Bio-based Polymer and Its Environmental Benefits Over Petro-polymers

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bio-polymer Evolution and Objectives

Bio-based polymers have emerged as a sustainable alternative to conventional petroleum-based polymers, evolving significantly over the past few decades. The journey began in the early 20th century with the development of cellulose-based materials, but gained momentum only in the 1970s when environmental concerns started influencing industrial practices. The 1990s marked a turning point with increased research into polylactic acid (PLA) and polyhydroxyalkanoates (PHAs), establishing the foundation for modern bio-polymer science.

The evolution accelerated in the 2000s with breakthroughs in fermentation technologies and genetic engineering, enabling more efficient production of bio-monomers. By 2010, companies like NatureWorks and Novamont had commercialized bio-based polymers at industrial scales, demonstrating their technical and economic viability. Recent advancements have focused on improving mechanical properties, thermal stability, and processing characteristics to match or exceed those of petroleum-based counterparts.

Current bio-polymer development follows three main technological trajectories: direct use of natural polymers (starch, cellulose), production of bio-based monomers for polymerization (bio-PET, bio-PE), and microbial synthesis (PHAs). Each pathway represents different approaches to achieving sustainability while maintaining performance requirements for various applications.

The primary objective of bio-polymer development is to create materials that reduce carbon footprint throughout their lifecycle. This includes minimizing greenhouse gas emissions during production, utilizing renewable feedstocks instead of fossil resources, and ensuring end-of-life biodegradability or recyclability. Research aims to achieve carbon neutrality while maintaining cost competitiveness with conventional plastics.

Technical objectives focus on overcoming existing limitations in mechanical properties, moisture sensitivity, and processing challenges. Researchers are working to develop bio-polymers with enhanced durability, heat resistance, and barrier properties to expand their application range beyond packaging into automotive, construction, and electronics sectors.

Market-oriented objectives include scaling production to reduce costs, standardizing material properties for consistent manufacturing, and developing drop-in solutions that require minimal changes to existing processing equipment. The industry targets a 25% market share of the global polymer market by 2030, representing a significant shift from the current 2-3%.

Long-term objectives extend to creating fully circular bio-polymer systems where agricultural waste serves as feedstock for polymers that eventually biodegrade into nutrients for new crops, completing a sustainable materials cycle that eliminates waste and pollution while regenerating natural systems.

The evolution accelerated in the 2000s with breakthroughs in fermentation technologies and genetic engineering, enabling more efficient production of bio-monomers. By 2010, companies like NatureWorks and Novamont had commercialized bio-based polymers at industrial scales, demonstrating their technical and economic viability. Recent advancements have focused on improving mechanical properties, thermal stability, and processing characteristics to match or exceed those of petroleum-based counterparts.

Current bio-polymer development follows three main technological trajectories: direct use of natural polymers (starch, cellulose), production of bio-based monomers for polymerization (bio-PET, bio-PE), and microbial synthesis (PHAs). Each pathway represents different approaches to achieving sustainability while maintaining performance requirements for various applications.

The primary objective of bio-polymer development is to create materials that reduce carbon footprint throughout their lifecycle. This includes minimizing greenhouse gas emissions during production, utilizing renewable feedstocks instead of fossil resources, and ensuring end-of-life biodegradability or recyclability. Research aims to achieve carbon neutrality while maintaining cost competitiveness with conventional plastics.

Technical objectives focus on overcoming existing limitations in mechanical properties, moisture sensitivity, and processing challenges. Researchers are working to develop bio-polymers with enhanced durability, heat resistance, and barrier properties to expand their application range beyond packaging into automotive, construction, and electronics sectors.

Market-oriented objectives include scaling production to reduce costs, standardizing material properties for consistent manufacturing, and developing drop-in solutions that require minimal changes to existing processing equipment. The industry targets a 25% market share of the global polymer market by 2030, representing a significant shift from the current 2-3%.

Long-term objectives extend to creating fully circular bio-polymer systems where agricultural waste serves as feedstock for polymers that eventually biodegrade into nutrients for new crops, completing a sustainable materials cycle that eliminates waste and pollution while regenerating natural systems.

Market Demand Analysis for Sustainable Polymers

The global market for sustainable polymers has witnessed remarkable growth in recent years, driven by increasing environmental concerns and regulatory pressures. The market size for bio-based polymers reached approximately 2.11 million tons in 2020, with projections indicating growth to 2.87 million tons by 2025, representing a compound annual growth rate (CAGR) of 6.3%. This growth trajectory significantly outpaces that of conventional petroleum-based plastics, which typically grow at 3-4% annually.

Consumer awareness and demand for environmentally friendly products have become major market drivers. According to recent surveys, 73% of global consumers express willingness to pay premium prices for sustainable products, including those made from bio-based polymers. This shift in consumer preference has prompted major brands across various industries to incorporate sustainability into their product development strategies.

Regulatory frameworks worldwide are increasingly favoring bio-based materials. The European Union's Single-Use Plastics Directive, China's ban on certain plastic products, and similar regulations in North America have created a favorable environment for sustainable polymer adoption. These regulatory changes are expected to accelerate market growth by 15-20% in key regions over the next five years.

The packaging industry represents the largest application segment for bio-based polymers, accounting for approximately 58% of total consumption. This is followed by consumer goods (16%), automotive (9%), textiles (8%), and other applications (9%). The food and beverage sector, in particular, has shown strong adoption rates due to consumer pressure and brand commitments to sustainability.

Regional analysis reveals that Europe leads the sustainable polymer market with a 34% share, followed by North America (28%), Asia-Pacific (25%), and other regions (13%). However, the fastest growth is projected in Asia-Pacific markets, particularly China and India, where industrial expansion coincides with strengthening environmental regulations.

Price sensitivity remains a significant market challenge, with bio-based polymers typically commanding a 20-40% premium over conventional alternatives. However, this price gap has been narrowing by approximately 2-3% annually as production scales increase and technologies mature. Industry analysts predict price parity for certain bio-based polymers with their petroleum counterparts by 2030.

Investment in sustainable polymer production capacity has seen substantial growth, with over $5.7 billion invested globally between 2018 and 2021. Major chemical companies and startups alike are expanding production capabilities, suggesting confidence in long-term market demand despite current economic uncertainties.

Consumer awareness and demand for environmentally friendly products have become major market drivers. According to recent surveys, 73% of global consumers express willingness to pay premium prices for sustainable products, including those made from bio-based polymers. This shift in consumer preference has prompted major brands across various industries to incorporate sustainability into their product development strategies.

Regulatory frameworks worldwide are increasingly favoring bio-based materials. The European Union's Single-Use Plastics Directive, China's ban on certain plastic products, and similar regulations in North America have created a favorable environment for sustainable polymer adoption. These regulatory changes are expected to accelerate market growth by 15-20% in key regions over the next five years.

The packaging industry represents the largest application segment for bio-based polymers, accounting for approximately 58% of total consumption. This is followed by consumer goods (16%), automotive (9%), textiles (8%), and other applications (9%). The food and beverage sector, in particular, has shown strong adoption rates due to consumer pressure and brand commitments to sustainability.

Regional analysis reveals that Europe leads the sustainable polymer market with a 34% share, followed by North America (28%), Asia-Pacific (25%), and other regions (13%). However, the fastest growth is projected in Asia-Pacific markets, particularly China and India, where industrial expansion coincides with strengthening environmental regulations.

Price sensitivity remains a significant market challenge, with bio-based polymers typically commanding a 20-40% premium over conventional alternatives. However, this price gap has been narrowing by approximately 2-3% annually as production scales increase and technologies mature. Industry analysts predict price parity for certain bio-based polymers with their petroleum counterparts by 2030.

Investment in sustainable polymer production capacity has seen substantial growth, with over $5.7 billion invested globally between 2018 and 2021. Major chemical companies and startups alike are expanding production capabilities, suggesting confidence in long-term market demand despite current economic uncertainties.

Bio-polymer Development Status and Barriers

Bio-based polymers have emerged as promising alternatives to conventional petroleum-based plastics, yet their global market penetration remains limited at approximately 1% of total polymer production. This modest adoption rate stems from several interconnected challenges that have hindered widespread commercialization despite significant research advancements.

Production capacity represents a primary constraint, with bio-polymer manufacturing facilities operating at scales significantly smaller than their petrochemical counterparts. This disparity creates economic disadvantages through reduced economies of scale, resulting in bio-polymers typically costing 2-4 times more than conventional plastics. The price premium remains a substantial barrier for mass-market adoption, particularly in price-sensitive industries and developing economies.

Technical performance limitations further complicate market expansion. Many bio-based polymers exhibit inferior mechanical properties compared to petroleum-derived alternatives, including challenges with moisture sensitivity, thermal stability, and processing consistency. These shortcomings restrict application potential in demanding sectors such as automotive components, durable consumer goods, and specialized packaging.

Feedstock availability and sustainability present additional complexities. First-generation bio-polymers derived from food crops (corn, sugarcane, etc.) face criticism regarding land-use competition with food production. While second-generation feedstocks utilizing agricultural waste and third-generation approaches using algae show promise, their commercial viability remains unproven at industrial scale.

Regulatory frameworks across different regions exhibit inconsistency, creating market fragmentation and compliance challenges for manufacturers. The lack of standardized end-of-life management infrastructure further complicates the environmental value proposition, as many bio-polymers require specific industrial composting conditions rarely available in conventional waste management systems.

Investment barriers persist due to the capital-intensive nature of polymer production facilities coupled with uncertain return timelines. The volatility of petroleum prices directly impacts the economic competitiveness of bio-alternatives, creating investment hesitancy during periods of low oil prices.

Despite these challenges, technological innovation continues to accelerate, particularly in areas of enzyme engineering, metabolic pathway optimization, and novel polymerization techniques. Academic-industry partnerships have intensified, with notable progress in developing drop-in bio-based equivalents that maintain compatibility with existing processing equipment and applications while offering improved environmental profiles.

The path forward requires coordinated efforts across the value chain, including continued research investment, supportive policy frameworks, consumer education, and infrastructure development to overcome these multifaceted barriers and realize the full potential of bio-based polymers in creating a more sustainable materials economy.

Production capacity represents a primary constraint, with bio-polymer manufacturing facilities operating at scales significantly smaller than their petrochemical counterparts. This disparity creates economic disadvantages through reduced economies of scale, resulting in bio-polymers typically costing 2-4 times more than conventional plastics. The price premium remains a substantial barrier for mass-market adoption, particularly in price-sensitive industries and developing economies.

Technical performance limitations further complicate market expansion. Many bio-based polymers exhibit inferior mechanical properties compared to petroleum-derived alternatives, including challenges with moisture sensitivity, thermal stability, and processing consistency. These shortcomings restrict application potential in demanding sectors such as automotive components, durable consumer goods, and specialized packaging.

Feedstock availability and sustainability present additional complexities. First-generation bio-polymers derived from food crops (corn, sugarcane, etc.) face criticism regarding land-use competition with food production. While second-generation feedstocks utilizing agricultural waste and third-generation approaches using algae show promise, their commercial viability remains unproven at industrial scale.

Regulatory frameworks across different regions exhibit inconsistency, creating market fragmentation and compliance challenges for manufacturers. The lack of standardized end-of-life management infrastructure further complicates the environmental value proposition, as many bio-polymers require specific industrial composting conditions rarely available in conventional waste management systems.

Investment barriers persist due to the capital-intensive nature of polymer production facilities coupled with uncertain return timelines. The volatility of petroleum prices directly impacts the economic competitiveness of bio-alternatives, creating investment hesitancy during periods of low oil prices.

Despite these challenges, technological innovation continues to accelerate, particularly in areas of enzyme engineering, metabolic pathway optimization, and novel polymerization techniques. Academic-industry partnerships have intensified, with notable progress in developing drop-in bio-based equivalents that maintain compatibility with existing processing equipment and applications while offering improved environmental profiles.

The path forward requires coordinated efforts across the value chain, including continued research investment, supportive policy frameworks, consumer education, and infrastructure development to overcome these multifaceted barriers and realize the full potential of bio-based polymers in creating a more sustainable materials economy.

Current Bio-polymer Production Methods

01 Biodegradability and reduced environmental impact

Bio-based polymers offer significant environmental benefits through their biodegradability properties. Unlike conventional petroleum-based plastics that persist in the environment for hundreds of years, many bio-based polymers can decompose naturally under appropriate conditions. This biodegradability helps reduce plastic pollution in landfills, oceans, and ecosystems. Additionally, these materials often have a lower environmental footprint throughout their lifecycle, from production to disposal, contributing to reduced ecological damage.- Reduced carbon footprint and greenhouse gas emissions: Bio-based polymers offer significant environmental benefits through reduced carbon footprint and greenhouse gas emissions compared to petroleum-based alternatives. These polymers sequester carbon during plant growth and require less fossil fuel energy during production. The life cycle assessment of bio-based polymers demonstrates lower environmental impact, contributing to climate change mitigation efforts and helping industries meet sustainability targets.

- Biodegradability and compostability advantages: Many bio-based polymers possess inherent biodegradability and compostability characteristics, allowing them to break down naturally in appropriate environments. This property helps reduce persistent plastic pollution in ecosystems and landfills. The controlled degradation of these materials can be engineered for specific applications, providing end-of-life options that conventional plastics cannot offer and supporting circular economy principles.

- Renewable resource utilization and resource conservation: Bio-based polymers utilize renewable agricultural and forestry resources instead of finite petroleum resources. This shift promotes sustainable resource management and reduces dependence on fossil fuels. By incorporating agricultural waste, food processing byproducts, and other biomass sources, these polymers support resource efficiency and create value from materials that might otherwise be discarded.

- Reduced toxicity and improved safety profile: Bio-based polymers typically contain fewer toxic additives and chemicals compared to conventional plastics. The absence of substances like bisphenol A, phthalates, and other potentially harmful compounds results in safer materials for consumer products, packaging, and medical applications. This reduced toxicity profile benefits both human health and environmental systems throughout the product lifecycle.

- Economic and social sustainability benefits: The development of bio-based polymer industries creates new economic opportunities, particularly in agricultural regions. These materials support sustainable development goals by connecting agricultural production with industrial manufacturing, creating rural jobs, and promoting innovation in green chemistry. Additionally, bio-based polymers can help companies meet consumer demand for environmentally responsible products and comply with increasingly stringent environmental regulations.

02 Reduced carbon footprint and greenhouse gas emissions

Bio-based polymers contribute to climate change mitigation by reducing carbon footprint and greenhouse gas emissions. Since these polymers are derived from renewable biomass sources that capture carbon dioxide during growth, they have the potential for carbon neutrality or even negative carbon impact. The production processes for bio-based polymers typically require less energy and generate fewer greenhouse gas emissions compared to conventional petroleum-based plastics, helping industries meet sustainability goals and reduce their environmental impact.Expand Specific Solutions03 Resource conservation and renewable feedstocks

Bio-based polymers utilize renewable feedstocks such as corn, sugarcane, cellulose, and other plant-based materials instead of finite fossil resources. This shift to renewable raw materials helps conserve petroleum resources and reduces dependence on fossil fuels. The agricultural feedstocks used can be regrown within a relatively short timeframe, creating a sustainable material cycle. This approach to polymer production aligns with circular economy principles and helps preserve natural resources for future generations.Expand Specific Solutions04 Reduced toxicity and safer end-of-life options

Many bio-based polymers offer reduced toxicity compared to their petroleum-based counterparts. They typically contain fewer harmful additives and chemicals, making them safer for human contact in applications like food packaging and medical devices. At the end of their useful life, bio-based polymers present multiple environmentally friendly disposal options, including industrial composting, biodegradation, and in some cases, recycling. This versatility in waste management helps reduce the environmental burden associated with plastic waste disposal.Expand Specific Solutions05 Economic and social sustainability benefits

Beyond environmental advantages, bio-based polymers offer economic and social sustainability benefits. The production of these materials creates new market opportunities for agricultural products and stimulates rural economies. Bio-based polymer industries generate green jobs throughout the supply chain, from farming to manufacturing. Additionally, these materials can help companies meet increasingly stringent environmental regulations and consumer demands for sustainable products, providing competitive advantages in the marketplace while contributing to corporate social responsibility goals.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The bio-based polymer market is currently in a growth phase, with increasing environmental awareness driving demand for sustainable alternatives to petro-polymers. The global market size is expanding rapidly, projected to reach significant value as companies like Coca-Cola and Archer-Daniels-Midland invest in bio-based solutions. Technologically, the field shows varying maturity levels across applications. Leading players include established chemical corporations like Sinopec and Kingfa Sci. & Tech., which are leveraging their manufacturing infrastructure, alongside innovative startups like Teysha Technologies and Solugen developing novel bio-polymer technologies. Academic institutions such as the University of Florida, EPFL, and Donghua University are contributing fundamental research, while companies like Toray Plastics and Celanese are commercializing applications, indicating a collaborative ecosystem advancing toward market-ready sustainable polymer solutions.

Kingfa Sci. & Tech. Co., Ltd.

Technical Solution: Kingfa has developed advanced bio-based polymer composites through their proprietary ECOMAX® technology platform. Their approach focuses on creating high-performance materials by blending bio-based polymers like PLA (polylactic acid) and PBS (polybutylene succinate) with natural fibers and specialized additives to enhance mechanical properties and processability. Kingfa's technology includes proprietary compatibilization techniques that improve the interface between natural fibers and polymer matrices, resulting in superior mechanical properties compared to conventional bio-composites. Their reactive extrusion process enables chain extension and branching of bio-based polymers, improving melt strength and heat resistance - traditionally weak points for materials like PLA. The company has also developed specialized nucleating agents and crystallization modifiers that enhance the crystallization behavior of bio-based polymers, improving their thermal stability and processing window. Kingfa's bio-based compounds are engineered for standard injection molding, extrusion, and thermoforming equipment, facilitating adoption by conventional plastic processors.

Strengths: Extensive formulation expertise allows tailoring of bio-based materials for specific industry requirements. Their materials maintain processability on conventional equipment, reducing barriers to adoption. Weaknesses: Some formulations require fossil-based additives to achieve performance targets, reducing overall bio-content. Higher cost compared to conventional plastics remains a challenge for price-sensitive applications.

Archer-Daniels-Midland Co.

Technical Solution: Archer-Daniels-Midland (ADM) has developed a comprehensive bio-based polymer platform utilizing agricultural feedstocks as renewable raw materials. Their technology focuses on converting corn, soybeans, and other crops into bio-based monomers and polymers through fermentation and chemical conversion processes. ADM's proprietary catalytic processes enable the production of bio-based polyols for polyurethanes, bio-based polyesters, and polylactic acid (PLA) derivatives with performance characteristics comparable to petroleum-based alternatives. The company has established integrated biorefineries that process agricultural feedstocks into both biofuels and bio-based polymer precursors, creating a circular economy approach. Their technology includes specialized purification methods to remove impurities from bio-based monomers, ensuring consistent polymer quality and performance across applications ranging from packaging to textiles and automotive components.

Strengths: Vertical integration from agricultural feedstock to finished polymers provides supply chain control and cost advantages. Their established global agricultural sourcing network ensures reliable raw material supply. Weaknesses: Bio-based polymers still face cost challenges compared to petroleum-based alternatives, particularly during periods of low oil prices. Some applications require blending with conventional polymers to achieve desired performance characteristics.

Breakthrough Patents in Bio-based Materials

Biopolymer compositions having improved flexibility

PatentInactiveEP2475714A1

Innovation

- A polymer blend comprising a biopolymer and an aliphatic polyester, where the polyester is derived from substituted or unsubstituted aliphatic diacids, diols, and alcohols, is used to enhance the flexibility of biopolymers by reducing glass transition temperatures and increasing elongation at break.

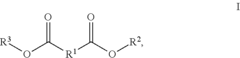

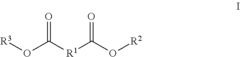

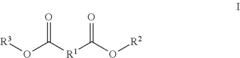

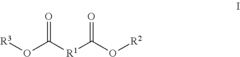

Biopolymer Compositions Having Improved Impact Resistance

PatentInactiveUS20120029112A1

Innovation

- A polymer blend comprising a biopolymer and an ester impact modifier, specifically esters of formula I, where R1 is a substituted or unsubstituted aliphatic hydrocarbon group with 1 to 10 carbon atoms, and R2 and R3 are aliphatic hydrocarbon groups with 4 to 14 carbon atoms, are combined in specific ratios to enhance impact resistance.

Life Cycle Assessment of Bio-based vs. Petro-polymers

Life Cycle Assessment (LCA) provides a comprehensive framework for evaluating the environmental impacts of bio-based polymers compared to their petroleum-based counterparts across their entire lifecycle. When examining bio-based polymers, the assessment typically begins with feedstock production, where significant differences emerge. Bio-based polymers utilize renewable resources such as corn, sugarcane, or cellulosic biomass, which generally require less fossil fuel input than the extraction and refining processes of petroleum for conventional plastics.

In the manufacturing phase, bio-based polymers often demonstrate reduced greenhouse gas emissions compared to petro-polymers. For instance, polylactic acid (PLA) production can generate 25-75% fewer CO2 emissions than polyethylene terephthalate (PET) or polystyrene (PS). However, the energy intensity of bio-polymer processing sometimes offsets these benefits, particularly when considering agricultural inputs like fertilizers and pesticides used in feedstock cultivation.

Water usage presents another critical comparison point. While bio-based feedstocks require significant water resources during cultivation, petroleum extraction and refining also consume substantial water volumes, particularly in hydraulic fracturing operations. Studies indicate that the water footprint of bio-based polymers varies significantly based on feedstock type and regional growing conditions.

Land use considerations reveal complex tradeoffs. Bio-based polymers require agricultural land that could potentially compete with food production, raising concerns about indirect land-use change. This factor must be carefully weighed against the environmental damages associated with petroleum extraction, including habitat destruction and potential contamination from spills.

End-of-life scenarios demonstrate perhaps the most significant advantages for bio-based polymers. Many bio-polymers offer biodegradability or compostability under appropriate conditions, reducing persistence in the environment compared to conventional plastics. PHA (polyhydroxyalkanoate) can biodegrade in marine environments within months, while conventional plastics may persist for centuries.

Carbon footprint analyses across full lifecycles typically favor bio-based polymers, with studies showing potential reductions of 30-80% in greenhouse gas emissions compared to petroleum-based alternatives. However, these benefits depend heavily on feedstock selection, production methods, and end-of-life management practices.

Transportation impacts throughout the supply chain must also be considered, as the distributed nature of biomass production can sometimes lead to higher transportation emissions compared to the centralized petroleum industry infrastructure.

Overall, LCA results indicate that while bio-based polymers generally offer environmental advantages over petro-polymers, these benefits are not universal across all impact categories and depend significantly on specific implementation contexts and technological advancements in processing efficiency.

In the manufacturing phase, bio-based polymers often demonstrate reduced greenhouse gas emissions compared to petro-polymers. For instance, polylactic acid (PLA) production can generate 25-75% fewer CO2 emissions than polyethylene terephthalate (PET) or polystyrene (PS). However, the energy intensity of bio-polymer processing sometimes offsets these benefits, particularly when considering agricultural inputs like fertilizers and pesticides used in feedstock cultivation.

Water usage presents another critical comparison point. While bio-based feedstocks require significant water resources during cultivation, petroleum extraction and refining also consume substantial water volumes, particularly in hydraulic fracturing operations. Studies indicate that the water footprint of bio-based polymers varies significantly based on feedstock type and regional growing conditions.

Land use considerations reveal complex tradeoffs. Bio-based polymers require agricultural land that could potentially compete with food production, raising concerns about indirect land-use change. This factor must be carefully weighed against the environmental damages associated with petroleum extraction, including habitat destruction and potential contamination from spills.

End-of-life scenarios demonstrate perhaps the most significant advantages for bio-based polymers. Many bio-polymers offer biodegradability or compostability under appropriate conditions, reducing persistence in the environment compared to conventional plastics. PHA (polyhydroxyalkanoate) can biodegrade in marine environments within months, while conventional plastics may persist for centuries.

Carbon footprint analyses across full lifecycles typically favor bio-based polymers, with studies showing potential reductions of 30-80% in greenhouse gas emissions compared to petroleum-based alternatives. However, these benefits depend heavily on feedstock selection, production methods, and end-of-life management practices.

Transportation impacts throughout the supply chain must also be considered, as the distributed nature of biomass production can sometimes lead to higher transportation emissions compared to the centralized petroleum industry infrastructure.

Overall, LCA results indicate that while bio-based polymers generally offer environmental advantages over petro-polymers, these benefits are not universal across all impact categories and depend significantly on specific implementation contexts and technological advancements in processing efficiency.

Regulatory Framework for Bio-polymer Commercialization

The regulatory landscape for bio-polymers is evolving rapidly as governments worldwide recognize the environmental benefits of these materials over petroleum-based alternatives. In the United States, the FDA has established specific guidelines for bio-based polymers in food packaging applications, requiring comprehensive safety assessments and migration studies. The EPA's Safer Choice program provides certification pathways for bio-polymers that meet stringent environmental and health criteria, offering market differentiation opportunities for compliant products.

The European Union has implemented more progressive regulatory frameworks, with the European Chemicals Agency (ECHA) overseeing the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation that impacts bio-polymer development. The EU's Single-Use Plastics Directive specifically promotes bio-based alternatives, creating market incentives through mandated reduction targets for conventional plastics. Additionally, the EN13432 standard for compostability certification has become a crucial benchmark for bio-polymer commercialization in European markets.

In Asia, Japan's Biomass Mark certification system provides a standardized approach to verifying bio-based content, while China has introduced its own bio-based product certification program under the China National Accreditation Service for Conformity Assessment (CNAS). These certification systems are increasingly becoming prerequisites for market entry in their respective regions.

Tax incentives represent another significant regulatory tool promoting bio-polymer adoption. Several countries have implemented preferential tax treatments for companies developing or utilizing bio-based materials. For instance, Italy offers a 36% tax credit for investments in biodegradable packaging technologies, while Malaysia provides tax exemptions for companies manufacturing bio-based products.

Extended Producer Responsibility (EPR) schemes are being adapted to recognize the environmental benefits of bio-polymers. France's EPR system now includes reduced fees for packaging with certified bio-based content, creating direct financial incentives for manufacturers to transition away from petroleum-based polymers.

Harmonization of standards remains a significant challenge for global commercialization. The International Organization for Standardization (ISO) has developed several standards, including ISO 16620 for determining bio-based carbon content and ISO 14855 for biodegradability testing, but regional variations in implementation create compliance complexities for manufacturers operating across multiple markets.

Looking forward, regulatory trends indicate increasing stringency in environmental performance requirements coupled with greater incentives for bio-polymer adoption. Companies investing in bio-polymer technologies must maintain active regulatory intelligence capabilities to navigate this complex and rapidly evolving landscape effectively.

The European Union has implemented more progressive regulatory frameworks, with the European Chemicals Agency (ECHA) overseeing the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation that impacts bio-polymer development. The EU's Single-Use Plastics Directive specifically promotes bio-based alternatives, creating market incentives through mandated reduction targets for conventional plastics. Additionally, the EN13432 standard for compostability certification has become a crucial benchmark for bio-polymer commercialization in European markets.

In Asia, Japan's Biomass Mark certification system provides a standardized approach to verifying bio-based content, while China has introduced its own bio-based product certification program under the China National Accreditation Service for Conformity Assessment (CNAS). These certification systems are increasingly becoming prerequisites for market entry in their respective regions.

Tax incentives represent another significant regulatory tool promoting bio-polymer adoption. Several countries have implemented preferential tax treatments for companies developing or utilizing bio-based materials. For instance, Italy offers a 36% tax credit for investments in biodegradable packaging technologies, while Malaysia provides tax exemptions for companies manufacturing bio-based products.

Extended Producer Responsibility (EPR) schemes are being adapted to recognize the environmental benefits of bio-polymers. France's EPR system now includes reduced fees for packaging with certified bio-based content, creating direct financial incentives for manufacturers to transition away from petroleum-based polymers.

Harmonization of standards remains a significant challenge for global commercialization. The International Organization for Standardization (ISO) has developed several standards, including ISO 16620 for determining bio-based carbon content and ISO 14855 for biodegradability testing, but regional variations in implementation create compliance complexities for manufacturers operating across multiple markets.

Looking forward, regulatory trends indicate increasing stringency in environmental performance requirements coupled with greater incentives for bio-polymer adoption. Companies investing in bio-polymer technologies must maintain active regulatory intelligence capabilities to navigate this complex and rapidly evolving landscape effectively.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!