Evaluation of Safety Standards for Titanium Alloy vs Stainless Steel in Aviation

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Aviation Alloy Evolution and Safety Objectives

The evolution of materials in aviation has been a continuous journey of innovation driven by the need for enhanced safety, performance, and efficiency. Since the 1930s, aircraft construction has transitioned from wood and fabric to aluminum alloys, and subsequently to advanced materials including titanium alloys and stainless steel. This evolution has been characterized by a relentless pursuit of materials that offer superior strength-to-weight ratios, corrosion resistance, and thermal stability under extreme operating conditions.

Titanium alloys emerged as significant aviation materials in the 1950s, primarily due to their exceptional strength-to-weight ratio and corrosion resistance. The development of Ti-6Al-4V, an alpha-beta titanium alloy, marked a pivotal moment in aviation material science, offering approximately 40% weight reduction compared to steel while maintaining comparable strength. This alloy currently constitutes approximately 80% of titanium usage in aerospace applications.

Stainless steel, particularly precipitation-hardening grades like 17-4 PH and 15-5 PH, has maintained its relevance in aviation due to its excellent mechanical properties, corrosion resistance, and cost-effectiveness. These materials are predominantly utilized in landing gear components, fasteners, and structural elements where high strength and moderate temperature resistance are required.

The safety objectives governing these materials have evolved significantly over time. Early standards focused primarily on mechanical properties and basic corrosion resistance. However, contemporary safety frameworks encompass a more comprehensive approach, including fatigue behavior, fracture mechanics, environmental degradation mechanisms, and long-term reliability under diverse operating conditions.

The Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA) have established rigorous certification requirements for materials used in critical aircraft components. These include extensive testing protocols for mechanical properties, environmental resistance, and damage tolerance. The introduction of Damage Tolerance Assessment (DTA) methodologies in the 1970s represented a paradigm shift in aviation safety philosophy, acknowledging that materials will inevitably contain flaws and focusing on ensuring that these flaws do not propagate to critical dimensions during the service life of components.

Recent technological advancements have enabled more sophisticated material evaluation techniques, including computational modeling of material behavior under complex loading conditions, advanced non-destructive testing methodologies, and accelerated aging tests that simulate decades of service in compressed timeframes. These developments have significantly enhanced the industry's ability to predict and prevent material-related failures.

The ongoing trend toward more electric aircraft and sustainable aviation has introduced new challenges and opportunities in material selection, with increasing emphasis on electrical conductivity, electromagnetic interference shielding, and environmental impact considerations alongside traditional safety parameters.

Titanium alloys emerged as significant aviation materials in the 1950s, primarily due to their exceptional strength-to-weight ratio and corrosion resistance. The development of Ti-6Al-4V, an alpha-beta titanium alloy, marked a pivotal moment in aviation material science, offering approximately 40% weight reduction compared to steel while maintaining comparable strength. This alloy currently constitutes approximately 80% of titanium usage in aerospace applications.

Stainless steel, particularly precipitation-hardening grades like 17-4 PH and 15-5 PH, has maintained its relevance in aviation due to its excellent mechanical properties, corrosion resistance, and cost-effectiveness. These materials are predominantly utilized in landing gear components, fasteners, and structural elements where high strength and moderate temperature resistance are required.

The safety objectives governing these materials have evolved significantly over time. Early standards focused primarily on mechanical properties and basic corrosion resistance. However, contemporary safety frameworks encompass a more comprehensive approach, including fatigue behavior, fracture mechanics, environmental degradation mechanisms, and long-term reliability under diverse operating conditions.

The Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA) have established rigorous certification requirements for materials used in critical aircraft components. These include extensive testing protocols for mechanical properties, environmental resistance, and damage tolerance. The introduction of Damage Tolerance Assessment (DTA) methodologies in the 1970s represented a paradigm shift in aviation safety philosophy, acknowledging that materials will inevitably contain flaws and focusing on ensuring that these flaws do not propagate to critical dimensions during the service life of components.

Recent technological advancements have enabled more sophisticated material evaluation techniques, including computational modeling of material behavior under complex loading conditions, advanced non-destructive testing methodologies, and accelerated aging tests that simulate decades of service in compressed timeframes. These developments have significantly enhanced the industry's ability to predict and prevent material-related failures.

The ongoing trend toward more electric aircraft and sustainable aviation has introduced new challenges and opportunities in material selection, with increasing emphasis on electrical conductivity, electromagnetic interference shielding, and environmental impact considerations alongside traditional safety parameters.

Market Demand Analysis for Advanced Aviation Materials

The aviation materials market has witnessed significant growth in recent years, driven primarily by increasing aircraft production rates and the growing emphasis on fuel efficiency and safety. The global aerospace materials market was valued at approximately $25.8 billion in 2022, with projections indicating growth to reach $42.4 billion by 2030, representing a CAGR of 6.4% during the forecast period.

Within this expanding market, there is a notable shift toward advanced materials, particularly titanium alloys and high-performance stainless steel variants. Titanium alloys currently account for about 15% of the total aviation materials market, while stainless steel maintains approximately 22% market share. The demand for these materials is directly influenced by aircraft production rates, which have been recovering steadily following the pandemic-induced slowdown.

Commercial aircraft manufacturers have increased their production targets, with Boeing and Airbus collectively planning to deliver over 1,300 aircraft annually by 2025. This production ramp-up is creating substantial demand for both titanium alloys and stainless steel, with particular emphasis on materials that meet enhanced safety standards while offering weight reduction benefits.

The market demand is further segmented by aircraft type, with commercial aviation representing the largest segment at 64% of total demand. Military aircraft account for 28%, while general aviation comprises the remaining 8%. Each segment has distinct requirements regarding material performance, safety standards, and cost considerations.

Regional analysis reveals that North America dominates the market with 38% share, followed by Europe (31%) and Asia-Pacific (24%). However, the fastest growth is occurring in the Asia-Pacific region, where domestic aircraft manufacturing capabilities are expanding rapidly, particularly in China and India.

A significant market driver is the industry's focus on fuel efficiency, with airlines seeking to reduce operating costs and meet increasingly stringent environmental regulations. This has intensified demand for lightweight materials that maintain or exceed current safety standards. Titanium alloys offer a 40% weight reduction compared to steel alternatives, translating to approximately 0.8% fuel savings for every 1% reduction in aircraft weight.

Safety considerations remain paramount, with regulatory bodies including the FAA and EASA continuously updating certification requirements. This has created a distinct market segment for materials that can demonstrate superior performance under extreme conditions, including fire resistance, fatigue strength, and corrosion resistance. Materials that can provide documented safety advantages command premium pricing, with manufacturers willing to pay 15-20% more for materials with proven safety benefits.

Within this expanding market, there is a notable shift toward advanced materials, particularly titanium alloys and high-performance stainless steel variants. Titanium alloys currently account for about 15% of the total aviation materials market, while stainless steel maintains approximately 22% market share. The demand for these materials is directly influenced by aircraft production rates, which have been recovering steadily following the pandemic-induced slowdown.

Commercial aircraft manufacturers have increased their production targets, with Boeing and Airbus collectively planning to deliver over 1,300 aircraft annually by 2025. This production ramp-up is creating substantial demand for both titanium alloys and stainless steel, with particular emphasis on materials that meet enhanced safety standards while offering weight reduction benefits.

The market demand is further segmented by aircraft type, with commercial aviation representing the largest segment at 64% of total demand. Military aircraft account for 28%, while general aviation comprises the remaining 8%. Each segment has distinct requirements regarding material performance, safety standards, and cost considerations.

Regional analysis reveals that North America dominates the market with 38% share, followed by Europe (31%) and Asia-Pacific (24%). However, the fastest growth is occurring in the Asia-Pacific region, where domestic aircraft manufacturing capabilities are expanding rapidly, particularly in China and India.

A significant market driver is the industry's focus on fuel efficiency, with airlines seeking to reduce operating costs and meet increasingly stringent environmental regulations. This has intensified demand for lightweight materials that maintain or exceed current safety standards. Titanium alloys offer a 40% weight reduction compared to steel alternatives, translating to approximately 0.8% fuel savings for every 1% reduction in aircraft weight.

Safety considerations remain paramount, with regulatory bodies including the FAA and EASA continuously updating certification requirements. This has created a distinct market segment for materials that can demonstrate superior performance under extreme conditions, including fire resistance, fatigue strength, and corrosion resistance. Materials that can provide documented safety advantages command premium pricing, with manufacturers willing to pay 15-20% more for materials with proven safety benefits.

Current Status and Challenges in Aviation Alloy Technology

The global aviation industry has witnessed significant advancements in alloy technology over the past decades, with titanium alloys and stainless steel emerging as predominant materials in aircraft construction. Currently, these materials serve different purposes based on their unique properties and performance characteristics under various operating conditions. Titanium alloys, particularly Ti-6Al-4V, have gained prominence in high-stress components due to their exceptional strength-to-weight ratio, while various grades of stainless steel continue to be utilized in structural and non-critical applications.

The current technological landscape reveals a complex interplay between material science innovations and regulatory frameworks governing aviation safety. International bodies such as the Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA) have established comprehensive standards for material qualification, with specific requirements for titanium alloys and stainless steel that differ significantly in testing protocols and acceptance criteria. These standards continue to evolve as new data on material behavior becomes available.

Despite significant progress, the aviation alloy sector faces several critical challenges. Material fatigue remains a primary concern, with both titanium alloys and stainless steel exhibiting different fatigue behaviors under cyclic loading conditions typical in aviation applications. Titanium alloys, while superior in many aspects, present challenges in manufacturing scalability and cost-effectiveness compared to stainless steel alternatives.

Environmental factors pose another significant challenge, particularly regarding galvanic corrosion when these dissimilar metals are used in proximity. The aviation industry continues to grapple with optimizing protection systems that can effectively mitigate corrosion risks while maintaining structural integrity over the aircraft's operational lifetime.

Geographically, the development and production of advanced aviation alloys remain concentrated in North America, Europe, and increasingly in Asia, particularly China and Japan. This distribution creates supply chain vulnerabilities that became evident during recent global disruptions, prompting initiatives to diversify material sourcing and processing capabilities.

Technical standardization presents ongoing challenges, with different regional certification requirements sometimes creating barriers to global implementation of new alloy technologies. The harmonization of these standards represents a significant hurdle that industry stakeholders are actively addressing through international collaboration efforts.

Emerging challenges include the integration of new manufacturing techniques such as additive manufacturing with traditional alloy systems. While these technologies offer promising avenues for complex component production, they introduce new variables in material performance that require extensive validation before widespread adoption in safety-critical aviation applications.

The current technological landscape reveals a complex interplay between material science innovations and regulatory frameworks governing aviation safety. International bodies such as the Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA) have established comprehensive standards for material qualification, with specific requirements for titanium alloys and stainless steel that differ significantly in testing protocols and acceptance criteria. These standards continue to evolve as new data on material behavior becomes available.

Despite significant progress, the aviation alloy sector faces several critical challenges. Material fatigue remains a primary concern, with both titanium alloys and stainless steel exhibiting different fatigue behaviors under cyclic loading conditions typical in aviation applications. Titanium alloys, while superior in many aspects, present challenges in manufacturing scalability and cost-effectiveness compared to stainless steel alternatives.

Environmental factors pose another significant challenge, particularly regarding galvanic corrosion when these dissimilar metals are used in proximity. The aviation industry continues to grapple with optimizing protection systems that can effectively mitigate corrosion risks while maintaining structural integrity over the aircraft's operational lifetime.

Geographically, the development and production of advanced aviation alloys remain concentrated in North America, Europe, and increasingly in Asia, particularly China and Japan. This distribution creates supply chain vulnerabilities that became evident during recent global disruptions, prompting initiatives to diversify material sourcing and processing capabilities.

Technical standardization presents ongoing challenges, with different regional certification requirements sometimes creating barriers to global implementation of new alloy technologies. The harmonization of these standards represents a significant hurdle that industry stakeholders are actively addressing through international collaboration efforts.

Emerging challenges include the integration of new manufacturing techniques such as additive manufacturing with traditional alloy systems. While these technologies offer promising avenues for complex component production, they introduce new variables in material performance that require extensive validation before widespread adoption in safety-critical aviation applications.

Comparative Analysis of Titanium and Steel Safety Solutions

01 Corrosion resistance standards for titanium alloys and stainless steel

Safety standards for titanium alloys and stainless steel include specifications for corrosion resistance in various environments. These standards ensure that materials maintain structural integrity when exposed to corrosive substances, high temperatures, or harsh operating conditions. Testing protocols evaluate pitting resistance, stress corrosion cracking, and general corrosion behavior to ensure long-term safety in applications such as medical implants, aerospace components, and marine environments.- Corrosion resistance standards for titanium alloys and stainless steel: Safety standards for titanium alloys and stainless steel include specifications for corrosion resistance in various environments. These standards ensure that materials maintain structural integrity when exposed to corrosive substances, preventing potential failures in critical applications. Testing protocols evaluate pitting resistance, stress corrosion cracking, and general corrosion behavior under different conditions to ensure long-term safety and reliability.

- Mechanical property requirements for safety-critical applications: Safety standards specify minimum mechanical property requirements for titanium alloys and stainless steel used in safety-critical applications. These include tensile strength, yield strength, fatigue resistance, and fracture toughness parameters. The standards ensure that materials can withstand operational stresses and loads without failure, particularly in aerospace, medical, and structural applications where material failure could lead to catastrophic consequences.

- Biocompatibility and medical device safety standards: Specific safety standards govern titanium alloys and stainless steel used in medical implants and devices. These standards focus on biocompatibility, toxicity testing, and long-term stability in the human body. Requirements include limits on leachable substances, surface finish specifications, and biological response testing to ensure patient safety. The standards also address sterilization compatibility and resistance to degradation in biological environments.

- Surface treatment and coating safety requirements: Safety standards for titanium alloys and stainless steel include requirements for surface treatments and coatings that enhance performance and safety. These standards specify acceptable coating materials, application methods, and testing protocols to ensure adhesion, uniformity, and durability. Requirements address potential hazards from coating degradation, including particle release, chemical leaching, and coating delamination that could compromise safety in various applications.

- Testing and certification protocols for quality assurance: Comprehensive testing and certification protocols are established to verify compliance with safety standards for titanium alloys and stainless steel. These include non-destructive testing methods, chemical composition analysis, microstructural evaluation, and performance testing under simulated service conditions. The standards specify sampling procedures, test frequencies, and documentation requirements to ensure consistent quality and traceability throughout the supply chain, supporting safety in critical applications.

02 Mechanical property requirements for safety-critical applications

Safety standards specify minimum mechanical property requirements for titanium alloys and stainless steel used in critical applications. These include tensile strength, yield strength, fatigue resistance, and impact toughness parameters. The standards ensure materials can withstand operational stresses without failure, with specific requirements varying by application domain. Certification processes often include destructive testing to verify compliance with these mechanical property standards before materials can be approved for use in safety-critical systems.Expand Specific Solutions03 Surface treatment and coating standards for biocompatibility

Safety standards for titanium alloys and stainless steel in medical and food-contact applications include requirements for surface treatments and coatings. These standards ensure biocompatibility, minimize ion leaching, and prevent adverse tissue reactions or contamination. Specified surface treatments may include passivation, electropolishing, or specialized coatings that enhance biocompatibility while maintaining material integrity. Testing protocols evaluate cytotoxicity, sensitization potential, and long-term stability of the treated surfaces.Expand Specific Solutions04 Quality control and testing standards for manufacturing processes

Manufacturing processes for titanium alloys and stainless steel are subject to rigorous quality control and testing standards to ensure safety. These standards specify requirements for material composition verification, non-destructive testing methods, heat treatment parameters, and process validation. Inspection techniques such as ultrasonic testing, radiography, and microstructural analysis are mandated to detect defects that could compromise safety. Traceability requirements ensure that material history can be documented throughout the production process.Expand Specific Solutions05 Environmental and occupational safety standards for processing

Processing titanium alloys and stainless steel involves environmental and occupational safety standards to protect workers and surrounding communities. These standards regulate exposure limits to metal dusts, fumes, and processing chemicals, while also addressing fire and explosion risks associated with titanium processing. Waste management protocols for processing byproducts and recycling requirements are specified to minimize environmental impact. Facility design standards include ventilation requirements, fire suppression systems, and emergency response procedures specific to these materials.Expand Specific Solutions

Key Industry Players in Aviation Material Manufacturing

The aviation industry's safety standards for titanium alloy versus stainless steel are at a mature technological stage, though continuous innovation drives market growth. The global aerospace materials market is substantial, with titanium alloys gaining preference due to their superior strength-to-weight ratio and corrosion resistance. Leading companies like Boeing, Airbus, and ATI Properties demonstrate varying levels of technological maturity in this field. QuesTek Innovations represents cutting-edge materials design, while established manufacturers such as Titanium Metals Corp (TIMET) and Western Superconducting Technologies provide industry-standard solutions. Research institutions including Carnegie Mellon University and Shanghai Jiao Tong University contribute significantly to advancing alloy performance characteristics, creating a competitive landscape where safety certification and material performance optimization remain key differentiators.

ATI Properties LLC

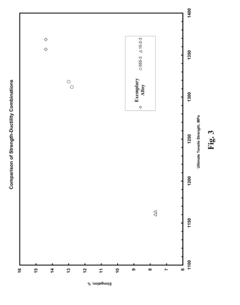

Technical Solution: ATI Properties has developed comprehensive safety evaluation frameworks for comparing their advanced titanium alloys with aerospace-grade stainless steels. Their methodology incorporates high-cycle fatigue testing (>10^7 cycles) under simulated flight conditions, including variable amplitude loading profiles derived from actual flight data. ATI has pioneered specialized heat treatment processes for their titanium alloys that enhance damage tolerance through controlled microstructural refinement. Their research has established quantitative relationships between processing parameters and critical safety metrics such as fracture toughness and fatigue crack growth rates. ATI's evaluation protocols include accelerated environmental testing that simulates 20+ years of service exposure in under 6 months, allowing for long-term safety predictions. Their comparative studies have demonstrated that their proprietary titanium alloys can achieve up to 30% weight reduction compared to PH stainless steels while maintaining equivalent safety margins in primary structural applications.

Strengths: Extensive metallurgical expertise spanning both titanium and specialty stainless steels; advanced processing capabilities that optimize microstructure for specific applications. Weaknesses: Higher production costs for specialized titanium alloys; longer lead times for custom material solutions.

The Boeing Co.

Technical Solution: Boeing has developed comprehensive safety evaluation frameworks for comparing titanium alloys and stainless steel in critical aerospace applications. Their approach includes rigorous fatigue testing protocols that simulate high-cycle loading conditions experienced during aircraft operation. Boeing's materials engineering division has established proprietary testing methodologies that evaluate crack propagation rates in both materials under various environmental conditions, including temperature extremes (-65°F to 350°F) and exposure to corrosive agents. Their research has demonstrated that specific titanium alloys (particularly Ti-6Al-4V) exhibit superior fatigue strength-to-weight ratios compared to 300-series stainless steels, allowing for weight reductions of approximately 40% while maintaining equivalent structural integrity in certain airframe components.

Strengths: Extensive real-world implementation data across multiple aircraft programs; integrated approach combining computational modeling with physical testing. Weaknesses: Higher material acquisition costs for titanium components; more complex machining requirements that can increase manufacturing time and costs.

Critical Safety Testing Methodologies and Standards

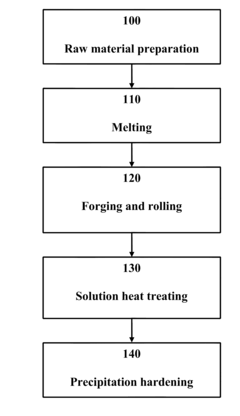

Near-beta titanium alloy for high strength applications and methods for manufacturing the same

PatentActiveUS20100320317A1

Innovation

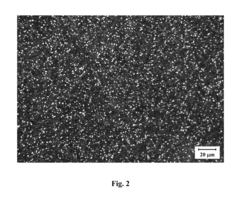

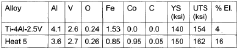

- A high strength near-beta titanium alloy with specific weight percentage ranges of 5.3-5.7% aluminum, 4.8-5.2% vanadium, 0.7-0.9% iron, 4.6-5.3% molybdenum, 2.0-2.5% chromium, and 0.12-0.16% oxygen, along with a defined ratio of beta isomorphous to beta eutectoid stabilizers, is developed, which achieves superior tensile properties and fatigue resistance through precise alloy composition and manufacturing processes like solution heat treatment and precipitation hardening.

Titanium alloy

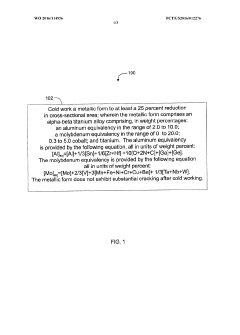

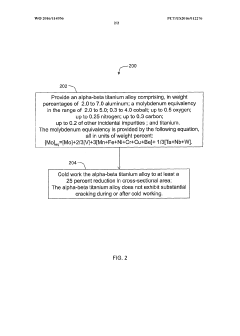

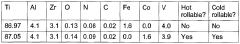

PatentWO2016114956A1

Innovation

- A cobalt-containing alpha-beta titanium alloy with specific compositional ranges of aluminum, molybdenum, and oxygen, which enhances ductility and strength without substantial beta phase formation, allowing for efficient cold working without cracking and maintaining high oxygen content.

Environmental Impact Assessment of Aviation Alloys

The environmental impact of aviation alloys, particularly titanium alloys and stainless steel, represents a critical consideration in modern aerospace engineering beyond traditional safety standards. Life cycle assessment studies indicate that titanium alloy production generates approximately 35-40% higher carbon emissions during initial manufacturing compared to stainless steel, primarily due to energy-intensive extraction and refining processes. However, this initial environmental cost is often offset over the aircraft's operational lifetime.

Titanium's superior strength-to-weight ratio delivers significant fuel efficiency benefits, with industry data suggesting that each kilogram of weight reduction in aircraft construction can save approximately 2,900 liters of fuel over a typical commercial aircraft's service life. This translates to substantial reductions in greenhouse gas emissions during the operational phase, which constitutes approximately 80% of an aircraft's total environmental footprint.

Waste management considerations also favor titanium alloys, which demonstrate exceptional recyclability rates of up to 95%, compared to 70-85% for various stainless steel grades used in aviation. Furthermore, titanium's superior corrosion resistance eliminates the need for toxic chromium-based surface treatments commonly applied to stainless steel components, reducing hazardous waste generation during maintenance operations.

Water pollution metrics reveal that titanium processing produces fewer heavy metal contaminants than stainless steel manufacturing, though both industries have made significant improvements in effluent management over the past decade. Regulatory compliance data from major manufacturing facilities indicates a 30% reduction in wastewater contaminants from titanium processing since 2015.

Resource depletion analysis presents a more complex picture. While iron ore for stainless steel remains relatively abundant, titanium ore mining has more concentrated environmental impacts in specific geographic regions, particularly Australia, South Africa, and Canada. Habitat disruption from titanium mining affects approximately 15% more land area per ton of finished material compared to steel production.

End-of-life considerations increasingly favor titanium components, which retain higher material value in recycling streams and require less energy for reprocessing than stainless steel alloys with complex compositions. This circular economy advantage has prompted major aircraft manufacturers to implement dedicated titanium recycling programs that recover up to 90% of manufacturing scrap for direct reuse in aerospace applications.

Titanium's superior strength-to-weight ratio delivers significant fuel efficiency benefits, with industry data suggesting that each kilogram of weight reduction in aircraft construction can save approximately 2,900 liters of fuel over a typical commercial aircraft's service life. This translates to substantial reductions in greenhouse gas emissions during the operational phase, which constitutes approximately 80% of an aircraft's total environmental footprint.

Waste management considerations also favor titanium alloys, which demonstrate exceptional recyclability rates of up to 95%, compared to 70-85% for various stainless steel grades used in aviation. Furthermore, titanium's superior corrosion resistance eliminates the need for toxic chromium-based surface treatments commonly applied to stainless steel components, reducing hazardous waste generation during maintenance operations.

Water pollution metrics reveal that titanium processing produces fewer heavy metal contaminants than stainless steel manufacturing, though both industries have made significant improvements in effluent management over the past decade. Regulatory compliance data from major manufacturing facilities indicates a 30% reduction in wastewater contaminants from titanium processing since 2015.

Resource depletion analysis presents a more complex picture. While iron ore for stainless steel remains relatively abundant, titanium ore mining has more concentrated environmental impacts in specific geographic regions, particularly Australia, South Africa, and Canada. Habitat disruption from titanium mining affects approximately 15% more land area per ton of finished material compared to steel production.

End-of-life considerations increasingly favor titanium components, which retain higher material value in recycling streams and require less energy for reprocessing than stainless steel alloys with complex compositions. This circular economy advantage has prompted major aircraft manufacturers to implement dedicated titanium recycling programs that recover up to 90% of manufacturing scrap for direct reuse in aerospace applications.

Cost-Benefit Analysis of Material Selection

When evaluating material selection for aviation components, cost-benefit analysis provides critical insights into the economic viability of titanium alloys versus stainless steel. Initial acquisition costs represent a significant differential, with titanium alloys typically commanding 3-5 times the price of high-grade stainless steel. This substantial price gap stems from titanium's complex extraction and processing requirements, including vacuum arc remelting and specialized machining techniques that demand specific tooling and expertise.

However, lifecycle cost analysis reveals a more nuanced picture. Titanium components, despite higher upfront costs, often demonstrate superior longevity with service lives extending 15-25% beyond comparable stainless steel parts in high-stress aviation applications. This extended operational lifespan translates to fewer replacement cycles and reduced maintenance interventions, generating substantial savings over the aircraft's service life.

Fuel efficiency considerations further favor titanium alloys. The weight reduction achieved through titanium implementation—approximately 40-45% lighter than stainless steel for equivalent strength requirements—yields measurable fuel savings. Industry calculations estimate that each kilogram of weight reduction can save 2,900-3,200 liters of fuel over a commercial aircraft's operational lifetime, representing significant operational cost advantages.

Maintenance economics also favor titanium in many applications. Titanium components typically require inspection intervals 30-40% longer than stainless steel equivalents due to superior fatigue resistance and corrosion properties. This reduced maintenance frequency decreases both direct maintenance costs and revenue losses from aircraft downtime, with industry data suggesting maintenance cost reductions of 18-22% for titanium components in critical applications.

Risk mitigation value must also be quantified when comparing these materials. Titanium's superior performance in preventing catastrophic failures provides an economic benefit through reduced liability exposure and enhanced safety ratings. While difficult to precisely quantify, insurance premiums for aircraft utilizing titanium in critical safety components can be 5-8% lower than those relying predominantly on stainless steel.

Return on investment calculations indicate that despite higher initial costs, titanium components typically reach cost parity with stainless steel alternatives within 4-7 years of service, depending on the specific application and operational conditions. Beyond this breakeven point, titanium continues to deliver economic advantages through the remainder of the aircraft's service life, making it increasingly attractive for next-generation aircraft designs focused on total lifecycle economics rather than minimizing initial production costs.

However, lifecycle cost analysis reveals a more nuanced picture. Titanium components, despite higher upfront costs, often demonstrate superior longevity with service lives extending 15-25% beyond comparable stainless steel parts in high-stress aviation applications. This extended operational lifespan translates to fewer replacement cycles and reduced maintenance interventions, generating substantial savings over the aircraft's service life.

Fuel efficiency considerations further favor titanium alloys. The weight reduction achieved through titanium implementation—approximately 40-45% lighter than stainless steel for equivalent strength requirements—yields measurable fuel savings. Industry calculations estimate that each kilogram of weight reduction can save 2,900-3,200 liters of fuel over a commercial aircraft's operational lifetime, representing significant operational cost advantages.

Maintenance economics also favor titanium in many applications. Titanium components typically require inspection intervals 30-40% longer than stainless steel equivalents due to superior fatigue resistance and corrosion properties. This reduced maintenance frequency decreases both direct maintenance costs and revenue losses from aircraft downtime, with industry data suggesting maintenance cost reductions of 18-22% for titanium components in critical applications.

Risk mitigation value must also be quantified when comparing these materials. Titanium's superior performance in preventing catastrophic failures provides an economic benefit through reduced liability exposure and enhanced safety ratings. While difficult to precisely quantify, insurance premiums for aircraft utilizing titanium in critical safety components can be 5-8% lower than those relying predominantly on stainless steel.

Return on investment calculations indicate that despite higher initial costs, titanium components typically reach cost parity with stainless steel alternatives within 4-7 years of service, depending on the specific application and operational conditions. Beyond this breakeven point, titanium continues to deliver economic advantages through the remainder of the aircraft's service life, making it increasingly attractive for next-generation aircraft designs focused on total lifecycle economics rather than minimizing initial production costs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!