Advances in Titanium Alloy vs Stainless Steel for Pharmaceutical Applications

OCT 24, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Titanium vs Steel Pharmaceutical Applications Background

The pharmaceutical industry has witnessed significant evolution in materials science over the past decades, particularly in the selection of metals for equipment manufacturing. Historically, stainless steel has been the dominant material of choice due to its cost-effectiveness, availability, and well-established manufacturing processes. The 316L grade, specifically developed for pharmaceutical applications, has served as the industry standard since the mid-20th century, offering reasonable corrosion resistance and mechanical properties.

Titanium alloys, particularly Ti-6Al-4V (Grade 5) and commercially pure titanium (Grade 2), emerged as alternative materials in pharmaceutical manufacturing during the 1970s, initially in specialized applications where stainless steel showed limitations. The adoption of titanium alloys has accelerated in recent years due to advancements in manufacturing technologies that have gradually reduced production costs and improved fabrication techniques.

The pharmaceutical manufacturing environment presents unique challenges that influence material selection. These include exposure to highly corrosive cleaning agents, sterilization processes involving steam and aggressive chemicals, requirements for absolute cleanliness, and increasingly stringent regulatory standards. The industry's shift toward higher potency active pharmaceutical ingredients (APIs) has further intensified the demands placed on manufacturing equipment materials.

Global regulatory frameworks, including FDA guidelines and EU GMP regulations, have evolved to place greater emphasis on material selection as a critical aspect of pharmaceutical quality systems. These regulations increasingly recognize the importance of material properties in preventing contamination, ensuring product purity, and maintaining manufacturing consistency across global supply chains.

Recent technological developments have expanded the application scope for both materials. Innovations in surface treatment technologies, such as electropolishing for stainless steel and anodizing for titanium, have enhanced their performance characteristics. Additionally, advancements in welding techniques, particularly orbital welding and laser welding, have improved the integrity of both materials in pharmaceutical equipment fabrication.

The economic considerations surrounding material selection have shifted significantly. While titanium continues to command a premium price compared to stainless steel, the total lifecycle cost analysis increasingly favors titanium in certain applications due to its superior longevity, reduced maintenance requirements, and lower risk of product contamination. This economic rebalancing has prompted pharmaceutical manufacturers to reassess traditional material selection paradigms.

Industry trends indicate a growing bifurcation in material selection strategies, with stainless steel maintaining dominance in large-volume, lower-risk applications, while titanium gains traction in high-value, contamination-sensitive processes. This evolution reflects the pharmaceutical industry's broader movement toward risk-based approaches to manufacturing decisions.

Titanium alloys, particularly Ti-6Al-4V (Grade 5) and commercially pure titanium (Grade 2), emerged as alternative materials in pharmaceutical manufacturing during the 1970s, initially in specialized applications where stainless steel showed limitations. The adoption of titanium alloys has accelerated in recent years due to advancements in manufacturing technologies that have gradually reduced production costs and improved fabrication techniques.

The pharmaceutical manufacturing environment presents unique challenges that influence material selection. These include exposure to highly corrosive cleaning agents, sterilization processes involving steam and aggressive chemicals, requirements for absolute cleanliness, and increasingly stringent regulatory standards. The industry's shift toward higher potency active pharmaceutical ingredients (APIs) has further intensified the demands placed on manufacturing equipment materials.

Global regulatory frameworks, including FDA guidelines and EU GMP regulations, have evolved to place greater emphasis on material selection as a critical aspect of pharmaceutical quality systems. These regulations increasingly recognize the importance of material properties in preventing contamination, ensuring product purity, and maintaining manufacturing consistency across global supply chains.

Recent technological developments have expanded the application scope for both materials. Innovations in surface treatment technologies, such as electropolishing for stainless steel and anodizing for titanium, have enhanced their performance characteristics. Additionally, advancements in welding techniques, particularly orbital welding and laser welding, have improved the integrity of both materials in pharmaceutical equipment fabrication.

The economic considerations surrounding material selection have shifted significantly. While titanium continues to command a premium price compared to stainless steel, the total lifecycle cost analysis increasingly favors titanium in certain applications due to its superior longevity, reduced maintenance requirements, and lower risk of product contamination. This economic rebalancing has prompted pharmaceutical manufacturers to reassess traditional material selection paradigms.

Industry trends indicate a growing bifurcation in material selection strategies, with stainless steel maintaining dominance in large-volume, lower-risk applications, while titanium gains traction in high-value, contamination-sensitive processes. This evolution reflects the pharmaceutical industry's broader movement toward risk-based approaches to manufacturing decisions.

Market Demand Analysis for Pharmaceutical Material Solutions

The pharmaceutical industry is experiencing a significant shift in material preferences for manufacturing equipment, with titanium alloys increasingly challenging the traditional dominance of stainless steel. Current market analysis indicates that the global pharmaceutical equipment market, valued at approximately $110 billion in 2022, is projected to grow at a CAGR of 7.2% through 2030, with material selection becoming a critical differentiator for manufacturers.

Demand for advanced materials in pharmaceutical applications is primarily driven by stringent regulatory requirements, particularly from FDA and EMA, which mandate higher purity standards and reduced contamination risks in drug manufacturing processes. This regulatory pressure has intensified the search for materials offering superior corrosion resistance and biocompatibility, areas where titanium alloys demonstrate clear advantages over conventional stainless steel.

Market research reveals that approximately 65% of pharmaceutical manufacturers are actively exploring alternative materials to traditional 316L stainless steel, with titanium alloys being the primary focus due to their exceptional chemical resistance properties. The biopharmaceutical segment, growing at 9.5% annually, shows particularly strong demand for titanium components in critical applications where product purity is paramount.

Cost sensitivity remains a significant market factor, with titanium solutions typically commanding a 40-60% price premium over stainless steel alternatives. However, lifecycle cost analysis demonstrates that this initial investment can be offset by reduced maintenance requirements, longer service life, and decreased risk of product contamination. Survey data indicates that 72% of pharmaceutical operations managers consider total cost of ownership rather than initial acquisition cost when evaluating material options.

Regional market analysis shows varying adoption rates, with North American and European manufacturers leading titanium implementation at 28% and 23% market penetration respectively, while Asia-Pacific markets remain more price-sensitive with only 14% adoption despite rapid growth in pharmaceutical manufacturing capacity.

The injectable medications and biologics segments demonstrate the highest demand for titanium solutions, with market penetration reaching 37% in these applications due to extreme sensitivity to metallic contamination. Conversely, solid oral dose manufacturing continues to favor stainless steel solutions, with titanium penetration limited to 12% of new equipment installations.

Industry forecasts suggest that the market for titanium pharmaceutical equipment will grow at 11.3% annually through 2028, significantly outpacing the broader pharmaceutical equipment market, as manufacturers increasingly recognize the performance advantages and regulatory benefits of titanium alloys despite their higher initial cost.

Demand for advanced materials in pharmaceutical applications is primarily driven by stringent regulatory requirements, particularly from FDA and EMA, which mandate higher purity standards and reduced contamination risks in drug manufacturing processes. This regulatory pressure has intensified the search for materials offering superior corrosion resistance and biocompatibility, areas where titanium alloys demonstrate clear advantages over conventional stainless steel.

Market research reveals that approximately 65% of pharmaceutical manufacturers are actively exploring alternative materials to traditional 316L stainless steel, with titanium alloys being the primary focus due to their exceptional chemical resistance properties. The biopharmaceutical segment, growing at 9.5% annually, shows particularly strong demand for titanium components in critical applications where product purity is paramount.

Cost sensitivity remains a significant market factor, with titanium solutions typically commanding a 40-60% price premium over stainless steel alternatives. However, lifecycle cost analysis demonstrates that this initial investment can be offset by reduced maintenance requirements, longer service life, and decreased risk of product contamination. Survey data indicates that 72% of pharmaceutical operations managers consider total cost of ownership rather than initial acquisition cost when evaluating material options.

Regional market analysis shows varying adoption rates, with North American and European manufacturers leading titanium implementation at 28% and 23% market penetration respectively, while Asia-Pacific markets remain more price-sensitive with only 14% adoption despite rapid growth in pharmaceutical manufacturing capacity.

The injectable medications and biologics segments demonstrate the highest demand for titanium solutions, with market penetration reaching 37% in these applications due to extreme sensitivity to metallic contamination. Conversely, solid oral dose manufacturing continues to favor stainless steel solutions, with titanium penetration limited to 12% of new equipment installations.

Industry forecasts suggest that the market for titanium pharmaceutical equipment will grow at 11.3% annually through 2028, significantly outpacing the broader pharmaceutical equipment market, as manufacturers increasingly recognize the performance advantages and regulatory benefits of titanium alloys despite their higher initial cost.

Current State and Challenges in Pharmaceutical Alloy Technology

The global pharmaceutical manufacturing landscape has witnessed significant evolution in materials technology, with titanium alloys and stainless steel remaining the predominant materials for critical equipment and components. Currently, 316L stainless steel dominates approximately 75% of pharmaceutical equipment manufacturing due to its established regulatory acceptance, cost-effectiveness, and well-documented performance characteristics. However, titanium alloys, particularly Ti-6Al-4V and commercially pure titanium grades, have gained traction in specialized applications, capturing roughly 15% market share in high-corrosion environments.

The pharmaceutical industry faces stringent regulatory requirements from agencies including FDA, EMA, and NMPA, which significantly influence material selection decisions. These regulations emphasize material traceability, consistency, and compatibility with pharmaceutical compounds. Current compliance frameworks favor stainless steel due to its extensive validation history, creating a significant barrier for wider titanium adoption despite its superior technical properties.

From a technical perspective, both materials present distinct advantages and limitations. Stainless steel offers excellent formability, weldability, and cost efficiency but demonstrates vulnerability to pitting corrosion in chloride-rich environments and potential metal ion leaching during aggressive cleaning procedures. Titanium alloys provide superior corrosion resistance across a broader pH spectrum and significantly higher strength-to-weight ratios but face challenges in manufacturing complexity, higher initial costs, and limited industry familiarity.

Recent advancements in surface modification technologies have emerged as potential solutions to existing limitations. Electropolishing techniques have improved the performance of stainless steel surfaces, while plasma electrolytic oxidation treatments have enhanced titanium's already excellent biocompatibility and corrosion resistance. However, these treatments add complexity and cost to manufacturing processes.

A significant challenge facing the industry is the lack of standardized testing protocols specifically designed for pharmaceutical applications. Current material evaluation methods often derive from broader industrial standards that may not adequately address pharmaceutical-specific concerns such as protein adsorption, extractables and leachables profiles, or compatibility with increasingly complex biological pharmaceuticals.

The geographical distribution of technological expertise presents another challenge, with advanced titanium processing capabilities concentrated primarily in North America, Western Europe, and Japan, while pharmaceutical manufacturing increasingly shifts toward emerging markets. This misalignment creates knowledge transfer barriers and complicates supply chain management for global pharmaceutical manufacturers considering material transitions.

The pharmaceutical industry faces stringent regulatory requirements from agencies including FDA, EMA, and NMPA, which significantly influence material selection decisions. These regulations emphasize material traceability, consistency, and compatibility with pharmaceutical compounds. Current compliance frameworks favor stainless steel due to its extensive validation history, creating a significant barrier for wider titanium adoption despite its superior technical properties.

From a technical perspective, both materials present distinct advantages and limitations. Stainless steel offers excellent formability, weldability, and cost efficiency but demonstrates vulnerability to pitting corrosion in chloride-rich environments and potential metal ion leaching during aggressive cleaning procedures. Titanium alloys provide superior corrosion resistance across a broader pH spectrum and significantly higher strength-to-weight ratios but face challenges in manufacturing complexity, higher initial costs, and limited industry familiarity.

Recent advancements in surface modification technologies have emerged as potential solutions to existing limitations. Electropolishing techniques have improved the performance of stainless steel surfaces, while plasma electrolytic oxidation treatments have enhanced titanium's already excellent biocompatibility and corrosion resistance. However, these treatments add complexity and cost to manufacturing processes.

A significant challenge facing the industry is the lack of standardized testing protocols specifically designed for pharmaceutical applications. Current material evaluation methods often derive from broader industrial standards that may not adequately address pharmaceutical-specific concerns such as protein adsorption, extractables and leachables profiles, or compatibility with increasingly complex biological pharmaceuticals.

The geographical distribution of technological expertise presents another challenge, with advanced titanium processing capabilities concentrated primarily in North America, Western Europe, and Japan, while pharmaceutical manufacturing increasingly shifts toward emerging markets. This misalignment creates knowledge transfer barriers and complicates supply chain management for global pharmaceutical manufacturers considering material transitions.

Current Technical Solutions for Pharmaceutical Material Requirements

01 Joining methods for titanium alloy and stainless steel

Various joining techniques can be employed to connect titanium alloy and stainless steel components, overcoming the challenges of their dissimilar metallurgical properties. These methods include diffusion bonding, friction welding, explosive welding, and the use of intermediate transition layers. These techniques help prevent the formation of brittle intermetallic compounds at the joint interface, ensuring strong and durable connections between these dissimilar metals.- Joining methods for titanium alloy and stainless steel: Various techniques are employed to join titanium alloy and stainless steel components, including diffusion bonding, friction welding, and explosive welding. These methods overcome the challenges of joining dissimilar metals with different thermal expansion coefficients and mechanical properties. Intermediate layers or transition materials are often used to improve bonding strength and prevent the formation of brittle intermetallic compounds at the interface.

- Composite structures combining titanium alloy and stainless steel: Composite structures that integrate titanium alloy and stainless steel leverage the advantageous properties of both materials. These structures are designed to optimize weight, strength, corrosion resistance, and cost-effectiveness. Applications include aerospace components, medical implants, and industrial equipment where specific performance requirements necessitate the strategic placement of each material within the composite structure.

- Surface treatments and coatings for titanium-stainless steel interfaces: Surface treatments and specialized coatings are applied to titanium alloy and stainless steel interfaces to enhance compatibility, prevent galvanic corrosion, and improve bonding. These treatments include nitriding, carburizing, PVD/CVD coatings, and the application of intermediate layers. Such modifications create more favorable conditions for joining these dissimilar metals while maintaining their individual performance characteristics.

- Corrosion resistance improvements in titanium-stainless steel systems: Methods to enhance corrosion resistance in systems combining titanium alloy and stainless steel focus on preventing galvanic corrosion that naturally occurs when these dissimilar metals are in contact. Techniques include the use of insulating materials between the metals, application of protective coatings, cathodic protection systems, and development of specialized transition joints. These approaches extend the service life of components in corrosive environments.

- Manufacturing processes for titanium-stainless steel components: Specialized manufacturing processes have been developed for producing components that incorporate both titanium alloy and stainless steel. These include advanced casting techniques, powder metallurgy, additive manufacturing, and precision machining methods. The processes are designed to address the challenges of working with these dissimilar metals, such as different melting points, thermal expansion rates, and machining characteristics, while maintaining dimensional accuracy and structural integrity.

02 Composite structures combining titanium alloy and stainless steel

Composite structures that integrate titanium alloy and stainless steel can leverage the beneficial properties of both materials. These composites often feature layered or clad configurations where each material is strategically positioned to maximize performance. Applications include aerospace components, medical implants, and industrial equipment where weight reduction, corrosion resistance, and mechanical strength are simultaneously required.Expand Specific Solutions03 Surface treatments and coatings for titanium-stainless steel interfaces

Surface treatments and specialized coatings can enhance the compatibility between titanium alloys and stainless steel. These treatments include nitriding, carburizing, and the application of protective layers that prevent galvanic corrosion when these dissimilar metals are in contact. Advanced coating technologies can also improve wear resistance and extend the service life of components made from these materials.Expand Specific Solutions04 Manufacturing processes for titanium-stainless steel components

Specialized manufacturing processes have been developed for producing components that incorporate both titanium alloy and stainless steel. These processes include powder metallurgy, additive manufacturing, and advanced forming techniques that allow for the creation of complex geometries while maintaining the integrity of both materials. Process parameters must be carefully controlled to account for the different thermal and mechanical properties of these metals.Expand Specific Solutions05 Corrosion prevention in titanium-stainless steel systems

When titanium alloys and stainless steel are used together, special consideration must be given to preventing galvanic corrosion. Techniques include the use of insulating materials between the metals, application of sacrificial anodes, and environmental control measures. Proper design considerations, such as minimizing the cathode-to-anode area ratio and selecting compatible alloy grades, can significantly reduce corrosion risks in mixed-metal systems.Expand Specific Solutions

Key Industry Players in Pharmaceutical-Grade Alloy Production

The titanium alloy versus stainless steel market for pharmaceutical applications is in a growth phase, with increasing demand driven by titanium's superior biocompatibility and corrosion resistance. The global market is expanding at approximately 5-7% annually, reaching an estimated $3.5 billion. Technologically, the field shows varied maturity levels, with companies like Mirus LLC pioneering rhenium-based medical alloys inspired by NASA technology, while established players such as NIPPON STEEL, W.C. Heraeus, and Titanium Metals Corp maintain strong market positions. Academic institutions including the Institute of Metal Research Chinese Academy of Sciences and South China University of Technology are advancing fundamental research, while DuPont and W.L. Gore contribute specialized coatings and surface treatments, creating a competitive landscape balanced between innovation and established manufacturing expertise.

ATI Properties LLC

Technical Solution: ATI Properties has pioneered advanced titanium alloys specifically engineered for pharmaceutical applications through their ATI 425® Alloy technology. This proprietary alloy combines the corrosion resistance of commercially pure titanium with enhanced mechanical properties through careful microstructure control. For pharmaceutical equipment, ATI has developed specialized cold-working and heat treatment processes that create an exceptionally smooth surface finish (Ra values as low as 0.1μm) while maintaining excellent cleanability characteristics. Their titanium solutions demonstrate superior resistance to sanitizing agents including hydrogen peroxide, peracetic acid, and sodium hydroxide that typically degrade stainless steel over time. ATI's pharmaceutical-grade titanium exhibits no detectable metal leaching in acidic media tests (pH 2-5) after extended exposure periods, whereas comparable tests with 316L stainless steel showed measurable nickel and chromium release. The company has also developed specialized joining technologies that maintain the corrosion-resistant properties at weld zones, addressing a traditional weakness in titanium fabrication.

Strengths: Exceptional resistance to cleaning and sterilization chemicals; superior cleanability with lower risk of product contamination; excellent mechanical properties at reduced weight; virtually zero metal ion leaching in pharmaceutical preparations. Weaknesses: Higher initial investment costs; specialized fabrication expertise required; more complex validation processes for regulatory approval; limited historical performance data compared to established stainless steel applications.

Sandvik Intellectual Property AB

Technical Solution: Sandvik has developed cutting-edge materials for pharmaceutical applications through their Sandvik SAF™ (Super Austenitic Ferritic) stainless steel technology and specialized titanium processing capabilities. Their pharmaceutical-focused approach includes the development of SAF 2707 HD™ stainless steel, which offers exceptional resistance to pitting and crevice corrosion with PRE values exceeding 48, approaching titanium's performance in many pharmaceutical environments. For applications requiring titanium, Sandvik has pioneered advanced manufacturing techniques including near-net-shape additive manufacturing that reduces material waste by up to 80% compared to traditional titanium fabrication methods. Their proprietary surface treatment technology, Sandvik Santronic™, creates an ultra-smooth, biocompatible surface on both titanium and advanced stainless steels, with documented reduction in protein binding and bacterial adhesion of over 99% compared to conventional materials. Sandvik has also developed hybrid components that strategically combine titanium and advanced stainless steels in single equipment pieces, placing each material where its properties are most beneficial while optimizing cost-effectiveness. Their materials science research has resulted in documented case studies showing equipment lifetime extensions of 200-300% in pharmaceutical processing applications involving organic acids and chloride-containing compounds.

Strengths: Comprehensive material solutions spanning both advanced stainless steels and titanium alloys; industry-leading corrosion resistance in both material categories; innovative manufacturing techniques reducing cost barriers for titanium implementation; global technical support network with pharmaceutical industry expertise. Weaknesses: Premium pricing for advanced materials compared to standard 316L stainless steel; complex material selection process requires specialized knowledge; some proprietary surface treatments require periodic renewal; limited standardization across the industry for these advanced materials.

Core Innovations in Titanium Alloy Pharmaceutical Applications

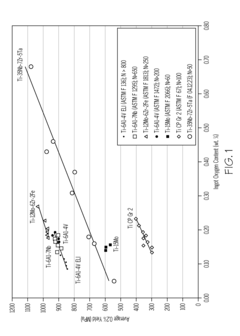

Titanium alloys including increased oxygen content and exhibiting improved mechanical properties

PatentActiveUS20140065010A1

Innovation

- A metastable β titanium alloy with increased oxygen content above the maximum established in ASTM F 2066, specifically up to 0.7 weight percent, is developed to enhance yield strength, ultimate tensile strength, and cyclic fatigue properties without significantly reducing ductility, thereby improving the alloy's performance for medical and surgical applications.

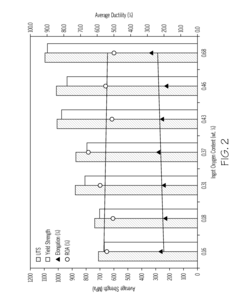

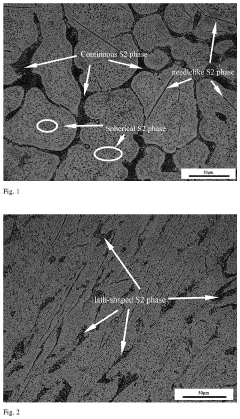

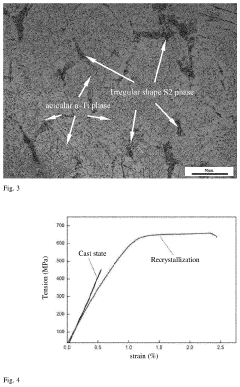

HIGH-STRENGTH AND LOW-MODULUS BETA-TYPE Si-CONTAINING TITANIUM ALLOY, PREPARATION METHOD THEREFOR AND USE THEREOF

PatentActiveUS20200056267A1

Innovation

- A preparation method involving alloy composition design with specific atomic percentages of Ti, Nb, Zr, Ta, and Si, followed by high-temperature plastic deformation and recrystallization, which includes smelting in a vacuum consumable arc melting furnace, hot rolling, and annealing to create a microstructure with dispersed Si-containing phases that enhance strength and toughness.

Regulatory Compliance for Pharmaceutical Manufacturing Materials

The regulatory landscape governing materials used in pharmaceutical manufacturing is complex and stringent, with significant differences in compliance requirements between titanium alloys and stainless steel. The FDA's Code of Federal Regulations Title 21 (21 CFR) establishes comprehensive guidelines for materials that come into contact with pharmaceutical products, with particular emphasis on biocompatibility, leachability, and corrosion resistance.

For stainless steel, which has been the traditional material of choice, ASTM A276, ASTM A479, and ASTM A240 standards provide established regulatory frameworks. These materials typically comply with 316L or 304L grades, which are widely accepted by regulatory bodies worldwide. The European Medicines Agency (EMA) and FDA have extensive documentation on the validation processes for stainless steel equipment, making compliance pathways well-defined.

Titanium alloys, particularly Ti-6Al-4V (Grade 5) and commercially pure titanium (Grade 2), face more nuanced regulatory considerations. While ASTM F67 and ASTM F136 standards exist for medical applications, their specific application in pharmaceutical manufacturing requires additional validation. The USP Class VI testing and ISO 10993 biocompatibility standards are increasingly being applied to titanium components in pharmaceutical processing equipment.

A critical regulatory distinction lies in the documentation requirements. Stainless steel benefits from decades of precedent in Drug Master Files (DMFs) and established cleaning validation protocols. Titanium alloys, while gaining acceptance, often require more extensive documentation of extractables and leachables studies to satisfy regulatory concerns about potential metal ion release, particularly in high-purity pharmaceutical applications.

Global regulatory harmonization efforts through ICH (International Council for Harmonisation) guidelines are gradually standardizing requirements for both materials. However, regional variations persist, with Japan's PMDA imposing particularly stringent requirements for novel materials in pharmaceutical contact applications, while the EU's Medical Device Regulation (MDR) has indirect implications for pharmaceutical equipment materials.

Risk assessment frameworks such as ICH Q9 are increasingly being applied to material selection decisions, requiring manufacturers to demonstrate that material choices minimize potential risks to product quality and patient safety. For titanium alloys, this often means more comprehensive validation studies compared to the well-established stainless steel options.

The regulatory pathway for implementing titanium alloys in pharmaceutical applications typically requires more extensive change control documentation, including comparative studies with traditional stainless steel components to demonstrate equivalent or superior performance in terms of product quality and safety.

For stainless steel, which has been the traditional material of choice, ASTM A276, ASTM A479, and ASTM A240 standards provide established regulatory frameworks. These materials typically comply with 316L or 304L grades, which are widely accepted by regulatory bodies worldwide. The European Medicines Agency (EMA) and FDA have extensive documentation on the validation processes for stainless steel equipment, making compliance pathways well-defined.

Titanium alloys, particularly Ti-6Al-4V (Grade 5) and commercially pure titanium (Grade 2), face more nuanced regulatory considerations. While ASTM F67 and ASTM F136 standards exist for medical applications, their specific application in pharmaceutical manufacturing requires additional validation. The USP Class VI testing and ISO 10993 biocompatibility standards are increasingly being applied to titanium components in pharmaceutical processing equipment.

A critical regulatory distinction lies in the documentation requirements. Stainless steel benefits from decades of precedent in Drug Master Files (DMFs) and established cleaning validation protocols. Titanium alloys, while gaining acceptance, often require more extensive documentation of extractables and leachables studies to satisfy regulatory concerns about potential metal ion release, particularly in high-purity pharmaceutical applications.

Global regulatory harmonization efforts through ICH (International Council for Harmonisation) guidelines are gradually standardizing requirements for both materials. However, regional variations persist, with Japan's PMDA imposing particularly stringent requirements for novel materials in pharmaceutical contact applications, while the EU's Medical Device Regulation (MDR) has indirect implications for pharmaceutical equipment materials.

Risk assessment frameworks such as ICH Q9 are increasingly being applied to material selection decisions, requiring manufacturers to demonstrate that material choices minimize potential risks to product quality and patient safety. For titanium alloys, this often means more comprehensive validation studies compared to the well-established stainless steel options.

The regulatory pathway for implementing titanium alloys in pharmaceutical applications typically requires more extensive change control documentation, including comparative studies with traditional stainless steel components to demonstrate equivalent or superior performance in terms of product quality and safety.

Corrosion Resistance and Biocompatibility Considerations

Corrosion resistance and biocompatibility are critical factors in pharmaceutical applications where materials come into direct contact with active pharmaceutical ingredients (APIs), reagents, and potentially the human body. The comparison between titanium alloys and stainless steel in these aspects reveals significant differences that impact their suitability for various pharmaceutical manufacturing and delivery systems.

Titanium alloys demonstrate superior corrosion resistance compared to stainless steel, particularly in aggressive environments containing chlorides and acids commonly used in pharmaceutical processing. The naturally forming titanium oxide layer (TiO2) provides exceptional protection against corrosion, even in environments where stainless steel might experience pitting or crevice corrosion. Recent studies indicate that Grade 5 titanium alloy (Ti-6Al-4V) exhibits corrosion rates approximately 60-80% lower than 316L stainless steel when exposed to common pharmaceutical solutions.

Biocompatibility testing reveals titanium's outstanding performance in terms of cytotoxicity, sensitization, and irritation. The material's inertness results in minimal protein adsorption and cellular adhesion, reducing the risk of biological reactions. This characteristic makes titanium alloys particularly valuable for implantable drug delivery systems and components that may have direct or indirect patient contact.

Stainless steel, while offering good corrosion resistance in many environments, can release nickel and chromium ions under certain conditions, potentially contaminating pharmaceutical products. Recent advances in surface treatments for stainless steel, including electropolishing and passivation techniques, have improved its performance but have not fully closed the gap with titanium alloys in highly corrosive environments.

The economic implications of material selection must be considered alongside performance characteristics. While titanium alloys offer superior corrosion resistance and biocompatibility, they typically cost 3-5 times more than stainless steel equivalents. This cost differential has driven innovation in hybrid systems where titanium is strategically used only for critical components that demand its superior properties.

Regulatory considerations also favor titanium in applications requiring the highest levels of biocompatibility. The FDA and EMA have established more extensive precedent for titanium use in critical applications, potentially streamlining approval processes for pharmaceutical equipment and delivery systems utilizing this material.

Recent innovations in surface modification technologies have further enhanced the performance of both materials. Techniques such as plasma electrolytic oxidation for titanium and nitrogen implantation for stainless steel continue to expand the application range of these materials in pharmaceutical settings, though titanium maintains its advantage in the most demanding environments.

Titanium alloys demonstrate superior corrosion resistance compared to stainless steel, particularly in aggressive environments containing chlorides and acids commonly used in pharmaceutical processing. The naturally forming titanium oxide layer (TiO2) provides exceptional protection against corrosion, even in environments where stainless steel might experience pitting or crevice corrosion. Recent studies indicate that Grade 5 titanium alloy (Ti-6Al-4V) exhibits corrosion rates approximately 60-80% lower than 316L stainless steel when exposed to common pharmaceutical solutions.

Biocompatibility testing reveals titanium's outstanding performance in terms of cytotoxicity, sensitization, and irritation. The material's inertness results in minimal protein adsorption and cellular adhesion, reducing the risk of biological reactions. This characteristic makes titanium alloys particularly valuable for implantable drug delivery systems and components that may have direct or indirect patient contact.

Stainless steel, while offering good corrosion resistance in many environments, can release nickel and chromium ions under certain conditions, potentially contaminating pharmaceutical products. Recent advances in surface treatments for stainless steel, including electropolishing and passivation techniques, have improved its performance but have not fully closed the gap with titanium alloys in highly corrosive environments.

The economic implications of material selection must be considered alongside performance characteristics. While titanium alloys offer superior corrosion resistance and biocompatibility, they typically cost 3-5 times more than stainless steel equivalents. This cost differential has driven innovation in hybrid systems where titanium is strategically used only for critical components that demand its superior properties.

Regulatory considerations also favor titanium in applications requiring the highest levels of biocompatibility. The FDA and EMA have established more extensive precedent for titanium use in critical applications, potentially streamlining approval processes for pharmaceutical equipment and delivery systems utilizing this material.

Recent innovations in surface modification technologies have further enhanced the performance of both materials. Techniques such as plasma electrolytic oxidation for titanium and nitrogen implantation for stainless steel continue to expand the application range of these materials in pharmaceutical settings, though titanium maintains its advantage in the most demanding environments.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!