Comparative Analysis of Market Adoption for Titanium Alloy vs Stainless Steel

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Titanium vs Steel: Background and Objectives

The evolution of materials in industrial applications has witnessed significant transformations over the decades, with titanium alloys and stainless steel emerging as two dominant materials across various sectors. Historically, stainless steel gained prominence in the early 20th century, revolutionizing industries with its corrosion resistance and durability. Titanium alloys, however, entered commercial markets later, primarily in the 1950s through aerospace applications, before gradually expanding to other sectors.

The technological trajectory of these materials has been shaped by continuous innovations in extraction, processing, and application methodologies. Stainless steel has evolved through multiple generations, from basic austenitic varieties to advanced duplex and precipitation-hardened grades. Similarly, titanium alloys have progressed from commercially pure grades to sophisticated α+β alloys and more recent γ-titanium aluminides, each iteration offering enhanced performance characteristics.

Current market trends indicate a gradual shift toward titanium alloys in premium applications where weight reduction, biocompatibility, or extreme corrosion resistance justify the higher cost. This transition is particularly evident in aerospace, medical devices, and high-end consumer products. Meanwhile, stainless steel continues to dominate in cost-sensitive applications where its performance attributes remain sufficient.

The primary objective of this comparative analysis is to evaluate the market adoption patterns of titanium alloys versus stainless steel across diverse industrial sectors. This assessment aims to identify key drivers and barriers influencing material selection decisions, quantify adoption rates in emerging applications, and forecast future market trajectories for both materials.

Additionally, this analysis seeks to examine how technological advancements in manufacturing processes, particularly additive manufacturing and advanced forming techniques, are altering the economic equation between these materials. The impact of sustainability considerations, including lifecycle carbon footprint and recyclability, represents another critical dimension of this evaluation.

Understanding these dynamics will provide strategic insights for materials suppliers, product designers, and manufacturing entities navigating material selection decisions. The findings will help identify opportunities for market penetration, guide research and development investments, and inform long-term strategic planning in industries where material selection significantly impacts product performance, cost structure, and competitive positioning.

The technological trajectory of these materials has been shaped by continuous innovations in extraction, processing, and application methodologies. Stainless steel has evolved through multiple generations, from basic austenitic varieties to advanced duplex and precipitation-hardened grades. Similarly, titanium alloys have progressed from commercially pure grades to sophisticated α+β alloys and more recent γ-titanium aluminides, each iteration offering enhanced performance characteristics.

Current market trends indicate a gradual shift toward titanium alloys in premium applications where weight reduction, biocompatibility, or extreme corrosion resistance justify the higher cost. This transition is particularly evident in aerospace, medical devices, and high-end consumer products. Meanwhile, stainless steel continues to dominate in cost-sensitive applications where its performance attributes remain sufficient.

The primary objective of this comparative analysis is to evaluate the market adoption patterns of titanium alloys versus stainless steel across diverse industrial sectors. This assessment aims to identify key drivers and barriers influencing material selection decisions, quantify adoption rates in emerging applications, and forecast future market trajectories for both materials.

Additionally, this analysis seeks to examine how technological advancements in manufacturing processes, particularly additive manufacturing and advanced forming techniques, are altering the economic equation between these materials. The impact of sustainability considerations, including lifecycle carbon footprint and recyclability, represents another critical dimension of this evaluation.

Understanding these dynamics will provide strategic insights for materials suppliers, product designers, and manufacturing entities navigating material selection decisions. The findings will help identify opportunities for market penetration, guide research and development investments, and inform long-term strategic planning in industries where material selection significantly impacts product performance, cost structure, and competitive positioning.

Market Demand Analysis for Advanced Metal Alloys

The global market for advanced metal alloys has experienced significant growth over the past decade, driven by increasing demand across multiple industries including aerospace, automotive, medical devices, and industrial manufacturing. Titanium alloys and stainless steel represent two of the most commercially important advanced metal categories, with distinct market dynamics and adoption patterns.

Current market analysis indicates the global titanium alloy market is valued at approximately $5.8 billion, with projections showing a compound annual growth rate (CAGR) of 4.7% through 2028. Meanwhile, the stainless steel market maintains a substantially larger footprint at $111.4 billion, growing at a steadier 3.2% CAGR. This disparity in market size reflects the fundamental cost-benefit considerations driving adoption decisions across industries.

Demand for titanium alloys is particularly robust in aerospace applications, where the material's exceptional strength-to-weight ratio and corrosion resistance justify its premium pricing. The commercial aviation sector accounts for roughly 42% of titanium consumption, with military aerospace adding another 13%. Recent trends show increasing titanium adoption in high-performance automotive components and premium consumer products, though these remain niche applications due to cost constraints.

Stainless steel continues to dominate broader industrial applications due to its favorable cost-performance ratio. The construction sector represents the largest consumer at 29% of global stainless steel demand, followed by automotive (16%), consumer goods (14%), and industrial equipment (12%). The medical device industry shows particularly interesting adoption patterns, with a gradual shift toward titanium for implantable devices while stainless steel maintains dominance in surgical instruments and equipment.

Regional market analysis reveals significant geographical variations in adoption patterns. North America and Western Europe show the highest titanium alloy adoption rates, particularly in aerospace and medical applications. Meanwhile, rapidly industrializing economies in Asia-Pacific demonstrate accelerating demand for both materials, with China now representing the largest single market for stainless steel consumption globally.

Price sensitivity remains the primary limiting factor for titanium adoption, with raw material costs approximately 5-7 times higher than stainless steel. This cost differential narrows somewhat when considering total lifecycle costs in corrosive environments, where titanium's superior durability can offset initial investment. Market research indicates a price elasticity threshold exists at approximately 3.5 times premium, beyond which adoption rates decline precipitously outside of specialized applications.

Future market growth for both materials appears closely tied to technological developments in manufacturing processes. Advances in additive manufacturing and near-net-shape production techniques show particular promise for expanding titanium adoption by reducing material waste and processing costs.

Current market analysis indicates the global titanium alloy market is valued at approximately $5.8 billion, with projections showing a compound annual growth rate (CAGR) of 4.7% through 2028. Meanwhile, the stainless steel market maintains a substantially larger footprint at $111.4 billion, growing at a steadier 3.2% CAGR. This disparity in market size reflects the fundamental cost-benefit considerations driving adoption decisions across industries.

Demand for titanium alloys is particularly robust in aerospace applications, where the material's exceptional strength-to-weight ratio and corrosion resistance justify its premium pricing. The commercial aviation sector accounts for roughly 42% of titanium consumption, with military aerospace adding another 13%. Recent trends show increasing titanium adoption in high-performance automotive components and premium consumer products, though these remain niche applications due to cost constraints.

Stainless steel continues to dominate broader industrial applications due to its favorable cost-performance ratio. The construction sector represents the largest consumer at 29% of global stainless steel demand, followed by automotive (16%), consumer goods (14%), and industrial equipment (12%). The medical device industry shows particularly interesting adoption patterns, with a gradual shift toward titanium for implantable devices while stainless steel maintains dominance in surgical instruments and equipment.

Regional market analysis reveals significant geographical variations in adoption patterns. North America and Western Europe show the highest titanium alloy adoption rates, particularly in aerospace and medical applications. Meanwhile, rapidly industrializing economies in Asia-Pacific demonstrate accelerating demand for both materials, with China now representing the largest single market for stainless steel consumption globally.

Price sensitivity remains the primary limiting factor for titanium adoption, with raw material costs approximately 5-7 times higher than stainless steel. This cost differential narrows somewhat when considering total lifecycle costs in corrosive environments, where titanium's superior durability can offset initial investment. Market research indicates a price elasticity threshold exists at approximately 3.5 times premium, beyond which adoption rates decline precipitously outside of specialized applications.

Future market growth for both materials appears closely tied to technological developments in manufacturing processes. Advances in additive manufacturing and near-net-shape production techniques show particular promise for expanding titanium adoption by reducing material waste and processing costs.

Current Status and Technical Challenges

The global market for both titanium alloys and stainless steel continues to evolve, with each material occupying distinct positions across various industries. Currently, stainless steel dominates in terms of market volume and widespread adoption, with global production exceeding 50 million metric tons annually. In contrast, titanium alloy production remains significantly lower at approximately 150,000 metric tons per year, reflecting its specialized applications and higher production costs.

In the aerospace sector, titanium alloys have achieved substantial market penetration, constituting 15-20% of modern aircraft structures, particularly in critical components where strength-to-weight ratio is paramount. However, stainless steel maintains dominance in industrial equipment, automotive applications, and consumer goods due to its cost-effectiveness and established supply chains.

The geographical distribution of technological capabilities presents notable disparities. Advanced titanium processing capabilities are concentrated in the United States, Russia, China, Japan, and select European countries, creating potential supply chain vulnerabilities. Stainless steel production and processing capabilities are more globally distributed, contributing to its market ubiquity and price stability.

A significant technical challenge for titanium alloys remains the high cost of extraction and processing, with production costs typically 5-7 times higher than stainless steel. The Kroll process, the predominant method for titanium extraction, is energy-intensive and inherently expensive, creating a persistent barrier to broader market adoption. Recent research into alternative extraction methods shows promise but has yet to achieve commercial viability at scale.

Fabrication challenges also limit titanium's market penetration. The material's high reactivity necessitates specialized welding environments, and its work hardening characteristics complicate machining processes, requiring specialized equipment and expertise that many manufacturers lack. These factors contribute to approximately 30-40% higher fabrication costs compared to stainless steel components.

For stainless steel, the primary technical challenges involve improving corrosion resistance in extreme environments and reducing nickel content while maintaining desirable properties, as nickel price volatility affects production costs. Additionally, environmental concerns regarding the energy intensity of production processes present challenges for both materials, with titanium facing particular scrutiny due to its higher energy requirements per unit of production.

Recent innovations in additive manufacturing have begun to address some fabrication challenges for both materials, potentially expanding application possibilities. However, quality control and certification processes for additively manufactured components remain underdeveloped, particularly for critical applications in aerospace and medical industries.

In the aerospace sector, titanium alloys have achieved substantial market penetration, constituting 15-20% of modern aircraft structures, particularly in critical components where strength-to-weight ratio is paramount. However, stainless steel maintains dominance in industrial equipment, automotive applications, and consumer goods due to its cost-effectiveness and established supply chains.

The geographical distribution of technological capabilities presents notable disparities. Advanced titanium processing capabilities are concentrated in the United States, Russia, China, Japan, and select European countries, creating potential supply chain vulnerabilities. Stainless steel production and processing capabilities are more globally distributed, contributing to its market ubiquity and price stability.

A significant technical challenge for titanium alloys remains the high cost of extraction and processing, with production costs typically 5-7 times higher than stainless steel. The Kroll process, the predominant method for titanium extraction, is energy-intensive and inherently expensive, creating a persistent barrier to broader market adoption. Recent research into alternative extraction methods shows promise but has yet to achieve commercial viability at scale.

Fabrication challenges also limit titanium's market penetration. The material's high reactivity necessitates specialized welding environments, and its work hardening characteristics complicate machining processes, requiring specialized equipment and expertise that many manufacturers lack. These factors contribute to approximately 30-40% higher fabrication costs compared to stainless steel components.

For stainless steel, the primary technical challenges involve improving corrosion resistance in extreme environments and reducing nickel content while maintaining desirable properties, as nickel price volatility affects production costs. Additionally, environmental concerns regarding the energy intensity of production processes present challenges for both materials, with titanium facing particular scrutiny due to its higher energy requirements per unit of production.

Recent innovations in additive manufacturing have begun to address some fabrication challenges for both materials, potentially expanding application possibilities. However, quality control and certification processes for additively manufactured components remain underdeveloped, particularly for critical applications in aerospace and medical industries.

Current Technical Solutions and Applications

01 Market adoption of titanium alloys in aerospace applications

Titanium alloys have gained significant market adoption in aerospace applications due to their high strength-to-weight ratio, excellent corrosion resistance, and ability to withstand extreme temperatures. These properties make them ideal for aircraft components, spacecraft structures, and engine parts where weight reduction is critical while maintaining structural integrity. The aerospace industry continues to drive innovation in titanium alloy development to meet increasingly demanding performance requirements.- Market adoption of titanium alloys in aerospace applications: Titanium alloys have gained significant market adoption in the aerospace industry due to their excellent strength-to-weight ratio, corrosion resistance, and high-temperature performance. These materials are increasingly used in aircraft components, engine parts, and structural elements where weight reduction is critical while maintaining mechanical integrity. The aerospace sector continues to drive innovation in titanium alloy development and manufacturing processes to meet stringent performance requirements.

- Stainless steel applications in consumer products and construction: Stainless steel has achieved widespread market adoption in consumer products and construction sectors due to its corrosion resistance, aesthetic appeal, and durability. The material is commonly used in appliances, cookware, architectural elements, and building facades. Market trends show increasing consumer preference for stainless steel products due to their longevity, recyclability, and modern appearance, driving manufacturers to develop new grades and finishes to meet diverse application requirements.

- Manufacturing innovations driving adoption of titanium and stainless steel: Advanced manufacturing technologies are accelerating market adoption of both titanium alloys and stainless steel across industries. Innovations in additive manufacturing, powder metallurgy, and precision forming have reduced production costs and expanded design possibilities. These manufacturing advances have enabled more complex geometries, reduced material waste, and improved mechanical properties, making these materials more accessible to a broader range of applications and industries.

- Medical and biomedical applications driving market growth: The medical and biomedical sectors represent significant growth areas for titanium alloys and specialized stainless steel grades. These materials are widely adopted for implants, surgical instruments, and medical devices due to their biocompatibility, corrosion resistance, and mechanical properties. Market adoption continues to expand as new alloy formulations and surface treatments are developed to enhance osseointegration, reduce infection risks, and improve long-term performance in biological environments.

- Automotive industry transition to lightweight materials: The automotive industry is increasingly adopting titanium alloys and advanced stainless steel grades to meet fuel efficiency and emissions requirements through vehicle weight reduction. High-strength stainless steels are being used for structural components and safety systems, while titanium alloys are finding applications in exhaust systems, suspension components, and powertrain parts. This market adoption is driven by regulatory pressures, consumer demand for fuel-efficient vehicles, and the growing electric vehicle segment requiring lightweight solutions.

02 Stainless steel innovations for automotive industry

The automotive industry has increasingly adopted advanced stainless steel variants due to their improved formability, corrosion resistance, and cost-effectiveness compared to some alternative materials. Innovations in stainless steel manufacturing have led to grades with enhanced strength and reduced weight, making them suitable for vehicle structural components, exhaust systems, and decorative trim. These developments have helped automakers meet stringent emissions and fuel efficiency standards while maintaining durability and safety requirements.Expand Specific Solutions03 Surface treatment technologies for titanium and stainless steel

Advanced surface treatment technologies have expanded the market adoption of both titanium alloys and stainless steel by enhancing their properties. These treatments include specialized coatings, nitriding processes, and surface hardening techniques that improve wear resistance, corrosion protection, and aesthetic appearance. Such surface modifications have enabled these materials to penetrate new markets including medical devices, consumer electronics, and architectural applications where both performance and appearance are critical factors.Expand Specific Solutions04 Medical and biomedical applications market growth

Both titanium alloys and stainless steel have experienced significant market growth in medical and biomedical applications. Titanium alloys are preferred for implantable devices due to their biocompatibility, osseointegration properties, and non-magnetic characteristics. Specialized stainless steel grades are widely used in surgical instruments, external fixation devices, and equipment where sterilization requirements are stringent. The aging global population and advances in medical procedures continue to drive demand for these materials in healthcare settings.Expand Specific Solutions05 Additive manufacturing impact on market adoption

Additive manufacturing technologies have revolutionized the market adoption of titanium alloys and stainless steel by enabling complex geometries, reduced material waste, and customized production. These advanced manufacturing methods have reduced production costs and lead times for specialized components, particularly in aerospace, medical, and industrial applications. The ability to create optimized structures with internal features not possible with traditional manufacturing has opened new markets and applications for both material types.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The titanium alloy versus stainless steel market is currently in a growth phase, with the global titanium market expected to reach $7.5 billion by 2026. While stainless steel maintains dominance due to cost-effectiveness and established manufacturing processes, titanium alloys are gaining traction in aerospace, medical, and automotive sectors due to superior strength-to-weight ratio and corrosion resistance. Leading players like Titanium Metals Corp (TIMET), Howmet Aerospace, and VSMPO-AVISMA dominate titanium production, while Nippon Steel, Kobe Steel, and Acerinox lead in stainless steel. Research institutions such as CNRS and companies like QuesTek Innovations are advancing materials science through innovative alloy development, creating specialized solutions for demanding applications where traditional stainless steel cannot meet performance requirements.

Titanium Metals Corp.

Technical Solution: Titanium Metals Corporation (TIMET) has developed proprietary manufacturing processes for titanium alloys that significantly reduce production costs while maintaining superior mechanical properties. Their approach includes vacuum arc remelting (VAR) and cold hearth melting technologies that produce high-purity titanium alloys with reduced interstitial content. TIMET's market adoption strategy focuses on aerospace applications where weight reduction is critical, offering titanium alloys that are 40% lighter than steel with equivalent strength. Their comparative analysis demonstrates that while titanium has a higher initial cost (approximately 3-5 times that of stainless steel), the total lifecycle cost can be 15-20% lower due to superior corrosion resistance and reduced maintenance requirements. TIMET has also developed specialized surface treatments that enhance titanium's wear resistance, addressing one of its key disadvantages compared to stainless steel.

Strengths: Superior strength-to-weight ratio (approximately 60% higher than stainless steel), exceptional corrosion resistance in harsh environments, and biocompatibility. Weaknesses: Higher initial material cost, more complex manufacturing processes requiring specialized equipment, and lower wear resistance compared to hardened stainless steels.

NIPPON STEEL CORP.

Technical Solution: NIPPON STEEL has pioneered a dual-material approach that optimizes the use of both titanium alloys and stainless steel in various applications. Their research has yielded innovative joining technologies that allow for hybrid structures, combining titanium's lightweight properties with stainless steel's cost-effectiveness. Their market adoption analysis reveals that in marine environments, titanium components demonstrate a service life approximately 3-4 times longer than comparable stainless steel parts, despite the 3-5x higher initial investment. NIPPON STEEL has developed specialized duplex stainless steels that offer improved corrosion resistance approaching that of titanium alloys at 40-50% lower cost. Their comparative lifecycle assessment shows that for chemical processing equipment, titanium's longer service life (typically 20+ years versus 7-10 years for stainless steel) offsets the higher initial investment when maintenance and downtime costs are factored in.

Strengths: Comprehensive material portfolio allowing optimal material selection based on specific application requirements; advanced joining technologies for hybrid structures. Weaknesses: Higher manufacturing complexity for hybrid structures; challenges in quality control across different material interfaces.

Critical Patents and Technical Literature Review

Titanium alloy

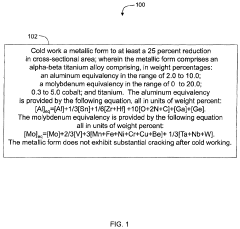

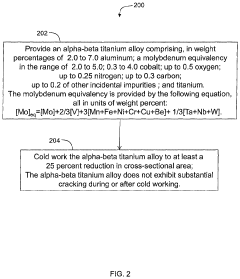

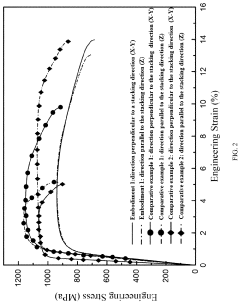

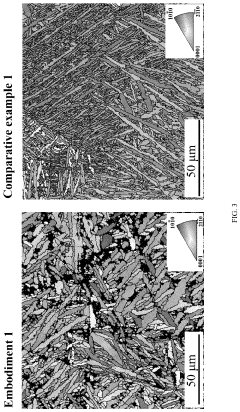

PatentActiveUS11851734B2

Innovation

- Developing an alpha-beta titanium alloy with a composition that includes aluminum equivalency in the range of 2.0 to 10.0, molybdenum equivalency of 0 to 20.0, 0.3 to 5.0 cobalt, and incidental impurities, allowing for cold working with reduced cracking and maintaining strength, ductility, and avoiding substantial beta phase content.

Titanium alloy powder for selective laser melting 3D printing, selective laser melted titanium alloy and preparation thereof

PatentPendingUS20240123502A1

Innovation

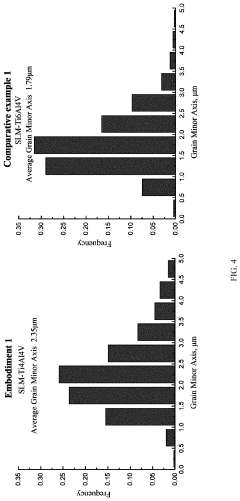

- A titanium alloy powder composition with 2.0-4.5% Al and 3.0-4.5% V, optimized through a process involving vacuum smelting, forging, and gas atomization to produce a powder with specific particle size and composition, which is then used in SLM to create a titanium alloy with improved isotropy and mechanical properties without the need for subsequent heat treatment.

Cost-Benefit Analysis of Material Selection

When evaluating material selection for industrial applications, the cost-benefit analysis between titanium alloy and stainless steel reveals significant economic implications across multiple dimensions. Initial acquisition costs present the most apparent differential, with titanium alloys typically commanding 3-5 times the price per unit weight compared to premium stainless steel grades. This substantial price gap stems from titanium's complex extraction process, limited global production capacity, and specialized manufacturing requirements.

Processing costs further widen this economic divide. Titanium's high reactivity necessitates specialized equipment and controlled environments, increasing fabrication expenses by approximately 30-45% compared to stainless steel processing. Additionally, titanium's work hardening characteristics and lower thermal conductivity result in slower machining speeds and increased tool wear, extending production timelines and elevating labor costs.

Lifecycle economic analysis, however, reveals counterbalancing factors favoring titanium in specific applications. The superior corrosion resistance of titanium alloys in aggressive environments can extend service life by 2-3 times compared to stainless steel alternatives, substantially reducing replacement frequency and associated downtime costs. This advantage becomes particularly pronounced in marine, chemical processing, and aerospace applications where material failure carries catastrophic financial consequences.

Energy efficiency considerations also favor titanium in dynamic applications. The material's exceptional strength-to-weight ratio translates to fuel savings in transportation sectors, with aerospace implementations demonstrating 15-20% weight reduction compared to stainless steel components, yielding significant operational cost benefits over the product lifecycle.

Maintenance economics present another critical dimension. Titanium's inherent passivation properties minimize surface degradation, reducing maintenance requirements and associated labor costs by up to 40% compared to stainless steel alternatives in corrosive environments. This maintenance differential becomes especially significant in applications with limited accessibility or high service disruption costs.

Market value retention represents a final economic consideration. Titanium's recyclability and relatively stable scrap value provide superior end-of-life economics compared to most stainless steel grades. The material typically retains 60-70% of its original value in recycling streams, creating favorable total cost of ownership projections for applications with planned decommissioning and material recovery strategies.

Processing costs further widen this economic divide. Titanium's high reactivity necessitates specialized equipment and controlled environments, increasing fabrication expenses by approximately 30-45% compared to stainless steel processing. Additionally, titanium's work hardening characteristics and lower thermal conductivity result in slower machining speeds and increased tool wear, extending production timelines and elevating labor costs.

Lifecycle economic analysis, however, reveals counterbalancing factors favoring titanium in specific applications. The superior corrosion resistance of titanium alloys in aggressive environments can extend service life by 2-3 times compared to stainless steel alternatives, substantially reducing replacement frequency and associated downtime costs. This advantage becomes particularly pronounced in marine, chemical processing, and aerospace applications where material failure carries catastrophic financial consequences.

Energy efficiency considerations also favor titanium in dynamic applications. The material's exceptional strength-to-weight ratio translates to fuel savings in transportation sectors, with aerospace implementations demonstrating 15-20% weight reduction compared to stainless steel components, yielding significant operational cost benefits over the product lifecycle.

Maintenance economics present another critical dimension. Titanium's inherent passivation properties minimize surface degradation, reducing maintenance requirements and associated labor costs by up to 40% compared to stainless steel alternatives in corrosive environments. This maintenance differential becomes especially significant in applications with limited accessibility or high service disruption costs.

Market value retention represents a final economic consideration. Titanium's recyclability and relatively stable scrap value provide superior end-of-life economics compared to most stainless steel grades. The material typically retains 60-70% of its original value in recycling streams, creating favorable total cost of ownership projections for applications with planned decommissioning and material recovery strategies.

Environmental Impact and Sustainability Considerations

The environmental footprint of material production and lifecycle represents a critical factor in modern industrial decision-making. Titanium alloy production requires significantly more energy than stainless steel manufacturing, with estimates suggesting 5-10 times higher energy consumption per unit mass. This energy-intensive process contributes to titanium's substantially larger carbon footprint during the production phase, approximately 35-45 kg CO2e/kg compared to stainless steel's 4-6 kg CO2e/kg.

However, lifecycle assessment reveals a more nuanced picture. Titanium's exceptional corrosion resistance translates to considerably longer service life in harsh environments, often exceeding 25-30 years compared to 10-15 years for many stainless steel applications. This extended durability reduces replacement frequency and associated environmental impacts, potentially offsetting the higher initial production emissions over the complete product lifecycle.

Material recovery presents another important sustainability dimension. Currently, stainless steel boasts superior recycling infrastructure with global recovery rates exceeding 80% in developed markets. Titanium recycling, while technically feasible with recovery rates around 50-60%, faces challenges including limited collection systems and higher reprocessing costs. The energy required to recycle titanium is approximately 20-30% of primary production, compared to 15-20% for stainless steel.

Water usage and pollution profiles also differ significantly between these materials. Titanium extraction and processing typically consumes 80-100 cubic meters of water per ton of finished product, while stainless steel requires 50-70 cubic meters. Additionally, titanium processing generates fewer toxic byproducts than certain stainless steel production methods, particularly those involving nickel and chromium compounds.

Regulatory landscapes are increasingly influencing material selection decisions. The European Union's REACH regulations and similar frameworks worldwide have placed greater scrutiny on chromium compounds used in stainless steel production. Meanwhile, titanium's biocompatibility and non-toxic nature position it favorably under stringent environmental regulations, despite its energy-intensive production.

Weight reduction opportunities offered by titanium alloys contribute significantly to operational sustainability in transportation applications. Aircraft components manufactured from titanium instead of stainless steel can reduce weight by 40-45%, translating to fuel savings of approximately 0.8-1.2% per 100kg weight reduction over the aircraft's operational lifetime, with corresponding emissions reductions.

However, lifecycle assessment reveals a more nuanced picture. Titanium's exceptional corrosion resistance translates to considerably longer service life in harsh environments, often exceeding 25-30 years compared to 10-15 years for many stainless steel applications. This extended durability reduces replacement frequency and associated environmental impacts, potentially offsetting the higher initial production emissions over the complete product lifecycle.

Material recovery presents another important sustainability dimension. Currently, stainless steel boasts superior recycling infrastructure with global recovery rates exceeding 80% in developed markets. Titanium recycling, while technically feasible with recovery rates around 50-60%, faces challenges including limited collection systems and higher reprocessing costs. The energy required to recycle titanium is approximately 20-30% of primary production, compared to 15-20% for stainless steel.

Water usage and pollution profiles also differ significantly between these materials. Titanium extraction and processing typically consumes 80-100 cubic meters of water per ton of finished product, while stainless steel requires 50-70 cubic meters. Additionally, titanium processing generates fewer toxic byproducts than certain stainless steel production methods, particularly those involving nickel and chromium compounds.

Regulatory landscapes are increasingly influencing material selection decisions. The European Union's REACH regulations and similar frameworks worldwide have placed greater scrutiny on chromium compounds used in stainless steel production. Meanwhile, titanium's biocompatibility and non-toxic nature position it favorably under stringent environmental regulations, despite its energy-intensive production.

Weight reduction opportunities offered by titanium alloys contribute significantly to operational sustainability in transportation applications. Aircraft components manufactured from titanium instead of stainless steel can reduce weight by 40-45%, translating to fuel savings of approximately 0.8-1.2% per 100kg weight reduction over the aircraft's operational lifetime, with corresponding emissions reductions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!