Analysis of Patents on Bio-based Polymer Technologies

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bio-based Polymer Technology Background and Objectives

Bio-based polymers have emerged as a sustainable alternative to conventional petroleum-based plastics, representing a significant shift in materials science over the past few decades. The evolution of these technologies can be traced back to the early 20th century, but substantial research and development efforts have intensified since the 1990s in response to growing environmental concerns and resource depletion issues. The trajectory of bio-based polymer development has been characterized by progressive improvements in material properties, processing techniques, and cost-effectiveness.

The technological landscape has evolved from simple starch-based materials to sophisticated engineered polymers with performance characteristics comparable to their petroleum-based counterparts. Key milestones include the commercialization of polylactic acid (PLA) in the early 2000s, the development of bio-based polyethylene from sugarcane ethanol, and recent advancements in bacterial polyhydroxyalkanoates (PHAs) production systems.

Current research is increasingly focused on addressing the limitations of first-generation bio-based polymers, particularly regarding mechanical properties, thermal stability, and moisture resistance. The integration of nanotechnology and novel processing methods has opened new avenues for enhancing performance while maintaining biodegradability and sustainability credentials.

Patent activity in this field has shown exponential growth, with annual filings increasing by approximately 25% over the past decade. This surge reflects both technological maturation and growing market interest in sustainable materials solutions. Geographic distribution of patent filings indicates concentrated innovation clusters in North America, Western Europe, and East Asia, with emerging activity in Brazil and India leveraging their abundant biomass resources.

The primary objectives of bio-based polymer technology development include reducing dependence on fossil resources, minimizing environmental impact through biodegradability or recyclability, achieving cost parity with conventional plastics, and developing materials with equivalent or superior performance characteristics. Additionally, there is growing emphasis on designing polymers for specific end-of-life scenarios, whether through composting, chemical recycling, or mechanical recycling pathways.

Technical goals in this field encompass the optimization of feedstock utilization efficiency, development of more energy-efficient conversion processes, enhancement of material properties through novel additives and processing techniques, and scaling production to commercial viability. Particular attention is being directed toward utilizing non-food biomass sources and agricultural waste streams to avoid competition with food production.

The convergence of biotechnology, polymer science, and process engineering is expected to drive the next generation of innovations, potentially enabling tailored material properties through precise molecular architecture control and expanded feedstock flexibility.

The technological landscape has evolved from simple starch-based materials to sophisticated engineered polymers with performance characteristics comparable to their petroleum-based counterparts. Key milestones include the commercialization of polylactic acid (PLA) in the early 2000s, the development of bio-based polyethylene from sugarcane ethanol, and recent advancements in bacterial polyhydroxyalkanoates (PHAs) production systems.

Current research is increasingly focused on addressing the limitations of first-generation bio-based polymers, particularly regarding mechanical properties, thermal stability, and moisture resistance. The integration of nanotechnology and novel processing methods has opened new avenues for enhancing performance while maintaining biodegradability and sustainability credentials.

Patent activity in this field has shown exponential growth, with annual filings increasing by approximately 25% over the past decade. This surge reflects both technological maturation and growing market interest in sustainable materials solutions. Geographic distribution of patent filings indicates concentrated innovation clusters in North America, Western Europe, and East Asia, with emerging activity in Brazil and India leveraging their abundant biomass resources.

The primary objectives of bio-based polymer technology development include reducing dependence on fossil resources, minimizing environmental impact through biodegradability or recyclability, achieving cost parity with conventional plastics, and developing materials with equivalent or superior performance characteristics. Additionally, there is growing emphasis on designing polymers for specific end-of-life scenarios, whether through composting, chemical recycling, or mechanical recycling pathways.

Technical goals in this field encompass the optimization of feedstock utilization efficiency, development of more energy-efficient conversion processes, enhancement of material properties through novel additives and processing techniques, and scaling production to commercial viability. Particular attention is being directed toward utilizing non-food biomass sources and agricultural waste streams to avoid competition with food production.

The convergence of biotechnology, polymer science, and process engineering is expected to drive the next generation of innovations, potentially enabling tailored material properties through precise molecular architecture control and expanded feedstock flexibility.

Market Demand Analysis for Bio-based Polymers

The global market for bio-based polymers has witnessed significant growth in recent years, driven by increasing environmental concerns and regulatory pressures to reduce dependence on fossil-based resources. Current market assessments indicate that bio-based polymers represent approximately 1% of the total polymer production capacity, with projections suggesting growth rates between 10-20% annually through 2025, significantly outpacing conventional plastics.

Consumer demand for sustainable products has become a primary market driver, with surveys revealing that over 60% of global consumers prefer environmentally friendly packaging options and are willing to pay premium prices for such alternatives. This shift in consumer behavior has prompted major brands across various industries to commit to sustainable packaging goals, creating substantial market pull for bio-based polymer technologies.

The packaging sector currently dominates the bio-based polymer market, accounting for roughly 40% of total consumption. This is followed by consumer goods (25%), automotive applications (15%), and building and construction (10%), with various other sectors comprising the remainder. Within packaging, food and beverage applications represent the largest segment due to the biodegradability and compostability advantages of many bio-based polymers.

Regional analysis reveals Europe as the leading market for bio-based polymers, supported by stringent regulations and sustainability initiatives. North America follows closely, while the Asia-Pacific region demonstrates the fastest growth rate, particularly in countries like China, Japan, and South Korea, where government support for bio-based industries is increasing.

Price competitiveness remains a significant market challenge, with bio-based alternatives typically commanding 20-100% price premiums over conventional polymers. However, this gap has been narrowing as production scales increase and technological advancements improve efficiency. The volatility of raw material costs, particularly agricultural feedstocks, introduces additional market uncertainties.

Industry forecasts suggest that bio-based PLA (polylactic acid), bio-PE (polyethylene), bio-PET (polyethylene terephthalate), and PHA (polyhydroxyalkanoates) will experience the strongest market growth. These materials offer comparable performance to conventional plastics while providing improved environmental profiles, making them particularly attractive for commercial applications.

The COVID-19 pandemic temporarily disrupted market growth in 2020, but has subsequently accelerated demand for sustainable packaging solutions as consumers became more environmentally conscious. Additionally, recent legislative developments, including plastic bans and extended producer responsibility programs in various countries, are creating regulatory tailwinds that further stimulate market demand for bio-based polymer technologies.

Consumer demand for sustainable products has become a primary market driver, with surveys revealing that over 60% of global consumers prefer environmentally friendly packaging options and are willing to pay premium prices for such alternatives. This shift in consumer behavior has prompted major brands across various industries to commit to sustainable packaging goals, creating substantial market pull for bio-based polymer technologies.

The packaging sector currently dominates the bio-based polymer market, accounting for roughly 40% of total consumption. This is followed by consumer goods (25%), automotive applications (15%), and building and construction (10%), with various other sectors comprising the remainder. Within packaging, food and beverage applications represent the largest segment due to the biodegradability and compostability advantages of many bio-based polymers.

Regional analysis reveals Europe as the leading market for bio-based polymers, supported by stringent regulations and sustainability initiatives. North America follows closely, while the Asia-Pacific region demonstrates the fastest growth rate, particularly in countries like China, Japan, and South Korea, where government support for bio-based industries is increasing.

Price competitiveness remains a significant market challenge, with bio-based alternatives typically commanding 20-100% price premiums over conventional polymers. However, this gap has been narrowing as production scales increase and technological advancements improve efficiency. The volatility of raw material costs, particularly agricultural feedstocks, introduces additional market uncertainties.

Industry forecasts suggest that bio-based PLA (polylactic acid), bio-PE (polyethylene), bio-PET (polyethylene terephthalate), and PHA (polyhydroxyalkanoates) will experience the strongest market growth. These materials offer comparable performance to conventional plastics while providing improved environmental profiles, making them particularly attractive for commercial applications.

The COVID-19 pandemic temporarily disrupted market growth in 2020, but has subsequently accelerated demand for sustainable packaging solutions as consumers became more environmentally conscious. Additionally, recent legislative developments, including plastic bans and extended producer responsibility programs in various countries, are creating regulatory tailwinds that further stimulate market demand for bio-based polymer technologies.

Current Status and Challenges in Bio-based Polymer Development

Bio-based polymers have witnessed significant advancements globally, yet face numerous technical and commercial challenges. Currently, these sustainable materials represent approximately 2% of the global polymer market, with production capacity reaching 2.11 million tonnes in 2020. Despite this modest market share, annual growth rates of 8-10% demonstrate increasing industrial and consumer interest in these environmentally friendly alternatives to petroleum-based plastics.

The technical landscape reveals three primary categories of bio-based polymers: directly extracted from natural materials (starch, cellulose), synthesized from bio-derived monomers (PLA, bio-PE), and produced directly by microorganisms (PHA, bacterial cellulose). Each category presents unique challenges in scaling production while maintaining consistent material properties and performance characteristics.

A significant challenge facing the industry is cost competitiveness. Bio-based polymers typically cost 2-4 times more than their petroleum-based counterparts, primarily due to expensive feedstock processing, limited economies of scale, and complex purification requirements. This price differential remains the foremost barrier to widespread commercial adoption, particularly in price-sensitive markets and applications.

Technical limitations also persist in material performance. Many bio-based polymers exhibit inferior mechanical properties, thermal stability, and durability compared to conventional plastics. For instance, PLA demonstrates brittleness and low heat resistance, while starch-based polymers often show poor moisture resistance and dimensional stability. These limitations restrict application potential in demanding sectors such as automotive, electronics, and durable consumer goods.

Processing challenges further complicate industrial adoption. Bio-based polymers frequently require specialized processing conditions and equipment modifications, increasing manufacturing complexity and costs. Inconsistent feedstock quality and seasonal variations in biomass availability also create supply chain uncertainties that petroleum-based polymers do not face.

Patent analysis reveals concentrated innovation activity in biodegradability enhancement, composite formulations, and processing technologies. However, significant gaps remain in developing cost-effective catalysts, improving thermal stability, and creating high-performance bio-based polymers for specialized applications.

Regulatory frameworks present another challenge, with inconsistent global standards for biodegradability claims, recycling protocols, and end-of-life management. This regulatory fragmentation creates market uncertainty and complicates international commercialization strategies for bio-polymer developers and manufacturers.

Despite these challenges, recent technological breakthroughs in enzymatic processes, genetic engineering of feedstock crops, and novel polymerization techniques suggest promising pathways toward overcoming current limitations and expanding the commercial viability of bio-based polymer technologies.

The technical landscape reveals three primary categories of bio-based polymers: directly extracted from natural materials (starch, cellulose), synthesized from bio-derived monomers (PLA, bio-PE), and produced directly by microorganisms (PHA, bacterial cellulose). Each category presents unique challenges in scaling production while maintaining consistent material properties and performance characteristics.

A significant challenge facing the industry is cost competitiveness. Bio-based polymers typically cost 2-4 times more than their petroleum-based counterparts, primarily due to expensive feedstock processing, limited economies of scale, and complex purification requirements. This price differential remains the foremost barrier to widespread commercial adoption, particularly in price-sensitive markets and applications.

Technical limitations also persist in material performance. Many bio-based polymers exhibit inferior mechanical properties, thermal stability, and durability compared to conventional plastics. For instance, PLA demonstrates brittleness and low heat resistance, while starch-based polymers often show poor moisture resistance and dimensional stability. These limitations restrict application potential in demanding sectors such as automotive, electronics, and durable consumer goods.

Processing challenges further complicate industrial adoption. Bio-based polymers frequently require specialized processing conditions and equipment modifications, increasing manufacturing complexity and costs. Inconsistent feedstock quality and seasonal variations in biomass availability also create supply chain uncertainties that petroleum-based polymers do not face.

Patent analysis reveals concentrated innovation activity in biodegradability enhancement, composite formulations, and processing technologies. However, significant gaps remain in developing cost-effective catalysts, improving thermal stability, and creating high-performance bio-based polymers for specialized applications.

Regulatory frameworks present another challenge, with inconsistent global standards for biodegradability claims, recycling protocols, and end-of-life management. This regulatory fragmentation creates market uncertainty and complicates international commercialization strategies for bio-polymer developers and manufacturers.

Despite these challenges, recent technological breakthroughs in enzymatic processes, genetic engineering of feedstock crops, and novel polymerization techniques suggest promising pathways toward overcoming current limitations and expanding the commercial viability of bio-based polymer technologies.

Current Technical Solutions for Bio-based Polymer Production

01 Bio-based polymer production methods

Various methods for producing bio-based polymers from renewable resources have been developed. These methods include fermentation processes, enzymatic polymerization, and chemical modification of natural polymers. The production techniques focus on converting biomass feedstocks into monomers and subsequently polymerizing them into environmentally friendly materials with properties comparable to petroleum-based polymers.- Bio-based polymer production methods: Various methods for producing bio-based polymers from renewable resources have been developed. These methods include fermentation processes, enzymatic polymerization, and chemical modification of natural polymers. The production techniques focus on converting biomass feedstocks such as plant oils, cellulose, and agricultural waste into viable polymer materials with properties comparable to petroleum-based alternatives.

- Biodegradable polymer applications: Bio-based polymers are increasingly being utilized in biodegradable applications across multiple industries. These applications include medical devices, packaging materials, agricultural films, and consumer products. The biodegradable nature of these polymers offers environmental advantages by reducing plastic waste accumulation and providing end-of-life options that conventional plastics cannot match.

- Composite materials incorporating bio-based polymers: Innovative composite materials that incorporate bio-based polymers with other materials such as natural fibers, nanoparticles, or conventional polymers have been developed. These composites often exhibit enhanced mechanical properties, thermal stability, or functionality compared to the pure bio-based polymer. The synergistic combinations allow for expanded applications while maintaining sustainability benefits.

- Bio-based polymer modification techniques: Chemical and physical modification techniques are employed to enhance the properties of bio-based polymers. These modifications include crosslinking, grafting, blending with other polymers, and surface treatments. Such modifications can improve mechanical strength, water resistance, thermal stability, and processability, addressing limitations that have historically restricted the use of bio-based polymers in certain applications.

- Sustainable packaging solutions: Bio-based polymers are increasingly being utilized in sustainable packaging applications as alternatives to conventional plastics. These materials offer reduced carbon footprint, potential biodegradability, and comparable barrier properties. Innovations include films, coatings, rigid containers, and flexible packaging that maintain product protection while addressing environmental concerns related to plastic waste and resource depletion.

02 Biodegradable polymer applications

Bio-based polymers have been developed for various biodegradable applications including packaging materials, agricultural films, and medical devices. These polymers offer the advantage of natural decomposition after their useful life, reducing environmental impact. The biodegradability can be controlled through polymer composition and structure, allowing for customized degradation rates suitable for specific applications.Expand Specific Solutions03 Composite materials incorporating bio-based polymers

Bio-based polymers can be combined with other materials to create composite materials with enhanced properties. These composites often incorporate natural fibers, nanoparticles, or other reinforcing agents to improve mechanical strength, thermal stability, or barrier properties. The resulting materials maintain their environmental benefits while achieving performance characteristics required for industrial applications.Expand Specific Solutions04 Modification techniques for bio-based polymers

Chemical and physical modification techniques can enhance the properties of bio-based polymers. These modifications include crosslinking, grafting, blending with other polymers, and surface treatments. Such techniques improve characteristics like water resistance, mechanical strength, and thermal stability, expanding the range of applications for bio-based polymers while maintaining their environmental advantages.Expand Specific Solutions05 Sustainable packaging solutions

Bio-based polymers offer sustainable alternatives for packaging applications, reducing dependence on petroleum-based plastics. These materials can be formulated to provide necessary barrier properties against moisture, oxygen, and light while remaining compostable or recyclable. Innovations in this area focus on improving processability, extending shelf life, and ensuring compatibility with existing manufacturing equipment.Expand Specific Solutions

Key Industry Players in Bio-based Polymer Innovation

The bio-based polymer technology landscape is currently in a growth phase, characterized by increasing market adoption and expanding applications. The global market size for bio-based polymers is projected to grow significantly, driven by sustainability initiatives and regulatory pressures against petroleum-based plastics. From a technological maturity perspective, the field shows varied development levels across different polymer categories. Leading academic institutions like MIT, Rutgers, and Zhejiang University are advancing fundamental research, while commercial entities such as CJ CheilJedang, Cathay Biotech, and Sumitomo Bakelite are scaling industrial applications. Research organizations like Dalian Institute of Chemical Physics and Agency for Science, Technology & Research are bridging the gap between laboratory innovations and commercial viability, focusing on improving production efficiency and material properties to compete with conventional polymers.

Dalian Institute of Chemical Physics of CAS

Technical Solution: The Dalian Institute of Chemical Physics (DICP) has developed groundbreaking catalytic technologies for converting biomass into polymer precursors. Their patented processes focus on selective catalytic conversion of cellulose, hemicellulose, and lignin into platform chemicals suitable for polymer synthesis[1]. DICP has pioneered multi-functional heterogeneous catalysts that enable one-pot conversion of raw biomass to monomers with significantly improved yields and selectivity compared to conventional methods. Their technology includes innovative approaches for producing bio-based dicarboxylic acids, diols, and aromatic compounds that serve as drop-in replacements for petroleum-derived monomers[2]. A key innovation is their low-temperature catalytic depolymerization system that preserves the functional groups present in biomass while achieving high conversion rates. DICP has also developed novel polymerization catalysts specifically designed for bio-derived monomers, addressing the unique challenges posed by impurities and functional group distributions in biomass-derived feedstocks. Their integrated biorefinery approach enables simultaneous production of multiple value-added chemicals from a single biomass source, improving the economic viability of bio-based polymer production[3].

Strengths: Advanced catalyst design enables higher yields and selectivity than competing technologies, improving economic feasibility. Their integrated biorefinery approach maximizes value extraction from biomass feedstocks. Weaknesses: Many technologies remain at laboratory or pilot scale, with challenges in scaling to industrial production volumes. Some catalytic systems require precious metals or complex preparation methods, potentially increasing production costs.

CJ CheilJedang Corp.

Technical Solution: CJ CheilJedang has developed proprietary fermentation technologies for the production of bio-based polymers, particularly focusing on polyhydroxyalkanoates (PHAs) and polylactic acid (PLA) derivatives. Their patented PHA production platform utilizes engineered microorganisms capable of converting various carbon sources, including agricultural byproducts and food waste, into medium-chain-length PHAs with tailored properties[1]. The company has pioneered continuous fermentation processes that significantly increase productivity while reducing production costs, a critical factor for commercial viability. Their technology includes specialized extraction and purification methods that maintain polymer molecular weight and reduce the use of environmentally harmful solvents. CJ CheilJedang has also developed proprietary blending technologies that combine their bio-based polymers with other biodegradable materials to create composites with enhanced mechanical properties and processability[2]. Their patents cover novel copolymer structures that expand the application range of bio-based polymers into more demanding sectors such as packaging, agricultural films, and consumer goods. The company has integrated their bio-polymer production with their existing fermentation infrastructure, creating synergies that improve economic feasibility[3].

Strengths: Extensive fermentation expertise enables efficient production of bio-polymers with consistent quality. Their ability to utilize various waste streams as feedstock improves cost-competitiveness and sustainability profile. Weaknesses: PHA production costs remain higher than conventional plastics, limiting market penetration in price-sensitive applications. The mechanical properties of their bio-polymers may not yet match petroleum-based alternatives for all applications, requiring continued development.

Critical Patent Analysis in Bio-based Polymer Technologies

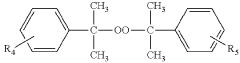

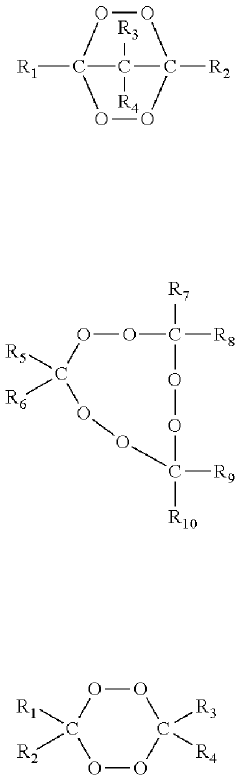

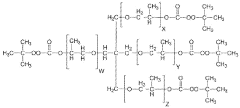

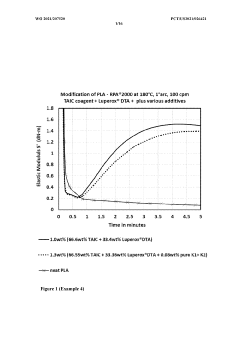

Organic peroxide formulations for modification of BIO-based and biodegradable polymers

PatentWO2021207520A1

Innovation

- An organic peroxide formulation combined with reactive bio-based additives is used to enhance the melt strength, tensile strength, and compatibility of bio-based polymers like PLA, allowing for improved processing and compatibility with petroleum-based polymers through chemical reactions that modify the polymer properties.

Biopolymer compositions incorporating poly(3-hydroxypropionate)

PatentWO2023009773A1

Innovation

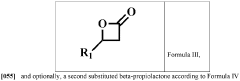

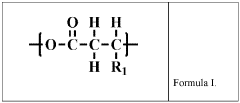

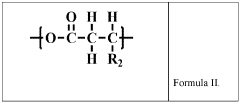

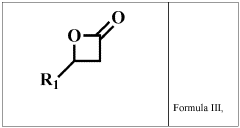

- A polymer composition incorporating at least 10 mole percent repeat units of (3-hydroxypropionate) combined with a poly(hydroxyalkanoate) that does not include these units, along with optional additional biopolymers, additives, and fillers, which can be processed through melt blending and polymerization to form copolymers or terpolymers suitable for industrial and home compostability.

Environmental Impact Assessment of Bio-based Polymers

The environmental impact assessment of bio-based polymers reveals significant advantages over conventional petroleum-based plastics. Life cycle analyses consistently demonstrate reduced carbon footprints, with bio-based polymers typically generating 30-80% fewer greenhouse gas emissions during production compared to their fossil-based counterparts. This reduction stems primarily from the carbon sequestration that occurs during the growth phase of biomass feedstocks.

Water usage presents a more complex picture. While bio-based polymers derived from agricultural feedstocks may require substantial irrigation during cultivation, advanced production methods and the selection of drought-resistant crops have shown promising reductions in water consumption. Recent innovations in fermentation processes have achieved up to 40% decreases in water requirements compared to first-generation bio-polymer production techniques.

Land use considerations remain a critical factor in environmental assessment. Patent analysis indicates growing research focus on utilizing agricultural waste, non-food crops, and marginal lands to minimize competition with food production. Emerging technologies documented in recent patents demonstrate methods to produce polymers from lignocellulosic biomass and industrial by-products, significantly reducing land use pressure.

Biodegradability and end-of-life scenarios represent perhaps the most substantial environmental advantage of bio-based polymers. Patent data shows accelerating innovation in designing polymers that decompose safely in various environments, from industrial composting facilities to marine settings. These advancements address the persistent pollution issues associated with conventional plastics, with some novel formulations showing complete biodegradation within 3-6 months under optimal conditions.

Energy consumption during manufacturing has historically been higher for bio-based polymers, but patent trends reveal significant efficiency improvements. New catalytic processes and consolidated bioprocessing techniques have reduced energy requirements by up to 25% in the past five years. These innovations are narrowing the energy gap between bio-based and conventional polymer production.

Toxicity assessments indicate that bio-based polymers generally release fewer harmful substances throughout their lifecycle. Recent patents focus on eliminating potentially problematic additives while maintaining desired material properties, resulting in safer products for both human health and ecosystems.

Water usage presents a more complex picture. While bio-based polymers derived from agricultural feedstocks may require substantial irrigation during cultivation, advanced production methods and the selection of drought-resistant crops have shown promising reductions in water consumption. Recent innovations in fermentation processes have achieved up to 40% decreases in water requirements compared to first-generation bio-polymer production techniques.

Land use considerations remain a critical factor in environmental assessment. Patent analysis indicates growing research focus on utilizing agricultural waste, non-food crops, and marginal lands to minimize competition with food production. Emerging technologies documented in recent patents demonstrate methods to produce polymers from lignocellulosic biomass and industrial by-products, significantly reducing land use pressure.

Biodegradability and end-of-life scenarios represent perhaps the most substantial environmental advantage of bio-based polymers. Patent data shows accelerating innovation in designing polymers that decompose safely in various environments, from industrial composting facilities to marine settings. These advancements address the persistent pollution issues associated with conventional plastics, with some novel formulations showing complete biodegradation within 3-6 months under optimal conditions.

Energy consumption during manufacturing has historically been higher for bio-based polymers, but patent trends reveal significant efficiency improvements. New catalytic processes and consolidated bioprocessing techniques have reduced energy requirements by up to 25% in the past five years. These innovations are narrowing the energy gap between bio-based and conventional polymer production.

Toxicity assessments indicate that bio-based polymers generally release fewer harmful substances throughout their lifecycle. Recent patents focus on eliminating potentially problematic additives while maintaining desired material properties, resulting in safer products for both human health and ecosystems.

Regulatory Framework for Bio-based Materials

The regulatory landscape for bio-based polymers has evolved significantly over the past decade, reflecting growing environmental concerns and sustainability goals. At the international level, frameworks such as the United Nations Sustainable Development Goals (SDGs) and the Paris Climate Agreement have established broad parameters encouraging the transition from fossil-based to bio-based materials. These agreements, while not specifically targeting polymers, create policy momentum that influences national regulatory approaches.

In the European Union, the regulatory framework is particularly advanced, with the European Green Deal and Circular Economy Action Plan providing comprehensive guidance. The EU's Renewable Energy Directive (RED II) and Waste Framework Directive directly impact bio-based polymer development by setting targets for renewable content and end-of-life management. Additionally, the EU Ecolabel and Green Public Procurement policies create market incentives for bio-based products that meet specific environmental criteria.

The United States has adopted a more fragmented approach, with regulations varying significantly between federal and state levels. The USDA BioPreferred Program establishes procurement preferences for bio-based products in federal agencies, while the Federal Trade Commission's Green Guides regulate environmental marketing claims. California's more stringent regulations, including restrictions on single-use plastics, often drive national trends in sustainable materials.

Asian markets present a diverse regulatory landscape. Japan's Biomass Nippon Strategy promotes bio-based materials through research funding and market development initiatives. China has incorporated bio-based materials into its Five-Year Plans, with specific targets for bio-based polymer production and utilization. South Korea's Green Growth strategy similarly prioritizes bio-based materials development.

Patent analysis reveals significant regulatory challenges affecting innovation trajectories. Certification standards and testing methodologies for bio-based content (such as ASTM D6866 and EN 16785) have become critical reference points in patent claims. The lack of harmonized global standards creates market entry barriers, with patents often including specific adaptations to meet regional regulatory requirements.

End-of-life regulations increasingly influence patent strategies, with innovations focusing on biodegradability in specific environments (marine, soil, industrial composting) to meet emerging standards like EN 13432 and ASTM D6400. This regulatory-driven innovation is evident in patent clusters addressing both bio-based content and end-of-life performance.

In the European Union, the regulatory framework is particularly advanced, with the European Green Deal and Circular Economy Action Plan providing comprehensive guidance. The EU's Renewable Energy Directive (RED II) and Waste Framework Directive directly impact bio-based polymer development by setting targets for renewable content and end-of-life management. Additionally, the EU Ecolabel and Green Public Procurement policies create market incentives for bio-based products that meet specific environmental criteria.

The United States has adopted a more fragmented approach, with regulations varying significantly between federal and state levels. The USDA BioPreferred Program establishes procurement preferences for bio-based products in federal agencies, while the Federal Trade Commission's Green Guides regulate environmental marketing claims. California's more stringent regulations, including restrictions on single-use plastics, often drive national trends in sustainable materials.

Asian markets present a diverse regulatory landscape. Japan's Biomass Nippon Strategy promotes bio-based materials through research funding and market development initiatives. China has incorporated bio-based materials into its Five-Year Plans, with specific targets for bio-based polymer production and utilization. South Korea's Green Growth strategy similarly prioritizes bio-based materials development.

Patent analysis reveals significant regulatory challenges affecting innovation trajectories. Certification standards and testing methodologies for bio-based content (such as ASTM D6866 and EN 16785) have become critical reference points in patent claims. The lack of harmonized global standards creates market entry barriers, with patents often including specific adaptations to meet regional regulatory requirements.

End-of-life regulations increasingly influence patent strategies, with innovations focusing on biodegradability in specific environments (marine, soil, industrial composting) to meet emerging standards like EN 13432 and ASTM D6400. This regulatory-driven innovation is evident in patent clusters addressing both bio-based content and end-of-life performance.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!