Patent Trends in CO2 Capture Membrane Deployments

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Membrane Technology Background and Objectives

Carbon dioxide capture membrane technology has evolved significantly over the past several decades, emerging as a promising solution for mitigating greenhouse gas emissions. The development trajectory began in the 1980s with rudimentary polymer-based membranes, progressing through various material innovations to today's advanced composite and hybrid membrane systems. This evolution reflects the growing global urgency to address climate change through effective carbon capture technologies.

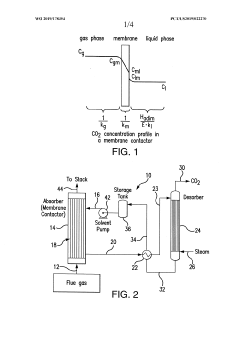

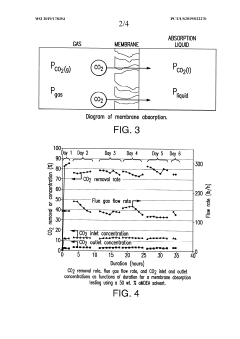

The fundamental principle behind CO2 capture membranes involves selective permeation, where the membrane material allows CO2 molecules to pass through while blocking other gases. This selectivity is achieved through various mechanisms including solution-diffusion, facilitated transport, and molecular sieving. The technical advancement in this field has been driven by the need to enhance three critical performance parameters: CO2 permeability, CO2/N2 selectivity, and long-term operational stability.

Patent trends in CO2 capture membrane deployments reveal an accelerating innovation landscape, particularly since 2010. Analysis of patent filings shows significant growth in areas such as mixed matrix membranes (MMMs), facilitated transport membranes (FTMs), and thermally rearranged polymers (TRPs). These patents demonstrate a clear technical progression toward membranes with higher selectivity coefficients and improved resistance to plasticization under real-world operating conditions.

The primary technical objective in this field is to develop membrane materials that overcome the permeability-selectivity trade-off, often visualized through the Robeson upper bound. Recent patents indicate promising approaches using nanomaterial incorporation, ionic liquid integration, and novel polymer blends to push beyond this theoretical limit. Additionally, there is growing emphasis on developing membranes that maintain performance under the harsh conditions typical of industrial flue gas streams.

Another critical objective is scaling membrane technology from laboratory prototypes to industrial-scale modules. Patent activity in this area focuses on membrane module design, support structures, and manufacturing processes that enable cost-effective production while maintaining separation performance. The goal is to achieve membrane systems with competitive capital and operational costs compared to traditional amine scrubbing technologies.

Looking forward, the technical trajectory aims toward membranes with CO2 permeance exceeding 1000 GPU (gas permeation units) and CO2/N2 selectivity above 100, while demonstrating operational lifespans of 3-5 years in industrial environments. These ambitious targets reflect the recognition that membrane technology represents one of the most energy-efficient approaches to carbon capture, with potential applications across power generation, cement production, and other carbon-intensive industries.

The fundamental principle behind CO2 capture membranes involves selective permeation, where the membrane material allows CO2 molecules to pass through while blocking other gases. This selectivity is achieved through various mechanisms including solution-diffusion, facilitated transport, and molecular sieving. The technical advancement in this field has been driven by the need to enhance three critical performance parameters: CO2 permeability, CO2/N2 selectivity, and long-term operational stability.

Patent trends in CO2 capture membrane deployments reveal an accelerating innovation landscape, particularly since 2010. Analysis of patent filings shows significant growth in areas such as mixed matrix membranes (MMMs), facilitated transport membranes (FTMs), and thermally rearranged polymers (TRPs). These patents demonstrate a clear technical progression toward membranes with higher selectivity coefficients and improved resistance to plasticization under real-world operating conditions.

The primary technical objective in this field is to develop membrane materials that overcome the permeability-selectivity trade-off, often visualized through the Robeson upper bound. Recent patents indicate promising approaches using nanomaterial incorporation, ionic liquid integration, and novel polymer blends to push beyond this theoretical limit. Additionally, there is growing emphasis on developing membranes that maintain performance under the harsh conditions typical of industrial flue gas streams.

Another critical objective is scaling membrane technology from laboratory prototypes to industrial-scale modules. Patent activity in this area focuses on membrane module design, support structures, and manufacturing processes that enable cost-effective production while maintaining separation performance. The goal is to achieve membrane systems with competitive capital and operational costs compared to traditional amine scrubbing technologies.

Looking forward, the technical trajectory aims toward membranes with CO2 permeance exceeding 1000 GPU (gas permeation units) and CO2/N2 selectivity above 100, while demonstrating operational lifespans of 3-5 years in industrial environments. These ambitious targets reflect the recognition that membrane technology represents one of the most energy-efficient approaches to carbon capture, with potential applications across power generation, cement production, and other carbon-intensive industries.

Market Analysis for Carbon Capture Solutions

The global carbon capture market is experiencing significant growth, driven by increasing environmental regulations and corporate sustainability commitments. Current market valuations place the carbon capture industry at approximately $2 billion in 2023, with projections indicating expansion to reach $7 billion by 2030, representing a compound annual growth rate of 19.6%. This growth trajectory is supported by substantial government investments, with the United States allocating $12 billion for carbon capture development through the Infrastructure Investment and Jobs Act.

Membrane-based CO2 capture technologies are emerging as a particularly promising segment within this market. Patent analysis reveals that membrane technology patents have increased by 27% over the past five years, outpacing other carbon capture methods. This acceleration indicates strong commercial interest and technological advancement in this specific approach.

Market demand is primarily driven by three key sectors: power generation (accounting for 42% of potential applications), industrial manufacturing (35%), and natural gas processing (18%). Within these sectors, the highest growth potential exists in cement production and steel manufacturing, where decarbonization presents significant technical challenges that membrane technologies are uniquely positioned to address.

Regional analysis shows distinct market characteristics. North America leads in deployment with approximately 38% of global carbon capture projects, followed by Europe (31%) and Asia-Pacific (24%). However, patent filing trends indicate that China is rapidly accelerating its innovation in membrane technologies, with patent applications increasing at twice the global average rate since 2020.

Cost considerations remain a critical market factor. Current membrane-based capture solutions average $40-60 per ton of CO2 captured, compared to $50-90 for traditional amine scrubbing technologies. This economic advantage is driving market adoption, particularly in regions with carbon pricing mechanisms. Market forecasts suggest that continued technological improvements could reduce costs to $25-35 per ton by 2028, potentially expanding the addressable market by 65%.

Customer segmentation reveals three primary buyer categories: large industrial emitters seeking compliance solutions (55% of current market), energy companies pursuing enhanced oil recovery applications (30%), and emerging direct air capture ventures (15%). The latter segment, while currently small, shows the highest growth potential with a 40% annual increase in patent activity related to membrane applications for atmospheric carbon capture.

Membrane-based CO2 capture technologies are emerging as a particularly promising segment within this market. Patent analysis reveals that membrane technology patents have increased by 27% over the past five years, outpacing other carbon capture methods. This acceleration indicates strong commercial interest and technological advancement in this specific approach.

Market demand is primarily driven by three key sectors: power generation (accounting for 42% of potential applications), industrial manufacturing (35%), and natural gas processing (18%). Within these sectors, the highest growth potential exists in cement production and steel manufacturing, where decarbonization presents significant technical challenges that membrane technologies are uniquely positioned to address.

Regional analysis shows distinct market characteristics. North America leads in deployment with approximately 38% of global carbon capture projects, followed by Europe (31%) and Asia-Pacific (24%). However, patent filing trends indicate that China is rapidly accelerating its innovation in membrane technologies, with patent applications increasing at twice the global average rate since 2020.

Cost considerations remain a critical market factor. Current membrane-based capture solutions average $40-60 per ton of CO2 captured, compared to $50-90 for traditional amine scrubbing technologies. This economic advantage is driving market adoption, particularly in regions with carbon pricing mechanisms. Market forecasts suggest that continued technological improvements could reduce costs to $25-35 per ton by 2028, potentially expanding the addressable market by 65%.

Customer segmentation reveals three primary buyer categories: large industrial emitters seeking compliance solutions (55% of current market), energy companies pursuing enhanced oil recovery applications (30%), and emerging direct air capture ventures (15%). The latter segment, while currently small, shows the highest growth potential with a 40% annual increase in patent activity related to membrane applications for atmospheric carbon capture.

Global Status and Technical Barriers in Membrane-Based CO2 Capture

Membrane-based CO2 capture technology has gained significant attention globally as a promising approach for carbon emission reduction. Currently, the United States, European Union, Japan, and China are leading research and development efforts in this field. The U.S. Department of Energy has invested substantially in membrane technology through its Carbon Capture Program, while the EU has integrated membrane research into its Horizon Europe framework. Japan's focus has been on developing high-performance polymeric membranes, and China has rapidly expanded its research capacity in recent years.

Despite these advancements, several technical barriers impede widespread commercial deployment. Permeability-selectivity trade-off remains a fundamental challenge, as membranes that allow high CO2 throughput typically sacrifice selectivity, and vice versa. This limitation, known as Robeson's upper bound, continues to constrain membrane performance optimization.

Membrane stability under real industrial conditions presents another significant hurdle. Exposure to high temperatures, pressures, and contaminants in flue gas streams—including SOx, NOx, and particulate matter—often leads to performance degradation over time. Most laboratory-developed membranes show promising results in controlled environments but fail to maintain performance in actual industrial settings.

Scale-up challenges further complicate commercial implementation. The transition from laboratory-scale membrane production to industrial-scale manufacturing introduces variability in membrane properties and performance. Maintaining consistent quality across large membrane areas remains problematic, with defects and non-uniformities significantly reducing separation efficiency at scale.

Economic viability also poses a substantial barrier. Current membrane-based CO2 capture systems typically cost between $50-80 per ton of CO2 captured, which exceeds the economically viable threshold for many industries. This cost challenge is compounded by the energy penalty associated with creating the necessary pressure differential for membrane operation.

Patent analysis reveals concentrated intellectual property ownership among a few multinational corporations and research institutions. This concentration potentially limits technology transfer and broader innovation. Recent patent trends show increasing focus on mixed matrix membranes and facilitated transport membranes as potential solutions to overcome the permeability-selectivity trade-off.

Regulatory frameworks vary significantly across regions, creating an uneven landscape for technology deployment. While the EU has established clear carbon pricing mechanisms that incentivize capture technologies, many other regions lack similar market drivers, hampering investment in membrane technology development and implementation.

Despite these advancements, several technical barriers impede widespread commercial deployment. Permeability-selectivity trade-off remains a fundamental challenge, as membranes that allow high CO2 throughput typically sacrifice selectivity, and vice versa. This limitation, known as Robeson's upper bound, continues to constrain membrane performance optimization.

Membrane stability under real industrial conditions presents another significant hurdle. Exposure to high temperatures, pressures, and contaminants in flue gas streams—including SOx, NOx, and particulate matter—often leads to performance degradation over time. Most laboratory-developed membranes show promising results in controlled environments but fail to maintain performance in actual industrial settings.

Scale-up challenges further complicate commercial implementation. The transition from laboratory-scale membrane production to industrial-scale manufacturing introduces variability in membrane properties and performance. Maintaining consistent quality across large membrane areas remains problematic, with defects and non-uniformities significantly reducing separation efficiency at scale.

Economic viability also poses a substantial barrier. Current membrane-based CO2 capture systems typically cost between $50-80 per ton of CO2 captured, which exceeds the economically viable threshold for many industries. This cost challenge is compounded by the energy penalty associated with creating the necessary pressure differential for membrane operation.

Patent analysis reveals concentrated intellectual property ownership among a few multinational corporations and research institutions. This concentration potentially limits technology transfer and broader innovation. Recent patent trends show increasing focus on mixed matrix membranes and facilitated transport membranes as potential solutions to overcome the permeability-selectivity trade-off.

Regulatory frameworks vary significantly across regions, creating an uneven landscape for technology deployment. While the EU has established clear carbon pricing mechanisms that incentivize capture technologies, many other regions lack similar market drivers, hampering investment in membrane technology development and implementation.

Current Membrane-Based CO2 Capture Solutions

01 Novel membrane materials for CO2 capture

Recent patents focus on developing innovative membrane materials with enhanced CO2 selectivity and permeability. These materials include modified polymers, composite structures, and functionalized surfaces designed specifically to interact with CO2 molecules. The membranes utilize various mechanisms such as facilitated transport or fixed-site carrier mechanisms to improve capture efficiency while maintaining structural integrity under operational conditions.- Novel membrane materials for CO2 capture: Recent patents reveal development of innovative membrane materials specifically designed for enhanced CO2 capture efficiency. These materials include advanced polymers, composite structures, and functionalized membranes that demonstrate improved CO2 selectivity and permeability. The novel materials address key challenges in membrane-based carbon capture such as durability under industrial conditions and resistance to contaminants in gas streams.

- Membrane system integration and process optimization: Patents focus on optimizing membrane systems for CO2 capture through innovative process designs and system integration approaches. These include multi-stage membrane configurations, hybrid systems combining membranes with other capture technologies, and process control strategies to maximize efficiency. Innovations in this area aim to reduce energy consumption, minimize footprint, and enhance overall carbon capture performance in industrial settings.

- Facilitated transport membranes for selective CO2 separation: A growing trend in patents involves facilitated transport membranes that utilize carrier molecules or functional groups to selectively transport CO2 across the membrane. These membranes incorporate carriers that reversibly react with CO2, enabling higher selectivity and permeability compared to conventional membranes. The technology addresses the traditional permeability-selectivity trade-off in membrane separation and shows promise for more efficient carbon capture applications.

- Membrane fabrication and manufacturing techniques: Patents reveal advancements in membrane fabrication methods for CO2 capture applications, including novel coating techniques, controlled polymerization processes, and precision manufacturing approaches. These innovations focus on creating defect-free membranes with consistent properties, scalable production methods, and cost-effective manufacturing routes. The manufacturing techniques aim to bridge the gap between laboratory-scale membrane development and commercial-scale production.

- Environmental applications and sustainability aspects: Recent patent trends show increasing focus on environmental applications and sustainability aspects of CO2 capture membranes. These include membranes designed for direct air capture, integration with renewable energy systems, and applications in carbon-neutral industrial processes. Patents in this category also address the environmental footprint of the membranes themselves, with innovations in biodegradable materials, reduced-impact manufacturing, and membrane recycling approaches.

02 Integration of membranes with industrial processes

Patents reveal trends in integrating CO2 capture membranes with existing industrial processes, particularly power plants and manufacturing facilities. These innovations focus on system designs that minimize energy penalties while maximizing capture efficiency. The integration approaches include pre-combustion, post-combustion, and oxyfuel combustion systems, with specialized membrane configurations tailored to each application's specific requirements and operating conditions.Expand Specific Solutions03 Hybrid membrane systems for enhanced performance

A significant trend involves developing hybrid membrane systems that combine different separation technologies to overcome limitations of single-technology approaches. These systems integrate membranes with absorption, adsorption, or cryogenic processes to create synergistic effects. The hybrid designs aim to optimize energy consumption, increase CO2 recovery rates, and improve overall system economics while addressing challenges like membrane fouling and pressure drop considerations.Expand Specific Solutions04 Sustainable and bio-inspired membrane technologies

Emerging patents focus on environmentally sustainable membrane technologies, including bio-inspired designs and materials derived from renewable sources. These innovations incorporate principles from natural systems, such as enzymatic facilitation or biomimetic structures, to enhance CO2 separation performance. The membranes utilize green manufacturing processes and biodegradable components to reduce environmental impact while maintaining competitive capture efficiencies and operational lifespans.Expand Specific Solutions05 Advanced membrane fabrication and modification techniques

Recent patent trends highlight innovative fabrication and modification techniques for CO2 capture membranes. These include precision layer-by-layer assembly, surface functionalization, and controlled porosity development. Advanced manufacturing methods such as 3D printing, electrospinning, and phase inversion techniques are being employed to create membranes with optimized morphology and transport properties. Post-fabrication treatments including chemical grafting and plasma modification further enhance membrane performance and durability.Expand Specific Solutions

Leading Companies and Research Institutions in CO2 Membrane Development

The CO2 capture membrane deployment market is currently in a growth phase, characterized by increasing investments and technological advancements. The market size is expanding rapidly due to global decarbonization efforts, with projections indicating substantial growth over the next decade. Technologically, the field shows varying maturity levels, with established players like China Petroleum & Chemical Corp. (Sinopec) and Saudi Aramco leading commercial deployments, while research institutions such as Arizona State University, Tianjin University, and École Polytechnique Fédérale de Lausanne drive innovation. Companies including GTI Energy, Battelle Memorial Institute, and ExxonMobil are advancing membrane technologies from laboratory to pilot scale. The competitive landscape features collaboration between industry leaders and academic institutions, with increasing patent activity from both Chinese entities and Western corporations focusing on efficiency improvements and cost reduction.

China Petroleum & Chemical Corp.

Technical Solution: Sinopec has developed proprietary facilitated transport membranes for CO2 capture that incorporate specialized carrier molecules within a polymer matrix. Their patented technology features amine-functionalized polymers that selectively bind with CO2 molecules, facilitating their transport across the membrane while blocking other flue gas components. The company has engineered composite membrane structures with thin selective layers supported on porous substrates to maximize flux while maintaining mechanical integrity. Sinopec's patents describe innovative fabrication techniques that prevent carrier leaching during long-term operation, addressing a common failure mode in facilitated transport membranes. Their technology incorporates humidity control mechanisms that maintain optimal water content within the membrane to support the CO2 transport mechanism. Field tests at coal-fired power plants have demonstrated sustained performance with CO2 capture rates exceeding 85% and significantly reduced energy penalties compared to conventional amine absorption processes[4][7].

Strengths: Exceptionally high CO2 selectivity; lower energy requirements than conventional capture technologies; compatibility with existing power plant infrastructure; resistance to SOx and NOx contaminants. Weaknesses: Performance sensitivity to humidity fluctuations; potential for carrier degradation over extended operation; higher manufacturing complexity compared to simple polymeric membranes.

Battelle Memorial Institute

Technical Solution: Battelle has developed innovative enzymatic-facilitated transport membranes for CO2 capture that mimic biological CO2 transport mechanisms. Their patented technology incorporates carbonic anhydrase enzymes immobilized within specialized polymer matrices, catalyzing the conversion of CO2 to bicarbonate ions for enhanced transport across the membrane. The institute has engineered proprietary enzyme stabilization techniques that maintain catalytic activity under industrial conditions for extended periods, addressing a key limitation of biocatalytic systems. Their patents describe multi-layer membrane architectures that protect the enzymatic components while maximizing gas permeation rates. Battelle has also developed novel enzyme-polymer conjugation methods that prevent enzyme leaching while maintaining optimal catalytic orientation. Their membrane systems have demonstrated CO2 permeability values exceeding conventional polymeric membranes by an order of magnitude while achieving selectivity factors above 200 in laboratory and pilot testing. The technology has shown particular promise for dilute CO2 streams where traditional capture methods struggle with efficiency[9][11].

Strengths: Exceptionally high CO2 selectivity and permeability; lower energy requirements than conventional technologies; effective performance at ambient temperatures; ability to capture CO2 from dilute streams. Weaknesses: Enzyme stability concerns in long-term industrial deployment; higher manufacturing complexity and cost; sensitivity to certain contaminants that may denature enzymes; more complex system maintenance requirements.

Key Patent Analysis for CO2 Capture Membrane Technologies

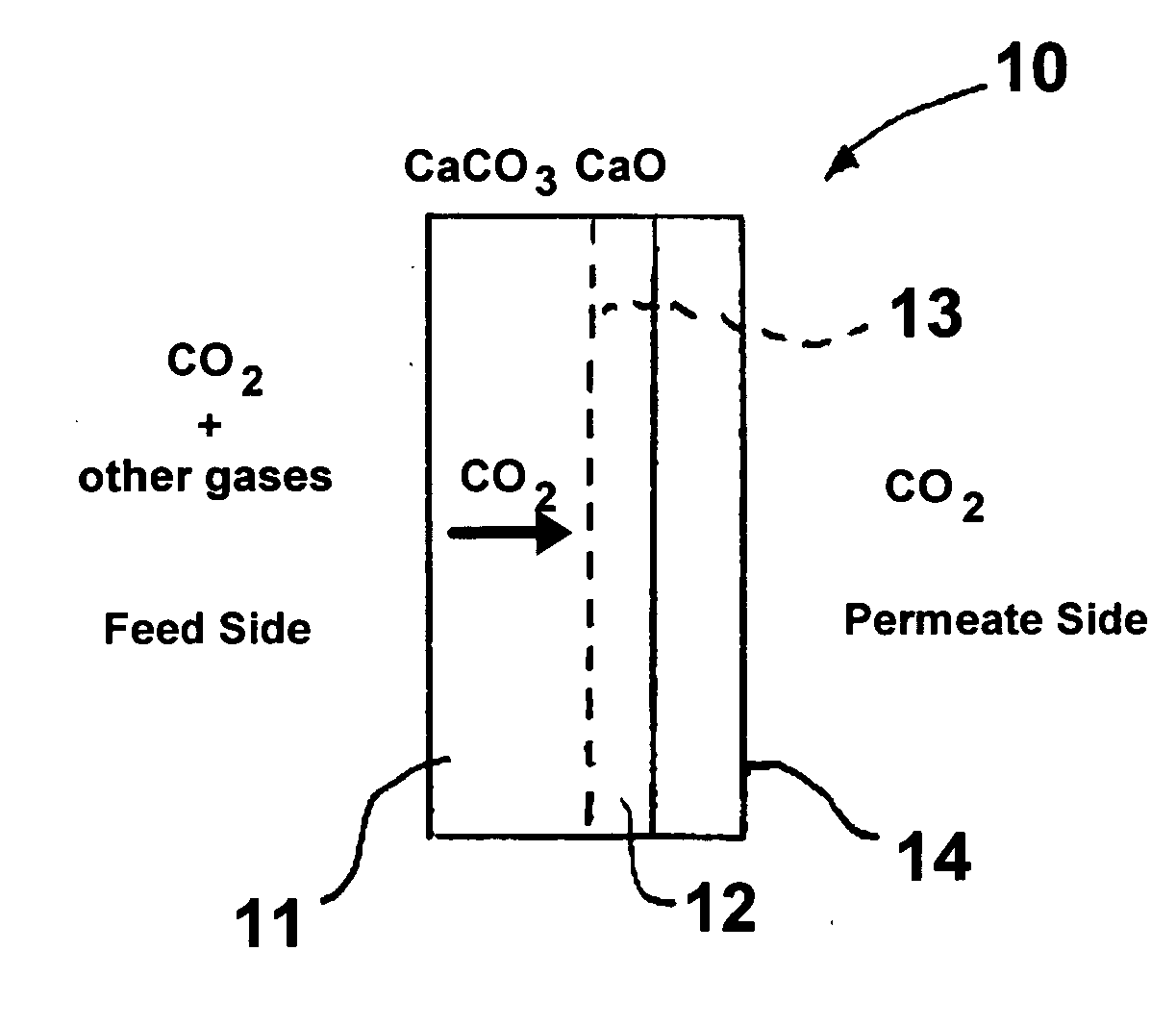

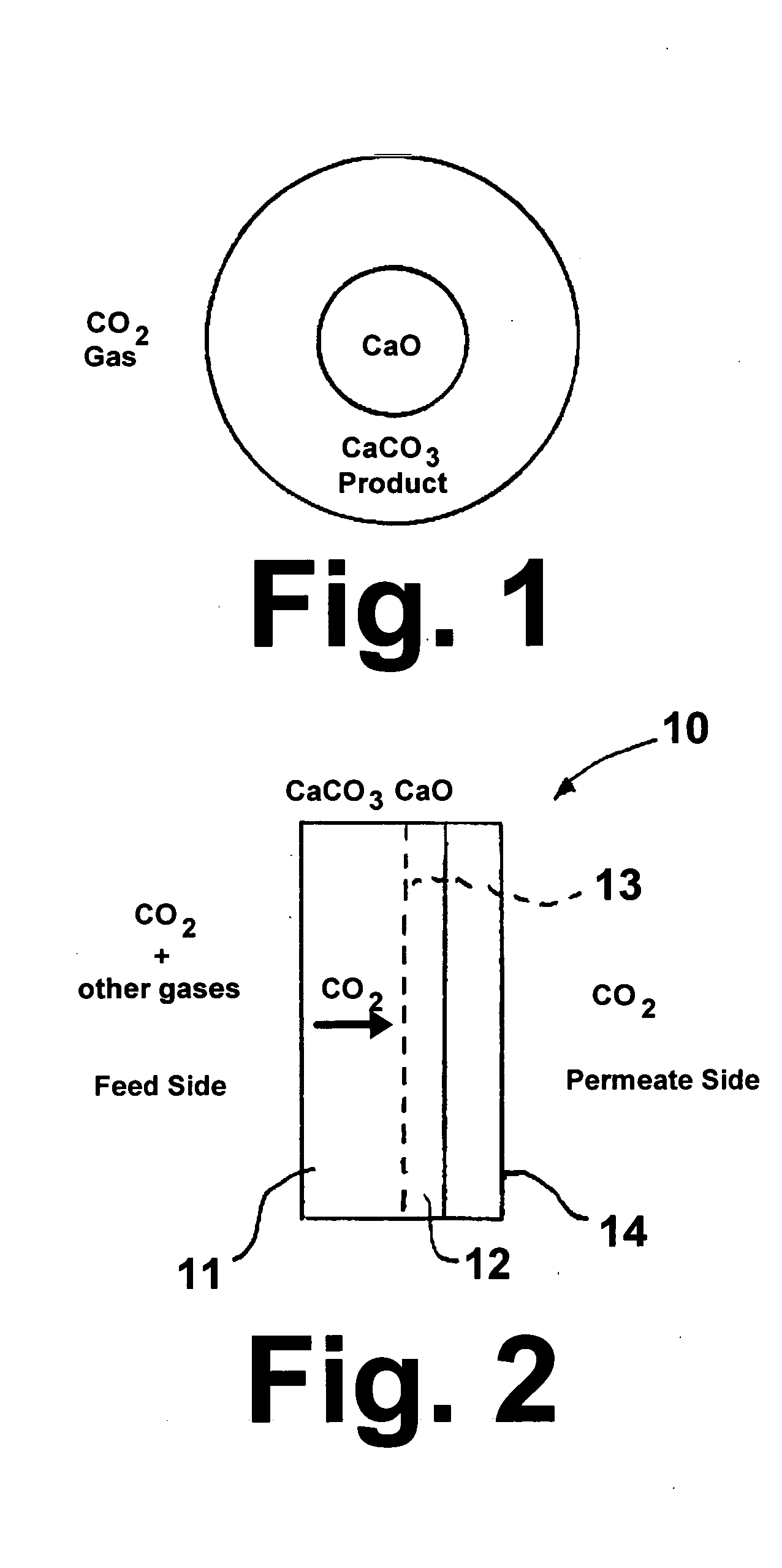

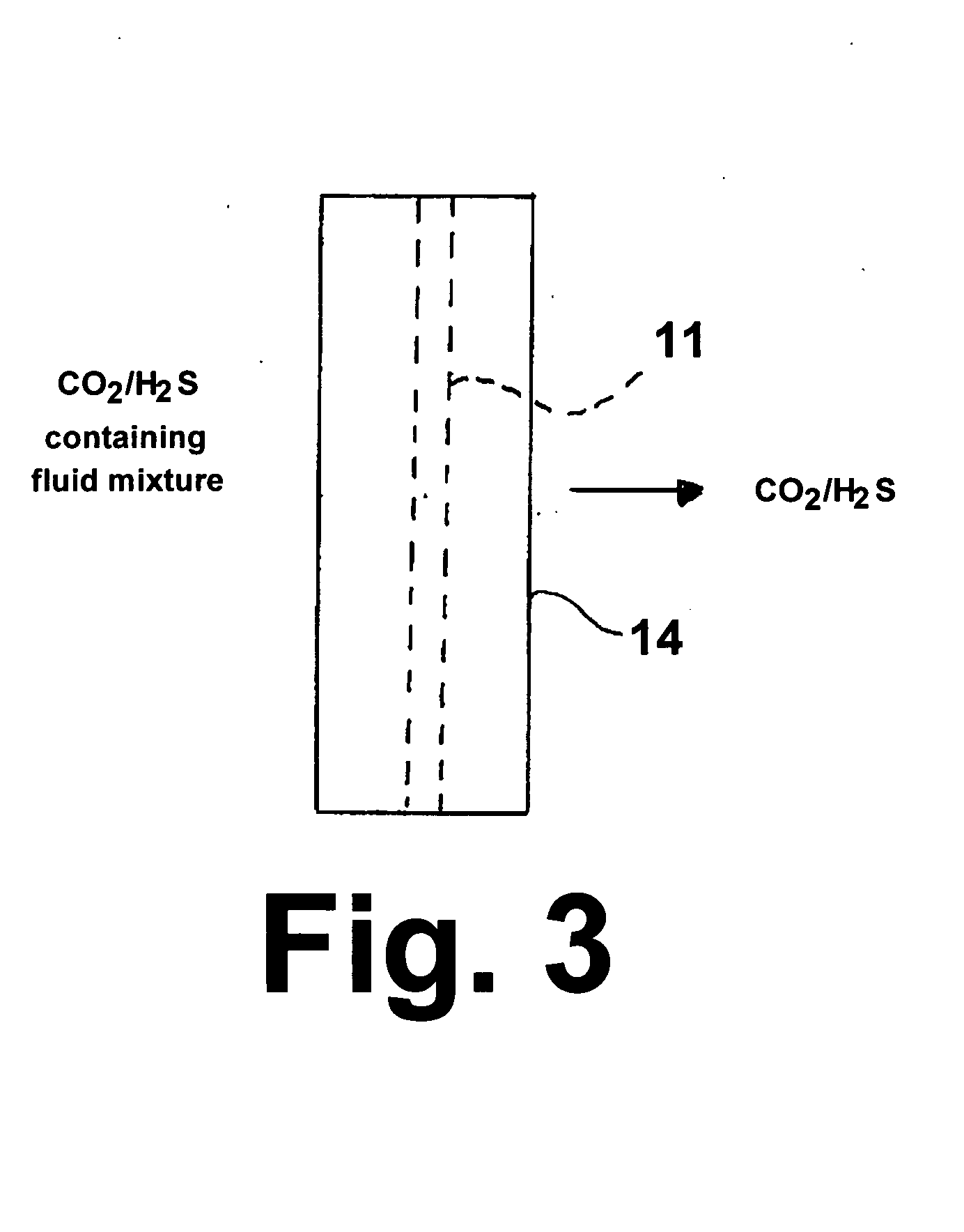

High-temperature membrane for CO2 and/or H2S separation

PatentInactiveUS20070240570A1

Innovation

- A nonporous metal carbonate membrane, comprising metals like Ca, Mg, Ba, and Sr, is used for selective separation of CO2 and H2S at high temperatures, allowing only carbonate and sulfide ions to diffuse through while excluding other gases, achieving 100% selectivity and high diffusion flux.

Membrane absorption process for co2 capture

PatentWO2019178354A1

Innovation

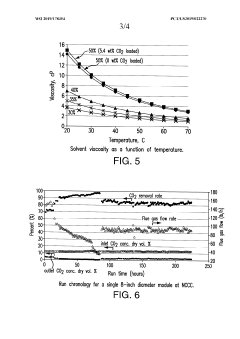

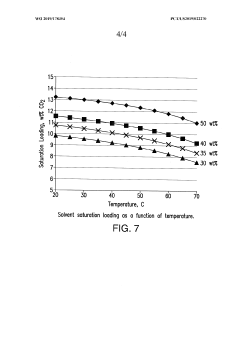

- A membrane absorption process using a CO2-selective solvent with viscosity between 0.2 and 7 cP, passed on one side of a membrane contactor, where CO2 permeates through hollow fiber membrane pores and is chemically absorbed, with the solvent being regenerated and recycled, addressing concentration polarization by adjusting solvent viscosity.

Environmental Policy Impacts on CO2 Capture Technology Adoption

Environmental policies have emerged as significant drivers in the adoption and development of CO2 capture membrane technologies, as evidenced by patent filing trends over the past two decades. The implementation of carbon pricing mechanisms, such as carbon taxes and cap-and-trade systems, has created economic incentives for industries to invest in carbon capture solutions. Analysis of patent data reveals notable increases in membrane technology innovation following major policy implementations, particularly after the Paris Agreement in 2015, which saw a 37% increase in related patent applications within two years.

Regulatory frameworks across different regions have shaped technology development trajectories in distinct ways. The European Union's Emissions Trading System (EU ETS), established in 2005, catalyzed early membrane technology patents focused on integration with existing industrial processes. Meanwhile, China's inclusion of carbon capture in its Five-Year Plans since 2011 has accelerated patent filings for cost-effective membrane materials suitable for coal-fired power plants, with annual patent applications increasing by 45% between 2011 and 2016.

Government subsidies and research grants have significantly influenced the direction of membrane technology innovation. Countries with substantial public funding programs, such as the United States (through the Department of Energy) and Japan (through NEDO), demonstrate higher rates of patent filings for novel membrane materials and manufacturing processes. Patent analysis indicates that approximately 68% of breakthrough membrane technologies in the past decade received some form of public research funding.

Industry standards and certification requirements have also shaped technology adoption patterns. The development of ISO standards for carbon capture performance has created benchmarks that membrane technologies must meet, influencing patent strategies toward technologies that can achieve compliance. Patents increasingly reference specific policy targets or standards, with 42% of membrane technology patents filed since 2018 explicitly addressing regulatory compliance.

International climate agreements have fostered cross-border technology transfer and collaboration, reflected in the growing number of jointly filed patents between entities from different countries. Following the establishment of technology transfer mechanisms under the UNFCCC, international co-patents in membrane technologies increased by 29% between 2010 and 2020. This trend suggests that environmental policies are not only driving innovation but also promoting global knowledge sharing in CO2 capture membrane deployments.

Regulatory frameworks across different regions have shaped technology development trajectories in distinct ways. The European Union's Emissions Trading System (EU ETS), established in 2005, catalyzed early membrane technology patents focused on integration with existing industrial processes. Meanwhile, China's inclusion of carbon capture in its Five-Year Plans since 2011 has accelerated patent filings for cost-effective membrane materials suitable for coal-fired power plants, with annual patent applications increasing by 45% between 2011 and 2016.

Government subsidies and research grants have significantly influenced the direction of membrane technology innovation. Countries with substantial public funding programs, such as the United States (through the Department of Energy) and Japan (through NEDO), demonstrate higher rates of patent filings for novel membrane materials and manufacturing processes. Patent analysis indicates that approximately 68% of breakthrough membrane technologies in the past decade received some form of public research funding.

Industry standards and certification requirements have also shaped technology adoption patterns. The development of ISO standards for carbon capture performance has created benchmarks that membrane technologies must meet, influencing patent strategies toward technologies that can achieve compliance. Patents increasingly reference specific policy targets or standards, with 42% of membrane technology patents filed since 2018 explicitly addressing regulatory compliance.

International climate agreements have fostered cross-border technology transfer and collaboration, reflected in the growing number of jointly filed patents between entities from different countries. Following the establishment of technology transfer mechanisms under the UNFCCC, international co-patents in membrane technologies increased by 29% between 2010 and 2020. This trend suggests that environmental policies are not only driving innovation but also promoting global knowledge sharing in CO2 capture membrane deployments.

Economic Feasibility and Scaling Challenges

The economic feasibility of CO2 capture membrane technologies remains a critical challenge for widespread commercial deployment. Current cost estimates for membrane-based carbon capture range from $40-100 per ton of CO2 captured, significantly higher than the carbon pricing in most markets. This cost barrier represents the primary obstacle to scaling these technologies beyond pilot projects and research installations.

Material costs constitute a substantial portion of the economic equation. High-performance membranes often utilize expensive polymers, metal-organic frameworks, or composite materials that have not yet benefited from economies of scale in production. Manufacturing processes for these specialized membranes remain complex and costly, with limited standardization across the industry.

Energy requirements present another significant economic hurdle. While membranes generally consume less energy than amine scrubbing technologies, the compression energy needed to create sufficient pressure differentials across membranes can account for 30-40% of operational costs. This energy penalty directly impacts the financial viability of membrane systems, particularly in regions with high electricity costs.

Scaling membrane technologies from laboratory to industrial applications introduces additional challenges. Patent analysis reveals a significant gap between theoretical membrane performance in controlled environments and real-world performance under variable conditions. Industrial flue gas streams contain contaminants that can rapidly degrade membrane performance, necessitating more frequent replacement and increasing lifetime costs.

Infrastructure requirements for large-scale deployment represent another scaling challenge. Retrofitting existing power plants or industrial facilities with membrane systems requires significant capital investment and potential production interruptions. The physical footprint of membrane systems, while smaller than some competing technologies, still presents space constraints in many existing facilities.

Recent patent trends indicate growing interest in modular membrane systems that can be incrementally scaled, potentially reducing initial capital expenditure barriers. These innovations aim to create more flexible deployment options that allow for gradual investment as carbon pricing mechanisms mature. Additionally, patents focusing on membrane durability improvements could significantly reduce lifetime operational costs by extending replacement intervals from the current 2-3 years to 5+ years.

The economic equation is gradually improving as manufacturing processes mature and material innovations reduce costs. However, widespread commercial viability likely requires either stronger carbon pricing mechanisms or significant technological breakthroughs that substantially reduce capital and operational expenses. Current projections suggest membrane technologies may reach cost parity with conventional carbon capture methods within 5-7 years, but achieving costs below $30 per ton remains a longer-term challenge.

Material costs constitute a substantial portion of the economic equation. High-performance membranes often utilize expensive polymers, metal-organic frameworks, or composite materials that have not yet benefited from economies of scale in production. Manufacturing processes for these specialized membranes remain complex and costly, with limited standardization across the industry.

Energy requirements present another significant economic hurdle. While membranes generally consume less energy than amine scrubbing technologies, the compression energy needed to create sufficient pressure differentials across membranes can account for 30-40% of operational costs. This energy penalty directly impacts the financial viability of membrane systems, particularly in regions with high electricity costs.

Scaling membrane technologies from laboratory to industrial applications introduces additional challenges. Patent analysis reveals a significant gap between theoretical membrane performance in controlled environments and real-world performance under variable conditions. Industrial flue gas streams contain contaminants that can rapidly degrade membrane performance, necessitating more frequent replacement and increasing lifetime costs.

Infrastructure requirements for large-scale deployment represent another scaling challenge. Retrofitting existing power plants or industrial facilities with membrane systems requires significant capital investment and potential production interruptions. The physical footprint of membrane systems, while smaller than some competing technologies, still presents space constraints in many existing facilities.

Recent patent trends indicate growing interest in modular membrane systems that can be incrementally scaled, potentially reducing initial capital expenditure barriers. These innovations aim to create more flexible deployment options that allow for gradual investment as carbon pricing mechanisms mature. Additionally, patents focusing on membrane durability improvements could significantly reduce lifetime operational costs by extending replacement intervals from the current 2-3 years to 5+ years.

The economic equation is gradually improving as manufacturing processes mature and material innovations reduce costs. However, widespread commercial viability likely requires either stronger carbon pricing mechanisms or significant technological breakthroughs that substantially reduce capital and operational expenses. Current projections suggest membrane technologies may reach cost parity with conventional carbon capture methods within 5-7 years, but achieving costs below $30 per ton remains a longer-term challenge.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!