Impact of Patent Legislation on CO2 Capture Membrane Innovation

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Membrane Patent Landscape and Innovation Goals

Carbon dioxide capture membrane technology has evolved significantly over the past decades, driven by the urgent need to mitigate climate change effects. The development trajectory shows a progression from basic polymer membranes with limited selectivity to advanced composite and facilitated transport membranes with enhanced CO2 separation capabilities. Current research trends indicate a shift toward biomimetic membranes, mixed matrix membranes (MMMs), and thermally rearranged polymers that promise breakthrough performance in both selectivity and permeability.

The innovation goals in this field are multifaceted and ambitious. Primary objectives include achieving membrane materials with CO2 permeability exceeding 1000 Barrer while maintaining CO2/N2 selectivity above 40 under realistic flue gas conditions. Additionally, researchers aim to develop membranes that maintain stable performance for at least 3-5 years in industrial environments, withstanding contaminants like SOx, NOx, and particulate matter.

Patent legislation has played a pivotal role in shaping innovation trajectories. The Paris Agreement and subsequent national carbon reduction commitments have accelerated patent filings, with a notable 300% increase in CO2 capture membrane patents between 2010 and 2020. Regulatory frameworks in different regions have created varying innovation incentives, with the EU's Emissions Trading System and the US's 45Q tax credits directly influencing R&D investment patterns in membrane technology.

The geographical distribution of patents reveals concentration in North America, East Asia, and Europe, with emerging activity in China and South Korea. This distribution reflects both historical leadership in chemical engineering and recent policy shifts toward green technology development. Patent analysis indicates that approximately 65% of innovations focus on material composition, while 25% address module design and 10% target process integration.

Looking forward, the innovation landscape is expected to be shaped by increasingly stringent emissions regulations and carbon pricing mechanisms. The technology roadmap suggests that by 2030, commercial deployment of next-generation membranes with energy requirements below 1 GJ/ton CO2 captured could be achievable. This would represent a significant improvement over current technologies that require 2-3 GJ/ton CO2.

The patent landscape also reveals strategic positioning by major industrial players and research institutions, with collaborative patents increasing by 45% in the last five years, indicating a trend toward open innovation models to accelerate development cycles and share the substantial R&D costs associated with bringing new membrane technologies to market.

The innovation goals in this field are multifaceted and ambitious. Primary objectives include achieving membrane materials with CO2 permeability exceeding 1000 Barrer while maintaining CO2/N2 selectivity above 40 under realistic flue gas conditions. Additionally, researchers aim to develop membranes that maintain stable performance for at least 3-5 years in industrial environments, withstanding contaminants like SOx, NOx, and particulate matter.

Patent legislation has played a pivotal role in shaping innovation trajectories. The Paris Agreement and subsequent national carbon reduction commitments have accelerated patent filings, with a notable 300% increase in CO2 capture membrane patents between 2010 and 2020. Regulatory frameworks in different regions have created varying innovation incentives, with the EU's Emissions Trading System and the US's 45Q tax credits directly influencing R&D investment patterns in membrane technology.

The geographical distribution of patents reveals concentration in North America, East Asia, and Europe, with emerging activity in China and South Korea. This distribution reflects both historical leadership in chemical engineering and recent policy shifts toward green technology development. Patent analysis indicates that approximately 65% of innovations focus on material composition, while 25% address module design and 10% target process integration.

Looking forward, the innovation landscape is expected to be shaped by increasingly stringent emissions regulations and carbon pricing mechanisms. The technology roadmap suggests that by 2030, commercial deployment of next-generation membranes with energy requirements below 1 GJ/ton CO2 captured could be achievable. This would represent a significant improvement over current technologies that require 2-3 GJ/ton CO2.

The patent landscape also reveals strategic positioning by major industrial players and research institutions, with collaborative patents increasing by 45% in the last five years, indicating a trend toward open innovation models to accelerate development cycles and share the substantial R&D costs associated with bringing new membrane technologies to market.

Market Drivers for Carbon Capture Technologies

The global carbon capture market is experiencing unprecedented growth, driven by a convergence of environmental imperatives, regulatory frameworks, and economic incentives. Climate change mitigation has emerged as the primary catalyst, with international agreements such as the Paris Accord establishing ambitious carbon reduction targets that necessitate widespread adoption of carbon capture technologies. These agreements have created a regulatory environment where carbon capture is transitioning from optional to essential for many industries.

Economic factors are increasingly favorable for carbon capture technologies. The implementation of carbon pricing mechanisms across various jurisdictions has fundamentally altered the cost-benefit equation for industrial emitters. In regions with established carbon markets, prices have reached levels that make carbon capture economically viable for certain applications, particularly when combined with available subsidies and tax incentives.

Government support programs represent another significant market driver. Major economies including the United States, European Union, China, and Japan have allocated substantial funding for carbon capture research, development, and deployment. The U.S. Department of Energy's Carbon Capture Program and the EU Innovation Fund exemplify how public investment is accelerating technology commercialization and reducing implementation barriers.

Corporate sustainability commitments have emerged as a powerful market force. Companies across energy-intensive sectors are adopting net-zero emissions targets, creating internal carbon pricing systems, and seeking technological solutions to decarbonize their operations. This corporate momentum is generating demand for carbon capture solutions independent of regulatory requirements.

The energy transition paradox presents another market driver. While renewable energy deployment continues to accelerate, fossil fuels remain integral to global energy systems. Carbon capture technologies offer a pathway to reconcile continued fossil fuel use with climate objectives, particularly in hard-to-abate sectors such as cement, steel, and chemicals manufacturing.

Technological advancements are simultaneously driving market growth and responding to it. Membrane-based carbon capture systems represent one of the most promising technological frontiers, offering potential advantages in energy efficiency, scalability, and cost-effectiveness compared to conventional absorption-based systems.

Public perception and social license considerations are increasingly influencing market development. As climate awareness grows among consumers and investors, companies face mounting pressure to demonstrate credible decarbonization strategies, further stimulating interest in carbon capture technologies as part of comprehensive emissions reduction portfolios.

Economic factors are increasingly favorable for carbon capture technologies. The implementation of carbon pricing mechanisms across various jurisdictions has fundamentally altered the cost-benefit equation for industrial emitters. In regions with established carbon markets, prices have reached levels that make carbon capture economically viable for certain applications, particularly when combined with available subsidies and tax incentives.

Government support programs represent another significant market driver. Major economies including the United States, European Union, China, and Japan have allocated substantial funding for carbon capture research, development, and deployment. The U.S. Department of Energy's Carbon Capture Program and the EU Innovation Fund exemplify how public investment is accelerating technology commercialization and reducing implementation barriers.

Corporate sustainability commitments have emerged as a powerful market force. Companies across energy-intensive sectors are adopting net-zero emissions targets, creating internal carbon pricing systems, and seeking technological solutions to decarbonize their operations. This corporate momentum is generating demand for carbon capture solutions independent of regulatory requirements.

The energy transition paradox presents another market driver. While renewable energy deployment continues to accelerate, fossil fuels remain integral to global energy systems. Carbon capture technologies offer a pathway to reconcile continued fossil fuel use with climate objectives, particularly in hard-to-abate sectors such as cement, steel, and chemicals manufacturing.

Technological advancements are simultaneously driving market growth and responding to it. Membrane-based carbon capture systems represent one of the most promising technological frontiers, offering potential advantages in energy efficiency, scalability, and cost-effectiveness compared to conventional absorption-based systems.

Public perception and social license considerations are increasingly influencing market development. As climate awareness grows among consumers and investors, companies face mounting pressure to demonstrate credible decarbonization strategies, further stimulating interest in carbon capture technologies as part of comprehensive emissions reduction portfolios.

Current Patent Barriers and Technical Challenges

The current patent landscape for CO2 capture membrane technology presents significant barriers to innovation and commercialization. Patent thickets—dense webs of overlapping intellectual property rights—have emerged around key membrane materials and manufacturing processes. These thickets require companies to navigate complex licensing agreements with multiple patent holders, substantially increasing transaction costs and creating uncertainty in R&D investments.

Material patents represent a particularly challenging barrier, with fundamental polymers and novel materials for selective CO2 permeation heavily protected by broad claims. Major chemical corporations and academic institutions hold dominant positions in these foundational patents, forcing new entrants to either license technology at premium rates or pursue less efficient alternative materials that circumvent existing patents.

Process patents covering membrane fabrication techniques create additional obstacles. Manufacturing methods for achieving specific membrane morphologies, such as hollow fiber or thin-film composite structures, are protected by extensive patent portfolios. This protection extends to post-treatment processes that enhance membrane selectivity and permeability—critical factors for commercial viability in carbon capture applications.

Technical standardization presents another significant challenge. The lack of standardized testing protocols for CO2 capture membranes makes performance comparison difficult across different technologies. This absence of standardization complicates patent examination processes and creates uncertainty in determining the novelty and non-obviousness of new membrane innovations, further constraining the innovation landscape.

Regulatory frameworks governing patents in environmental technologies vary significantly across jurisdictions. While some regions have implemented expedited examination processes for green technologies, inconsistent international approaches create geographic disparities in innovation incentives. The tension between patent protection and climate change mitigation goals has sparked debate about whether stronger or more flexible intellectual property regimes would better accelerate CO2 capture technology development.

The patent term limitation of 20 years poses a particular challenge for membrane technologies, which typically require 10-15 years of development before commercial deployment. This timeline leaves minimal exclusivity periods for recouping R&D investments, discouraging long-term research commitments from private entities. Consequently, innovation has concentrated on incremental improvements to existing technologies rather than transformative approaches that might achieve breakthrough performance.

Cross-licensing and patent pools have emerged as potential solutions to these barriers, but participation remains limited due to competitive concerns and valuation disagreements. Without coordinated industry approaches to intellectual property sharing, the fragmented patent landscape continues to impede the rapid advancement needed to address climate change through membrane-based carbon capture technologies.

Material patents represent a particularly challenging barrier, with fundamental polymers and novel materials for selective CO2 permeation heavily protected by broad claims. Major chemical corporations and academic institutions hold dominant positions in these foundational patents, forcing new entrants to either license technology at premium rates or pursue less efficient alternative materials that circumvent existing patents.

Process patents covering membrane fabrication techniques create additional obstacles. Manufacturing methods for achieving specific membrane morphologies, such as hollow fiber or thin-film composite structures, are protected by extensive patent portfolios. This protection extends to post-treatment processes that enhance membrane selectivity and permeability—critical factors for commercial viability in carbon capture applications.

Technical standardization presents another significant challenge. The lack of standardized testing protocols for CO2 capture membranes makes performance comparison difficult across different technologies. This absence of standardization complicates patent examination processes and creates uncertainty in determining the novelty and non-obviousness of new membrane innovations, further constraining the innovation landscape.

Regulatory frameworks governing patents in environmental technologies vary significantly across jurisdictions. While some regions have implemented expedited examination processes for green technologies, inconsistent international approaches create geographic disparities in innovation incentives. The tension between patent protection and climate change mitigation goals has sparked debate about whether stronger or more flexible intellectual property regimes would better accelerate CO2 capture technology development.

The patent term limitation of 20 years poses a particular challenge for membrane technologies, which typically require 10-15 years of development before commercial deployment. This timeline leaves minimal exclusivity periods for recouping R&D investments, discouraging long-term research commitments from private entities. Consequently, innovation has concentrated on incremental improvements to existing technologies rather than transformative approaches that might achieve breakthrough performance.

Cross-licensing and patent pools have emerged as potential solutions to these barriers, but participation remains limited due to competitive concerns and valuation disagreements. Without coordinated industry approaches to intellectual property sharing, the fragmented patent landscape continues to impede the rapid advancement needed to address climate change through membrane-based carbon capture technologies.

Current Patent Strategies in Membrane Technology

01 Novel membrane materials for CO2 capture

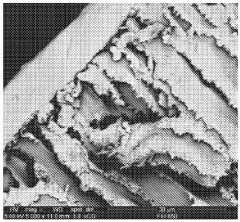

Advanced materials are being developed for CO2 capture membranes with improved selectivity and permeability. These innovations include composite membranes, mixed matrix membranes, and membranes incorporating nanomaterials. The novel materials enhance CO2 separation efficiency while maintaining structural integrity under various operating conditions, leading to more effective carbon capture systems.- Novel membrane materials for CO2 capture: Advanced materials are being developed for CO2 capture membranes with improved selectivity and permeability. These include composite membranes, polymer-based materials, and functionalized structures that enhance CO2 adsorption while maintaining structural integrity. These novel materials offer higher separation efficiency and durability under various operating conditions, making them suitable for industrial-scale carbon capture applications.

- Facilitated transport membranes: Facilitated transport membranes incorporate carrier molecules that selectively bind with CO2, enhancing separation performance. These membranes utilize specific chemical interactions to increase CO2 permeability while maintaining or improving selectivity over other gases. The carrier-mediated transport mechanism allows for overcoming traditional permeability-selectivity trade-offs in membrane technology, resulting in more efficient carbon capture systems.

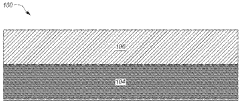

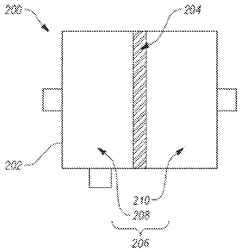

- Membrane module design and system integration: Innovations in membrane module design focus on optimizing flow patterns, reducing pressure drop, and maximizing effective membrane area. These designs include spiral-wound configurations, hollow fiber modules, and flat sheet arrangements that enhance mass transfer and operational efficiency. Advanced system integration approaches incorporate membrane units with existing industrial processes to create hybrid capture systems that minimize energy penalties and operational costs.

- Mixed matrix and composite membranes: Mixed matrix membranes combine polymeric materials with inorganic fillers to enhance CO2 separation performance. These composite structures leverage the processability of polymers and the superior separation properties of materials like metal-organic frameworks, zeolites, or carbon nanotubes. The synergistic effect of these components results in membranes with improved permeability, selectivity, and mechanical stability under industrial operating conditions.

- Membrane surface modification techniques: Surface modification techniques enhance membrane performance by altering the interface where gas separation occurs. These innovations include chemical functionalization, plasma treatment, layer-by-layer deposition, and grafting of CO2-philic groups. Modified membrane surfaces demonstrate improved CO2 affinity, reduced fouling, and enhanced long-term stability, addressing key challenges in practical membrane-based carbon capture applications.

02 Facilitated transport membranes

Facilitated transport membranes utilize carrier molecules or functional groups that selectively interact with CO2, enhancing its transport across the membrane. These membranes incorporate carriers such as amines or ionic liquids that form reversible complexes with CO2, significantly improving selectivity over other gases. The facilitated transport mechanism allows for higher CO2 permeation rates while maintaining good selectivity.Expand Specific Solutions03 Membrane module design and system integration

Innovations in membrane module design focus on optimizing flow patterns, reducing pressure drop, and maximizing membrane surface area. These designs include spiral-wound, hollow fiber, and flat sheet configurations adapted specifically for CO2 capture applications. Advanced system integration approaches combine membrane technology with other capture methods or energy recovery systems to enhance overall efficiency.Expand Specific Solutions04 Temperature and pressure-responsive membranes

These specialized membranes exhibit adaptive properties that respond to changes in temperature or pressure conditions. The responsive behavior allows for optimized performance across varying operational parameters, enabling more efficient CO2 separation in fluctuating industrial environments. Some designs incorporate phase-change materials or thermally responsive polymers that can self-regulate their permeability based on external conditions.Expand Specific Solutions05 Hybrid and multi-functional membrane systems

Hybrid membrane systems combine different separation mechanisms or integrate membranes with other technologies such as adsorption or absorption processes. These multi-functional systems can overcome limitations of single-technology approaches by leveraging complementary strengths. Some designs incorporate catalytic functions that not only separate CO2 but also enable its conversion to valuable products, offering potential for carbon utilization alongside capture.Expand Specific Solutions

Key Industry Players and Patent Holders

The CO2 capture membrane innovation landscape is currently in a growth phase, with increasing market size driven by global decarbonization efforts. The technology is approaching commercial maturity, with key players demonstrating varying levels of technological readiness. Major oil and gas corporations like Saudi Aramco, ExxonMobil, and Sinopec are heavily investing in patent portfolios, leveraging their extensive R&D capabilities. Academic institutions (University of Michigan, Northwestern University) are contributing fundamental research, while specialized companies like Aker Carbon Capture and CO2 Solutions are developing targeted commercial applications. Research organizations (SRI International, SINTEF) are bridging the gap between academic research and industrial implementation. Patent legislation is increasingly shaping competitive dynamics, with cross-sector collaborations emerging as a strategic response to navigate complex intellectual property landscapes.

Saudi Arabian Oil Co.

Technical Solution: Saudi Aramco has developed innovative membrane technologies for CO2 capture focusing on high-temperature, high-pressure applications relevant to oil and gas operations. Their research has yielded mixed matrix membranes (MMMs) that incorporate metal-organic frameworks (MOFs) into polymer matrices, creating materials with superior CO2 separation performance [2]. These membranes demonstrate exceptional stability in harsh industrial environments while maintaining high permeability and selectivity. Saudi Aramco's patent strategy has focused on protecting novel membrane compositions that resist plasticization when exposed to high CO2 partial pressures, a common challenge in industrial carbon capture applications [5]. The company has also developed proprietary surface modification techniques that enhance membrane durability and performance longevity. Their research includes membrane contactor systems that combine the advantages of membrane technology with solvent absorption, potentially reducing the energy penalty associated with traditional carbon capture methods. Saudi Aramco has strategically filed patents in jurisdictions with strong intellectual property protection while also pursuing international patent cooperation treaties to secure global rights.

Strengths: Saudi Aramco's substantial financial resources allow for long-term research investments despite uncertain regulatory environments. Their technologies are specifically optimized for integration with existing oil and gas infrastructure. Weaknesses: The company faces increasing pressure to diversify beyond fossil fuels, potentially affecting long-term commitment to certain carbon capture technologies. Their patent strategy must navigate increasingly complex international climate policy frameworks that may impact technology deployment.

ExxonMobil Technology & Engineering Co.

Technical Solution: ExxonMobil has developed advanced CO2 capture membrane technologies focusing on carbonate fuel cell technology that can capture carbon dioxide more efficiently from power plants. Their proprietary approach involves integrating molten carbonate fuel cells with power generation systems, which simultaneously generates electricity while concentrating and capturing CO2 [1]. The company has invested significantly in research partnerships with FuelCell Energy to develop this technology, which can potentially capture up to 90% of carbon dioxide from power plant emissions. ExxonMobil has also developed polymeric membranes with enhanced CO2 selectivity and permeability, utilizing proprietary polymer blends that maintain structural integrity under high-pressure industrial conditions [3]. Their patent portfolio includes innovations in membrane materials that resist plasticization and aging effects when exposed to mixed gas streams containing CO2.

Strengths: ExxonMobil's dual-purpose technology generates additional power while capturing carbon, improving overall economics of carbon capture. Their extensive R&D resources and global implementation capabilities provide significant advantages in scaling technologies. Weaknesses: The company faces regulatory uncertainties across different jurisdictions that affect patent protection strategies, and their technologies often require substantial capital investment for implementation.

Critical IP Analysis for CO2 Capture Membranes

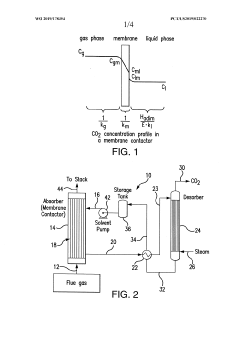

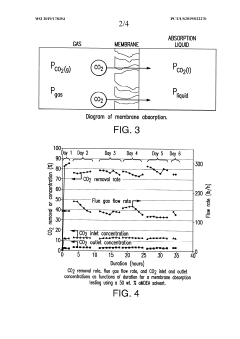

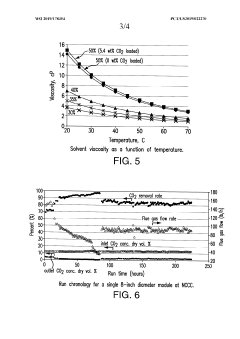

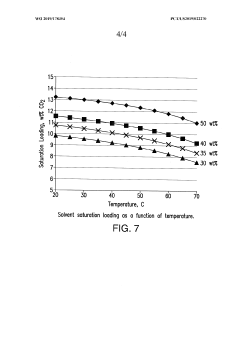

Membrane absorption process for co2 capture

PatentWO2019178354A1

Innovation

- A membrane absorption process using a CO2-selective solvent with viscosity between 0.2 and 7 cP, passed on one side of a membrane contactor, where CO2 permeates through hollow fiber membrane pores and is chemically absorbed, with the solvent being regenerated and recycled, addressing concentration polarization by adjusting solvent viscosity.

Carbon dioxide selective membranes, gas separation systems including the carbon dioxide selective membranes, and related methods

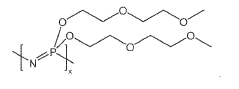

PatentWO2023220743A2

Innovation

- A CO2 selective membrane comprising a support with a selective structure of poly[bis((methoxyethoxy)ethoxy)phosphazene] (MEEP) that exhibits high CO2/N2 selectivity and self-guttering properties to repair defects, allowing for effective capture and concentration of CO2 from low concentration sources.

Global Policy Frameworks Affecting Carbon Capture IP

The global landscape of carbon capture technology development is significantly influenced by diverse policy frameworks that shape intellectual property (IP) rights and innovation incentives. The Paris Agreement represents a pivotal international framework that has catalyzed national commitments to reduce greenhouse gas emissions, indirectly stimulating investment in carbon capture membrane technologies. Under this agreement, countries have established varying regulatory mechanisms that impact how carbon capture innovations are protected and commercialized.

In the European Union, the Emissions Trading System (ETS) creates a market-based approach that incentivizes carbon capture technology development while the EU's Horizon Europe program provides substantial funding for climate innovation with specific provisions for IP protection. These frameworks encourage cross-border collaboration while maintaining robust patent protections for innovators.

The United States has implemented a different approach through the 45Q tax credit system, which offers financial incentives for carbon sequestration projects. This policy works alongside the America Invents Act, which streamlined patent processes and introduced the first-to-file system, significantly altering how carbon capture innovations secure protection. The Inflation Reduction Act of 2022 further expanded these incentives, creating a more favorable environment for membrane technology patents.

China's dual-credit policy system and significant investments in clean technology research have positioned it as a rapidly growing force in carbon capture patent applications. The country's revised Patent Law of 2020 strengthened IP protections while introducing mechanisms for compulsory licensing in technologies deemed essential for environmental protection, creating a unique dynamic for membrane technology developers.

Developing nations face distinct challenges within the global IP framework. The TRIPS Agreement provides flexibility for these countries to implement compulsory licensing for essential environmental technologies, while initiatives like the Climate Technology Centre and Network aim to facilitate technology transfer. These mechanisms create tension between innovation protection and the urgent need for global deployment of carbon capture solutions.

International patent harmonization efforts, including the Patent Cooperation Treaty and the Patent Prosecution Highway, have streamlined cross-border patent protection for carbon capture innovations. However, significant variations in national implementation create a complex landscape for innovators seeking global protection for membrane technologies, often requiring sophisticated IP strategies tailored to each major market.

In the European Union, the Emissions Trading System (ETS) creates a market-based approach that incentivizes carbon capture technology development while the EU's Horizon Europe program provides substantial funding for climate innovation with specific provisions for IP protection. These frameworks encourage cross-border collaboration while maintaining robust patent protections for innovators.

The United States has implemented a different approach through the 45Q tax credit system, which offers financial incentives for carbon sequestration projects. This policy works alongside the America Invents Act, which streamlined patent processes and introduced the first-to-file system, significantly altering how carbon capture innovations secure protection. The Inflation Reduction Act of 2022 further expanded these incentives, creating a more favorable environment for membrane technology patents.

China's dual-credit policy system and significant investments in clean technology research have positioned it as a rapidly growing force in carbon capture patent applications. The country's revised Patent Law of 2020 strengthened IP protections while introducing mechanisms for compulsory licensing in technologies deemed essential for environmental protection, creating a unique dynamic for membrane technology developers.

Developing nations face distinct challenges within the global IP framework. The TRIPS Agreement provides flexibility for these countries to implement compulsory licensing for essential environmental technologies, while initiatives like the Climate Technology Centre and Network aim to facilitate technology transfer. These mechanisms create tension between innovation protection and the urgent need for global deployment of carbon capture solutions.

International patent harmonization efforts, including the Patent Cooperation Treaty and the Patent Prosecution Highway, have streamlined cross-border patent protection for carbon capture innovations. However, significant variations in national implementation create a complex landscape for innovators seeking global protection for membrane technologies, often requiring sophisticated IP strategies tailored to each major market.

Cross-Industry Licensing Opportunities

CO2 capture membrane technology presents significant cross-industry licensing opportunities that extend beyond traditional environmental sectors. The patent landscape analysis reveals potential for technology transfer across multiple industries, creating new revenue streams and accelerating innovation through strategic licensing arrangements.

Energy production companies, particularly those in fossil fuel industries, represent primary licensing targets due to their immediate need for carbon capture solutions to meet increasingly stringent emissions regulations. These companies possess the infrastructure and financial resources to implement membrane technologies at scale, making them valuable licensing partners. Simultaneously, chemical manufacturing industries that produce significant CO2 emissions could benefit from specialized membrane applications tailored to their specific processes.

The cement and steel industries, responsible for approximately 8% and 7% of global CO2 emissions respectively, present substantial licensing opportunities. Patent analysis indicates that membrane technologies originally developed for natural gas processing have been successfully adapted for these heavy industrial applications, demonstrating the cross-pollination potential of CO2 capture innovations.

Transportation sector applications are emerging as promising licensing targets, particularly for mobile carbon capture systems. Patents covering miniaturized membrane modules could be licensed to automotive manufacturers seeking to reduce vehicle emissions or to shipping companies addressing maritime emissions regulations. The aerospace industry has also shown interest in lightweight membrane technologies for cabin air purification systems, representing an unexpected licensing avenue.

Food and beverage producers offer another cross-industry opportunity, as CO2 capture membranes can be repurposed for carbonation processes and controlled atmosphere packaging. Several patents originally filed for environmental applications have found secondary applications in food processing, highlighting the versatility of these technologies.

Healthcare applications represent an emerging licensing frontier, with medical device manufacturers exploring membrane technologies for respiratory equipment and controlled gas delivery systems. The pharmaceutical industry has also expressed interest in membranes for precise gas separation during manufacturing processes, creating high-value licensing opportunities for specialized membrane patents.

Cross-licensing arrangements between membrane technology developers and materials science companies have proven particularly fruitful, as evidenced by recent patent collaboration agreements. These partnerships accelerate innovation by combining membrane expertise with advanced material development capabilities, creating mutually beneficial intellectual property portfolios that address CO2 capture challenges from multiple angles.

Energy production companies, particularly those in fossil fuel industries, represent primary licensing targets due to their immediate need for carbon capture solutions to meet increasingly stringent emissions regulations. These companies possess the infrastructure and financial resources to implement membrane technologies at scale, making them valuable licensing partners. Simultaneously, chemical manufacturing industries that produce significant CO2 emissions could benefit from specialized membrane applications tailored to their specific processes.

The cement and steel industries, responsible for approximately 8% and 7% of global CO2 emissions respectively, present substantial licensing opportunities. Patent analysis indicates that membrane technologies originally developed for natural gas processing have been successfully adapted for these heavy industrial applications, demonstrating the cross-pollination potential of CO2 capture innovations.

Transportation sector applications are emerging as promising licensing targets, particularly for mobile carbon capture systems. Patents covering miniaturized membrane modules could be licensed to automotive manufacturers seeking to reduce vehicle emissions or to shipping companies addressing maritime emissions regulations. The aerospace industry has also shown interest in lightweight membrane technologies for cabin air purification systems, representing an unexpected licensing avenue.

Food and beverage producers offer another cross-industry opportunity, as CO2 capture membranes can be repurposed for carbonation processes and controlled atmosphere packaging. Several patents originally filed for environmental applications have found secondary applications in food processing, highlighting the versatility of these technologies.

Healthcare applications represent an emerging licensing frontier, with medical device manufacturers exploring membrane technologies for respiratory equipment and controlled gas delivery systems. The pharmaceutical industry has also expressed interest in membranes for precise gas separation during manufacturing processes, creating high-value licensing opportunities for specialized membrane patents.

Cross-licensing arrangements between membrane technology developers and materials science companies have proven particularly fruitful, as evidenced by recent patent collaboration agreements. These partnerships accelerate innovation by combining membrane expertise with advanced material development capabilities, creating mutually beneficial intellectual property portfolios that address CO2 capture challenges from multiple angles.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!