Bio-based Polymer Certification Standards and Challenges

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bio-Polymer Evolution and Certification Objectives

Bio-based polymers have evolved significantly over the past century, transitioning from early experimentation with natural materials to sophisticated engineered biomaterials. The journey began in the early 20th century with the development of cellophane and other cellulose-derived materials, but gained substantial momentum only in the 1980s and 1990s as environmental concerns grew and petroleum prices fluctuated.

The evolution accelerated in the 2000s with the commercialization of polylactic acid (PLA) and polyhydroxyalkanoates (PHAs), demonstrating that bio-based polymers could achieve properties comparable to conventional plastics. This period marked a shift from viewing bio-polymers as niche alternatives to recognizing them as viable commercial materials with distinct advantages beyond biodegradability.

Recent technological advancements have expanded the bio-polymer landscape dramatically, with innovations in fermentation processes, enzymatic polymerization, and genetic engineering of production organisms. The field now encompasses a diverse range of materials from drop-in replacements for conventional plastics to novel polymers with unique properties unattainable through petrochemical routes.

Despite this progress, certification standards for bio-based polymers remain fragmented globally, creating market confusion and hindering wider adoption. Current certification frameworks primarily focus on bio-based carbon content (ASTM D6866, EN 16640) and biodegradability (ASTM D6400, EN 13432), but lack comprehensive approaches addressing the full lifecycle environmental impact.

The primary objective of bio-polymer certification must evolve beyond simply verifying biological origin to encompass sustainability metrics throughout the value chain. This includes agricultural practices, processing efficiency, energy consumption, water usage, and end-of-life management. Certification systems need to provide clear differentiation between partially and fully bio-based materials while accounting for regional variations in feedstock sustainability.

Another critical objective is harmonization of global standards to reduce market fragmentation and compliance costs. The current proliferation of competing certification schemes creates barriers to international trade and confuses consumers. A unified approach would accelerate market adoption while maintaining rigorous verification protocols.

Future certification frameworks must also address emerging technologies like chemically recycled content and carbon capture utilization, which blur traditional boundaries between bio-based and conventional polymers. The ultimate goal should be a transparent, science-based certification system that enables fair comparison between materials while driving continuous improvement in environmental performance across the entire polymer industry.

The evolution accelerated in the 2000s with the commercialization of polylactic acid (PLA) and polyhydroxyalkanoates (PHAs), demonstrating that bio-based polymers could achieve properties comparable to conventional plastics. This period marked a shift from viewing bio-polymers as niche alternatives to recognizing them as viable commercial materials with distinct advantages beyond biodegradability.

Recent technological advancements have expanded the bio-polymer landscape dramatically, with innovations in fermentation processes, enzymatic polymerization, and genetic engineering of production organisms. The field now encompasses a diverse range of materials from drop-in replacements for conventional plastics to novel polymers with unique properties unattainable through petrochemical routes.

Despite this progress, certification standards for bio-based polymers remain fragmented globally, creating market confusion and hindering wider adoption. Current certification frameworks primarily focus on bio-based carbon content (ASTM D6866, EN 16640) and biodegradability (ASTM D6400, EN 13432), but lack comprehensive approaches addressing the full lifecycle environmental impact.

The primary objective of bio-polymer certification must evolve beyond simply verifying biological origin to encompass sustainability metrics throughout the value chain. This includes agricultural practices, processing efficiency, energy consumption, water usage, and end-of-life management. Certification systems need to provide clear differentiation between partially and fully bio-based materials while accounting for regional variations in feedstock sustainability.

Another critical objective is harmonization of global standards to reduce market fragmentation and compliance costs. The current proliferation of competing certification schemes creates barriers to international trade and confuses consumers. A unified approach would accelerate market adoption while maintaining rigorous verification protocols.

Future certification frameworks must also address emerging technologies like chemically recycled content and carbon capture utilization, which blur traditional boundaries between bio-based and conventional polymers. The ultimate goal should be a transparent, science-based certification system that enables fair comparison between materials while driving continuous improvement in environmental performance across the entire polymer industry.

Market Demand Analysis for Certified Bio-based Polymers

The global market for bio-based polymers has experienced significant growth in recent years, driven by increasing environmental awareness and regulatory pressures to reduce dependence on fossil-based materials. Current market analysis indicates that the certified bio-based polymer sector is expanding at a compound annual growth rate of approximately 15-20%, outpacing traditional petroleum-based plastics which grow at 3-4% annually. This accelerated growth reflects shifting consumer preferences and corporate sustainability commitments.

Consumer demand for environmentally responsible products has become a primary market driver, with surveys showing that 65% of global consumers actively seek products with sustainable packaging. Particularly strong demand exists in packaging (representing about 40% of bio-based polymer applications), consumer goods (25%), and automotive sectors (15%), where brand owners are increasingly making public commitments to incorporate certified sustainable materials.

Regional market analysis reveals varying adoption rates, with Europe leading in market penetration due to stringent regulations and well-established certification frameworks like the European Bioplastics certification. North America follows with growing demand primarily in consumer-facing industries, while the Asia-Pacific region shows the fastest growth rate as manufacturing hubs respond to export requirements from Western markets.

Price premiums remain a significant market factor, with certified bio-based polymers typically commanding 20-30% higher prices than conventional alternatives. However, this premium has been gradually decreasing as production scales up and technologies mature. Market research indicates that approximately 40% of consumers are willing to pay up to 10% more for products with certified sustainable materials, though this willingness varies significantly by product category and region.

Industry stakeholders report that certification standards directly impact market access, with major retailers and brand owners increasingly requiring third-party verification of bio-based content claims. The fragmentation of certification standards across regions creates market inefficiencies, with manufacturers often needing to obtain multiple certifications to serve different markets, increasing compliance costs by an estimated 15-25%.

Future market projections suggest that demand for certified bio-based polymers will continue to grow as regulatory frameworks strengthen globally. The EU's Single-Use Plastics Directive and similar policies emerging in other regions are expected to create substantial new market opportunities. However, market analysts caution that growth could be constrained by limited feedstock availability, certification costs, and technical performance limitations in certain high-demand applications.

Consumer demand for environmentally responsible products has become a primary market driver, with surveys showing that 65% of global consumers actively seek products with sustainable packaging. Particularly strong demand exists in packaging (representing about 40% of bio-based polymer applications), consumer goods (25%), and automotive sectors (15%), where brand owners are increasingly making public commitments to incorporate certified sustainable materials.

Regional market analysis reveals varying adoption rates, with Europe leading in market penetration due to stringent regulations and well-established certification frameworks like the European Bioplastics certification. North America follows with growing demand primarily in consumer-facing industries, while the Asia-Pacific region shows the fastest growth rate as manufacturing hubs respond to export requirements from Western markets.

Price premiums remain a significant market factor, with certified bio-based polymers typically commanding 20-30% higher prices than conventional alternatives. However, this premium has been gradually decreasing as production scales up and technologies mature. Market research indicates that approximately 40% of consumers are willing to pay up to 10% more for products with certified sustainable materials, though this willingness varies significantly by product category and region.

Industry stakeholders report that certification standards directly impact market access, with major retailers and brand owners increasingly requiring third-party verification of bio-based content claims. The fragmentation of certification standards across regions creates market inefficiencies, with manufacturers often needing to obtain multiple certifications to serve different markets, increasing compliance costs by an estimated 15-25%.

Future market projections suggest that demand for certified bio-based polymers will continue to grow as regulatory frameworks strengthen globally. The EU's Single-Use Plastics Directive and similar policies emerging in other regions are expected to create substantial new market opportunities. However, market analysts caution that growth could be constrained by limited feedstock availability, certification costs, and technical performance limitations in certain high-demand applications.

Global Certification Landscape and Technical Barriers

The global certification landscape for bio-based polymers is characterized by a complex network of standards, certifications, and regulatory frameworks that vary significantly across regions. In North America, the USDA BioPreferred program stands as a cornerstone initiative, providing certification for products with verified bio-based content. This program has established a comprehensive testing methodology using ASTM D6866 for measuring the bio-based carbon content through radiocarbon analysis.

In Europe, the landscape is dominated by the European Committee for Standardization (CEN) which has developed the EN 16785 series specifically for bio-based products. The EU's approach is more holistic, incorporating not only bio-based content verification but also sustainability criteria through frameworks like the EU Ecolabel and specific standards for biodegradability (EN 13432).

Asia presents a more fragmented certification environment, with Japan's BiomassPla mark and China's recently developed GB/T standards for bio-based materials gaining prominence. These regional differences create significant challenges for global manufacturers seeking multinational market access, often necessitating multiple certifications for a single product.

A major technical barrier in certification is the analytical methodology discrepancy. While carbon-14 dating (radiocarbon analysis) is widely accepted, variations in sample preparation, reference materials, and calculation methodologies lead to inconsistent results across different certification bodies. This technical inconsistency undermines the comparability of bio-based content claims globally.

Another significant challenge is the definition scope of "bio-based" itself. Some certification schemes focus exclusively on carbon content derived from contemporary biomass, while others incorporate broader sustainability metrics including land use, water consumption, and social impacts. This fundamental definitional variance creates market confusion and hampers international trade.

The verification of complex polymer blends presents additional technical difficulties. Current analytical methods struggle to accurately determine bio-based content in products containing multiple polymer types or additives. This limitation is particularly problematic for innovative composite materials that combine conventional and bio-based components.

End-of-life considerations further complicate certification efforts. The relationship between bio-based content and biodegradability remains poorly addressed in many certification schemes, despite being frequently conflated in marketing claims. Some materials with high bio-based content may not be biodegradable, while some biodegradable polymers may contain minimal bio-based content, creating consumer confusion and potential greenwashing concerns.

In Europe, the landscape is dominated by the European Committee for Standardization (CEN) which has developed the EN 16785 series specifically for bio-based products. The EU's approach is more holistic, incorporating not only bio-based content verification but also sustainability criteria through frameworks like the EU Ecolabel and specific standards for biodegradability (EN 13432).

Asia presents a more fragmented certification environment, with Japan's BiomassPla mark and China's recently developed GB/T standards for bio-based materials gaining prominence. These regional differences create significant challenges for global manufacturers seeking multinational market access, often necessitating multiple certifications for a single product.

A major technical barrier in certification is the analytical methodology discrepancy. While carbon-14 dating (radiocarbon analysis) is widely accepted, variations in sample preparation, reference materials, and calculation methodologies lead to inconsistent results across different certification bodies. This technical inconsistency undermines the comparability of bio-based content claims globally.

Another significant challenge is the definition scope of "bio-based" itself. Some certification schemes focus exclusively on carbon content derived from contemporary biomass, while others incorporate broader sustainability metrics including land use, water consumption, and social impacts. This fundamental definitional variance creates market confusion and hampers international trade.

The verification of complex polymer blends presents additional technical difficulties. Current analytical methods struggle to accurately determine bio-based content in products containing multiple polymer types or additives. This limitation is particularly problematic for innovative composite materials that combine conventional and bio-based components.

End-of-life considerations further complicate certification efforts. The relationship between bio-based content and biodegradability remains poorly addressed in many certification schemes, despite being frequently conflated in marketing claims. Some materials with high bio-based content may not be biodegradable, while some biodegradable polymers may contain minimal bio-based content, creating consumer confusion and potential greenwashing concerns.

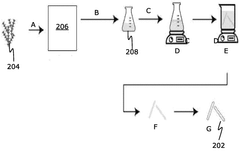

Current Bio-content Verification Methodologies

01 International certification standards for bio-based polymers

Various international standards exist for certifying bio-based polymers, ensuring they meet specific environmental and quality criteria. These standards typically verify the renewable content, biodegradability, and sustainability aspects of the polymers. Certification processes often include testing methods to determine the percentage of bio-based content and environmental impact assessments to ensure compliance with global sustainability goals.- International certification standards for bio-based polymers: Various international standards exist for certifying bio-based polymers, including their composition, biodegradability, and environmental impact. These standards provide frameworks for testing and verifying the bio-based content of polymers, ensuring compliance with global sustainability requirements. Certification processes typically involve third-party verification and may include lifecycle assessment methodologies to validate environmental claims.

- Testing methodologies for bio-based content verification: Specific testing methodologies are employed to verify the bio-based content in polymers, including carbon-14 dating, isotope analysis, and mass spectrometry. These techniques help quantify the percentage of renewable materials in polymer formulations and distinguish between fossil-based and bio-based components. Testing protocols are standardized to ensure consistency and reliability in certification processes across different laboratories and regions.

- Environmental impact assessment of bio-based polymers: Certification standards for bio-based polymers include comprehensive environmental impact assessments that evaluate factors such as carbon footprint, water usage, land use, and end-of-life scenarios. These assessments help determine the overall sustainability of bio-based polymers compared to conventional petroleum-based alternatives. Life cycle analysis methodologies are employed to quantify environmental benefits and identify potential areas for improvement in production processes.

- Blockchain technology for bio-based polymer certification: Blockchain technology is being implemented to enhance transparency and traceability in bio-based polymer certification systems. This technology creates immutable records of certification data, material sourcing, and manufacturing processes, allowing stakeholders to verify compliance with standards throughout the supply chain. Blockchain-based certification systems help prevent fraud and misrepresentation while facilitating more efficient verification processes.

- Regulatory frameworks for bio-based polymer market access: Various regulatory frameworks govern market access for bio-based polymers across different regions, including requirements for certification, labeling, and performance standards. These regulations aim to ensure product safety, environmental protection, and accurate consumer information. Compliance with these regulatory frameworks is essential for manufacturers seeking to commercialize bio-based polymers and make sustainability claims in global markets.

02 Testing methodologies for bio-based content verification

Specific testing methodologies are employed to verify the bio-based content in polymers. These include carbon-14 dating techniques, isotope analysis, and molecular characterization methods that can accurately determine the percentage of renewable materials in the polymer composition. These testing protocols are essential for certification and help manufacturers validate their claims about the renewable content of their products.Expand Specific Solutions03 Environmental impact assessment of bio-based polymers

Certification standards for bio-based polymers include comprehensive environmental impact assessments that evaluate the entire lifecycle of the polymer from raw material extraction to disposal. These assessments consider factors such as carbon footprint, water usage, energy consumption, and end-of-life biodegradability. The results help determine whether the bio-based polymer meets sustainability criteria and qualifies for environmental certifications.Expand Specific Solutions04 Market validation and consumer trust mechanisms

Certification standards serve as market validation tools that build consumer trust in bio-based polymer products. These standards often include transparent labeling requirements, chain-of-custody documentation, and third-party verification processes. By adhering to these standards, manufacturers can differentiate their products in the marketplace and provide consumers with reliable information about the environmental benefits of their bio-based polymers.Expand Specific Solutions05 Regulatory compliance frameworks for bio-based polymers

Bio-based polymer certification standards are often integrated into broader regulatory compliance frameworks that govern the production, distribution, and disposal of these materials. These frameworks may include requirements for registration, safety assessments, and reporting of environmental performance metrics. Compliance with these regulatory frameworks is essential for manufacturers seeking to market their bio-based polymers in different regions and jurisdictions.Expand Specific Solutions

Key Certification Bodies and Industry Leaders

The bio-based polymer certification landscape is currently in a growth phase, with the market expected to expand significantly due to increasing environmental concerns and regulatory pressures. The global bio-polymer market demonstrates moderate technological maturity, though standardization remains fragmented. Key industry players like BASF, Arkema, and Bayer are driving innovation through substantial R&D investments, while academic institutions such as Nanjing University and Arizona State University contribute fundamental research. Companies like Novomer and Flexsea represent emerging disruptors with novel approaches. Advanced Industrial Science & Technology and The Regents of the University of California are establishing certification frameworks, though challenges remain in harmonizing standards across regions and ensuring consistent verification methodologies for bio-content claims and biodegradability assessments.

BASF Corp.

Technical Solution: BASF has developed a comprehensive certification framework for bio-based polymers called "Biomass Balance Approach." This methodology tracks the flow of bio-based raw materials through their production system, allowing them to allocate bio-based content to specific products. Their certification process involves third-party verification through TÜV SÜD, which validates the traceability and calculation methodology. BASF's approach addresses the challenge of mixed feedstock production facilities where fossil and renewable resources are processed together[1]. Their certification standard includes life cycle assessments that measure carbon footprint reduction compared to conventional polymers, with some products achieving up to 85% lower CO2 emissions[3]. BASF also employs mass balance accounting principles aligned with ISO 14040 and 14044 standards to ensure credible claims about bio-based content in their final products.

Strengths: BASF's system allows for gradual transition to bio-based materials without requiring separate production lines, making it economically viable. Their third-party verification enhances credibility and market acceptance. Weaknesses: The mass balance approach doesn't guarantee that the actual molecules in the end product are bio-based, which can create consumer confusion and skepticism about green claims.

Archer-Daniels-Midland Co.

Technical Solution: Archer-Daniels-Midland (ADM) has pioneered a vertically integrated approach to bio-based polymer certification, leveraging their agricultural supply chain expertise. Their certification system focuses on traceability from farm to finished polymer, implementing blockchain technology to track the origin and processing of bio-based feedstocks[2]. ADM's certification methodology emphasizes sustainable sourcing practices, requiring that biomass feedstocks meet specific environmental criteria including land use considerations and agricultural practices. Their standard incorporates both ASTM D6866 testing for bio-based carbon content and ISCC PLUS certification for sustainability claims. ADM has developed proprietary analytical methods to distinguish between first-generation (food-competing) and second-generation (non-food) biomass sources in their polymers, addressing a key challenge in the industry regarding food security concerns[4]. Their certification process also includes verification of biodegradability and compostability according to EN 13432 or ASTM D6400 standards when applicable.

Strengths: ADM's agricultural background provides unique insights into sustainable feedstock sourcing and supply chain management. Their integrated approach from farm to polymer offers superior traceability. Weaknesses: Their heavy reliance on agricultural feedstocks makes them vulnerable to crop failures, price volatility, and potential food vs. materials debates, especially for first-generation biomass sources.

Critical Testing Protocols and Validation Research

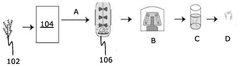

Biopolymer, and system and method for producing biopolymer

PatentWO2025022306A2

Innovation

- A biopolymer produced from a biowaste substrate, such as cellular biomass or acellular material, combined with a supplementary substrate, under optimized process conditions, allowing for regulation of yield and physicochemical properties, and enabling industrial scalability and sustainability.

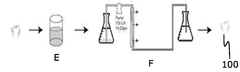

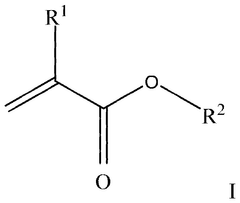

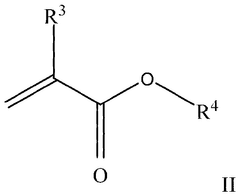

BIO-based elastomeric polymer compositions

PatentWO2025049240A2

Innovation

- The solution involves polymerizing bio-based acrylate monomers to form an aqueous dispersion of elastomeric polymer compositions. These compositions include specific monomers such as C6-C10 alkyl(meth)acrylate and C1-C5 alkyl(meth)acrylate, along with unsaturated ionic acid and functional monomers, which result in a biocarbon content of 22% or more.

Environmental Impact Assessment Metrics

Environmental impact assessment metrics for bio-based polymers represent a critical framework for evaluating the sustainability credentials of these materials throughout their lifecycle. Current metrics focus on several key parameters including carbon footprint, water usage, land use efficiency, energy consumption, and biodegradability rates. These metrics provide quantifiable data that enable meaningful comparisons between bio-based polymers and their petroleum-based counterparts.

Carbon footprint measurement has evolved significantly, with methodologies now accounting for both direct emissions during production and indirect emissions from feedstock cultivation. Advanced Life Cycle Assessment (LCA) tools have become increasingly sophisticated, allowing for more accurate quantification of greenhouse gas emissions reduction potential, which typically ranges from 30% to 80% compared to conventional polymers depending on feedstock and production processes.

Water footprint analysis has gained prominence as a critical environmental indicator, particularly as many bio-based polymers rely on agricultural feedstocks. Current metrics distinguish between green water (rainwater), blue water (surface and groundwater), and grey water (polluted water) footprints, providing a more nuanced understanding of water resource impacts. Leading certification systems now require comprehensive water stewardship plans as part of their assessment protocols.

Land use efficiency metrics have been refined to address concerns about competition with food production. Contemporary assessment frameworks incorporate indirect land use change (ILUC) factors and prioritize feedstocks derived from agricultural residues, marginal lands, or waste streams. These metrics help identify bio-based polymers that minimize pressure on arable land while maximizing carbon sequestration benefits.

Biodegradability and end-of-life scenarios present unique challenges for environmental impact assessment. Current metrics include standardized testing protocols for various disposal environments (industrial composting, home composting, soil, marine environments) with specific timeframes and degradation thresholds. However, significant gaps remain in harmonizing these standards across different regions and disposal contexts.

Toxicity assessment has emerged as an increasingly important metric, evaluating potential environmental and human health impacts from additives, processing aids, and degradation products. Advanced ecotoxicological testing methodologies now complement traditional chemical safety assessments, though standardization efforts are still evolving in this area.

The integration of these diverse environmental metrics into comprehensive certification systems remains challenging, with trade-offs often existing between different environmental impact categories. Next-generation assessment frameworks are moving toward weighted scoring systems that reflect regional environmental priorities and enable more balanced decision-making in material selection and development.

Carbon footprint measurement has evolved significantly, with methodologies now accounting for both direct emissions during production and indirect emissions from feedstock cultivation. Advanced Life Cycle Assessment (LCA) tools have become increasingly sophisticated, allowing for more accurate quantification of greenhouse gas emissions reduction potential, which typically ranges from 30% to 80% compared to conventional polymers depending on feedstock and production processes.

Water footprint analysis has gained prominence as a critical environmental indicator, particularly as many bio-based polymers rely on agricultural feedstocks. Current metrics distinguish between green water (rainwater), blue water (surface and groundwater), and grey water (polluted water) footprints, providing a more nuanced understanding of water resource impacts. Leading certification systems now require comprehensive water stewardship plans as part of their assessment protocols.

Land use efficiency metrics have been refined to address concerns about competition with food production. Contemporary assessment frameworks incorporate indirect land use change (ILUC) factors and prioritize feedstocks derived from agricultural residues, marginal lands, or waste streams. These metrics help identify bio-based polymers that minimize pressure on arable land while maximizing carbon sequestration benefits.

Biodegradability and end-of-life scenarios present unique challenges for environmental impact assessment. Current metrics include standardized testing protocols for various disposal environments (industrial composting, home composting, soil, marine environments) with specific timeframes and degradation thresholds. However, significant gaps remain in harmonizing these standards across different regions and disposal contexts.

Toxicity assessment has emerged as an increasingly important metric, evaluating potential environmental and human health impacts from additives, processing aids, and degradation products. Advanced ecotoxicological testing methodologies now complement traditional chemical safety assessments, though standardization efforts are still evolving in this area.

The integration of these diverse environmental metrics into comprehensive certification systems remains challenging, with trade-offs often existing between different environmental impact categories. Next-generation assessment frameworks are moving toward weighted scoring systems that reflect regional environmental priorities and enable more balanced decision-making in material selection and development.

Regulatory Harmonization Strategies

The fragmented regulatory landscape for bio-based polymers presents significant challenges for manufacturers operating across multiple markets. Achieving global regulatory harmonization requires strategic approaches that balance regional priorities with international standardization efforts. A comprehensive harmonization strategy must address the current disparities in certification methodologies, testing protocols, and labeling requirements across different jurisdictions.

One promising approach involves the establishment of mutual recognition agreements (MRAs) between certification bodies in key markets. These agreements would enable certifications obtained in one region to be recognized in partner regions, reducing redundant testing and documentation requirements. The European Committee for Standardization (CEN) and the American Society for Testing and Materials (ASTM) have initiated preliminary discussions on alignment of their respective bio-based content verification methodologies, which could serve as a foundation for broader international cooperation.

Industry consortia play a crucial role in driving harmonization efforts by creating platforms for stakeholders to develop consensus-based approaches. The Bio-based Industries Consortium in Europe and the Bioplastics Feedstock Alliance globally have established working groups specifically focused on regulatory alignment. These collaborative initiatives facilitate dialogue between industry players, certification bodies, and regulatory authorities to identify common ground for standardization.

Implementing tiered certification frameworks represents another viable strategy for regulatory harmonization. Such frameworks would establish core universal requirements applicable across all markets, supplemented by market-specific modules addressing unique regional priorities. This approach allows for flexibility while maintaining a consistent baseline for certification, reducing compliance complexity for manufacturers while respecting regional regulatory sovereignty.

Digital certification platforms utilizing blockchain technology offer innovative solutions for transparent verification across jurisdictions. These systems can create immutable records of certification data, testing results, and supply chain documentation accessible to regulators worldwide. Several pilot programs implementing such technology have demonstrated improved efficiency in cross-border verification processes and reduced administrative burdens.

International standards organizations must take a more proactive role in coordinating harmonization efforts. The International Organization for Standardization (ISO) could establish a dedicated technical committee focused specifically on bio-based polymer certification, bringing together experts from diverse regulatory environments to develop globally applicable standards. This would provide a neutral forum for addressing technical differences and working toward consensus-based solutions that bridge regional regulatory approaches.

One promising approach involves the establishment of mutual recognition agreements (MRAs) between certification bodies in key markets. These agreements would enable certifications obtained in one region to be recognized in partner regions, reducing redundant testing and documentation requirements. The European Committee for Standardization (CEN) and the American Society for Testing and Materials (ASTM) have initiated preliminary discussions on alignment of their respective bio-based content verification methodologies, which could serve as a foundation for broader international cooperation.

Industry consortia play a crucial role in driving harmonization efforts by creating platforms for stakeholders to develop consensus-based approaches. The Bio-based Industries Consortium in Europe and the Bioplastics Feedstock Alliance globally have established working groups specifically focused on regulatory alignment. These collaborative initiatives facilitate dialogue between industry players, certification bodies, and regulatory authorities to identify common ground for standardization.

Implementing tiered certification frameworks represents another viable strategy for regulatory harmonization. Such frameworks would establish core universal requirements applicable across all markets, supplemented by market-specific modules addressing unique regional priorities. This approach allows for flexibility while maintaining a consistent baseline for certification, reducing compliance complexity for manufacturers while respecting regional regulatory sovereignty.

Digital certification platforms utilizing blockchain technology offer innovative solutions for transparent verification across jurisdictions. These systems can create immutable records of certification data, testing results, and supply chain documentation accessible to regulators worldwide. Several pilot programs implementing such technology have demonstrated improved efficiency in cross-border verification processes and reduced administrative burdens.

International standards organizations must take a more proactive role in coordinating harmonization efforts. The International Organization for Standardization (ISO) could establish a dedicated technical committee focused specifically on bio-based polymer certification, bringing together experts from diverse regulatory environments to develop globally applicable standards. This would provide a neutral forum for addressing technical differences and working toward consensus-based solutions that bridge regional regulatory approaches.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!