CO2 Capture Membranes: Challenges and Solutions in Industry Standards

OCT 15, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Membrane Technology Background and Objectives

Carbon dioxide capture membrane technology has evolved significantly over the past three decades, emerging as a promising solution for reducing greenhouse gas emissions. Initially developed in the 1990s as experimental materials, these membranes have progressed from laboratory curiosities to commercially viable technologies. The evolution has been driven by increasing global concerns about climate change and the need for efficient carbon capture technologies that can be implemented at industrial scales.

The fundamental principle behind CO2 capture membranes involves selective permeation, allowing CO2 molecules to pass through while blocking other gases. Early membranes suffered from low selectivity and permeability, but continuous research has led to substantial improvements in these critical parameters. The technology has progressed through several generations, from simple polymer-based membranes to advanced mixed matrix membranes (MMMs) and facilitated transport membranes that incorporate carriers specifically designed to interact with CO2.

Recent technological breakthroughs have focused on enhancing membrane stability under harsh industrial conditions, improving CO2 selectivity over other flue gas components, and increasing the overall capture efficiency while reducing energy penalties. These advancements align with the global push toward carbon neutrality and the implementation of carbon pricing mechanisms in many regions, which have created economic incentives for CO2 capture technologies.

The primary objective of current CO2 capture membrane research is to develop materials that can achieve high CO2 permeability (>1000 Barrer) while maintaining excellent CO2/N2 selectivity (>50) under realistic operating conditions. Additionally, these membranes must demonstrate long-term stability (>5 years) when exposed to actual flue gas compositions, which often contain contaminants that can degrade membrane performance over time.

Another critical goal is cost reduction, as current membrane technologies remain relatively expensive compared to conventional amine scrubbing. The target is to develop membrane systems with a capture cost below $40 per ton of CO2, making them economically competitive with other carbon capture technologies. This requires innovations not only in membrane materials but also in module design and system integration.

The technology trajectory is moving toward multi-functional membranes that can simultaneously capture CO2 and convert it into valuable products, potentially creating a circular carbon economy. Research is also exploring the integration of membrane technology with other capture methods in hybrid systems to leverage the strengths of different approaches while minimizing their individual limitations.

As climate policies become more stringent globally, CO2 capture membranes are positioned to play an increasingly important role in industrial decarbonization strategies, particularly for sectors where emissions are difficult to abate through other means, such as cement production, steel manufacturing, and certain chemical processes.

The fundamental principle behind CO2 capture membranes involves selective permeation, allowing CO2 molecules to pass through while blocking other gases. Early membranes suffered from low selectivity and permeability, but continuous research has led to substantial improvements in these critical parameters. The technology has progressed through several generations, from simple polymer-based membranes to advanced mixed matrix membranes (MMMs) and facilitated transport membranes that incorporate carriers specifically designed to interact with CO2.

Recent technological breakthroughs have focused on enhancing membrane stability under harsh industrial conditions, improving CO2 selectivity over other flue gas components, and increasing the overall capture efficiency while reducing energy penalties. These advancements align with the global push toward carbon neutrality and the implementation of carbon pricing mechanisms in many regions, which have created economic incentives for CO2 capture technologies.

The primary objective of current CO2 capture membrane research is to develop materials that can achieve high CO2 permeability (>1000 Barrer) while maintaining excellent CO2/N2 selectivity (>50) under realistic operating conditions. Additionally, these membranes must demonstrate long-term stability (>5 years) when exposed to actual flue gas compositions, which often contain contaminants that can degrade membrane performance over time.

Another critical goal is cost reduction, as current membrane technologies remain relatively expensive compared to conventional amine scrubbing. The target is to develop membrane systems with a capture cost below $40 per ton of CO2, making them economically competitive with other carbon capture technologies. This requires innovations not only in membrane materials but also in module design and system integration.

The technology trajectory is moving toward multi-functional membranes that can simultaneously capture CO2 and convert it into valuable products, potentially creating a circular carbon economy. Research is also exploring the integration of membrane technology with other capture methods in hybrid systems to leverage the strengths of different approaches while minimizing their individual limitations.

As climate policies become more stringent globally, CO2 capture membranes are positioned to play an increasingly important role in industrial decarbonization strategies, particularly for sectors where emissions are difficult to abate through other means, such as cement production, steel manufacturing, and certain chemical processes.

Market Demand Analysis for Carbon Capture Solutions

The global market for carbon capture solutions has witnessed significant growth in recent years, driven primarily by increasing environmental concerns and stringent regulatory frameworks aimed at reducing greenhouse gas emissions. The carbon capture market was valued at approximately $2.5 billion in 2022 and is projected to reach $7.0 billion by 2030, representing a compound annual growth rate of 13.8%. This growth trajectory underscores the escalating demand for effective carbon capture technologies, particularly membrane-based solutions.

Industrial sectors, especially power generation, cement production, and chemical manufacturing, constitute the largest market segments for carbon capture technologies. These industries collectively account for over 65% of global CO2 emissions from industrial processes. The power generation sector alone represents nearly 40% of the total addressable market for carbon capture solutions, highlighting its significance as a primary target for deployment.

Geographically, North America and Europe currently lead the market adoption of carbon capture technologies, with Asia-Pacific emerging as the fastest-growing region. China and India, with their substantial industrial bases and increasing environmental commitments, are expected to become major markets for carbon capture solutions in the coming decade. Government initiatives in these regions, such as carbon pricing mechanisms and emission reduction targets, are creating favorable market conditions for technology providers.

Membrane-based carbon capture technologies are gaining particular traction due to their operational advantages over traditional absorption and adsorption methods. The market for CO2 capture membranes specifically is projected to grow at a rate of 15.2% annually through 2030, outpacing the broader carbon capture market. This accelerated growth reflects the increasing recognition of membranes' potential to offer more energy-efficient and cost-effective carbon capture solutions.

Customer requirements are evolving rapidly, with industries increasingly demanding solutions that not only capture carbon effectively but also integrate seamlessly with existing infrastructure. Key market demands include reduced energy penalties, lower capital and operational costs, and enhanced durability under industrial conditions. Survey data indicates that 78% of potential adopters consider cost-effectiveness as the primary decision factor, followed by operational reliability at 65%.

The market is also witnessing a shift toward integrated carbon capture and utilization systems, reflecting growing interest in creating value from captured carbon. This trend is particularly evident in the chemical and fuel production sectors, where captured CO2 can serve as a feedstock for various products. The market for carbon utilization technologies is expected to reach $3.5 billion by 2030, creating additional demand drivers for advanced capture solutions, including high-performance membranes.

Industrial sectors, especially power generation, cement production, and chemical manufacturing, constitute the largest market segments for carbon capture technologies. These industries collectively account for over 65% of global CO2 emissions from industrial processes. The power generation sector alone represents nearly 40% of the total addressable market for carbon capture solutions, highlighting its significance as a primary target for deployment.

Geographically, North America and Europe currently lead the market adoption of carbon capture technologies, with Asia-Pacific emerging as the fastest-growing region. China and India, with their substantial industrial bases and increasing environmental commitments, are expected to become major markets for carbon capture solutions in the coming decade. Government initiatives in these regions, such as carbon pricing mechanisms and emission reduction targets, are creating favorable market conditions for technology providers.

Membrane-based carbon capture technologies are gaining particular traction due to their operational advantages over traditional absorption and adsorption methods. The market for CO2 capture membranes specifically is projected to grow at a rate of 15.2% annually through 2030, outpacing the broader carbon capture market. This accelerated growth reflects the increasing recognition of membranes' potential to offer more energy-efficient and cost-effective carbon capture solutions.

Customer requirements are evolving rapidly, with industries increasingly demanding solutions that not only capture carbon effectively but also integrate seamlessly with existing infrastructure. Key market demands include reduced energy penalties, lower capital and operational costs, and enhanced durability under industrial conditions. Survey data indicates that 78% of potential adopters consider cost-effectiveness as the primary decision factor, followed by operational reliability at 65%.

The market is also witnessing a shift toward integrated carbon capture and utilization systems, reflecting growing interest in creating value from captured carbon. This trend is particularly evident in the chemical and fuel production sectors, where captured CO2 can serve as a feedstock for various products. The market for carbon utilization technologies is expected to reach $3.5 billion by 2030, creating additional demand drivers for advanced capture solutions, including high-performance membranes.

Global Status and Technical Barriers in CO2 Capture Membranes

The global landscape of CO2 capture membrane technology presents a complex picture of advancement and challenges. Currently, membrane-based carbon capture systems have achieved commercial deployment in several regions, with North America, Europe, and East Asia leading in research and implementation. The United States, Germany, Japan, and China have established significant research infrastructures and pilot projects, demonstrating the technology's viability at various scales.

Despite these advancements, membrane-based CO2 capture faces substantial technical barriers that limit widespread industrial adoption. The most significant challenge remains the trade-off between permeability and selectivity – membranes with high CO2 permeation rates often suffer from poor selectivity over other gases, particularly nitrogen and methane. This fundamental limitation has constrained the technology's efficiency in real-world applications.

Material stability presents another critical barrier, as many promising membrane materials degrade under industrial conditions. Exposure to high temperatures, pressure fluctuations, and contaminants such as SOx, NOx, and particulate matter significantly reduces membrane lifespan and performance. Current membrane materials typically maintain optimal performance for only 2-3 years before requiring replacement, creating economic challenges for large-scale implementation.

Scalability issues further complicate industrial adoption. Laboratory-scale membranes that demonstrate excellent performance often encounter manufacturing difficulties when scaled to industrial dimensions. Maintaining uniform thickness, preventing defects, and ensuring consistent performance across large membrane areas remain significant engineering challenges that have not been fully resolved.

Energy requirements for membrane-based systems also present barriers to implementation. While membranes theoretically offer energy advantages over traditional amine scrubbing, practical systems still require substantial energy inputs for compression and maintaining optimal operating conditions. Current systems typically consume 0.8-1.2 GJ/ton CO2 captured, which remains higher than theoretical minimums.

Standardization represents another significant challenge in the field. The lack of universally accepted testing protocols and performance metrics makes comparing different membrane technologies difficult. This absence of standardization has fragmented research efforts and complicated investment decisions for industrial stakeholders considering membrane technology implementation.

Cost factors continue to limit widespread adoption, with current membrane systems averaging $40-60 per ton of CO2 captured. This cost structure, while improving, remains above the economic threshold for many potential industrial applications, particularly in regions without strong carbon pricing mechanisms or regulatory frameworks.

Despite these advancements, membrane-based CO2 capture faces substantial technical barriers that limit widespread industrial adoption. The most significant challenge remains the trade-off between permeability and selectivity – membranes with high CO2 permeation rates often suffer from poor selectivity over other gases, particularly nitrogen and methane. This fundamental limitation has constrained the technology's efficiency in real-world applications.

Material stability presents another critical barrier, as many promising membrane materials degrade under industrial conditions. Exposure to high temperatures, pressure fluctuations, and contaminants such as SOx, NOx, and particulate matter significantly reduces membrane lifespan and performance. Current membrane materials typically maintain optimal performance for only 2-3 years before requiring replacement, creating economic challenges for large-scale implementation.

Scalability issues further complicate industrial adoption. Laboratory-scale membranes that demonstrate excellent performance often encounter manufacturing difficulties when scaled to industrial dimensions. Maintaining uniform thickness, preventing defects, and ensuring consistent performance across large membrane areas remain significant engineering challenges that have not been fully resolved.

Energy requirements for membrane-based systems also present barriers to implementation. While membranes theoretically offer energy advantages over traditional amine scrubbing, practical systems still require substantial energy inputs for compression and maintaining optimal operating conditions. Current systems typically consume 0.8-1.2 GJ/ton CO2 captured, which remains higher than theoretical minimums.

Standardization represents another significant challenge in the field. The lack of universally accepted testing protocols and performance metrics makes comparing different membrane technologies difficult. This absence of standardization has fragmented research efforts and complicated investment decisions for industrial stakeholders considering membrane technology implementation.

Cost factors continue to limit widespread adoption, with current membrane systems averaging $40-60 per ton of CO2 captured. This cost structure, while improving, remains above the economic threshold for many potential industrial applications, particularly in regions without strong carbon pricing mechanisms or regulatory frameworks.

Current Membrane Solutions for Industrial Carbon Capture

01 Membrane material standards for CO2 capture

Various materials are standardized for use in CO2 capture membranes, including polymeric, inorganic, and mixed matrix membranes. These standards specify the physical and chemical properties required for effective CO2 separation, such as permeability, selectivity, and mechanical strength. The materials must meet specific criteria for durability under industrial conditions, including resistance to contaminants and temperature variations typically encountered in flue gas streams.- Membrane material standards for CO2 capture: Industry standards for membrane materials used in CO2 capture focus on specific properties such as permeability, selectivity, and durability. These standards ensure that membranes can effectively separate CO2 from other gases under various operating conditions. Materials must meet specific performance benchmarks for gas separation efficiency while maintaining structural integrity over extended operational periods. Standards also address the compatibility of membrane materials with different gas compositions and contaminants typically found in industrial emissions.

- Testing and certification protocols for CO2 capture membranes: Standardized testing and certification protocols have been established to validate the performance of CO2 capture membranes. These protocols include methods for measuring CO2 permeation rates, selectivity ratios, and mechanical strength under simulated industrial conditions. Certification processes require membranes to undergo accelerated aging tests, chemical resistance evaluations, and performance consistency checks. These standards ensure that membrane technologies meet minimum requirements for commercial deployment in carbon capture applications.

- Environmental and safety standards for membrane-based CO2 capture: Environmental and safety standards govern the implementation of membrane-based CO2 capture systems. These standards address the environmental impact of membrane manufacturing, installation, operation, and disposal. Safety protocols focus on preventing gas leakage, managing pressure differentials, and ensuring operator safety during maintenance. Standards also cover the integration of membrane systems with existing industrial infrastructure to minimize disruption while maximizing carbon capture efficiency.

- Performance metrics and efficiency standards for CO2 capture membranes: Industry standards define specific performance metrics for evaluating CO2 capture membrane efficiency. These metrics include CO2 removal rate, energy consumption per ton of CO2 captured, membrane lifespan, and operational cost benchmarks. Standards establish minimum threshold values for these parameters based on application type and scale. Performance requirements vary for different industrial sectors such as power generation, cement production, and natural gas processing, with each having tailored efficiency standards for membrane-based carbon capture systems.

- Quality control and manufacturing standards for CO2 capture membranes: Manufacturing standards for CO2 capture membranes ensure consistent quality and performance across production batches. These standards specify acceptable tolerances for membrane thickness, pore size distribution, surface defects, and chemical composition. Quality control protocols include in-line testing methods, statistical process control, and traceability requirements. Standards also address scaling considerations for transitioning from laboratory-scale to industrial-scale membrane production while maintaining performance characteristics and reliability.

02 Performance testing protocols for CO2 capture membranes

Standardized testing protocols have been established to evaluate the performance of CO2 capture membranes. These protocols include methods for measuring CO2 permeability, selectivity over other gases (particularly N2, O2, and H2O), and long-term stability. The testing standards specify conditions such as temperature, pressure, and gas composition that simulate real-world industrial environments. Accelerated aging tests are also included to predict membrane lifetime and performance degradation over time.Expand Specific Solutions03 Manufacturing and quality control standards

Industry standards for the manufacturing of CO2 capture membranes include specifications for production processes, quality control measures, and consistency requirements. These standards cover membrane thickness uniformity, defect detection methods, and acceptable tolerance ranges. Quality assurance protocols include in-line testing during manufacturing and batch certification procedures. The standards also address scaling considerations for transitioning from laboratory to industrial-scale membrane production while maintaining performance characteristics.Expand Specific Solutions04 Integration and system design standards

Standards for integrating CO2 capture membranes into larger industrial systems specify requirements for module design, housing materials, and connection interfaces. These standards address flow distribution, pressure drop considerations, and sealing requirements to prevent gas bypass. System design standards include specifications for pre-treatment requirements to protect membranes from contaminants, as well as guidelines for optimizing membrane module arrangements to maximize capture efficiency while minimizing energy consumption and footprint.Expand Specific Solutions05 Environmental and safety compliance standards

Environmental and safety standards for CO2 capture membrane systems include specifications for emissions during operation, end-of-life disposal or recycling, and safety protocols for handling. These standards address the potential release of membrane materials or captured CO2 during normal operation or failure scenarios. Safety requirements cover pressure vessel design, emergency shutdown procedures, and monitoring systems. The standards also specify documentation requirements for regulatory compliance and certification processes necessary for commercial deployment in various jurisdictions.Expand Specific Solutions

Leading Companies and Research Institutions in CO2 Capture Membranes

The CO2 capture membrane market is currently in a growth phase, characterized by increasing adoption as industries seek to reduce carbon emissions. The market size is expanding rapidly, driven by stringent environmental regulations and corporate sustainability goals, with projections indicating substantial growth over the next decade. Technologically, the field shows varying maturity levels across different membrane types. Leading players like ExxonMobil Technology & Engineering, Sinopec, and Saipem are advancing commercial-scale solutions, while research institutions such as CNRS, EPFL, and Arizona State University are developing next-generation materials. Chinese entities including Huaneng Clean Energy Research Institute and Zhejiang University are making significant progress in membrane performance and cost reduction, while specialized companies like CO2 Solutions and Corning are focusing on innovative capture technologies that address current efficiency and durability challenges.

China Petroleum & Chemical Corp.

Technical Solution: Sinopec (China Petroleum & Chemical Corp.) has developed a comprehensive CO2 capture membrane technology platform called SinoCap that addresses multiple industry challenges. Their approach utilizes composite membranes featuring a thin selective layer of modified polyimide on a porous support structure, achieving CO2 permeability exceeding 1000 Barrer with CO2/N2 selectivity above 40. The company has implemented temperature-resistant ceramic-polymer hybrid membranes capable of operating in harsh industrial environments up to 200°C. Sinopec's membrane modules employ spiral-wound and hollow fiber configurations optimized for different capture scenarios, with their latest generation achieving 30% higher flux rates than previous versions. The company has successfully deployed this technology at their Qilu Petrochemical facility, capturing over 0.4 million tons of CO2 annually while meeting stringent industry standards for pressure drop and contaminant resistance.

Strengths: High temperature tolerance suitable for direct flue gas applications; proven at commercial scale; integrated with existing petrochemical infrastructure; lower regeneration energy requirements than solvent systems. Weaknesses: Higher initial capital costs; membrane performance degradation in presence of SOx and particulates; requires periodic replacement cycles; limited effectiveness at lower CO2 partial pressures.

Commonwealth Scientific & Industrial Research Organisation

Technical Solution: CSIRO has pioneered mixed matrix membrane (MMM) technology for CO2 capture, combining polymeric materials with engineered metal-organic frameworks (MOFs) to overcome traditional membrane limitations. Their proprietary membrane architecture incorporates nano-sized MOF particles (primarily Cu-BTC and ZIF-8) dispersed within high-performance polymers like PEBAX and PIM-1, creating synergistic gas separation properties. This approach has achieved CO2 permeability exceeding 2000 Barrer while maintaining CO2/N2 selectivity above 50 - performance metrics that surpass the Robeson upper bound. CSIRO's membranes demonstrate exceptional stability under industrial conditions, maintaining performance for over 1000 hours in the presence of contaminants like SOx and water vapor. The organization has scaled this technology to pilot demonstration at an Australian power station, where their membrane modules captured 85% of CO2 emissions while consuming approximately 30% less energy than conventional amine absorption processes.

Strengths: Exceptional permeability-selectivity balance; good resistance to contaminants; lower energy requirements than conventional technologies; potential for modular deployment. Weaknesses: Higher manufacturing complexity and cost; challenges in ensuring uniform MOF dispersion at scale; limited long-term operational data in varied industrial environments; requires precise operating conditions.

Key Patents and Innovations in CO2 Selective Membrane Materials

A carbon capture membrane

PatentActiveUS20200129930A1

Innovation

- A thin, lightweight carbon capture membrane with a polymeric support layer and a carbon dioxide capture layer comprising solid porous materials, featuring spatially ordered pores and amine-functionalized materials, which can be easily integrated and regenerated, reducing pressure drop and fouling.

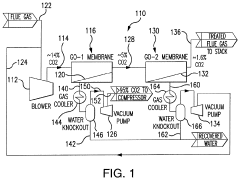

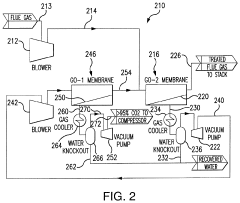

Energy efficient membrane-based process for CO<sub>2 </sub>capture

PatentActiveUS11117092B2

Innovation

- The implementation of a two-stage membrane separation process using high CO2/N2 selectivity graphene oxide (GO)-based membranes in power plants, where a first stage high selectivity membrane is followed by a second stage high flux membrane to efficiently capture CO2 from flue gas streams, with a focus on reducing energy consumption and costs.

Regulatory Framework and Industry Standards for Carbon Capture Technologies

The regulatory landscape for CO2 capture membranes is characterized by a complex interplay of international agreements, national policies, and industry-specific standards. The Paris Agreement serves as the overarching framework driving carbon capture technology adoption, with signatory nations committing to specific emission reduction targets that directly influence membrane technology requirements.

At the international level, organizations such as the International Organization for Standardization (ISO) have developed standards like ISO 14064 and ISO 14065, which establish protocols for greenhouse gas quantification, monitoring, and verification. These standards indirectly affect membrane technology specifications by defining how carbon capture efficiency must be measured and reported.

In the United States, the Environmental Protection Agency (EPA) has established performance standards under the Clean Air Act that specify emission limits for power plants and industrial facilities. These regulations create a compliance framework that membrane technologies must satisfy, particularly regarding capture efficiency rates and operational reliability under various conditions.

The European Union's Emissions Trading System (EU ETS) represents another significant regulatory mechanism, creating economic incentives for carbon capture through carbon pricing. This market-based approach has spurred investment in membrane research that meets specific performance benchmarks related to capture efficiency and operational costs.

Industry standards for membrane technologies have evolved considerably, with organizations like ASTM International developing testing protocols (ASTM D6400 series) that evaluate membrane durability, selectivity, and permeability under standardized conditions. These technical standards ensure consistency in performance evaluation across different membrane technologies and applications.

The International Energy Agency (IEA) has established technical guidelines specifically for carbon capture technologies, including minimum performance criteria for industrial-scale implementation. These guidelines often serve as de facto standards in the absence of formal regulatory requirements in emerging markets.

Certification systems have also emerged, with third-party verification bodies providing performance validation according to established protocols. These certification programs help technology developers demonstrate compliance with regulatory requirements and industry expectations, facilitating market acceptance of novel membrane solutions.

Recent regulatory trends indicate a shift toward outcome-based standards rather than prescriptive requirements, allowing greater flexibility in technological approaches while maintaining focus on capture efficiency targets. This evolution creates opportunities for innovative membrane designs that may employ unconventional materials or configurations while still meeting performance objectives.

At the international level, organizations such as the International Organization for Standardization (ISO) have developed standards like ISO 14064 and ISO 14065, which establish protocols for greenhouse gas quantification, monitoring, and verification. These standards indirectly affect membrane technology specifications by defining how carbon capture efficiency must be measured and reported.

In the United States, the Environmental Protection Agency (EPA) has established performance standards under the Clean Air Act that specify emission limits for power plants and industrial facilities. These regulations create a compliance framework that membrane technologies must satisfy, particularly regarding capture efficiency rates and operational reliability under various conditions.

The European Union's Emissions Trading System (EU ETS) represents another significant regulatory mechanism, creating economic incentives for carbon capture through carbon pricing. This market-based approach has spurred investment in membrane research that meets specific performance benchmarks related to capture efficiency and operational costs.

Industry standards for membrane technologies have evolved considerably, with organizations like ASTM International developing testing protocols (ASTM D6400 series) that evaluate membrane durability, selectivity, and permeability under standardized conditions. These technical standards ensure consistency in performance evaluation across different membrane technologies and applications.

The International Energy Agency (IEA) has established technical guidelines specifically for carbon capture technologies, including minimum performance criteria for industrial-scale implementation. These guidelines often serve as de facto standards in the absence of formal regulatory requirements in emerging markets.

Certification systems have also emerged, with third-party verification bodies providing performance validation according to established protocols. These certification programs help technology developers demonstrate compliance with regulatory requirements and industry expectations, facilitating market acceptance of novel membrane solutions.

Recent regulatory trends indicate a shift toward outcome-based standards rather than prescriptive requirements, allowing greater flexibility in technological approaches while maintaining focus on capture efficiency targets. This evolution creates opportunities for innovative membrane designs that may employ unconventional materials or configurations while still meeting performance objectives.

Economic Viability and Scalability Assessment of Membrane-Based Solutions

The economic viability of membrane-based CO2 capture technologies remains a critical factor determining their widespread industrial adoption. Current cost analyses indicate that membrane systems require capital investments ranging from $40-80 per ton of CO2 captured, which positions them competitively against traditional amine scrubbing technologies that typically cost $60-100 per ton. However, these figures vary significantly depending on the specific membrane materials, system configurations, and operational parameters.

Scale-up challenges present substantial barriers to commercialization. Laboratory-scale membrane performance often deteriorates when implemented at industrial scales due to issues such as membrane fouling, pressure drop across larger modules, and uneven gas distribution. These factors can reduce separation efficiency by 15-30% compared to laboratory results, necessitating robust engineering solutions for practical deployment.

Energy consumption represents another crucial economic consideration. While membranes generally offer lower thermal energy requirements compared to solvent-based systems, the electrical energy needed for gas compression can offset these advantages. Current membrane systems consume approximately 0.5-1.2 GJ/ton CO2, with next-generation materials targeting reductions to 0.3-0.7 GJ/ton to improve economic feasibility.

Manufacturing scalability presents both challenges and opportunities. Traditional membrane fabrication methods face limitations in producing consistent, defect-free membranes at industrial scales. Recent advances in continuous roll-to-roll processing and automated quality control systems have improved manufacturing yields from 60-70% to over 85%, significantly reducing production costs.

Lifetime operational costs must be factored into economic assessments. Membrane replacement intervals typically range from 3-5 years, with degradation rates accelerated by contaminants in industrial gas streams. Innovations in membrane stabilization and self-healing materials could potentially extend operational lifetimes to 7-10 years, dramatically improving long-term economics.

Market adoption pathways suggest a phased approach is most economically viable. Initial deployment in high-value, niche applications with concentrated CO2 streams (biogas upgrading, natural gas processing) allows technology maturation before expanding to more challenging, larger-scale applications like power plant flue gas capture. This strategy enables cost reduction through learning curve effects, with historical data suggesting a 15-20% cost reduction for each doubling of installed capacity.

Return on investment timelines currently range from 5-8 years for most membrane-based carbon capture installations, exceeding the 3-5 year threshold typically required by industrial investors. Achieving broader market penetration will require further improvements in membrane performance, manufacturing economics, and supportive policy frameworks.

Scale-up challenges present substantial barriers to commercialization. Laboratory-scale membrane performance often deteriorates when implemented at industrial scales due to issues such as membrane fouling, pressure drop across larger modules, and uneven gas distribution. These factors can reduce separation efficiency by 15-30% compared to laboratory results, necessitating robust engineering solutions for practical deployment.

Energy consumption represents another crucial economic consideration. While membranes generally offer lower thermal energy requirements compared to solvent-based systems, the electrical energy needed for gas compression can offset these advantages. Current membrane systems consume approximately 0.5-1.2 GJ/ton CO2, with next-generation materials targeting reductions to 0.3-0.7 GJ/ton to improve economic feasibility.

Manufacturing scalability presents both challenges and opportunities. Traditional membrane fabrication methods face limitations in producing consistent, defect-free membranes at industrial scales. Recent advances in continuous roll-to-roll processing and automated quality control systems have improved manufacturing yields from 60-70% to over 85%, significantly reducing production costs.

Lifetime operational costs must be factored into economic assessments. Membrane replacement intervals typically range from 3-5 years, with degradation rates accelerated by contaminants in industrial gas streams. Innovations in membrane stabilization and self-healing materials could potentially extend operational lifetimes to 7-10 years, dramatically improving long-term economics.

Market adoption pathways suggest a phased approach is most economically viable. Initial deployment in high-value, niche applications with concentrated CO2 streams (biogas upgrading, natural gas processing) allows technology maturation before expanding to more challenging, larger-scale applications like power plant flue gas capture. This strategy enables cost reduction through learning curve effects, with historical data suggesting a 15-20% cost reduction for each doubling of installed capacity.

Return on investment timelines currently range from 5-8 years for most membrane-based carbon capture installations, exceeding the 3-5 year threshold typically required by industrial investors. Achieving broader market penetration will require further improvements in membrane performance, manufacturing economics, and supportive policy frameworks.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!