What Drives Bio-based Polymer Innovation in Automotive Sector?

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bio-Polymer Automotive Evolution & Objectives

The evolution of bio-based polymers in the automotive industry represents a significant shift in material science and manufacturing practices over the past several decades. Initially emerging as experimental alternatives in the 1990s, these sustainable materials have gradually transitioned from niche applications to mainstream consideration in vehicle design and production. This evolution has been driven by increasing environmental concerns, regulatory pressures, and consumer demand for more sustainable transportation options.

The automotive industry's interest in bio-polymers has accelerated notably since 2010, coinciding with stricter emissions regulations and corporate sustainability initiatives. Early applications focused primarily on non-structural interior components, but technological advancements have expanded potential uses to include semi-structural parts and even exterior applications. This progression demonstrates the industry's growing confidence in bio-based materials' performance capabilities.

Key milestones in this evolution include Ford's introduction of soy-based foam for seat cushions in 2008, Toyota's development of bio-PET for interior applications in 2012, and more recent innovations in bio-composite materials that combine natural fibers with bio-based resins for structural components. These developments illustrate the progressive integration of renewable materials into increasingly demanding automotive applications.

The technological trajectory shows a clear pattern of improvement in mechanical properties, durability, and processing compatibility. Early bio-polymers often suffered from performance limitations including moisture sensitivity, thermal instability, and inconsistent mechanical properties. Modern formulations have largely overcome these challenges through advanced polymerization techniques, innovative additives, and hybrid material approaches.

The primary objectives driving bio-polymer development in the automotive sector are multifaceted. Weight reduction remains paramount, as lighter vehicles directly contribute to improved fuel efficiency and reduced emissions. Bio-polymers typically offer density advantages over conventional petroleum-based counterparts, supporting lightweighting initiatives. Additionally, carbon footprint reduction represents a critical goal, with bio-based materials offering potential lifecycle emissions reductions of 30-80% compared to conventional plastics.

Manufacturing efficiency constitutes another key objective, with automotive manufacturers seeking bio-polymers that can be processed using existing equipment and techniques to minimize capital investment requirements. Cost competitiveness remains essential, as widespread adoption depends on achieving price parity with conventional materials, particularly in mass-market vehicle segments.

Looking forward, the industry aims to develop bio-polymers with enhanced performance characteristics that can replace petroleum-based materials in increasingly demanding applications, including under-hood components and structural elements. This ambitious objective requires continued innovation in molecular design, processing technology, and material science.

The automotive industry's interest in bio-polymers has accelerated notably since 2010, coinciding with stricter emissions regulations and corporate sustainability initiatives. Early applications focused primarily on non-structural interior components, but technological advancements have expanded potential uses to include semi-structural parts and even exterior applications. This progression demonstrates the industry's growing confidence in bio-based materials' performance capabilities.

Key milestones in this evolution include Ford's introduction of soy-based foam for seat cushions in 2008, Toyota's development of bio-PET for interior applications in 2012, and more recent innovations in bio-composite materials that combine natural fibers with bio-based resins for structural components. These developments illustrate the progressive integration of renewable materials into increasingly demanding automotive applications.

The technological trajectory shows a clear pattern of improvement in mechanical properties, durability, and processing compatibility. Early bio-polymers often suffered from performance limitations including moisture sensitivity, thermal instability, and inconsistent mechanical properties. Modern formulations have largely overcome these challenges through advanced polymerization techniques, innovative additives, and hybrid material approaches.

The primary objectives driving bio-polymer development in the automotive sector are multifaceted. Weight reduction remains paramount, as lighter vehicles directly contribute to improved fuel efficiency and reduced emissions. Bio-polymers typically offer density advantages over conventional petroleum-based counterparts, supporting lightweighting initiatives. Additionally, carbon footprint reduction represents a critical goal, with bio-based materials offering potential lifecycle emissions reductions of 30-80% compared to conventional plastics.

Manufacturing efficiency constitutes another key objective, with automotive manufacturers seeking bio-polymers that can be processed using existing equipment and techniques to minimize capital investment requirements. Cost competitiveness remains essential, as widespread adoption depends on achieving price parity with conventional materials, particularly in mass-market vehicle segments.

Looking forward, the industry aims to develop bio-polymers with enhanced performance characteristics that can replace petroleum-based materials in increasingly demanding applications, including under-hood components and structural elements. This ambitious objective requires continued innovation in molecular design, processing technology, and material science.

Market Demand for Sustainable Automotive Materials

The automotive industry is experiencing a significant shift towards sustainability, driven by increasing environmental concerns, regulatory pressures, and changing consumer preferences. This transformation has created a substantial market demand for sustainable automotive materials, particularly bio-based polymers. According to recent market analyses, the global automotive bio-based polymer market was valued at approximately $600 million in 2022 and is projected to grow at a compound annual growth rate of 12% through 2030.

Environmental regulations worldwide are becoming increasingly stringent, with the European Union's End-of-Life Vehicle Directive requiring 95% of vehicle materials to be recoverable and 85% to be recyclable. Similarly, China's evolving environmental policies and the United States' Corporate Average Fuel Economy (CAFE) standards are pushing automakers to adopt more sustainable materials and manufacturing processes.

Consumer awareness regarding environmental issues has risen dramatically, with surveys indicating that over 70% of global consumers consider sustainability when making purchasing decisions. This trend is particularly pronounced among younger demographics, with millennials and Generation Z showing strong preferences for environmentally responsible products. Automotive manufacturers are responding to this shift by incorporating sustainable materials into their vehicle designs as a key differentiator in the competitive marketplace.

Weight reduction remains a critical factor in automotive design, directly impacting fuel efficiency and emissions. Bio-based polymers offer significant advantages in this regard, with many variants being 15-30% lighter than their petroleum-based counterparts while maintaining comparable mechanical properties. This weight reduction can translate to fuel savings of approximately 5-7% for every 10% reduction in vehicle weight.

The circular economy concept has gained substantial traction in the automotive sector, with manufacturers increasingly focusing on materials that can be recycled, reused, or biodegraded at the end of their lifecycle. Bio-based polymers align perfectly with this approach, offering reduced carbon footprints and enhanced end-of-life options compared to traditional materials.

Cost considerations remain a significant factor in material selection for automotive applications. While bio-based polymers typically command a premium of 10-30% over conventional alternatives, this gap is narrowing as production scales increase and technologies mature. Furthermore, the total lifecycle cost analysis increasingly favors sustainable materials when considering factors such as regulatory compliance, brand value enhancement, and waste management expenses.

Supply chain resilience has emerged as a critical concern following recent global disruptions. Bio-based polymers, which can be sourced from diverse agricultural feedstocks, offer potential advantages in reducing dependence on petroleum-based supply chains that are subject to geopolitical volatility and price fluctuations.

Environmental regulations worldwide are becoming increasingly stringent, with the European Union's End-of-Life Vehicle Directive requiring 95% of vehicle materials to be recoverable and 85% to be recyclable. Similarly, China's evolving environmental policies and the United States' Corporate Average Fuel Economy (CAFE) standards are pushing automakers to adopt more sustainable materials and manufacturing processes.

Consumer awareness regarding environmental issues has risen dramatically, with surveys indicating that over 70% of global consumers consider sustainability when making purchasing decisions. This trend is particularly pronounced among younger demographics, with millennials and Generation Z showing strong preferences for environmentally responsible products. Automotive manufacturers are responding to this shift by incorporating sustainable materials into their vehicle designs as a key differentiator in the competitive marketplace.

Weight reduction remains a critical factor in automotive design, directly impacting fuel efficiency and emissions. Bio-based polymers offer significant advantages in this regard, with many variants being 15-30% lighter than their petroleum-based counterparts while maintaining comparable mechanical properties. This weight reduction can translate to fuel savings of approximately 5-7% for every 10% reduction in vehicle weight.

The circular economy concept has gained substantial traction in the automotive sector, with manufacturers increasingly focusing on materials that can be recycled, reused, or biodegraded at the end of their lifecycle. Bio-based polymers align perfectly with this approach, offering reduced carbon footprints and enhanced end-of-life options compared to traditional materials.

Cost considerations remain a significant factor in material selection for automotive applications. While bio-based polymers typically command a premium of 10-30% over conventional alternatives, this gap is narrowing as production scales increase and technologies mature. Furthermore, the total lifecycle cost analysis increasingly favors sustainable materials when considering factors such as regulatory compliance, brand value enhancement, and waste management expenses.

Supply chain resilience has emerged as a critical concern following recent global disruptions. Bio-based polymers, which can be sourced from diverse agricultural feedstocks, offer potential advantages in reducing dependence on petroleum-based supply chains that are subject to geopolitical volatility and price fluctuations.

Bio-Polymer Technology Landscape & Barriers

The global bio-polymer landscape for automotive applications is currently experiencing significant growth, driven by increasing environmental regulations and consumer demand for sustainable products. Bio-based polymers derived from renewable resources such as corn starch, sugarcane, and cellulose are gaining traction as viable alternatives to petroleum-based plastics in vehicle manufacturing.

Despite promising developments, the bio-polymer industry faces substantial technical barriers. The mechanical properties of many bio-based polymers still fall short of conventional plastics, particularly in terms of tensile strength, impact resistance, and thermal stability required for automotive applications. These limitations restrict their use to non-structural components like interior trims and packaging materials.

Cost competitiveness remains a significant obstacle. Bio-polymers typically command a 20-50% price premium over traditional petroleum-based alternatives, making widespread adoption economically challenging for automotive manufacturers operating on tight margins. The production infrastructure for bio-polymers also lacks the economies of scale enjoyed by conventional plastic manufacturing.

Processing challenges present another barrier. Bio-polymers often require modified processing parameters and equipment adjustments, increasing implementation costs. Their sensitivity to moisture during processing can lead to hydrolytic degradation, affecting both manufacturing efficiency and final product quality.

Durability concerns persist in automotive applications where components must withstand extreme temperatures, UV exposure, and chemical contact over a vehicle's lifespan. Many bio-polymers exhibit accelerated degradation under these conditions, raising questions about long-term performance reliability.

The regulatory landscape adds complexity, with inconsistent global standards for biodegradability claims and sustainability metrics. This creates market confusion and hampers industry-wide adoption of standardized materials and processes.

Supply chain stability represents another challenge, as agricultural feedstock availability fluctuates with seasonal variations, weather conditions, and competing food-production demands. This volatility complicates production planning and inventory management for automotive manufacturers.

Recent technological breakthroughs are addressing these barriers through composite formulations that blend bio-polymers with reinforcing agents to enhance mechanical properties. Advanced polymerization techniques are improving thermal stability, while novel additives are extending service life under automotive conditions.

Cross-industry collaborations between chemical companies, automotive manufacturers, and research institutions are accelerating innovation cycles. These partnerships focus on developing drop-in bio-polymer solutions that require minimal modifications to existing manufacturing processes, thereby lowering adoption barriers.

Despite promising developments, the bio-polymer industry faces substantial technical barriers. The mechanical properties of many bio-based polymers still fall short of conventional plastics, particularly in terms of tensile strength, impact resistance, and thermal stability required for automotive applications. These limitations restrict their use to non-structural components like interior trims and packaging materials.

Cost competitiveness remains a significant obstacle. Bio-polymers typically command a 20-50% price premium over traditional petroleum-based alternatives, making widespread adoption economically challenging for automotive manufacturers operating on tight margins. The production infrastructure for bio-polymers also lacks the economies of scale enjoyed by conventional plastic manufacturing.

Processing challenges present another barrier. Bio-polymers often require modified processing parameters and equipment adjustments, increasing implementation costs. Their sensitivity to moisture during processing can lead to hydrolytic degradation, affecting both manufacturing efficiency and final product quality.

Durability concerns persist in automotive applications where components must withstand extreme temperatures, UV exposure, and chemical contact over a vehicle's lifespan. Many bio-polymers exhibit accelerated degradation under these conditions, raising questions about long-term performance reliability.

The regulatory landscape adds complexity, with inconsistent global standards for biodegradability claims and sustainability metrics. This creates market confusion and hampers industry-wide adoption of standardized materials and processes.

Supply chain stability represents another challenge, as agricultural feedstock availability fluctuates with seasonal variations, weather conditions, and competing food-production demands. This volatility complicates production planning and inventory management for automotive manufacturers.

Recent technological breakthroughs are addressing these barriers through composite formulations that blend bio-polymers with reinforcing agents to enhance mechanical properties. Advanced polymerization techniques are improving thermal stability, while novel additives are extending service life under automotive conditions.

Cross-industry collaborations between chemical companies, automotive manufacturers, and research institutions are accelerating innovation cycles. These partnerships focus on developing drop-in bio-polymer solutions that require minimal modifications to existing manufacturing processes, thereby lowering adoption barriers.

Current Bio-Polymer Automotive Applications

01 Bio-based polymers from renewable resources

Bio-based polymers derived from renewable resources such as plant oils, cellulose, and agricultural waste offer sustainable alternatives to petroleum-based polymers. These polymers can be synthesized through various polymerization techniques and modified to enhance their properties. The use of renewable resources reduces dependency on fossil fuels and decreases the carbon footprint of polymer production.- Plant-derived bio-based polymers: Polymers derived from plant sources such as cellulose, starch, and lignin offer sustainable alternatives to petroleum-based plastics. These materials can be processed into various forms including films, fibers, and molded products with comparable mechanical properties. Plant-derived polymers typically have lower carbon footprints and can be biodegradable under specific conditions, making them environmentally advantageous for packaging and consumer goods applications.

- Microbial fermentation for bio-polymer production: Microbial fermentation processes utilize bacteria, fungi, or algae to convert feedstocks into polymeric materials. These biotechnological approaches can produce polyhydroxyalkanoates (PHAs), polylactic acid (PLA), and other biopolymers with controlled molecular weights and structures. The fermentation conditions, including temperature, pH, and nutrient availability, can be optimized to enhance polymer yield and properties, offering scalable production methods for bio-based materials.

- Composite materials incorporating bio-based polymers: Bio-based polymers can be combined with natural fibers, minerals, or other reinforcing materials to create composite materials with enhanced mechanical properties. These composites often exhibit improved strength, stiffness, and durability compared to the neat biopolymers. The interface between the bio-based polymer matrix and reinforcing elements can be modified through compatibilizers or surface treatments to optimize performance for applications in automotive parts, construction materials, and consumer goods.

- Chemical modification of bio-based polymers: Chemical modifications of bio-based polymers can enhance their properties and expand their application range. Techniques such as esterification, etherification, grafting, and crosslinking can improve water resistance, thermal stability, and mechanical properties. These modifications allow bio-based polymers to meet performance requirements for specific applications while maintaining their environmental advantages over conventional petroleum-based materials.

- Processing technologies for bio-based polymers: Specialized processing technologies have been developed to address the unique characteristics of bio-based polymers. These include modified extrusion techniques, injection molding parameters, and film-blowing processes that accommodate the thermal sensitivity and rheological properties of bio-based materials. Advanced processing methods can prevent degradation during manufacturing while optimizing the final product properties, enabling the production of bio-based polymer products with consistent quality and performance.

02 Biodegradable polymer compositions

Biodegradable polymer compositions are formulated to break down naturally in the environment through microbial action. These compositions often combine bio-based polymers with additives that enhance their degradation properties while maintaining necessary performance characteristics. The development of biodegradable polymers addresses end-of-life concerns and reduces environmental pollution from plastic waste.Expand Specific Solutions03 Bio-based polymer processing techniques

Specialized processing techniques for bio-based polymers include reactive extrusion, solution casting, and melt processing methods adapted to the unique characteristics of these materials. These techniques address challenges such as thermal sensitivity and variable molecular structure of bio-based polymers. Innovations in processing enable the production of bio-based polymer products with consistent quality and performance.Expand Specific Solutions04 Bio-based polymer blends and composites

Bio-based polymer blends and composites combine different bio-polymers or incorporate natural fibers and fillers to achieve enhanced mechanical properties, thermal stability, and functionality. These materials can be tailored for specific applications by adjusting composition ratios and processing conditions. The synergistic effects of components in blends and composites often result in materials with superior performance compared to single bio-polymers.Expand Specific Solutions05 Applications of bio-based polymers

Bio-based polymers find applications across various industries including packaging, agriculture, automotive, construction, and biomedical fields. These polymers can be formulated into films, coatings, adhesives, foams, and structural materials. The versatility of bio-based polymers allows them to replace conventional plastics in many applications while offering additional benefits such as biocompatibility, reduced environmental impact, and novel functionalities.Expand Specific Solutions

Key Industry Players & Competitive Analysis

The bio-based polymer innovation in the automotive sector is currently in a growth phase, with market size expanding due to increasing sustainability demands and regulatory pressures. The technology maturity varies across applications, with companies at different development stages. University of Florida and Beijing University of Chemical Technology lead academic research, while commercial players show varying degrees of advancement. Hyundai Motor and Kia are integrating these materials into vehicle designs, while specialized materials companies like Shanghai PRET Composites, Cathay Biotech, and Red Avenue New Materials are developing commercial-scale production capabilities. Archer-Daniels-Midland and UPM-Kymmene are leveraging their biomass expertise to enter this space. The sector is characterized by increasing collaboration between automotive OEMs and materials specialists to overcome technical and cost barriers.

Hyundai Motor Co., Ltd.

Technical Solution: Hyundai Motor has developed an innovative bio-based polymer strategy focusing on sustainable materials for vehicle interiors and components. Their approach includes bio-based polyurethanes derived from vegetable oils for seat cushions and interior trim, reducing petroleum dependency by up to 20%. The company has also pioneered bio-composite materials combining natural fibers (kenaf, hemp, flax) with bio-resins for door panels and dashboard components, achieving weight reductions of 10-15% compared to conventional materials while maintaining mechanical properties. Hyundai's Bio Materials Development Center has created proprietary bio-based polyamides from renewable sources like castor oil for engine components, offering heat resistance up to 200°C. Their integrated sustainability approach includes lifecycle assessment methodologies to quantify environmental benefits, showing 30-40% carbon footprint reduction for bio-based components compared to petroleum-based counterparts.

Strengths: Comprehensive integration of bio-materials across multiple vehicle components; established bio-materials R&D infrastructure; proven weight reduction capabilities while maintaining performance standards. Weaknesses: Higher initial production costs compared to conventional materials; potential supply chain challenges for consistent bio-feedstock quality; longer development cycles for new bio-based materials to meet automotive durability requirements.

Cathay Biotech, Inc.

Technical Solution: Cathay Biotech has developed a revolutionary platform for bio-based long-chain polyamides (PA) specifically engineered for automotive applications. Their proprietary fermentation technology converts renewable resources like corn and sugarcane into long-chain dicarboxylic acids and diamines, the building blocks for their flagship Terryl® polyamide products. These bio-based polyamides offer exceptional heat resistance (up to 230°C), chemical resistance, and dimensional stability - critical properties for under-hood components and structural parts. Their bio-based PA11 and PA12 variants demonstrate 50-70% reduced carbon footprint compared to petroleum-based counterparts while maintaining comparable or superior mechanical properties. Cathay's integrated biorefinery approach ensures vertical integration from feedstock to final polymer, with production capacity exceeding 100,000 tons annually. The company has established partnerships with major automotive OEMs to develop custom formulations for specific applications, including fuel lines, air intake manifolds, and electrical connectors, where their materials have demonstrated 15-20% weight reduction potential compared to traditional engineering plastics.

Strengths: Vertically integrated production from bio-feedstock to final polymer; established commercial-scale production capacity; materials with proven high-temperature performance suitable for demanding automotive applications. Weaknesses: Higher production costs compared to conventional polyamides; limited global manufacturing footprint may create supply chain vulnerabilities; relatively newer entrant to automotive qualification processes compared to established chemical companies.

Critical Patents & Research in Automotive Bio-Polymers

Method of recovering and regenerating a metal catalyst in adipic acid production process

PatentPendingUS20240075468A1

Innovation

- A method for recovering and regenerating a metal catalyst during adipic acid production using a glucaric acid potassium salt, acid catalyst, and metal catalyst through hydrogenation and deoxydehydration reactions, followed by filtering, heating, drying, and calcination, to produce adipic acid from glucose, reducing environmental impact and processing costs.

Biobased rubber modifiers for polymer blends

PatentActiveUS20170166740A1

Innovation

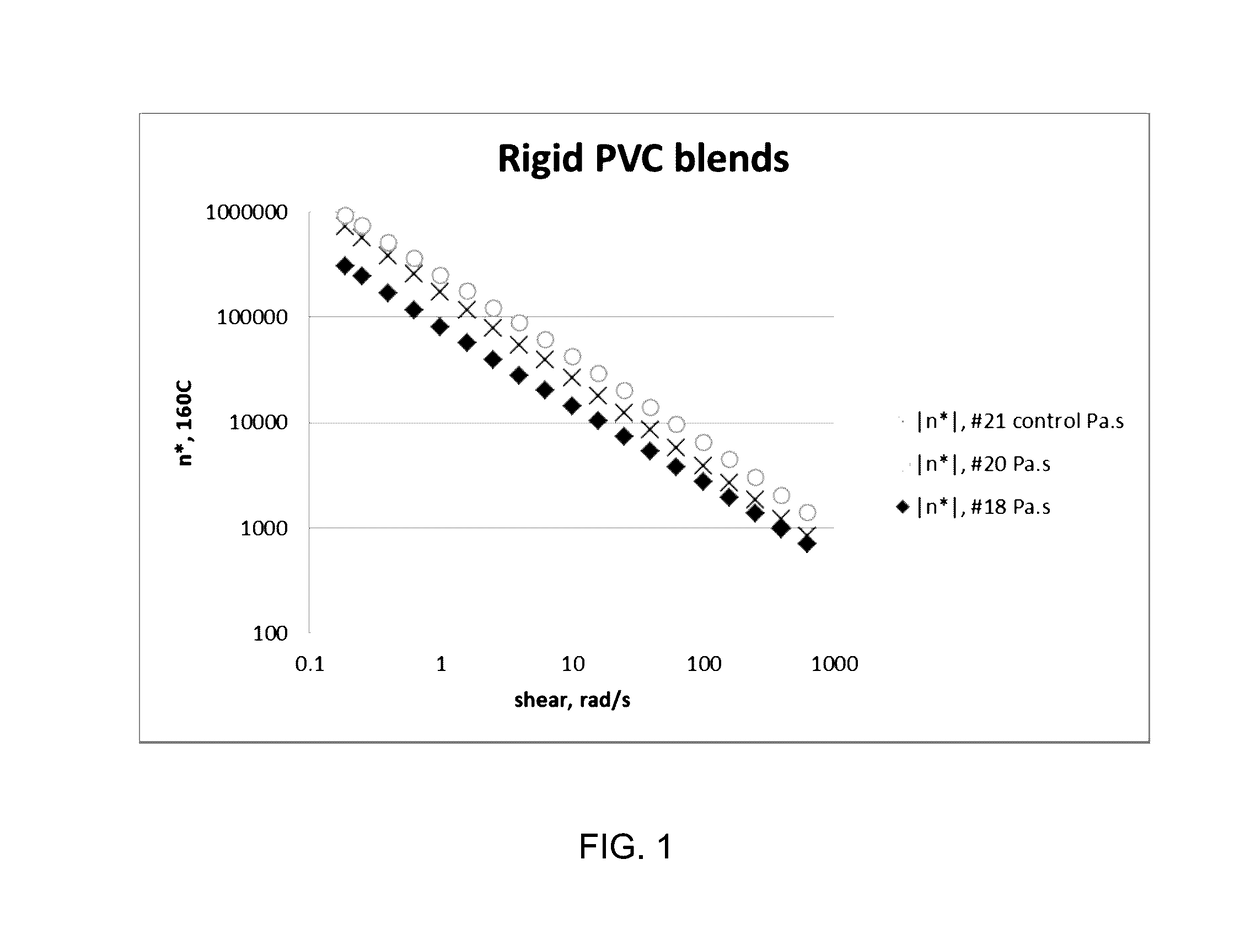

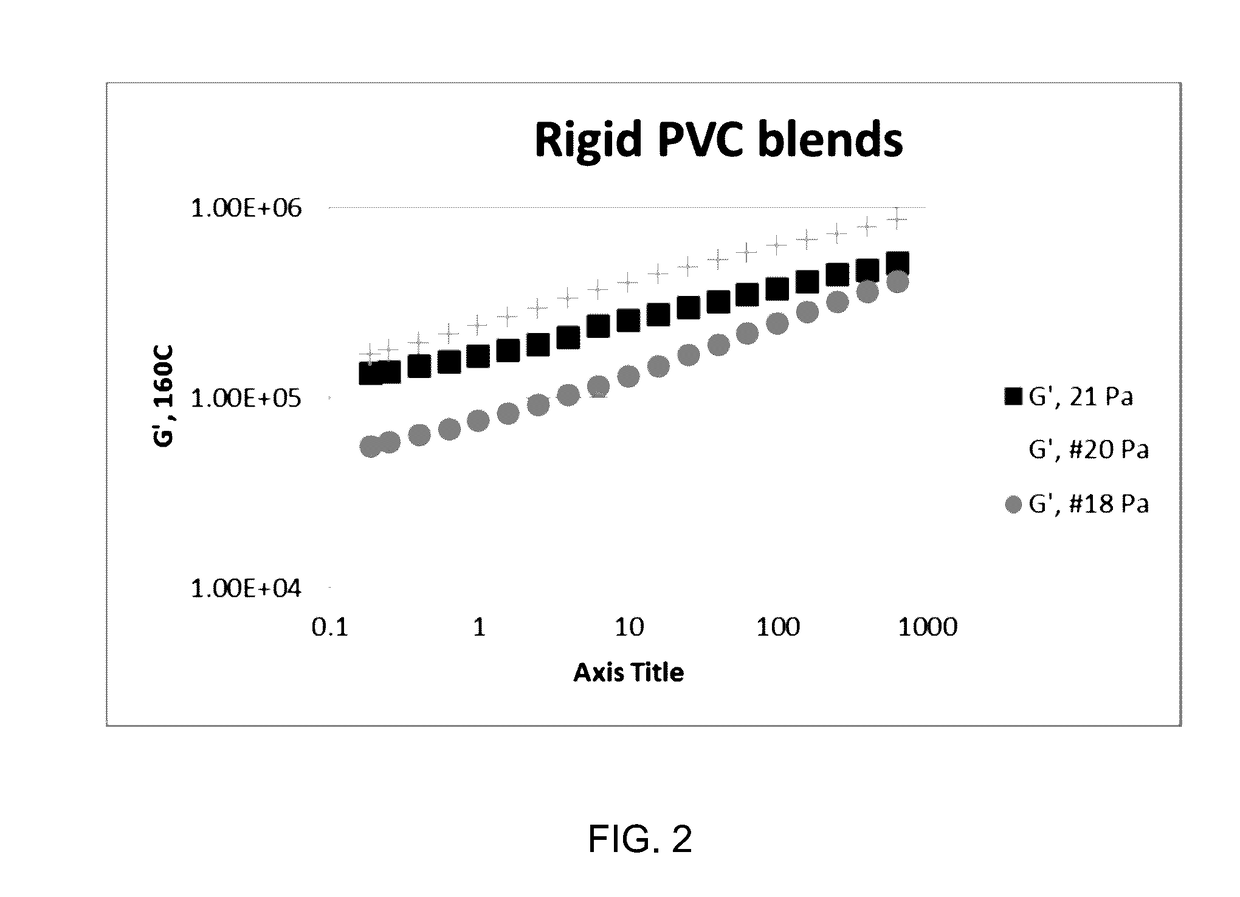

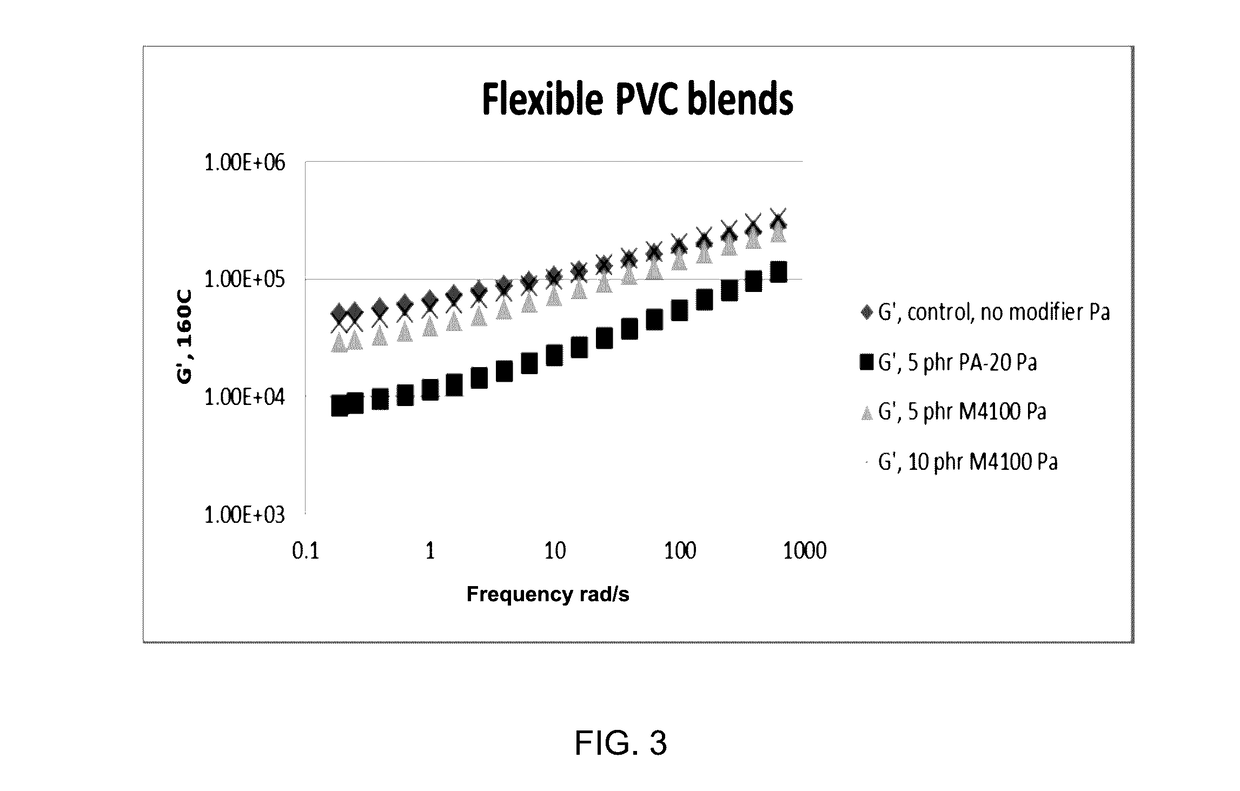

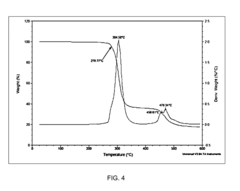

- The development of polymer blend compositions combining polyvinyl chloride (PVC) or polymethylmethacrylate (PMMA) with biobased non-extractable, non-volatile plasticizing polyhydroxyalkanoate (PHA) copolymers, specifically 3-polyhydroxybutyrate copolymers, which improve mechanical and thermal properties by enhancing glass transition temperature, crystallinity, and miscibility, and are branched or crosslinked to improve impact resistance.

Environmental Regulations & Compliance Factors

Environmental regulations have emerged as a primary catalyst for bio-based polymer innovation in the automotive sector. The European Union's End-of-Life Vehicle (ELV) Directive mandates that 95% of vehicle components must be recyclable or recoverable, pushing manufacturers to adopt more sustainable materials. This directive, coupled with the EU's broader circular economy strategy, has created a regulatory framework that actively promotes bio-based alternatives to conventional petroleum-derived polymers.

In North America, the Corporate Average Fuel Economy (CAFE) standards indirectly drive bio-based polymer adoption by requiring improved fuel efficiency, which can be achieved through vehicle weight reduction. Bio-based polymers typically offer weight advantages over traditional materials, making them increasingly attractive to automotive manufacturers seeking compliance with these standards.

The global push toward carbon neutrality has further accelerated regulatory pressure. Several major automotive markets, including China, Japan, and the European Union, have announced plans to phase out internal combustion engines between 2030 and 2040. These transitions necessitate holistic approaches to vehicle sustainability, extending beyond powertrains to include materials selection and manufacturing processes.

Compliance with volatile organic compound (VOC) emission regulations represents another significant driver. Bio-based polymers generally emit fewer VOCs during manufacturing and vehicle use compared to petroleum-based alternatives. The California Air Resources Board (CARB) regulations, which are often adopted by other states and influence global standards, have particularly stringent VOC limitations that favor bio-based materials.

Tax incentives and subsidies for sustainable manufacturing practices provide additional regulatory motivation. Countries including Germany, Japan, and South Korea offer substantial financial benefits to manufacturers implementing bio-based materials in their production processes. These incentives help offset the typically higher initial costs of bio-based polymer implementation.

Extended Producer Responsibility (EPR) schemes, increasingly common worldwide, place the financial burden of end-of-life product management on manufacturers. This accountability creates strong incentives for designing vehicles with materials that are easier to recycle or biodegrade, further driving interest in bio-based polymers that can reduce end-of-life environmental impacts and associated compliance costs.

In North America, the Corporate Average Fuel Economy (CAFE) standards indirectly drive bio-based polymer adoption by requiring improved fuel efficiency, which can be achieved through vehicle weight reduction. Bio-based polymers typically offer weight advantages over traditional materials, making them increasingly attractive to automotive manufacturers seeking compliance with these standards.

The global push toward carbon neutrality has further accelerated regulatory pressure. Several major automotive markets, including China, Japan, and the European Union, have announced plans to phase out internal combustion engines between 2030 and 2040. These transitions necessitate holistic approaches to vehicle sustainability, extending beyond powertrains to include materials selection and manufacturing processes.

Compliance with volatile organic compound (VOC) emission regulations represents another significant driver. Bio-based polymers generally emit fewer VOCs during manufacturing and vehicle use compared to petroleum-based alternatives. The California Air Resources Board (CARB) regulations, which are often adopted by other states and influence global standards, have particularly stringent VOC limitations that favor bio-based materials.

Tax incentives and subsidies for sustainable manufacturing practices provide additional regulatory motivation. Countries including Germany, Japan, and South Korea offer substantial financial benefits to manufacturers implementing bio-based materials in their production processes. These incentives help offset the typically higher initial costs of bio-based polymer implementation.

Extended Producer Responsibility (EPR) schemes, increasingly common worldwide, place the financial burden of end-of-life product management on manufacturers. This accountability creates strong incentives for designing vehicles with materials that are easier to recycle or biodegrade, further driving interest in bio-based polymers that can reduce end-of-life environmental impacts and associated compliance costs.

Supply Chain Sustainability & Scalability

The sustainability and scalability of bio-based polymer supply chains represent critical factors in determining the widespread adoption of these materials in the automotive industry. Currently, the supply chain for bio-based polymers faces significant challenges related to feedstock availability, processing infrastructure, and economic viability at scale.

Feedstock sourcing presents a primary concern, as bio-based polymers require consistent, high-quality agricultural or waste-derived inputs. The automotive sector's substantial material demands necessitate reliable access to these feedstocks, which can be subject to seasonal variations, regional availability constraints, and competition with food production. Companies like Ford and Toyota have begun establishing strategic partnerships with agricultural producers to secure long-term feedstock supplies, reducing vulnerability to market fluctuations.

Processing infrastructure represents another critical bottleneck in scaling bio-based polymer production. Traditional polymer manufacturing facilities require significant modifications to accommodate bio-based feedstocks, involving substantial capital investments. The distributed nature of biomass resources often conflicts with the centralized model of conventional polymer production, necessitating new approaches to supply chain design and logistics management.

Cost competitiveness remains a persistent challenge, with bio-based alternatives typically commanding 20-30% price premiums over petroleum-based counterparts. However, economies of scale are gradually improving this situation. Companies achieving production volumes exceeding 50,000 tons annually have reported cost reductions of 15-25%, approaching price parity with conventional materials in select applications.

Life cycle sustainability represents both a driver and challenge for bio-based polymer supply chains. While these materials offer reduced carbon footprints during production and end-of-life phases, the environmental impacts of agricultural practices, processing, and transportation must be carefully managed. Leading automotive manufacturers have implemented comprehensive life cycle assessment protocols to ensure genuine sustainability benefits across the entire supply chain.

Regulatory frameworks increasingly influence supply chain development, with policies like the European Union's Circular Economy Action Plan and various carbon pricing mechanisms creating incentives for sustainable material sourcing. These policies are accelerating investments in bio-based supply chain infrastructure while establishing sustainability standards that shape industry practices.

The transition toward circular economy principles is reshaping supply chain models, with increasing emphasis on material recovery and recycling. Innovative approaches combining bio-based inputs with recycled content are emerging as promising pathways to enhance both sustainability and scalability, creating hybrid supply chains that leverage the advantages of multiple material streams.

Feedstock sourcing presents a primary concern, as bio-based polymers require consistent, high-quality agricultural or waste-derived inputs. The automotive sector's substantial material demands necessitate reliable access to these feedstocks, which can be subject to seasonal variations, regional availability constraints, and competition with food production. Companies like Ford and Toyota have begun establishing strategic partnerships with agricultural producers to secure long-term feedstock supplies, reducing vulnerability to market fluctuations.

Processing infrastructure represents another critical bottleneck in scaling bio-based polymer production. Traditional polymer manufacturing facilities require significant modifications to accommodate bio-based feedstocks, involving substantial capital investments. The distributed nature of biomass resources often conflicts with the centralized model of conventional polymer production, necessitating new approaches to supply chain design and logistics management.

Cost competitiveness remains a persistent challenge, with bio-based alternatives typically commanding 20-30% price premiums over petroleum-based counterparts. However, economies of scale are gradually improving this situation. Companies achieving production volumes exceeding 50,000 tons annually have reported cost reductions of 15-25%, approaching price parity with conventional materials in select applications.

Life cycle sustainability represents both a driver and challenge for bio-based polymer supply chains. While these materials offer reduced carbon footprints during production and end-of-life phases, the environmental impacts of agricultural practices, processing, and transportation must be carefully managed. Leading automotive manufacturers have implemented comprehensive life cycle assessment protocols to ensure genuine sustainability benefits across the entire supply chain.

Regulatory frameworks increasingly influence supply chain development, with policies like the European Union's Circular Economy Action Plan and various carbon pricing mechanisms creating incentives for sustainable material sourcing. These policies are accelerating investments in bio-based supply chain infrastructure while establishing sustainability standards that shape industry practices.

The transition toward circular economy principles is reshaping supply chain models, with increasing emphasis on material recovery and recycling. Innovative approaches combining bio-based inputs with recycled content are emerging as promising pathways to enhance both sustainability and scalability, creating hybrid supply chains that leverage the advantages of multiple material streams.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!