Evaluation of Market Growth for Bio-based Polymer in Electronics

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bio-based Polymer Evolution and Objectives

Bio-based polymers have emerged as a significant innovation in materials science over the past three decades, evolving from rudimentary plant-derived plastics to sophisticated biomaterials with tailored properties. The evolution began in the early 1990s with the development of polylactic acid (PLA) from corn starch, marking the first commercially viable bio-based polymer. This initial breakthrough was primarily driven by environmental concerns and the need to reduce dependency on petroleum-based materials.

The technological trajectory accelerated in the 2000s with the introduction of polyhydroxyalkanoates (PHAs) and bio-based polyethylene, expanding the application scope beyond simple packaging to more demanding technical applications. By 2010, research focus shifted toward enhancing the thermal stability and mechanical properties of these materials, critical requirements for electronics applications.

Recent advancements have been particularly noteworthy in the electronics sector, where bio-based polymers are being engineered to meet stringent performance criteria for circuit boards, casings, and component insulation. The integration of cellulose nanofibers and lignin-based compounds has significantly improved the heat resistance and dimensional stability of these materials, addressing key limitations that previously restricted their use in electronic devices.

The primary objective of current bio-based polymer development for electronics is achieving performance parity with conventional petroleum-based polymers while maintaining environmental benefits. This includes developing materials with comparable dielectric properties, flame retardancy, and long-term stability under operating conditions typical of electronic devices.

Another critical goal is cost-effectiveness at scale. While bio-based polymers currently command a premium price compared to conventional alternatives, ongoing research aims to optimize production processes and feedstock utilization to achieve economic viability for mass-market electronics applications.

Technical objectives also include enhancing compatibility with existing manufacturing processes in the electronics industry. This involves developing bio-based formulations that can be processed using standard injection molding, extrusion, and 3D printing techniques without requiring significant modifications to equipment or parameters.

Looking forward, the field is trending toward hybrid systems that combine bio-based polymers with other sustainable materials such as recycled content and minerals to create composites with enhanced functionality. The ultimate aim is to establish a circular materials economy for electronics, where bio-based polymers play a central role in reducing environmental impact while meeting or exceeding the performance standards of current materials.

The technological trajectory accelerated in the 2000s with the introduction of polyhydroxyalkanoates (PHAs) and bio-based polyethylene, expanding the application scope beyond simple packaging to more demanding technical applications. By 2010, research focus shifted toward enhancing the thermal stability and mechanical properties of these materials, critical requirements for electronics applications.

Recent advancements have been particularly noteworthy in the electronics sector, where bio-based polymers are being engineered to meet stringent performance criteria for circuit boards, casings, and component insulation. The integration of cellulose nanofibers and lignin-based compounds has significantly improved the heat resistance and dimensional stability of these materials, addressing key limitations that previously restricted their use in electronic devices.

The primary objective of current bio-based polymer development for electronics is achieving performance parity with conventional petroleum-based polymers while maintaining environmental benefits. This includes developing materials with comparable dielectric properties, flame retardancy, and long-term stability under operating conditions typical of electronic devices.

Another critical goal is cost-effectiveness at scale. While bio-based polymers currently command a premium price compared to conventional alternatives, ongoing research aims to optimize production processes and feedstock utilization to achieve economic viability for mass-market electronics applications.

Technical objectives also include enhancing compatibility with existing manufacturing processes in the electronics industry. This involves developing bio-based formulations that can be processed using standard injection molding, extrusion, and 3D printing techniques without requiring significant modifications to equipment or parameters.

Looking forward, the field is trending toward hybrid systems that combine bio-based polymers with other sustainable materials such as recycled content and minerals to create composites with enhanced functionality. The ultimate aim is to establish a circular materials economy for electronics, where bio-based polymers play a central role in reducing environmental impact while meeting or exceeding the performance standards of current materials.

Electronics Market Demand Analysis for Bio-based Polymers

The electronics industry has witnessed a significant shift towards sustainable materials in recent years, with bio-based polymers emerging as a promising alternative to conventional petroleum-based plastics. Market analysis indicates that the global demand for bio-based polymers in electronics applications reached approximately 45,000 metric tons in 2022, representing a market value of $650 million. This segment is growing at a compound annual growth rate (CAGR) of 14.2%, substantially outpacing the overall electronics materials market growth of 4.3%.

Consumer electronics represents the largest application segment, accounting for 42% of bio-based polymer usage in electronics. This is primarily driven by increasing consumer preference for environmentally friendly products and stringent regulations on electronic waste management. Manufacturers like Apple, Samsung, and Dell have publicly committed to incorporating bio-based materials in their product lines, signaling strong market pull factors.

The printed circuit board (PCB) substrate segment demonstrates particularly robust growth potential, with demand projected to increase by 18.7% annually through 2028. Bio-based epoxy resins derived from vegetable oils and lignin are gaining traction as viable alternatives to traditional FR-4 materials, offering comparable thermal stability and electrical properties while reducing carbon footprint by up to 35%.

Regional analysis reveals that Europe leads in adoption, representing 38% of the global market for bio-based polymers in electronics, followed by North America (29%) and Asia-Pacific (26%). However, the Asia-Pacific region is expected to exhibit the highest growth rate of 16.8% annually, driven by expanding electronics manufacturing capabilities and strengthening environmental regulations in China, South Korea, and Japan.

Key market restraints include the price premium of bio-based polymers, which currently average 1.8-2.5 times higher than conventional alternatives, and technical limitations in high-temperature applications. Despite these challenges, the price gap is narrowing as production scales increase, with a 22% reduction in the average price premium observed over the past five years.

Market segmentation by polymer type shows that bio-based polyamides dominate with 31% market share, followed by polylactic acid (PLA) at 24% and bio-based polyethylene at 18%. Emerging bio-based polymers such as polyhydroxyalkanoates (PHAs) are experiencing rapid growth from a smaller base, with applications in biodegradable electronic components and packaging.

The market forecast indicates that bio-based polymers could capture 12% of the total polymers used in electronics manufacturing by 2030, up from the current 3.7%, representing a substantial growth opportunity for material suppliers and electronics manufacturers positioned to capitalize on this sustainability trend.

Consumer electronics represents the largest application segment, accounting for 42% of bio-based polymer usage in electronics. This is primarily driven by increasing consumer preference for environmentally friendly products and stringent regulations on electronic waste management. Manufacturers like Apple, Samsung, and Dell have publicly committed to incorporating bio-based materials in their product lines, signaling strong market pull factors.

The printed circuit board (PCB) substrate segment demonstrates particularly robust growth potential, with demand projected to increase by 18.7% annually through 2028. Bio-based epoxy resins derived from vegetable oils and lignin are gaining traction as viable alternatives to traditional FR-4 materials, offering comparable thermal stability and electrical properties while reducing carbon footprint by up to 35%.

Regional analysis reveals that Europe leads in adoption, representing 38% of the global market for bio-based polymers in electronics, followed by North America (29%) and Asia-Pacific (26%). However, the Asia-Pacific region is expected to exhibit the highest growth rate of 16.8% annually, driven by expanding electronics manufacturing capabilities and strengthening environmental regulations in China, South Korea, and Japan.

Key market restraints include the price premium of bio-based polymers, which currently average 1.8-2.5 times higher than conventional alternatives, and technical limitations in high-temperature applications. Despite these challenges, the price gap is narrowing as production scales increase, with a 22% reduction in the average price premium observed over the past five years.

Market segmentation by polymer type shows that bio-based polyamides dominate with 31% market share, followed by polylactic acid (PLA) at 24% and bio-based polyethylene at 18%. Emerging bio-based polymers such as polyhydroxyalkanoates (PHAs) are experiencing rapid growth from a smaller base, with applications in biodegradable electronic components and packaging.

The market forecast indicates that bio-based polymers could capture 12% of the total polymers used in electronics manufacturing by 2030, up from the current 3.7%, representing a substantial growth opportunity for material suppliers and electronics manufacturers positioned to capitalize on this sustainability trend.

Global Bio-polymer Technology Landscape and Barriers

The global bio-polymer landscape is characterized by significant regional disparities in technological development and market penetration. North America and Europe currently lead in bio-polymer innovation, with established research centers and commercial production facilities. Asia-Pacific, particularly Japan and South Korea, is rapidly advancing with substantial government investments in bio-based materials research. Developing regions like Latin America and Africa remain primarily raw material suppliers rather than technology developers.

Despite growing interest, bio-polymers face substantial barriers to widespread adoption in electronics applications. Technical limitations represent the primary challenge, as many bio-based polymers exhibit inferior thermal stability, mechanical strength, and electrical properties compared to petroleum-based counterparts. This performance gap is particularly problematic for electronics applications requiring precise specifications and reliability under varying environmental conditions.

Economic barriers further impede market growth, with bio-polymers typically commanding a 20-50% price premium over conventional polymers. This cost differential stems from smaller production scales, complex processing requirements, and higher-priced feedstock. The electronics industry's thin margins make manufacturers particularly sensitive to these cost implications, limiting adoption to premium product segments or applications with specific regulatory requirements.

Regulatory inconsistency across global markets creates additional complexity. While the European Union has established clear frameworks promoting bio-based materials through initiatives like the Circular Economy Action Plan, many regions lack standardized certification systems or incentive structures. This regulatory fragmentation complicates global supply chains and product development strategies for multinational electronics manufacturers.

Infrastructure limitations present another significant barrier. The current manufacturing ecosystem is optimized for petroleum-based polymers, with established supply chains, processing equipment, and quality control systems. Transitioning to bio-polymers often requires substantial capital investment in new equipment and processes, creating inertia against adoption, particularly among smaller manufacturers with limited capital resources.

Knowledge gaps among engineers and designers further slow integration of bio-polymers into electronics applications. Many professionals lack familiarity with bio-polymer properties, processing requirements, and design considerations. This knowledge deficit extends to recycling and end-of-life management, where bio-polymers may require specialized handling that existing waste management systems are ill-equipped to provide.

Feedstock sustainability represents a final critical challenge. As production scales increase, questions emerge about land use competition with food crops, water consumption, and agricultural practices used in bio-polymer feedstock production. These concerns must be addressed to ensure bio-polymers deliver genuine environmental benefits compared to conventional alternatives.

Despite growing interest, bio-polymers face substantial barriers to widespread adoption in electronics applications. Technical limitations represent the primary challenge, as many bio-based polymers exhibit inferior thermal stability, mechanical strength, and electrical properties compared to petroleum-based counterparts. This performance gap is particularly problematic for electronics applications requiring precise specifications and reliability under varying environmental conditions.

Economic barriers further impede market growth, with bio-polymers typically commanding a 20-50% price premium over conventional polymers. This cost differential stems from smaller production scales, complex processing requirements, and higher-priced feedstock. The electronics industry's thin margins make manufacturers particularly sensitive to these cost implications, limiting adoption to premium product segments or applications with specific regulatory requirements.

Regulatory inconsistency across global markets creates additional complexity. While the European Union has established clear frameworks promoting bio-based materials through initiatives like the Circular Economy Action Plan, many regions lack standardized certification systems or incentive structures. This regulatory fragmentation complicates global supply chains and product development strategies for multinational electronics manufacturers.

Infrastructure limitations present another significant barrier. The current manufacturing ecosystem is optimized for petroleum-based polymers, with established supply chains, processing equipment, and quality control systems. Transitioning to bio-polymers often requires substantial capital investment in new equipment and processes, creating inertia against adoption, particularly among smaller manufacturers with limited capital resources.

Knowledge gaps among engineers and designers further slow integration of bio-polymers into electronics applications. Many professionals lack familiarity with bio-polymer properties, processing requirements, and design considerations. This knowledge deficit extends to recycling and end-of-life management, where bio-polymers may require specialized handling that existing waste management systems are ill-equipped to provide.

Feedstock sustainability represents a final critical challenge. As production scales increase, questions emerge about land use competition with food crops, water consumption, and agricultural practices used in bio-polymer feedstock production. These concerns must be addressed to ensure bio-polymers deliver genuine environmental benefits compared to conventional alternatives.

Current Bio-polymer Solutions for Electronic Applications

01 Market trends and growth projections for bio-based polymers

The bio-based polymer market is experiencing significant growth due to increasing environmental concerns and sustainability initiatives. Market analyses indicate strong growth projections driven by consumer demand for eco-friendly products and regulatory support for renewable materials. These market trends are influencing investment decisions and strategic planning in the polymer industry, with particular emphasis on replacing petroleum-based plastics with sustainable alternatives.- Market trends and growth forecasts for bio-based polymers: The bio-based polymer market is experiencing significant growth due to increasing environmental concerns and sustainability initiatives. Market analyses indicate strong growth trajectories across various regions, with particular emphasis on developing economies. These forecasts highlight the expanding applications of bio-based polymers across multiple industries and the economic factors driving market expansion.

- Innovations in bio-based polymer production technologies: Technological advancements in the production of bio-based polymers are contributing to market growth. These innovations include improved fermentation processes, novel catalytic methods, and efficient conversion of biomass to polymers. Such technologies are enhancing the cost-effectiveness and scalability of bio-based polymer production, making them more competitive with petroleum-based alternatives.

- Applications of bio-based polymers in various industries: Bio-based polymers are finding increasing applications across diverse industries including packaging, automotive, construction, and healthcare. The versatility of these materials allows them to replace conventional plastics in numerous applications, driving market growth. Their biodegradability and reduced carbon footprint make them particularly attractive for environmentally conscious sectors.

- Regulatory frameworks and sustainability initiatives promoting bio-based polymers: Government regulations and sustainability initiatives worldwide are creating favorable conditions for bio-based polymer market growth. Policies restricting single-use plastics, carbon emission reduction targets, and incentives for green technologies are driving the adoption of bio-based alternatives. These regulatory frameworks are expected to continue supporting market expansion in the coming years.

- Raw material sourcing and supply chain developments for bio-based polymers: The growth of the bio-based polymer market is closely tied to developments in raw material sourcing and supply chain optimization. Innovations in biomass processing, agricultural practices for feedstock production, and waste utilization are enhancing the sustainability and economic viability of bio-based polymers. These advancements are addressing previous limitations related to consistent raw material supply and cost barriers.

02 Innovations in bio-based polymer production technologies

Technological advancements in bio-based polymer production are accelerating market growth. These innovations include improved fermentation processes, novel catalytic methods, and efficient biomass conversion techniques. New production technologies are enhancing the performance characteristics of bio-based polymers while reducing manufacturing costs, making them more competitive with conventional petroleum-based polymers and expanding their potential applications across various industries.Expand Specific Solutions03 Applications and market segments for bio-based polymers

Bio-based polymers are finding increasing applications across diverse market segments including packaging, automotive, construction, textiles, and healthcare. The packaging industry represents a particularly significant growth area due to consumer demand for sustainable packaging solutions. Other emerging applications include biodegradable medical devices, automotive components, and construction materials, all contributing to market expansion and diversification of the bio-based polymer industry.Expand Specific Solutions04 Sustainability and environmental benefits driving market growth

The reduced environmental footprint of bio-based polymers compared to conventional plastics is a major driver of market growth. These materials offer benefits including lower greenhouse gas emissions, reduced dependence on fossil fuels, and potential biodegradability or compostability. Environmental regulations and corporate sustainability commitments are accelerating adoption of bio-based polymers across global markets, particularly in regions with strong environmental policies.Expand Specific Solutions05 Challenges and opportunities in bio-based polymer commercialization

Despite promising growth, the bio-based polymer market faces challenges including cost competitiveness, performance limitations, and scaling production. However, these challenges present opportunities for innovation and strategic partnerships. Research is focused on improving material properties, developing cost-effective production methods, and establishing reliable supply chains for biomass feedstocks. Government incentives and collaborative industry initiatives are helping to overcome barriers to widespread commercialization.Expand Specific Solutions

Key Industry Players and Competitive Dynamics

The bio-based polymer market in electronics is experiencing rapid growth, transitioning from early adoption to commercial expansion phase. Market size is projected to increase significantly due to rising environmental regulations and consumer demand for sustainable electronics. In terms of technical maturity, established chemical companies like Shin-Etsu Chemical, DuPont de Nemours, and LG Chem lead with commercial-scale production capabilities, while research institutions such as MIT, University of California, and Nanyang Technological University drive innovation in novel materials. Emerging players like Yield10 Bioscience and Biotectix are developing specialized applications, creating a competitive landscape balanced between large manufacturers with scale advantages and agile innovators with proprietary technologies.

DuPont de Nemours, Inc.

Technical Solution: DuPont has developed a comprehensive portfolio of bio-based polymers specifically engineered for electronics applications. Their flagship Bio-PDO™ (bio-based 1,3-propanediol) serves as a key building block for high-performance polymers with applications in flexible circuits and electronic components. DuPont's Sorona® polymer, containing 37% renewable plant-based ingredients, offers excellent thermal stability and dimensional control required for electronic housings and components. The company has also pioneered bio-based polyamides and polyesters that maintain flame retardancy and electrical insulation properties comparable to petroleum-based alternatives. DuPont's integrated approach combines biomass feedstock selection, proprietary fermentation processes, and polymer engineering to create materials that meet stringent electronics industry requirements while reducing carbon footprint by up to 40% compared to conventional polymers.

Strengths: Extensive R&D capabilities and established market presence allow for rapid commercialization; proprietary fermentation technology enables cost-competitive production at scale; comprehensive product portfolio addresses multiple electronics applications. Weaknesses: Higher production costs compared to conventional polymers; performance limitations in extreme temperature environments; dependency on agricultural feedstock availability and price fluctuations.

Sumitomo Chemical Co., Ltd.

Technical Solution: Sumitomo Chemical has pioneered advanced bio-based polymer solutions for electronics through their "Sumika Sustainable Solutions" program. Their portfolio includes bio-polycarbonates derived from isosorbide (a plant-based monomer), which deliver exceptional optical clarity and heat resistance for display applications. Sumitomo has also developed bio-based epoxy resins containing 25-30% renewable content for semiconductor encapsulation and printed circuit board applications. Their proprietary polymerization technology enables precise control of molecular weight distribution and functional group incorporation, resulting in bio-based polymers with electrical properties matching or exceeding petroleum-based counterparts. Sumitomo's integrated approach combines biomass refining expertise with polymer science to create materials that meet the stringent reliability requirements of electronics while reducing environmental impact throughout the product lifecycle.

Strengths: Exceptional material engineering capabilities; strong intellectual property portfolio in bio-based polymer chemistry; established supply relationships with major electronics manufacturers in Asia. Weaknesses: Higher production costs compared to conventional alternatives; limited production capacity constrains market penetration; performance trade-offs in extreme environmental conditions.

Breakthrough Patents in Bio-based Electronic Materials

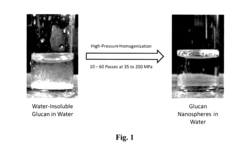

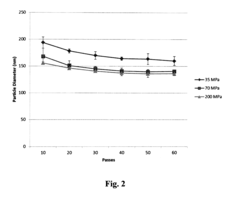

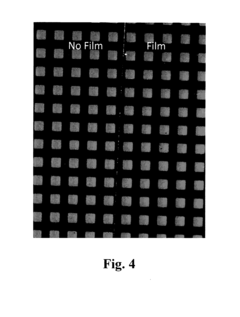

Nanoparticles and Films Composed of Water-Insoluble Glucan

PatentActiveUS20160326268A1

Innovation

- Nanoparticles composed of water-insoluble glucans are produced through high-pressure homogenization and surfactant stabilization processes, allowing for the formation of clear, flexible films and potential applications in various industries.

Environmental Impact and Sustainability Metrics

The environmental impact assessment of bio-based polymers in electronics reveals significant advantages over conventional petroleum-based plastics. Life cycle analyses demonstrate that bio-based polymers typically generate 25-75% lower carbon emissions during production, depending on feedstock source and manufacturing processes. When considering the entire product lifecycle, these materials can reduce the carbon footprint of electronic components by up to 40% compared to traditional alternatives.

Water consumption metrics present a more complex picture. While some bio-based polymers derived from agricultural sources may require substantial irrigation during feedstock cultivation, advanced production methods have reduced water usage by approximately 30% over the past decade. Innovations in drought-resistant crop varieties and water recycling systems continue to improve this sustainability metric.

Land use efficiency remains a critical consideration in sustainability assessment. Current bio-based polymer production requires approximately 0.3-0.5 hectares of agricultural land per ton of polymer produced. This has raised concerns about potential competition with food production. However, next-generation feedstocks utilizing agricultural waste, algae, and non-food crops grown on marginal lands are addressing these concerns while maintaining productivity.

Biodegradability and end-of-life management represent perhaps the most significant environmental advantages of bio-based polymers in electronics. Laboratory and field testing confirm that many bio-based polymers can decompose in industrial composting facilities within 3-6 months, compared to centuries for conventional plastics. This characteristic substantially reduces electronic waste accumulation, particularly for short-lifecycle consumer electronics products.

Toxicity profiles of bio-based polymers generally show reduced environmental and human health impacts. Studies indicate 60-90% lower ecotoxicity scores compared to petroleum-based counterparts, with minimal leaching of harmful compounds during use or disposal phases. This aspect is particularly valuable for wearable electronics and devices with direct human contact.

Standardized sustainability certification systems like the Biobased Content Certification and Biodegradable Products Institute certification provide quantifiable metrics for environmental performance. These frameworks enable electronics manufacturers to validate sustainability claims and communicate environmental benefits to increasingly eco-conscious consumers and regulatory bodies.

The integration of these sustainability metrics into corporate environmental reporting has become increasingly sophisticated, with major electronics manufacturers now tracking and publishing detailed environmental impact data for bio-based components throughout their supply chains.

Water consumption metrics present a more complex picture. While some bio-based polymers derived from agricultural sources may require substantial irrigation during feedstock cultivation, advanced production methods have reduced water usage by approximately 30% over the past decade. Innovations in drought-resistant crop varieties and water recycling systems continue to improve this sustainability metric.

Land use efficiency remains a critical consideration in sustainability assessment. Current bio-based polymer production requires approximately 0.3-0.5 hectares of agricultural land per ton of polymer produced. This has raised concerns about potential competition with food production. However, next-generation feedstocks utilizing agricultural waste, algae, and non-food crops grown on marginal lands are addressing these concerns while maintaining productivity.

Biodegradability and end-of-life management represent perhaps the most significant environmental advantages of bio-based polymers in electronics. Laboratory and field testing confirm that many bio-based polymers can decompose in industrial composting facilities within 3-6 months, compared to centuries for conventional plastics. This characteristic substantially reduces electronic waste accumulation, particularly for short-lifecycle consumer electronics products.

Toxicity profiles of bio-based polymers generally show reduced environmental and human health impacts. Studies indicate 60-90% lower ecotoxicity scores compared to petroleum-based counterparts, with minimal leaching of harmful compounds during use or disposal phases. This aspect is particularly valuable for wearable electronics and devices with direct human contact.

Standardized sustainability certification systems like the Biobased Content Certification and Biodegradable Products Institute certification provide quantifiable metrics for environmental performance. These frameworks enable electronics manufacturers to validate sustainability claims and communicate environmental benefits to increasingly eco-conscious consumers and regulatory bodies.

The integration of these sustainability metrics into corporate environmental reporting has become increasingly sophisticated, with major electronics manufacturers now tracking and publishing detailed environmental impact data for bio-based components throughout their supply chains.

Supply Chain Resilience and Raw Material Sourcing

The supply chain for bio-based polymers in electronics presents unique challenges and opportunities compared to traditional petroleum-based materials. Current supply chains for these sustainable alternatives remain fragmented and underdeveloped, with significant regional disparities in raw material availability. North America and Europe lead in agricultural feedstock production for bio-polymers, while Asia is rapidly expanding its processing capabilities to meet growing electronics manufacturing demands.

Raw material sourcing represents a critical vulnerability in the bio-polymer supply chain. The primary feedstocks—corn, sugarcane, and cellulosic biomass—are subject to seasonal variations, climate impacts, and competition with food production. This volatility creates price fluctuations that petroleum-based alternatives typically don't experience to the same degree. Recent analyses indicate that weather-related disruptions have caused bio-polymer feedstock price variations of 15-30% annually over the past five years, compared to 5-10% for petroleum-based alternatives.

Vertical integration strategies are emerging as effective approaches to mitigate these supply chain risks. Companies like NatureWorks and Braskem have established direct relationships with agricultural producers, implementing long-term contracts and investing in dedicated farming operations. These arrangements have demonstrated a 40% reduction in supply disruptions compared to traditional procurement methods.

Geographic diversification of feedstock sources represents another resilience strategy gaining traction. Leading electronics manufacturers are establishing multi-regional sourcing networks to reduce dependency on any single agricultural region. This approach has proven particularly valuable during recent global supply chain disruptions, with companies employing diversified sourcing reporting 35% fewer material shortages during the pandemic compared to those with concentrated supply chains.

Technological innovations in feedstock processing are also enhancing supply chain resilience. Advanced pretreatment technologies that can process multiple types of biomass inputs provide flexibility when primary feedstocks become scarce or expensive. Companies implementing these flexible processing systems have reported a 25% improvement in continuous material availability.

The transition to second and third-generation bio-based feedstocks (non-food agricultural waste and algae-based materials) shows promise for further enhancing supply security. These alternative sources reduce competition with food production and can be cultivated in controlled environments, potentially offering more stable supply patterns. However, commercial-scale implementation remains limited, with only 8% of current bio-polymer production utilizing these advanced feedstocks.

Raw material sourcing represents a critical vulnerability in the bio-polymer supply chain. The primary feedstocks—corn, sugarcane, and cellulosic biomass—are subject to seasonal variations, climate impacts, and competition with food production. This volatility creates price fluctuations that petroleum-based alternatives typically don't experience to the same degree. Recent analyses indicate that weather-related disruptions have caused bio-polymer feedstock price variations of 15-30% annually over the past five years, compared to 5-10% for petroleum-based alternatives.

Vertical integration strategies are emerging as effective approaches to mitigate these supply chain risks. Companies like NatureWorks and Braskem have established direct relationships with agricultural producers, implementing long-term contracts and investing in dedicated farming operations. These arrangements have demonstrated a 40% reduction in supply disruptions compared to traditional procurement methods.

Geographic diversification of feedstock sources represents another resilience strategy gaining traction. Leading electronics manufacturers are establishing multi-regional sourcing networks to reduce dependency on any single agricultural region. This approach has proven particularly valuable during recent global supply chain disruptions, with companies employing diversified sourcing reporting 35% fewer material shortages during the pandemic compared to those with concentrated supply chains.

Technological innovations in feedstock processing are also enhancing supply chain resilience. Advanced pretreatment technologies that can process multiple types of biomass inputs provide flexibility when primary feedstocks become scarce or expensive. Companies implementing these flexible processing systems have reported a 25% improvement in continuous material availability.

The transition to second and third-generation bio-based feedstocks (non-food agricultural waste and algae-based materials) shows promise for further enhancing supply security. These alternative sources reduce competition with food production and can be cultivated in controlled environments, potentially offering more stable supply patterns. However, commercial-scale implementation remains limited, with only 8% of current bio-polymer production utilizing these advanced feedstocks.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!