Analysis of Biopolymer Engineering for Medical Applications

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Biopolymer Medical Applications Background and Objectives

Biopolymers represent a revolutionary class of materials that bridge the gap between synthetic polymer science and biological systems. The field has evolved significantly over the past five decades, transitioning from basic research into naturally occurring polymers such as cellulose, chitin, and collagen to sophisticated engineering of these materials for specific medical applications. This evolution has been driven by increasing demands for biocompatible, biodegradable materials that can interface effectively with biological systems while minimizing adverse reactions.

The technological trajectory of biopolymer engineering has been characterized by several key developments, including improved extraction and purification methods, enhanced understanding of structure-property relationships, and advanced modification techniques to tailor biopolymers for specific medical applications. Recent breakthroughs in genetic engineering and synthetic biology have further expanded the possibilities, enabling the production of novel biopolymers with precisely controlled properties.

Current research focuses on addressing critical challenges in healthcare through biopolymer applications, including drug delivery systems with controlled release profiles, tissue engineering scaffolds that promote cellular growth and differentiation, wound healing materials with antimicrobial properties, and implantable devices with reduced foreign body responses. The convergence of biopolymer science with nanotechnology has opened new avenues for targeted therapies and diagnostic tools.

The primary objective of biopolymer engineering for medical applications is to develop materials that can effectively integrate with biological systems while performing specific therapeutic or diagnostic functions. This includes creating materials with tunable mechanical properties, controlled degradation rates, specific biological interactions, and the ability to respond to physiological stimuli. Additionally, there is a growing emphasis on developing sustainable and cost-effective production methods to facilitate widespread clinical adoption.

Global healthcare challenges, including an aging population, increasing prevalence of chronic diseases, and antimicrobial resistance, are driving demand for innovative biopolymer solutions. The COVID-19 pandemic has further highlighted the need for advanced biomaterials in diagnostic tools, protective equipment, and vaccine delivery systems, accelerating research and development in this field.

The ultimate goal of biopolymer engineering for medical applications extends beyond creating functional materials to developing integrated systems that can revolutionize healthcare delivery. This includes personalized medicine approaches using patient-derived biopolymers, smart materials that can adapt to changing physiological conditions, and regenerative medicine solutions that harness the body's natural healing processes. As the field continues to mature, interdisciplinary collaboration between materials scientists, biologists, clinicians, and engineers will be essential to translate promising research into clinically viable solutions.

The technological trajectory of biopolymer engineering has been characterized by several key developments, including improved extraction and purification methods, enhanced understanding of structure-property relationships, and advanced modification techniques to tailor biopolymers for specific medical applications. Recent breakthroughs in genetic engineering and synthetic biology have further expanded the possibilities, enabling the production of novel biopolymers with precisely controlled properties.

Current research focuses on addressing critical challenges in healthcare through biopolymer applications, including drug delivery systems with controlled release profiles, tissue engineering scaffolds that promote cellular growth and differentiation, wound healing materials with antimicrobial properties, and implantable devices with reduced foreign body responses. The convergence of biopolymer science with nanotechnology has opened new avenues for targeted therapies and diagnostic tools.

The primary objective of biopolymer engineering for medical applications is to develop materials that can effectively integrate with biological systems while performing specific therapeutic or diagnostic functions. This includes creating materials with tunable mechanical properties, controlled degradation rates, specific biological interactions, and the ability to respond to physiological stimuli. Additionally, there is a growing emphasis on developing sustainable and cost-effective production methods to facilitate widespread clinical adoption.

Global healthcare challenges, including an aging population, increasing prevalence of chronic diseases, and antimicrobial resistance, are driving demand for innovative biopolymer solutions. The COVID-19 pandemic has further highlighted the need for advanced biomaterials in diagnostic tools, protective equipment, and vaccine delivery systems, accelerating research and development in this field.

The ultimate goal of biopolymer engineering for medical applications extends beyond creating functional materials to developing integrated systems that can revolutionize healthcare delivery. This includes personalized medicine approaches using patient-derived biopolymers, smart materials that can adapt to changing physiological conditions, and regenerative medicine solutions that harness the body's natural healing processes. As the field continues to mature, interdisciplinary collaboration between materials scientists, biologists, clinicians, and engineers will be essential to translate promising research into clinically viable solutions.

Healthcare Market Demand for Engineered Biopolymers

The global healthcare market for engineered biopolymers is experiencing unprecedented growth, driven by increasing demand for biocompatible materials in medical applications. Current market valuations indicate that the medical biopolymer sector reached approximately 10.5 billion USD in 2022, with projections suggesting a compound annual growth rate (CAGR) of 13.7% through 2030. This robust growth trajectory reflects the expanding applications of engineered biopolymers across diverse medical fields including tissue engineering, drug delivery systems, wound healing, and implantable devices.

Demographic shifts are significantly influencing market demand patterns. The aging global population, particularly in developed regions such as North America, Europe, and parts of Asia, has created substantial demand for advanced biomaterials in orthopedic applications, cardiovascular devices, and regenerative medicine. According to healthcare demographic analyses, populations aged 65 and above are expected to double by 2050, creating sustained demand for biopolymer-based medical solutions.

The wound care segment represents one of the fastest-growing application areas, with biopolymer-based dressings and scaffolds showing 17.2% annual growth. This acceleration is attributed to rising chronic wound prevalence associated with diabetes and vascular disorders, conditions that are increasing in prevalence worldwide. Healthcare providers are increasingly favoring biopolymer solutions due to their superior healing properties, reduced infection rates, and improved patient outcomes compared to traditional materials.

Surgical applications constitute another significant market segment, with biopolymer sutures, adhesives, and barriers collectively accounting for 3.8 billion USD in 2022. The shift toward minimally invasive procedures has further accelerated demand for specialized biopolymer products that can facilitate these advanced surgical techniques while reducing recovery times and complications.

Regional market analysis reveals varying adoption patterns, with North America currently leading in market share (38%), followed by Europe (29%) and Asia-Pacific (24%). However, the highest growth rates are being observed in emerging economies, particularly in India and China, where healthcare infrastructure development and increasing access to advanced medical technologies are creating new market opportunities for engineered biopolymers.

Consumer and healthcare provider preferences are evolving toward sustainable and environmentally responsible medical products. This trend has created a distinct market segment for bio-based polymers derived from renewable resources, which is growing at 15.9% annually—outpacing the overall market. Hospitals and healthcare systems are increasingly incorporating sustainability metrics into procurement decisions, further driving demand for responsibly sourced biopolymer alternatives to traditional petroleum-based medical plastics.

Demographic shifts are significantly influencing market demand patterns. The aging global population, particularly in developed regions such as North America, Europe, and parts of Asia, has created substantial demand for advanced biomaterials in orthopedic applications, cardiovascular devices, and regenerative medicine. According to healthcare demographic analyses, populations aged 65 and above are expected to double by 2050, creating sustained demand for biopolymer-based medical solutions.

The wound care segment represents one of the fastest-growing application areas, with biopolymer-based dressings and scaffolds showing 17.2% annual growth. This acceleration is attributed to rising chronic wound prevalence associated with diabetes and vascular disorders, conditions that are increasing in prevalence worldwide. Healthcare providers are increasingly favoring biopolymer solutions due to their superior healing properties, reduced infection rates, and improved patient outcomes compared to traditional materials.

Surgical applications constitute another significant market segment, with biopolymer sutures, adhesives, and barriers collectively accounting for 3.8 billion USD in 2022. The shift toward minimally invasive procedures has further accelerated demand for specialized biopolymer products that can facilitate these advanced surgical techniques while reducing recovery times and complications.

Regional market analysis reveals varying adoption patterns, with North America currently leading in market share (38%), followed by Europe (29%) and Asia-Pacific (24%). However, the highest growth rates are being observed in emerging economies, particularly in India and China, where healthcare infrastructure development and increasing access to advanced medical technologies are creating new market opportunities for engineered biopolymers.

Consumer and healthcare provider preferences are evolving toward sustainable and environmentally responsible medical products. This trend has created a distinct market segment for bio-based polymers derived from renewable resources, which is growing at 15.9% annually—outpacing the overall market. Hospitals and healthcare systems are increasingly incorporating sustainability metrics into procurement decisions, further driving demand for responsibly sourced biopolymer alternatives to traditional petroleum-based medical plastics.

Current Biopolymer Engineering Challenges

Despite significant advancements in biopolymer engineering for medical applications, the field faces several critical challenges that impede broader clinical implementation. Biocompatibility remains a primary concern, as even naturally derived polymers can trigger immune responses when processed or combined with synthetic materials. Researchers continue to struggle with optimizing the balance between biocompatibility and desired mechanical properties, particularly for load-bearing applications like orthopedic implants.

Scalability presents another significant hurdle, as laboratory-scale production methods often fail to translate effectively to industrial manufacturing. The complex structural characteristics of biopolymers like collagen and silk fibroin are difficult to maintain during large-scale processing, resulting in inconsistent performance across production batches. This variability undermines regulatory approval pathways and commercial viability.

Degradation kinetics control remains elusive for many biopolymer systems. The ideal medical implant should degrade at a rate that matches tissue regeneration, but current technologies struggle to achieve this synchronization. Environmental factors such as pH, enzyme concentration, and mechanical loading can dramatically alter degradation profiles in vivo, making predictable performance challenging.

Sterilization compatibility constitutes a persistent challenge, as conventional methods like gamma irradiation and ethylene oxide treatment can compromise the structural integrity and functionality of biopolymers. This limitation necessitates the development of novel sterilization approaches that preserve material properties while ensuring patient safety.

Cost-effectiveness barriers significantly limit widespread adoption of biopolymer technologies. Current extraction, purification, and processing methods for natural biopolymers remain labor-intensive and expensive compared to synthetic alternatives. The specialized equipment and expertise required for quality control further elevate production costs.

Regulatory hurdles compound these technical challenges. The complex and variable nature of biopolymers complicates the standardization necessary for regulatory approval. Manufacturers must navigate different regulatory frameworks across global markets, each with unique requirements for demonstrating safety and efficacy.

Cross-disciplinary integration challenges also persist, as effective biopolymer engineering requires seamless collaboration between materials scientists, biologists, clinicians, and manufacturing engineers. Communication barriers between these disciplines often result in materials that excel in laboratory settings but fail to address practical clinical needs or manufacturing constraints.

Scalability presents another significant hurdle, as laboratory-scale production methods often fail to translate effectively to industrial manufacturing. The complex structural characteristics of biopolymers like collagen and silk fibroin are difficult to maintain during large-scale processing, resulting in inconsistent performance across production batches. This variability undermines regulatory approval pathways and commercial viability.

Degradation kinetics control remains elusive for many biopolymer systems. The ideal medical implant should degrade at a rate that matches tissue regeneration, but current technologies struggle to achieve this synchronization. Environmental factors such as pH, enzyme concentration, and mechanical loading can dramatically alter degradation profiles in vivo, making predictable performance challenging.

Sterilization compatibility constitutes a persistent challenge, as conventional methods like gamma irradiation and ethylene oxide treatment can compromise the structural integrity and functionality of biopolymers. This limitation necessitates the development of novel sterilization approaches that preserve material properties while ensuring patient safety.

Cost-effectiveness barriers significantly limit widespread adoption of biopolymer technologies. Current extraction, purification, and processing methods for natural biopolymers remain labor-intensive and expensive compared to synthetic alternatives. The specialized equipment and expertise required for quality control further elevate production costs.

Regulatory hurdles compound these technical challenges. The complex and variable nature of biopolymers complicates the standardization necessary for regulatory approval. Manufacturers must navigate different regulatory frameworks across global markets, each with unique requirements for demonstrating safety and efficacy.

Cross-disciplinary integration challenges also persist, as effective biopolymer engineering requires seamless collaboration between materials scientists, biologists, clinicians, and manufacturing engineers. Communication barriers between these disciplines often result in materials that excel in laboratory settings but fail to address practical clinical needs or manufacturing constraints.

Current Biopolymer Engineering Solutions

01 Biopolymers in medical applications

Biopolymers are increasingly used in medical applications due to their biocompatibility and biodegradability. These materials can be formulated into drug delivery systems, tissue engineering scaffolds, and wound healing products. Their natural origin makes them less likely to trigger immune responses, and their degradation products are typically non-toxic. Medical applications of biopolymers include controlled release formulations, implantable devices, and regenerative medicine technologies.- Biopolymers in medical applications: Biopolymers are increasingly used in medical applications due to their biocompatibility and biodegradability. These materials can be formulated into drug delivery systems, tissue engineering scaffolds, and wound healing products. Their natural origin makes them less likely to trigger immune responses, and their degradation products are typically non-toxic. Medical applications include controlled release formulations, implantable devices, and regenerative medicine platforms.

- Biopolymer-based analytical methods: Biopolymers serve as important tools in analytical and diagnostic methods. They can be used as substrates, recognition elements, or separation media in various analytical techniques. These applications leverage the specific binding properties and structural characteristics of biopolymers such as proteins, nucleic acids, and polysaccharides. The methods include biosensors, chromatographic separations, and molecular diagnostic assays for detecting biomarkers or pathogens.

- Biopolymer production and processing technologies: Various technologies have been developed for the production and processing of biopolymers from renewable resources. These include fermentation processes, enzymatic synthesis, and chemical modification of natural polymers. Processing techniques involve methods to control molecular weight, crosslinking, and physical properties to tailor biopolymers for specific applications. Innovations in this area focus on improving yield, purity, and sustainability of biopolymer production.

- Environmental applications of biopolymers: Biopolymers offer sustainable solutions for environmental challenges due to their biodegradability and renewable sourcing. They can be used in packaging materials to reduce plastic waste, in soil remediation as carriers for beneficial microorganisms, and in water treatment as flocculants or adsorbents. Their natural degradation pathways make them particularly valuable for applications where persistence in the environment would be problematic.

- Biopolymer modification and functionalization: Chemical and enzymatic modifications of biopolymers can enhance their properties and expand their applications. These modifications include crosslinking, grafting, and introduction of functional groups to improve mechanical properties, water resistance, or to add specific functionalities. Modified biopolymers can exhibit improved thermal stability, mechanical strength, or gain new properties such as antimicrobial activity, adhesiveness, or stimuli-responsiveness.

02 Biopolymers for environmental applications

Biopolymers offer sustainable alternatives to petroleum-based plastics for environmental applications. These materials are derived from renewable resources and can be designed to biodegrade under specific conditions. Applications include biodegradable packaging, agricultural films, and environmental remediation technologies. The development of biopolymers with enhanced properties such as water resistance, mechanical strength, and thermal stability has expanded their potential uses in addressing environmental challenges.Expand Specific Solutions03 Analytical methods for biopolymer characterization

Advanced analytical techniques are essential for characterizing the structure, properties, and behavior of biopolymers. These methods include spectroscopic techniques, chromatography, microscopy, and computational modeling. Characterization is crucial for understanding structure-property relationships, quality control, and regulatory compliance. Recent developments in high-throughput screening and artificial intelligence have accelerated the discovery and optimization of biopolymers with tailored properties for specific applications.Expand Specific Solutions04 Biopolymers in diagnostic and biosensing applications

Biopolymers play a critical role in diagnostic and biosensing technologies due to their ability to interact specifically with biological molecules. These materials can be functionalized to detect biomarkers, pathogens, or environmental contaminants with high sensitivity and selectivity. Applications include point-of-care diagnostics, environmental monitoring, and food safety testing. The integration of biopolymers with microfluidics and nanotechnology has enabled the development of miniaturized, portable, and cost-effective biosensing platforms.Expand Specific Solutions05 Production and processing of biopolymers

Various methods exist for the production and processing of biopolymers, including microbial fermentation, enzymatic synthesis, and chemical modification of natural polymers. These processes can be optimized to control molecular weight, composition, and functionality. Sustainable production methods focus on using renewable feedstocks, reducing energy consumption, and minimizing waste. Recent advances in synthetic biology and bioprocess engineering have enabled the development of novel biopolymers with improved properties and reduced production costs.Expand Specific Solutions

Leading Biopolymer Research Organizations and Companies

Biopolymer engineering for medical applications is currently in a growth phase, with the market expected to reach significant expansion due to increasing demand for biocompatible materials in healthcare. The competitive landscape features a mix of established medical device companies (Medtronic, Ethicon, FUJIFILM), specialized biopolymer innovators (PolyNovo, Bezwada Biomedical, REVA Medical), and academic research powerhouses (MIT, Johns Hopkins, Rutgers). Technology maturity varies across applications, with some biopolymers already commercialized for wound healing and tissue engineering, while more complex applications like drug delivery systems and bioactive implants remain in development stages. Industry-academic partnerships are accelerating innovation, with companies like Abyrx and Sdip Innovations commercializing technologies developed in research institutions, creating a dynamic ecosystem that balances scientific advancement with clinical implementation.

PolyNovo Biomaterials Pty Ltd.

Technical Solution: PolyNovo has developed a proprietary biopolymer platform called NovoSorb®, which represents a significant advancement in biodegradable polymer technology for medical applications. The NovoSorb® technology is based on a family of biocompatible and biodegradable polyurethane polymers that can be engineered with specific mechanical properties, degradation rates, and bioactive functionalities. Their flagship product, the NovoSorb® Biodegradable Temporizing Matrix (BTM), is designed for the treatment of complex wounds and burns, providing a dermal scaffold that supports tissue regeneration while gradually degrading as new tissue forms. The polymer chemistry allows for controlled porosity and interconnected pore structures that facilitate cell migration, vascularization, and integration with surrounding tissues. PolyNovo's biopolymers demonstrate excellent biocompatibility with minimal foreign body response, addressing a critical challenge in implantable biomaterials. The company has engineered their polymers to degrade through hydrolysis at predictable rates that can be tailored to specific clinical applications, ranging from weeks to years depending on the formulation[2][5]. Recent advancements include antimicrobial-infused variants and specialized formulations for orthopedic and hernia repair applications.

Strengths: Highly customizable polymer platform that can be tailored for diverse medical applications; established clinical evidence supporting safety and efficacy; scalable manufacturing processes that maintain consistent quality. Weaknesses: Limited to synthetic polymer-based approaches rather than naturally-derived materials; relatively higher cost compared to conventional wound care products; degradation byproducts may potentially cause local pH changes in some applications.

Medtronic Vascular, Inc.

Technical Solution: Medtronic Vascular has developed sophisticated biopolymer engineering solutions specifically targeting cardiovascular applications. Their technology platform centers on biocompatible polymer coatings and drug-eluting systems for vascular implants such as stents and heart valves. The company has pioneered biodegradable polymer drug carriers that provide controlled release of anti-proliferative and anti-inflammatory agents to prevent restenosis following vascular interventions. Their proprietary polymer matrices are engineered to degrade at predetermined rates, releasing therapeutic agents in a time-controlled manner while eventually leaving only the bare metal stent or other implant structure. Medtronic has also developed biopolymer-based tissue engineering scaffolds for vascular grafts that promote endothelialization and reduce thrombogenicity. Their advanced hydrogel technologies incorporate bioactive molecules that modulate the healing response and promote favorable tissue integration. Recent innovations include bioresorbable vascular scaffolds composed entirely of engineered polymers that provide temporary mechanical support before completely degrading over 1-2 years, eliminating the permanent implant[4][7]. The company has also developed composite biopolymer systems that combine synthetic and natural materials to optimize mechanical properties while enhancing biocompatibility and cellular interactions.

Strengths: Extensive clinical validation through large-scale trials; sophisticated manufacturing infrastructure ensuring consistent quality; strong integration with other cardiovascular technologies in their portfolio. Weaknesses: Relatively slow innovation cycle due to regulatory constraints in high-risk cardiovascular applications; higher cost compared to non-coated alternatives; some polymer formulations may trigger inflammatory responses in certain patient populations.

Key Biopolymer Patents and Research Breakthroughs

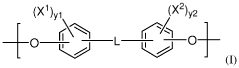

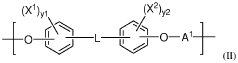

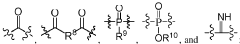

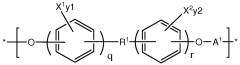

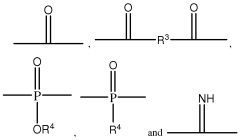

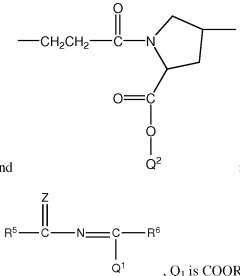

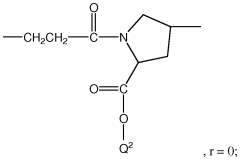

Polymeric biomaterials derived from phenolic monomers and their medical uses

PatentWO2017111994A1

Innovation

- Development of diphenolic monomers derived from tyrosol and hydroxybenzoic acid, which are used to synthesize bioerodible polycarbonates and polyarylates with ester linkages instead of amide bonds, allowing for controlled bioerosion and improved processability through the formation of polymers with repeating structural units that include halogenated phenolic compounds for enhanced properties.

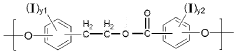

Phase-separated biocompatible polymer compositions for medical uses

PatentWO2010042917A1

Innovation

- Development of phase-separated polymer compositions with specific thermal transition temperatures and molecular structures, including a first polymer phase with a high wet thermal transition temperature and a second phase with a lower transition temperature, to create a biocompatible, bioresorbable, and radiopaque material suitable for medical devices.

Regulatory Framework for Medical Biopolymers

The regulatory landscape governing medical biopolymers represents a complex and evolving framework that significantly impacts product development, market approval, and commercial viability. In the United States, the FDA categorizes biopolymer-based medical products primarily under medical device regulations (21 CFR Part 820), drug regulations (21 CFR Parts 210 and 211), or combination product provisions, depending on their primary mode of action. The regulatory pathway determines testing requirements, with most biopolymer implants requiring extensive biocompatibility testing according to ISO 10993 standards.

European regulation has undergone significant transformation with the implementation of the Medical Device Regulation (MDR 2017/745) and In Vitro Diagnostic Regulation (IVDR 2017/746), which introduced more stringent requirements for clinical evidence and post-market surveillance. Notably, biopolymers derived from animal sources face additional scrutiny under special provisions addressing transmissible spongiform encephalopathies.

Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has established the Sakigake designation system to accelerate approval for innovative medical technologies, including advanced biopolymer applications. This program offers priority consultation and review for qualifying products, potentially reducing time-to-market by up to six months.

Harmonization efforts through the International Medical Device Regulators Forum (IMDRF) have yielded progress in standardizing requirements across major markets, though significant regional variations persist. The implementation of Unique Device Identification (UDI) systems globally represents a positive step toward regulatory convergence and enhanced supply chain transparency.

Environmental regulations increasingly impact biopolymer development, with the European Union's REACH regulation (Registration, Evaluation, Authorization and Restriction of Chemicals) requiring comprehensive safety data for polymers and their constituents. Similarly, the FDA has recently issued guidance on considering environmental impact in medical product development.

Regulatory challenges specific to biopolymers include demonstrating long-term stability, addressing batch-to-batch variability for naturally derived materials, and establishing appropriate degradation profiles for biodegradable formulations. The regulatory framework for 3D-printed biopolymer constructs remains particularly fluid, with the FDA's guidance on Additive Manufacturing (2017) providing initial direction while acknowledging the need for evolving standards.

Companies developing medical biopolymers must implement robust regulatory strategies early in product development, incorporating regulatory considerations into material selection, manufacturing process design, and clinical evaluation planning. Successful navigation of this complex regulatory landscape requires dedicated regulatory affairs expertise and continuous monitoring of evolving requirements across target markets.

European regulation has undergone significant transformation with the implementation of the Medical Device Regulation (MDR 2017/745) and In Vitro Diagnostic Regulation (IVDR 2017/746), which introduced more stringent requirements for clinical evidence and post-market surveillance. Notably, biopolymers derived from animal sources face additional scrutiny under special provisions addressing transmissible spongiform encephalopathies.

Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has established the Sakigake designation system to accelerate approval for innovative medical technologies, including advanced biopolymer applications. This program offers priority consultation and review for qualifying products, potentially reducing time-to-market by up to six months.

Harmonization efforts through the International Medical Device Regulators Forum (IMDRF) have yielded progress in standardizing requirements across major markets, though significant regional variations persist. The implementation of Unique Device Identification (UDI) systems globally represents a positive step toward regulatory convergence and enhanced supply chain transparency.

Environmental regulations increasingly impact biopolymer development, with the European Union's REACH regulation (Registration, Evaluation, Authorization and Restriction of Chemicals) requiring comprehensive safety data for polymers and their constituents. Similarly, the FDA has recently issued guidance on considering environmental impact in medical product development.

Regulatory challenges specific to biopolymers include demonstrating long-term stability, addressing batch-to-batch variability for naturally derived materials, and establishing appropriate degradation profiles for biodegradable formulations. The regulatory framework for 3D-printed biopolymer constructs remains particularly fluid, with the FDA's guidance on Additive Manufacturing (2017) providing initial direction while acknowledging the need for evolving standards.

Companies developing medical biopolymers must implement robust regulatory strategies early in product development, incorporating regulatory considerations into material selection, manufacturing process design, and clinical evaluation planning. Successful navigation of this complex regulatory landscape requires dedicated regulatory affairs expertise and continuous monitoring of evolving requirements across target markets.

Sustainability and Biodegradability Considerations

The integration of sustainability principles into biopolymer engineering represents a critical advancement in medical applications. Biopolymers derived from renewable resources offer significant environmental advantages over traditional petroleum-based polymers, including reduced carbon footprint and decreased reliance on fossil fuels. Recent life cycle assessments indicate that medical devices manufactured from biopolymers such as polylactic acid (PLA) and polyhydroxyalkanoates (PHAs) can reduce greenhouse gas emissions by 25-68% compared to conventional alternatives, depending on production methods and end-of-life scenarios.

Biodegradability characteristics of medical biopolymers must be precisely engineered to match their intended applications. For temporary implants and drug delivery systems, controlled degradation rates are essential to ensure therapeutic efficacy while minimizing the need for removal procedures. Research indicates that degradation profiles can be tailored through molecular weight adjustment, copolymerization strategies, and surface modifications, allowing for degradation periods ranging from weeks to years based on clinical requirements.

Environmental fate considerations present both opportunities and challenges in biopolymer development. While biodegradable medical products reduce waste accumulation, their degradation byproducts must be thoroughly evaluated for potential ecotoxicological impacts. Recent studies have demonstrated that some biopolymer degradation products may contribute to microplastic pollution or release compounds that affect aquatic ecosystems, necessitating comprehensive environmental risk assessments.

Regulatory frameworks for sustainable biopolymers in medical applications continue to evolve globally. The FDA and EMA have established guidelines for evaluating the safety and efficacy of biodegradable medical materials, though harmonization of sustainability metrics remains incomplete. Manufacturers must navigate varying regional requirements while demonstrating both clinical performance and environmental benefits, creating a complex regulatory landscape that influences development timelines and market access.

Circular economy approaches are increasingly being applied to medical biopolymers, with innovations in collection, processing, and repurposing of medical waste. Closed-loop systems for hospital waste management have shown promise in pilot programs, where PLA-based disposables are collected and enzymatically processed into feedstock for new medical products, reducing waste by up to 40% in participating facilities.

Economic considerations remain significant barriers to widespread adoption of sustainable biopolymers in medical applications. Production costs typically exceed those of conventional polymers by 30-150%, though economies of scale and process innovations are gradually reducing this gap. Healthcare institutions increasingly factor lifecycle costs and sustainability benefits into procurement decisions, creating market pull for environmentally responsible medical materials despite higher initial investments.

Biodegradability characteristics of medical biopolymers must be precisely engineered to match their intended applications. For temporary implants and drug delivery systems, controlled degradation rates are essential to ensure therapeutic efficacy while minimizing the need for removal procedures. Research indicates that degradation profiles can be tailored through molecular weight adjustment, copolymerization strategies, and surface modifications, allowing for degradation periods ranging from weeks to years based on clinical requirements.

Environmental fate considerations present both opportunities and challenges in biopolymer development. While biodegradable medical products reduce waste accumulation, their degradation byproducts must be thoroughly evaluated for potential ecotoxicological impacts. Recent studies have demonstrated that some biopolymer degradation products may contribute to microplastic pollution or release compounds that affect aquatic ecosystems, necessitating comprehensive environmental risk assessments.

Regulatory frameworks for sustainable biopolymers in medical applications continue to evolve globally. The FDA and EMA have established guidelines for evaluating the safety and efficacy of biodegradable medical materials, though harmonization of sustainability metrics remains incomplete. Manufacturers must navigate varying regional requirements while demonstrating both clinical performance and environmental benefits, creating a complex regulatory landscape that influences development timelines and market access.

Circular economy approaches are increasingly being applied to medical biopolymers, with innovations in collection, processing, and repurposing of medical waste. Closed-loop systems for hospital waste management have shown promise in pilot programs, where PLA-based disposables are collected and enzymatically processed into feedstock for new medical products, reducing waste by up to 40% in participating facilities.

Economic considerations remain significant barriers to widespread adoption of sustainable biopolymers in medical applications. Production costs typically exceed those of conventional polymers by 30-150%, though economies of scale and process innovations are gradually reducing this gap. Healthcare institutions increasingly factor lifecycle costs and sustainability benefits into procurement decisions, creating market pull for environmentally responsible medical materials despite higher initial investments.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!