterns to accommodate stretching.Expand Specific Solutions04 Surface modification and functionalization of silver nanowires

Methods for modifying the surface properties of silver nanowires to enhance their performance and integration into various applications. These techniques include coating with protective layers, functionalization with specific chemical groups, and hybridization with other nanomaterials. Surface modifications can improve stability, prevent oxidation, enhance conductivity, and enable better compatibility with different matrices or substrates.Expand Specific Solutions05 Silver nanowire composites and hybrid materials

Development of composite and hybrid materials incorporating silver nanowires with other materials such as polymers, carbon nanomaterials, metal oxides, or other nanostructures. These composites combine the unique properties of silver nanowires with complementary materials to create multifunctional systems with enhanced electrical, thermal, mechanical, or optical properties for applications in sensors, energy storage, electromagnetic shielding, and thermal management.Expand Specific Solutions

Key Industry Players and Patent Holders

The silver nanowire technology market in renewable energy is currently in a growth phase, characterized by increasing adoption and expanding applications. The market size is projected to grow significantly as renewable energy sectors seek more efficient conductive materials. Technologically, silver nanowires are advancing from experimental to commercial applications, with varying degrees of maturity across companies. Leading players include C3 Nano, which has developed solution-based transparent conductive inks, Global Graphene Group focusing on nanomaterial commercialization, and established corporations like Samsung Electronics and Xerox Holdings integrating these technologies into their renewable energy solutions. Academic institutions such as Harvard, MIT, and Hong Kong University of Science & Technology are driving fundamental research, while specialized firms like OneD Material and Blue Nano are developing niche applications for energy storage and solar technologies.

GLOBAL GRAPHENE GROUP INC

Technical Solution: Global Graphene Group has developed a groundbreaking hybrid nanomaterial technology combining silver nanowires with graphene for renewable energy applications. Their patented process creates a synergistic composite where graphene sheets are strategically integrated with silver nanowire networks, resulting in exceptional electrical conductivity (>10,000 S/cm) while using significantly less silver than conventional approaches. This hybrid material exhibits remarkable mechanical flexibility, withstanding over 10,000 bending cycles without performance degradation, making it ideal for flexible solar panels and other renewable energy devices. The company's manufacturing process utilizes environmentally friendly reducing agents and stabilizers, reducing the ecological footprint of production. Their silver nanowire-graphene films demonstrate superior thermal stability compared to standard silver nanowire networks, maintaining performance at temperatures up to 200°C, which extends the operational range for solar applications in extreme environments. Additionally, the graphene component provides a protective barrier against oxidation and sulfidation, significantly enhancing the longevity of the silver nanowire network in real-world deployment scenarios.

Strengths: Reduced silver content lowers material costs while maintaining performance; graphene integration provides enhanced mechanical and environmental stability; compatible with existing roll-to-roll manufacturing processes for scalable production. Weaknesses: More complex material system requires precise process control; potential challenges in achieving uniform dispersion at industrial scales; higher initial technology implementation costs compared to traditional transparent conductors.

C3 Nano, Inc.

Technical Solution: C3 Nano has pioneered ActiveGrid™ technology, a revolutionary silver nanowire-based transparent conductive film specifically engineered for renewable energy applications. Their patented fusion welding process creates highly conductive junctions between individual silver nanowires, resulting in a robust conductive network with significantly reduced contact resistance. This proprietary technology enables the creation of transparent electrodes with sheet resistance as low as 5-10 ohms/square while maintaining over 90% transparency - critical parameters for high-efficiency solar cells. C3 Nano's formulations incorporate proprietary additives that enhance environmental stability, preventing oxidation and sulfidation that typically degrade silver nanowire performance over time. Their roll-to-roll compatible manufacturing process allows for the production of flexible, stretchable conductive films that maintain performance even after thousands of bending cycles, making them ideal for next-generation flexible photovoltaics and other renewable energy technologies.

Strengths: Industry-leading combination of transparency and conductivity; exceptional mechanical durability with bend radius capabilities below 1mm; proprietary fusion welding technology creates superior junction resistance properties. Weaknesses: Higher cost structure compared to traditional materials; requires specialized integration expertise; potential challenges with large-scale manufacturing consistency across wide web widths.

Core Patent Analysis and Technical Innovations

Silver nanowires with thin diameter and high aspect ratio and hydrothermal synthesis method for making the same

PatentInactiveUS20150266096A1

Innovation

- A hydrothermal synthesis method using high-purity water, a silver reducing agent, an organic polymer template protective compound, and a halogen ion solution to produce silver nanowires with high aspect ratios, involving steps of mixing and heating solutions to control crystal growth and increase yield.

Thin and uniform silver nanowires, method of synthesis and transparent conductive films formed from the nanowires

PatentWO2019113162A2

Innovation

- A method involving a reaction solution with polyol solvent, polyvinyl pyrrolidone, chloride or bromide salts, and a five-membered aromatic heterocyclic cation, heated to a peak temperature with a soluble silver salt added subsequently, to produce silver nanowires with an average diameter of no more than 20 nm and a standard deviation of no more than 2.5 nm, achieving high uniformity and yield.

Environmental Impact and Sustainability Assessment

The environmental impact of silver nanowire (AgNW) technologies in renewable energy applications presents a complex sustainability profile that requires thorough assessment. Life cycle analyses reveal that while AgNW production does involve resource-intensive mining and processing of silver, the environmental footprint is significantly lower than traditional indium tin oxide (ITO) manufacturing. Studies indicate that AgNW-based solar cells and energy storage systems can reduce carbon emissions by 30-45% compared to conventional alternatives when evaluated across their complete lifecycle.

Water consumption during AgNW synthesis remains a concern, with patented processes requiring between 15-20 liters per gram of nanowire produced. However, recent innovations such as the closed-loop solvent recovery systems patented by Cambrios Technologies have demonstrated water usage reductions of up to 60%, establishing new industry benchmarks for sustainable nanomaterial production.

The end-of-life management of AgNW technologies presents both challenges and opportunities. Silver's inherent value creates strong economic incentives for recycling, with recovery rates potentially reaching 95% using patented selective dissolution techniques. This circular economy approach significantly mitigates concerns regarding silver's status as a finite resource and addresses potential environmental contamination from improper disposal.

Toxicological assessments of AgNW materials show varying results depending on specific dimensions and surface treatments. Patented polymer-coated AgNWs demonstrate substantially reduced ecotoxicity compared to uncoated variants, with minimal leaching observed in standardized environmental testing protocols. Nevertheless, regulatory frameworks for nanomaterial management continue to evolve, requiring manufacturers to implement robust environmental monitoring systems.

Energy payback periods for AgNW-enhanced renewable technologies are remarkably favorable. Solar panels incorporating patented AgNW transparent conductors achieve energy payback in 0.8-1.2 years, compared to 1.5-2.5 years for conventional panels. This accelerated energy return represents a significant sustainability advantage that compounds over the operational lifetime of renewable energy installations.

The scalability of environmentally optimized AgNW production remains a critical consideration for widespread adoption. Patented continuous-flow synthesis methods have demonstrated promising results, reducing solvent usage by approximately 40% while maintaining nanowire quality. These advancements suggest that environmental performance will likely improve further as manufacturing scales increase and additional green chemistry principles are incorporated into production processes.

Water consumption during AgNW synthesis remains a concern, with patented processes requiring between 15-20 liters per gram of nanowire produced. However, recent innovations such as the closed-loop solvent recovery systems patented by Cambrios Technologies have demonstrated water usage reductions of up to 60%, establishing new industry benchmarks for sustainable nanomaterial production.

The end-of-life management of AgNW technologies presents both challenges and opportunities. Silver's inherent value creates strong economic incentives for recycling, with recovery rates potentially reaching 95% using patented selective dissolution techniques. This circular economy approach significantly mitigates concerns regarding silver's status as a finite resource and addresses potential environmental contamination from improper disposal.

Toxicological assessments of AgNW materials show varying results depending on specific dimensions and surface treatments. Patented polymer-coated AgNWs demonstrate substantially reduced ecotoxicity compared to uncoated variants, with minimal leaching observed in standardized environmental testing protocols. Nevertheless, regulatory frameworks for nanomaterial management continue to evolve, requiring manufacturers to implement robust environmental monitoring systems.

Energy payback periods for AgNW-enhanced renewable technologies are remarkably favorable. Solar panels incorporating patented AgNW transparent conductors achieve energy payback in 0.8-1.2 years, compared to 1.5-2.5 years for conventional panels. This accelerated energy return represents a significant sustainability advantage that compounds over the operational lifetime of renewable energy installations.

The scalability of environmentally optimized AgNW production remains a critical consideration for widespread adoption. Patented continuous-flow synthesis methods have demonstrated promising results, reducing solvent usage by approximately 40% while maintaining nanowire quality. These advancements suggest that environmental performance will likely improve further as manufacturing scales increase and additional green chemistry principles are incorporated into production processes.

Manufacturing Scalability and Cost Analysis

The manufacturing scalability of silver nanowire technologies represents a critical factor in their commercial viability within renewable energy applications. Current production methods primarily utilize polyol synthesis processes, which have demonstrated reasonable scalability at laboratory and pilot scales but face significant challenges in industrial-scale implementation. The transition from batch processing to continuous flow manufacturing remains a key hurdle, with several patented innovations addressing this gap through modified reactor designs and process control systems.

Cost analysis reveals that raw material expenses constitute approximately 65-70% of total production costs, with silver precursors being the dominant factor. Recent patents by leading manufacturers have focused on reducing silver content while maintaining performance characteristics through core-shell structures and alloying techniques. These innovations have demonstrated potential cost reductions of 30-40% compared to conventional silver nanowire production methods.

Equipment investment represents another significant cost component, particularly specialized reactors capable of precise temperature control and mixing parameters. Patents filed between 2018-2023 show a trend toward modular manufacturing systems that can be scaled incrementally, reducing initial capital expenditure barriers for market entrants.

Yield optimization remains a critical economic factor, with current industrial processes achieving 75-85% conversion efficiency. Patented purification and separation technologies have emerged as key differentiators among manufacturers, with membrane-based and centrifugal techniques showing particular promise for reducing waste and improving economics.

Energy consumption during manufacturing presents both an economic and sustainability challenge. Several patented innovations focus on low-temperature synthesis routes and energy recovery systems that can reduce energy requirements by up to 50% compared to conventional methods. These advancements align with the sustainability goals of the renewable energy sector.

Quality control systems represent an often-overlooked aspect of manufacturing scalability. Recent patents have introduced in-line monitoring technologies using optical and electrical characterization methods that can detect defects and variations in real-time, significantly reducing rejection rates and improving overall process economics.

The competitive landscape shows significant regional variations in manufacturing capabilities, with East Asian manufacturers demonstrating cost advantages through vertical integration and economies of scale. Western patent holders have focused more on high-precision, specialized nanowire variants that command premium pricing in specific renewable energy applications such as next-generation photovoltaics and advanced energy storage systems.

Cost analysis reveals that raw material expenses constitute approximately 65-70% of total production costs, with silver precursors being the dominant factor. Recent patents by leading manufacturers have focused on reducing silver content while maintaining performance characteristics through core-shell structures and alloying techniques. These innovations have demonstrated potential cost reductions of 30-40% compared to conventional silver nanowire production methods.

Equipment investment represents another significant cost component, particularly specialized reactors capable of precise temperature control and mixing parameters. Patents filed between 2018-2023 show a trend toward modular manufacturing systems that can be scaled incrementally, reducing initial capital expenditure barriers for market entrants.

Yield optimization remains a critical economic factor, with current industrial processes achieving 75-85% conversion efficiency. Patented purification and separation technologies have emerged as key differentiators among manufacturers, with membrane-based and centrifugal techniques showing particular promise for reducing waste and improving economics.

Energy consumption during manufacturing presents both an economic and sustainability challenge. Several patented innovations focus on low-temperature synthesis routes and energy recovery systems that can reduce energy requirements by up to 50% compared to conventional methods. These advancements align with the sustainability goals of the renewable energy sector.

Quality control systems represent an often-overlooked aspect of manufacturing scalability. Recent patents have introduced in-line monitoring technologies using optical and electrical characterization methods that can detect defects and variations in real-time, significantly reducing rejection rates and improving overall process economics.

The competitive landscape shows significant regional variations in manufacturing capabilities, with East Asian manufacturers demonstrating cost advantages through vertical integration and economies of scale. Western patent holders have focused more on high-precision, specialized nanowire variants that command premium pricing in specific renewable energy applications such as next-generation photovoltaics and advanced energy storage systems.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!