Analysis of CO2 Capture Membrane Usage in Regulatory Context

OCT 15, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Membrane Technology Background and Objectives

Carbon dioxide capture and separation technologies have evolved significantly over the past several decades, driven by the urgent need to mitigate greenhouse gas emissions and combat climate change. Membrane-based CO2 capture represents one of the most promising approaches due to its potential for energy efficiency, operational flexibility, and reduced environmental footprint compared to conventional absorption processes. The development trajectory of membrane technology for CO2 capture can be traced back to the 1980s, with significant acceleration in research and development occurring in the early 2000s as climate concerns gained prominence.

The evolution of CO2 capture membranes has progressed through several distinct phases, beginning with simple polymeric membranes with limited selectivity and permeability, advancing to mixed matrix membranes incorporating inorganic fillers, and most recently exploring facilitated transport membranes and thermally rearranged polymers. Each iteration has sought to overcome the fundamental permeability-selectivity trade-off that has historically limited membrane performance in industrial applications.

Current technological trends indicate a shift toward multifunctional membrane materials that can withstand harsh industrial conditions while maintaining high separation performance. Research is increasingly focused on developing membranes that can operate effectively in the presence of contaminants such as SOx, NOx, and water vapor, which are common in flue gas streams from power plants and industrial facilities.

The primary technical objectives for CO2 capture membrane development include achieving CO2 permeability exceeding 1000 Barrer while maintaining CO2/N2 selectivity above 40, ensuring membrane stability for operational lifetimes of 3-5 years, and reducing manufacturing costs to make the technology economically competitive with established capture methods. Additionally, there is a growing emphasis on developing membranes that can be integrated into existing infrastructure with minimal modifications.

Regulatory frameworks worldwide are increasingly influencing the trajectory of membrane technology development. The Paris Agreement's emission reduction targets, coupled with carbon pricing mechanisms in various jurisdictions, have created a more favorable environment for CO2 capture technologies. However, the lack of standardized performance metrics and testing protocols specifically for membrane-based capture systems presents challenges for technology validation and regulatory compliance.

The intersection of technological advancement and regulatory requirements represents a critical area for future research and development. Membrane technologies must not only achieve technical performance targets but also demonstrate compliance with evolving environmental regulations, safety standards, and reporting requirements to gain widespread adoption in industrial carbon capture applications.

The evolution of CO2 capture membranes has progressed through several distinct phases, beginning with simple polymeric membranes with limited selectivity and permeability, advancing to mixed matrix membranes incorporating inorganic fillers, and most recently exploring facilitated transport membranes and thermally rearranged polymers. Each iteration has sought to overcome the fundamental permeability-selectivity trade-off that has historically limited membrane performance in industrial applications.

Current technological trends indicate a shift toward multifunctional membrane materials that can withstand harsh industrial conditions while maintaining high separation performance. Research is increasingly focused on developing membranes that can operate effectively in the presence of contaminants such as SOx, NOx, and water vapor, which are common in flue gas streams from power plants and industrial facilities.

The primary technical objectives for CO2 capture membrane development include achieving CO2 permeability exceeding 1000 Barrer while maintaining CO2/N2 selectivity above 40, ensuring membrane stability for operational lifetimes of 3-5 years, and reducing manufacturing costs to make the technology economically competitive with established capture methods. Additionally, there is a growing emphasis on developing membranes that can be integrated into existing infrastructure with minimal modifications.

Regulatory frameworks worldwide are increasingly influencing the trajectory of membrane technology development. The Paris Agreement's emission reduction targets, coupled with carbon pricing mechanisms in various jurisdictions, have created a more favorable environment for CO2 capture technologies. However, the lack of standardized performance metrics and testing protocols specifically for membrane-based capture systems presents challenges for technology validation and regulatory compliance.

The intersection of technological advancement and regulatory requirements represents a critical area for future research and development. Membrane technologies must not only achieve technical performance targets but also demonstrate compliance with evolving environmental regulations, safety standards, and reporting requirements to gain widespread adoption in industrial carbon capture applications.

Market Demand Analysis for Carbon Capture Solutions

The global carbon capture market is experiencing significant growth, driven by increasing regulatory pressures and corporate sustainability commitments. Current market valuations place the carbon capture, utilization, and storage (CCUS) sector at approximately $2.2 billion in 2022, with projections indicating expansion to reach $7.0 billion by 2030, representing a compound annual growth rate (CAGR) of 15.6%. This robust growth trajectory underscores the escalating demand for effective carbon capture solutions across various industries.

Industrial sectors, particularly power generation, cement manufacturing, steel production, and chemical processing, constitute the primary market segments for carbon capture technologies. These industries collectively account for over 70% of global industrial CO2 emissions, creating substantial demand for membrane-based and other capture technologies. The power generation sector alone represents nearly 40% of the current market share for carbon capture solutions.

Regional analysis reveals varying levels of market maturity and growth potential. North America currently leads the market with approximately 35% share, followed by Europe at 30% and Asia-Pacific at 25%. However, the Asia-Pacific region is expected to demonstrate the fastest growth rate over the next decade, primarily due to China's aggressive decarbonization targets and industrial expansion.

Regulatory frameworks are increasingly becoming key market drivers. The implementation of carbon pricing mechanisms in over 45 countries has created economic incentives for carbon capture adoption. The European Union's Emissions Trading System (EU ETS) carbon price has reached €80-90 per tonne, while various tax credits in the United States, such as the 45Q tax credit offering up to $85 per tonne for sequestered CO2, are stimulating market growth.

Customer demand patterns indicate a shift toward integrated solutions that combine capture technology with utilization or storage options. End-users are increasingly seeking technologies that offer lower energy penalties, reduced operational costs, and smaller physical footprints. Membrane-based systems are gaining traction due to their modularity, scalability, and potential for retrofit applications in existing facilities.

Market forecasts suggest that membrane-based carbon capture technologies specifically will grow at a CAGR of 17.8% through 2030, outpacing the overall carbon capture market. This accelerated growth is attributed to advancements in membrane materials science, improved separation efficiencies, and decreasing manufacturing costs. Industry analysts project that membrane technologies could capture up to 25% of the total carbon capture market by 2030, compared to approximately 15% today.

Industrial sectors, particularly power generation, cement manufacturing, steel production, and chemical processing, constitute the primary market segments for carbon capture technologies. These industries collectively account for over 70% of global industrial CO2 emissions, creating substantial demand for membrane-based and other capture technologies. The power generation sector alone represents nearly 40% of the current market share for carbon capture solutions.

Regional analysis reveals varying levels of market maturity and growth potential. North America currently leads the market with approximately 35% share, followed by Europe at 30% and Asia-Pacific at 25%. However, the Asia-Pacific region is expected to demonstrate the fastest growth rate over the next decade, primarily due to China's aggressive decarbonization targets and industrial expansion.

Regulatory frameworks are increasingly becoming key market drivers. The implementation of carbon pricing mechanisms in over 45 countries has created economic incentives for carbon capture adoption. The European Union's Emissions Trading System (EU ETS) carbon price has reached €80-90 per tonne, while various tax credits in the United States, such as the 45Q tax credit offering up to $85 per tonne for sequestered CO2, are stimulating market growth.

Customer demand patterns indicate a shift toward integrated solutions that combine capture technology with utilization or storage options. End-users are increasingly seeking technologies that offer lower energy penalties, reduced operational costs, and smaller physical footprints. Membrane-based systems are gaining traction due to their modularity, scalability, and potential for retrofit applications in existing facilities.

Market forecasts suggest that membrane-based carbon capture technologies specifically will grow at a CAGR of 17.8% through 2030, outpacing the overall carbon capture market. This accelerated growth is attributed to advancements in membrane materials science, improved separation efficiencies, and decreasing manufacturing costs. Industry analysts project that membrane technologies could capture up to 25% of the total carbon capture market by 2030, compared to approximately 15% today.

Current Status and Challenges in Membrane-Based CO2 Capture

Membrane-based CO2 capture technology has emerged as a promising solution for carbon emissions reduction, with significant advancements achieved globally over the past decade. Currently, polymeric membranes dominate the commercial landscape, with materials such as polyimides, polysulfones, and cellulose acetate demonstrating moderate CO2 selectivity and permeability. These conventional membranes typically achieve CO2/N2 selectivity of 20-50 and CO2 permeability of 10-100 Barrers, which represents a substantial improvement from early generations but remains below theoretical performance limits.

Mixed matrix membranes (MMMs), incorporating both polymeric matrices and inorganic fillers like metal-organic frameworks (MOFs) and zeolites, have shown enhanced separation performance in laboratory settings. However, their translation to industrial scale faces significant challenges related to manufacturing consistency, long-term stability, and cost-effectiveness. Recent field trials of MMMs have demonstrated promising results with up to 30% improvement in separation efficiency compared to conventional polymeric membranes.

Facilitated transport membranes, utilizing carriers that selectively and reversibly react with CO2, represent another advanced approach currently under development. These membranes have achieved impressive laboratory-scale selectivity values exceeding 100, but suffer from stability issues in real-world conditions, particularly in the presence of impurities like SOx and NOx commonly found in flue gas streams.

The geographical distribution of membrane technology development shows concentration in North America, Europe, and East Asia, with the United States, Germany, Japan, and China leading patent applications. Academic-industrial partnerships have accelerated in recent years, particularly in regions with stringent carbon regulations or carbon pricing mechanisms.

Major technical challenges currently limiting widespread adoption include membrane fouling and plasticization in real flue gas environments, which significantly reduce operational lifetimes. Most membranes experience performance degradation of 15-30% within the first 1,000 hours of operation under industrial conditions. Additionally, the trade-off between permeability and selectivity (Robeson upper bound) continues to constrain membrane performance optimization.

Scalability presents another significant hurdle, as many high-performance membrane materials developed in laboratories prove difficult to manufacture at industrial scale while maintaining consistent properties and reasonable costs. Current manufacturing techniques struggle to produce defect-free membranes with thicknesses below 100 nm at scale, limiting the achievable flux rates necessary for economic viability in large CO2 emission sources.

Regulatory frameworks globally remain inconsistent regarding performance standards and certification requirements for membrane-based carbon capture systems, creating market uncertainty that hampers investment and commercialization efforts. This regulatory landscape varies significantly across regions, with the EU establishing the most comprehensive standards for membrane-based capture technologies.

Mixed matrix membranes (MMMs), incorporating both polymeric matrices and inorganic fillers like metal-organic frameworks (MOFs) and zeolites, have shown enhanced separation performance in laboratory settings. However, their translation to industrial scale faces significant challenges related to manufacturing consistency, long-term stability, and cost-effectiveness. Recent field trials of MMMs have demonstrated promising results with up to 30% improvement in separation efficiency compared to conventional polymeric membranes.

Facilitated transport membranes, utilizing carriers that selectively and reversibly react with CO2, represent another advanced approach currently under development. These membranes have achieved impressive laboratory-scale selectivity values exceeding 100, but suffer from stability issues in real-world conditions, particularly in the presence of impurities like SOx and NOx commonly found in flue gas streams.

The geographical distribution of membrane technology development shows concentration in North America, Europe, and East Asia, with the United States, Germany, Japan, and China leading patent applications. Academic-industrial partnerships have accelerated in recent years, particularly in regions with stringent carbon regulations or carbon pricing mechanisms.

Major technical challenges currently limiting widespread adoption include membrane fouling and plasticization in real flue gas environments, which significantly reduce operational lifetimes. Most membranes experience performance degradation of 15-30% within the first 1,000 hours of operation under industrial conditions. Additionally, the trade-off between permeability and selectivity (Robeson upper bound) continues to constrain membrane performance optimization.

Scalability presents another significant hurdle, as many high-performance membrane materials developed in laboratories prove difficult to manufacture at industrial scale while maintaining consistent properties and reasonable costs. Current manufacturing techniques struggle to produce defect-free membranes with thicknesses below 100 nm at scale, limiting the achievable flux rates necessary for economic viability in large CO2 emission sources.

Regulatory frameworks globally remain inconsistent regarding performance standards and certification requirements for membrane-based carbon capture systems, creating market uncertainty that hampers investment and commercialization efforts. This regulatory landscape varies significantly across regions, with the EU establishing the most comprehensive standards for membrane-based capture technologies.

Current Membrane Solutions for Carbon Dioxide Capture

01 Polymer-based membranes for CO2 capture

Polymer-based membranes are widely used for CO2 capture due to their versatility and tunable properties. These membranes can be designed with specific functional groups that enhance CO2 selectivity and permeability. Various polymers such as polyimides, polyethylene oxide, and polysulfones can be modified to improve their CO2 separation performance. The incorporation of additives or the creation of mixed matrix membranes can further enhance the CO2 capture efficiency of these polymer-based systems.- Polymer-based membranes for CO2 capture: Polymer-based membranes are widely used for CO2 capture due to their versatility and processability. These membranes can be engineered with specific chemical structures to enhance CO2 selectivity and permeability. Various polymers such as polyimides, polysulfones, and cellulose derivatives can be modified with functional groups that have high affinity for CO2, improving the capture efficiency. The polymer matrix can also be optimized for mechanical stability and durability under industrial operating conditions.

- Mixed matrix membranes incorporating fillers: Mixed matrix membranes combine polymeric materials with inorganic fillers to enhance CO2 capture performance. These fillers, such as metal-organic frameworks (MOFs), zeolites, or silica particles, create additional pathways and adsorption sites for CO2 molecules. The synergistic effect between the polymer matrix and the dispersed fillers results in improved selectivity and permeability compared to pure polymer membranes. The interface between the fillers and polymer matrix is critical for preventing defects and maintaining membrane integrity during operation.

- Facilitated transport membranes: Facilitated transport membranes incorporate carrier molecules that selectively and reversibly react with CO2, enhancing the transport of carbon dioxide across the membrane. These carriers, such as amines or carbonate salts, form complexes with CO2 at the feed side and release it at the permeate side, effectively increasing the CO2 flux. The membrane design focuses on optimizing carrier concentration, mobility, and stability to maintain high performance over extended operation periods. This approach significantly improves selectivity for CO2 over other gases present in flue gas streams.

- Hollow fiber and thin-film composite membrane configurations: Membrane configuration plays a crucial role in CO2 capture efficiency. Hollow fiber membranes provide high surface area-to-volume ratios, making them suitable for large-scale applications. Thin-film composite membranes consist of an ultrathin selective layer supported on a porous substrate, combining high permeability with mechanical strength. These configurations can be optimized for specific operating conditions, such as temperature, pressure, and gas composition. Advanced manufacturing techniques allow for precise control of membrane thickness and structure, minimizing mass transfer resistance while maintaining selectivity.

- Temperature and pressure-responsive membrane systems: Temperature and pressure-responsive membrane systems adapt their properties based on operating conditions to optimize CO2 capture. These smart membranes can change their permeability and selectivity in response to environmental stimuli, allowing for dynamic operation. Some designs incorporate phase-change materials or thermally responsive polymers that adjust their configuration at different temperatures. Pressure-swing systems utilize membranes that perform differently under varying pressure conditions, enabling more efficient separation cycles. These responsive systems can significantly reduce the energy requirements for CO2 capture compared to conventional fixed-property membranes.

02 Facilitated transport membranes for CO2 separation

Facilitated transport membranes incorporate carriers or functional groups that specifically interact with CO2 molecules, enhancing selectivity and transport rates. These membranes often contain amine groups or other CO2-philic moieties that form reversible complexes with CO2, allowing for selective transport across the membrane. The carrier-mediated transport mechanism significantly improves CO2/N2 and CO2/CH4 separation factors compared to conventional membranes, making them particularly effective for post-combustion carbon capture applications.Expand Specific Solutions03 Inorganic and ceramic membranes for high-temperature CO2 capture

Inorganic and ceramic membranes offer superior thermal and chemical stability for CO2 capture in harsh environments. These membranes, typically made from materials such as zeolites, silica, alumina, or metal oxides, can operate at elevated temperatures and pressures where polymer membranes would fail. Their rigid pore structure allows for molecular sieving of CO2 from other gases. Some advanced ceramic membranes incorporate alkali metal carbonates or other CO2-selective components to enhance separation performance while maintaining structural integrity under extreme conditions.Expand Specific Solutions04 Mixed matrix membranes combining organic and inorganic materials

Mixed matrix membranes (MMMs) integrate inorganic fillers within a polymer matrix to combine the advantages of both materials. The inorganic components, such as metal-organic frameworks (MOFs), zeolites, or carbon nanotubes, provide enhanced CO2 selectivity and permeability, while the polymer matrix offers processability and mechanical stability. These composite membranes can overcome the permeability-selectivity trade-off that limits conventional membranes. The interface between the filler and polymer matrix is crucial for optimizing performance, with various surface modifications employed to improve compatibility.Expand Specific Solutions05 Membrane module designs and system integration for CO2 capture

Effective CO2 capture requires not only advanced membrane materials but also optimized module designs and system integration. Various membrane configurations, including hollow fiber, spiral wound, and flat sheet modules, offer different advantages in terms of packing density, pressure drop, and fouling resistance. Multi-stage membrane systems can achieve higher CO2 purity and recovery rates. Integration with other capture technologies or process optimization through heat integration and pressure management can significantly improve the overall efficiency and economics of membrane-based CO2 capture systems.Expand Specific Solutions

Key Industry Players in CO2 Capture Membrane Development

The CO2 capture membrane market is in a growth phase, characterized by increasing regulatory pressures driving adoption across industries. The market is expanding rapidly with projections indicating substantial growth as carbon reduction policies become more stringent globally. Technologically, the field shows varying maturity levels, with established players like Air Liquide, ExxonMobil, and Sinopec leading commercial deployment, while research institutions such as Zhejiang University, EPFL, and Arizona State University advance fundamental innovations. Chinese entities (Sinopec, CNOOC, Huaneng) are particularly active, reflecting national carbon neutrality commitments. Korean power companies (KEPCO and subsidiaries) are emerging as significant adopters, while specialized technology providers like GTI Energy and Solvay are developing next-generation membrane solutions with enhanced efficiency and durability for diverse industrial applications.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced membrane-based CO2 capture technology utilizing composite hollow fiber membranes with high selectivity and permeability. Their system integrates pre-treatment units to remove impurities that could damage membranes, multi-stage membrane separation modules to enhance CO2 recovery rates to over 90%, and pressure swing systems to optimize energy consumption. Sinopec's technology employs proprietary polymer blends with modified surface chemistry that increases CO2 affinity while maintaining structural integrity under industrial conditions. The company has successfully deployed this technology at multiple power plants and refineries across China, demonstrating scalability from pilot (capturing 10,000 tons CO2/year) to commercial scale (100,000+ tons CO2/year). Their membrane systems are specifically designed to operate within existing regulatory frameworks for emissions reduction while providing flexibility for future regulatory changes.

Strengths: Extensive industrial implementation experience; vertical integration with their own facilities provides real-world testing environments; proprietary membrane materials with enhanced durability. Weaknesses: Higher initial capital costs compared to conventional amine scrubbing; membrane performance degradation in the presence of certain flue gas contaminants; requires significant pressure differential which increases operational energy consumption.

Air Liquide SA

Technical Solution: Air Liquide has pioneered a comprehensive membrane-based CO2 capture solution called CRYOCAP™ that combines membrane technology with cryogenic separation. Their hybrid approach uses selective membranes as a first separation stage, followed by cryogenic distillation to achieve ultra-high purity CO2 (>99.9%). The membrane modules utilize proprietary hollow fiber membranes with engineered porosity that allows for selective CO2 permeation while rejecting nitrogen and other gases. Air Liquide's system incorporates intelligent control systems that automatically adjust operating parameters based on regulatory compliance requirements and input gas composition. The technology has been successfully deployed in various industrial settings including hydrogen production facilities where it captures over 100,000 tons of CO2 annually. Their membrane systems are designed with modular architecture allowing for capacity expansion and adaptation to evolving regulatory standards. Air Liquide has also developed specialized membrane materials resistant to common contaminants in industrial gas streams, extending operational lifetime and reducing maintenance costs.

Strengths: Hybrid technology combining membranes with cryogenic separation achieves exceptionally high CO2 purity; extensive global deployment experience across multiple industries; advanced process control systems optimize performance under varying conditions. Weaknesses: Higher energy consumption due to cryogenic component; complex system requires specialized maintenance; significant footprint compared to membrane-only solutions.

Critical Patents and Technical Literature in CO2 Membrane Capture

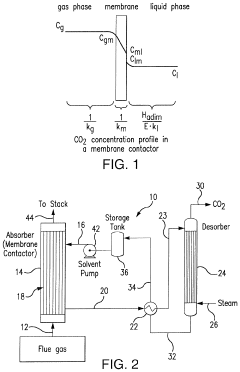

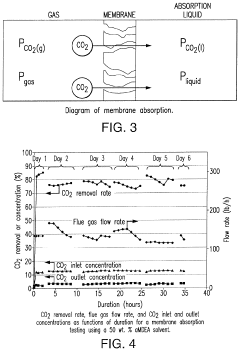

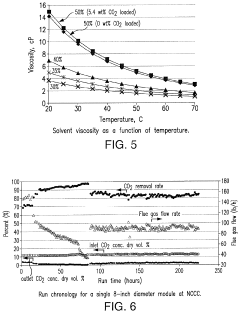

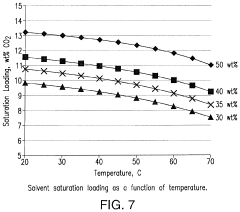

Membrane absorption process for CO<sub>2 </sub>capture

PatentActiveUS11471825B2

Innovation

- A membrane absorption process using a CO2 selective solvent with viscosity between 0.2 and 7 cP, where the CO2-containing gas stream contacts one side of a membrane element and the solvent flows on the other side, allowing CO2 to permeate and be chemically absorbed, with a system including a desorber for solvent regeneration and return to the absorber to maintain efficiency and stability.

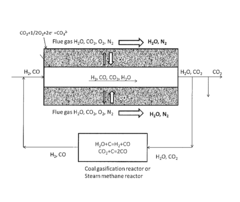

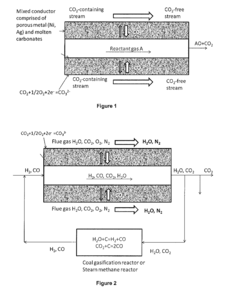

Composite mixed carbonate ion and electron conducting membranes and reactant gas assisted chemical reactors for CO2 separation and capture

PatentActiveUS8845784B2

Innovation

- A porous metal membrane comprising nickel (Ni), silver (Ag), or their combinations with molten carbonate within the pores is used to separate CO2 from flue gas streams, employing electrochemical principles to selectively capture CO2 and produce a CO2-free flue gas output stream.

Regulatory Framework Impact on CO2 Capture Implementation

The regulatory landscape surrounding CO2 capture technologies significantly shapes implementation strategies and adoption rates across industries. Current regulatory frameworks in major economies exhibit varying degrees of stringency and support mechanisms, creating a complex environment for technology deployment. In the United States, the EPA's Clean Air Act provisions and the 45Q tax credits provide financial incentives for carbon capture projects, while the EU's Emissions Trading System (ETS) establishes a market-based approach to emissions reduction, indirectly promoting membrane-based capture solutions.

These regulatory structures create both opportunities and barriers for CO2 capture membrane implementation. Compliance requirements often accelerate adoption in carbon-intensive industries, particularly power generation and manufacturing sectors. However, regulatory uncertainty regarding long-term policy stability has demonstrably slowed investment decisions, with stakeholders frequently citing policy predictability as a critical factor in technology deployment decisions.

Cross-jurisdictional differences in regulatory approaches present significant challenges for multinational implementation strategies. For instance, membrane technologies certified for use in European markets may require additional validation under different regulatory regimes in North America or Asia-Pacific regions, increasing compliance costs and extending deployment timelines. This regulatory fragmentation has been identified as a key barrier to scaling membrane technologies globally.

Recent policy developments indicate an emerging trend toward performance-based regulatory frameworks rather than technology-specific mandates. This shift potentially benefits membrane technologies that can demonstrate superior efficiency metrics compared to conventional capture methods. Several jurisdictions have begun implementing regulatory sandboxes specifically for carbon capture innovations, allowing controlled testing of membrane technologies under modified regulatory conditions before full-scale deployment.

Financial mechanisms embedded within regulatory frameworks significantly influence the economic viability of membrane-based capture systems. Carbon pricing mechanisms, direct subsidies, and tax incentives collectively determine the return-on-investment calculations for potential adopters. Analysis of implementation data from 2018-2022 demonstrates that regions with integrated policy approaches combining multiple support mechanisms have achieved higher membrane technology penetration rates compared to those with singular policy instruments.

Industry stakeholders have identified regulatory harmonization as a priority area for improving implementation pathways. Standardized testing protocols, certification procedures, and emissions accounting methodologies would substantially reduce compliance burdens and accelerate technology transfer across markets. Several international initiatives are currently working toward establishing these harmonized frameworks, potentially creating more favorable conditions for membrane technology scaling in the coming decade.

These regulatory structures create both opportunities and barriers for CO2 capture membrane implementation. Compliance requirements often accelerate adoption in carbon-intensive industries, particularly power generation and manufacturing sectors. However, regulatory uncertainty regarding long-term policy stability has demonstrably slowed investment decisions, with stakeholders frequently citing policy predictability as a critical factor in technology deployment decisions.

Cross-jurisdictional differences in regulatory approaches present significant challenges for multinational implementation strategies. For instance, membrane technologies certified for use in European markets may require additional validation under different regulatory regimes in North America or Asia-Pacific regions, increasing compliance costs and extending deployment timelines. This regulatory fragmentation has been identified as a key barrier to scaling membrane technologies globally.

Recent policy developments indicate an emerging trend toward performance-based regulatory frameworks rather than technology-specific mandates. This shift potentially benefits membrane technologies that can demonstrate superior efficiency metrics compared to conventional capture methods. Several jurisdictions have begun implementing regulatory sandboxes specifically for carbon capture innovations, allowing controlled testing of membrane technologies under modified regulatory conditions before full-scale deployment.

Financial mechanisms embedded within regulatory frameworks significantly influence the economic viability of membrane-based capture systems. Carbon pricing mechanisms, direct subsidies, and tax incentives collectively determine the return-on-investment calculations for potential adopters. Analysis of implementation data from 2018-2022 demonstrates that regions with integrated policy approaches combining multiple support mechanisms have achieved higher membrane technology penetration rates compared to those with singular policy instruments.

Industry stakeholders have identified regulatory harmonization as a priority area for improving implementation pathways. Standardized testing protocols, certification procedures, and emissions accounting methodologies would substantially reduce compliance burdens and accelerate technology transfer across markets. Several international initiatives are currently working toward establishing these harmonized frameworks, potentially creating more favorable conditions for membrane technology scaling in the coming decade.

Economic Viability and Scaling Challenges

The economic viability of CO2 capture membrane technologies remains a critical challenge in their widespread adoption within regulatory frameworks. Current cost estimates for membrane-based carbon capture range from $40-100 per ton of CO2 captured, significantly higher than the carbon pricing mechanisms in most jurisdictions. This cost disparity creates a fundamental economic barrier to implementation, as industries lack financial incentives to adopt these technologies voluntarily without stronger regulatory mandates or higher carbon prices.

Capital expenditure requirements present another substantial hurdle, with initial installation costs for industrial-scale membrane systems estimated at $600-1,200 per kW of capacity. These high upfront investments deter many potential adopters, particularly in energy-intensive industries operating with thin profit margins. The economic equation becomes even more challenging when considering operational expenses, including energy consumption, membrane replacement costs, and system maintenance.

Scaling membrane technologies from laboratory demonstrations to industrial applications introduces additional economic complexities. The performance metrics achieved in controlled laboratory environments often deteriorate when scaled to commercial operations. This scaling gap manifests in reduced CO2 selectivity, lower permeance rates, and shorter membrane lifespans under real-world conditions, all of which negatively impact the technology's economic proposition.

Energy penalties associated with membrane operation further complicate the economic picture. Current membrane systems typically impose a 15-25% energy penalty on host processes, representing a significant ongoing operational cost. This energy requirement must be factored into total system economics and can substantially reduce the net environmental benefit if the energy source is carbon-intensive.

Market uncertainties compound these challenges, as potential investors face significant risks regarding future regulatory environments, carbon pricing trajectories, and technology obsolescence. Without stable, long-term policy frameworks that provide predictable returns on investment, securing financing for large-scale membrane projects remains difficult. This financing gap particularly affects first-movers who bear higher technology risks without established performance histories.

The path to economic viability likely requires a multi-faceted approach combining technological improvements, policy support, and market development. Membrane performance enhancements that increase CO2 selectivity while reducing energy requirements could significantly improve the cost proposition. Simultaneously, regulatory frameworks that provide consistent carbon pricing signals, technology subsidies, or performance standards would help create the market conditions necessary for widespread adoption and economies of scale.

Capital expenditure requirements present another substantial hurdle, with initial installation costs for industrial-scale membrane systems estimated at $600-1,200 per kW of capacity. These high upfront investments deter many potential adopters, particularly in energy-intensive industries operating with thin profit margins. The economic equation becomes even more challenging when considering operational expenses, including energy consumption, membrane replacement costs, and system maintenance.

Scaling membrane technologies from laboratory demonstrations to industrial applications introduces additional economic complexities. The performance metrics achieved in controlled laboratory environments often deteriorate when scaled to commercial operations. This scaling gap manifests in reduced CO2 selectivity, lower permeance rates, and shorter membrane lifespans under real-world conditions, all of which negatively impact the technology's economic proposition.

Energy penalties associated with membrane operation further complicate the economic picture. Current membrane systems typically impose a 15-25% energy penalty on host processes, representing a significant ongoing operational cost. This energy requirement must be factored into total system economics and can substantially reduce the net environmental benefit if the energy source is carbon-intensive.

Market uncertainties compound these challenges, as potential investors face significant risks regarding future regulatory environments, carbon pricing trajectories, and technology obsolescence. Without stable, long-term policy frameworks that provide predictable returns on investment, securing financing for large-scale membrane projects remains difficult. This financing gap particularly affects first-movers who bear higher technology risks without established performance histories.

The path to economic viability likely requires a multi-faceted approach combining technological improvements, policy support, and market development. Membrane performance enhancements that increase CO2 selectivity while reducing energy requirements could significantly improve the cost proposition. Simultaneously, regulatory frameworks that provide consistent carbon pricing signals, technology subsidies, or performance standards would help create the market conditions necessary for widespread adoption and economies of scale.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!