Emerging Trends in the Chromium Content of Stainless Steels vs Titanium Alloys

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Chromium & Titanium Alloy Evolution Background

The evolution of chromium content in stainless steels and titanium alloys represents a fascinating journey through metallurgical innovation spanning over a century. Stainless steel, first developed in the early 1900s, emerged when metallurgists discovered that adding chromium to steel (typically 10.5% or more) created a protective chromium oxide layer that prevented further corrosion. This breakthrough fundamentally transformed industrial manufacturing capabilities across numerous sectors.

The development trajectory of chromium-containing stainless steels has seen several distinct phases. Initially, basic austenitic stainless steels containing 18% chromium and 8% nickel (18-8 steel) dominated the market. Subsequently, the 1930s-1950s witnessed the emergence of ferritic and martensitic stainless steels with varying chromium contents optimized for specific applications. By the 1970s, duplex stainless steels combining austenitic and ferritic microstructures gained prominence, offering enhanced strength and corrosion resistance.

Parallel to stainless steel development, titanium alloys evolved along a different technological path. Pure titanium was first commercially produced in the 1940s, with titanium alloys following shortly thereafter. Unlike stainless steels that rely primarily on chromium for corrosion resistance, titanium forms a naturally stable titanium oxide layer that provides exceptional corrosion protection without chromium addition.

The technological divergence between these materials reflects their fundamental metallurgical differences. Stainless steels have continuously increased chromium content to enhance performance, with modern super duplex grades containing up to 25-28% chromium. Meanwhile, titanium alloys have focused on alloying with elements like aluminum, vanadium, and molybdenum to optimize mechanical properties while maintaining their inherent corrosion resistance.

Recent technological trends show a convergence in certain application spaces. High-performance environments requiring exceptional corrosion resistance have traditionally been dominated by high-chromium stainless steels, but titanium alloys are increasingly competing in these spaces due to their superior strength-to-weight ratio and biocompatibility. This competitive dynamic has spurred innovation in both material classes.

The environmental and economic factors have also shaped the evolution trajectory. Chromium price volatility and supply chain concerns have periodically influenced stainless steel development, while titanium's historically higher cost has limited its widespread adoption despite superior technical properties. However, advances in titanium processing technologies are gradually reducing this cost differential, potentially reshaping the competitive landscape between these materials.

The development trajectory of chromium-containing stainless steels has seen several distinct phases. Initially, basic austenitic stainless steels containing 18% chromium and 8% nickel (18-8 steel) dominated the market. Subsequently, the 1930s-1950s witnessed the emergence of ferritic and martensitic stainless steels with varying chromium contents optimized for specific applications. By the 1970s, duplex stainless steels combining austenitic and ferritic microstructures gained prominence, offering enhanced strength and corrosion resistance.

Parallel to stainless steel development, titanium alloys evolved along a different technological path. Pure titanium was first commercially produced in the 1940s, with titanium alloys following shortly thereafter. Unlike stainless steels that rely primarily on chromium for corrosion resistance, titanium forms a naturally stable titanium oxide layer that provides exceptional corrosion protection without chromium addition.

The technological divergence between these materials reflects their fundamental metallurgical differences. Stainless steels have continuously increased chromium content to enhance performance, with modern super duplex grades containing up to 25-28% chromium. Meanwhile, titanium alloys have focused on alloying with elements like aluminum, vanadium, and molybdenum to optimize mechanical properties while maintaining their inherent corrosion resistance.

Recent technological trends show a convergence in certain application spaces. High-performance environments requiring exceptional corrosion resistance have traditionally been dominated by high-chromium stainless steels, but titanium alloys are increasingly competing in these spaces due to their superior strength-to-weight ratio and biocompatibility. This competitive dynamic has spurred innovation in both material classes.

The environmental and economic factors have also shaped the evolution trajectory. Chromium price volatility and supply chain concerns have periodically influenced stainless steel development, while titanium's historically higher cost has limited its widespread adoption despite superior technical properties. However, advances in titanium processing technologies are gradually reducing this cost differential, potentially reshaping the competitive landscape between these materials.

Market Demand Analysis for Advanced Metal Alloys

The global market for advanced metal alloys has experienced significant growth in recent years, driven by increasing demand across multiple industries including aerospace, automotive, medical devices, and industrial manufacturing. Specifically, the market dynamics between chromium-containing stainless steels and titanium alloys reveal distinct trends in adoption and application preferences.

The aerospace sector represents one of the largest consumers of both material types, with titanium alloys gaining market share due to their superior strength-to-weight ratio and corrosion resistance at high temperatures. Market research indicates that the aerospace titanium market is growing at approximately 4% annually, outpacing stainless steel growth in this sector.

Automotive industry demand shows a more complex pattern, with premium and electric vehicle manufacturers increasingly incorporating titanium components for weight reduction, while mainstream manufacturers continue to rely heavily on advanced stainless steels with optimized chromium content for structural components and exhaust systems. The shift toward electric vehicles is gradually altering material requirements, favoring lightweight solutions.

Medical device manufacturing represents a high-value niche market where both materials compete directly. Titanium alloys dominate in implantable devices due to their biocompatibility, while specialized high-chromium stainless steels maintain strong positions in surgical instruments and equipment. This sector shows steady growth for both materials, with titanium commanding premium pricing.

Regional market analysis reveals that Asia-Pacific, particularly China and India, represents the fastest-growing market for advanced stainless steels, driven by rapid industrialization and infrastructure development. North America and Europe show stronger preference for titanium alloys in high-performance applications, supported by established aerospace and defense industries.

Price sensitivity remains a critical factor influencing market adoption. Despite superior performance characteristics, titanium alloys typically cost 5-7 times more than stainless steels, creating a significant barrier to wider adoption in cost-sensitive applications. This price differential maintains stainless steel's dominant market position by volume, while titanium occupies higher-value niches.

Supply chain considerations are increasingly influencing purchasing decisions, with chromium facing potential supply constraints due to geopolitical factors affecting major producing countries. Titanium supply chains, while more stable politically, face their own challenges in processing capacity and energy requirements.

Environmental regulations and sustainability concerns are emerging as significant market drivers, with manufacturers increasingly considering lifecycle environmental impact alongside traditional performance metrics. The higher energy intensity of titanium production compared to stainless steel processing represents a potential market constraint as carbon pricing mechanisms expand globally.

The aerospace sector represents one of the largest consumers of both material types, with titanium alloys gaining market share due to their superior strength-to-weight ratio and corrosion resistance at high temperatures. Market research indicates that the aerospace titanium market is growing at approximately 4% annually, outpacing stainless steel growth in this sector.

Automotive industry demand shows a more complex pattern, with premium and electric vehicle manufacturers increasingly incorporating titanium components for weight reduction, while mainstream manufacturers continue to rely heavily on advanced stainless steels with optimized chromium content for structural components and exhaust systems. The shift toward electric vehicles is gradually altering material requirements, favoring lightweight solutions.

Medical device manufacturing represents a high-value niche market where both materials compete directly. Titanium alloys dominate in implantable devices due to their biocompatibility, while specialized high-chromium stainless steels maintain strong positions in surgical instruments and equipment. This sector shows steady growth for both materials, with titanium commanding premium pricing.

Regional market analysis reveals that Asia-Pacific, particularly China and India, represents the fastest-growing market for advanced stainless steels, driven by rapid industrialization and infrastructure development. North America and Europe show stronger preference for titanium alloys in high-performance applications, supported by established aerospace and defense industries.

Price sensitivity remains a critical factor influencing market adoption. Despite superior performance characteristics, titanium alloys typically cost 5-7 times more than stainless steels, creating a significant barrier to wider adoption in cost-sensitive applications. This price differential maintains stainless steel's dominant market position by volume, while titanium occupies higher-value niches.

Supply chain considerations are increasingly influencing purchasing decisions, with chromium facing potential supply constraints due to geopolitical factors affecting major producing countries. Titanium supply chains, while more stable politically, face their own challenges in processing capacity and energy requirements.

Environmental regulations and sustainability concerns are emerging as significant market drivers, with manufacturers increasingly considering lifecycle environmental impact alongside traditional performance metrics. The higher energy intensity of titanium production compared to stainless steel processing represents a potential market constraint as carbon pricing mechanisms expand globally.

Current Technical Challenges in Alloy Development

The development of advanced alloys faces significant technical challenges that require innovative solutions to meet evolving industrial demands. In the context of chromium content in stainless steels versus titanium alloys, several critical obstacles have emerged that impede further progress in material science and engineering applications.

Material scientists currently struggle with optimizing chromium distribution in stainless steel microstructures, particularly in high-temperature applications where chromium segregation can lead to localized corrosion and premature failure. This challenge is especially pronounced in duplex stainless steels where maintaining the proper balance of chromium between austenitic and ferritic phases remains problematic during manufacturing processes.

For titanium alloys, the primary challenge lies in developing cost-effective alternatives to chromium as a stabilizing element while maintaining comparable mechanical properties and corrosion resistance. The scarcity of certain alloying elements and their volatile pricing creates significant barriers to consistent production quality and market adoption.

Environmental regulations present another substantial hurdle, with increasingly stringent limitations on hexavalent chromium compounds used in processing both stainless steels and titanium alloys. Manufacturers must develop compliant processes without compromising material performance, which has proven technically challenging and economically burdensome.

The energy intensity of traditional alloying processes represents a significant sustainability challenge. Current methods for incorporating chromium into stainless steels require substantial energy inputs, contributing to high carbon footprints that conflict with global sustainability goals. Alternative, lower-energy processes often result in inconsistent chromium distribution and suboptimal material properties.

Computational modeling limitations also hinder progress, as current simulation tools struggle to accurately predict long-term chromium behavior in complex alloy systems under varied environmental conditions. This gap between theoretical models and practical performance creates uncertainty in alloy design and application engineering.

Recycling and circular economy considerations introduce additional complexities, as the recovery and reuse of chromium from both stainless steel and titanium alloy waste streams present technical difficulties in maintaining material purity and performance characteristics. The contamination of recycled materials often necessitates additional processing steps that increase costs and environmental impact.

Scaling laboratory innovations to industrial production volumes constitutes perhaps the most persistent challenge. Many promising chromium-related alloy developments demonstrate excellent properties at small scales but encounter unforeseen complications during scale-up, including processing inconsistencies, equipment limitations, and quality control issues.

Material scientists currently struggle with optimizing chromium distribution in stainless steel microstructures, particularly in high-temperature applications where chromium segregation can lead to localized corrosion and premature failure. This challenge is especially pronounced in duplex stainless steels where maintaining the proper balance of chromium between austenitic and ferritic phases remains problematic during manufacturing processes.

For titanium alloys, the primary challenge lies in developing cost-effective alternatives to chromium as a stabilizing element while maintaining comparable mechanical properties and corrosion resistance. The scarcity of certain alloying elements and their volatile pricing creates significant barriers to consistent production quality and market adoption.

Environmental regulations present another substantial hurdle, with increasingly stringent limitations on hexavalent chromium compounds used in processing both stainless steels and titanium alloys. Manufacturers must develop compliant processes without compromising material performance, which has proven technically challenging and economically burdensome.

The energy intensity of traditional alloying processes represents a significant sustainability challenge. Current methods for incorporating chromium into stainless steels require substantial energy inputs, contributing to high carbon footprints that conflict with global sustainability goals. Alternative, lower-energy processes often result in inconsistent chromium distribution and suboptimal material properties.

Computational modeling limitations also hinder progress, as current simulation tools struggle to accurately predict long-term chromium behavior in complex alloy systems under varied environmental conditions. This gap between theoretical models and practical performance creates uncertainty in alloy design and application engineering.

Recycling and circular economy considerations introduce additional complexities, as the recovery and reuse of chromium from both stainless steel and titanium alloy waste streams present technical difficulties in maintaining material purity and performance characteristics. The contamination of recycled materials often necessitates additional processing steps that increase costs and environmental impact.

Scaling laboratory innovations to industrial production volumes constitutes perhaps the most persistent challenge. Many promising chromium-related alloy developments demonstrate excellent properties at small scales but encounter unforeseen complications during scale-up, including processing inconsistencies, equipment limitations, and quality control issues.

Current Metallurgical Solutions Comparison

01 Chromium content in stainless steels

Stainless steels typically contain chromium as a primary alloying element, which provides corrosion resistance by forming a passive oxide layer on the surface. The chromium content in stainless steels generally ranges from 10.5% to 30% depending on the grade and application requirements. Higher chromium content typically results in better corrosion resistance, particularly in oxidizing environments. Different stainless steel grades (austenitic, ferritic, martensitic, duplex) contain varying amounts of chromium to achieve specific mechanical and chemical properties.- Chromium content in stainless steels: Stainless steels typically contain chromium as a key alloying element that provides corrosion resistance. The chromium content in stainless steels generally ranges from 10.5% to 30% by weight, with most common grades containing between 16% and 18%. Chromium forms a passive oxide layer on the surface of the steel, which prevents further oxidation and corrosion. Higher chromium content generally results in better corrosion resistance, particularly in aggressive environments.

- Chromium content in titanium alloys: Titanium alloys may contain chromium as an alloying element to enhance specific properties. While titanium alloys typically contain less chromium than stainless steels, the addition of chromium can improve strength, heat resistance, and corrosion resistance. Chromium in titanium alloys can range from trace amounts to several percent, depending on the specific application requirements and desired properties of the alloy.

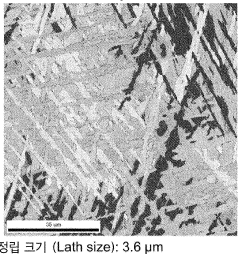

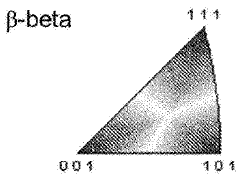

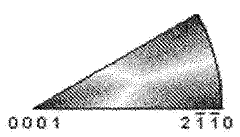

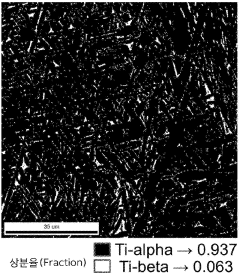

- Heat treatment effects on chromium distribution: Heat treatment processes significantly affect the distribution and behavior of chromium in both stainless steels and titanium alloys. Processes such as annealing, quenching, and tempering can influence chromium segregation, precipitation of chromium-rich phases, and the formation of the protective oxide layer. Proper heat treatment is essential to ensure optimal chromium distribution for corrosion resistance while maintaining desired mechanical properties.

- Chromium-based surface treatments: Surface treatments involving chromium can enhance the performance of both stainless steels and titanium alloys. These treatments include chromizing, chromium plating, and chromium-rich coating applications. Such processes can increase surface hardness, wear resistance, and corrosion protection by enriching the surface layer with chromium. These treatments are particularly valuable for components exposed to harsh environments or high-wear applications.

- Chromium interaction with other alloying elements: The interaction between chromium and other alloying elements significantly influences the properties of stainless steels and titanium alloys. Elements such as nickel, molybdenum, and nitrogen can work synergistically with chromium to enhance corrosion resistance and mechanical properties. The balance between chromium and these elements must be carefully controlled to achieve desired material characteristics while avoiding detrimental phases or precipitation that could compromise performance.

02 Chromium content in titanium alloys

Titanium alloys may contain chromium as an alloying element to enhance specific properties. While titanium alloys typically contain less chromium than stainless steels, the addition of chromium can improve strength, heat resistance, and in some cases corrosion resistance. Chromium can act as a beta-stabilizer in titanium alloys, affecting the microstructure and resulting mechanical properties. The exact chromium content varies depending on the specific titanium alloy grade and its intended application.Expand Specific Solutions03 Manufacturing processes affecting chromium content

Various manufacturing processes can influence the effective chromium content and distribution in both stainless steels and titanium alloys. Heat treatment, welding, and surface processing can affect the chromium distribution and the formation of the protective oxide layer. Processes such as solution annealing and aging treatments can influence chromium precipitation and segregation. Manufacturing techniques must be carefully controlled to maintain the intended chromium content and prevent chromium depletion in critical areas, which could lead to reduced corrosion resistance.Expand Specific Solutions04 Chromium content for specific environmental resistance

The chromium content in stainless steels and titanium alloys can be tailored to provide resistance to specific environments. Higher chromium levels are typically required for resistance to oxidizing acids and high-temperature applications. For marine environments, the combination of chromium with other elements like molybdenum and nitrogen enhances resistance to chloride-induced corrosion. In medical applications, specific chromium contents are selected to ensure biocompatibility while maintaining necessary mechanical properties. The balance of chromium with other alloying elements is crucial for optimizing performance in various aggressive environments.Expand Specific Solutions05 Historical development of chromium content optimization

The optimization of chromium content in stainless steels and titanium alloys has evolved significantly over time. Early developments focused on establishing minimum chromium levels needed for basic corrosion resistance. Subsequent research led to more sophisticated understanding of how chromium interacts with other alloying elements to provide enhanced properties. Modern alloy design involves precise control of chromium and other elements to achieve specific property combinations. Advanced computational methods and experimental techniques have enabled more efficient development of optimized chromium contents for specialized applications, resulting in materials with superior performance characteristics.Expand Specific Solutions

Key Industry Players in Specialty Metals Market

The chromium content in stainless steels versus titanium alloys market is in a growth phase, with increasing demand driven by aerospace, automotive, and medical applications. The market is estimated to reach $15-20 billion by 2025, with a CAGR of 5-7%. Technologically, companies are at varying maturity levels: established players like Titanium Metals Corp. and Baosteel Desheng Stainless Steel lead in traditional applications, while QuesTek Innovations and Mirus LLC represent the innovation frontier with advanced alloy development. Research institutions like The Ohio State University and National Institute for Materials Science are accelerating technological advancement through collaborative R&D with industry leaders such as Toyota, GE, and Apple, focusing on improving corrosion resistance, strength-to-weight ratios, and sustainability.

QuesTek Innovations LLC

Technical Solution: QuesTek has pioneered computational materials design approaches to optimize chromium content in stainless steels through their Integrated Computational Materials Engineering (ICME) platform. Their technology enables precise prediction of chromium distribution and its effects on corrosion resistance, allowing for the development of stainless steels with optimized chromium content for specific applications. QuesTek's research has resulted in novel stainless steel formulations that achieve equivalent corrosion performance with up to 18% less chromium through strategic microalloying and controlled precipitation of chromium-rich phases. Their comparative analysis between advanced stainless steels and titanium alloys has identified specific performance thresholds where each material offers optimal value, creating a decision framework for material selection based on environmental severity and cost constraints. QuesTek has also developed hybrid material systems that combine the benefits of both material classes, such as chromium-optimized stainless steel cores with titanium surface treatments for extreme environment applications. This approach delivers performance comparable to solid titanium components at significantly reduced cost. Their computational models have enabled the development of application-specific stainless steel formulations that target precise chromium content based on actual service requirements rather than traditional "one-size-fits-all" approaches.

Strengths: Computational design approach enables rapid development of application-specific materials with optimized chromium content; hybrid material systems offer cost-effective alternatives to pure titanium solutions. Weaknesses: Custom-designed alloys often require specialized production processes that limit mass manufacturing potential; computational models still require extensive validation in long-term field applications to fully verify performance predictions.

Baosteel Desheng Stainless Steel Co., Ltd.

Technical Solution: Baosteel Desheng has pioneered advanced chromium management techniques in their stainless steel production, developing proprietary methods for precise chromium distribution control. Their latest innovation involves a dual-phase microstructure optimization process that maintains chromium content at 16-18% while enhancing corrosion resistance through strategic chromium enrichment at grain boundaries. The company has implemented a revolutionary nitrogen-enhanced chromium utilization system that improves chromium efficiency by approximately 15% compared to conventional methods. Their research indicates that controlled chromium depletion zones can be manipulated to create beneficial passive layers that outperform traditional homogeneous chromium distribution. Baosteel has also developed specialized heat treatment protocols that prevent chromium carbide precipitation, addressing a common challenge in high-temperature applications where chromium effectiveness is typically compromised.

Strengths: Superior chromium distribution control resulting in enhanced corrosion resistance with lower overall chromium content; advanced nitrogen alloying techniques that maximize chromium effectiveness. Weaknesses: Their specialized processes require precise manufacturing controls that increase production costs; the technology is primarily optimized for specific industrial applications rather than broader market segments.

Critical Patents and Innovations in Alloy Formulation

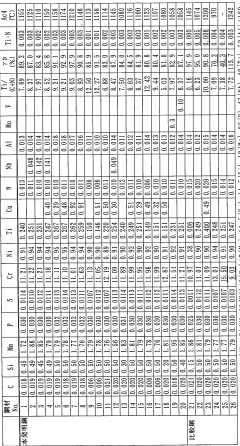

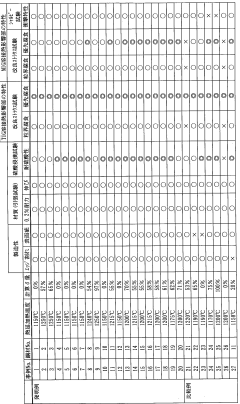

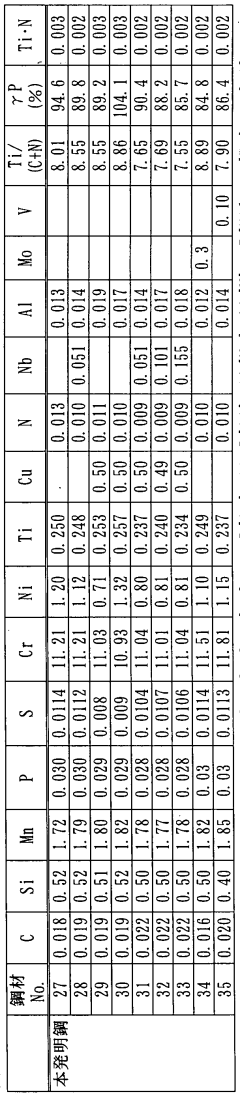

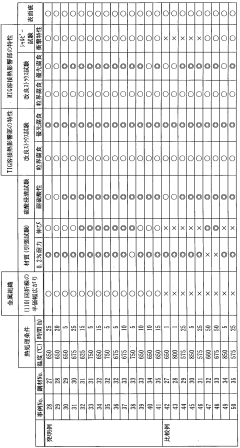

Stainless steel with low chromium content excellent in the corrosion resistance of repeatedly heat-affected zones and process for production thereof

PatentWO2008004684A1

Innovation

- A low chromium-containing stainless steel composition with specific element ratios, including Ti, Nb, and controlled Cr concentration, combined with optimized heat treatment and hot rolling processes, to enhance intergranular corrosion resistance and prevent preferential corrosion, while maintaining strength and ductility.

Chromium-added titanium alloy having stress corrosion resistance and manufacturing method therefor

PatentWO2024075894A1

Innovation

- A chromium-added titanium alloy with a composition of 2.5 to 4.5% Cr, 5.0 to 5.5% Al, and 3.5 to 3.8% V, balanced with Ti and inevitable impurities, is manufactured using a method involving hot forging and air cooling to form a composite phase of α and β phases, enhancing mechanical strength and corrosion resistance.

Environmental Impact and Sustainability Considerations

The environmental footprint of chromium extraction and processing represents a significant concern in the metals industry. Traditional chromium mining operations are associated with substantial land degradation, water pollution, and energy consumption. Recent life cycle assessments indicate that producing one ton of ferrochromium—the primary input for chromium in stainless steel—generates approximately 3-4 tons of CO2 equivalent emissions, significantly higher than many other alloying elements.

Titanium alloy production presents a different environmental profile. While titanium extraction through the Kroll process is energy-intensive, consuming approximately 100-200 kWh per kilogram of titanium, the metal's exceptional durability and corrosion resistance result in longer product lifecycles that may offset initial environmental costs. Furthermore, titanium's lower density compared to steel reduces transportation-related emissions throughout the supply chain.

Regulatory frameworks worldwide are increasingly targeting hexavalent chromium compounds, classified as carcinogenic by multiple environmental protection agencies. The European Union's REACH regulation and similar initiatives in North America have accelerated research into reduced-chromium stainless steel formulations. These regulatory pressures have stimulated innovation in both material science and manufacturing processes, with several major steel producers developing proprietary low-chromium alloys that maintain corrosion resistance through alternative microstructural engineering.

Recycling efficiency represents another critical sustainability factor. Stainless steel boasts impressive recycling rates of 80-90% in developed economies, with minimal quality degradation through multiple recycling cycles. Titanium recycling, while technically feasible, faces challenges including contamination concerns and complex separation requirements, resulting in lower overall recycling rates of approximately 50-60%.

Water usage patterns differ significantly between these material systems. Chromium processing typically requires 40-60 cubic meters of water per ton of finished product, with potential for toxic chromium leaching into watersheds. Titanium production generally consumes less water but generates different effluent profiles requiring specialized treatment protocols.

Emerging trends indicate a shift toward more sustainable practices in both material systems. Advanced chromium recovery technologies are reducing primary extraction requirements, while innovations in titanium production, such as the FFC Cambridge process, promise energy reductions of up to 50% compared to conventional methods. Additionally, computational materials science is enabling the development of novel alloy compositions that maintain performance while reducing dependence on environmentally problematic elements.

Titanium alloy production presents a different environmental profile. While titanium extraction through the Kroll process is energy-intensive, consuming approximately 100-200 kWh per kilogram of titanium, the metal's exceptional durability and corrosion resistance result in longer product lifecycles that may offset initial environmental costs. Furthermore, titanium's lower density compared to steel reduces transportation-related emissions throughout the supply chain.

Regulatory frameworks worldwide are increasingly targeting hexavalent chromium compounds, classified as carcinogenic by multiple environmental protection agencies. The European Union's REACH regulation and similar initiatives in North America have accelerated research into reduced-chromium stainless steel formulations. These regulatory pressures have stimulated innovation in both material science and manufacturing processes, with several major steel producers developing proprietary low-chromium alloys that maintain corrosion resistance through alternative microstructural engineering.

Recycling efficiency represents another critical sustainability factor. Stainless steel boasts impressive recycling rates of 80-90% in developed economies, with minimal quality degradation through multiple recycling cycles. Titanium recycling, while technically feasible, faces challenges including contamination concerns and complex separation requirements, resulting in lower overall recycling rates of approximately 50-60%.

Water usage patterns differ significantly between these material systems. Chromium processing typically requires 40-60 cubic meters of water per ton of finished product, with potential for toxic chromium leaching into watersheds. Titanium production generally consumes less water but generates different effluent profiles requiring specialized treatment protocols.

Emerging trends indicate a shift toward more sustainable practices in both material systems. Advanced chromium recovery technologies are reducing primary extraction requirements, while innovations in titanium production, such as the FFC Cambridge process, promise energy reductions of up to 50% compared to conventional methods. Additionally, computational materials science is enabling the development of novel alloy compositions that maintain performance while reducing dependence on environmentally problematic elements.

Supply Chain Resilience for Critical Alloying Elements

The global supply chain for critical alloying elements used in stainless steels and titanium alloys faces unprecedented challenges amid geopolitical tensions, resource nationalism, and increasing demand from emerging technologies. Chromium, essential for stainless steel production, and titanium, the base for high-performance alloys, both rely on complex, vulnerable supply networks that span multiple continents and political jurisdictions.

Recent disruptions have highlighted the fragility of these supply chains. The COVID-19 pandemic caused significant bottlenecks in chromium production, with South Africa—responsible for approximately 60% of global chromium supply—experiencing severe mining restrictions and export limitations. Similarly, titanium supply chains were disrupted when sanctions affected Russian exports, which account for approximately 20% of global titanium sponge production.

Material manufacturers are increasingly implementing diversification strategies to mitigate these vulnerabilities. Companies like Outokumpu and Acerinox have established multi-sourcing policies for chromium, maintaining relationships with suppliers across different geographical regions including Kazakhstan, India, and Zimbabwe alongside traditional South African sources. For titanium, aerospace manufacturers have expanded supplier networks beyond traditional sources in Russia and China to include emerging producers in Vietnam and Saudi Arabia.

Vertical integration has emerged as another resilience strategy. ThyssenKrupp's acquisition of chromite mining operations in Zimbabwe represents a trend of steel producers securing upstream resources. Similarly, titanium processor TIMET has invested in rutile mining operations to ensure stable titanium feedstock availability, reducing dependency on external suppliers during market volatility.

Technological innovation is creating additional pathways to supply chain resilience. Reduced-chromium stainless steel grades maintain corrosion resistance while decreasing dependency on chromium inputs by 15-25% through precise alloying with nitrogen and molybdenum. In titanium production, improved recycling technologies have increased scrap utilization rates from 30% to over 50% in new aerospace components, creating a circular economy buffer against raw material shortages.

Stockpiling practices have evolved from traditional inventory management to sophisticated strategic reserves. The EU's Critical Raw Materials Act now classifies both chromium and titanium as strategic materials, encouraging member states to maintain minimum reserves. Japan's JOGMEC has expanded its national stockpile of these metals to cover 90 days of industrial consumption, setting a benchmark that other nations are following.

Looking forward, synthetic alternatives and material substitution represent promising long-term resilience strategies. Research into chromium-free stainless steel alternatives using silicon-aluminum alloys has progressed to pilot production stage. Meanwhile, carbon fiber composites continue to replace titanium in certain aerospace and automotive applications, reducing pressure on titanium supply chains during periods of constraint.

Recent disruptions have highlighted the fragility of these supply chains. The COVID-19 pandemic caused significant bottlenecks in chromium production, with South Africa—responsible for approximately 60% of global chromium supply—experiencing severe mining restrictions and export limitations. Similarly, titanium supply chains were disrupted when sanctions affected Russian exports, which account for approximately 20% of global titanium sponge production.

Material manufacturers are increasingly implementing diversification strategies to mitigate these vulnerabilities. Companies like Outokumpu and Acerinox have established multi-sourcing policies for chromium, maintaining relationships with suppliers across different geographical regions including Kazakhstan, India, and Zimbabwe alongside traditional South African sources. For titanium, aerospace manufacturers have expanded supplier networks beyond traditional sources in Russia and China to include emerging producers in Vietnam and Saudi Arabia.

Vertical integration has emerged as another resilience strategy. ThyssenKrupp's acquisition of chromite mining operations in Zimbabwe represents a trend of steel producers securing upstream resources. Similarly, titanium processor TIMET has invested in rutile mining operations to ensure stable titanium feedstock availability, reducing dependency on external suppliers during market volatility.

Technological innovation is creating additional pathways to supply chain resilience. Reduced-chromium stainless steel grades maintain corrosion resistance while decreasing dependency on chromium inputs by 15-25% through precise alloying with nitrogen and molybdenum. In titanium production, improved recycling technologies have increased scrap utilization rates from 30% to over 50% in new aerospace components, creating a circular economy buffer against raw material shortages.

Stockpiling practices have evolved from traditional inventory management to sophisticated strategic reserves. The EU's Critical Raw Materials Act now classifies both chromium and titanium as strategic materials, encouraging member states to maintain minimum reserves. Japan's JOGMEC has expanded its national stockpile of these metals to cover 90 days of industrial consumption, setting a benchmark that other nations are following.

Looking forward, synthetic alternatives and material substitution represent promising long-term resilience strategies. Research into chromium-free stainless steel alternatives using silicon-aluminum alloys has progressed to pilot production stage. Meanwhile, carbon fiber composites continue to replace titanium in certain aerospace and automotive applications, reducing pressure on titanium supply chains during periods of constraint.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!