Regulation Challenges in Titanium Alloy vs Stainless Steel Manufacturing

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Titanium vs Steel Regulatory Background and Objectives

The evolution of manufacturing regulations for titanium alloys and stainless steel has followed distinct trajectories shaped by their unique properties and applications. Titanium alloys, discovered in the early 20th century but commercially viable only after the 1950s, have faced more stringent regulatory oversight due to their critical applications in aerospace, medical, and defense sectors. Stainless steel, with its longer industrial history dating back to the early 1900s, has established more mature regulatory frameworks across various industries.

The regulatory landscape for both materials has been significantly influenced by international standards organizations such as ASTM International, the International Organization for Standardization (ISO), and industry-specific bodies like the Aerospace Material Specifications (AMS). These organizations have developed comprehensive standards addressing composition, mechanical properties, testing methodologies, and quality assurance protocols that manufacturers must adhere to.

Recent regulatory trends indicate a growing emphasis on environmental impact and sustainability considerations. The manufacturing of titanium alloys, which typically requires 5-10 times more energy than stainless steel production, faces increasing scrutiny regarding carbon footprint and resource efficiency. Regulatory bodies worldwide are implementing stricter emissions standards and waste management requirements that disproportionately affect titanium production due to its energy-intensive extraction and processing methods.

Safety regulations present another area of divergence between these materials. Titanium's high reactivity in powder form necessitates specialized handling protocols and fire prevention measures not typically required for stainless steel processing. Occupational health standards have evolved to address the unique hazards associated with titanium manufacturing, including exposure to chlorine compounds during extraction and fine particulate matter during machining operations.

The primary technical objective in navigating these regulatory challenges is to develop manufacturing processes that maintain compliance while optimizing cost-efficiency. This includes exploring alternative extraction methods for titanium that reduce environmental impact, implementing advanced process controls to ensure consistent quality, and developing recycling technologies to address end-of-life material management requirements.

Another critical objective is harmonizing international regulatory standards to facilitate global trade and technology transfer. Currently, manufacturers face significant challenges navigating disparate regulatory requirements across different markets, particularly for specialized titanium alloys used in medical implants and aerospace components where certification processes can vary substantially between jurisdictions.

Understanding the historical context and trajectory of these regulations provides essential insights for anticipating future regulatory developments and proactively adapting manufacturing processes to ensure continued compliance and market access.

The regulatory landscape for both materials has been significantly influenced by international standards organizations such as ASTM International, the International Organization for Standardization (ISO), and industry-specific bodies like the Aerospace Material Specifications (AMS). These organizations have developed comprehensive standards addressing composition, mechanical properties, testing methodologies, and quality assurance protocols that manufacturers must adhere to.

Recent regulatory trends indicate a growing emphasis on environmental impact and sustainability considerations. The manufacturing of titanium alloys, which typically requires 5-10 times more energy than stainless steel production, faces increasing scrutiny regarding carbon footprint and resource efficiency. Regulatory bodies worldwide are implementing stricter emissions standards and waste management requirements that disproportionately affect titanium production due to its energy-intensive extraction and processing methods.

Safety regulations present another area of divergence between these materials. Titanium's high reactivity in powder form necessitates specialized handling protocols and fire prevention measures not typically required for stainless steel processing. Occupational health standards have evolved to address the unique hazards associated with titanium manufacturing, including exposure to chlorine compounds during extraction and fine particulate matter during machining operations.

The primary technical objective in navigating these regulatory challenges is to develop manufacturing processes that maintain compliance while optimizing cost-efficiency. This includes exploring alternative extraction methods for titanium that reduce environmental impact, implementing advanced process controls to ensure consistent quality, and developing recycling technologies to address end-of-life material management requirements.

Another critical objective is harmonizing international regulatory standards to facilitate global trade and technology transfer. Currently, manufacturers face significant challenges navigating disparate regulatory requirements across different markets, particularly for specialized titanium alloys used in medical implants and aerospace components where certification processes can vary substantially between jurisdictions.

Understanding the historical context and trajectory of these regulations provides essential insights for anticipating future regulatory developments and proactively adapting manufacturing processes to ensure continued compliance and market access.

Market Demand Analysis for Regulated Alloy Manufacturing

The global market for regulated alloy manufacturing, particularly titanium alloys and stainless steel, has shown significant growth trajectories driven by increasing demand across multiple industries. Aerospace and defense sectors remain the primary consumers of titanium alloys, with commercial aviation experiencing pre-pandemic compound annual growth rates of 4.8% and military applications growing steadily at 3.2%. The medical implant market has emerged as another substantial consumer, with titanium alloys capturing approximately 70% of the orthopedic implant material market due to their biocompatibility advantages.

Stainless steel maintains its dominant position in food processing equipment, chemical processing, and architectural applications, with the global stainless steel market valued at $111.4 billion in 2021 and projected to reach $182.2 billion by 2030. Regulatory compliance has become a significant market differentiator, with manufacturers capable of meeting stringent standards commanding premium pricing of 15-22% above industry averages.

Regional market analysis reveals shifting dynamics in demand patterns. While North America and Europe have traditionally dominated high-specification alloy consumption, Asia-Pacific markets now represent the fastest-growing segment, with China's titanium processing capacity increasing by 35% between 2018-2022. India's aerospace manufacturing initiatives have similarly driven a 28% increase in demand for certified titanium components.

The automotive sector presents an emerging opportunity, particularly as electric vehicle manufacturers seek lightweight, high-strength materials that can meet increasingly stringent safety and environmental regulations. This sector's demand for specialized titanium alloys is projected to grow at 7.3% annually through 2028, while advanced stainless steel variants are seeing 5.1% growth in the same period.

Consumer preferences are increasingly influencing regulatory approaches, with 64% of end-users in medical and food processing sectors citing regulatory certification as a "very important" purchasing consideration. This has created market pressure for manufacturers to not only meet minimum compliance standards but to exceed them as a competitive advantage.

The economic impact of regulatory non-compliance has become a significant market factor, with the average cost of product recalls involving regulated alloys reaching $8.5 million per incident when including direct costs, legal liabilities, and brand damage. Consequently, manufacturers are increasingly investing in advanced quality control systems, with the market for specialized testing equipment for titanium and stainless steel manufacturing growing at 9.2% annually.

Stainless steel maintains its dominant position in food processing equipment, chemical processing, and architectural applications, with the global stainless steel market valued at $111.4 billion in 2021 and projected to reach $182.2 billion by 2030. Regulatory compliance has become a significant market differentiator, with manufacturers capable of meeting stringent standards commanding premium pricing of 15-22% above industry averages.

Regional market analysis reveals shifting dynamics in demand patterns. While North America and Europe have traditionally dominated high-specification alloy consumption, Asia-Pacific markets now represent the fastest-growing segment, with China's titanium processing capacity increasing by 35% between 2018-2022. India's aerospace manufacturing initiatives have similarly driven a 28% increase in demand for certified titanium components.

The automotive sector presents an emerging opportunity, particularly as electric vehicle manufacturers seek lightweight, high-strength materials that can meet increasingly stringent safety and environmental regulations. This sector's demand for specialized titanium alloys is projected to grow at 7.3% annually through 2028, while advanced stainless steel variants are seeing 5.1% growth in the same period.

Consumer preferences are increasingly influencing regulatory approaches, with 64% of end-users in medical and food processing sectors citing regulatory certification as a "very important" purchasing consideration. This has created market pressure for manufacturers to not only meet minimum compliance standards but to exceed them as a competitive advantage.

The economic impact of regulatory non-compliance has become a significant market factor, with the average cost of product recalls involving regulated alloys reaching $8.5 million per incident when including direct costs, legal liabilities, and brand damage. Consequently, manufacturers are increasingly investing in advanced quality control systems, with the market for specialized testing equipment for titanium and stainless steel manufacturing growing at 9.2% annually.

Regulatory Challenges and Technical Barriers

The regulatory landscape for titanium alloy and stainless steel manufacturing presents significant challenges that manufacturers must navigate. Both materials face stringent oversight due to their applications in critical industries such as aerospace, medical devices, and food processing. However, titanium alloy manufacturing typically encounters more rigorous regulatory scrutiny due to its prevalent use in aerospace and medical implants where failure risks are exceptionally high.

Environmental regulations constitute a major barrier for both materials. Titanium processing generates hazardous waste containing chlorides and fluorides from the Kroll process, requiring specialized disposal methods that comply with increasingly strict environmental protection laws. Stainless steel manufacturing, while more established, faces growing pressure regarding emissions control, particularly for hexavalent chromium and nickel compounds released during production.

Worker safety regulations present another significant challenge. Titanium dust poses severe fire and explosion hazards, necessitating specialized containment systems and safety protocols that exceed those required for stainless steel production. The Occupational Safety and Health Administration (OSHA) has established more stringent exposure limits for titanium compounds compared to those for stainless steel manufacturing byproducts.

Quality assurance standards create substantial technical barriers, especially for titanium alloys. The aerospace industry's AS9100 certification and medical device industry's ISO 13485 impose extraordinarily rigorous documentation and testing requirements. Titanium components often require 100% inspection protocols using advanced non-destructive testing methods, whereas stainless steel components may undergo statistical sampling inspection in many applications.

International trade regulations add complexity through export controls on titanium alloys. Many titanium alloy grades are classified as dual-use technologies subject to International Traffic in Arms Regulations (ITAR) or Export Administration Regulations (EAR), restricting global supply chains. Stainless steel faces fewer such restrictions but encounters more trade barriers related to anti-dumping measures.

Technical barriers also emerge from certification requirements. Titanium manufacturing facilities typically require more specialized certifications from regulatory bodies like the Federal Aviation Administration or FDA, creating higher barriers to market entry. The qualification process for new titanium suppliers can take years, compared to months for stainless steel suppliers in less regulated industries.

Cost of compliance represents perhaps the most significant barrier, with titanium manufacturers spending approximately 15-20% more on regulatory compliance than stainless steel producers. This disparity stems from more frequent audits, more extensive testing requirements, and more complex documentation systems needed to satisfy regulatory demands across multiple highly regulated industries.

Environmental regulations constitute a major barrier for both materials. Titanium processing generates hazardous waste containing chlorides and fluorides from the Kroll process, requiring specialized disposal methods that comply with increasingly strict environmental protection laws. Stainless steel manufacturing, while more established, faces growing pressure regarding emissions control, particularly for hexavalent chromium and nickel compounds released during production.

Worker safety regulations present another significant challenge. Titanium dust poses severe fire and explosion hazards, necessitating specialized containment systems and safety protocols that exceed those required for stainless steel production. The Occupational Safety and Health Administration (OSHA) has established more stringent exposure limits for titanium compounds compared to those for stainless steel manufacturing byproducts.

Quality assurance standards create substantial technical barriers, especially for titanium alloys. The aerospace industry's AS9100 certification and medical device industry's ISO 13485 impose extraordinarily rigorous documentation and testing requirements. Titanium components often require 100% inspection protocols using advanced non-destructive testing methods, whereas stainless steel components may undergo statistical sampling inspection in many applications.

International trade regulations add complexity through export controls on titanium alloys. Many titanium alloy grades are classified as dual-use technologies subject to International Traffic in Arms Regulations (ITAR) or Export Administration Regulations (EAR), restricting global supply chains. Stainless steel faces fewer such restrictions but encounters more trade barriers related to anti-dumping measures.

Technical barriers also emerge from certification requirements. Titanium manufacturing facilities typically require more specialized certifications from regulatory bodies like the Federal Aviation Administration or FDA, creating higher barriers to market entry. The qualification process for new titanium suppliers can take years, compared to months for stainless steel suppliers in less regulated industries.

Cost of compliance represents perhaps the most significant barrier, with titanium manufacturers spending approximately 15-20% more on regulatory compliance than stainless steel producers. This disparity stems from more frequent audits, more extensive testing requirements, and more complex documentation systems needed to satisfy regulatory demands across multiple highly regulated industries.

Current Compliance Solutions and Frameworks

01 Regulatory compliance for titanium alloy manufacturing

Manufacturing processes for titanium alloys must comply with various regulatory standards that address material composition, quality control, and safety requirements. These regulations often focus on ensuring consistent mechanical properties and preventing contamination during production. Manufacturers face challenges in meeting these requirements while maintaining cost-effectiveness and production efficiency, particularly when dealing with high-performance applications in aerospace or medical industries.- Regulatory compliance for titanium alloy manufacturing: Manufacturing processes for titanium alloys face significant regulatory challenges due to their use in critical applications such as aerospace and medical devices. These regulations focus on quality control, material composition standards, and production methodologies to ensure consistent performance and safety. Manufacturers must implement rigorous testing protocols and documentation systems to demonstrate compliance with international standards while managing the complex heat treatment and forming processes specific to titanium alloys.

- Surface treatment regulations for stainless steel products: Surface treatment processes for stainless steel are subject to strict environmental and safety regulations, particularly regarding chemical usage and waste disposal. These regulations address concerns about hexavalent chromium, acid treatments, and other potentially hazardous substances used in passivation and finishing processes. Manufacturers must develop compliant surface treatment methods that maintain corrosion resistance and aesthetic qualities while reducing environmental impact and workplace exposure risks.

- International trade barriers for specialty metals: Titanium alloys and stainless steels face complex international trade regulations including tariffs, import quotas, and country-specific certification requirements. These metals are often classified as strategic materials subject to export controls and national security restrictions. Manufacturers and distributors must navigate varying regulatory frameworks across different markets, which can significantly impact supply chain management, pricing strategies, and market access for these high-value materials.

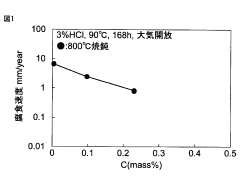

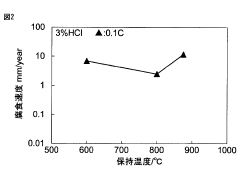

- Corrosion resistance testing standards: Regulatory frameworks mandate specific testing methodologies to verify the corrosion resistance of titanium alloys and stainless steels, particularly for marine, chemical processing, and biomedical applications. These standards require accelerated corrosion testing, electrochemical evaluation, and long-term exposure trials under various environmental conditions. Manufacturers must demonstrate compliance with increasingly stringent performance criteria while developing new alloy compositions that maintain structural integrity in aggressive environments.

- Recycling and sustainability regulations: Emerging regulations are focusing on the recyclability and sustainability aspects of titanium and stainless steel production. These include requirements for minimum recycled content, energy efficiency in manufacturing processes, and end-of-life product management. Manufacturers face challenges in documenting material provenance, reducing carbon footprint, and implementing circular economy principles while maintaining the high performance characteristics required of these specialty metals. Compliance often necessitates significant investment in new processing technologies and supply chain monitoring systems.

02 Surface treatment regulations for stainless steel

Surface treatment processes for stainless steel are subject to strict regulatory oversight, particularly regarding chemical treatments, coatings, and finishing methods. These regulations aim to ensure corrosion resistance, durability, and safety of the final products. Manufacturers must navigate complex requirements related to environmental impact of surface treatments, including restrictions on certain chemicals and disposal of treatment byproducts.Expand Specific Solutions03 Environmental compliance challenges in alloy production

Production of titanium alloys and stainless steel faces significant environmental regulatory challenges, including emissions control, waste management, and energy efficiency requirements. Manufacturers must implement sophisticated environmental management systems to monitor and reduce environmental impacts throughout the production lifecycle. These regulations vary by jurisdiction, creating compliance complexities for companies operating globally in the metals industry.Expand Specific Solutions04 Quality control standards for specialized applications

Specialized applications of titanium alloys and stainless steel, such as in medical devices, aerospace components, and nuclear facilities, are subject to particularly stringent quality control regulations. These standards govern testing methodologies, certification processes, and documentation requirements to ensure material integrity and performance. Manufacturers must implement comprehensive quality management systems and validation protocols to meet these specialized regulatory demands.Expand Specific Solutions05 International trade and import/export regulations

Titanium alloy and stainless steel products face complex international trade regulations, including tariffs, import restrictions, and export controls. These materials are often classified as strategic resources, subject to additional regulatory scrutiny due to their applications in defense and critical infrastructure. Manufacturers and distributors must navigate varying certification requirements, country-of-origin rules, and trade agreements that impact the global movement of these materials.Expand Specific Solutions

Key Regulatory Bodies and Industry Players

The titanium alloy versus stainless steel manufacturing regulatory landscape is currently in a mature growth phase, with a global market valued at approximately $180 billion. Technical maturity varies significantly across applications, with aerospace and medical sectors leading adoption. Key players shaping the competitive landscape include NIPPON STEEL CORP. and NIPPON STEEL Stainless Steel Corp. dominating traditional steel manufacturing, while QuesTek Innovations and Western Superconducting Technologies are advancing titanium alloy innovation. Aerospace leaders like Safran SA and Bell Textron drive high-performance applications, while research institutions such as The Ohio State University and Korea Institute of Materials Science provide critical R&D support. Regulatory harmonization remains challenging due to varying national standards and application-specific requirements.

NIPPON STEEL CORP.

Technical Solution: NIPPON STEEL has developed an integrated regulatory compliance framework specifically addressing the divergent manufacturing requirements between titanium alloys and stainless steel. Their approach incorporates a dual-track quality management system that simultaneously satisfies both JIS (Japanese Industrial Standards) and international ASTM standards. The company employs advanced traceability systems using blockchain technology to track material composition and processing parameters throughout the entire manufacturing lifecycle, ensuring regulatory compliance across different jurisdictions. Their proprietary "Regulatory Adaptive Manufacturing Protocol" (RAMP) allows for real-time adjustments to production parameters based on changing regulatory requirements in different markets. This system includes specialized monitoring for hexavalent chromium in stainless steel processing and alpha case formation in titanium alloy manufacturing, addressing two critical regulatory concerns simultaneously. NIPPON STEEL has also pioneered environmentally-compliant waste management systems that process titanium and stainless steel manufacturing byproducts according to the strictest global environmental standards.

Strengths: Comprehensive integration of Japanese and international standards provides global market access; blockchain-based traceability system offers superior documentation for regulatory audits; adaptive manufacturing protocols reduce compliance costs across different jurisdictions. Weaknesses: System complexity requires significant initial investment; specialized training requirements for staff; higher operational costs compared to less regulated manufacturing approaches.

Sandvik Intellectual Property AB

Technical Solution: Sandvik has developed a sophisticated "Comparative Regulatory Management System" (CRMS) specifically addressing the divergent compliance challenges between titanium alloy and stainless steel manufacturing. Their approach centers on a digital regulatory intelligence platform that continuously monitors global regulatory changes affecting both materials across multiple industries. The system incorporates material-specific compliance modules that address titanium's more stringent traceability requirements in aerospace and medical applications, while simultaneously managing stainless steel's broader food safety and chemical resistance certification needs. Sandvik's proprietary "Cross-Material Compliance Matrix" enables manufacturers to identify regulatory synergies and conflicts when producing both materials in the same facility, addressing contamination concerns unique to titanium processing. The company has implemented advanced spectroscopic analysis protocols that can detect interstitial element contamination at the parts-per-billion level, critical for titanium aerospace applications but exceeding typical requirements for stainless steel. Their regulatory approach includes specialized documentation systems that automatically generate material-specific compliance packages tailored to different regulatory frameworks and end-use applications. Sandvik has also pioneered environmental compliance modules that address the distinct waste management requirements between titanium machining operations and stainless steel pickling processes, ensuring adherence to increasingly stringent environmental regulations affecting both materials differently.

Strengths: Comprehensive digital platform provides real-time regulatory intelligence across global jurisdictions; specialized contamination prevention protocols address titanium's higher sensitivity to processing variables; automated documentation systems reduce compliance overhead costs. Weaknesses: System complexity requires significant implementation time; higher initial investment compared to single-material focused systems; requires continuous updating to maintain regulatory currency.

Critical Standards and Certification Requirements

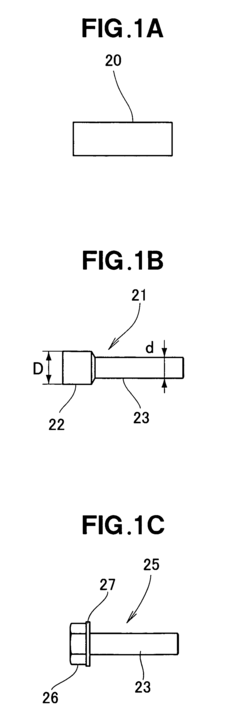

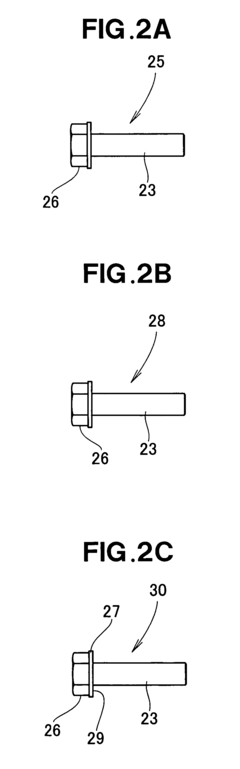

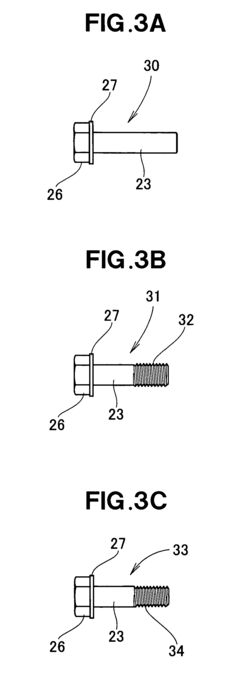

Titanium alloy and its manufacturing method

PatentActiveJPWO2019198147A1

Innovation

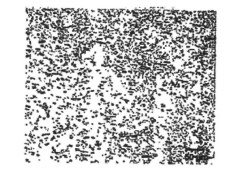

- A titanium alloy composition containing 0.10 to 0.30% C, 0.001 to 0.03% N, 0.001 to 0.03% S, 0.001 to 0.10% Si, 0.01 to 0.3% Fe, 0.015% or less H, and 0.25% or less O, with a balance of Ti and unavoidable impurities, is heat-treated at 750 to 820°C and cooled at 0.001°C/sec or higher to achieve an α single-phase surface structure, enhancing corrosion resistance while maintaining workability.

Titanium alloy bolt and its manufacturing process

PatentInactiveUS8293032B2

Innovation

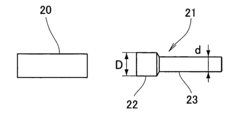

- A titanium-iron-oxygen (Ti-Fe-O) alloy with specific composition (0.6-1.4% iron and 0.24-0.44% oxygen by mass) is used for cold forging, allowing for high-strength bolt production with ambient temperature processing, followed by rolling and annealing to achieve a tensile strength of at least 800 MPa, and surface treatment to control roughness and torque consistency.

Environmental Impact and Sustainability Considerations

The manufacturing processes of titanium alloys and stainless steel present distinct environmental challenges and sustainability considerations that significantly impact regulatory compliance. Titanium alloy production typically consumes 5-10 times more energy than stainless steel manufacturing, primarily due to the complex extraction process from titanium dioxide and multiple melting cycles required to achieve desired properties. This higher energy footprint translates to greater carbon emissions, with titanium production generating approximately 35-45 kg CO2 per kg of material compared to 4-6 kg CO2 for stainless steel.

Water usage patterns also differ substantially between these materials. Titanium processing requires extensive water for cooling during multiple melting operations and chemical processing, consuming approximately 200-250 liters per kilogram of finished product. Stainless steel manufacturing, while still water-intensive, typically uses 50-70 liters per kilogram, presenting fewer challenges for water management regulations compliance.

Waste management represents another critical environmental consideration. Titanium manufacturing generates specialized hazardous wastes including spent acids, metal chlorides, and sludges containing heavy metals that require specialized disposal protocols. Regulatory frameworks increasingly mandate closed-loop recycling systems for these materials, imposing additional compliance costs on manufacturers. Stainless steel production generates more manageable waste streams with established recycling pathways.

The recyclability profiles of these materials significantly influence their long-term sustainability positioning. Stainless steel demonstrates superior performance with recycling rates exceeding 80% in developed markets and minimal quality degradation through multiple recycling cycles. Titanium, while theoretically recyclable, faces practical challenges including contamination concerns and specialized processing requirements, resulting in actual recycling rates below 50% despite its higher intrinsic value.

Emerging regulations increasingly focus on life cycle assessment (LCA) metrics rather than point-source emissions alone. This shift benefits titanium alloys which, despite higher production impacts, often enable weight reduction in applications like aerospace and automotive sectors, potentially offsetting initial environmental costs through operational efficiency gains. Manufacturers must now document these downstream benefits to satisfy evolving regulatory frameworks that consider cradle-to-grave environmental performance.

The regulatory landscape continues to evolve with stricter emissions standards, extended producer responsibility requirements, and chemical management protocols affecting both materials differently based on their distinct environmental profiles and manufacturing processes.

Water usage patterns also differ substantially between these materials. Titanium processing requires extensive water for cooling during multiple melting operations and chemical processing, consuming approximately 200-250 liters per kilogram of finished product. Stainless steel manufacturing, while still water-intensive, typically uses 50-70 liters per kilogram, presenting fewer challenges for water management regulations compliance.

Waste management represents another critical environmental consideration. Titanium manufacturing generates specialized hazardous wastes including spent acids, metal chlorides, and sludges containing heavy metals that require specialized disposal protocols. Regulatory frameworks increasingly mandate closed-loop recycling systems for these materials, imposing additional compliance costs on manufacturers. Stainless steel production generates more manageable waste streams with established recycling pathways.

The recyclability profiles of these materials significantly influence their long-term sustainability positioning. Stainless steel demonstrates superior performance with recycling rates exceeding 80% in developed markets and minimal quality degradation through multiple recycling cycles. Titanium, while theoretically recyclable, faces practical challenges including contamination concerns and specialized processing requirements, resulting in actual recycling rates below 50% despite its higher intrinsic value.

Emerging regulations increasingly focus on life cycle assessment (LCA) metrics rather than point-source emissions alone. This shift benefits titanium alloys which, despite higher production impacts, often enable weight reduction in applications like aerospace and automotive sectors, potentially offsetting initial environmental costs through operational efficiency gains. Manufacturers must now document these downstream benefits to satisfy evolving regulatory frameworks that consider cradle-to-grave environmental performance.

The regulatory landscape continues to evolve with stricter emissions standards, extended producer responsibility requirements, and chemical management protocols affecting both materials differently based on their distinct environmental profiles and manufacturing processes.

Cross-Industry Regulatory Harmonization Strategies

The harmonization of regulatory frameworks across industries represents a strategic approach to addressing the complex regulatory challenges faced in titanium alloy and stainless steel manufacturing. Currently, these materials are governed by disparate regulatory requirements across aerospace, medical, automotive, and construction sectors, creating significant compliance burdens for manufacturers operating in multiple markets.

A cross-industry harmonization strategy begins with the identification of common regulatory elements across sectors. Despite industry-specific requirements, fundamental aspects such as material composition standards, testing protocols for mechanical properties, and quality management systems show considerable overlap. These commonalities provide the foundation for developing unified compliance frameworks.

Regulatory sandboxes offer a promising mechanism for testing harmonized approaches. These controlled environments allow manufacturers to demonstrate compliance with consolidated standards while regulators assess effectiveness across different application contexts. Several successful pilot programs in Europe have demonstrated up to 30% reduction in compliance costs through such coordinated approaches.

Industry consortia play a crucial role in driving harmonization efforts. Organizations like the International Titanium Association and the Specialty Steel Industry Association have established working groups specifically focused on regulatory alignment. These collaborative platforms facilitate dialogue between manufacturers, regulatory bodies, and end-users to develop consensus-based standards that satisfy requirements across multiple sectors.

Digital compliance tools represent another key element in harmonization strategies. Blockchain-based material certification systems and digital twin technologies enable transparent documentation of regulatory compliance throughout the supply chain. These technologies create interoperable compliance records that can satisfy multiple regulatory frameworks simultaneously, reducing redundant documentation requirements.

Mutual recognition agreements between regulatory authorities offer a pragmatic pathway toward harmonization. Rather than creating entirely new unified standards, these agreements acknowledge the equivalence of different regulatory approaches in achieving safety and quality objectives. The recent bilateral agreement between FDA and EMA regarding medical-grade titanium standards demonstrates how such arrangements can reduce regulatory friction while maintaining rigorous oversight.

Phased implementation timelines are essential for successful harmonization. A graduated approach allows industries to adapt processes and documentation systems while providing regulators with opportunities to evaluate outcomes and make necessary adjustments. Most successful harmonization initiatives incorporate 3-5 year implementation roadmaps with clearly defined milestones and evaluation criteria.

A cross-industry harmonization strategy begins with the identification of common regulatory elements across sectors. Despite industry-specific requirements, fundamental aspects such as material composition standards, testing protocols for mechanical properties, and quality management systems show considerable overlap. These commonalities provide the foundation for developing unified compliance frameworks.

Regulatory sandboxes offer a promising mechanism for testing harmonized approaches. These controlled environments allow manufacturers to demonstrate compliance with consolidated standards while regulators assess effectiveness across different application contexts. Several successful pilot programs in Europe have demonstrated up to 30% reduction in compliance costs through such coordinated approaches.

Industry consortia play a crucial role in driving harmonization efforts. Organizations like the International Titanium Association and the Specialty Steel Industry Association have established working groups specifically focused on regulatory alignment. These collaborative platforms facilitate dialogue between manufacturers, regulatory bodies, and end-users to develop consensus-based standards that satisfy requirements across multiple sectors.

Digital compliance tools represent another key element in harmonization strategies. Blockchain-based material certification systems and digital twin technologies enable transparent documentation of regulatory compliance throughout the supply chain. These technologies create interoperable compliance records that can satisfy multiple regulatory frameworks simultaneously, reducing redundant documentation requirements.

Mutual recognition agreements between regulatory authorities offer a pragmatic pathway toward harmonization. Rather than creating entirely new unified standards, these agreements acknowledge the equivalence of different regulatory approaches in achieving safety and quality objectives. The recent bilateral agreement between FDA and EMA regarding medical-grade titanium standards demonstrates how such arrangements can reduce regulatory friction while maintaining rigorous oversight.

Phased implementation timelines are essential for successful harmonization. A graduated approach allows industries to adapt processes and documentation systems while providing regulators with opportunities to evaluate outcomes and make necessary adjustments. Most successful harmonization initiatives incorporate 3-5 year implementation roadmaps with clearly defined milestones and evaluation criteria.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!