Comparative Analysis of Bio-based Polymer and Conventional Plastics

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bio-Polymer Evolution and Objectives

Bio-based polymers have evolved significantly over the past century, with their development trajectory closely aligned with environmental concerns and sustainability initiatives. The earliest forms of bio-polymers date back to the 1920s with Henry Ford's experiments using soybean-derived plastics for automotive components. However, the post-World War II era saw petroleum-based plastics dominate the market due to their cost-effectiveness and versatile properties, relegating bio-polymers to niche applications.

The resurgence of interest in bio-based polymers began in the 1970s, coinciding with the first oil crisis and growing environmental awareness. This period marked the initial scientific exploration into polylactic acid (PLA), polyhydroxyalkanoates (PHAs), and starch-based polymers as viable alternatives to conventional plastics. The 1990s witnessed accelerated research and development, with the first commercial-scale production of PLA by Cargill Dow (now NatureWorks) in 2002.

Recent technological advancements have significantly improved the performance characteristics of bio-polymers, addressing historical limitations in thermal stability, mechanical strength, and moisture resistance. Modern bio-based polymers can be categorized into three generations: first-generation derived directly from biomass (starch, cellulose), second-generation synthesized from bio-derived monomers (PLA, bio-PET), and third-generation produced by microorganisms (PHAs, bacterial cellulose).

The primary objective of bio-polymer development is to create sustainable alternatives that match or exceed the performance of conventional plastics while reducing environmental impact. This includes developing materials with comparable mechanical properties, processability, and durability, but with enhanced biodegradability or compostability. Additionally, the industry aims to reduce production costs to achieve price parity with petroleum-based plastics, currently a significant barrier to widespread adoption.

Another critical objective is to establish bio-polymers that do not compete with food resources, focusing instead on agricultural waste, algae, and non-food crops as feedstock. This addresses ethical concerns regarding land use and food security while promoting circular economy principles. The development of drop-in bio-based equivalents of conventional plastics (such as bio-PE and bio-PET) represents a strategic approach to facilitate market adoption without requiring changes to existing processing infrastructure.

Looking forward, the bio-polymer industry aims to achieve complete carbon neutrality across the entire value chain, from raw material sourcing to end-of-life management. This holistic approach encompasses reducing energy consumption during production, optimizing transportation logistics, and developing effective recycling or composting systems for bio-polymer products.

The resurgence of interest in bio-based polymers began in the 1970s, coinciding with the first oil crisis and growing environmental awareness. This period marked the initial scientific exploration into polylactic acid (PLA), polyhydroxyalkanoates (PHAs), and starch-based polymers as viable alternatives to conventional plastics. The 1990s witnessed accelerated research and development, with the first commercial-scale production of PLA by Cargill Dow (now NatureWorks) in 2002.

Recent technological advancements have significantly improved the performance characteristics of bio-polymers, addressing historical limitations in thermal stability, mechanical strength, and moisture resistance. Modern bio-based polymers can be categorized into three generations: first-generation derived directly from biomass (starch, cellulose), second-generation synthesized from bio-derived monomers (PLA, bio-PET), and third-generation produced by microorganisms (PHAs, bacterial cellulose).

The primary objective of bio-polymer development is to create sustainable alternatives that match or exceed the performance of conventional plastics while reducing environmental impact. This includes developing materials with comparable mechanical properties, processability, and durability, but with enhanced biodegradability or compostability. Additionally, the industry aims to reduce production costs to achieve price parity with petroleum-based plastics, currently a significant barrier to widespread adoption.

Another critical objective is to establish bio-polymers that do not compete with food resources, focusing instead on agricultural waste, algae, and non-food crops as feedstock. This addresses ethical concerns regarding land use and food security while promoting circular economy principles. The development of drop-in bio-based equivalents of conventional plastics (such as bio-PE and bio-PET) represents a strategic approach to facilitate market adoption without requiring changes to existing processing infrastructure.

Looking forward, the bio-polymer industry aims to achieve complete carbon neutrality across the entire value chain, from raw material sourcing to end-of-life management. This holistic approach encompasses reducing energy consumption during production, optimizing transportation logistics, and developing effective recycling or composting systems for bio-polymer products.

Market Demand Analysis for Sustainable Plastics

The global market for sustainable plastics has witnessed significant growth in recent years, driven by increasing environmental concerns and regulatory pressures. Consumer awareness regarding plastic pollution has reached unprecedented levels, with approximately 85% of global consumers expressing concern about plastic waste according to recent market surveys. This heightened awareness has translated into tangible market demand, with the sustainable plastics market valued at $9.1 billion in 2022 and projected to grow at a CAGR of 14.5% through 2030.

Regulatory frameworks have become major market drivers across different regions. The European Union's Single-Use Plastics Directive, which aims to reduce the impact of certain plastic products on the environment, has created substantial demand for bio-based alternatives. Similarly, over 127 countries have implemented some form of plastic bag regulations, creating immediate market opportunities for sustainable alternatives.

Corporate sustainability commitments represent another significant market force. Major consumer goods companies including Unilever, Coca-Cola, and Nestlé have pledged to make their packaging 100% recyclable, reusable, or compostable by 2025. These commitments have catalyzed investment in bio-based polymer technologies and created reliable demand channels for sustainable plastic producers.

Market segmentation reveals varying adoption rates across industries. The packaging sector currently dominates the sustainable plastics market with a 45% share, followed by consumer goods (22%), automotive (15%), and construction (10%). Within packaging, food and beverage applications show the strongest growth trajectory due to direct consumer visibility and regulatory focus.

Price sensitivity remains a critical market factor. The average price premium for bio-based polymers currently ranges between 20-100% above conventional plastics, depending on the specific material and application. This premium represents a significant barrier to mass adoption, particularly in price-sensitive markets and applications. However, willingness to pay this premium varies significantly by region and consumer segment.

Regional analysis indicates that Europe leads in sustainable plastics adoption with approximately 38% of global market share, followed by North America (29%) and Asia-Pacific (24%). Developing markets show lower current adoption but higher growth rates, particularly in countries implementing new plastic regulations such as India and several Southeast Asian nations.

Future market projections suggest that as production scales and technologies mature, the cost gap between bio-based polymers and conventional plastics will narrow significantly by 2030. This price convergence, combined with stricter regulations and continued consumer pressure, is expected to accelerate market growth beyond current projections, potentially reaching market penetration of 25-30% in key application areas by 2035.

Regulatory frameworks have become major market drivers across different regions. The European Union's Single-Use Plastics Directive, which aims to reduce the impact of certain plastic products on the environment, has created substantial demand for bio-based alternatives. Similarly, over 127 countries have implemented some form of plastic bag regulations, creating immediate market opportunities for sustainable alternatives.

Corporate sustainability commitments represent another significant market force. Major consumer goods companies including Unilever, Coca-Cola, and Nestlé have pledged to make their packaging 100% recyclable, reusable, or compostable by 2025. These commitments have catalyzed investment in bio-based polymer technologies and created reliable demand channels for sustainable plastic producers.

Market segmentation reveals varying adoption rates across industries. The packaging sector currently dominates the sustainable plastics market with a 45% share, followed by consumer goods (22%), automotive (15%), and construction (10%). Within packaging, food and beverage applications show the strongest growth trajectory due to direct consumer visibility and regulatory focus.

Price sensitivity remains a critical market factor. The average price premium for bio-based polymers currently ranges between 20-100% above conventional plastics, depending on the specific material and application. This premium represents a significant barrier to mass adoption, particularly in price-sensitive markets and applications. However, willingness to pay this premium varies significantly by region and consumer segment.

Regional analysis indicates that Europe leads in sustainable plastics adoption with approximately 38% of global market share, followed by North America (29%) and Asia-Pacific (24%). Developing markets show lower current adoption but higher growth rates, particularly in countries implementing new plastic regulations such as India and several Southeast Asian nations.

Future market projections suggest that as production scales and technologies mature, the cost gap between bio-based polymers and conventional plastics will narrow significantly by 2030. This price convergence, combined with stricter regulations and continued consumer pressure, is expected to accelerate market growth beyond current projections, potentially reaching market penetration of 25-30% in key application areas by 2035.

Bio-Polymer Technology Status and Barriers

The global landscape of bio-based polymer technology has witnessed significant advancement in recent years, yet remains constrained by several technical and economic barriers. Currently, bio-polymers represent approximately 1% of the 368 million tons of plastic produced annually worldwide, indicating substantial room for growth but also highlighting existing limitations in widespread adoption.

From a technical perspective, bio-based polymers have achieved considerable progress in material properties. PLA (Polylactic Acid) and PHA (Polyhydroxyalkanoates) have emerged as leading bio-polymer categories with improved thermal stability and mechanical strength. However, these materials still face performance challenges when compared to conventional plastics, particularly in terms of moisture resistance, durability under extreme conditions, and long-term stability.

Production scalability remains a significant barrier. Current bio-polymer manufacturing processes require sophisticated fermentation technologies and precise processing conditions, resulting in higher production costs compared to petroleum-based alternatives. The average production cost for bio-polymers ranges from 2-4 times higher than conventional plastics, creating a substantial economic hurdle for market penetration.

Feedstock availability and consistency present another challenge. Bio-polymers rely on agricultural feedstocks which are subject to seasonal variations, regional availability, and potential competition with food production. This dependency creates supply chain vulnerabilities not present in the more established petroleum-based plastic industry.

Geographically, bio-polymer technology development shows distinct patterns. Europe leads in research and innovation with approximately 45% of global patents in this field, followed by North America (30%) and Asia (20%). However, commercial-scale production has seen faster growth in Asia, particularly in China and Thailand, due to favorable manufacturing conditions and access to agricultural feedstocks.

Regulatory frameworks worldwide remain inconsistent, creating market fragmentation. While the European Union has implemented supportive policies for bio-based materials through initiatives like the European Green Deal, other regions lack comprehensive regulatory support, hampering global standardization and adoption.

End-of-life management presents both technical and infrastructural challenges. While bio-polymers offer theoretical advantages in biodegradability, actual decomposition depends heavily on specific environmental conditions rarely found in conventional waste management systems. The lack of specialized industrial composting facilities in most regions limits the practical environmental benefits of biodegradable bio-polymers.

Cross-industry collaboration between material scientists, chemical engineers, and biotechnology experts has accelerated in recent years but remains insufficient to overcome the multidisciplinary challenges facing bio-polymer development and implementation at scale.

From a technical perspective, bio-based polymers have achieved considerable progress in material properties. PLA (Polylactic Acid) and PHA (Polyhydroxyalkanoates) have emerged as leading bio-polymer categories with improved thermal stability and mechanical strength. However, these materials still face performance challenges when compared to conventional plastics, particularly in terms of moisture resistance, durability under extreme conditions, and long-term stability.

Production scalability remains a significant barrier. Current bio-polymer manufacturing processes require sophisticated fermentation technologies and precise processing conditions, resulting in higher production costs compared to petroleum-based alternatives. The average production cost for bio-polymers ranges from 2-4 times higher than conventional plastics, creating a substantial economic hurdle for market penetration.

Feedstock availability and consistency present another challenge. Bio-polymers rely on agricultural feedstocks which are subject to seasonal variations, regional availability, and potential competition with food production. This dependency creates supply chain vulnerabilities not present in the more established petroleum-based plastic industry.

Geographically, bio-polymer technology development shows distinct patterns. Europe leads in research and innovation with approximately 45% of global patents in this field, followed by North America (30%) and Asia (20%). However, commercial-scale production has seen faster growth in Asia, particularly in China and Thailand, due to favorable manufacturing conditions and access to agricultural feedstocks.

Regulatory frameworks worldwide remain inconsistent, creating market fragmentation. While the European Union has implemented supportive policies for bio-based materials through initiatives like the European Green Deal, other regions lack comprehensive regulatory support, hampering global standardization and adoption.

End-of-life management presents both technical and infrastructural challenges. While bio-polymers offer theoretical advantages in biodegradability, actual decomposition depends heavily on specific environmental conditions rarely found in conventional waste management systems. The lack of specialized industrial composting facilities in most regions limits the practical environmental benefits of biodegradable bio-polymers.

Cross-industry collaboration between material scientists, chemical engineers, and biotechnology experts has accelerated in recent years but remains insufficient to overcome the multidisciplinary challenges facing bio-polymer development and implementation at scale.

Current Bio-Polymer Production Methods

01 Bio-based polymer compositions and blends

Bio-based polymers can be blended with conventional plastics to create hybrid materials with improved properties. These compositions often incorporate renewable resources such as plant-derived monomers or agricultural waste products to partially replace petroleum-based components. The resulting materials maintain many of the desirable characteristics of conventional plastics while reducing environmental impact and carbon footprint. These blends can be engineered to achieve specific mechanical properties, biodegradability profiles, or processing characteristics.- Bio-based polymer compositions and blends: Bio-based polymers can be blended with conventional plastics to create composite materials with improved properties. These blends combine the biodegradability of bio-based polymers with the durability and performance characteristics of conventional plastics. The compositions may include various ratios of bio-based polymers such as PLA, PHA, or starch-based materials mixed with traditional polymers like polyethylene or polypropylene to achieve specific material properties while reducing environmental impact.

- Manufacturing processes for bio-based polymers: Innovative manufacturing processes have been developed to produce bio-based polymers that can compete with conventional plastics. These processes include fermentation techniques, enzymatic polymerization, and chemical modifications of natural materials. The manufacturing methods focus on improving efficiency, reducing energy consumption, and enhancing the scalability of bio-based polymer production to make them more economically viable alternatives to petroleum-based plastics.

- Biodegradable packaging solutions: Bio-based polymers are increasingly used in packaging applications as alternatives to conventional plastics. These biodegradable packaging solutions include films, containers, and wraps made from materials such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and cellulose derivatives. The packaging materials are designed to maintain necessary barrier properties and mechanical strength while offering improved end-of-life options through composting or biodegradation.

- Additives and modifiers for bio-based polymers: Various additives and modifiers can enhance the properties of bio-based polymers to match or exceed those of conventional plastics. These include plasticizers, compatibilizers, impact modifiers, and reinforcing agents. Such additives can improve flexibility, thermal stability, mechanical strength, and processability of bio-based polymers, making them more suitable for applications traditionally dominated by petroleum-based plastics.

- Bio-based polymer applications in durable goods: Bio-based polymers are increasingly being used in durable goods applications beyond single-use items. These applications include automotive components, electronic housings, construction materials, and consumer goods. The development focuses on creating bio-based alternatives that can match the performance characteristics of conventional plastics in terms of durability, heat resistance, and mechanical properties while offering environmental benefits such as reduced carbon footprint and potential biodegradability at end-of-life.

02 Manufacturing processes for bio-based polymers

Specialized manufacturing techniques have been developed to process bio-based polymers efficiently. These processes often require modifications to conventional plastic processing equipment to accommodate the different rheological properties and thermal sensitivities of bio-based materials. Innovations include optimized extrusion parameters, novel catalyst systems, and specialized molding techniques that preserve the integrity of the biological components while ensuring consistent product quality. These manufacturing advances help bridge the gap between laboratory-scale bio-polymer development and commercial-scale production.Expand Specific Solutions03 Biodegradability and compostability enhancements

Techniques to enhance the biodegradability and compostability of polymer materials involve incorporating specific additives, enzymes, or structural modifications that facilitate breakdown in natural environments. These innovations address end-of-life concerns for plastic products by ensuring they can decompose under industrial composting conditions or in natural settings without leaving harmful microplastics. The technologies often focus on controlling the degradation rate to maintain product integrity during use while ensuring complete decomposition after disposal.Expand Specific Solutions04 Bio-based additives for conventional plastics

Bio-derived additives can be incorporated into conventional plastic formulations to improve sustainability profiles without completely replacing the base polymer. These additives include bio-based plasticizers, fillers, reinforcing agents, and stabilizers derived from renewable resources. The incorporation of these components can reduce the overall petroleum content of plastic products while potentially enhancing properties such as flexibility, impact resistance, or UV stability. This approach represents an incremental step toward more sustainable plastic formulations.Expand Specific Solutions05 Performance comparison and property enhancement

Research comparing the performance characteristics of bio-based polymers with conventional plastics has led to innovations that enhance the mechanical, thermal, and chemical properties of bio-based alternatives. These developments include cross-linking techniques, nanocomposite formulations, and molecular architecture modifications that address traditional limitations of bio-polymers such as moisture sensitivity, thermal instability, or insufficient mechanical strength. The goal is to create bio-based materials that can directly substitute for conventional plastics in demanding applications without compromising performance.Expand Specific Solutions

Key Industry Players and Competition Landscape

The bio-based polymer market is experiencing rapid growth within the sustainable materials sector, currently transitioning from early commercialization to mainstream adoption. Market size is expanding significantly, projected to reach substantial volumes as consumer demand for eco-friendly alternatives increases. Technologically, the field shows varying maturity levels across applications, with companies like Novamont, CJ CheilJedang, and LG Chem leading commercial deployment of PHA and PLA polymers. Academic institutions including South China University of Technology and Texas A&M are advancing fundamental research, while innovative startups like Teysha Technologies and B4Plastics are developing next-generation biomaterials. Established corporations such as Mitsubishi Gas Chemical and Coca-Cola are increasingly investing in bio-based alternatives to conventional plastics, indicating growing industry confidence in this technology's commercial viability.

LG Chem Ltd.

Technical Solution: LG Chem has developed a comprehensive bio-based polymer portfolio including bio-PET, bio-PE, and PLA (polylactic acid) derived from renewable resources such as corn starch and sugarcane. Their proprietary technology focuses on enhancing the mechanical properties of bio-based polymers through advanced polymerization techniques and specialized additives. LG Chem's bio-PET contains up to 30% plant-derived materials, reducing fossil resource dependency while maintaining performance comparable to conventional PET. Their bio-degradable polymers utilize a controlled degradation mechanism that allows for precise timing of material breakdown based on environmental conditions. The company has also pioneered a mass balance approach for bio-attributed polymers, allowing them to scale production while maintaining sustainability credentials.

Strengths: Strong R&D capabilities with extensive polymer engineering expertise; established global manufacturing infrastructure; ability to scale production to commercial levels. Weaknesses: Higher production costs compared to conventional plastics; some bio-based products still contain significant petroleum-derived components; performance limitations in certain high-stress applications.

Novamont SpA

Technical Solution: Novamont has pioneered the MATER-BI technology platform, producing fully biodegradable and compostable bioplastics derived from starches, cellulose, and vegetable oils. Their patented process transforms these renewable resources into versatile polymers through a combination of chemical modifications and proprietary additives. The MATER-BI family includes grades specifically engineered for different applications, from flexible packaging to rigid containers, with tailored biodegradation rates. Novamont's technology incorporates a multi-phase structure that balances mechanical performance with controlled biodegradability. Their fourth-generation bioplastics integrate locally-sourced feedstocks and biorefinery concepts, creating integrated value chains that minimize environmental impact. The company has developed specialized formulations that maintain stability during product use but activate biodegradation under specific composting conditions.

Strengths: Comprehensive portfolio of fully biodegradable solutions; vertical integration from feedstock to finished materials; proven commercial applications across multiple sectors. Weaknesses: Higher cost structure compared to conventional plastics; performance limitations in high-temperature applications; dependent on proper waste management infrastructure for optimal end-of-life outcomes.

Critical Patents and Innovations in Bio-Polymers

Biopolymer Compositions Having Improved Impact Resistance

PatentInactiveUS20120029112A1

Innovation

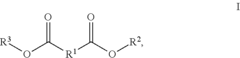

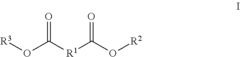

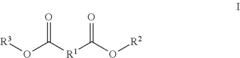

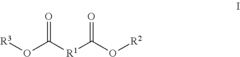

- A polymer blend comprising a biopolymer and an ester impact modifier, specifically esters of formula I, where R1 is a substituted or unsubstituted aliphatic hydrocarbon group with 1 to 10 carbon atoms, and R2 and R3 are aliphatic hydrocarbon groups with 4 to 14 carbon atoms, are combined in specific ratios to enhance impact resistance.

Biopolymer compositions having improved flexibility

PatentInactiveEP2475714A1

Innovation

- A polymer blend comprising a biopolymer and an aliphatic polyester, where the polyester is derived from substituted or unsubstituted aliphatic diacids, diols, and alcohols, is used to enhance the flexibility of biopolymers by reducing glass transition temperatures and increasing elongation at break.

Environmental Impact Assessment

The environmental impact assessment of bio-based polymers versus conventional plastics reveals significant differences across their entire life cycles. Bio-based polymers generally demonstrate reduced carbon footprints compared to petroleum-based alternatives, with studies indicating 30-80% lower greenhouse gas emissions depending on the specific polymer type and production method. This reduction stems primarily from the carbon sequestration during biomass growth, which partially offsets emissions during manufacturing processes.

Water consumption presents a more complex picture. While conventional plastic production requires substantial water for petroleum extraction and refining, bio-based polymers often demand higher agricultural water inputs. For instance, PLA (polylactic acid) production from corn can require 2-5 times more water than conventional PET production, though advanced farming techniques and alternative feedstocks like agricultural waste can mitigate this impact.

Land use considerations represent a critical environmental factor, as bio-based polymers require agricultural land that could potentially compete with food production. Current estimates suggest that dedicating approximately 5% of global agricultural land to bio-polymer production could replace 20% of conventional plastics, highlighting the need for careful land management strategies and increased use of non-food crop sources.

Biodegradability offers bio-based polymers a distinct advantage in addressing end-of-life environmental impacts. While conventional plastics persist for centuries, many bio-based alternatives can decompose within months to years under proper conditions. However, this benefit is highly dependent on appropriate waste management infrastructure, as bio-polymers in landfills may generate methane, a potent greenhouse gas.

Toxicity assessments indicate that bio-based polymers generally release fewer harmful chemicals during production and disposal. Conventional plastics manufacturing involves numerous potentially hazardous substances, including phthalates, bisphenol A, and styrene monomers. Bio-based alternatives typically exhibit lower ecotoxicity profiles, though additives used to enhance performance characteristics can sometimes introduce similar concerns.

Energy consumption analysis shows mixed results. While some bio-based polymers require less energy to produce than their conventional counterparts, others demand more intensive processing. For example, bio-PE production consumes approximately 15-20% less energy than conventional PE, while certain PHA (polyhydroxyalkanoate) production methods may require up to 30% more energy than comparable conventional plastics.

Life cycle assessments consistently demonstrate that the environmental advantages of bio-based polymers are highly context-dependent, varying with feedstock selection, production technology, regional energy mix, and end-of-life management. This underscores the importance of holistic environmental impact evaluations when comparing these material categories.

Water consumption presents a more complex picture. While conventional plastic production requires substantial water for petroleum extraction and refining, bio-based polymers often demand higher agricultural water inputs. For instance, PLA (polylactic acid) production from corn can require 2-5 times more water than conventional PET production, though advanced farming techniques and alternative feedstocks like agricultural waste can mitigate this impact.

Land use considerations represent a critical environmental factor, as bio-based polymers require agricultural land that could potentially compete with food production. Current estimates suggest that dedicating approximately 5% of global agricultural land to bio-polymer production could replace 20% of conventional plastics, highlighting the need for careful land management strategies and increased use of non-food crop sources.

Biodegradability offers bio-based polymers a distinct advantage in addressing end-of-life environmental impacts. While conventional plastics persist for centuries, many bio-based alternatives can decompose within months to years under proper conditions. However, this benefit is highly dependent on appropriate waste management infrastructure, as bio-polymers in landfills may generate methane, a potent greenhouse gas.

Toxicity assessments indicate that bio-based polymers generally release fewer harmful chemicals during production and disposal. Conventional plastics manufacturing involves numerous potentially hazardous substances, including phthalates, bisphenol A, and styrene monomers. Bio-based alternatives typically exhibit lower ecotoxicity profiles, though additives used to enhance performance characteristics can sometimes introduce similar concerns.

Energy consumption analysis shows mixed results. While some bio-based polymers require less energy to produce than their conventional counterparts, others demand more intensive processing. For example, bio-PE production consumes approximately 15-20% less energy than conventional PE, while certain PHA (polyhydroxyalkanoate) production methods may require up to 30% more energy than comparable conventional plastics.

Life cycle assessments consistently demonstrate that the environmental advantages of bio-based polymers are highly context-dependent, varying with feedstock selection, production technology, regional energy mix, and end-of-life management. This underscores the importance of holistic environmental impact evaluations when comparing these material categories.

Regulatory Framework and Standards

The regulatory landscape for plastics and bio-based polymers has evolved significantly in recent years, driven by growing environmental concerns and sustainability goals. At the international level, frameworks such as the United Nations Environment Programme's (UNEP) Global Plastics Treaty are establishing coordinated approaches to plastic pollution. This emerging treaty aims to address the full lifecycle of plastics, from production to waste management, with particular emphasis on promoting sustainable alternatives like bio-based polymers.

In the European Union, the regulatory framework is particularly advanced, with the Single-Use Plastics Directive (2019/904) restricting certain conventional plastic products and promoting bio-based alternatives. The EU's Circular Economy Action Plan further strengthens this approach by setting targets for plastic recycling and encouraging the development of biodegradable materials. Additionally, the European Committee for Standardization (CEN) has developed specific standards for bio-based products, including EN 16785 for bio-based content certification and EN 13432 for compostability requirements.

The United States regulatory approach is more fragmented, with policies varying significantly between states. California's SB 270 ban on single-use plastic bags and similar legislation in other states have created market opportunities for bio-based alternatives. The ASTM D6400 standard for compostable plastics serves as a key reference point for bio-based polymer manufacturers in the US market.

In Asia, countries like Japan and South Korea have implemented comprehensive plastic management strategies that include incentives for bio-based materials. Japan's Biomass Nippon Strategy specifically promotes bio-based plastics as part of its broader sustainability goals. China's recent ban on certain plastic waste imports has accelerated domestic development of sustainable alternatives, supported by standards like GB/T 32366 for biodegradable plastics.

Certification systems play a crucial role in market acceptance of bio-based polymers. Programs such as TÜV Austria's "OK biobased" and "OK compost" certifications, the Biodegradable Products Institute's (BPI) certification in North America, and DIN CERTCO's "DIN-Geprüft Biobased" label provide consumers and businesses with verification of environmental claims. These certification schemes typically assess factors including bio-based content percentage, biodegradability under specific conditions, and absence of harmful substances.

Emerging regulatory trends indicate a shift toward lifecycle assessment approaches rather than focusing solely on end-of-life considerations. This holistic perspective evaluates the environmental impact of both conventional and bio-based plastics from raw material extraction through production, use, and disposal. Future regulatory frameworks are likely to incorporate carbon footprint metrics, requiring manufacturers to demonstrate reduced greenhouse gas emissions compared to petroleum-based alternatives.

In the European Union, the regulatory framework is particularly advanced, with the Single-Use Plastics Directive (2019/904) restricting certain conventional plastic products and promoting bio-based alternatives. The EU's Circular Economy Action Plan further strengthens this approach by setting targets for plastic recycling and encouraging the development of biodegradable materials. Additionally, the European Committee for Standardization (CEN) has developed specific standards for bio-based products, including EN 16785 for bio-based content certification and EN 13432 for compostability requirements.

The United States regulatory approach is more fragmented, with policies varying significantly between states. California's SB 270 ban on single-use plastic bags and similar legislation in other states have created market opportunities for bio-based alternatives. The ASTM D6400 standard for compostable plastics serves as a key reference point for bio-based polymer manufacturers in the US market.

In Asia, countries like Japan and South Korea have implemented comprehensive plastic management strategies that include incentives for bio-based materials. Japan's Biomass Nippon Strategy specifically promotes bio-based plastics as part of its broader sustainability goals. China's recent ban on certain plastic waste imports has accelerated domestic development of sustainable alternatives, supported by standards like GB/T 32366 for biodegradable plastics.

Certification systems play a crucial role in market acceptance of bio-based polymers. Programs such as TÜV Austria's "OK biobased" and "OK compost" certifications, the Biodegradable Products Institute's (BPI) certification in North America, and DIN CERTCO's "DIN-Geprüft Biobased" label provide consumers and businesses with verification of environmental claims. These certification schemes typically assess factors including bio-based content percentage, biodegradability under specific conditions, and absence of harmful substances.

Emerging regulatory trends indicate a shift toward lifecycle assessment approaches rather than focusing solely on end-of-life considerations. This holistic perspective evaluates the environmental impact of both conventional and bio-based plastics from raw material extraction through production, use, and disposal. Future regulatory frameworks are likely to incorporate carbon footprint metrics, requiring manufacturers to demonstrate reduced greenhouse gas emissions compared to petroleum-based alternatives.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!