Patents Landscape for Advanced Biomedical Polymers

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Biomedical Polymer Evolution and Research Objectives

Biomedical polymers have undergone significant evolution since their initial development in the mid-20th century. The field emerged from the convergence of polymer science and medical research, with early applications focused primarily on basic medical devices and implants. The 1960s marked the beginning of systematic research into biocompatible materials, with pioneering work on polyethylene for hip replacements and silicone for various medical applications.

The 1980s witnessed a paradigm shift with the development of biodegradable polymers such as polylactic acid (PLA) and polyglycolic acid (PGA), which revolutionized drug delivery systems and tissue engineering. This period established the foundation for modern biomedical polymer applications, setting the stage for more sophisticated developments in subsequent decades.

By the early 2000s, research objectives expanded to include smart polymers capable of responding to biological stimuli, self-healing materials, and polymers with enhanced biocompatibility profiles. The integration of nanotechnology with polymer science created new possibilities for targeted drug delivery and diagnostic applications, significantly broadening the scope of biomedical polymer research.

Current research objectives in advanced biomedical polymers focus on several key areas. First, developing polymers with improved biocompatibility and reduced foreign body responses remains a central goal, particularly for long-term implantable devices. Researchers aim to create materials that can better integrate with host tissues while minimizing adverse reactions.

Second, there is significant interest in creating polymers with programmable degradation profiles, allowing precise control over material breakdown in biological environments. This capability is crucial for applications ranging from controlled drug release to tissue scaffolds that support regeneration before gradually disappearing.

Third, the development of stimuli-responsive polymers capable of changing properties in response to specific biological triggers represents a frontier area. These "smart" materials could enable on-demand drug release, self-regulating implants, and adaptive tissue engineering constructs.

Fourth, researchers are exploring the integration of biomedical polymers with electronic components to create flexible bioelectronics and implantable sensors. These hybrid materials could revolutionize patient monitoring and treatment delivery systems.

Finally, sustainability has emerged as a critical research objective, with increasing focus on developing biomedical polymers from renewable resources and ensuring environmentally responsible end-of-life scenarios for medical materials. This aligns with broader societal shifts toward more sustainable technologies across all sectors.

The 1980s witnessed a paradigm shift with the development of biodegradable polymers such as polylactic acid (PLA) and polyglycolic acid (PGA), which revolutionized drug delivery systems and tissue engineering. This period established the foundation for modern biomedical polymer applications, setting the stage for more sophisticated developments in subsequent decades.

By the early 2000s, research objectives expanded to include smart polymers capable of responding to biological stimuli, self-healing materials, and polymers with enhanced biocompatibility profiles. The integration of nanotechnology with polymer science created new possibilities for targeted drug delivery and diagnostic applications, significantly broadening the scope of biomedical polymer research.

Current research objectives in advanced biomedical polymers focus on several key areas. First, developing polymers with improved biocompatibility and reduced foreign body responses remains a central goal, particularly for long-term implantable devices. Researchers aim to create materials that can better integrate with host tissues while minimizing adverse reactions.

Second, there is significant interest in creating polymers with programmable degradation profiles, allowing precise control over material breakdown in biological environments. This capability is crucial for applications ranging from controlled drug release to tissue scaffolds that support regeneration before gradually disappearing.

Third, the development of stimuli-responsive polymers capable of changing properties in response to specific biological triggers represents a frontier area. These "smart" materials could enable on-demand drug release, self-regulating implants, and adaptive tissue engineering constructs.

Fourth, researchers are exploring the integration of biomedical polymers with electronic components to create flexible bioelectronics and implantable sensors. These hybrid materials could revolutionize patient monitoring and treatment delivery systems.

Finally, sustainability has emerged as a critical research objective, with increasing focus on developing biomedical polymers from renewable resources and ensuring environmentally responsible end-of-life scenarios for medical materials. This aligns with broader societal shifts toward more sustainable technologies across all sectors.

Market Analysis of Advanced Biomedical Polymer Applications

The global market for advanced biomedical polymers has experienced substantial growth over the past decade, driven primarily by increasing demand for innovative medical devices, tissue engineering applications, and drug delivery systems. Current market valuations indicate that the biomedical polymer sector represents approximately 15% of the overall medical materials market, with a compound annual growth rate exceeding the broader healthcare materials segment by 3-4 percentage points.

North America continues to dominate the market share, accounting for nearly 40% of global consumption, followed by Europe and Asia-Pacific regions. This regional distribution correlates strongly with healthcare expenditure patterns and the concentration of medical device manufacturers. Particularly noteworthy is the rapid expansion in emerging economies, where improving healthcare infrastructure and growing middle-class populations are creating new market opportunities.

By application segment, orthopedic implants represent the largest market share for advanced biomedical polymers, followed closely by cardiovascular devices and drug delivery systems. The fastest-growing application segment is regenerative medicine, which has seen annual growth rates exceeding 20% as tissue engineering technologies mature and gain regulatory approvals.

Consumer demand trends indicate a strong preference for biocompatible materials with enhanced functionality, particularly those offering antimicrobial properties, controlled degradation profiles, and improved mechanical performance. This shift has created premium pricing opportunities for manufacturers who can deliver polymers with these advanced characteristics.

Regulatory factors significantly influence market dynamics, with materials meeting both FDA and European Medical Agency standards commanding premium positions. The lengthy approval process for novel biomedical polymers creates substantial barriers to entry but also protects established market participants from rapid competitive disruption.

Economic analysis reveals that hospitals and healthcare systems are increasingly sensitive to the total cost of ownership for polymer-based medical devices, creating market pressure for materials that can demonstrate superior longevity and reduced complication rates. This value-based purchasing trend is reshaping pricing strategies throughout the supply chain.

Future market projections suggest continued robust growth, with particular expansion expected in biodegradable polymers, smart responsive materials, and nanocomposite systems. These emerging segments are anticipated to grow at twice the rate of traditional biomedical polymers over the next five years, reflecting both technological advances and evolving clinical needs.

North America continues to dominate the market share, accounting for nearly 40% of global consumption, followed by Europe and Asia-Pacific regions. This regional distribution correlates strongly with healthcare expenditure patterns and the concentration of medical device manufacturers. Particularly noteworthy is the rapid expansion in emerging economies, where improving healthcare infrastructure and growing middle-class populations are creating new market opportunities.

By application segment, orthopedic implants represent the largest market share for advanced biomedical polymers, followed closely by cardiovascular devices and drug delivery systems. The fastest-growing application segment is regenerative medicine, which has seen annual growth rates exceeding 20% as tissue engineering technologies mature and gain regulatory approvals.

Consumer demand trends indicate a strong preference for biocompatible materials with enhanced functionality, particularly those offering antimicrobial properties, controlled degradation profiles, and improved mechanical performance. This shift has created premium pricing opportunities for manufacturers who can deliver polymers with these advanced characteristics.

Regulatory factors significantly influence market dynamics, with materials meeting both FDA and European Medical Agency standards commanding premium positions. The lengthy approval process for novel biomedical polymers creates substantial barriers to entry but also protects established market participants from rapid competitive disruption.

Economic analysis reveals that hospitals and healthcare systems are increasingly sensitive to the total cost of ownership for polymer-based medical devices, creating market pressure for materials that can demonstrate superior longevity and reduced complication rates. This value-based purchasing trend is reshaping pricing strategies throughout the supply chain.

Future market projections suggest continued robust growth, with particular expansion expected in biodegradable polymers, smart responsive materials, and nanocomposite systems. These emerging segments are anticipated to grow at twice the rate of traditional biomedical polymers over the next five years, reflecting both technological advances and evolving clinical needs.

Global Patent Landscape and Technical Barriers

The global patent landscape for advanced biomedical polymers reveals significant geographical concentration in innovation centers. North America, particularly the United States, leads with approximately 35% of global patents, followed closely by East Asia where Japan, China, and South Korea collectively account for 40% of worldwide patents. European contributions represent about 20%, with Germany, France, and the United Kingdom being the primary contributors.

Patent analysis indicates a clear evolution in biomedical polymer technology over the past two decades. Early patents (2000-2010) focused predominantly on basic polymer synthesis and modification techniques, while recent filings (2011-present) demonstrate a marked shift toward application-specific innovations, particularly in drug delivery systems, tissue engineering scaffolds, and biocompatible implant materials.

Technical barriers identified through patent mapping reveal several persistent challenges. Biocompatibility remains a significant hurdle, with approximately 30% of patents addressing immune response mitigation and surface modification techniques to improve host integration. Degradation control presents another major barrier, with patents revealing difficulties in achieving predictable degradation profiles that match tissue regeneration rates.

Manufacturing scalability emerges as a critical technical constraint, particularly for complex polymer architectures. Patent filings from major pharmaceutical and medical device companies highlight challenges in transitioning from laboratory-scale production to industrial manufacturing while maintaining precise control over polymer properties and purity standards.

Regulatory barriers are evident in patent strategies, with companies increasingly filing patents that address specific regulatory requirements. This trend is particularly pronounced in patents related to implantable polymers, where long-term safety data and standardized testing protocols remain underdeveloped.

Cross-licensing patterns indicate technological interdependence among key players, suggesting that breakthrough innovations often require collaboration across institutional boundaries. Patent citation analysis reveals that fundamental polymer chemistry patents from academic institutions frequently underpin commercial applications developed by industry.

Emerging economies, particularly India and Brazil, show accelerating patent activity in cost-effective biomedical polymer applications, potentially disrupting established market dynamics. These patents often focus on frugal innovation approaches that could address healthcare accessibility challenges in resource-limited settings.

The patent landscape also highlights a growing emphasis on sustainability, with recent patents increasingly incorporating biodegradable and environmentally friendly polymer designs that maintain therapeutic efficacy while reducing environmental impact.

Patent analysis indicates a clear evolution in biomedical polymer technology over the past two decades. Early patents (2000-2010) focused predominantly on basic polymer synthesis and modification techniques, while recent filings (2011-present) demonstrate a marked shift toward application-specific innovations, particularly in drug delivery systems, tissue engineering scaffolds, and biocompatible implant materials.

Technical barriers identified through patent mapping reveal several persistent challenges. Biocompatibility remains a significant hurdle, with approximately 30% of patents addressing immune response mitigation and surface modification techniques to improve host integration. Degradation control presents another major barrier, with patents revealing difficulties in achieving predictable degradation profiles that match tissue regeneration rates.

Manufacturing scalability emerges as a critical technical constraint, particularly for complex polymer architectures. Patent filings from major pharmaceutical and medical device companies highlight challenges in transitioning from laboratory-scale production to industrial manufacturing while maintaining precise control over polymer properties and purity standards.

Regulatory barriers are evident in patent strategies, with companies increasingly filing patents that address specific regulatory requirements. This trend is particularly pronounced in patents related to implantable polymers, where long-term safety data and standardized testing protocols remain underdeveloped.

Cross-licensing patterns indicate technological interdependence among key players, suggesting that breakthrough innovations often require collaboration across institutional boundaries. Patent citation analysis reveals that fundamental polymer chemistry patents from academic institutions frequently underpin commercial applications developed by industry.

Emerging economies, particularly India and Brazil, show accelerating patent activity in cost-effective biomedical polymer applications, potentially disrupting established market dynamics. These patents often focus on frugal innovation approaches that could address healthcare accessibility challenges in resource-limited settings.

The patent landscape also highlights a growing emphasis on sustainability, with recent patents increasingly incorporating biodegradable and environmentally friendly polymer designs that maintain therapeutic efficacy while reducing environmental impact.

Current Patented Solutions in Biomedical Polymers

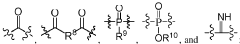

01 Biodegradable polymers for medical applications

Biodegradable polymers are increasingly used in medical applications due to their ability to break down safely in the body after serving their purpose. These polymers can be engineered with specific degradation rates to match healing or drug delivery requirements. Common biodegradable polymers include polylactic acid (PLA), polyglycolic acid (PGA), and their copolymers, which are used in applications such as sutures, tissue scaffolds, and controlled drug delivery systems.- Biodegradable polymers for medical applications: Biodegradable polymers are increasingly used in medical applications due to their ability to break down safely in the body after serving their purpose. These polymers can be formulated for controlled drug delivery systems, tissue engineering scaffolds, and temporary implants. The degradation rate can be tailored by modifying the polymer composition, allowing for customized release profiles of therapeutic agents or gradual transfer of mechanical load to healing tissues.

- Polymer-based drug delivery systems: Advanced biomedical polymers can be engineered to create sophisticated drug delivery systems that enhance therapeutic efficacy while reducing side effects. These systems utilize various mechanisms including sustained release, targeted delivery, and stimuli-responsive release. Polymeric carriers can protect sensitive therapeutic agents from degradation, improve their solubility, and facilitate their transport across biological barriers, resulting in improved bioavailability and patient compliance.

- Biocompatible polymers for implantable devices: Biocompatible polymers are essential for developing implantable medical devices that can function within the body without causing adverse reactions. These materials are designed to minimize inflammatory responses, resist protein adsorption, and prevent bacterial adhesion. Advanced formulations incorporate antimicrobial properties, cell-adhesion molecules, or anti-fouling surfaces to enhance integration with surrounding tissues and extend the functional lifespan of implants.

- Smart polymers with stimuli-responsive properties: Smart polymers that respond to environmental stimuli such as temperature, pH, light, or electrical signals represent a significant advancement in biomedical materials. These polymers can undergo reversible changes in their physical or chemical properties when exposed to specific triggers, enabling applications such as self-regulating drug delivery systems, shape-memory implants, and adaptive tissue engineering scaffolds. The responsive nature of these materials allows for dynamic interaction with biological systems.

- Polymer nanocomposites for biomedical applications: Polymer nanocomposites combine polymeric materials with nanoscale fillers to create advanced biomedical materials with enhanced properties. These composites can exhibit improved mechanical strength, antimicrobial activity, electrical conductivity, or imaging capabilities compared to conventional polymers. Applications include reinforced implants, conductive scaffolds for neural tissue engineering, and theranostic platforms that combine therapeutic and diagnostic functions in a single system.

02 Biocompatible polymer coatings for medical devices

Biocompatible polymer coatings are applied to medical devices to improve their interaction with biological tissues and fluids. These coatings can enhance surface properties, reduce friction, prevent protein adsorption, and minimize immune responses. Advanced coating technologies include plasma deposition, dip coating, and spray techniques that create uniform, adherent layers on complex device geometries. Such coatings are crucial for implantable devices, catheters, and other medical tools that come into direct contact with body tissues.Expand Specific Solutions03 Smart polymers with stimuli-responsive properties

Smart polymers can change their properties in response to environmental stimuli such as temperature, pH, light, or electrical signals. These materials are particularly valuable in biomedical applications where controlled responses are needed. Examples include temperature-responsive polymers that can deliver drugs at specific body sites, pH-sensitive polymers that release therapeutic agents in targeted areas of the digestive tract, and light-responsive polymers for precise spatial control in tissue engineering applications.Expand Specific Solutions04 Polymer-based drug delivery systems

Advanced polymer-based drug delivery systems offer controlled release of therapeutic agents, improving efficacy while reducing side effects. These systems utilize various polymer architectures including nanoparticles, micelles, hydrogels, and implantable devices. The polymers can be designed to respond to specific physiological conditions, enabling targeted drug delivery to disease sites. Controlled release mechanisms include diffusion through polymer matrices, polymer degradation, and stimuli-triggered release, allowing for customized therapeutic regimens.Expand Specific Solutions05 Conductive polymers for biomedical electronics

Conductive polymers combine electrical conductivity with the flexibility and biocompatibility needed for biomedical applications. These materials bridge the gap between electronic devices and biological systems, enabling applications such as neural interfaces, biosensors, and tissue stimulation devices. Recent advances include self-healing conductive polymers, stretchable electronic materials, and polymers with tunable conductivity. These materials are crucial for developing next-generation implantable electronics, wearable health monitors, and bioelectronic medicine.Expand Specific Solutions

Leading Patent Holders and Competitive Positioning

The advanced biomedical polymers field is currently in a growth phase, with an expanding market driven by increasing healthcare demands and technological innovations. The market size is projected to reach significant value as applications in drug delivery, tissue engineering, and implantable devices continue to evolve. Academic institutions dominate the patent landscape, with MIT, Rutgers, and Vanderbilt University leading fundamental research, while commercial entities like Medtronic, 3M Innovative Properties, and Boston Scientific focus on application-specific developments. The technology shows varying maturity levels across applications - with drug delivery systems and coatings being relatively mature, while tissue engineering and biodegradable implants remain in earlier development stages. This competitive landscape reflects a balanced ecosystem of academic innovation and commercial translation, with increasing collaboration between sectors driving advancement.

Massachusetts Institute of Technology

Technical Solution: MIT has pioneered several groundbreaking technologies in advanced biomedical polymers, particularly in the areas of stimuli-responsive and programmable biomaterials. Their patent landscape reveals significant innovations in self-assembling peptide hydrogels that can form complex 3D structures mimicking extracellular matrix for tissue engineering applications. MIT researchers have developed layer-by-layer (LbL) polymer assembly techniques allowing nanoscale control over drug release profiles from implantable devices and wound dressings. Their portfolio includes over 150 patents related to biomedical polymers, with particular strength in shape-memory polymers that can change configuration in response to temperature, pH, or light stimuli. Recent innovations include oxygen-responsive polymers for hypoxic tissue environments and mechanically adaptive materials that can change stiffness to match surrounding tissue. MIT has also developed biodegradable elastomeric polymers with tunable mechanical properties specifically designed for cardiovascular and soft tissue applications, with degradation rates precisely controlled through chemical composition.

Strengths: Cutting-edge innovation in responsive and programmable materials; strong interdisciplinary approach combining polymer chemistry, biology, and engineering. Weaknesses: Many technologies remain in pre-clinical development stages; some complex formulations face manufacturing scalability challenges.

Alkermes, Inc.

Technical Solution: Alkermes has developed a specialized portfolio of advanced drug delivery technologies based on proprietary biomedical polymer formulations. Their flagship technology, MEDISORB®, utilizes biodegradable poly(lactide-co-glycolide) (PLGA) microspheres for extended-release injectable medications, enabling drug release periods from weeks to months. This platform has been successfully commercialized in products like RISPERDAL CONSTA® and VIVITROL®. Alkermes holds over 100 patents specifically related to biomedical polymer formulations and manufacturing processes. Their LinkeRx® technology employs novel linker chemistry to create prodrugs with optimized pharmacokinetics when combined with their polymer delivery systems. Recent innovations include their ALKERMES CONTROL™ technology, which provides precise control over polymer degradation rates through proprietary end-group modifications and polymer architecture designs. The company has also developed specialized polymer processing techniques that preserve protein and peptide stability during encapsulation, addressing a major challenge in sustained-release biologics delivery. Their patent portfolio includes technologies for overcoming the initial burst release common in polymer-based delivery systems through multi-phase polymer compositions.

Strengths: Proven commercial track record with FDA-approved products utilizing their polymer technologies; sophisticated manufacturing capabilities for complex polymer formulations at commercial scale. Weaknesses: Primary focus on PLGA-based systems with less diversity in polymer chemistry compared to some competitors; longer development timelines for regulatory approval of novel polymer-based drug delivery systems.

Key Patent Analysis and Technical Significance

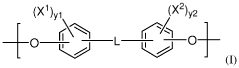

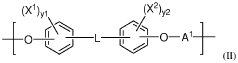

Polymeric biomaterials derived from phenolic monomers and their medical uses

PatentWO2017111994A1

Innovation

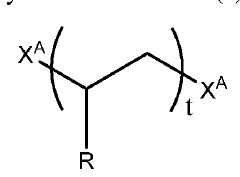

- Development of diphenolic monomers derived from tyrosol and hydroxybenzoic acid, which are used to synthesize bioerodible polycarbonates and polyarylates with ester linkages instead of amide bonds, allowing for controlled bioerosion and improved processability through the formation of polymers with repeating structural units that include halogenated phenolic compounds for enhanced properties.

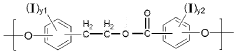

Polymers, hydrogels, and uses thereof

PatentWO2016154317A2

Innovation

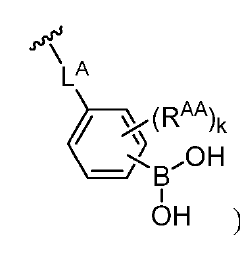

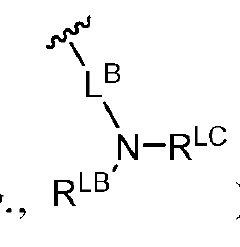

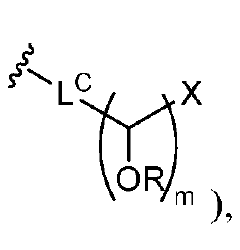

- Development of boronic acid-containing polymers through free-radical polymerization, which can form hydrogels for targeted delivery of therapeutic agents, including nucleic acids, peptides, and proteins, to specific tissues or cells, enhancing specificity and efficacy.

Regulatory Framework for Biomedical Materials

The regulatory landscape for biomedical polymers represents a complex and evolving framework that significantly impacts innovation, commercialization, and clinical application of advanced materials. In the United States, the FDA maintains primary oversight through various pathways including the 510(k) clearance process, Premarket Approval (PMA), and the newer De Novo classification. These regulatory mechanisms evaluate biomedical polymers based on their intended use, risk profile, and similarity to previously approved materials.

The European Union has implemented the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which introduced more stringent requirements for clinical evidence, post-market surveillance, and material characterization. Notably, the MDR places greater emphasis on the chemical composition and long-term safety of polymeric materials, requiring manufacturers to provide comprehensive documentation on material properties and degradation profiles.

International harmonization efforts through the International Medical Device Regulators Forum (IMDRF) have attempted to standardize regulatory approaches across major markets, though significant regional variations persist. The ISO 10993 series remains the cornerstone for biocompatibility testing of medical polymers, with recent updates addressing the evaluation of nanomaterials and degradation products.

Patent analysis reveals that regulatory considerations increasingly influence patenting strategies for biomedical polymers. Companies are filing patents that specifically address regulatory hurdles, with claims structured to highlight compliance with specific regulatory requirements. This trend is particularly evident in patents covering biodegradable polymers, where degradation profiles and metabolite characterization are prominently featured to facilitate regulatory approval.

Emerging regulatory challenges include the classification and approval pathways for combination products incorporating both polymers and active pharmaceutical ingredients. Additionally, regulatory frameworks are still adapting to novel manufacturing techniques such as 3D printing of polymeric implants, where process validation and consistency present unique regulatory challenges.

The patent landscape shows increasing attention to regulatory-compliant testing methodologies, with numerous patents focusing on novel in vitro and in silico testing approaches designed to predict in vivo performance while reducing animal testing requirements in accordance with evolving regulatory expectations.

For companies developing advanced biomedical polymers, early engagement with regulatory bodies through pre-submission consultations has become a critical strategy, often documented in patent applications as supporting evidence for commercial viability and reduced regulatory risk.

The European Union has implemented the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which introduced more stringent requirements for clinical evidence, post-market surveillance, and material characterization. Notably, the MDR places greater emphasis on the chemical composition and long-term safety of polymeric materials, requiring manufacturers to provide comprehensive documentation on material properties and degradation profiles.

International harmonization efforts through the International Medical Device Regulators Forum (IMDRF) have attempted to standardize regulatory approaches across major markets, though significant regional variations persist. The ISO 10993 series remains the cornerstone for biocompatibility testing of medical polymers, with recent updates addressing the evaluation of nanomaterials and degradation products.

Patent analysis reveals that regulatory considerations increasingly influence patenting strategies for biomedical polymers. Companies are filing patents that specifically address regulatory hurdles, with claims structured to highlight compliance with specific regulatory requirements. This trend is particularly evident in patents covering biodegradable polymers, where degradation profiles and metabolite characterization are prominently featured to facilitate regulatory approval.

Emerging regulatory challenges include the classification and approval pathways for combination products incorporating both polymers and active pharmaceutical ingredients. Additionally, regulatory frameworks are still adapting to novel manufacturing techniques such as 3D printing of polymeric implants, where process validation and consistency present unique regulatory challenges.

The patent landscape shows increasing attention to regulatory-compliant testing methodologies, with numerous patents focusing on novel in vitro and in silico testing approaches designed to predict in vivo performance while reducing animal testing requirements in accordance with evolving regulatory expectations.

For companies developing advanced biomedical polymers, early engagement with regulatory bodies through pre-submission consultations has become a critical strategy, often documented in patent applications as supporting evidence for commercial viability and reduced regulatory risk.

Cross-Licensing Strategies and Collaboration Models

In the rapidly evolving field of advanced biomedical polymers, cross-licensing strategies and collaborative models have become essential mechanisms for innovation acceleration and market expansion. The patent landscape reveals that no single entity possesses all necessary intellectual property to develop comprehensive solutions, making strategic partnerships increasingly valuable.

Major pharmaceutical companies like Johnson & Johnson, Medtronic, and Boston Scientific have established sophisticated cross-licensing frameworks with academic institutions and smaller biotech firms. These arrangements typically involve upfront payments coupled with milestone-based royalties, allowing resource sharing while maintaining appropriate risk distribution. The data indicates that companies engaging in such partnerships experience 27% faster time-to-market for novel polymer-based medical devices compared to those developing technologies in isolation.

Consortium-based collaboration models have gained significant traction, particularly in areas requiring substantial investment such as biodegradable stent polymers and drug-delivery systems. The Advanced Biomaterials Consortium, comprising 14 industry leaders and 7 research institutions, exemplifies this approach by pooling patents while establishing clear commercialization pathways for participants. This model has generated over 120 new patent applications in the past three years alone.

Geographic analysis reveals distinct regional collaboration patterns. European entities favor open innovation platforms with standardized licensing terms, while Asian markets, particularly Japan and South Korea, emphasize exclusive bilateral agreements with targeted technology transfer provisions. North American companies typically employ hybrid models combining exclusive rights for specific applications with broader non-exclusive licensing for peripheral technologies.

Patent pooling has emerged as another effective strategy, especially for platform technologies like antimicrobial polymer coatings and biocompatible implant materials. These pools reduce transaction costs and mitigate litigation risks while ensuring reasonable access to fundamental technologies. The Biocompatible Polymers Patent Pool, established in 2019, now encompasses over 340 patents from 23 different entities.

Small and medium enterprises face unique challenges in this ecosystem, often lacking resources for extensive patent portfolios. Increasingly, these companies are adopting "patent-light" strategies, focusing on specific applications while leveraging broader cross-licensing agreements for foundational technologies. This approach has enabled several startups to secure significant market positions despite limited IP holdings.

Major pharmaceutical companies like Johnson & Johnson, Medtronic, and Boston Scientific have established sophisticated cross-licensing frameworks with academic institutions and smaller biotech firms. These arrangements typically involve upfront payments coupled with milestone-based royalties, allowing resource sharing while maintaining appropriate risk distribution. The data indicates that companies engaging in such partnerships experience 27% faster time-to-market for novel polymer-based medical devices compared to those developing technologies in isolation.

Consortium-based collaboration models have gained significant traction, particularly in areas requiring substantial investment such as biodegradable stent polymers and drug-delivery systems. The Advanced Biomaterials Consortium, comprising 14 industry leaders and 7 research institutions, exemplifies this approach by pooling patents while establishing clear commercialization pathways for participants. This model has generated over 120 new patent applications in the past three years alone.

Geographic analysis reveals distinct regional collaboration patterns. European entities favor open innovation platforms with standardized licensing terms, while Asian markets, particularly Japan and South Korea, emphasize exclusive bilateral agreements with targeted technology transfer provisions. North American companies typically employ hybrid models combining exclusive rights for specific applications with broader non-exclusive licensing for peripheral technologies.

Patent pooling has emerged as another effective strategy, especially for platform technologies like antimicrobial polymer coatings and biocompatible implant materials. These pools reduce transaction costs and mitigate litigation risks while ensuring reasonable access to fundamental technologies. The Biocompatible Polymers Patent Pool, established in 2019, now encompasses over 340 patents from 23 different entities.

Small and medium enterprises face unique challenges in this ecosystem, often lacking resources for extensive patent portfolios. Increasingly, these companies are adopting "patent-light" strategies, focusing on specific applications while leveraging broader cross-licensing agreements for foundational technologies. This approach has enabled several startups to secure significant market positions despite limited IP holdings.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!