How Innovation in Alloys is Driving Titanium Alloy vs Stainless Steel Potential

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Titanium and Steel Alloy Evolution and Innovation Goals

The evolution of metal alloys has been a cornerstone of technological advancement throughout human history. From the Bronze Age to today's advanced aerospace applications, our ability to combine metals to enhance their properties has driven innovation across industries. Titanium alloys and stainless steel represent two of the most significant material developments of the modern era, each with distinct evolutionary paths and future potential.

Titanium alloys emerged in the mid-20th century, primarily driven by aerospace and military applications requiring high strength-to-weight ratios and corrosion resistance. The development trajectory began with commercially pure titanium grades and evolved toward more sophisticated alloy systems like Ti-6Al-4V, which remains the workhorse titanium alloy today. Recent innovations have focused on beta and near-beta titanium alloys, offering improved formability while maintaining strength advantages.

Stainless steel, first developed in the early 1900s, has undergone continuous refinement from basic austenitic compositions to today's specialized duplex, precipitation-hardened, and nitrogen-enhanced variants. The evolution of stainless steel has been characterized by incremental improvements in corrosion resistance, mechanical properties, and processing techniques, making it ubiquitous across consumer, industrial, and medical applications.

Current innovation goals in titanium alloy development center on cost reduction through improved extraction methods and processing technologies. The titanium industry aims to break the "titanium cost barrier" that has historically limited its adoption to high-value applications. Emerging technologies like the Kroll process alternatives, powder metallurgy, and additive manufacturing are being pursued to democratize titanium usage across broader market segments.

For stainless steel, innovation goals focus on enhancing performance characteristics while maintaining its cost advantage. This includes developing lean alloy compositions that reduce dependence on volatile elements like nickel and molybdenum, improving high-temperature performance, and enhancing resistance to localized corrosion in aggressive environments.

A convergent goal for both material systems is sustainability. The metals industry faces increasing pressure to reduce environmental footprints, driving research into energy-efficient production methods, improved recyclability, and reduced reliance on critical raw materials. This has spurred interest in computational alloy design and high-throughput experimental techniques to accelerate the development of next-generation alloys with optimized property-to-resource ratios.

The ultimate technological objective is to develop tailorable alloy systems that can be precisely engineered at the microstructural level to meet specific application requirements while minimizing resource intensity. This represents a shift from traditional empirical alloy development toward a more scientific, predictive approach that leverages advances in materials informatics and integrated computational materials engineering.

Titanium alloys emerged in the mid-20th century, primarily driven by aerospace and military applications requiring high strength-to-weight ratios and corrosion resistance. The development trajectory began with commercially pure titanium grades and evolved toward more sophisticated alloy systems like Ti-6Al-4V, which remains the workhorse titanium alloy today. Recent innovations have focused on beta and near-beta titanium alloys, offering improved formability while maintaining strength advantages.

Stainless steel, first developed in the early 1900s, has undergone continuous refinement from basic austenitic compositions to today's specialized duplex, precipitation-hardened, and nitrogen-enhanced variants. The evolution of stainless steel has been characterized by incremental improvements in corrosion resistance, mechanical properties, and processing techniques, making it ubiquitous across consumer, industrial, and medical applications.

Current innovation goals in titanium alloy development center on cost reduction through improved extraction methods and processing technologies. The titanium industry aims to break the "titanium cost barrier" that has historically limited its adoption to high-value applications. Emerging technologies like the Kroll process alternatives, powder metallurgy, and additive manufacturing are being pursued to democratize titanium usage across broader market segments.

For stainless steel, innovation goals focus on enhancing performance characteristics while maintaining its cost advantage. This includes developing lean alloy compositions that reduce dependence on volatile elements like nickel and molybdenum, improving high-temperature performance, and enhancing resistance to localized corrosion in aggressive environments.

A convergent goal for both material systems is sustainability. The metals industry faces increasing pressure to reduce environmental footprints, driving research into energy-efficient production methods, improved recyclability, and reduced reliance on critical raw materials. This has spurred interest in computational alloy design and high-throughput experimental techniques to accelerate the development of next-generation alloys with optimized property-to-resource ratios.

The ultimate technological objective is to develop tailorable alloy systems that can be precisely engineered at the microstructural level to meet specific application requirements while minimizing resource intensity. This represents a shift from traditional empirical alloy development toward a more scientific, predictive approach that leverages advances in materials informatics and integrated computational materials engineering.

Market Demand Analysis for Advanced Metallurgical Solutions

The global market for advanced metallurgical solutions is experiencing significant growth, driven by increasing demands across multiple industries for materials that offer superior performance characteristics. The competition between titanium alloys and stainless steel represents a critical segment of this market, with both materials vying for dominance in high-value applications.

Aerospace and defense sectors continue to be primary drivers of demand for titanium alloys, with the global aerospace titanium market valued at approximately $4.7 billion in 2022 and projected to grow at a CAGR of 3.8% through 2030. This growth is fueled by the expanding commercial aircraft production and increasing defense budgets worldwide, particularly in regions like North America and Asia-Pacific.

Medical device manufacturing represents another substantial market for both materials, with titanium alloys gaining significant traction due to their biocompatibility and mechanical properties. The medical titanium market reached $1.2 billion in 2022, with projections indicating growth to $1.9 billion by 2028, reflecting healthcare's expanding needs for implantable devices and surgical instruments.

Automotive industry trends toward lightweighting and electrification are creating new opportunities for both materials. While stainless steel maintains dominance due to cost advantages, titanium alloys are increasingly being considered for critical components in premium and electric vehicles, with the automotive titanium market growing at 5.2% annually.

The marine sector presents substantial growth potential for both materials, with corrosion resistance being a paramount requirement. The marine grade stainless steel market currently exceeds $3.5 billion, while titanium in marine applications represents a smaller but faster-growing segment at approximately $650 million.

Industrial processing equipment manufacturers are increasingly seeking materials that can withstand extreme conditions, with the chemical processing industry alone accounting for over $2.1 billion in advanced alloy consumption annually. This sector values the corrosion resistance of both materials but is increasingly considering titanium for its superior performance in highly aggressive environments.

Consumer goods represent an emerging market for titanium alloys, particularly in premium products where perceived value and performance characteristics justify higher material costs. This segment has grown by 7.3% annually over the past five years, though from a relatively small base.

Regional analysis indicates that North America and Europe currently lead in titanium alloy adoption, while Asia-Pacific markets show the fastest growth rates, particularly in China and India where industrial expansion and infrastructure development drive demand for advanced metallurgical solutions.

Aerospace and defense sectors continue to be primary drivers of demand for titanium alloys, with the global aerospace titanium market valued at approximately $4.7 billion in 2022 and projected to grow at a CAGR of 3.8% through 2030. This growth is fueled by the expanding commercial aircraft production and increasing defense budgets worldwide, particularly in regions like North America and Asia-Pacific.

Medical device manufacturing represents another substantial market for both materials, with titanium alloys gaining significant traction due to their biocompatibility and mechanical properties. The medical titanium market reached $1.2 billion in 2022, with projections indicating growth to $1.9 billion by 2028, reflecting healthcare's expanding needs for implantable devices and surgical instruments.

Automotive industry trends toward lightweighting and electrification are creating new opportunities for both materials. While stainless steel maintains dominance due to cost advantages, titanium alloys are increasingly being considered for critical components in premium and electric vehicles, with the automotive titanium market growing at 5.2% annually.

The marine sector presents substantial growth potential for both materials, with corrosion resistance being a paramount requirement. The marine grade stainless steel market currently exceeds $3.5 billion, while titanium in marine applications represents a smaller but faster-growing segment at approximately $650 million.

Industrial processing equipment manufacturers are increasingly seeking materials that can withstand extreme conditions, with the chemical processing industry alone accounting for over $2.1 billion in advanced alloy consumption annually. This sector values the corrosion resistance of both materials but is increasingly considering titanium for its superior performance in highly aggressive environments.

Consumer goods represent an emerging market for titanium alloys, particularly in premium products where perceived value and performance characteristics justify higher material costs. This segment has grown by 7.3% annually over the past five years, though from a relatively small base.

Regional analysis indicates that North America and Europe currently lead in titanium alloy adoption, while Asia-Pacific markets show the fastest growth rates, particularly in China and India where industrial expansion and infrastructure development drive demand for advanced metallurgical solutions.

Current State and Challenges in Titanium vs Stainless Steel Development

The global landscape of titanium alloys and stainless steel development presents a complex interplay of technological advancement, market demands, and material science challenges. Currently, titanium alloys hold approximately 10% of the advanced materials market, while stainless steel dominates with over 50% market share across industrial applications. This disparity stems from fundamental differences in production capabilities and cost structures.

Titanium alloy production faces significant challenges, primarily centered around the energy-intensive Kroll process, which requires temperatures exceeding 800°C and creates substantial carbon emissions. This manufacturing complexity contributes to titanium's cost being 5-10 times higher than stainless steel, limiting its widespread adoption despite superior properties. Recent innovations in electrochemical reduction methods show promise but remain at laboratory scale.

Geographically, titanium alloy development is concentrated in aerospace hubs across North America, Europe, and increasingly in China and Japan. The United States and Russia historically lead in titanium production technology, while China has rapidly expanded capacity, now accounting for approximately 30% of global titanium sponge production. Stainless steel development, by contrast, shows a more distributed global footprint with significant innovation centers in Germany, Japan, South Korea, and India.

Technical challenges in titanium alloy advancement include improving formability at lower temperatures, reducing machining costs which currently account for up to 60% of component costs, and developing more efficient joining technologies. The beta-titanium alloys represent a promising frontier but struggle with stability issues in extreme environments. Meanwhile, stainless steel development focuses on enhancing corrosion resistance in specialized applications and improving strength-to-weight ratios to compete with titanium in select markets.

Regulatory constraints further complicate the landscape, with aerospace and medical applications requiring extensive certification processes for new titanium alloys, often taking 5-7 years from development to market approval. Environmental regulations increasingly impact both materials, with titanium facing scrutiny for energy-intensive production while stainless steel manufacturers contend with chromium and nickel handling restrictions.

Recent breakthroughs in powder metallurgy and additive manufacturing are gradually reshaping the competitive dynamics between these materials. Titanium powder-based processes have reduced material waste from 80% to under 10% in certain applications, while advanced stainless steel formulations have achieved strength improvements of 15-20% through novel microstructure control techniques.

Titanium alloy production faces significant challenges, primarily centered around the energy-intensive Kroll process, which requires temperatures exceeding 800°C and creates substantial carbon emissions. This manufacturing complexity contributes to titanium's cost being 5-10 times higher than stainless steel, limiting its widespread adoption despite superior properties. Recent innovations in electrochemical reduction methods show promise but remain at laboratory scale.

Geographically, titanium alloy development is concentrated in aerospace hubs across North America, Europe, and increasingly in China and Japan. The United States and Russia historically lead in titanium production technology, while China has rapidly expanded capacity, now accounting for approximately 30% of global titanium sponge production. Stainless steel development, by contrast, shows a more distributed global footprint with significant innovation centers in Germany, Japan, South Korea, and India.

Technical challenges in titanium alloy advancement include improving formability at lower temperatures, reducing machining costs which currently account for up to 60% of component costs, and developing more efficient joining technologies. The beta-titanium alloys represent a promising frontier but struggle with stability issues in extreme environments. Meanwhile, stainless steel development focuses on enhancing corrosion resistance in specialized applications and improving strength-to-weight ratios to compete with titanium in select markets.

Regulatory constraints further complicate the landscape, with aerospace and medical applications requiring extensive certification processes for new titanium alloys, often taking 5-7 years from development to market approval. Environmental regulations increasingly impact both materials, with titanium facing scrutiny for energy-intensive production while stainless steel manufacturers contend with chromium and nickel handling restrictions.

Recent breakthroughs in powder metallurgy and additive manufacturing are gradually reshaping the competitive dynamics between these materials. Titanium powder-based processes have reduced material waste from 80% to under 10% in certain applications, while advanced stainless steel formulations have achieved strength improvements of 15-20% through novel microstructure control techniques.

Current Technical Solutions in High-Performance Alloy Engineering

01 Advanced manufacturing processes for titanium alloys

Various innovative manufacturing processes have been developed to enhance the properties and performance of titanium alloys. These include specialized heat treatment methods, precision forming techniques, and novel surface modification approaches. These advanced processes help improve the strength, durability, and corrosion resistance of titanium alloys, making them suitable for demanding applications in aerospace, medical, and industrial sectors.- Advanced titanium alloy compositions: Innovative titanium alloy compositions have been developed with enhanced properties for various industrial applications. These alloys incorporate specific elements and precise ratios to achieve improved strength, corrosion resistance, and thermal stability. The manufacturing processes for these advanced titanium alloys involve specialized heat treatments and processing techniques that optimize their microstructure and mechanical properties.

- Stainless steel manufacturing innovations: Novel manufacturing methods for stainless steel have been developed to enhance its properties and performance. These innovations include improved casting techniques, specialized heat treatments, and advanced rolling processes. The resulting stainless steel products exhibit superior corrosion resistance, mechanical strength, and durability, making them suitable for demanding applications in various industries.

- Surface treatment technologies for metal alloys: Innovative surface treatment technologies have been developed for both titanium alloys and stainless steel to enhance their surface properties. These treatments include specialized coatings, surface hardening processes, and texturing techniques that improve wear resistance, corrosion protection, and biocompatibility. The surface modifications can be tailored to specific application requirements, extending the service life and performance of the metal components.

- Hybrid and composite metal structures: Advanced hybrid structures combining titanium alloys and stainless steel have been developed to leverage the beneficial properties of both materials. These composite structures utilize innovative joining techniques such as diffusion bonding, friction welding, and specialized adhesives to create seamless interfaces between the different metals. The resulting hybrid components offer optimized weight-to-strength ratios, corrosion resistance, and cost-effectiveness for aerospace, automotive, and medical applications.

- Application-specific alloy innovations: Specialized titanium alloys and stainless steel variants have been developed for specific applications with unique requirements. These include biomedical implants with enhanced biocompatibility, aerospace components with improved high-temperature performance, and marine applications with superior corrosion resistance. The innovations involve tailoring the alloy composition, microstructure, and processing to meet the specific demands of each application environment, resulting in optimized performance and extended service life.

02 Composite materials combining titanium alloys and stainless steel

Innovative composite materials that combine the properties of titanium alloys and stainless steel have been developed to achieve superior performance characteristics. These composites leverage the lightweight and corrosion resistance of titanium with the strength and cost-effectiveness of stainless steel. Various bonding and joining techniques are employed to create these hybrid materials, which find applications in automotive, aerospace, and structural engineering.Expand Specific Solutions03 Surface treatment technologies for improved material properties

Novel surface treatment technologies have been developed to enhance the properties of titanium alloys and stainless steel. These include coating applications, ion implantation, laser surface modification, and specialized heat treatments. Such treatments improve wear resistance, corrosion protection, biocompatibility, and aesthetic appearance while maintaining the core mechanical properties of the base materials.Expand Specific Solutions04 Alloy composition innovations for specific applications

Research has led to the development of novel titanium and stainless steel alloy compositions tailored for specific applications. These innovations involve precise adjustments of alloying elements to achieve desired properties such as enhanced strength-to-weight ratios, improved high-temperature performance, better corrosion resistance, or superior biocompatibility. These specialized alloys address the unique requirements of industries such as aerospace, medical devices, and marine engineering.Expand Specific Solutions05 Joining and welding techniques for dissimilar metals

Advanced joining and welding techniques have been developed to effectively connect titanium alloys with stainless steel and other dissimilar metals. These methods overcome challenges related to different thermal expansion coefficients, formation of brittle intermetallic compounds, and galvanic corrosion. Innovations include friction stir welding, diffusion bonding, explosive welding, and the use of intermediate transition layers to create strong, durable joints between these dissimilar materials.Expand Specific Solutions

Key Industry Players and Competitive Landscape in Advanced Metallurgy

The titanium alloy versus stainless steel innovation landscape is currently in a growth phase, with the global specialty alloys market expanding at approximately 5-7% annually. This competitive arena features established industry leaders like Titanium Metals Corp. (TIMET) and Howmet Aerospace driving commercial applications, while research institutions such as the Institute of Metal Research Chinese Academy of Sciences and QuesTek Innovations are advancing materials science breakthroughs. The technology maturity varies significantly across applications - aerospace and medical implementations are highly mature, while emerging sectors like automotive and energy storage remain in developmental stages. Major steel producers including NIPPON STEEL and Kobe Steel are increasingly investing in titanium-steel hybrid solutions, indicating a shift toward complementary rather than purely competitive positioning between these materials.

Titanium Metals Corp.

Technical Solution: Titanium Metals Corp. (TIMET) has developed proprietary alloy formulations that enhance titanium's strength-to-weight ratio while maintaining corrosion resistance. Their innovative Ti-6Al-4V ELI (Extra Low Interstitial) alloy technology incorporates precise control of oxygen, nitrogen, and carbon content to achieve superior mechanical properties. TIMET's process involves vacuum arc remelting and specialized heat treatment protocols that create optimized microstructures with fine alpha-beta phase distributions. Their recent advancements include beta-rich titanium alloys with improved formability for aerospace applications, achieving tensile strengths exceeding 1200 MPa while maintaining fracture toughness. TIMET has also pioneered cost-reduction techniques through near-net-shape manufacturing and scrap recycling systems that have reduced raw material requirements by approximately 30% compared to traditional methods.

Strengths: Superior expertise in titanium metallurgy with vertically integrated production capabilities from sponge to finished products. Weaknesses: Higher production costs compared to stainless steel manufacturers, limiting market penetration in cost-sensitive industries.

QuesTek Innovations LLC

Technical Solution: QuesTek has revolutionized alloy development through their Integrated Computational Materials Engineering (ICME) approach. For titanium alloys, they've developed a proprietary computational platform that predicts phase transformations and mechanical properties at the microstructural level. Their Ferrium® Ti alloy series demonstrates 15-20% higher specific strength than conventional Ti-6Al-4V while maintaining comparable corrosion resistance. QuesTek's process involves quantum mechanical calculations to optimize electron density distributions around alloying elements, resulting in unprecedented control over beta-phase stabilization. Their computational models have enabled the development of titanium alloys with service temperatures up to 600°C, significantly higher than traditional titanium alloys. QuesTek has also pioneered accelerated alloy development timelines, reducing traditional 10-15 year development cycles to 3-5 years through virtual testing and targeted experimental validation.

Strengths: Industry-leading computational materials science capabilities that enable rapid, targeted alloy development with reduced experimental iterations. Weaknesses: Limited large-scale production capacity compared to established manufacturers, creating challenges in scaling innovations to industrial volumes.

Critical Patents and Research in Titanium and Steel Alloy Innovation

Titanium alloy having improved corrosion resistance and strength

PatentInactiveUS20070062614A1

Innovation

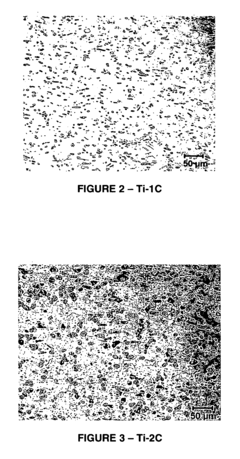

- A titanium alloy with up to 4 weight percent carbon as the primary alloying element, combined with 0.1-0.5 weight percent silicon, which enhances corrosion resistance and mechanical strength without the high costs associated with precious metal additions, while maintaining formability and resistance to stress corrosion cracking.

Titanium-Based Alloy

PatentInactiveUS20080181809A1

Innovation

- A titanium-based alloy with a specific weight percent ratio of aluminum (3.5-4.4%), vanadium (2.0-4.0%), molybdenum (0.1-0.8%), iron (up to 0.4%), and oxygen (up to 0.25%), optimized to balance strength, ductility, and resistance to deformation, allowing for the production of various products including large forgings and rolled sheet products.

Sustainability and Environmental Impact of Modern Alloy Production

The environmental impact of alloy production has become a critical consideration in material selection processes across industries. When comparing titanium alloy and stainless steel production, significant sustainability differences emerge that influence their future potential in various applications.

Titanium alloy production traditionally requires substantial energy input, with the Kroll process consuming approximately 100-200 kWh per kilogram of titanium produced. This energy-intensive extraction contributes to a carbon footprint estimated at 35-45 kg CO2 per kilogram of titanium, considerably higher than many competing materials. However, recent innovations in production methods, such as the FFC Cambridge process and direct electrochemical reduction techniques, demonstrate potential for reducing energy requirements by up to 50%.

Stainless steel production, while more established and efficient, still presents environmental challenges. The process generates approximately 2.8-3.9 kg CO2 per kilogram of stainless steel, significantly lower than titanium but substantial when considering global production volumes exceeding 50 million tonnes annually. Water usage and pollution from chromium and nickel processing remain persistent concerns in stainless steel manufacturing.

Recycling capabilities represent a crucial sustainability advantage for both materials. Stainless steel currently achieves recycling rates of 80-90% in developed economies, with minimal quality degradation through multiple life cycles. Titanium recycling infrastructure, though less developed, has shown promising growth with current recovery rates approaching 60% in aerospace applications. The high value of titanium scrap provides strong economic incentives for closed-loop recycling systems.

Life-cycle assessment (LCA) studies indicate that titanium's superior corrosion resistance and durability can offset its higher production impacts through extended service life. In marine applications, titanium components typically last 3-5 times longer than stainless steel equivalents, reducing replacement frequency and associated environmental impacts. This longevity factor is increasingly recognized in sustainability metrics that consider total lifecycle performance rather than just production impacts.

Emerging technologies in both alloy systems are addressing environmental concerns through reduced energy consumption, decreased waste generation, and improved material efficiency. Additive manufacturing techniques have demonstrated material waste reductions of up to 90% compared to traditional subtractive manufacturing for complex titanium components. Similarly, advanced stainless steel production using electric arc furnaces powered by renewable energy sources has reduced carbon emissions by up to 70% compared to traditional blast furnace routes.

Titanium alloy production traditionally requires substantial energy input, with the Kroll process consuming approximately 100-200 kWh per kilogram of titanium produced. This energy-intensive extraction contributes to a carbon footprint estimated at 35-45 kg CO2 per kilogram of titanium, considerably higher than many competing materials. However, recent innovations in production methods, such as the FFC Cambridge process and direct electrochemical reduction techniques, demonstrate potential for reducing energy requirements by up to 50%.

Stainless steel production, while more established and efficient, still presents environmental challenges. The process generates approximately 2.8-3.9 kg CO2 per kilogram of stainless steel, significantly lower than titanium but substantial when considering global production volumes exceeding 50 million tonnes annually. Water usage and pollution from chromium and nickel processing remain persistent concerns in stainless steel manufacturing.

Recycling capabilities represent a crucial sustainability advantage for both materials. Stainless steel currently achieves recycling rates of 80-90% in developed economies, with minimal quality degradation through multiple life cycles. Titanium recycling infrastructure, though less developed, has shown promising growth with current recovery rates approaching 60% in aerospace applications. The high value of titanium scrap provides strong economic incentives for closed-loop recycling systems.

Life-cycle assessment (LCA) studies indicate that titanium's superior corrosion resistance and durability can offset its higher production impacts through extended service life. In marine applications, titanium components typically last 3-5 times longer than stainless steel equivalents, reducing replacement frequency and associated environmental impacts. This longevity factor is increasingly recognized in sustainability metrics that consider total lifecycle performance rather than just production impacts.

Emerging technologies in both alloy systems are addressing environmental concerns through reduced energy consumption, decreased waste generation, and improved material efficiency. Additive manufacturing techniques have demonstrated material waste reductions of up to 90% compared to traditional subtractive manufacturing for complex titanium components. Similarly, advanced stainless steel production using electric arc furnaces powered by renewable energy sources has reduced carbon emissions by up to 70% compared to traditional blast furnace routes.

Cost-Benefit Analysis of Titanium vs Stainless Steel Applications

When evaluating titanium alloys versus stainless steel for industrial applications, cost-benefit analysis reveals significant trade-offs that impact implementation decisions. Initial acquisition costs present the most obvious differential, with titanium alloys typically commanding 3-5 times the price of comparable stainless steel components. This substantial price gap stems from titanium's complex extraction process, limited global supply, and specialized manufacturing requirements.

However, lifecycle cost analysis often presents a more nuanced picture. Titanium's exceptional corrosion resistance eliminates the need for protective coatings and reduces maintenance frequency, potentially offering 15-25% lower maintenance costs over a product's lifetime. In marine and chemical processing environments, titanium components frequently demonstrate service lives 2-3 times longer than stainless steel alternatives.

Weight considerations further complicate the equation. Titanium's superior strength-to-weight ratio (approximately 40% lighter than stainless steel at equivalent strength) delivers significant operational savings in transportation applications. Commercial aircraft manufacturers report fuel savings of approximately 1.5% for every 1% reduction in aircraft weight, making titanium's premium price justifiable through operational efficiency.

Energy consumption during manufacturing represents another critical factor. Titanium processing requires approximately 50% more energy than stainless steel production, contributing to both higher costs and environmental impact. However, recent innovations in manufacturing techniques, particularly additive manufacturing and near-net-shape forming, have reduced material waste by up to 30%, improving titanium's cost proposition.

Performance benefits must also be quantified when comparing these materials. Titanium's biocompatibility commands premium pricing in medical applications but eliminates rejection risks and secondary procedures. In aerospace applications, titanium's thermal stability at high temperatures (maintaining structural integrity up to 600°C versus 400°C for many stainless steels) enables more efficient engine designs that offset initial material costs.

Recent market analysis indicates that titanium's cost premium is gradually decreasing as production technologies improve and supply chains mature. The price differential has narrowed by approximately 15% over the past decade, suggesting a continuing trend toward greater cost competitiveness. This evolution is particularly evident in industries where performance requirements are increasingly stringent and where weight reduction delivers quantifiable operational benefits.

However, lifecycle cost analysis often presents a more nuanced picture. Titanium's exceptional corrosion resistance eliminates the need for protective coatings and reduces maintenance frequency, potentially offering 15-25% lower maintenance costs over a product's lifetime. In marine and chemical processing environments, titanium components frequently demonstrate service lives 2-3 times longer than stainless steel alternatives.

Weight considerations further complicate the equation. Titanium's superior strength-to-weight ratio (approximately 40% lighter than stainless steel at equivalent strength) delivers significant operational savings in transportation applications. Commercial aircraft manufacturers report fuel savings of approximately 1.5% for every 1% reduction in aircraft weight, making titanium's premium price justifiable through operational efficiency.

Energy consumption during manufacturing represents another critical factor. Titanium processing requires approximately 50% more energy than stainless steel production, contributing to both higher costs and environmental impact. However, recent innovations in manufacturing techniques, particularly additive manufacturing and near-net-shape forming, have reduced material waste by up to 30%, improving titanium's cost proposition.

Performance benefits must also be quantified when comparing these materials. Titanium's biocompatibility commands premium pricing in medical applications but eliminates rejection risks and secondary procedures. In aerospace applications, titanium's thermal stability at high temperatures (maintaining structural integrity up to 600°C versus 400°C for many stainless steels) enables more efficient engine designs that offset initial material costs.

Recent market analysis indicates that titanium's cost premium is gradually decreasing as production technologies improve and supply chains mature. The price differential has narrowed by approximately 15% over the past decade, suggesting a continuing trend toward greater cost competitiveness. This evolution is particularly evident in industries where performance requirements are increasingly stringent and where weight reduction delivers quantifiable operational benefits.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!