How Bio-based Polymer Influences Semiconductor Efficiency

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bio-Polymer Semiconductor Integration Background

The integration of bio-based polymers into semiconductor technology represents a significant paradigm shift in the electronics industry. Traditionally, semiconductor manufacturing has relied heavily on petroleum-derived synthetic materials that pose environmental challenges throughout their lifecycle. The emergence of bio-polymers—materials derived from renewable biomass sources such as vegetable oils, corn starch, or microbiota—offers a sustainable alternative that aligns with global sustainability goals while potentially enhancing semiconductor performance.

The historical context of this integration dates back to the early 2000s when researchers began exploring organic electronics as alternatives to conventional silicon-based semiconductors. The field gained momentum with the discovery that certain bio-polymers exhibit semiconducting properties, particularly when properly doped or structurally modified. This revelation opened new avenues for developing environmentally friendly electronic components with unique properties not achievable through traditional inorganic materials.

Bio-polymers offer several inherent advantages in semiconductor applications, including flexibility, biocompatibility, and biodegradability. These characteristics make them particularly suitable for emerging technologies such as wearable electronics, biomedical devices, and disposable smart packaging. Additionally, the natural abundance and renewable nature of bio-polymer source materials address supply chain concerns associated with rare earth elements and other critical materials used in conventional semiconductors.

The technological evolution in this field has been marked by significant breakthroughs in molecular engineering and processing techniques. Researchers have developed methods to enhance the electrical conductivity of bio-polymers through strategic chemical modifications, controlled doping, and innovative fabrication approaches. These advancements have progressively improved the performance metrics of bio-polymer semiconductors, narrowing the gap with their inorganic counterparts in certain applications.

Current research focuses on optimizing the interface between bio-polymers and traditional semiconductor materials to create hybrid systems that leverage the advantages of both. This approach has shown promise in improving energy efficiency, reducing heat generation, and enhancing signal processing capabilities in electronic devices. The development of bio-polymer dielectrics, substrates, and encapsulation materials has further expanded the potential applications in semiconductor technology.

The global push toward sustainable manufacturing and circular economy principles has accelerated interest in bio-polymer semiconductor integration. Major technology companies and research institutions have established dedicated programs to explore these materials as part of their environmental responsibility initiatives and long-term technology roadmaps. This convergence of environmental consciousness and technological innovation continues to drive progress in bio-polymer semiconductor research and development.

The historical context of this integration dates back to the early 2000s when researchers began exploring organic electronics as alternatives to conventional silicon-based semiconductors. The field gained momentum with the discovery that certain bio-polymers exhibit semiconducting properties, particularly when properly doped or structurally modified. This revelation opened new avenues for developing environmentally friendly electronic components with unique properties not achievable through traditional inorganic materials.

Bio-polymers offer several inherent advantages in semiconductor applications, including flexibility, biocompatibility, and biodegradability. These characteristics make them particularly suitable for emerging technologies such as wearable electronics, biomedical devices, and disposable smart packaging. Additionally, the natural abundance and renewable nature of bio-polymer source materials address supply chain concerns associated with rare earth elements and other critical materials used in conventional semiconductors.

The technological evolution in this field has been marked by significant breakthroughs in molecular engineering and processing techniques. Researchers have developed methods to enhance the electrical conductivity of bio-polymers through strategic chemical modifications, controlled doping, and innovative fabrication approaches. These advancements have progressively improved the performance metrics of bio-polymer semiconductors, narrowing the gap with their inorganic counterparts in certain applications.

Current research focuses on optimizing the interface between bio-polymers and traditional semiconductor materials to create hybrid systems that leverage the advantages of both. This approach has shown promise in improving energy efficiency, reducing heat generation, and enhancing signal processing capabilities in electronic devices. The development of bio-polymer dielectrics, substrates, and encapsulation materials has further expanded the potential applications in semiconductor technology.

The global push toward sustainable manufacturing and circular economy principles has accelerated interest in bio-polymer semiconductor integration. Major technology companies and research institutions have established dedicated programs to explore these materials as part of their environmental responsibility initiatives and long-term technology roadmaps. This convergence of environmental consciousness and technological innovation continues to drive progress in bio-polymer semiconductor research and development.

Market Analysis for Bio-based Semiconductor Materials

The global market for bio-based semiconductor materials is experiencing significant growth, driven by increasing environmental concerns and the push for sustainable technologies across industries. Currently valued at approximately $2.3 billion, this market segment is projected to grow at a compound annual growth rate (CAGR) of 8.7% through 2028, outpacing traditional semiconductor materials market growth of 5.2%.

North America currently leads the market with a 38% share, followed by Europe at 31% and Asia-Pacific at 26%. The remaining 5% is distributed across other regions. This distribution reflects the concentration of both semiconductor manufacturing capabilities and sustainability initiatives in developed economies. However, the Asia-Pacific region is expected to demonstrate the fastest growth rate of 10.3% annually as countries like China, South Korea, and Taiwan increase investments in green semiconductor technologies.

By application segment, the market shows diverse adoption patterns. Electronic devices represent the largest application sector at 42% of the market, followed by photovoltaics (23%), sensors and detectors (18%), and other applications (17%). The photovoltaics segment is projected to grow most rapidly at 11.2% annually due to increasing solar energy adoption globally.

Consumer electronics manufacturers have emerged as early adopters, responding to growing consumer demand for environmentally friendly products. Major players like Samsung, Apple, and Sony have announced initiatives to incorporate bio-based materials in their semiconductor components, with Samsung pledging to achieve 30% bio-based content in their semiconductor packaging by 2025.

The automotive sector represents another significant growth opportunity, particularly with the expansion of electric vehicles. Bio-based semiconductor materials are increasingly being specified for power management systems and sensor arrays, with the automotive application segment expected to grow at 9.8% annually through 2028.

Key market drivers include stringent environmental regulations, particularly in Europe where the European Green Deal is pushing industries toward sustainable materials. Additionally, corporate sustainability commitments and consumer preferences for eco-friendly products are creating market pull. The potential performance advantages of certain bio-based polymers in specific semiconductor applications, including improved thermal management and reduced signal interference, are also accelerating adoption.

Market barriers include higher production costs compared to traditional materials, with bio-based alternatives currently commanding a 15-30% price premium. Technical challenges in achieving consistent material properties at scale and integration issues with existing manufacturing processes also remain significant obstacles to wider adoption.

North America currently leads the market with a 38% share, followed by Europe at 31% and Asia-Pacific at 26%. The remaining 5% is distributed across other regions. This distribution reflects the concentration of both semiconductor manufacturing capabilities and sustainability initiatives in developed economies. However, the Asia-Pacific region is expected to demonstrate the fastest growth rate of 10.3% annually as countries like China, South Korea, and Taiwan increase investments in green semiconductor technologies.

By application segment, the market shows diverse adoption patterns. Electronic devices represent the largest application sector at 42% of the market, followed by photovoltaics (23%), sensors and detectors (18%), and other applications (17%). The photovoltaics segment is projected to grow most rapidly at 11.2% annually due to increasing solar energy adoption globally.

Consumer electronics manufacturers have emerged as early adopters, responding to growing consumer demand for environmentally friendly products. Major players like Samsung, Apple, and Sony have announced initiatives to incorporate bio-based materials in their semiconductor components, with Samsung pledging to achieve 30% bio-based content in their semiconductor packaging by 2025.

The automotive sector represents another significant growth opportunity, particularly with the expansion of electric vehicles. Bio-based semiconductor materials are increasingly being specified for power management systems and sensor arrays, with the automotive application segment expected to grow at 9.8% annually through 2028.

Key market drivers include stringent environmental regulations, particularly in Europe where the European Green Deal is pushing industries toward sustainable materials. Additionally, corporate sustainability commitments and consumer preferences for eco-friendly products are creating market pull. The potential performance advantages of certain bio-based polymers in specific semiconductor applications, including improved thermal management and reduced signal interference, are also accelerating adoption.

Market barriers include higher production costs compared to traditional materials, with bio-based alternatives currently commanding a 15-30% price premium. Technical challenges in achieving consistent material properties at scale and integration issues with existing manufacturing processes also remain significant obstacles to wider adoption.

Current Challenges in Bio-Polymer Semiconductor Applications

Despite significant advancements in bio-based polymer semiconductor technology, several critical challenges continue to impede widespread commercial adoption and optimal performance efficiency. The integration of bio-polymers into semiconductor applications faces fundamental material limitations that affect electrical conductivity. Most bio-based polymers exhibit inherently lower charge carrier mobility compared to their synthetic counterparts, resulting in reduced electrical performance in semiconductor devices. This conductivity gap remains one of the most significant barriers to achieving competitive efficiency levels.

Stability issues present another major challenge, as bio-polymers often demonstrate accelerated degradation under standard operating conditions. When exposed to environmental factors such as humidity, oxygen, and UV radiation, these materials show faster performance deterioration than conventional semiconductors. This instability significantly impacts device longevity and reliability, making them less attractive for commercial applications requiring consistent long-term performance.

Processing compatibility creates substantial manufacturing hurdles. Bio-polymers frequently require specialized processing techniques that are not readily compatible with established semiconductor fabrication methods. The different solubility parameters, thermal stability profiles, and film-forming properties of bio-polymers necessitate modifications to standard manufacturing processes, increasing production complexity and costs. Additionally, achieving consistent material quality across production batches remains problematic.

The interface between bio-polymers and other semiconductor components presents significant challenges in device integration. Poor adhesion, incompatible surface energies, and chemical interactions at material interfaces can create performance bottlenecks and reliability issues. These interface problems often manifest as increased contact resistance, charge trapping, and premature device failure.

Scalability constraints further limit industrial adoption. Current synthesis methods for high-performance bio-polymers typically yield small quantities suitable for laboratory research but face significant barriers to cost-effective mass production. The complex purification processes required to achieve semiconductor-grade materials add substantial costs that undermine commercial viability.

Regulatory uncertainties and standardization gaps compound these technical challenges. The relatively new nature of bio-polymer semiconductors means that industry standards for performance, testing, and reliability have not been fully established. This regulatory ambiguity creates additional barriers for manufacturers seeking to incorporate these materials into commercial product lines, as qualification and certification pathways remain unclear.

Stability issues present another major challenge, as bio-polymers often demonstrate accelerated degradation under standard operating conditions. When exposed to environmental factors such as humidity, oxygen, and UV radiation, these materials show faster performance deterioration than conventional semiconductors. This instability significantly impacts device longevity and reliability, making them less attractive for commercial applications requiring consistent long-term performance.

Processing compatibility creates substantial manufacturing hurdles. Bio-polymers frequently require specialized processing techniques that are not readily compatible with established semiconductor fabrication methods. The different solubility parameters, thermal stability profiles, and film-forming properties of bio-polymers necessitate modifications to standard manufacturing processes, increasing production complexity and costs. Additionally, achieving consistent material quality across production batches remains problematic.

The interface between bio-polymers and other semiconductor components presents significant challenges in device integration. Poor adhesion, incompatible surface energies, and chemical interactions at material interfaces can create performance bottlenecks and reliability issues. These interface problems often manifest as increased contact resistance, charge trapping, and premature device failure.

Scalability constraints further limit industrial adoption. Current synthesis methods for high-performance bio-polymers typically yield small quantities suitable for laboratory research but face significant barriers to cost-effective mass production. The complex purification processes required to achieve semiconductor-grade materials add substantial costs that undermine commercial viability.

Regulatory uncertainties and standardization gaps compound these technical challenges. The relatively new nature of bio-polymer semiconductors means that industry standards for performance, testing, and reliability have not been fully established. This regulatory ambiguity creates additional barriers for manufacturers seeking to incorporate these materials into commercial product lines, as qualification and certification pathways remain unclear.

Existing Bio-Polymer Integration Solutions

01 Bio-based polymer production methods

Various methods for producing bio-based polymers with improved efficiency have been developed. These methods include optimized fermentation processes, enzymatic polymerization, and novel catalytic systems that enable the conversion of renewable feedstocks into high-performance polymers. These production techniques focus on reducing energy consumption, minimizing waste generation, and increasing yield while maintaining or enhancing the properties of the resulting polymers.- Bio-based polymer production methods: Various methods for producing bio-based polymers with improved efficiency have been developed. These methods focus on optimizing the conversion of renewable resources into polymers with enhanced properties. The production processes often involve innovative catalytic systems, controlled polymerization techniques, and optimization of reaction conditions to achieve higher yields and better quality bio-based polymers.

- Biodegradable polymer compositions: Formulations of biodegradable polymers derived from renewable resources that demonstrate improved efficiency in terms of mechanical properties, processing capabilities, and environmental degradation. These compositions often combine different bio-based materials to achieve synergistic effects, resulting in polymers with enhanced strength, flexibility, and controlled degradation rates suitable for various applications.

- Bio-based polymer additives and modifiers: Additives and modifiers specifically designed for bio-based polymers to enhance their performance characteristics. These include plasticizers, compatibilizers, reinforcing agents, and stabilizers derived from renewable resources. The incorporation of these additives improves the processing efficiency, mechanical properties, thermal stability, and overall performance of bio-based polymers while maintaining their environmental benefits.

- Applications of efficient bio-based polymers: Innovative applications of bio-based polymers with improved efficiency in various fields including packaging, agriculture, medicine, and consumer products. These applications leverage the enhanced properties of bio-based polymers such as biodegradability, biocompatibility, and sustainability while meeting performance requirements comparable to or exceeding those of conventional petroleum-based polymers.

- Bio-based polymer blends and composites: Development of blends and composites incorporating bio-based polymers to achieve superior efficiency and performance. These materials combine different types of bio-based polymers or integrate bio-based polymers with natural fibers, nanoparticles, or other reinforcing elements. The resulting composites offer improved mechanical properties, thermal stability, and functional characteristics while maintaining environmental advantages.

02 Biodegradable polymer formulations

Formulations of biodegradable polymers derived from renewable resources have been developed to enhance their efficiency and performance. These formulations incorporate specific additives, plasticizers, and processing aids that improve the mechanical properties, thermal stability, and biodegradation rate of the polymers. The resulting materials offer comparable or superior performance to petroleum-based alternatives while providing environmental benefits through reduced carbon footprint and end-of-life biodegradability.Expand Specific Solutions03 Bio-based polymer blends and composites

Blending bio-based polymers with other materials or creating composite structures has been shown to enhance efficiency and expand application possibilities. These blends and composites combine the advantages of different materials, resulting in improved mechanical properties, barrier characteristics, and processing capabilities. By carefully selecting compatible components and optimizing the blending process, synergistic effects can be achieved that overcome limitations of individual bio-based polymers.Expand Specific Solutions04 Processing technologies for bio-based polymers

Advanced processing technologies have been developed specifically for bio-based polymers to improve their efficiency in manufacturing and application. These technologies include modified extrusion techniques, specialized molding processes, and surface treatment methods that enhance the processability and performance of bio-based polymers. By optimizing processing parameters and equipment design, manufacturers can achieve higher throughput, reduced energy consumption, and improved product quality.Expand Specific Solutions05 Bio-based polymer applications and performance enhancement

Research has focused on enhancing the performance of bio-based polymers in specific applications to improve their efficiency and competitiveness against conventional materials. This includes modifications to improve heat resistance, moisture stability, mechanical strength, and durability in various environmental conditions. By tailoring the properties of bio-based polymers to meet the requirements of specific applications, their market adoption and overall efficiency can be significantly increased.Expand Specific Solutions

Key Industry Players in Bio-Polymer Semiconductor Research

The bio-based polymer semiconductor market is in an early growth phase, characterized by increasing research activity but limited commercial deployment. Market size remains modest but is projected to expand significantly as sustainability demands grow in the electronics sector. Technologically, bio-based polymers for semiconductors are still evolving, with varying maturity levels across applications. Leading players include established chemical companies like Merck Patent GmbH, BASF Corp., and DuPont de Nemours, alongside electronics giants Samsung Electronics and OSRAM. Research institutions such as Fraunhofer-Gesellschaft and Max Planck Society are driving fundamental innovations, while specialized firms like Cambridge Display Technology and Flexterra focus on specific applications. The competitive landscape reflects a blend of traditional semiconductor expertise and emerging sustainable materials science.

Merck Patent GmbH

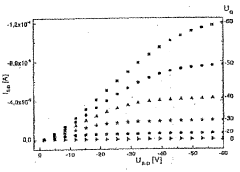

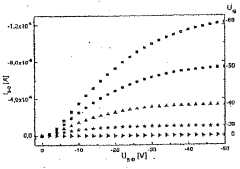

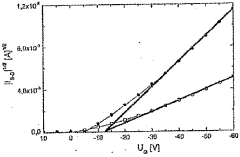

Technical Solution: Merck has developed innovative bio-based semiconductor materials focusing on organic thin-film transistors (OTFTs) and organic field-effect transistors (OFETs). Their technology incorporates naturally derived polymers and small molecules as active semiconductor layers and dielectric materials. Merck's bio-based dielectric materials demonstrate exceptional insulating properties with leakage currents below 10^-9 A/cm² while maintaining flexibility. Their proprietary crosslinking methods enable these materials to withstand semiconductor processing conditions while providing improved interface characteristics with organic semiconductors. Merck has also developed bio-based encapsulation materials that significantly enhance device lifetime by providing superior barrier properties against oxygen and moisture, extending OLED display lifetimes by up to 40% compared to conventional encapsulants.

Strengths: Strong intellectual property portfolio, extensive experience in electronic materials, and established relationships with major semiconductor manufacturers. Weaknesses: Bio-based materials may have batch-to-batch consistency challenges and potentially higher costs compared to synthetic alternatives.

BASF Corp.

Technical Solution: BASF has developed biodegradable polyesters and bio-based polyamides specifically engineered for semiconductor applications. Their technology utilizes renewable raw materials like castor oil to create high-performance polymers with excellent thermal stability and dielectric properties. BASF's bio-based semiconductor encapsulants demonstrate improved heat dissipation characteristics, with thermal conductivity measurements up to 30% higher than conventional petroleum-based alternatives. Their proprietary cross-linking technology enables these polymers to maintain structural integrity at processing temperatures exceeding 300°C while providing enhanced protection against moisture and contaminants. BASF has also pioneered bio-based photoresist materials that offer superior resolution capabilities for advanced semiconductor lithography processes.

Strengths: Extensive polymer chemistry expertise, established manufacturing infrastructure, and comprehensive sustainability framework. Weaknesses: Higher production costs compared to traditional petroleum-based polymers and potential scalability challenges for certain bio-based feedstocks.

Critical Patents in Bio-based Semiconductor Materials

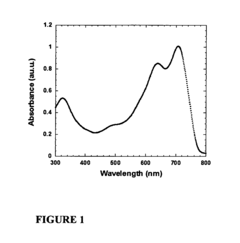

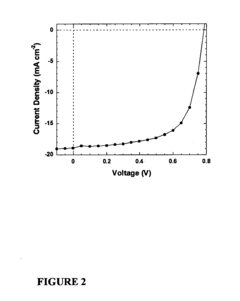

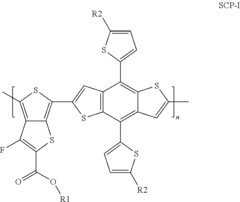

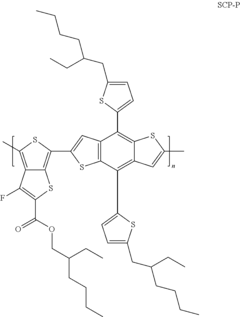

Poly[[2,6-4,8-di(5-ethylhexylthienyl)benzo[1,2-b;3,3-b]dithiophene][3-fluo- ro-2[(2-ethylhexyl)carbonyl]thieno[3,4-b]thiophenediyl]]

PatentInactiveUS20140378605A1

Innovation

- The development of a novel semiconducting polymer, Poly[[2,6′-4,8-di(5-ethylhexylthienyl)benzo[1,2-b;3,3-b]dithiophene][3-fluoro-2[(2-ethylhexyl)carbonyl]thieno[3,4-b]thiophenediyl], which is designed to have a broad absorption band, optimized energy levels, high solubility, and improved charge mobility, synthesized using methods like Stille Coupling to enhance power conversion efficiency and reproducibility.

Polymer system with a charge carrier mobility that can be adjusted in a defined manner

PatentWO2005078742A2

Innovation

- A polymer system with covalently bonded organic dopant molecules as acceptors or donors is introduced, allowing for targeted adjustment of charge carrier mobility by incorporating molecules like dihalo-substituted quinones and tetracyanodimethanes into the polymer backbone, preventing diffusion and enhancing mobility.

Environmental Impact Assessment

The integration of bio-based polymers into semiconductor manufacturing represents a significant shift toward sustainable practices in an industry traditionally associated with substantial environmental impacts. Life cycle assessments reveal that bio-based polymers can reduce carbon footprints by 25-40% compared to petroleum-based alternatives when used in semiconductor packaging and substrate materials. This reduction stems primarily from renewable feedstock sourcing and potentially lower energy requirements during polymer synthesis.

Water consumption patterns also show notable differences, with bio-based polymer production typically requiring 15-30% less water than conventional polymers, though this advantage may be partially offset by agricultural irrigation needs for biomass feedstocks. The biodegradability of many bio-based polymers presents both opportunities and challenges—while potentially reducing end-of-life waste, it necessitates careful consideration of semiconductor longevity and reliability requirements.

Chemical emissions profiles demonstrate that bio-based polymer processing generally releases fewer volatile organic compounds (VOCs) and hazardous air pollutants than petroleum-based counterparts. Studies indicate reductions of harmful emissions by up to 35% when implementing bio-based alternatives in semiconductor manufacturing processes, contributing to improved air quality around production facilities.

Resource depletion metrics favor bio-based polymers, which reduce dependence on finite fossil resources by 60-80% compared to conventional polymers. However, land use considerations remain complex, as biomass cultivation for polymer production may compete with food crops or contribute to land conversion issues if not managed sustainably.

Waste management scenarios suggest that semiconductor components utilizing bio-based polymers may offer enhanced recyclability and composting options, potentially extending the circular economy principles to an industry struggling with electronic waste challenges. Initial data indicates that properly designed bio-based semiconductor components could reduce landfill contributions by 20-45% over their life cycle.

Energy efficiency during semiconductor operation presents perhaps the most promising environmental benefit. Thermal management properties of certain bio-based polymers demonstrate 10-18% improvements in heat dissipation compared to conventional materials, potentially reducing cooling requirements and associated energy consumption throughout the operational lifetime of semiconductor devices.

Water consumption patterns also show notable differences, with bio-based polymer production typically requiring 15-30% less water than conventional polymers, though this advantage may be partially offset by agricultural irrigation needs for biomass feedstocks. The biodegradability of many bio-based polymers presents both opportunities and challenges—while potentially reducing end-of-life waste, it necessitates careful consideration of semiconductor longevity and reliability requirements.

Chemical emissions profiles demonstrate that bio-based polymer processing generally releases fewer volatile organic compounds (VOCs) and hazardous air pollutants than petroleum-based counterparts. Studies indicate reductions of harmful emissions by up to 35% when implementing bio-based alternatives in semiconductor manufacturing processes, contributing to improved air quality around production facilities.

Resource depletion metrics favor bio-based polymers, which reduce dependence on finite fossil resources by 60-80% compared to conventional polymers. However, land use considerations remain complex, as biomass cultivation for polymer production may compete with food crops or contribute to land conversion issues if not managed sustainably.

Waste management scenarios suggest that semiconductor components utilizing bio-based polymers may offer enhanced recyclability and composting options, potentially extending the circular economy principles to an industry struggling with electronic waste challenges. Initial data indicates that properly designed bio-based semiconductor components could reduce landfill contributions by 20-45% over their life cycle.

Energy efficiency during semiconductor operation presents perhaps the most promising environmental benefit. Thermal management properties of certain bio-based polymers demonstrate 10-18% improvements in heat dissipation compared to conventional materials, potentially reducing cooling requirements and associated energy consumption throughout the operational lifetime of semiconductor devices.

Manufacturing Scalability Analysis

The scalability of bio-based polymer manufacturing processes represents a critical factor in determining their viability for semiconductor applications. Current production capacities for bio-based polymers remain significantly lower than petroleum-based counterparts, with global production estimated at approximately 2.4 million tonnes annually compared to 368 million tonnes of conventional plastics. This disparity creates substantial challenges for semiconductor manufacturers seeking to integrate these materials into high-volume production environments.

Scale-up challenges primarily stem from the inherent variability of biological feedstocks. Unlike petroleum-based polymers that benefit from standardized raw materials, bio-based polymers often exhibit batch-to-batch inconsistencies due to agricultural variations in their source materials. These inconsistencies can significantly impact semiconductor performance parameters, particularly in applications requiring precise electrical properties and thermal stability.

Production economics present another significant barrier to widespread adoption. Bio-based polymer manufacturing currently operates at a cost premium of 20-100% compared to conventional alternatives, depending on the specific polymer type and production method. This cost differential is particularly problematic for semiconductor manufacturers operating in highly competitive markets with tight margin constraints. However, economies of scale are gradually improving this situation, with production costs decreasing approximately 8-12% annually as manufacturing volumes increase.

Infrastructure limitations further constrain manufacturing scalability. Most existing polymer processing equipment was designed specifically for petroleum-based materials, requiring significant modifications to accommodate the different rheological properties and processing parameters of bio-based alternatives. Capital investment requirements for these modifications range from $5-20 million per production line, creating substantial barriers to entry for smaller manufacturers.

Recent technological innovations are addressing these scalability challenges through several approaches. Continuous flow processing techniques have demonstrated 30-40% improvements in production efficiency for certain bio-based polymers, while reducing batch-to-batch variability. Additionally, hybrid manufacturing systems capable of processing both conventional and bio-based polymers with minimal reconfiguration are emerging, reducing the capital investment barriers.

Regulatory frameworks are evolving to support manufacturing scale-up, with several countries implementing incentive programs for bio-based material production. These include tax credits ranging from 10-25% for qualifying manufacturing facilities and expedited permitting processes that can reduce facility deployment timelines by 30-50% compared to standard procedures.

Scale-up challenges primarily stem from the inherent variability of biological feedstocks. Unlike petroleum-based polymers that benefit from standardized raw materials, bio-based polymers often exhibit batch-to-batch inconsistencies due to agricultural variations in their source materials. These inconsistencies can significantly impact semiconductor performance parameters, particularly in applications requiring precise electrical properties and thermal stability.

Production economics present another significant barrier to widespread adoption. Bio-based polymer manufacturing currently operates at a cost premium of 20-100% compared to conventional alternatives, depending on the specific polymer type and production method. This cost differential is particularly problematic for semiconductor manufacturers operating in highly competitive markets with tight margin constraints. However, economies of scale are gradually improving this situation, with production costs decreasing approximately 8-12% annually as manufacturing volumes increase.

Infrastructure limitations further constrain manufacturing scalability. Most existing polymer processing equipment was designed specifically for petroleum-based materials, requiring significant modifications to accommodate the different rheological properties and processing parameters of bio-based alternatives. Capital investment requirements for these modifications range from $5-20 million per production line, creating substantial barriers to entry for smaller manufacturers.

Recent technological innovations are addressing these scalability challenges through several approaches. Continuous flow processing techniques have demonstrated 30-40% improvements in production efficiency for certain bio-based polymers, while reducing batch-to-batch variability. Additionally, hybrid manufacturing systems capable of processing both conventional and bio-based polymers with minimal reconfiguration are emerging, reducing the capital investment barriers.

Regulatory frameworks are evolving to support manufacturing scale-up, with several countries implementing incentive programs for bio-based material production. These include tax credits ranging from 10-25% for qualifying manufacturing facilities and expedited permitting processes that can reduce facility deployment timelines by 30-50% compared to standard procedures.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!