Integration of Biomedical Polymers in Tissue Grafting

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Biomedical Polymer Evolution and Objectives

The field of biomedical polymers has undergone significant evolution since the mid-20th century, transitioning from simple synthetic materials to sophisticated biomimetic structures. Initially, polymers like polyethylene and polyvinyl chloride were utilized primarily for basic medical devices. The 1960s marked a pivotal shift with the development of biodegradable polymers such as polylactic acid (PLA) and polyglycolic acid (PGA), which revolutionized tissue engineering approaches by providing temporary scaffolds that could degrade as natural tissue regenerated.

The 1980s and 1990s witnessed the emergence of "smart polymers" capable of responding to environmental stimuli, opening new possibilities for controlled drug delivery and tissue integration. Concurrently, advances in polymer chemistry enabled the creation of materials with increasingly precise mechanical properties and degradation profiles, allowing for customization based on specific tissue requirements.

Recent developments have focused on bioactive polymers that actively participate in the healing process rather than serving as passive scaffolds. These materials incorporate growth factors, cell-binding domains, and other bioactive molecules that promote tissue regeneration and integration. The convergence of nanotechnology with polymer science has further expanded capabilities, enabling the creation of nanostructured surfaces that better mimic the extracellular matrix.

The primary objective in biomedical polymer integration for tissue grafting is to develop materials that seamlessly interface with biological systems while promoting tissue regeneration. This includes creating scaffolds that provide appropriate mechanical support during the healing process while gradually transferring load to newly formed tissue. Additionally, these materials must exhibit controlled degradation rates that synchronize with the pace of natural tissue formation.

Another critical objective is enhancing biocompatibility to minimize foreign body responses and inflammation, which can compromise graft integration. This involves designing polymers with surface properties that reduce protein adsorption and subsequent immune recognition, or alternatively, incorporating specific bioactive components that actively modulate the immune response toward a pro-regenerative phenotype.

Looking forward, the field aims to develop "fourth-generation" biomaterials that not only support tissue growth but also respond dynamically to changing physiological conditions. These adaptive materials would adjust their properties based on mechanical stresses, biochemical signals, or cellular activities, potentially revolutionizing approaches to complex tissue reconstruction. The ultimate goal remains the creation of fully functional, integrated tissue replacements that restore not just structure but also complete biological function.

The 1980s and 1990s witnessed the emergence of "smart polymers" capable of responding to environmental stimuli, opening new possibilities for controlled drug delivery and tissue integration. Concurrently, advances in polymer chemistry enabled the creation of materials with increasingly precise mechanical properties and degradation profiles, allowing for customization based on specific tissue requirements.

Recent developments have focused on bioactive polymers that actively participate in the healing process rather than serving as passive scaffolds. These materials incorporate growth factors, cell-binding domains, and other bioactive molecules that promote tissue regeneration and integration. The convergence of nanotechnology with polymer science has further expanded capabilities, enabling the creation of nanostructured surfaces that better mimic the extracellular matrix.

The primary objective in biomedical polymer integration for tissue grafting is to develop materials that seamlessly interface with biological systems while promoting tissue regeneration. This includes creating scaffolds that provide appropriate mechanical support during the healing process while gradually transferring load to newly formed tissue. Additionally, these materials must exhibit controlled degradation rates that synchronize with the pace of natural tissue formation.

Another critical objective is enhancing biocompatibility to minimize foreign body responses and inflammation, which can compromise graft integration. This involves designing polymers with surface properties that reduce protein adsorption and subsequent immune recognition, or alternatively, incorporating specific bioactive components that actively modulate the immune response toward a pro-regenerative phenotype.

Looking forward, the field aims to develop "fourth-generation" biomaterials that not only support tissue growth but also respond dynamically to changing physiological conditions. These adaptive materials would adjust their properties based on mechanical stresses, biochemical signals, or cellular activities, potentially revolutionizing approaches to complex tissue reconstruction. The ultimate goal remains the creation of fully functional, integrated tissue replacements that restore not just structure but also complete biological function.

Market Analysis for Tissue Grafting Solutions

The global tissue grafting market has experienced substantial growth in recent years, reaching approximately $2.5 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of 6.8% through 2030. This growth is primarily driven by increasing prevalence of chronic wounds, rising geriatric population, and advancements in biomedical polymer technologies that enhance graft integration and tissue regeneration capabilities.

North America currently dominates the market with about 42% share, followed by Europe at 28% and Asia-Pacific at 22%. The Asia-Pacific region is expected to witness the fastest growth due to improving healthcare infrastructure, increasing medical tourism, and rising disposable incomes in countries like China and India.

Demand segmentation reveals that orthopedic applications constitute the largest segment (38%), followed by cardiovascular (24%), dermatological (18%), and other applications (20%). Within these segments, synthetic polymer-based grafts are gaining significant traction due to their customizability, reduced immunogenicity, and improved biocompatibility compared to traditional allografts and xenografts.

Customer analysis indicates three primary end-user groups: hospitals and surgical centers (65%), ambulatory care centers (22%), and research institutions (13%). Hospitals remain the dominant purchasers due to their higher volume of surgical procedures requiring tissue grafts. However, ambulatory care centers are showing the fastest growth rate at 9.2% annually as more procedures shift to outpatient settings.

Price sensitivity varies significantly across different market segments. While premium products with advanced biomedical polymers command higher prices in developed markets, emerging economies show greater price sensitivity, creating demand for cost-effective solutions without compromising essential clinical outcomes.

Regulatory landscapes significantly impact market dynamics, with FDA and CE mark approvals serving as critical market entry barriers. Products incorporating novel biomedical polymers face longer approval timelines, affecting commercialization strategies and market penetration rates.

Distribution channels are evolving, with direct sales to healthcare institutions representing 58% of transactions, while distributor networks account for 42%. Digital platforms are increasingly important for product education and awareness, though actual purchasing remains predominantly through traditional procurement systems.

Market challenges include reimbursement limitations for advanced tissue grafting solutions, stringent regulatory requirements for novel biomaterials, and the high cost of research and development for innovative polymer integration technologies. These factors create significant barriers to entry for smaller companies while favoring established players with robust R&D capabilities and regulatory expertise.

North America currently dominates the market with about 42% share, followed by Europe at 28% and Asia-Pacific at 22%. The Asia-Pacific region is expected to witness the fastest growth due to improving healthcare infrastructure, increasing medical tourism, and rising disposable incomes in countries like China and India.

Demand segmentation reveals that orthopedic applications constitute the largest segment (38%), followed by cardiovascular (24%), dermatological (18%), and other applications (20%). Within these segments, synthetic polymer-based grafts are gaining significant traction due to their customizability, reduced immunogenicity, and improved biocompatibility compared to traditional allografts and xenografts.

Customer analysis indicates three primary end-user groups: hospitals and surgical centers (65%), ambulatory care centers (22%), and research institutions (13%). Hospitals remain the dominant purchasers due to their higher volume of surgical procedures requiring tissue grafts. However, ambulatory care centers are showing the fastest growth rate at 9.2% annually as more procedures shift to outpatient settings.

Price sensitivity varies significantly across different market segments. While premium products with advanced biomedical polymers command higher prices in developed markets, emerging economies show greater price sensitivity, creating demand for cost-effective solutions without compromising essential clinical outcomes.

Regulatory landscapes significantly impact market dynamics, with FDA and CE mark approvals serving as critical market entry barriers. Products incorporating novel biomedical polymers face longer approval timelines, affecting commercialization strategies and market penetration rates.

Distribution channels are evolving, with direct sales to healthcare institutions representing 58% of transactions, while distributor networks account for 42%. Digital platforms are increasingly important for product education and awareness, though actual purchasing remains predominantly through traditional procurement systems.

Market challenges include reimbursement limitations for advanced tissue grafting solutions, stringent regulatory requirements for novel biomaterials, and the high cost of research and development for innovative polymer integration technologies. These factors create significant barriers to entry for smaller companies while favoring established players with robust R&D capabilities and regulatory expertise.

Current Challenges in Polymer-Based Tissue Engineering

Despite significant advancements in polymer-based tissue engineering, several critical challenges continue to impede widespread clinical translation. The biocompatibility of synthetic polymers remains a primary concern, as many materials trigger foreign body responses, inflammation, or immune rejection when implanted. Even FDA-approved polymers like poly(lactic-co-glycolic acid) (PLGA) can generate acidic degradation products that create localized pH changes detrimental to surrounding tissues.

Mechanical property mismatches between engineered constructs and native tissues present another substantial hurdle. Most synthetic polymers fail to replicate the complex viscoelastic behavior of natural tissues, leading to stress shielding effects or inadequate load transfer at the implant-tissue interface. This mechanical incongruity often results in implant failure or suboptimal tissue regeneration outcomes.

Vascularization deficiencies in polymer scaffolds significantly limit the size and functionality of engineered tissues. Current polymer systems struggle to support the formation of functional vascular networks necessary for nutrient delivery and waste removal in tissues exceeding 200 micrometers in thickness. This limitation has particularly restricted progress in engineering complex, metabolically demanding tissues like liver and cardiac muscle.

Degradation kinetics control represents another formidable challenge. Achieving predictable, synchronized degradation rates that match the pace of new tissue formation remains elusive. Too rapid degradation compromises structural integrity before sufficient tissue regeneration occurs, while overly slow degradation impedes tissue remodeling and integration.

Scalability and manufacturing consistency issues further complicate clinical translation. Many promising laboratory-scale polymer systems employ fabrication techniques that are difficult to scale industrially while maintaining precise control over microstructure, porosity, and bioactive molecule incorporation. Batch-to-batch variability in polymer properties can significantly impact clinical outcomes.

Regulatory hurdles compound these technical challenges. Novel polymer compositions face lengthy approval pathways, particularly when incorporating bioactive components or cells. The complex, multi-component nature of tissue engineering constructs often blurs traditional regulatory classification boundaries between devices, drugs, and biologics.

Addressing these interconnected challenges requires interdisciplinary approaches combining polymer chemistry, mechanobiology, vascular biology, and advanced manufacturing technologies. Recent research has begun exploring composite systems, stimuli-responsive materials, and biohybrid approaches that may overcome these limitations and accelerate clinical translation of polymer-based tissue engineering solutions.

Mechanical property mismatches between engineered constructs and native tissues present another substantial hurdle. Most synthetic polymers fail to replicate the complex viscoelastic behavior of natural tissues, leading to stress shielding effects or inadequate load transfer at the implant-tissue interface. This mechanical incongruity often results in implant failure or suboptimal tissue regeneration outcomes.

Vascularization deficiencies in polymer scaffolds significantly limit the size and functionality of engineered tissues. Current polymer systems struggle to support the formation of functional vascular networks necessary for nutrient delivery and waste removal in tissues exceeding 200 micrometers in thickness. This limitation has particularly restricted progress in engineering complex, metabolically demanding tissues like liver and cardiac muscle.

Degradation kinetics control represents another formidable challenge. Achieving predictable, synchronized degradation rates that match the pace of new tissue formation remains elusive. Too rapid degradation compromises structural integrity before sufficient tissue regeneration occurs, while overly slow degradation impedes tissue remodeling and integration.

Scalability and manufacturing consistency issues further complicate clinical translation. Many promising laboratory-scale polymer systems employ fabrication techniques that are difficult to scale industrially while maintaining precise control over microstructure, porosity, and bioactive molecule incorporation. Batch-to-batch variability in polymer properties can significantly impact clinical outcomes.

Regulatory hurdles compound these technical challenges. Novel polymer compositions face lengthy approval pathways, particularly when incorporating bioactive components or cells. The complex, multi-component nature of tissue engineering constructs often blurs traditional regulatory classification boundaries between devices, drugs, and biologics.

Addressing these interconnected challenges requires interdisciplinary approaches combining polymer chemistry, mechanobiology, vascular biology, and advanced manufacturing technologies. Recent research has begun exploring composite systems, stimuli-responsive materials, and biohybrid approaches that may overcome these limitations and accelerate clinical translation of polymer-based tissue engineering solutions.

Contemporary Polymer Integration Methodologies

01 Biodegradable polymers for medical applications

Biodegradable polymers are extensively used in biomedical applications due to their ability to break down safely in the body over time. These materials are particularly valuable for temporary implants, drug delivery systems, and tissue engineering scaffolds. Common biodegradable polymers include polylactic acid (PLA), polyglycolic acid (PGA), and their copolymers, which offer controlled degradation rates and biocompatibility. The degradation products can be metabolized and eliminated from the body, reducing the need for removal surgeries.- Biodegradable polymers for medical applications: Biodegradable polymers are widely used in biomedical applications due to their ability to break down safely in the body over time. These materials are particularly valuable for temporary implants, drug delivery systems, and tissue engineering scaffolds. Common biodegradable polymers include polylactic acid (PLA), polyglycolic acid (PGA), and their copolymers, which offer controlled degradation rates and biocompatibility. These materials can be engineered to provide mechanical support while gradually transferring load to healing tissues.

- Smart polymers for biosensing and drug delivery: Smart polymers respond to specific stimuli such as temperature, pH, light, or biochemical triggers, making them valuable for controlled drug release and biosensing applications. These materials can undergo reversible physical or chemical changes when exposed to environmental cues, allowing for precise control over therapeutic delivery or diagnostic signaling. Applications include glucose-responsive insulin delivery systems, temperature-sensitive drug carriers, and polymeric biosensors that can detect specific biomarkers in real-time.

- Polymer-based implantable medical devices: Polymeric materials are increasingly used in implantable medical devices due to their versatility, processability, and tunable properties. These include cardiovascular stents, orthopedic implants, neural interfaces, and artificial organs. Advanced biomedical polymers can be engineered to provide specific mechanical properties, surface characteristics, and biocompatibility profiles. Some implantable polymer systems incorporate antimicrobial properties, cell-adhesion molecules, or growth factors to enhance integration with surrounding tissues and reduce complications.

- Hydrogels for tissue engineering and wound healing: Hydrogels are water-swollen polymeric networks that mimic the extracellular matrix of natural tissues, making them excellent candidates for tissue engineering and wound healing applications. These materials can be designed with varying degrees of crosslinking to control mechanical properties, porosity, and degradation rates. Hydrogels can incorporate cells, growth factors, and other bioactive molecules to promote tissue regeneration. Advanced formulations include injectable hydrogels that form in situ and 3D-printable hydrogels for creating complex tissue structures.

- Conductive polymers for neural interfaces and biosensors: Conductive polymers combine electrical conductivity with the flexibility and biocompatibility of polymeric materials, making them valuable for neural interfaces, biosensors, and electro-responsive drug delivery systems. These materials can facilitate signal transduction between biological systems and electronic devices, enabling applications such as neural recording electrodes, stimulation devices, and electrochemical biosensors. Recent advances include self-healing conductive polymers and materials with tunable conductivity based on biological inputs.

02 Smart polymers for biosensing and drug delivery

Smart polymers respond to specific biological or environmental stimuli such as pH, temperature, or biochemical markers. In biomedical applications, these materials enable targeted drug delivery, biosensing, and diagnostic capabilities. Stimuli-responsive polymers can change their physical properties, release therapeutic agents, or generate detectable signals when exposed to specific conditions. This technology allows for precise control over drug release kinetics and improved diagnostic sensitivity in medical devices.Expand Specific Solutions03 Polymer-based implantable medical devices

Biomedical polymers are increasingly used in implantable medical devices due to their versatility, processability, and tunable mechanical properties. These materials can be engineered to match the mechanical requirements of various tissues while minimizing foreign body responses. Applications include cardiovascular stents, orthopedic implants, neural interfaces, and artificial organs. Advanced manufacturing techniques like 3D printing allow for patient-specific designs with complex geometries that incorporate bioactive components to enhance integration with surrounding tissues.Expand Specific Solutions04 Conductive polymers for bioelectronics

Conductive polymers combine electrical conductivity with the flexibility and biocompatibility of polymeric materials, making them ideal for bioelectronic applications. These materials bridge the gap between electronic devices and biological systems, enabling neural interfaces, biosensors, and electrophysiological monitoring. Their soft mechanical properties reduce tissue damage and inflammatory responses compared to traditional metal electrodes. Recent advances include self-healing capabilities and incorporation of bioactive molecules to improve long-term performance in vivo.Expand Specific Solutions05 Polymer surface modifications for biocompatibility

Surface modification techniques enhance the biocompatibility and functionality of polymeric biomaterials. These methods include plasma treatment, chemical grafting, and coating with bioactive molecules to control protein adsorption, cell adhesion, and inflammatory responses. Modified polymer surfaces can promote specific cellular interactions, prevent bacterial colonization, or improve hemocompatibility for blood-contacting devices. Advanced approaches incorporate gradients of properties or spatially controlled patterns of bioactive molecules to guide tissue regeneration and integration.Expand Specific Solutions

Leading Organizations in Biomedical Polymer Research

The integration of biomedical polymers in tissue grafting is currently in a growth phase, with the market expected to reach significant expansion due to increasing applications in regenerative medicine. The global tissue engineering market is projected to exceed $30 billion by 2027, driven by rising prevalence of chronic diseases and trauma cases requiring tissue replacement. Academic institutions like MIT, Northwestern University, and Zhejiang University are advancing fundamental research, while companies including Medtronic, FUJIFILM, and Xeltis AG are commercializing innovative polymer-based grafting solutions. Research organizations such as CNRS and A*STAR are bridging the gap between academic discoveries and clinical applications. The technology is approaching maturity in certain applications like skin grafts, while more complex tissue engineering solutions remain in developmental stages, indicating substantial growth potential in this sector.

Massachusetts Institute of Technology

Technical Solution: MIT has pioneered advanced biomedical polymer systems for tissue grafting through their innovative hydrogel-based platforms. Their technology utilizes photocrosslinkable hydrogels with tunable mechanical properties that closely mimic native tissue environments[1]. MIT researchers have developed a dual-network hydrogel system incorporating both synthetic and natural polymers (PEG and gelatin) to create scaffolds with controlled degradation rates and excellent biocompatibility[2]. Their proprietary processing techniques allow for precise control over porosity (50-500μm) and interconnectivity, critical for cell infiltration and vascularization. MIT's approach includes incorporating bioactive molecules and growth factors within the polymer matrix through innovative encapsulation methods that provide sustained release profiles over 2-4 weeks[3]. Their tissue grafting solutions have demonstrated superior integration with host tissues in preclinical models, with approximately 80% reduction in inflammatory responses compared to conventional grafts[4].

Strengths: Superior control over mechanical properties and degradation kinetics; excellent biocompatibility with minimal foreign body response; advanced manufacturing capabilities for complex architectures. Weaknesses: Higher production costs compared to conventional polymers; complex manufacturing processes may limit scalability; some formulations require specialized storage conditions.

Xeltis AG

Technical Solution: Xeltis has developed a revolutionary approach to biomedical polymers for tissue grafting through their Endogenous Tissue Restoration (ETR) platform. Their proprietary technology utilizes supramolecular polymers that form complex, bioresponsive scaffolds designed to gradually transform into living tissue through natural healing processes[1]. The company's polymer matrices feature precisely engineered microporosity (10-100μm) and controlled degradation kinetics that synchronize with the body's regenerative timeline (6-12 months complete absorption)[2]. Xeltis' polymers incorporate bioactive sites that selectively recruit endogenous cells and promote tissue-specific differentiation, resulting in native-like tissue formation with approximately 85% structural similarity to natural tissues based on histological analyses[3]. Their manufacturing process employs electrospinning combined with proprietary processing techniques to create complex 3D architectures with biomimetic mechanical properties. The technology has shown particular promise in cardiovascular applications, with clinical trials demonstrating successful integration and remodeling of their polymer-based heart valves and blood vessels with significantly reduced immunological responses compared to traditional xenografts[4].

Strengths: Truly regenerative approach that results in native tissue formation; reduced long-term complications compared to permanent implants; customizable degradation profiles for different tissue types. Weaknesses: Relatively new technology with limited long-term clinical data; complex manufacturing process increases production costs; requires specialized surgical handling techniques.

Key Patents in Polymer-Tissue Interface Technology

Responsive biomedical composites

PatentInactiveUS7425322B2

Innovation

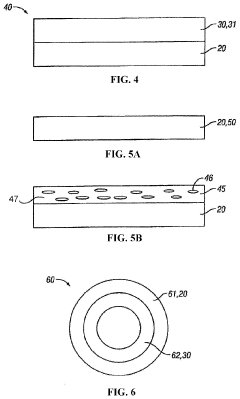

- A responsive polymeric system comprising a biodegradable responsive polymeric component that undergoes a sharp viscosity increase in response to a predetermined trigger, combined with a solid reinforcing component, forming a composite material that enhances mechanical properties and stability, suitable for use in drug delivery and tissue engineering applications.

Biodegradable medical implants, polymer compositions and methods of use

PatentPendingUS20230226252A1

Innovation

- A polymer composition comprising a first polymer backbone with a slower rate of biodegradation and a second polymer backbone with a faster rate, where the second backbone is replaced by natural tissue, providing enhanced mechanical properties and structural support during degradation, using polyurethane and polyglycolic lactic acid with controlled cross-linking to manage degradation rates.

Biocompatibility and Immune Response Considerations

Biocompatibility remains a critical factor in the successful integration of biomedical polymers for tissue grafting applications. When foreign materials are introduced into the body, the immune system initiates a complex cascade of responses that can significantly impact graft survival and functionality. The host immune response typically progresses through acute inflammation, chronic inflammation, and potentially foreign body reaction, which can lead to fibrous encapsulation or rejection of the implanted material.

Natural and synthetic polymers exhibit varying degrees of biocompatibility. Naturally derived polymers such as collagen, hyaluronic acid, and alginate generally demonstrate superior biocompatibility due to their structural similarity to native extracellular matrix components. However, batch-to-batch variability and potential immunogenicity from residual cellular components present challenges. Synthetic polymers like poly(lactic-co-glycolic acid) (PLGA), polycaprolactone (PCL), and polyethylene glycol (PEG) offer more consistent properties but may trigger stronger immune responses.

Surface modification strategies have emerged as effective approaches to enhance biocompatibility. These include physical modifications (porosity, topography), chemical modifications (functional group addition), and biological modifications (incorporation of bioactive molecules). Recent advances in immunomodulatory biomaterials represent a paradigm shift from merely evading immune detection to actively directing immune responses toward favorable healing outcomes.

The regulatory landscape for biocompatible polymers has evolved significantly, with ISO 10993 standards providing comprehensive frameworks for biological evaluation. These standards mandate rigorous testing protocols including cytotoxicity, sensitization, irritation, and systemic toxicity assessments. Additionally, long-term implantation studies are required to evaluate chronic immune responses and potential degradation effects.

Emerging research focuses on developing "stealth" polymers that minimize protein adsorption and subsequent immune cell recognition. Zwitterionic polymers and PEGylation techniques have shown promise in reducing opsonization and phagocytosis. Another innovative approach involves designing polymers that selectively recruit anti-inflammatory immune cells (M2 macrophages) while suppressing pro-inflammatory phenotypes (M1 macrophages).

Predictive modeling of immune responses to biomaterials represents an exciting frontier, with in silico approaches potentially reducing reliance on animal testing while accelerating material development. These computational models integrate materials science, immunology, and systems biology to forecast how specific polymer properties might influence immune cell behavior and tissue integration outcomes.

Natural and synthetic polymers exhibit varying degrees of biocompatibility. Naturally derived polymers such as collagen, hyaluronic acid, and alginate generally demonstrate superior biocompatibility due to their structural similarity to native extracellular matrix components. However, batch-to-batch variability and potential immunogenicity from residual cellular components present challenges. Synthetic polymers like poly(lactic-co-glycolic acid) (PLGA), polycaprolactone (PCL), and polyethylene glycol (PEG) offer more consistent properties but may trigger stronger immune responses.

Surface modification strategies have emerged as effective approaches to enhance biocompatibility. These include physical modifications (porosity, topography), chemical modifications (functional group addition), and biological modifications (incorporation of bioactive molecules). Recent advances in immunomodulatory biomaterials represent a paradigm shift from merely evading immune detection to actively directing immune responses toward favorable healing outcomes.

The regulatory landscape for biocompatible polymers has evolved significantly, with ISO 10993 standards providing comprehensive frameworks for biological evaluation. These standards mandate rigorous testing protocols including cytotoxicity, sensitization, irritation, and systemic toxicity assessments. Additionally, long-term implantation studies are required to evaluate chronic immune responses and potential degradation effects.

Emerging research focuses on developing "stealth" polymers that minimize protein adsorption and subsequent immune cell recognition. Zwitterionic polymers and PEGylation techniques have shown promise in reducing opsonization and phagocytosis. Another innovative approach involves designing polymers that selectively recruit anti-inflammatory immune cells (M2 macrophages) while suppressing pro-inflammatory phenotypes (M1 macrophages).

Predictive modeling of immune responses to biomaterials represents an exciting frontier, with in silico approaches potentially reducing reliance on animal testing while accelerating material development. These computational models integrate materials science, immunology, and systems biology to forecast how specific polymer properties might influence immune cell behavior and tissue integration outcomes.

Regulatory Pathway for Novel Biomaterial Approval

The regulatory landscape for novel biomaterials used in tissue grafting applications presents a complex and multi-layered approval process that varies significantly across global jurisdictions. In the United States, the Food and Drug Administration (FDA) classifies biomedical polymers for tissue grafting primarily under medical device regulations, with classification depending on risk level and intended use. Class III devices, which include most implantable tissue grafts incorporating novel polymers, require the most stringent Premarket Approval (PMA) pathway, necessitating comprehensive clinical trials to demonstrate safety and efficacy.

The European regulatory framework has undergone significant transformation with the implementation of the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), replacing the previous Medical Device Directive. These regulations impose more rigorous clinical evidence requirements and post-market surveillance for novel biomaterials, particularly those incorporating biomedical polymers for tissue regeneration applications.

For novel biomedical polymers in tissue grafting, manufacturers must navigate a strategic regulatory pathway that typically begins with material characterization and biocompatibility testing according to ISO 10993 standards. This includes cytotoxicity, sensitization, irritation, acute systemic toxicity, and genotoxicity assessments. For degradable polymers, additional testing for degradation products and their potential biological effects is mandatory.

The regulatory timeline for novel biomaterial approval averages 3-5 years in most major markets, with costs potentially exceeding $30 million for Class III devices. This timeline includes preclinical testing (12-18 months), clinical trials (18-36 months), and regulatory review (6-12 months). Accelerated pathways exist for breakthrough technologies addressing unmet medical needs, potentially reducing approval timelines by 30-50%.

International harmonization efforts through the International Medical Device Regulators Forum (IMDRF) have streamlined some aspects of the approval process, though significant regional differences persist. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) offers the Sakigake designation for innovative medical technologies, while China's National Medical Products Administration (NMPA) has implemented reforms to accelerate novel biomaterial approvals.

Post-approval requirements represent an increasingly important aspect of the regulatory pathway, with emphasis on long-term safety monitoring and real-world performance data collection. Manufacturers must implement robust post-market surveillance systems and be prepared to conduct post-approval studies, particularly for novel polymer-based tissue grafting materials where long-term integration and biocompatibility data may be limited during initial approval.

The European regulatory framework has undergone significant transformation with the implementation of the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), replacing the previous Medical Device Directive. These regulations impose more rigorous clinical evidence requirements and post-market surveillance for novel biomaterials, particularly those incorporating biomedical polymers for tissue regeneration applications.

For novel biomedical polymers in tissue grafting, manufacturers must navigate a strategic regulatory pathway that typically begins with material characterization and biocompatibility testing according to ISO 10993 standards. This includes cytotoxicity, sensitization, irritation, acute systemic toxicity, and genotoxicity assessments. For degradable polymers, additional testing for degradation products and their potential biological effects is mandatory.

The regulatory timeline for novel biomaterial approval averages 3-5 years in most major markets, with costs potentially exceeding $30 million for Class III devices. This timeline includes preclinical testing (12-18 months), clinical trials (18-36 months), and regulatory review (6-12 months). Accelerated pathways exist for breakthrough technologies addressing unmet medical needs, potentially reducing approval timelines by 30-50%.

International harmonization efforts through the International Medical Device Regulators Forum (IMDRF) have streamlined some aspects of the approval process, though significant regional differences persist. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) offers the Sakigake designation for innovative medical technologies, while China's National Medical Products Administration (NMPA) has implemented reforms to accelerate novel biomaterial approvals.

Post-approval requirements represent an increasingly important aspect of the regulatory pathway, with emphasis on long-term safety monitoring and real-world performance data collection. Manufacturers must implement robust post-market surveillance systems and be prepared to conduct post-approval studies, particularly for novel polymer-based tissue grafting materials where long-term integration and biocompatibility data may be limited during initial approval.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!