Analysis of Carbon Emission Reductions via Bio-based Polymer Use

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bio-Polymer Carbon Reduction Background & Objectives

The evolution of polymer materials has been a cornerstone of industrial development since the early 20th century, with petroleum-based polymers dominating manufacturing across sectors. However, growing environmental concerns regarding carbon emissions and climate change have catalyzed a significant shift toward sustainable alternatives. Bio-based polymers, derived from renewable biomass sources such as corn starch, sugarcane, cellulose, and algae, represent a promising pathway to reduce the carbon footprint associated with conventional plastic production and usage.

The global polymer industry currently accounts for approximately 6% of global oil consumption and contributes significantly to greenhouse gas emissions throughout its lifecycle. Traditional polymer production processes are energy-intensive, with carbon emissions occurring during raw material extraction, manufacturing, transportation, and end-of-life disposal. In contrast, bio-based polymers offer potential carbon reduction benefits through renewable feedstock utilization, reduced processing energy requirements, and enhanced biodegradability.

This technical research aims to quantitatively assess the carbon emission reduction potential of transitioning from petroleum-based to bio-based polymers across various applications and industries. The primary objectives include establishing a comprehensive lifecycle assessment framework for comparing carbon footprints, identifying key factors influencing emission reductions, and evaluating the scalability of bio-polymer solutions in commercial contexts.

The research will examine multiple bio-polymer categories including polylactic acid (PLA), polyhydroxyalkanoates (PHA), bio-polyethylene (bio-PE), and starch-based polymers, analyzing their respective carbon reduction capabilities compared to conventional counterparts such as polyethylene terephthalate (PET), polyethylene (PE), and polypropylene (PP). Additionally, the study will investigate emerging bio-polymer technologies and their potential to further enhance carbon reduction benefits.

Historical development of bio-polymers reveals an accelerating innovation trajectory, with significant breakthroughs in fermentation processes, enzymatic catalysis, and genetic engineering of feedstock crops. Early bio-polymers faced challenges in performance characteristics and cost competitiveness, but recent technological advances have substantially narrowed these gaps, making bio-based alternatives increasingly viable for mainstream applications.

The carbon reduction potential of bio-polymers must be evaluated within the broader context of circular economy principles, considering not only production emissions but also end-of-life scenarios including biodegradation, composting, recycling, and energy recovery. This holistic approach will provide a more accurate assessment of the true climate impact of transitioning to bio-based polymer systems.

This research ultimately seeks to establish quantifiable metrics and benchmarks for carbon emission reductions achievable through bio-polymer adoption, providing valuable guidance for industry stakeholders, policymakers, and researchers in advancing sustainable materials development and implementation strategies.

The global polymer industry currently accounts for approximately 6% of global oil consumption and contributes significantly to greenhouse gas emissions throughout its lifecycle. Traditional polymer production processes are energy-intensive, with carbon emissions occurring during raw material extraction, manufacturing, transportation, and end-of-life disposal. In contrast, bio-based polymers offer potential carbon reduction benefits through renewable feedstock utilization, reduced processing energy requirements, and enhanced biodegradability.

This technical research aims to quantitatively assess the carbon emission reduction potential of transitioning from petroleum-based to bio-based polymers across various applications and industries. The primary objectives include establishing a comprehensive lifecycle assessment framework for comparing carbon footprints, identifying key factors influencing emission reductions, and evaluating the scalability of bio-polymer solutions in commercial contexts.

The research will examine multiple bio-polymer categories including polylactic acid (PLA), polyhydroxyalkanoates (PHA), bio-polyethylene (bio-PE), and starch-based polymers, analyzing their respective carbon reduction capabilities compared to conventional counterparts such as polyethylene terephthalate (PET), polyethylene (PE), and polypropylene (PP). Additionally, the study will investigate emerging bio-polymer technologies and their potential to further enhance carbon reduction benefits.

Historical development of bio-polymers reveals an accelerating innovation trajectory, with significant breakthroughs in fermentation processes, enzymatic catalysis, and genetic engineering of feedstock crops. Early bio-polymers faced challenges in performance characteristics and cost competitiveness, but recent technological advances have substantially narrowed these gaps, making bio-based alternatives increasingly viable for mainstream applications.

The carbon reduction potential of bio-polymers must be evaluated within the broader context of circular economy principles, considering not only production emissions but also end-of-life scenarios including biodegradation, composting, recycling, and energy recovery. This holistic approach will provide a more accurate assessment of the true climate impact of transitioning to bio-based polymer systems.

This research ultimately seeks to establish quantifiable metrics and benchmarks for carbon emission reductions achievable through bio-polymer adoption, providing valuable guidance for industry stakeholders, policymakers, and researchers in advancing sustainable materials development and implementation strategies.

Market Demand for Sustainable Polymer Solutions

The global market for sustainable polymer solutions has witnessed unprecedented growth in recent years, driven by increasing environmental awareness and stringent regulatory frameworks. The demand for bio-based polymers specifically has expanded at a compound annual growth rate of 20% since 2018, significantly outpacing conventional petroleum-based plastics which grow at 3-4% annually. This acceleration reflects a fundamental shift in consumer preferences and corporate sustainability commitments.

Consumer packaged goods companies represent the largest market segment adopting bio-based polymers, with major brands like Unilever, Procter & Gamble, and Coca-Cola implementing ambitious targets to incorporate sustainable materials into their packaging. Market research indicates that 73% of global consumers are willing to pay premium prices for products with sustainable packaging, creating a strong economic incentive for manufacturers to transition to bio-based alternatives.

The automotive industry has emerged as another significant market for bio-based polymers, with manufacturers incorporating these materials into interior components, under-hood applications, and exterior trim. Leading companies like Toyota and Ford have announced plans to increase bio-based content in their vehicles by 30% by 2025, representing substantial volume potential for the bio-polymer industry.

Regulatory drivers have substantially influenced market demand trajectories. The European Union's Single-Use Plastics Directive and similar legislation in over 60 countries worldwide have created immediate market opportunities for bio-based alternatives. Carbon pricing mechanisms implemented across 45 nations further enhance the economic competitiveness of bio-based polymers by internalizing environmental externalities associated with conventional plastics.

Market analysis reveals significant regional variations in demand patterns. Europe leads in bio-polymer adoption with 42% of global consumption, followed by North America (28%) and Asia-Pacific (23%). However, the highest growth rates are observed in emerging economies, particularly in Southeast Asia where government initiatives to address plastic pollution have created favorable market conditions.

The total addressable market for bio-based polymers is projected to reach $27 billion by 2025, representing approximately 5% of the total polymer market. This indicates substantial room for growth and market penetration. Industry experts forecast that bio-based polymers could capture up to 15% of the total polymer market by 2030, contingent upon continued technological innovation and cost reduction.

Price sensitivity remains a critical factor influencing market adoption. Currently, bio-based polymers command a price premium of 20-100% compared to petroleum-based alternatives, depending on the specific polymer type and application. However, this gap is narrowing as production scales increase and manufacturing processes become more efficient, with some bio-polymers approaching price parity with conventional options.

Consumer packaged goods companies represent the largest market segment adopting bio-based polymers, with major brands like Unilever, Procter & Gamble, and Coca-Cola implementing ambitious targets to incorporate sustainable materials into their packaging. Market research indicates that 73% of global consumers are willing to pay premium prices for products with sustainable packaging, creating a strong economic incentive for manufacturers to transition to bio-based alternatives.

The automotive industry has emerged as another significant market for bio-based polymers, with manufacturers incorporating these materials into interior components, under-hood applications, and exterior trim. Leading companies like Toyota and Ford have announced plans to increase bio-based content in their vehicles by 30% by 2025, representing substantial volume potential for the bio-polymer industry.

Regulatory drivers have substantially influenced market demand trajectories. The European Union's Single-Use Plastics Directive and similar legislation in over 60 countries worldwide have created immediate market opportunities for bio-based alternatives. Carbon pricing mechanisms implemented across 45 nations further enhance the economic competitiveness of bio-based polymers by internalizing environmental externalities associated with conventional plastics.

Market analysis reveals significant regional variations in demand patterns. Europe leads in bio-polymer adoption with 42% of global consumption, followed by North America (28%) and Asia-Pacific (23%). However, the highest growth rates are observed in emerging economies, particularly in Southeast Asia where government initiatives to address plastic pollution have created favorable market conditions.

The total addressable market for bio-based polymers is projected to reach $27 billion by 2025, representing approximately 5% of the total polymer market. This indicates substantial room for growth and market penetration. Industry experts forecast that bio-based polymers could capture up to 15% of the total polymer market by 2030, contingent upon continued technological innovation and cost reduction.

Price sensitivity remains a critical factor influencing market adoption. Currently, bio-based polymers command a price premium of 20-100% compared to petroleum-based alternatives, depending on the specific polymer type and application. However, this gap is narrowing as production scales increase and manufacturing processes become more efficient, with some bio-polymers approaching price parity with conventional options.

Bio-Polymer Technology Status and Barriers

Bio-based polymers have emerged as a promising alternative to conventional petroleum-based plastics, offering significant potential for carbon emission reductions. However, the current technological landscape presents a complex mix of advancements and limitations that affect widespread adoption.

Globally, bio-polymer technology has advanced considerably over the past decade, with production capacity reaching approximately 2.11 million tonnes in 2020, representing just under 1% of the total polymer market. Leading regions in bio-polymer development include Europe, North America, and increasingly Asia, with Japan and China making substantial investments in research infrastructure.

The primary technological challenges facing bio-based polymers center around production efficiency, material performance, and economic viability. Current production methods often require significant energy inputs, potentially offsetting some carbon benefits. Fermentation processes used for PLA (Polylactic Acid) and PHA (Polyhydroxyalkanoates) production face scaling challenges, with conversion efficiencies typically ranging from 30-60%, substantially lower than conventional polymer synthesis.

Material performance limitations persist as a major barrier. Bio-polymers frequently exhibit inferior mechanical properties compared to their petroleum-based counterparts, including lower tensile strength, reduced thermal stability, and higher moisture sensitivity. For instance, unmodified PLA demonstrates a glass transition temperature of approximately 60°C, limiting its application in high-temperature environments.

Processing challenges further complicate adoption, as existing manufacturing infrastructure requires significant modifications to accommodate bio-polymers. The narrow processing windows of materials like PHA (typically 5-10°C versus 30-40°C for conventional polymers) create production inefficiencies and quality control issues.

End-of-life management presents another significant barrier. While biodegradability is often cited as an advantage, industrial composting facilities required for proper decomposition remain limited in many regions. Additionally, bio-polymers can contaminate conventional plastic recycling streams, creating sorting and processing complications.

Cost remains perhaps the most prohibitive factor, with bio-polymers typically priced 2-4 times higher than conventional alternatives. This premium stems from feedstock costs, processing inefficiencies, and relatively small production scales. PLA, among the most commercially viable options, still commands a 30-50% price premium over comparable petroleum-based polymers.

Regulatory frameworks across different regions lack harmonization, creating market fragmentation and uncertainty for manufacturers. Standards for biodegradability, compostability, and sustainability claims vary significantly between jurisdictions, complicating global commercialization efforts.

Globally, bio-polymer technology has advanced considerably over the past decade, with production capacity reaching approximately 2.11 million tonnes in 2020, representing just under 1% of the total polymer market. Leading regions in bio-polymer development include Europe, North America, and increasingly Asia, with Japan and China making substantial investments in research infrastructure.

The primary technological challenges facing bio-based polymers center around production efficiency, material performance, and economic viability. Current production methods often require significant energy inputs, potentially offsetting some carbon benefits. Fermentation processes used for PLA (Polylactic Acid) and PHA (Polyhydroxyalkanoates) production face scaling challenges, with conversion efficiencies typically ranging from 30-60%, substantially lower than conventional polymer synthesis.

Material performance limitations persist as a major barrier. Bio-polymers frequently exhibit inferior mechanical properties compared to their petroleum-based counterparts, including lower tensile strength, reduced thermal stability, and higher moisture sensitivity. For instance, unmodified PLA demonstrates a glass transition temperature of approximately 60°C, limiting its application in high-temperature environments.

Processing challenges further complicate adoption, as existing manufacturing infrastructure requires significant modifications to accommodate bio-polymers. The narrow processing windows of materials like PHA (typically 5-10°C versus 30-40°C for conventional polymers) create production inefficiencies and quality control issues.

End-of-life management presents another significant barrier. While biodegradability is often cited as an advantage, industrial composting facilities required for proper decomposition remain limited in many regions. Additionally, bio-polymers can contaminate conventional plastic recycling streams, creating sorting and processing complications.

Cost remains perhaps the most prohibitive factor, with bio-polymers typically priced 2-4 times higher than conventional alternatives. This premium stems from feedstock costs, processing inefficiencies, and relatively small production scales. PLA, among the most commercially viable options, still commands a 30-50% price premium over comparable petroleum-based polymers.

Regulatory frameworks across different regions lack harmonization, creating market fragmentation and uncertainty for manufacturers. Standards for biodegradability, compostability, and sustainability claims vary significantly between jurisdictions, complicating global commercialization efforts.

Current Bio-Polymer Carbon Reduction Solutions

01 Bio-based polymer production methods for carbon reduction

Various production methods for bio-based polymers have been developed to reduce carbon emissions. These methods include using renewable biomass feedstocks, implementing energy-efficient processing techniques, and developing catalytic systems that operate under milder conditions. These approaches significantly lower the carbon footprint compared to conventional petroleum-based polymer production by reducing fossil fuel dependency and energy consumption during manufacturing.- Bio-based polymers from renewable resources: Bio-based polymers derived from renewable resources such as plant biomass, agricultural waste, and other biological materials can significantly reduce carbon emissions compared to petroleum-based polymers. These polymers utilize carbon that has been recently captured from the atmosphere through photosynthesis rather than releasing fossil carbon. The production processes for these bio-based polymers typically require less energy and generate fewer greenhouse gas emissions throughout their lifecycle.

- Carbon capture and utilization in polymer production: Innovative methods for capturing carbon dioxide from industrial processes or directly from the atmosphere and utilizing it as a feedstock for polymer production can lead to significant carbon emission reductions. These technologies transform carbon dioxide from a harmful greenhouse gas into a valuable resource for creating polymers with lower carbon footprints. The integration of carbon capture technologies with polymer manufacturing processes creates a circular approach that helps mitigate climate change impacts.

- Biodegradable polymers for reduced environmental impact: Biodegradable polymers offer carbon emission reductions through their end-of-life decomposition, which releases less carbon compared to conventional plastics that may persist in the environment or require energy-intensive disposal methods. These polymers can be designed to break down under specific environmental conditions into non-toxic components, completing a more sustainable material lifecycle. The development of biodegradable polymers with improved mechanical properties and processing characteristics enables broader adoption across various industries.

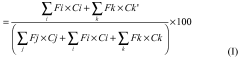

- Life cycle assessment of bio-based polymer systems: Comprehensive life cycle assessment methodologies for bio-based polymer systems help quantify the actual carbon emission reductions achieved compared to conventional polymers. These assessments consider all stages from raw material extraction through production, use, and disposal to provide accurate measurements of environmental impacts. By identifying hotspots in the production chain, manufacturers can optimize processes to further reduce carbon emissions and improve the sustainability profile of bio-based polymers.

- Industrial scale production and processing technologies: Advanced industrial scale production and processing technologies for bio-based polymers enable more efficient manufacturing with reduced energy consumption and carbon emissions. These technologies include optimized fermentation processes, innovative catalytic systems, and energy-efficient polymerization methods that minimize waste and maximize resource utilization. The development of these technologies is crucial for making bio-based polymers economically competitive with conventional petroleum-based plastics while maintaining their environmental benefits.

02 Carbon capture and utilization in bio-polymer synthesis

Innovative technologies have been developed to capture carbon dioxide and utilize it as a feedstock in bio-polymer synthesis. These processes convert atmospheric CO2 or industrial emissions into valuable polymer precursors, effectively sequestering carbon while producing sustainable materials. This approach creates a circular carbon economy where greenhouse gases become resources rather than pollutants, offering a dual benefit of emissions reduction and sustainable material production.Expand Specific Solutions03 Life cycle assessment and carbon footprint reduction strategies

Comprehensive life cycle assessment methodologies have been developed to quantify the carbon footprint reduction achieved through bio-based polymers. These assessments consider all stages from raw material extraction to end-of-life disposal. Various strategies are employed to minimize emissions throughout the value chain, including optimized transportation logistics, renewable energy use in manufacturing, and designing products for recyclability or biodegradability.Expand Specific Solutions04 Biodegradable and compostable bio-polymers for reduced end-of-life emissions

Specialized biodegradable and compostable bio-polymers have been engineered to reduce carbon emissions at the end of product life cycles. These materials naturally decompose into environmentally benign substances, eliminating the need for energy-intensive recycling processes or the methane emissions associated with landfill disposal. The development focuses on maintaining performance properties while ensuring complete biodegradation under various environmental conditions.Expand Specific Solutions05 Industrial applications and scaling of bio-polymers for climate impact

Technologies for scaling up bio-polymer production and expanding their industrial applications have been developed to maximize climate impact. These innovations address challenges in manufacturing efficiency, cost-effectiveness, and material performance to enable broader market adoption. Applications span multiple sectors including packaging, automotive, construction, and consumer goods, with each implementation displacing conventional plastics and reducing overall carbon emissions across industries.Expand Specific Solutions

Key Industry Players in Bio-Polymer Development

The carbon emission reduction via bio-based polymers market is currently in a growth phase, with increasing adoption driven by sustainability imperatives. The global market size is expanding rapidly, projected to reach significant scale as regulatory pressures and consumer demand for eco-friendly materials intensify. Technologically, the field shows varying maturity levels across different bio-polymer categories. Leading players like Braskem SA have achieved commercial-scale production of bio-polyethylene, while Arkema, Novamont, and UPM-Kymmene demonstrate strong innovation in specialized bio-based materials. Companies such as LG Chem and SINOPEC are investing heavily in R&D to improve performance and cost-competitiveness. Teysha Technologies and Novomer represent emerging innovators with novel approaches to biodegradable polymers. Academic-industry partnerships, particularly with institutions like Texas A&M and Nanjing Tech University, are accelerating technological advancement in this promising but still-evolving sector.

Braskem SA

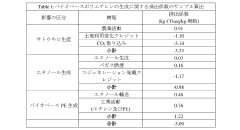

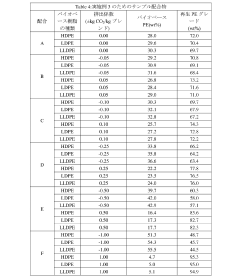

Technical Solution: Braskem has developed a comprehensive bio-based polymer production system centered around their "I'm green™" polyethylene technology. This innovative approach utilizes sugarcane ethanol as a renewable feedstock, capturing approximately 3.09 tons of CO2 from the atmosphere for each ton of bio-based polyethylene produced. Their vertically integrated production process begins with sustainable sugarcane cultivation in Brazil, followed by fermentation to produce bioethanol, which is then dehydrated to create ethylene - the building block for their bio-based polymers. The resulting polymers maintain identical technical properties to conventional fossil-based polyethylene while offering a significantly reduced carbon footprint. Braskem has expanded this technology to produce bio-based EVA (Ethylene Vinyl Acetate) and has invested in circular economy initiatives to further enhance sustainability through mechanical and chemical recycling processes.

Strengths: Established commercial-scale production with proven carbon negative lifecycle; drop-in replacement for conventional plastics requiring no equipment modifications; strong agricultural integration in Brazil. Weaknesses: Dependence on agricultural feedstocks may create land-use concerns; production concentrated in specific geographic regions; higher production costs compared to conventional polymers.

DSM IP Assets BV

Technical Solution: DSM has developed an innovative portfolio of bio-based and partially bio-based engineering polymers under their Arnitel® Eco and EcoPaXX® product lines. Their technology utilizes castor oil as a renewable feedstock, which is converted through proprietary chemical processes into bio-based building blocks for high-performance polymers. The EcoPaXX® polyamide 410 contains 70% bio-based content derived from castor beans grown in non-food competing regions, achieving carbon neutrality through the carbon captured during plant growth offsetting emissions during production. DSM's technology enables the creation of bio-based thermoplastic copolyesters (TPCs) that maintain exceptional mechanical properties while reducing carbon footprint by up to 50% compared to fossil-based alternatives. Their life cycle assessments demonstrate that these materials can achieve carbon emission reductions of 4-6 kg CO2 equivalent per kilogram of polymer when substituting conventional engineering plastics in automotive, electrical, and consumer goods applications.

Strengths: High-performance engineering polymers suitable for demanding applications; utilization of non-food competing castor oil as feedstock; drop-in solutions for existing manufacturing processes. Weaknesses: Only partially bio-based content in some product lines; higher cost compared to conventional engineering plastics; limited biodegradability at end-of-life.

Critical Patents in Bio-based Polymer Technology

Low-impact co2 emission polymer compositions and methods of preparing the same

PatentInactiveJP2023083275A

Innovation

- Development of blended polymer compositions combining biobased polymers and recycled polymers to achieve zero or near-zero carbon emissions compared to traditional fossil fuel-based materials.

- Creation of a flexible three-component system (biobased polymers, recycled polymers, and optional virgin petrochemical polymers) that allows for customization based on specific application requirements and environmental impact goals.

- Establishment of a methodology for producing polymer compositions with reduced overall environmental impact through strategic material selection and blending techniques.

Polyamide, composition comprising such a polyamide and their uses

PatentWO2010004199A2

Innovation

- Polyamides are synthesized using butanediamine and dicarboxylic acids from renewable resources, ensuring a significant percentage of organic carbon originates from bio-based materials, thereby reducing CO2 emissions and aligning with sustainable development goals.

Life Cycle Assessment Methodologies

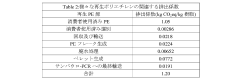

Life Cycle Assessment (LCA) methodologies serve as the cornerstone for quantifying environmental impacts of bio-based polymers compared to conventional petroleum-based alternatives. The ISO 14040 and 14044 standards provide the fundamental framework for conducting comprehensive LCAs, establishing four critical phases: goal and scope definition, inventory analysis, impact assessment, and interpretation. These standardized approaches ensure consistency and comparability across different polymer assessments.

For bio-based polymers specifically, cradle-to-grave assessments track carbon emissions from biomass cultivation through manufacturing, use, and end-of-life management. This comprehensive approach captures the full spectrum of environmental impacts, including land use changes that can significantly affect the carbon footprint calculation. Attributional LCA methodologies focus on static environmental impacts of production systems, while consequential LCAs examine broader market effects of transitioning from conventional to bio-based polymers.

Recent methodological advancements have introduced dynamic LCA approaches that account for temporal variations in carbon sequestration and emissions throughout the polymer lifecycle. These temporal considerations are particularly relevant for bio-based materials, as carbon sequestration during biomass growth occurs at different rates than subsequent emissions during product use and disposal.

Allocation methods represent another critical aspect of bio-based polymer LCAs, particularly when agricultural feedstocks serve multiple purposes beyond polymer production. Mass allocation, economic allocation, and system expansion approaches each present different advantages and limitations when distributing environmental impacts across co-products.

Sensitivity and uncertainty analyses have become increasingly important components of bio-based polymer LCAs, acknowledging the variability in agricultural practices, processing technologies, and end-of-life scenarios. Monte Carlo simulations and scenario analyses help quantify the robustness of carbon reduction claims across different implementation contexts.

Emerging methodological refinements include the integration of biodiversity impacts, water footprinting, and social sustainability metrics into traditional carbon-focused assessments. These developments reflect a growing recognition that environmental sustainability extends beyond carbon emissions alone, requiring holistic evaluation frameworks that capture the multidimensional impacts of material choices.

For bio-based polymers specifically, cradle-to-grave assessments track carbon emissions from biomass cultivation through manufacturing, use, and end-of-life management. This comprehensive approach captures the full spectrum of environmental impacts, including land use changes that can significantly affect the carbon footprint calculation. Attributional LCA methodologies focus on static environmental impacts of production systems, while consequential LCAs examine broader market effects of transitioning from conventional to bio-based polymers.

Recent methodological advancements have introduced dynamic LCA approaches that account for temporal variations in carbon sequestration and emissions throughout the polymer lifecycle. These temporal considerations are particularly relevant for bio-based materials, as carbon sequestration during biomass growth occurs at different rates than subsequent emissions during product use and disposal.

Allocation methods represent another critical aspect of bio-based polymer LCAs, particularly when agricultural feedstocks serve multiple purposes beyond polymer production. Mass allocation, economic allocation, and system expansion approaches each present different advantages and limitations when distributing environmental impacts across co-products.

Sensitivity and uncertainty analyses have become increasingly important components of bio-based polymer LCAs, acknowledging the variability in agricultural practices, processing technologies, and end-of-life scenarios. Monte Carlo simulations and scenario analyses help quantify the robustness of carbon reduction claims across different implementation contexts.

Emerging methodological refinements include the integration of biodiversity impacts, water footprinting, and social sustainability metrics into traditional carbon-focused assessments. These developments reflect a growing recognition that environmental sustainability extends beyond carbon emissions alone, requiring holistic evaluation frameworks that capture the multidimensional impacts of material choices.

Policy Frameworks for Bio-based Materials

Policy frameworks across the globe have evolved significantly to support the adoption of bio-based materials as part of broader carbon reduction strategies. The European Union leads with its comprehensive Bioeconomy Strategy, which explicitly promotes bio-based polymers through financial incentives, research funding, and regulatory preferences. This framework integrates with the European Green Deal and Circular Economy Action Plan, creating a cohesive policy environment that encourages market transformation toward sustainable materials.

In North America, the United States has implemented the BioPreferred Program, which mandates federal agencies to prioritize bio-based products in procurement processes. This market-pull mechanism has successfully stimulated demand for bio-based polymers across various sectors. Additionally, the USDA's BioRefinery Assistance Program provides loan guarantees for facilities producing bio-based materials, addressing capital investment barriers.

Asian economies, particularly China and Japan, have developed distinct approaches. China's 14th Five-Year Plan specifically targets bio-based materials as a strategic emerging industry, offering tax incentives and subsidies for manufacturers. Japan's Biomass Nippon Strategy focuses on technological innovation and commercialization pathways for bio-based polymers, supported by substantial R&D investments.

International standards and certification systems play a crucial role in policy implementation. The ISO 14040 series for Life Cycle Assessment provides methodological frameworks for evaluating environmental impacts of bio-based materials. Meanwhile, certification schemes like ISCC PLUS and RSB ensure sustainability throughout the supply chain, addressing concerns about land use and food security competition.

Carbon pricing mechanisms increasingly influence the competitiveness of bio-based polymers. The EU Emissions Trading System and similar carbon markets create economic advantages for materials with lower carbon footprints. Some jurisdictions have begun implementing carbon border adjustment mechanisms that may further enhance the market position of bio-based alternatives to conventional polymers.

Policy gaps remain significant barriers to wider adoption. Inconsistent end-of-life regulations create uncertainty for manufacturers, while fragmented standards across regions complicate international trade. Future policy development should focus on harmonizing these frameworks while addressing specific challenges in waste management infrastructure and creating technology-neutral incentives that reward actual carbon reduction performance rather than specific material types.

In North America, the United States has implemented the BioPreferred Program, which mandates federal agencies to prioritize bio-based products in procurement processes. This market-pull mechanism has successfully stimulated demand for bio-based polymers across various sectors. Additionally, the USDA's BioRefinery Assistance Program provides loan guarantees for facilities producing bio-based materials, addressing capital investment barriers.

Asian economies, particularly China and Japan, have developed distinct approaches. China's 14th Five-Year Plan specifically targets bio-based materials as a strategic emerging industry, offering tax incentives and subsidies for manufacturers. Japan's Biomass Nippon Strategy focuses on technological innovation and commercialization pathways for bio-based polymers, supported by substantial R&D investments.

International standards and certification systems play a crucial role in policy implementation. The ISO 14040 series for Life Cycle Assessment provides methodological frameworks for evaluating environmental impacts of bio-based materials. Meanwhile, certification schemes like ISCC PLUS and RSB ensure sustainability throughout the supply chain, addressing concerns about land use and food security competition.

Carbon pricing mechanisms increasingly influence the competitiveness of bio-based polymers. The EU Emissions Trading System and similar carbon markets create economic advantages for materials with lower carbon footprints. Some jurisdictions have begun implementing carbon border adjustment mechanisms that may further enhance the market position of bio-based alternatives to conventional polymers.

Policy gaps remain significant barriers to wider adoption. Inconsistent end-of-life regulations create uncertainty for manufacturers, while fragmented standards across regions complicate international trade. Future policy development should focus on harmonizing these frameworks while addressing specific challenges in waste management infrastructure and creating technology-neutral incentives that reward actual carbon reduction performance rather than specific material types.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!