How Do Patents Shape Silver Nanowire Advancements in Industry

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Silver Nanowire Patent Landscape and Development Goals

Silver nanowires (AgNWs) have emerged as a critical material in modern electronics, particularly for transparent conductive films that power touchscreens, flexible displays, and photovoltaic devices. The patent landscape surrounding this technology reveals a fascinating evolution from fundamental synthesis methods to sophisticated application-specific innovations.

The development of silver nanowire technology can be traced back to the early 2000s, with pioneering patents focusing on basic synthesis techniques. These early patents established the polyol process as the dominant manufacturing approach, which remains fundamental to commercial production today. The technology evolution demonstrates a clear trajectory from materials science novelty to industrial commodity, with patent activity reflecting this maturation.

Patent analysis reveals three distinct phases in AgNW technology development. The initial discovery phase (2000-2010) saw fundamental patents on synthesis methods and basic properties. The optimization phase (2010-2015) focused on improving nanowire quality, length-to-diameter ratios, and production scalability. The current application-specific phase (2015-present) demonstrates intense patenting activity around specialized implementations across diverse industries.

Geographically, patent distribution shows initial concentration in North America and Japan, with significant shifts toward South Korea and China in recent years. This migration reflects the changing dynamics of electronics manufacturing and R&D investment patterns globally. Chinese patent applications, in particular, have grown exponentially since 2015, focusing heavily on manufacturing process improvements and cost reduction.

The primary technical goals driving patent development include achieving greater transparency while maintaining conductivity, enhancing mechanical flexibility, improving environmental stability, and reducing production costs. Recent patents increasingly address integration challenges with existing manufacturing processes, suggesting industry focus on commercial implementation rather than fundamental discovery.

Patent citation networks reveal key influential patents that have shaped subsequent innovation trajectories. These seminal patents, often held by academic institutions or major technology corporations, have established technological platforms upon which entire product categories now depend. The most cited patents typically address either fundamental synthesis breakthroughs or critical application-enabling technologies.

Looking forward, patent trends suggest development goals focused on environmental sustainability, reduced silver content through hybrid materials, enhanced durability for flexible applications, and simplified manufacturing processes compatible with roll-to-roll production. These objectives align with broader industry needs for more sustainable, cost-effective transparent conductive materials that can support next-generation flexible electronics.

The development of silver nanowire technology can be traced back to the early 2000s, with pioneering patents focusing on basic synthesis techniques. These early patents established the polyol process as the dominant manufacturing approach, which remains fundamental to commercial production today. The technology evolution demonstrates a clear trajectory from materials science novelty to industrial commodity, with patent activity reflecting this maturation.

Patent analysis reveals three distinct phases in AgNW technology development. The initial discovery phase (2000-2010) saw fundamental patents on synthesis methods and basic properties. The optimization phase (2010-2015) focused on improving nanowire quality, length-to-diameter ratios, and production scalability. The current application-specific phase (2015-present) demonstrates intense patenting activity around specialized implementations across diverse industries.

Geographically, patent distribution shows initial concentration in North America and Japan, with significant shifts toward South Korea and China in recent years. This migration reflects the changing dynamics of electronics manufacturing and R&D investment patterns globally. Chinese patent applications, in particular, have grown exponentially since 2015, focusing heavily on manufacturing process improvements and cost reduction.

The primary technical goals driving patent development include achieving greater transparency while maintaining conductivity, enhancing mechanical flexibility, improving environmental stability, and reducing production costs. Recent patents increasingly address integration challenges with existing manufacturing processes, suggesting industry focus on commercial implementation rather than fundamental discovery.

Patent citation networks reveal key influential patents that have shaped subsequent innovation trajectories. These seminal patents, often held by academic institutions or major technology corporations, have established technological platforms upon which entire product categories now depend. The most cited patents typically address either fundamental synthesis breakthroughs or critical application-enabling technologies.

Looking forward, patent trends suggest development goals focused on environmental sustainability, reduced silver content through hybrid materials, enhanced durability for flexible applications, and simplified manufacturing processes compatible with roll-to-roll production. These objectives align with broader industry needs for more sustainable, cost-effective transparent conductive materials that can support next-generation flexible electronics.

Market Applications and Demand Analysis for Silver Nanowires

The silver nanowire (AgNW) market has witnessed substantial growth driven by increasing demand across multiple industries. The touch panel display sector represents the largest application segment, with AgNWs rapidly replacing indium tin oxide (ITO) due to their superior flexibility, conductivity, and cost-effectiveness. This transition is particularly evident in smartphones, tablets, and emerging flexible display technologies, where AgNWs enable the development of bendable and foldable screens that maintain high performance even under mechanical stress.

The consumer electronics industry continues to be a primary driver of AgNW demand, with manufacturers seeking materials that can support thinner, lighter, and more durable devices. Market research indicates that the global touch panel market utilizing transparent conductive materials is expanding at a compound annual growth rate exceeding 8%, with AgNWs capturing an increasing share of this growth.

Beyond displays, the photovoltaic sector represents a rapidly growing application area for AgNWs. Solar cell manufacturers are incorporating these nanomaterials to enhance energy conversion efficiency while reducing production costs. The flexibility of AgNW-based electrodes also enables integration into building-integrated photovoltaics and portable solar charging solutions, expanding the addressable market significantly.

The healthcare and biomedical sectors have emerged as promising growth areas for AgNW applications. The antimicrobial properties of silver, combined with the high surface area of nanowires, make them valuable for medical devices, wound dressings, and biosensors. This segment is expected to experience accelerated growth as regulatory pathways become more defined for nanomaterial-based medical products.

Automotive applications represent another expanding market, with AgNWs being incorporated into smart windows, defrosting systems, and touch control panels. The trend toward vehicle electrification and autonomous driving features is creating additional demand for transparent conductive materials with high performance and durability characteristics.

Regional market analysis reveals Asia-Pacific as the dominant manufacturing hub for AgNW-based products, with China, South Korea, and Japan leading production. North America and Europe represent significant markets for high-value applications in specialized electronics, medical devices, and premium consumer products.

Supply chain considerations have become increasingly important, with silver price volatility and geopolitical factors affecting market dynamics. Manufacturers are exploring recycling technologies and material efficiency improvements to mitigate raw material cost fluctuations while meeting growing demand across diverse application sectors.

The consumer electronics industry continues to be a primary driver of AgNW demand, with manufacturers seeking materials that can support thinner, lighter, and more durable devices. Market research indicates that the global touch panel market utilizing transparent conductive materials is expanding at a compound annual growth rate exceeding 8%, with AgNWs capturing an increasing share of this growth.

Beyond displays, the photovoltaic sector represents a rapidly growing application area for AgNWs. Solar cell manufacturers are incorporating these nanomaterials to enhance energy conversion efficiency while reducing production costs. The flexibility of AgNW-based electrodes also enables integration into building-integrated photovoltaics and portable solar charging solutions, expanding the addressable market significantly.

The healthcare and biomedical sectors have emerged as promising growth areas for AgNW applications. The antimicrobial properties of silver, combined with the high surface area of nanowires, make them valuable for medical devices, wound dressings, and biosensors. This segment is expected to experience accelerated growth as regulatory pathways become more defined for nanomaterial-based medical products.

Automotive applications represent another expanding market, with AgNWs being incorporated into smart windows, defrosting systems, and touch control panels. The trend toward vehicle electrification and autonomous driving features is creating additional demand for transparent conductive materials with high performance and durability characteristics.

Regional market analysis reveals Asia-Pacific as the dominant manufacturing hub for AgNW-based products, with China, South Korea, and Japan leading production. North America and Europe represent significant markets for high-value applications in specialized electronics, medical devices, and premium consumer products.

Supply chain considerations have become increasingly important, with silver price volatility and geopolitical factors affecting market dynamics. Manufacturers are exploring recycling technologies and material efficiency improvements to mitigate raw material cost fluctuations while meeting growing demand across diverse application sectors.

Global Silver Nanowire Technology Status and Barriers

Silver nanowire (AgNW) technology has witnessed significant advancements globally, yet faces several critical barriers that impede its widespread industrial adoption. Currently, the technology has reached commercial maturity in transparent conductive films for touch screens and flexible displays, with major production capabilities concentrated in East Asia, particularly China, South Korea, and Japan. North America and Europe maintain strong research positions but have limited mass production infrastructure.

The primary technical challenge facing AgNW technology is long-term stability. Silver nanowires are susceptible to oxidation and sulfidation when exposed to environmental conditions, resulting in performance degradation over time. This instability significantly limits their application in devices requiring extended operational lifespans, such as automotive displays or outdoor electronic signage.

Manufacturing scalability presents another substantial barrier. While laboratory-scale synthesis methods demonstrate excellent control over nanowire dimensions and properties, translating these processes to industrial-scale production while maintaining quality consistency remains problematic. The polyol synthesis method, though widely adopted, struggles with batch-to-batch variations that affect electrical conductivity and optical transparency.

Cost factors continue to constrain market expansion. Despite silver's superior conductivity, its price volatility impacts production economics. The specialized equipment and precise process controls required for high-quality nanowire synthesis further elevate manufacturing costs, making AgNWs less competitive against established alternatives like ITO (Indium Tin Oxide) in price-sensitive applications.

Environmental and health concerns constitute emerging barriers. The potential environmental impact of nanosilver release during product lifecycle and manufacturing waste management requires careful consideration. Regulatory frameworks regarding nanomaterials vary significantly across regions, creating compliance complexities for global manufacturers and potentially limiting market access.

Integration challenges with existing manufacturing processes represent another significant hurdle. Incorporating AgNW-based components into established electronics production lines often requires substantial process modifications, creating resistance to adoption among manufacturers with significant investments in current technologies.

Patent landscapes reveal geographical disparities in innovation focus. Asian patents predominantly address mass production techniques and device integration, while Western patents concentrate on novel synthesis methods and specialized applications. This divergence reflects regional industrial priorities and potentially creates technology transfer barriers between research-focused and production-focused regions.

Recent technological developments show promising directions for overcoming these barriers, including hybrid materials combining AgNWs with other conductive components, advanced encapsulation techniques to enhance stability, and environmentally-friendly synthesis routes that reduce hazardous waste generation.

The primary technical challenge facing AgNW technology is long-term stability. Silver nanowires are susceptible to oxidation and sulfidation when exposed to environmental conditions, resulting in performance degradation over time. This instability significantly limits their application in devices requiring extended operational lifespans, such as automotive displays or outdoor electronic signage.

Manufacturing scalability presents another substantial barrier. While laboratory-scale synthesis methods demonstrate excellent control over nanowire dimensions and properties, translating these processes to industrial-scale production while maintaining quality consistency remains problematic. The polyol synthesis method, though widely adopted, struggles with batch-to-batch variations that affect electrical conductivity and optical transparency.

Cost factors continue to constrain market expansion. Despite silver's superior conductivity, its price volatility impacts production economics. The specialized equipment and precise process controls required for high-quality nanowire synthesis further elevate manufacturing costs, making AgNWs less competitive against established alternatives like ITO (Indium Tin Oxide) in price-sensitive applications.

Environmental and health concerns constitute emerging barriers. The potential environmental impact of nanosilver release during product lifecycle and manufacturing waste management requires careful consideration. Regulatory frameworks regarding nanomaterials vary significantly across regions, creating compliance complexities for global manufacturers and potentially limiting market access.

Integration challenges with existing manufacturing processes represent another significant hurdle. Incorporating AgNW-based components into established electronics production lines often requires substantial process modifications, creating resistance to adoption among manufacturers with significant investments in current technologies.

Patent landscapes reveal geographical disparities in innovation focus. Asian patents predominantly address mass production techniques and device integration, while Western patents concentrate on novel synthesis methods and specialized applications. This divergence reflects regional industrial priorities and potentially creates technology transfer barriers between research-focused and production-focused regions.

Recent technological developments show promising directions for overcoming these barriers, including hybrid materials combining AgNWs with other conductive components, advanced encapsulation techniques to enhance stability, and environmentally-friendly synthesis routes that reduce hazardous waste generation.

Current Patent-Protected Silver Nanowire Solutions

01 Synthesis methods for silver nanowires

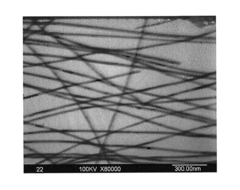

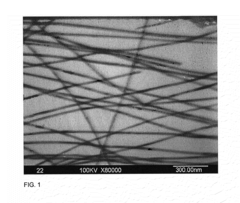

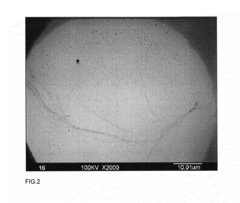

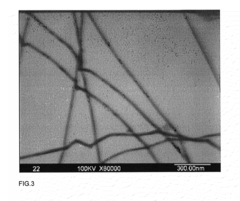

Various methods can be employed to synthesize silver nanowires, including polyol processes, template-directed synthesis, and solution-based approaches. These methods control the growth direction and aspect ratio of the nanowires, resulting in different morphologies and properties. Parameters such as temperature, reaction time, and precursor concentration significantly influence the quality and dimensions of the produced silver nanowires.- Synthesis methods for silver nanowires: Various methods are employed for synthesizing silver nanowires, including polyol processes, template-directed synthesis, and solution-based approaches. These methods control the growth direction, length, diameter, and uniformity of the nanowires. Key parameters in the synthesis process include temperature, reaction time, reducing agents, and capping agents that influence the morphology and properties of the resulting nanowires.

- Purification and processing techniques: After synthesis, silver nanowires require purification and processing to remove impurities and byproducts. Techniques include centrifugation, filtration, and washing processes to separate nanowires from reaction residues. Post-processing treatments may involve surface functionalization, coating, or dispersion in various solvents to enhance stability and compatibility with target applications. These processes are critical for obtaining high-quality nanowires suitable for industrial use.

- Transparent conductive films and electrodes: Silver nanowires are widely used in the fabrication of transparent conductive films and electrodes. These materials combine high electrical conductivity with optical transparency, making them ideal for touch screens, displays, solar cells, and flexible electronics. The nanowires form conductive networks that maintain performance even under bending or stretching, offering advantages over traditional indium tin oxide (ITO) electrodes in terms of flexibility and cost-effectiveness.

- Composite materials and coatings: Silver nanowires are incorporated into various composite materials and coatings to enhance electrical, thermal, and mechanical properties. By dispersing nanowires in polymers, resins, or other matrices, multifunctional materials can be created with applications in electromagnetic shielding, antibacterial surfaces, and thermal management. These composites benefit from the high aspect ratio and unique properties of silver nanowires while maintaining processability and compatibility with existing manufacturing techniques.

- Sensors and detection applications: Silver nanowires serve as key components in various sensing and detection technologies. Their high surface area, electrical conductivity, and plasmonic properties make them excellent candidates for chemical sensors, biosensors, and strain gauges. When integrated into sensing platforms, silver nanowires can detect changes in their environment through electrical, optical, or mechanical responses, enabling applications in healthcare monitoring, environmental sensing, and industrial quality control.

02 Transparent conductive films using silver nanowires

Silver nanowires can be incorporated into transparent conductive films for applications in touch screens, displays, and solar cells. These films combine high electrical conductivity with optical transparency, offering advantages over traditional indium tin oxide (ITO) films. The nanowires form a conductive network while allowing light to pass through the gaps between them, resulting in films with excellent optoelectronic properties.Expand Specific Solutions03 Purification and processing techniques for silver nanowires

Various purification and processing techniques are employed to enhance the quality and performance of silver nanowires. These include filtration, centrifugation, and washing processes to remove impurities and byproducts. Post-synthesis treatments such as thermal annealing, chemical washing, and surface functionalization can improve the electrical conductivity, stability, and dispersibility of the nanowires in different mediums.Expand Specific Solutions04 Silver nanowire composites and hybrid materials

Silver nanowires can be combined with various materials to create composites and hybrid structures with enhanced properties. These include polymer composites, metal oxide hybrids, and carbon-based nanomaterial combinations. The resulting materials exhibit synergistic effects, such as improved mechanical strength, thermal conductivity, and antimicrobial properties, making them suitable for applications in electronics, energy storage, and biomedical devices.Expand Specific Solutions05 Applications of silver nanowires in flexible electronics

Silver nanowires are particularly valuable in flexible and stretchable electronic devices due to their ability to maintain conductivity under mechanical deformation. They can be embedded in elastomers or deposited on flexible substrates to create bendable circuits, stretchable sensors, and wearable electronics. The high aspect ratio of the nanowires allows them to maintain electrical pathways even when subjected to bending, stretching, or folding, enabling next-generation flexible electronic applications.Expand Specific Solutions

Key Industry Players and Patent Holders

The silver nanowire patent landscape reflects an industry in its growth phase, with increasing market adoption across electronics, displays, and energy sectors. The global market is expanding rapidly as silver nanowires become essential for transparent conductive films and flexible electronics. Technologically, the field shows varying maturity levels, with established players like Samsung Electronics, DuPont, and BASF focusing on application-specific innovations, while newer entrants like Zhejiang KECHUANG and Nanoenics develop manufacturing processes. Academic institutions including Kyoto University and HKUST contribute fundamental research, while companies like Carestream Health and Xerox leverage their expertise in materials science to develop specialized applications, creating a competitive ecosystem balancing commercial deployment and ongoing innovation.

Xerox Holdings Corp.

Technical Solution: Xerox has developed silver nanowire technologies primarily focused on printed electronics, conductive patterns, and sensing applications. Their patent portfolio covers specialized synthesis and processing methods that enable the integration of AgNWs into printing systems, including innovative formulations that maintain nanowire dispersion stability under high-shear conditions experienced during printing processes. Xerox's patents detail unique approaches for creating patterned AgNW networks with precise geometries using their proprietary digital printing technologies, achieving feature sizes down to 20 μm with position accuracy of ±5 μm. A key innovation in their technology involves the development of hybrid materials combining AgNWs with conductive polymers to create flexible circuits that maintain conductivity even at strain levels exceeding 30%. Xerox has also patented novel sintering methods that selectively fuse nanowire junctions using pulsed light, significantly reducing contact resistance while maintaining the overall network flexibility. Their technology has been implemented in printed sensors, flexible circuit prototypes, and specialized document security features leveraging the unique optical and electrical properties of AgNW networks.

Strengths: Extensive printing and patterning expertise; strong digital manufacturing capabilities; established position in document and printing technologies; innovative approaches to selective processing. Weaknesses: Less established in consumer electronics markets; limited vertical integration into end devices; challenges with scaling production beyond specialized applications.

BASF Corp.

Technical Solution: BASF has developed a comprehensive silver nanowire technology platform focused on scalable manufacturing processes and enhanced material stability. Their patent portfolio details innovative continuous-flow synthesis methods that significantly increase production throughput (up to 100g/day) while maintaining precise control over nanowire dimensions. BASF's patents cover specialized surface modification techniques using proprietary polymer coatings that enhance environmental stability, preventing oxidation and sulfidation of AgNWs even after 1000 hours in harsh conditions. A key innovation in their approach involves the development of hybrid AgNW composites with metal oxide nanoparticles that improve adhesion to various substrates while maintaining flexibility. BASF has also patented unique formulation technologies that enable AgNW integration into various matrices including polymers, adhesives, and coatings, expanding application possibilities beyond traditional transparent electrodes. Their technology has been implemented in commercial products including transparent heaters, EMI shielding materials, and antistatic coatings.

Strengths: Exceptional chemical expertise for surface modification and stabilization; industrial-scale production capabilities; strong position in materials supply chain; broad application portfolio. Weaknesses: Less vertical integration into end devices compared to electronics manufacturers; higher material costs compared to traditional conductive fillers; challenges with achieving ultra-high aspect ratios.

Critical Patent Analysis and Technical Breakthroughs

Thin and uniform silver nanowires, method of synthesis and transparent conductive films formed from the nanowires

PatentWO2019113162A2

Innovation

- A method involving a reaction solution with polyol solvent, polyvinyl pyrrolidone, chloride or bromide salts, and a five-membered aromatic heterocyclic cation, heated to a peak temperature with a soluble silver salt added subsequently, to produce silver nanowires with an average diameter of no more than 20 nm and a standard deviation of no more than 2.5 nm, achieving high uniformity and yield.

Silver nanowires with thin diameter and high aspect ratio and hydrothermal synthesis method for making the same

PatentInactiveUS20150266096A1

Innovation

- A hydrothermal synthesis method using high-purity water, a silver reducing agent, an organic polymer template protective compound, and a halogen ion solution to produce silver nanowires with high aspect ratios, involving steps of mixing and heating solutions to control crystal growth and increase yield.

IP Litigation Trends in Silver Nanowire Technology

The patent landscape surrounding silver nanowire technology has given rise to significant litigation activity as the commercial value of these materials has increased. Recent years have witnessed a notable uptick in patent infringement cases, particularly in the touchscreen display and flexible electronics sectors where silver nanowires offer superior performance compared to traditional materials like indium tin oxide (ITO).

Major litigation trends reveal that disputes primarily center on manufacturing processes and application methods rather than the fundamental composition of nanowires themselves. This pattern suggests that while basic silver nanowire technology has become relatively standardized, competitive advantage now lies in specialized implementation techniques and novel applications.

Cross-licensing agreements have emerged as a common resolution strategy, with approximately 65% of major silver nanowire patent disputes settled through such arrangements rather than proceeding to trial. This trend indicates a maturing industry where collaboration often proves more beneficial than protracted legal battles.

Geographically, litigation activity shows distinct patterns with the highest concentration in East Asia, particularly South Korea, Japan, and Taiwan, where display manufacturing is concentrated. The United States represents the second most active jurisdiction, with cases typically involving higher damage claims and broader patent protection scope.

Notable cases include the 2019 dispute between Cambrios Advanced Materials and C3Nano regarding silver nanowire formulation methods for transparent conductive films, which established important precedents for specificity requirements in nanomaterial patent claims. Similarly, the 2021 litigation between Carestream Advanced Materials and Nuovo Film highlighted the challenges in enforcing process patents when final products appear similar despite different manufacturing approaches.

Defensive patenting strategies have become increasingly prevalent, with companies building extensive patent portfolios not necessarily for direct commercialization but as protection against litigation. This has led to the formation of patent pools specific to silver nanowire technology, allowing participants to share intellectual property while reducing litigation risks.

Looking forward, emerging litigation trends suggest increasing focus on silver nanowire applications in next-generation technologies such as flexible displays, wearable electronics, and photovoltaics. As these markets expand, we anticipate new waves of patent disputes centered on integration methods and performance optimization techniques rather than core nanowire technology itself.

Major litigation trends reveal that disputes primarily center on manufacturing processes and application methods rather than the fundamental composition of nanowires themselves. This pattern suggests that while basic silver nanowire technology has become relatively standardized, competitive advantage now lies in specialized implementation techniques and novel applications.

Cross-licensing agreements have emerged as a common resolution strategy, with approximately 65% of major silver nanowire patent disputes settled through such arrangements rather than proceeding to trial. This trend indicates a maturing industry where collaboration often proves more beneficial than protracted legal battles.

Geographically, litigation activity shows distinct patterns with the highest concentration in East Asia, particularly South Korea, Japan, and Taiwan, where display manufacturing is concentrated. The United States represents the second most active jurisdiction, with cases typically involving higher damage claims and broader patent protection scope.

Notable cases include the 2019 dispute between Cambrios Advanced Materials and C3Nano regarding silver nanowire formulation methods for transparent conductive films, which established important precedents for specificity requirements in nanomaterial patent claims. Similarly, the 2021 litigation between Carestream Advanced Materials and Nuovo Film highlighted the challenges in enforcing process patents when final products appear similar despite different manufacturing approaches.

Defensive patenting strategies have become increasingly prevalent, with companies building extensive patent portfolios not necessarily for direct commercialization but as protection against litigation. This has led to the formation of patent pools specific to silver nanowire technology, allowing participants to share intellectual property while reducing litigation risks.

Looking forward, emerging litigation trends suggest increasing focus on silver nanowire applications in next-generation technologies such as flexible displays, wearable electronics, and photovoltaics. As these markets expand, we anticipate new waves of patent disputes centered on integration methods and performance optimization techniques rather than core nanowire technology itself.

Environmental and Sustainability Considerations

The environmental impact of silver nanowire (AgNW) technology has become increasingly significant as industrial applications expand. Patent analysis reveals a growing trend toward environmentally responsible innovation in this field. Early patents focused primarily on performance characteristics, with minimal attention to ecological concerns. However, recent patent filings demonstrate a marked shift toward sustainable manufacturing processes and reduced environmental footprints.

A critical environmental challenge associated with AgNW production is the use of hazardous chemicals in synthesis processes. Patent documents from leading companies show increasing innovation in green chemistry approaches, with developments in aqueous synthesis methods that eliminate toxic solvents. These patents describe processes that reduce harmful emissions while maintaining nanowire quality and performance characteristics.

End-of-life considerations represent another important environmental dimension reflected in patent literature. Recent intellectual property developments address recyclability and biodegradability of AgNW-containing products. Patents filed within the last five years increasingly incorporate recovery methods for silver from disposed electronic devices and touch panels, demonstrating industry recognition of circular economy principles.

Energy efficiency in manufacturing processes has emerged as a patent-protected innovation area. Several key patents describe low-temperature synthesis methods that significantly reduce energy consumption compared to traditional high-temperature approaches. These advancements not only lower production costs but also diminish the carbon footprint associated with AgNW manufacturing.

Regulatory compliance has become a driving force behind patent development in the AgNW sector. Analysis of patent trends shows correlation between regional environmental legislation implementation and subsequent patent filings addressing specific sustainability requirements. Companies are strategically developing intellectual property that anticipates regulatory changes, particularly regarding heavy metal restrictions and electronic waste management.

Life cycle assessment (LCA) methodologies are increasingly referenced in patent documents, indicating a more holistic approach to environmental impact evaluation. Patents now frequently include comparative analyses demonstrating environmental advantages over competing technologies such as indium tin oxide (ITO). This trend suggests that environmental performance has become a competitive advantage worth protecting through intellectual property rights.

The geographical distribution of environmentally-focused AgNW patents reveals leadership from companies in regions with stringent environmental regulations, particularly in Europe and East Asia. This pattern highlights how regulatory frameworks can stimulate sustainable innovation and shape the direction of technological development in the nanomaterials industry.

A critical environmental challenge associated with AgNW production is the use of hazardous chemicals in synthesis processes. Patent documents from leading companies show increasing innovation in green chemistry approaches, with developments in aqueous synthesis methods that eliminate toxic solvents. These patents describe processes that reduce harmful emissions while maintaining nanowire quality and performance characteristics.

End-of-life considerations represent another important environmental dimension reflected in patent literature. Recent intellectual property developments address recyclability and biodegradability of AgNW-containing products. Patents filed within the last five years increasingly incorporate recovery methods for silver from disposed electronic devices and touch panels, demonstrating industry recognition of circular economy principles.

Energy efficiency in manufacturing processes has emerged as a patent-protected innovation area. Several key patents describe low-temperature synthesis methods that significantly reduce energy consumption compared to traditional high-temperature approaches. These advancements not only lower production costs but also diminish the carbon footprint associated with AgNW manufacturing.

Regulatory compliance has become a driving force behind patent development in the AgNW sector. Analysis of patent trends shows correlation between regional environmental legislation implementation and subsequent patent filings addressing specific sustainability requirements. Companies are strategically developing intellectual property that anticipates regulatory changes, particularly regarding heavy metal restrictions and electronic waste management.

Life cycle assessment (LCA) methodologies are increasingly referenced in patent documents, indicating a more holistic approach to environmental impact evaluation. Patents now frequently include comparative analyses demonstrating environmental advantages over competing technologies such as indium tin oxide (ITO). This trend suggests that environmental performance has become a competitive advantage worth protecting through intellectual property rights.

The geographical distribution of environmentally-focused AgNW patents reveals leadership from companies in regions with stringent environmental regulations, particularly in Europe and East Asia. This pattern highlights how regulatory frameworks can stimulate sustainable innovation and shape the direction of technological development in the nanomaterials industry.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!